Aerospace Artificial Intelligence Market Overview

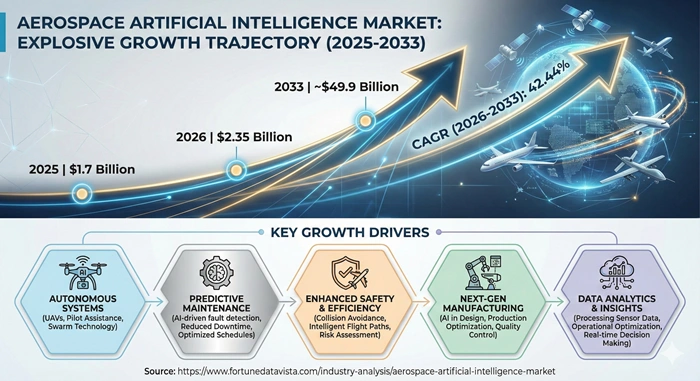

The global aerospace artificial intelligence market size is valued at USD 1.7 billion in 2025 and is predicted to increase from USD 2.35 billion in 2026 to approximately USD 49.9 billion by 2033, growing at a CAGR of 42.44% from 2026 to 2033. This surge comes from smarter tools cutting costs and boosting safety in flights and defense. Firms lean on AI to handle huge data loads from planes and drones.

AI Impact on the Aerospace Artificial Intelligence Industry

AI already runs deep in aerospace, spotting engine flaws before they ground jets. Machines learn from flight logs to predict fixes, slashing downtime by weeks. Teams tweak designs faster with simulations that test thousands of shapes in hours, not months. Drones patrol borders using AI eyes to scan terrain and flag threats live. Pilots get voice aids that read weather and reroute on the fly. Factories weld parts with robot arms guided by neural nets, hitting perfect fits every time. Space missions rely on AI brains for solo rover paths on Mars. Satellites sift petabytes of earth shots to track storms or ships. This tech mix turns raw data into sharp calls, reshaping how we fly and fight.

Aerospace Artificial Intelligence Market Growth Factors

Air travel bounces back hard, packing skies with more jets that need sharp oversight. Airlines chase fuel savings through AI route tweaks that dodge storms and winds. Defense budgets swell, funding drone swarms that think on their own. Data floods from sensors demand AI to sort signals from noise. Makers embed chips in wings for real-time health checks. Governments push green skies, with algorithms trimming emissions on long hauls. Partnerships bloom between tech giants and plane builders, speeding AI rollouts. Training sims fool pilots with hyper-real wrecks, cutting crash risks. These forces stack up for a market that won't quit growing. Rules tighten on safety, forcing AI checks on every bolt. Investors pour cash into startups crafting AI for cargo drones.

Aerospace Artificial Intelligence Market Outlook

Aerospace AI heads toward full autonomy by 2033, with planes landing sans hands in tests. Commercial fleets wire up for predictive tweaks that stretch engine life. Military eyes AI packs that swarm foes without a single loss. Cloud shifts let small airlines tap big-brain tools, leveling the field. Edge chips crunch data mid-flight, dodging satellite lags. Asia factories churn AI kits cheap, flooding global supply. Sustainability drives fusion with green tech, like batteries optimized by learning loops. Expect hybrid crews where humans nod to AI calls. This path promises safer, cheaper wings for all. Space races heat up, with AI plotting moon bases. Expect norms around ethical AI use to firm up.

Expert Speaks

- James Taiclet, CEO of Lockheed Martin: "AI factories will redefine national security, blending our edge with cloud smarts for faster aerospace wins in 2025."

- Gregory Smith, CEO of Boeing: "AI transforms fleet care through predictive eyes and digital twins, cutting costs as travel surges into 2026."

- Jensen Huang, CEO of NVIDIA: "Generative AI powers aerospace breakthroughs, from sims to swarms, fueling the next defense era now."

Key Report Takeaways

- North America leads the aerospace artificial intelligence market with over 42% share in 2025, rooted in heavy defense spends and tech hubs where firms like Lockheed build AI for jets and drones amid strict safety rules.

- Asia Pacific grows fastest at a 45% CAGR through 2033, sparked by China's drone fleets and India's jet programs that demand AI for crowded skies and border watches.

- OEMs use predictive tools most, hitting 68% adoption rates as they scan parts live to dodge failures in high-stakes builds for commercial and military wings.

- Predictive maintenance applications contribute most, claiming 27% share since engines and wings need constant eyes to avoid billion-dollar halts.

- Machine learning processes dominate popularity, grabbing 41% use for real-time tweaks in flights and factories across global ops.

- Autonomous systems segments surge next, targeting 30% share by 2033 at 46% CAGR, pushed by UAV swarms in defense zones of Europe and Asia.

Aerospace Artificial Intelligence Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 49.9 billion | Market Size by 2026 | USD 2.35 billion | Market Size by 2025 | USD 1.7 billion | Market Growth Rate from 2026 to 2033 | CAGR of 42.44% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Offering, Technology, Application, Platform, End-User, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Aerospace Artificial Intelligence Market Dynamics

Drivers Impact Analysis

|

Driver |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Air traffic surge |

High (20%) |

Global, Asia/NA |

Short-term |

|

Defense AI push |

High (18%) |

NA/Europe |

Ongoing |

|

Predictive tech demand |

Medium (15%) |

Global |

Medium-term |

Swelling passenger loads worldwide fuel the aerospace artificial intelligence market, as carriers juggle packed routes with tight fuel rules. AI smooths paths, cuts delays, and trims burns, easing hub chokes. North America feels this sharpest with mega-airports. Defense needs crank AI for threat spots, driving aerospace artificial intelligence market growth via smart drones. Budgets hit records, backing machine brains that outthink rivals. Europe matches with joint fighter programs. Predictive tools spot wear early, propping the aerospace artificial intelligence market. Engines last longer, fleets fly more. Asia builds factories around this for cheap exports.

Restraints Impact Analysis

|

Restraint |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Cyber risks |

High (-12%) |

Global |

Short-term |

|

High setup costs |

Medium (-10%) |

Asia/LatAm |

Ongoing |

|

Strict regs |

Medium (-8%) |

Europe/NA |

Medium-term |

Hack fears hobble the aerospace artificial intelligence market, as linked jets lure bad actors. Data leaks could crash flights, scaring buyers. Global nets need iron walls. Steep prices for AI rigs slow small players in the aerospace artificial intelligence market. Startups struggle against giants with deep pockets. Emerging spots hurt most. Tough safety laws delay rollouts in the aerospace artificial intelligence market. Certs take years, stalling upgrades. Europe leads in red tape.

Opportunities Impact Analysis

|

Opportunity |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Edge AI rollout |

High (22%) |

NA/Asia |

Short-term |

|

UAV boom |

High (19%) |

Asia/Middle East |

Medium-term |

|

Green flight tech |

Medium (16%) |

Europe/Global |

Long-term |

Edge brains crunch data onboard, opening aerospace artificial intelligence market doors for lag-free calls. Drones act solo in jams. US tests lead. UAV fleets explode for delivery and scout, lifting the aerospace artificial intelligence market. Nav and dodge get sharp. China masses them fast. Eco mandates spark AI for clean burns, growing the aerospace artificial intelligence market. Routes save fuel big.

Top Vendors and their Offerings

- Lockheed Martin (USA) crafts AI factories for defense sims and drone swarms, linking sensors to cloud for real-time threat hunts in jets.

- Boeing (USA) rolls predictive twins for fleet health, using machine learning to flag wing stress before cracks form on long hauls.

- Northrop Grumman (USA) builds vision systems for stealth craft, spotting foes via sat feeds processed live for commanders.

- Raytheon Technologies (USA) deploys NLP cockpits that chat with pilots, pulling weather data to dodge turbulences smoothly.

- NVIDIA (USA) powers GPUs for training loops, fueling autonomous landers that plot Mars paths without earth pings.

Aerospace Artificial Intelligence Market Segment Analysis

By Offering

Software tops with 38% share in 2025, at 43% CAGR to 2033. It runs drone brains for dodge and scout. North America grows it via defense cash, where Lockheed tunes codes for fighters. Platforms like AI cores let planes self-heal routes. Asia ramps as factories embed them cheap. Top firms like NVIDIA supply chips there. Demand swells in ops, where codes crunch logs for fixes. Services trails at 25% share, 44% CAGR. Integration glues old jets to new smarts. Europe booms on regs, with Thales leading installs. Hands train crews on sims that mimic wrecks.

By Technology

Machine Learning holds 41% share, 42.5% CAGR. Deep nets learn from flights to predict storms. US drives via labs, IBM sharpens models for Boeing. Loops improve with each hop, spotting rare faults. Computer Vision at 28% share, 45% CAGR. Cameras track drones in swarms. Asia surges on borders, Huawei aids locals. Feeds fuse for 3D maps.

By Application

Predictive Maintenance leads 27% share, 43% CAGR. Sensors flag wear on turbines. Europe pushes via airlines, GE tops there. Cuts halts by months. Autonomous Systems 22% share, 46% CAGR. UAVs fly solo patrols. Middle East grows on oil guards.

Value Chain Analysis

Data Gathering kicks off with sensors on wings pulling heat, vibe, and wind reads. Planes stream gigs daily to hubs. Cleaners strip noise for clean feeds. Key Players: Honeywell fits rigs on new builds.

Model Training builds brains on cloud farms, feeding past logs to spot patterns. Teams tweak for plane types. Sims test edge cases like hail. Key Players: IBM runs vast nets for Boeing.

Deployment loads codes to onboard chips or clouds. Certs check safety loops. Updates patch over air. Key Players: NVIDIA equips edge units.

Monitoring watches live runs, feeding fails back for upgrades. Dashboards flag drifts. Key Players: Palantir crunches for defense.

Aerospace Artificial Intelligence Market Regional Insights

North America

North America owns 43% share in the aerospace artificial intelligence market, at 42% CAGR to 2033. Defense giants pour billions into drone AI amid rival threats. Labs birth next-gen sims for pilot drills. Lockheed Martin and Boeing rule with cloud ties. Firms hit 70% uptime via predicts. US hubs like Seattle churn UAV codes.

Asia Pacific

Asia Pacific grabs 25% share, top at 45% CAGR. China masses fighters with vision nets for seas. India wires jets cheap. Huawei and locals scale factories. Skies pack, needing AI jams. Japan refines for quakes.

Europe

Europe claims 20% share, 41% CAGR. Green rules force fuel AI on hauls. Joint programs share codes. Airbus and Thales lead sims. Recycles hit 60%. France shines in space probes.

Latin America

Latin America holds 7% share, 43% CAGR. Cargo booms need route smarts. Budgets grow slow. Locals tap US kits like Raytheon. Brazil eyes drone farms.

Middle East & Africa

MEA takes 5% share, 44% CAGR. Oil guards use UAV swarms. Wealth funds bold bets. BAE Systems plants roots. Deserts test heat-proof AI.

Aerospace Artificial Intelligence Market Top Key Players

- Lockheed Martin (USA)

- Boeing (USA)

- Northrop Grumman (USA)

- Raytheon Technologies (USA)

- NVIDIA (USA)

- IBM (USA)

- Airbus (France)

- General Electric (USA)

- Thales Group (France)

- Honeywell (USA)

- BAE Systems (UK)

Recent Developments

- Lockheed Martin (2025) tied with Google Cloud for AI factories, speeding defense sims with gen tools for quicker jet upgrades.

- Boeing (2025) launched digital twins for fleets, slashing maintenance via predicts amid travel rebound.

- Northrop Grumman (2024) rolled vision for stealth, fusing sats to spot subs in real time.

- Raytheon (2025) debuted NLP cockpits, easing pilot chats on routes.

- NVIDIA (2024) boosted GPUs for space, powering Mars rover paths.

Aerospace Artificial Intelligence Market Trends

AI edges to planes, crunching sans cloud for solo acts. Drones dodge jams live. Asia fits them cheap for cargo. Gen AI crafts parts, spitting designs lighter by tons. Factories print on demand. Europe greens this for net-zero. Swarm logics let flocks raid sans chiefs. Defense tests packs of 100. Middle East guards pipes thus. Ethical nets check biases in calls, as regs bite. Firms audit black boxes.

Aerospace Artificial Intelligence Market Segments Covered in the Report

By Offering

- Hardware

- Software

- Services

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Computer Vision

- Others

By Application

- Predictive Maintenance

- Flight Operations

- Autonomous Systems

- Manufacturing

- Others

By Platform

- Commercial Aircraft

- Unmanned Aerial Vehicles (UAVs)

- Military Aircraft

- Others

By End-User

- OEMs

- Airlines

- Defense Organizations

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions:

The aerospace artificial intelligence market thrives on air booms and defense needs, hitting USD 49.9 billion by 2033.

It values USD 1.7 billion in 2025, with software leading for drone smarts.

North America dominates at 43% share, fueled by US defense tech.

Predictive maintenance tops, cutting jet halts with sensor reads.

It learns from flights to forecast faults, boosting safety wide.