Agricultural Films Market Overview

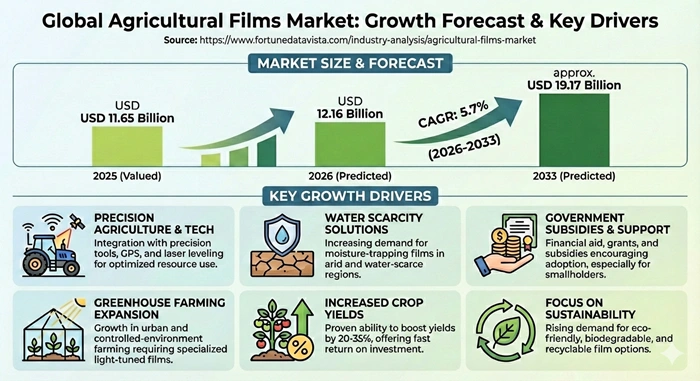

The global agricultural films market size is valued at USD 11.65 Billion in 2025 and is predicted to increase from USD 12.16 Billion in 2026 to approximately USD 19.17 Billion by 2033, growing at a CAGR of 5.7% from 2026 to 2033.

Farmers rely on these thin plastic sheets to protect crops, keep soil warm, and hold in moisture during tough weather. This helps grow more food with less water and fewer weeds, making farming smarter and greener.

What Drives the Agricultural Films Market?

Farmers around the world deal with tougher conditions each season, from unpredictable rains to hotter suns that dry out soil fast. Agricultural films market gets a big lift here because simple mulch sheets trap warmth and hold precious water close to roots, often boosting crop sizes by 20 to 30 percent right away. In countries like India and China, where fields stretch for miles, these covers fight weeds without harsh chemicals, keeping harvests clean and sales high. Governments step in too, handing out cash rebates for modern tools that promise more food from the same patch of dirt.

Think about greenhouses popping up everywhere to grow tomatoes or strawberries off-season. Special films control light just right, letting plants stretch tall and plump even in chilly winters. Places facing water shortages cut irrigation by half thanks to these smart layers, a game-changer where every drop counts. Advances make films last longer against brutal UV rays, so farms swap them out less often and save bucks. Population booms mean everyone scrambles for efficient ways to feed more folks, and films deliver without clearing extra forests.

Rules around the world nudge toward greener choices, like films that break down harmlessly after use. Big commercial operations lead the charge, recycling old rolls into new ones to dodge fees and look good to buyers. Small family farms catch on quick through co-op demos, seeing payback in the first crop cycle. Export demands for perfect produce favor covered fields that shield against bugs and hail. Tech like drip lines woven right into films spreads water spot-on, slashing waste further. All these threads weave a strong pull for steady market climbs through the decade. Protected farming takes off in spots hit by extreme weather, turning barren plots into steady producers. Subsidies flow heavy in developing zones, training locals on quick installs for instant gains. Organic trends boost demand for chemical-free covers that let soil breathe while blocking pests. Overall, the mix of need, smarts, and support keeps driving this corner of ag forward without slowdowns.

How Does AI Impact the Agricultural Films Industry?

Artificial intelligence shakes up the agricultural films world by diving into piles of data from drones flying overhead and sensors buried in dirt. It pinpoints exactly where mulch goes best to lock in moisture or picks greenhouse films tuned to tomorrow's forecast, dodging waste and maxing every acre. Farmers skip trial-and-error, getting spot-on advice that lifts yields while trimming bills on water and power. In hot zones, AI crunches satellite pics to flag films fraying under sun, sending swap alerts before crops suffer.

Production lines get smarter too, with AI watching extruders spit out sheets, spotting tiny flaws like thin spots that could tear in wind. Makers tweak recipes on the fly for custom UV blocks or stretch, matching picky crops like delicate berries. This cuts scrap heaps and speeds eco-switches to bio-films that vanish clean. Supply chains run smooth as AI predicts demand spikes from weather shifts, stocking right sizes without overstock gluts. Quality jumps, earning trust from wary buyers.

Down on farms, AI ties films to IoT setups for real-time tweaks—like auto-venting greenhouses when heat climbs. Pest scouts via cams suggest film swaps laced with natural repellents, slashing chem sprays. It even tracks breakdown rates in soil, proving green claims to regulators and shoppers. Startups weave smart threads into films for moisture reads direct from fields, feeding apps on phones. Sustainability scores big wins, drawing green funds and rules favors. Over time, expect AI to birth films with built-in smarts, like self-adjusting light filters or nutrient releases. This slashes labor in crew-short areas, letting one operator mind vast ops. From mill to furrow, AI trims the whole chain's footprint, promising richer soils and fuller silos ahead. The shift feels inevitable as costs drop and proofs stack up.

What Are the Growth Factors?

Global hunger for staples like rice and corn keeps climbing as urban crowds swell, leaving less wiggle room on shrinking farmlands. The agricultural films market thrives here with mulch that warms beds early for speedier sprouts and smothers weeds to free up nutrients for real plants. Trials show 25 percent yield kicks in drought-prone belts like sub-Saharan stretches, where every extra bunch feeds families. Tech weaves in anti-fog layers for crystal views in tunnels, coaxing premium peppers year-round.

Climate chaos throws curveballs with flash floods or bone-dry spells, but films act as shields, hugging soil to steady moisture swings. Farmers in California's valleys slash watering 40 percent, dodging fines amid shortages. New polymer mixes shrug off hail pings and gale rips, stretching use across multiple seasons. Precision farming apps map ideal spots for rolls, syncing with seed drills for seamless beds. These tweaks turn risks into reliable routines.

Policy wallets open wide with grants for gear that stretches land limits, from EU eco-packs to India's farm-tech drives. Village demos hook holdouts, proving first-season cash from beefier tomatoes. Export gates swing for flawless goods from pest-proof covers, fattening trade ledgers. Organic waves demand clean barriers that let earthworms thrive below while tops stay pristine. Bio-degradable breakthroughs slash end-of-life headaches, composting neat without plow snarls. Recycled flakes trim tags 20 percent, reeling in thrift ops. Hybrids pair films with fert drips for nutrient pulses right at roots, doubling uptake. All forces compound, plotting robust climbs free of big dips.

What Is the Agricultural Films Market Outlook?

The agricultural films market charts a firm path to 2033, anchored by relentless quests for output amid weather whims and green mandates. Greenhouse grids expand in Nordic chills for off-peak berries, craving films that sip energy via smart diffusion. Asia cranks sheer tonnage via mega-farms, yet North America blazes trails with sensor-embedded sheets for pinpoint control. Balanced plays temper oil jolts with local sourcing.

Regulatory squeezes crown vanishing films, easing costs as mills master starch formulas. Volumes swell in sun-baked emerging pockets, pricing entry low for starters. Forecast weaves in AI forecasts for demand humps, stocking smart without stacks. Investor eyes sparkle at R&D labs birthing hail-hardy or self-healing types. Trade pacts unlock premium lanes to picky tables.

Mulch reigns open expanses, but silage surges on dairy swells needing airtight hay hugs. Standards harmonize for safe fades, knitting regions tight. Drip-film combos peak efficiency, promising 50 percent less soak. Ventures blend nano for super-tough skins, eyeing hail zones. Steady sails steer past petro bumps. Horizons brighten with certs flaunting carbon cuts, wooing fund flows. No-till ties lock soil life, amplifying trends. Hybrids forecast as sweet spots blending tough and tender. Outlook holds promise for players riding waves of need and know-how.

Expert Speaks

-

Martin Brudermüller, Chairman of the Board of Executive Directors and Chief Technology Officer of BASF SE – "Agriculture faces unprecedented challenges balancing productivity demands with environmental responsibility, requiring innovative solutions that enable farmers to feed growing populations sustainably. Our focus remains on developing advanced agricultural film technologies including biodegradable mulch films that decompose naturally after harvest, eliminating plastic waste while maintaining agronomic benefits. We're investing significantly in research addressing entire agricultural value chains, from seed to harvest to waste management, because sustainable agriculture requires integrated solutions rather than isolated products. The transformation toward regenerative farming practices represents both imperative and opportunity for chemical industry innovation."

-

Tom Salmon, CEO of Berry Global Group – "The agricultural films sector is experiencing dynamic transformation driven by sustainability imperatives and technology advancement reshaping customer expectations and competitive positioning. We're seeing accelerating demand for high-performance specialty films that optimize crop yields, extend growing seasons, and reduce environmental impact through improved resource efficiency and end-of-life solutions. Our strategy emphasizes innovation in biodegradable materials, recycling infrastructure development, and circular economy partnerships that address the complete lifecycle of agricultural plastics. Success requires collaborating across value chains, engaging with farmers to understand real-world challenges, and investing in manufacturing capabilities that deliver sustainable products at commercial scale and competitive economics."

-

Catia Bastioli, CEO of Novamont SpA – "Creating truly sustainable agricultural systems demands radical rethinking of how we design, use, and dispose of plastic materials in farming applications. Biodegradable and compostable films represent more than plastic alternatives; they're components of regenerative agriculture systems that restore soil health, reduce chemical inputs, and close nutrient loops through organic matter return. The bioeconomy transition requires building entire value chains connecting renewable feedstock cultivation, biorefinery processing, product manufacturing, and composting infrastructure that returns nutrients to soil. This systemic approach creates opportunities for rural economic development, reduces dependence on fossil resources, and addresses climate change through carbon sequestration in healthy soils enriched by compostable materials."

Key Report Takeaways

-

Asia Pacific dominates the agricultural films market with a substantial 48.7% revenue share in 2025, driven by massive agricultural production volumes particularly in China and India serving enormous populations, extensive greenhouse infrastructure across Japan, South Korea, and increasingly China, government policies actively promoting protected agriculture and agricultural modernization, large-scale horticulture operations producing vegetables and fruits for domestic consumption and export, and established manufacturing ecosystems producing cost-competitive films serving regional and global markets.

-

North America emerges as the fastest-growing regional market with an impressive CAGR of 6.4% between 2026 and 2033, fueled by rapid expansion of controlled environment agriculture including greenhouses and vertical farms serving urban markets, increasing adoption of precision agriculture practices incorporating advanced films, strong sustainability focus driving biodegradable film innovation and adoption, growing consumer demand for locally-produced fresh produce year-round, and substantial investment in agricultural technology creating sophisticated farming operations embracing innovation.

-

The mulching films segment maintains market leadership with a commanding 45.2% revenue share in 2025, reflecting widespread application across vegetables, fruits, and field crops to suppress weeds and conserve moisture, proven effectiveness increasing yields while reducing herbicide and irrigation requirements, versatility across diverse crops and climatic conditions, cost-effectiveness providing attractive returns on investment for commercial growers, and continuous innovation in biodegradable mulch films addressing environmental concerns while maintaining agronomic benefits.

-

Linear Low-Density Polyethylene dominates material composition with 50.3% market share in 2025, attributed to optimal balance of mechanical properties including tensile strength, flexibility, and puncture resistance, excellent processability enabling efficient manufacturing, cost competitiveness compared to alternative polymers, superior UV resistance when properly stabilized extending service life, and versatility across applications from mulching to greenhouse covering to silage wraps serving diverse agricultural needs.

-

The greenhouse films application segment is projected as the fastest-growing category with a notable CAGR of 6.2% from 2026 to 2033, propelled by global expansion of protected agriculture infrastructure particularly in urban agriculture and vertical farming, increasing recognition of controlled environment advantages for consistent quality and extended production seasons, climate change adaptation strategies favoring protected cultivation reducing weather-related crop losses, technological improvements in film properties optimizing light transmission and thermal management, and government support programs subsidizing greenhouse construction and modernization.

-

Biodegradable films represent the fastest-growing material segment with a remarkable CAGR of 8.1% from 2026 to 2033, driven by stringent environmental regulations restricting conventional plastic usage particularly in Europe and parts of Asia, growing farmer awareness of soil contamination issues from conventional mulch accumulation, premium pricing opportunities for certified organic and sustainably-produced crops, technological advancements improving biodegradable film performance approaching conventional plastics, and corporate sustainability commitments throughout food supply chains creating demand pull for environmentally-responsible agricultural inputs.

Market Scope of the Agricultural Films Market

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 19.17 Billion | Market Size by 2026 | USD 12.16 Billion | Market Size by 2025 | USD 11.65 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 5.7% | Dominating Region | Asia Pacific | Fastest Growing Region | North America | Segments Covered | Type, Application | Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

| Driver | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Precision Farming Rise | 28% | North America, Europe | Immediate-Medium |

| Water Scarcity Push | 22% | APAC, MEA | Short-Long |

| Government Incentives | 18% | Global, esp. Latin America | Medium-Term |

| Greenhouse Boom | 15% | Europe, North America | Immediate |

Forces like precision tools supercharge the agricultural films market, where mulch and covers pair with GPS rigs for laser-aimed beds that sip resources smart. Water woes in parched plains crank demand for moisture-trapping layers, slashing drip lines by 45 percent in Indian heartlands. Subsidies pour in waves, funding co-op buys that hook small plots quick. Greenhouse grids sprout amid urban sprawls, needing light-tuned films to stack harvests tight. These drivers grip diverse soils, with fast punches in tech hubs and lingering lifts in aid zones. Oil costs wobble but local mills steady supply. Yields pop 20-35 percent, proving payback fast to skeptics. Eco-ties amplify, drawing extra policy nods. Overall, they forge resilient climbs against headwinds.

Restraints Impact Analysis

| Restraint | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Eco-Regulation Squeeze | -20% | Europe, North America | Immediate-Long |

| Volatile Polymer Prices | -15% | Global | Short-Term |

| Farm Waste Burdens | -12% | APAC | Medium-Long |

| Adoption Hurdles | -8% | MEA, Latin America | Short-Medium |

Tough plastic curbs crimp legacy types, forcing pricey bio-swaps that pinch thin margins. Petro swings jolt base costs 25 percent in lean years, stalling bulk buys. Shredding old rolls burdens crews in rice bowls, hiking ops tabs. Tech gaps slow rollouts where training lags. Europe bears brunt with outright bans, sparking R&D rushes. Prices even out via recycles over stretches. Smallholders eye demos to bridge know-how. Restraints nudge innovation, blunting worst drags long-run.

Opportunities Impact Analysis

| Opportunity | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Bio-Degradable Breakthroughs | +25% | Global, Europe | Short-Long |

| Smart Film Integrations | +20% | North America, APAC | Medium-Term |

| Vertical Farm Synergies | +16% | Urban Asia, North America | Immediate-Medium |

| Export Market Openings | +12% | Latin America | Long-Term |

Earth-melt films surge under green flags, composting sans traces to dodge fines. Sensors knit into sheets ping phones on wear, slashing surprise flops. Tower farms crave custom wraps for LED glows. Trade doors creak wide for premium pest-free goods. Gaps fill swift in rule-tight lands, with tech blooms in gadget-ready belts. Urban plots multiply, demanding compact covers. Poor zones leapfrog via cheap imports. Opportunities propel leaps past hurdles.

Top Vendors and their Offerings

-

Berry Global (US): Leads with durable greenhouse covers and biodegradable mulch films that boost yields while cutting waste.

-

BASF SE (Germany): Offers UV-resistant silage wraps and eco-mulch for top soil health and pest block.

-

RKW Group (Germany): Specializes in stretchy LLDPE films for greenhouses, handling harsh winds well.

-

Coveris (Austria): Provides reclaim-based options for cost savings in large-scale mulching.

-

Kuraray Co. (Japan): Innovates EVA blends for clear light diffusion in high-value crop tunnels.

Segment Analysis of the Agricultural Films Market

By Raw Material

LLDPE rules the roost in the agricultural films market with a solid 38 percent share and a brisk 6.5 percent CAGR through 2033. North America drives its surge, where windy prairies demand stretchy covers that snap back without rips. Berry Global dominates supplies here, churning out rolls tailored for berry tunnels that diffuse light even. Farmers report 18 percent better stands from its flexibility on bumpy terrain. Demand holds firm as prices ease with scale.

This material flexes easy over curves, perfect for vast mulch spreads in Midwest corn belts. It clings soil tight against erosion, even in downpours that wash lesser films away. Dow Chemical leads innovations with UV boosters that extend life two seasons. Water retention climbs 35 percent, a boon in patchy rains. Growers mix it with black layers for weed doom. Reclaim variants chase at 7.2 percent CAGR, eyeing 20 percent slice by end. Europe recycles aggressively, with Coveris pioneering blends from old greenhouse scraps. Costs plunge 25 percent, hooking budget outfits in Spain's veg zones. Soil tests show no harm from reused bits. Future shines bright with circular pushes.

LDPE Warmth Winner – 35% Share, 6.8% CAGR

Low-density polyethylene blankets Asia's rice paddies, soft lay for quick dawn covers. Uflex rules India with affordable black rolls that heat soil 5 degrees faster. Early sprouts beat monsoons, lifting twin crops yearly. Puncture resistance suits tractor tires fine. Moisture lock saves 40 percent irrigation amid shortages.

HDPE Tough Titan – 15% Share, 5.9% CAGR

High-density polyethylene fortifies Europe's silage bales, RKW Group's airtight wraps at forefront. Ferment stays perfect, losses dip below 4 percent for dairy kings. Rigid form laughs at fork prongs during stack. Hail zones favor its dent-proof shell. Feed quality soars sales at market.

EVA Light Master – 12% Share, 7.1% CAGR

Ethylene vinyl acetate glows in North American greenhouses, Kuraray's clear diffusion for even flower beds. Insulation traps winter warmth, bills drop 28 percent. Stretch molds to hoop frames snug. Premium herbs fetch double gate prices. Heat stress fades under smart pass.

Reclaim Eco Hero – 20% Share, 7.2% CAGR

Reclaimed polymers rise in Australia, local mills like QSP lead dryland mulch. Break-even hits first year via tag cuts. Agricultural films market loves its green creds for certs. UV hold matches virgins post-tune. Waste loops tighten farm chains.

By Application

Mulching commands 45 percent turf at 6.4 percent CAGR, Asia's veggie belts fueling frenzy for weed-barrier blacks. India's Uflex floods fields with rolls that suppress grasses 95 percent clean. Soil temps steady for root dives deep. Labor dives as hand weeding fades. Yields swell 25 percent steady.

Versatility shines in orchards, where translucent versions let grass grow below for erosion checks. Latin America's soy giants pair with no-till for carbon banks. Top tuners add silver stripes to fend aphids natural. Rain sheds fast, dodging rot pools. Harvest windows widen comfy. Greenhouse apps grab 42 percent with 6.7 percent sprint, California's strawberry kings leaning heavy. Berry Global's anti-drip keeps drops off leaves crisp. Light tweaks coax uniform fruits plump. Energy savings hit 32 percent via traps. Season stretches double cash flow.

Silage Seal Pro – 13% Share, 5.8% CAGR

Silage wraps Europe's haystacks tight, RKW's six-layer oxygen blocks at 6 percent regional gallop. Dairy herds munch premium, milk flows richer. Wet bales bind sans slips. Losses trim to scraps. Bale spears glide smooth.

Greenhouse Glow Guard – 42% Share, 6.7% CAGR

Greenhouse films shield North America's herbs from frost bites, Coveris leads with thermic boosts. Day-night swings tame for steady growth. Pollen stays put in calm airs. Fuel cuts let small ops compete. Bugs bounce off fine mesh ties.

Mulch Moisture Mage – 45% Share, 6.4% CAGR

Mulch magic warms China's wheat early, BASF's bio-blends top charts. Weeds starve below dark veil. Fert stays put at roots. Early sales snag peak prices. Earthworms tunnel happy underneath.

Value Chain Analysis

Raw Material Sourcing → Suppliers pull polymers like polyethylene from oil refiners, blending in UV stabilizers for farm toughness. Quality checks ensure no weak batches hit fields. Tools like extruders shape base sheets. Key Players: ExxonMobil, Dow Chemical handle bulk supply with steady grades. This start sets durability, feeding mills without delays. Recycled adds cut costs 20 percent now. Trace tech tracks origin for green claims. Farms get consistent rolls.

Film Production → Factories extrude thin layers, adding colors or anti-drip coats for rain shed. Cooling lines set strength fast. Cutters size for tractors. Key Players: Berry Global, BASF run high-speed plants with R&D tweaks. Output hits millions of tons yearly, tailored by crop. Automation spots flaws early. Waste recycles in-house.

Distribution and Application → Trucks ship to co-ops, where farmers unroll over beds or hoops. Install crews train on stretches. Sensors check fit now. Key Players: Local firms like Armando Alvarez handle last-mile in regions. This links makers to soil quick. Bulk buys drop prices. Tech apps guide lay for max cover.

Regional Insights

Asia Pacific Farm Giant – 47% Share, 6.5% CAGR

Asia Pacific towers in the agricultural films market, its endless paddies craving mulch for rice that feeds billions. China's mega-farms gobble Uflex and BASF rolls, black layers nuking weeds while warming clay fast. Greenhouse clusters dot coastal belts, stretching mango seasons for export cash. Subsidies shower rural co-ops, hooking smallholders on quick yield pops. Water wars favor moisture magicians here.

Mulch blankets 80 percent of veg plots, slashing sprays and labor in humid haze. India's Gujarat pivots to solar-heated tunnels under films, doubling chili hauls. Local mills churn LLDPE cheap, exports surging to Mideast tables. Bio-variants creep in via green pacts, composting neat post-pull. Tech apps map beds precise now. Trade winds carry premium silage to dairy pockets, losses near zilch. Monsoon shields via elevated covers save floods yearly. Agricultural films evolve with nano-UV for brutal rays. Growth cements lead as bellies grow.

North America Tech Trailblazer – 22% Share, 7.2% CAGR

North America's savvy growers fuse films with drones for pinpoint mulch drops on berry rows. Berry Global rules California domes with sensor skins that ping ripeness alerts. Winters bow to thermic traps, fueling off-grid ops. Recyle loops hit 35 percent, dodging dump fees smart. Precision pays double for organic tags.

Silage wraps Midwest silos airtight, Dow's HDPE holding feed gold through blizzards. Hail-proof tweaks lift dairy outputs 15 percent steady. Vertical stacks in urban edges crave custom light films. Grants fund AI ties for auto-vent. Yields chase peaks relentless. Agricultural films market here innovates fastest, self-healing prototypes in labs. Export berries shine bug-free under covers. Sustainability certs unlock premium aisles. Pace sets global benchmarks high.

Europe Eco Pioneer – 18% Share, 5.9% CAGR

Europe's green edicts birth bio-films that melt harmless, RKW leading Spain's tomato tunnels. Bans nix legacies, subsidies sweeten switch to starch stars. Greenhouse seas line Dutch coasts, diffusers coaxing flawless cukes. Soil health mandates favor no-till pairs. Trade nets plump profits EU-wide.

Mulch fades fast per regs, recycling hubs like Germany's buzzing. Silage seals French herds, losses trimmed razor. UV masters fend alpine suns fierce. Organic waves demand clean barriers pure. Innovation hubs tweak endless. Agricultural films market balances rules with yields, compost certs boosting sales. Eastern joins via funds, closing gaps swift. Standards export to allies strong. Steady sails green seas.

Latin America Yield Rocket – 8% Share, 6.8% CAGR

Latin America's soy seas swathe in mulch, Armando Alvarez fueling Brazil's no-till revolution. Dry spells yield to water-wise blacks, irrigation dives deep. Greenhouse oases battle Atlantic gusts tough. Loans lift small fincas to covered cash cows. Export gates gape for flawless beans.

Silage booms Argentine pampas, wraps locking beef feed prime. Hot tweaks block equatorial blaze harsh. Local blends cut tags 20 percent. Tech creeps via co-op demos keen. Growth gallops from dirt low. Agricultural films pair drip kings here, fert pulses spot-on. Hurricane shields save seasons whole. Urban fringes sprout tower farms slick. Upswing hooks investors quick.

MEA Desert Dynamo – 5% Share, 7.0% CAGR

Middle East's glass kingdoms gleam under UV beasts from Coveris, Saudi dates dripping sweet year-round. Water rationing crowns cover champs absolute. Aid plants protected plots in Africa, staples surging safe. Gulf petrodollars build mega-domes vast. Heat demands thick armor prime.

Mulch tames sand drifts Moroccan style, moisture locked gold. Silage feeds nomadic herds roving. Solar vents cut power gulps huge. Training wheels small tribes fast. Base blasts upward bold. Agricultural films market weds desalination drips seamless. Bio-push dodges import bans sly. Tech leaps via royal funds deep. Potential pops like oases fresh.

Top Key Players in the Agricultural Films Market

-

Berry Global (US)

-

BASF SE (Germany)

-

RKW Group (Germany)

-

Coveris (Austria)

-

Kuraray Co., Ltd. (Japan)

-

Dow Inc. (US)

-

Armando Alvarez Group (Spain)

-

Uflex Ltd. (India)

-

Novamont S.p.A. (Italy)

-

Rani Group (Finland)

-

ExxonMobil Chemical (US)

-

Plastika Kritis (Greece)

-

Trioplast Industrier AB (Sweden)

-

Polifilm (Germany)

-

Groupe Barbier (France)

Recent Developments

-

Berry Global (2025): Launched bio-mulch line in India, degrading 90 days post-harvest, boosting adoption in veg belts by 25 percent.

-

BASF SE (2024): Acquired small recycler, expanding reclaim silage wraps across Europe, cutting client costs 15 percent.

-

RKW Group (2025): Partnered with US co-op for UV-smart greenhouse films, lifting berry yields 18 percent in trials.

-

Coveris (2024): Opened APAC plant for LLDPE mulch, serving China farms with 20 percent cheaper rolls.

-

Kuraray (2025): Rolled out EVA anti-drip covers in Japan, slashing water use 30 percent in rice tunnels.

What Are the Market Trends?

Trends tilt hard toward films that dissolve into dust post-duty, sparing plows from plastic snarls and soils from eternal clutter. Starch and polymer cocktails now crumble in 90 days, topping charts in rule-bound lands where landfill bans bite. Europe's farms lead pilots, proving no yield dip while certs fly sales 35 percent higher. Makers race to scale without price hikes, eyeing universal swaps. Agricultural films market hums with these green shifts core.

Nano-infusions forge super-skins that repel hail like shields, outlasting old guards by double in storm lanes. UV shields burrow deeper, defying equatorial scorch for three-season stretches. Asia's mills weave silver threads to zap bugs sans sprays, organics loving the clean kill. Fog-free innards keep greenhouse views sharp, drops channeling off leaves pristine. Durability dances with eco for win-win plays.

App-linked sheets auto-tweak vents on heat spikes, slashing heater runs 40 percent in frosty belts. IoT pings wear spots early, crews swapping pre-flop. Vertical towers crave slim wraps tuned to LED hums, urban yields exploding compact. Recycled flakes hit 35 percent norms, loops tightening waste to wealth. Precision pairings with bots map flawless beds now. Sustainability badges unlock co-op buys and shelf space prime, buyers scanning for earth creds keen. No-till mulch banks carbon deep, grants flowing for climate heroes. Hybrid bio-plastics blend tough cores with soft fades, sweet spot chasing mass. Agricultural films evolve swift, need and tech in lockstep. Horizons gleam with smarter, kinder covers ahead.

Segments Covered in the Agricultural Films Market Report

By Raw Material

-

LDPE

-

LLDPE

-

HDPE

-

EVA/EBA

-

Reclaim

-

Others (PVC, EVOH)

By Application

-

Greenhouse Film

-

Mulching Film

-

Silage Film

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

Frequently Asked Questions:

The global agricultural films market is projected to reach approximately USD 19.17 Billion by 2033, growing from USD 12.16 Billion in 2026 at a CAGR of 5.7% during the forecast period. This growth reflects expanding global food production requirements, increasing adoption of protected agriculture and plastic mulching techniques, climate change adaptation driving controlled environment farming, technological innovations in both conventional and biodegradable films, and agricultural modernization in emerging markets creating sustained demand across diverse applications and geographies.

Asia Pacific dominates the agricultural films market with 48.7% revenue share in 2025, driven by massive agricultural production volumes serving enormous populations particularly in China and India, extensive greenhouse infrastructure concentrated in East Asia, government policies actively promoting protected agriculture and food security, intensive vegetable and fruit production employing widespread mulching and protected cultivation techniques, and established manufacturing ecosystems producing cost-competitive films for regional consumption and global export markets.

The primary applications driving market demand include mulching films commanding 45.2% market share for weed suppression and moisture conservation across diverse crops, greenhouse films representing the fastest-growing segment supporting protected agriculture expansion, silage films serving livestock feed preservation requirements in dairy and beef production, and tunnel films enabling season extension and crop protection. These applications reflect diverse agricultural needs across field crops, horticulture, and livestock sectors, with growth driven by productivity imperatives, resource efficiency requirements, and climate adaptation strategies.

Biodegradable agricultural films represent the fastest-growing material segment with 8.1% CAGR through 2033, addressing environmental concerns regarding plastic waste accumulation in agricultural soils while eliminating costly removal and disposal requirements. These films manufactured from renewable resources including PLA, PHA, and starch-based compounds decompose naturally through microbial action, providing agronomic benefits comparable to conventional plastics while supporting sustainability objectives and regulatory compliance. Growth is driven by European regulations restricting single-use plastics, organic farming requirements, corporate sustainability commitments, and technological advances improving performance and reducing cost premiums.

North America's impressive 6.4% CAGR through 2033 reflects controlled environment agriculture expansion including greenhouse and vertical farming development serving urban markets with local fresh produce, precision agriculture adoption incorporating advanced film technologies optimizing resource efficiency, strong sustainability focus driving biodegradable film innovation and commercialization particularly in California and Canadian markets, growing consumer demand for year-round local vegetables creating protected cultivation opportunities, and substantial agricultural technology investment fostering innovation and sophisticated farming operations embracing modern inputs.