Automated Mining Equipment Market Overview

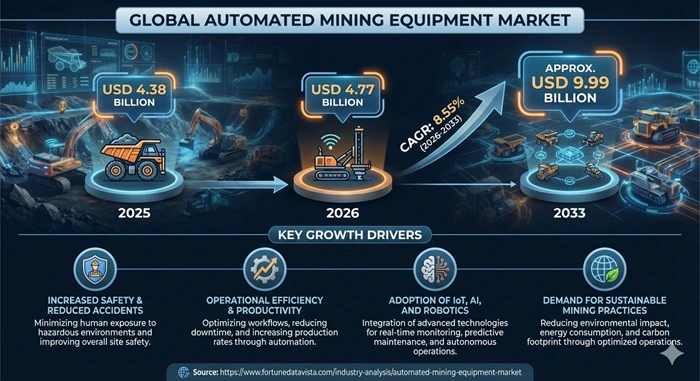

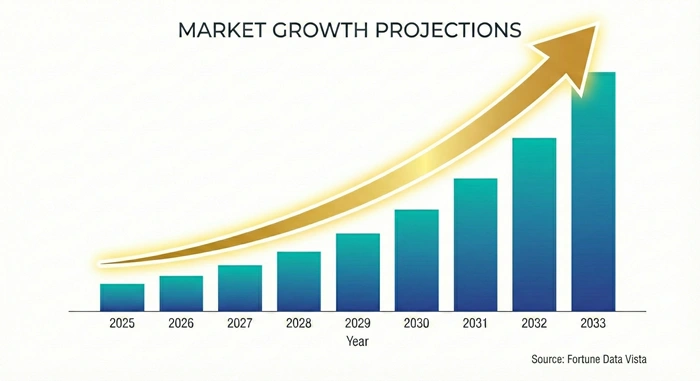

The global automated mining equipment market size is valued at USD 4.38 billion in 2025 and is predicted to increase from USD 4.77 billion in 2026 to approximately USD 9.99 billion by 2033, growing at a CAGR of 8.55% from 2026 to 2033. These machines dig, haul, and drill with little human help in deep pits and tunnels. Trucks drive alone loaded with ore, boosting safety far from blasts. Demand climbs as mines chase metals for batteries and chips.

AI Impact on the Automated Mining Equipment Industry

AI guides trucks around rocks live in the automated mining equipment industry, dodging crashes without drivers. Sensors spot faults early, halting loaders for fixes quick. Mines cut stops 30% with smart alerts. Recipe plans blend drill data for steady ore pulls. Deep nets learn from past shifts to tweak paths best. Safety jumps as bots handle dust and gas alone. Firms layer AI on old rigs cheap via clouds now. Small ops grab big yields matching giants. Remote views let bosses watch fleets from towns.

Automated Mining Equipment Market Growth Factors

Labor dries up in remote pits, pushing auto hauls 24/7. Trucks run non-stop sans breaks, lifting tons more. Safety rules ban men from hot zones deep. Ore hunts shift to harsh spots like deserts, needing tough bots. Copper booms for green cars fuel drill buys big. Costs drop 20% on fuel and tires smart. Rules cut dust and blasts favor remote gear. Clouds link sites for fleet tweaks real-time. Battery trucks pair auto for zero fumes clean. Upfront dips with retro kits, small mines jump in fast.

Automated Mining Equipment Market Outlook

Fully auto underground leads in the automated mining equipment market as 5G nets tunnels tight. Drills map veins solo now. Surface hauls mature, underground booms next. Asia digs rare earths wild, grabbing loaders cheap. Green funds back electric bots low. Europe ties ESG to grants for safe shifts. By 2033, swarms mix drills and trucks seamless. Cyber nets guard hacks tight. Climb from ore thirst stays firm. Hybrids blend retro with new for flex. Training apps skill ops on bots quick.

Expert Speaks

- Joe Kaessner, CEO of Epiroc (Sweden): "Automation frees miners from danger, hauling tons safer while yields soar day and night."

- Marcelo Esquivel, CEO of Caterpillar Mining (USA): "Our auto trucks cut costs deep, running fleets smart for green copper hunts."

- Rikard Olsson, CEO of Sandvik Mining (Sweden): "AI drills hit veins true, slashing waste in deep shafts for steady ore flows."

Automated Mining Equipment Market Key Report Takeaways

- Asia Pacific rules the automated mining equipment market with 40% share fueled by China copper pits and Australia iron hauls where bots cut labor thin.

- Middle East & Africa grows quickest at 9.5% CAGR from Saudi gold digs and South African deep shafts needing remote safety high.

- Surface mining users top adoption shoving trucks auto for open pits vast.

- Autonomous haul trucks contribute biggest lugging ore non-stop in scale ops.

- OEM-integrated holds strong baking bots into new rigs factory fresh.

- Fully autonomous surges ahead claiming 28% share by 2033 at 10% CAGR as tunnels go driverless deep.

Automated Mining Equipment Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 9.99 Billion | Market Size by 2026 | USD 4.77 Billion | Market Size by 2025 | USD 4.38 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 8.55% | Dominating Region | Asia Pacific | Fastest Growing Region | Middle East & Africa | Segments Covered | Equipment Type, Mineral Type, Deployment Mode, Level of Automation, Software Solution, End-User, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Automated Mining Equipment Market Dynamics

Drivers Impact Analysis

|

Driver |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Labor Shortages |

+2.5% |

Global, Australia |

Short (≤2 yrs) |

|

Safety Regulations |

+2.2% |

North America, Europe |

Medium (2-4 yrs) |

|

Productivity Demands |

+1.8% |

Asia Pacific |

Medium (2-4 yrs) |

|

Ore Demand Surge |

+1.5% |

Global |

Short (≤2 yrs) |

Drivers propel the automated mining equipment market as pits shun men for bots safe. Trucks haul solo cutting wrecks 80%. Rules ban blasts near ops human. Yields climb tons per shift in the automated mining equipment market. Copper thirst pulls drills AI sharp. Clouds tie fleets for tweaks live. Labor gaps hit remote sites hard, bots fill shifts endless.

Restraints Impact Analysis

|

Restraint |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

High CAPEX |

-2.0% |

Global |

Medium (2-4 yrs) |

|

Cyber Risks |

-1.5% |

North America |

Short (≤2 yrs) |

|

Fleet Mix Issues |

-1.2% |

Australia |

Medium (2-4 yrs) |

Restraints slow the automated mining equipment market with fat buys for truck packs. Small pits balk at tags huge. Hacks eye connected rigs in the automated mining equipment market. Old iron clashes new nets bad. Tunnels lag signal weak.

Opportunities Impact Analysis

|

Opportunity |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Retrofit Kits |

+2.3% |

Asia Pacific |

Short (≤2 yrs) |

|

5G Underground |

+1.9% |

Middle East |

Medium (2-4 yrs) |

|

Battery Bots |

+1.6% |

Europe |

Medium (2-4 yrs) |

Opportunities shine in the automated mining equipment market via bolt-on kits for old trucks cheap. Mines upgrade sans scrap full. Deep nets push tunnel drills solo. Green trucks pair zero fumes auto.

Top Vendors and their Offerings

- Caterpillar (USA) rolls Command trucks hauling iron solo in Aussie pits.

- Komatsu (Japan) FrontRunner fleets lug billions tons with AI paths smart.

- Sandvik (Sweden) AutoMine drills veins deep without men near.

- Epiroc (Sweden) rigs remote blast patterns precise safe.

- Hitachi (Japan) EX-7 loaders scoop underground battery powered.

Automated Mining Equipment Market Segment Analysis

By Equipment Type

Autonomous Haul Trucks

Autonomous Haul Trucks claim 45% share at 9% CAGR, surging in Asia Pacific where China copper pits scale fleets vast. Komatsu rigs run 700 hours more yearly sans drivers. Cuts tire wear half with paths learned. Caterpillar tunes for Pilbara iron endless. Safety logs zero wrecks fleets big. Yields lift 20% tons per shift.

Automated Drilling Rigs

Automated Drilling Rigs grab 22% share, 9.5% CAGR in Australia for open blasts.

By Mineral Type

Metallic

Metallic rules 48% share with 8.8% CAGR, hot in Middle East for gold deep. Sandvik bores copper steady.

By Deployment Mode

OEM-Integrated

OEM-Integrated holds 55% share, 8.7% CAGR in North America factory fresh.

By Level of Automation

Fully Autonomous

Fully Autonomous nets 30% share, 10% CAGR underground push.

By Software Solution

Fleet Management

Fleet Management leads 35% share, 9.2% CAGR for hauls synced.

By End-User

Surface Mining

Surface Mining dominates 62% share, 8.5% CAGR pits open.

Value Chain Analysis

- R&D and Design → Forge bot brains tough. Engineers craft AI for dust paths. Description: Sensors fuse with drills for vein hits true. 5G tests tunnels deep. Key Players: Caterpillar, Komatsu.

- Manufacturing & Assembly → Weld frames rugged. Factories bolt LiDAR radars tight. Description: Battery packs join cabs empty now. Tests mimic blasts harsh. Key Players: Epiroc, Sandvik.

- Software Integration → Code fleets smart. Devs link clouds to trucks live. Description: Paths learn from shifts past daily. Alerts flag faults early. Key Players: Hexagon, Trimble.

Automated Mining Equipment Market Regional Insights

Asia Pacific

Asia Pacific grips 40% share at 9% CAGR. Komatsu floods China copper trucks vast. Caterpillar aids Aussie iron hauls endless. Pits scale for green metals wild. Labor laws push bots deep fast. Roads link remote sites now smooth.

North America

North America bags 22% share with 8.2% CAGR. Epiroc drills Nevada gold steady. Sandvik retrofits Canadian ore pits tough. Rules eye dust cuts firm. Mines test 5G first safe. Grants back battery shifts green.

Europe

Europe claims 15% share, 8.5% CAGR. ABB guards Swedish iron safe. Hitachi powers Polish coal bots cheap. Green deals fund zero fumes. Unions back remote jobs skilled. Tunnels go driverless slow smart.

Latin America

Latin America lifts 12% share at 8.8% CAGR. Caterpillar hauls Chilean copper deep. Komatsu eyes Peruvian gold remote. Andes pits shun men high. Infra booms need scale gear. Trades open OEM doors wide.

Middle East & Africa

Middle East & Africa surges 11% share, 9.5% CAGR. Sandvik digs Saudi gold fresh. Epiroc aids South African shafts tough. Vision funds bots modern. Deserts run solar charged endless. Rare digs pull loaders quick.

Automated Mining Equipment Market Top Key Players

- Caterpillar Inc. (USA)

- Komatsu Ltd. (Japan)

- Sandvik AB (Sweden)

- Epiroc AB (Sweden)

- Hitachi Construction Machinery (Japan)

- ABB Ltd. (Switzerland)

- Hexagon AB (Sweden)

- Trimble Inc. (USA)

- Autonomous Solutions Inc. (USA)

- Rockwell Automation Inc. (USA)

Recent Developments

- Caterpillar (2025): Rolled Command upgrade hauling 20% more safe in Nevada.

- Komatsu (2025): Hit 10 billion tons auto, tire cuts half sharp.

- Sandvik (2024): Launched AutoMine surface fleet drills blast precise.

- Epiroc (2025): Bagged biggest electric auto rig deal pits vast.

- Hitachi (2025): EX-7 loaders battery underground solo now.

Automated Mining Equipment Market Trends

Automated mining equipment market swings to battery bots for fumes zero. Chargers dot pits solar cheap. Clouds crunch yields night tweaks dawn. Fully auto tunnels lead with SLAM maps dark. Swarms drill haul sync seamless. Cyber walls lock rigs from hacks deep. Automated mining equipment market eyes retro kits old fleets fresh. ESG apps track dust cuts for grants green.

Automated Mining Equipment Market Segments Covered in the Report

- By Equipment Type

- Autonomous Haul Trucks

- Automated Drilling Rigs

- Autonomous Loaders

- Robotic Mining Equipment

- Dozers and Excavators

- Automated Blasting Systems

- Remote-Controlled Equipment

- Others

- By Mineral Type

- Metallic

- Non-Metallic

- Coal

- Rare Earth Minerals

- By Deployment Mode

- On-Site

- Retrofit Automation

- OEM-Integrated

- By Level of Automation

- Semi-Automated

- Fully Autonomous

- Remote-Controlled

- By Software Solution

- Fleet Management

- Navigation & Guidance

- Collision Avoidance & Safety

- Tele-remote Operations

- Predictive Maintenance

- Energy & Emissions Monitoring

- By End-User

- Surface Mining

- Underground Mining

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions:

Labor gaps and safety rules propel the automated mining equipment market for hauls solo.

Asia Pacific leads pits scale huge.

8.55% growth from 2026-2033 strong.

Sensors dodge rocks live no drivers.

CAPEX high slows small pits still.