Automated Truck Loading System Market Overview

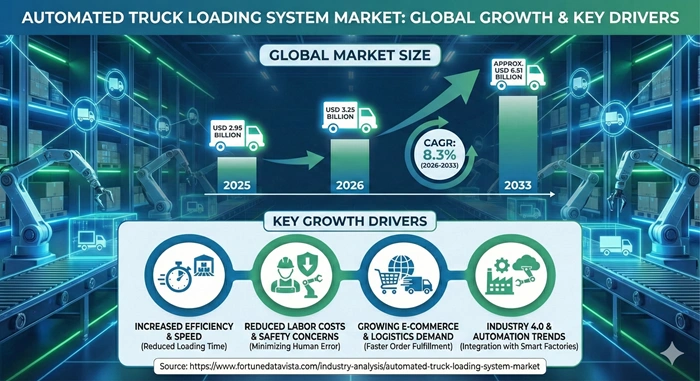

The global automated truck loading system market size is valued at USD 2.95 billion in 2025 and is predicted to increase from USD 3.25 billion in 2026 to approximately USD 6.51 billion by 2033, growing at a CAGR of 8.3% from 2026 to 2033. Businesses today face mounting pressure to speed up logistics while cutting down on mistakes and costs. These systems use smart tech to handle loading tasks smoothly making warehouses run like clockwork. As e-commerce booms companies turn to such solutions for reliable operations.

AI Impact on the Automated Truck Loading System Industry

Artificial intelligence reshapes how trucks get loaded by crunching data in real time to plan the best cargo setups. Machines learn from past loads to stack items tighter avoiding wasted space and balancing weight just right. This cuts fuel use and speeds up trips which matters a lot in tight delivery schedules.

AI also teams up with robots and sensors to spot issues early like a jammed conveyor or shifted load. Safety jumps because humans stay out of harm's way during heavy lifts. Over time these smart setups predict maintenance needs keeping downtime low and flow steady. In busy hubs AI links loading systems to full supply chains tracking goods from factory to customer. This visibility helps managers tweak routes on the fly dodging delays from weather or traffic. The result smarter logistics that scale with demand.

Automated Truck Loading System Market Growth Factors

E-commerce explosion demands faster truck turnarounds pushing firms toward automated loading to meet same-day delivery promises. High-volume sectors like retail handle endless pallets manually leading to errors and slow paces. Automation steps in slashing load times by half while boosting accuracy. Labor shortages hit hard with rising wages making machines a smart swap. Workers prefer safer roles leaving loading to reliable tech that runs nonstop. Governments back this shift through grants for green efficient warehouses cutting overall costs.

Tech leaps in sensors and software make these systems plug-and-play even for older trucks. Firms save big on training as intuitive controls need little oversight. Sustainability wins too with fewer trips meaning lower emissions aligning with global rules. Supply chain snarls from recent disruptions spotlight the need for tough flexible loading tech. Companies that automate bounce back quicker handling surges without extra staff. Long-term this builds resilience turning headaches into advantages.

Automated Truck Loading System Market Outlook

Logistics pros see steady climbs ahead as more factories and stores go digital. Edge computing will let loading systems react faster to live data from trucks and docks. Expect hybrid models blending AI with human checks for tricky loads. Green pushes will favor electric AGVs in loading cutting noise and power draw. Big players invest heavy in modular designs fitting any warehouse size. By 2030 over half of large hubs could run full auto.

Global trade rebounds fueling demand in emerging spots where infrastructure lags. Partnerships between tech firms and truck makers speed rollout. Overall the field looks bright with innovation driving down prices for wider use. Challenges like custom fits for odd cargo persist but software updates close gaps quick. Regulators ease rules for proven safe systems opening doors wider. The path forward points to seamless integrated ops.

Automated Truck Loading System Market Expert Speaks

- Mary T. Barra CEO General Motors (Automotive Logistics Leader): "Automation in truck loading transforms our supply chains making just-in-time delivery reality amid chip shortages and port backups as of late 2025. It slashes wait times by 40% letting us focus on innovation."

- Doug McMillon CEO Walmart (Retail Supply Chain Giant): "We've rolled out AI-driven loading across 200 centers boosting throughput 25% this year. Current market shifts demand such tech to handle holiday peaks without labor crunches."

- Raj Subramaniam CEO FedEx (Global Logistics Powerhouse): "In 2025 updates show automated systems key to our net-zero goals by optimizing loads and routes. Efficiency gains hit 30% helping us navigate fuel volatility."

Automated Truck Loading System Market Key Report Takeaways

- Europe leads the automated truck loading system market with over 40% share thanks to early tech adoption in manufacturing powerhouses like Germany and the UK where strict efficiency rules push warehouses to automate heavily for seamless cross-border flows.

- Asia Pacific grows fastest at a projected 9.5% CAGR driven by China's mega-logistics parks and India's e-commerce surge creating high demand for scalable systems that handle booming volumes in dense urban setups.

- FMCG customers lead adoption due to constant high-volume pallet moves requiring round-the-clock reliability which these systems deliver cutting manual errors in fast-paced consumer goods distribution.

- Automotive and transportation contributes most holding 30% share as just-in-time factories need precise part loading to avoid assembly line halts making belt and roller systems staples in this sector.

- Belt conveyor systems prove most popular with 25% market share for their simple setup and speed in straight-line loads ideal for standard pallets across industries.

- AGV-based systems will grow quickest eyeing 12% CAGR and 15% share by 2033 powered by wireless navigation fitting modern flexible warehouses especially in North America.

Automated Truck Loading System Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 6.51 Billion | Market Size by 2026 | USD 3.25 Billion | Market Size by 2025 | USD 2.95 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 8.3% | Dominating Region | Europe | Fastest Growing Region | Asia Pacific | Segments Covered | Loading Dock Type, Truck Type, System Type, Industry, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Automated Truck Loading System Market Dynamics

Drivers Impact Analysis

|

Driver |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

E-commerce Boom |

35% |

Global, esp. Asia Pacific |

Short-term (2026-2028) |

|

Labor Shortages |

25% |

North America, Europe |

Immediate |

|

Efficiency Needs |

20% |

All Regions |

Medium-term |

Rising e-commerce volumes force companies to automate truck loading for quicker dock turns handling surges without extra hands. In high-throughput warehouses automated truck loading system market growth ties directly to platforms like Amazon pushing 24/7 ops. This driver lifts overall CAGR by streamlining what used to take hours into minutes. Labor gaps widen as skilled workers move to better gigs leaving firms no choice but machines. Regions with tight rules see biggest gains since systems run error-free day and night. Over time this cuts costs 20-30% fueling broader adoption. Tech integrations like IoT sensors add precision making loads safer and faster. Businesses stack more per truck reducing trips and emissions which regulators love. These forces compound to steady market expansion.

Automated Truck Loading System Market Restraints Impact Analysis

|

Restraint |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

High Initial Costs |

-20% |

Developing Regions |

Long-term |

|

Integration Challenges |

-15% |

SMEs Globally |

Medium-term |

|

Cheap Labor Availability |

-10% |

Asia, LATAM |

Ongoing |

Upfront prices for robotics and software scare smaller outfits despite payback in two years. Custom installs add headaches slowing rollout in budget-tight spots. This caps near-term growth until financing eases. Old warehouses resist retrofits needing dock overhauls which disrupt ops. Compatibility issues with legacy trucks drag timelines stretching ROI waits. Firms weigh risks carefully holding back full shifts. Abundant low-wage workers in emerging areas make manual loading seem fine short-term. Cultural reliance on hands-on work slows tech trust building. These hurdles temper but do not halt progress.

Automated Truck Loading System Market Opportunities Impact Analysis

|

Opportunity |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Sustainability Mandates |

+25% |

Europe, North America |

Medium-term |

|

Smart City Projects |

+20% |

Asia Pacific |

Short-term |

|

AGV Advancements |

+15% |

Global |

Long-term |

Green laws push low-emission loading cutting truck idles and fuel burn. Firms grab grants for eco-upgrades gaining edge in bids. This opens doors for modular systems fitting net-zero goals. Urban hubs build AI-ready infra welcoming plug-in loaders. Governments fund pilots scaling successes nationwide. High-density trade zones benefit most from quick efficient flows. Next-gen AGVs dodge obstacles wirelessly suiting dynamic yards. Battery leaps mean non-stop runs slashing downtime. These innovations lure early adopters spurring wider use.

Automated Truck Loading System Market Top Vendors and their Offerings

- Dematic (USA) leads with integrated conveyor and AGV setups handling pallets up to 2 tons ideal for automotive lines featuring AI load optimization for 30% faster cycles.

- BEUMER Group (Germany) excels in belt systems for bulk goods like cement bags supporting high-speed docks with modular designs that adapt to flush or sawtooth setups.

- Joloda Hydraroll (UK) specializes in hydraulic rollers for non-modified trucks enabling safe side-loads reducing injury risks by 50% in FMCG warehouses.

- Haver & Boecker (Germany) offers chain conveyors for bagged cargo with dust-proof seals perfect for pharma ensuring zero contamination during transfers.

- Ancra Systems (Netherlands) provides skate systems for aviation parts lightweight yet durable for frequent use in climate docks maintaining temp control.

Automated Truck Loading System Market Segment Analysis

By Loading Dock Type

Flush docks grab 35% share growing at 8.5% CAGR led by Europe where tight spaces demand seamless truck aligns. These setups hug building walls minimizing weather exposure for food goods. Top firms like BEUMER dominate here with quick-install kits boosting throughput in German hubs. Growth stems from retrofits in old factories needing speed without rebuilds. Enclosed docks speed at 9.2% CAGR in Asia Pacific's humid zones shielding cargo from rain. Sensors auto-adjust heights cutting setup time by minutes per truck. Dematic rules with sealed conveyor links preventing dust in electronics plants. Demand rises as e-commerce parks multiply demanding weather-proof ops.

By Truck Type

Non-modified trucks hold 45% share with 8.1% CAGR strongest in North America where fleets avoid costly changes. Standard beds pair with roller tracks for easy pallet slides. Joloda leads supplying flexible skates for US logistics giants. Popularity comes from plug-and-play saving millions in mods while handling daily volumes. Modified trucks grow 9.0% CAGR in automotive-heavy Europe tailoring beds for AGVs. Custom lifts speed heavy part loads avoiding forklift jams. Ancra excels with hydraulic upgrades fitting specialized trailers. Factories chase this for precision in just-in-time chains.

By System Type

Belt conveyors claim 28% share at 8.4% CAGR thriving in Asia's FMCG boom for smooth box flows. Adjustable speeds match truck paces reducing jams. Haver & Boecker tops with extendable arms reaching deep trailers. Factories pick them for reliability in high-shift ops. AGVs surge 11.5% CAGR in North America using lasers to navigate tight docks autonomously. Battery swaps enable 24-hour runs cutting labor overnight. Dematic's wireless fleets lead in e-commerce fulfilling orders solo. Warehouses love them for scaling without headcount hikes.

By Industry

Automotive and transportation dominates 32% share growing 8.7% CAGR powered by Europe's assembly lines needing part precision. Systems sync with robots for zero-damage transfers. BEUMER supplies most here with vibration-free belts. Growth ties to EV ramps demanding faster supplier links. FMCG follows at 9.3% CAGR in Asia Pacific chasing daily stock turns for groceries. Multi-line conveyors handle varied packs efficiently. Joloda's rollers shine in wet goods avoiding slips. Retail chains adopt to beat rivals on shelf freshness.

Automated Truck Loading System Market Value Chain Analysis

Raw Material Sourcing. Suppliers provide steel rollers sensors and motors forming the backbone of sturdy frames. Quality checks ensure durability under heavy daily use handling thousands of cycles without wear. Key Players: Steel giants like ArcelorMittal and chip makers such as Texas Instruments supply core parts keeping costs steady through bulk deals.

System Design and Manufacturing. Engineers craft modular blueprints blending software with hardware for custom fits. Prototypes test load capacities simulating real docks before assembly lines churn units. IoT embeds track performance live aiding tweaks. Key Players: Firms like Dematic and BEUMER run factories outputting tailored lines for global ship.

Installation and Integration. Technicians site systems linking to warehouse software and power grids. Calibration aligns with truck heights ensuring smooth first runs minimizing teething issues. Training equips staff on overrides for odd loads. Key Players: Local partners like Ancra handle on-site work tying into existing conveyors seamlessly.

Operation and Maintenance. Daily runs monitored via dashboards flagging wear early for part swaps. Predictive AI schedules downtime avoiding peak disruptions. Upgrades add features like faster belts yearly. Key Players: Service arms from Joloda and Haver offer contracts ensuring 99% uptime through remote diagnostics.

Automated Truck Loading System Market Regional Insights

North America

This region commands 25% share growing at 8.0% CAGR fueled by US e-commerce giants automating mega-centers. Vast spaces allow expansive AGV fleets cutting turns to under 15 minutes. Labor costs push adoption while ports like LA test dock tech for backlog busts. Dematic (USA) and Joloda (via US ops) lead supplying scalable kits for retail hubs ensuring quick ROI in high-wage markets. Canada mirrors with cold chain focus using enclosed docks for perishables. Investments hit USD 500M in smart logistics by 2026. Growth hits from cross-border trade demanding speed.

Europe

Largest at 42% share with 8.6% CAGR thanks to Germany's manufacturing muscle. Strict safety rules favor enclosed systems reducing accidents 40%. Flush docks fit urban factories perfectly. BEUMER (Germany) and Ancra (Netherlands) dominate customizing for auto lines like BMW boosting efficiency amid energy crunches. UK post-Brexit leans on rollers for parcel surges handling 20% volume jumps. France pushes green AGVs aligning with EU carbon cuts.

Asia Pacific

Fastest at 9.8% CAGR holding 22% share driven by China's warehouse boom. Dense ports need compact skate systems for container flips. E-commerce like Alibaba demands 24/7 loads. Haver & Boecker (Asia plants) and local players equip vast parks cutting Beijing delivery times. India's FMCG rush favors belts for spice bags with 15% yearly growth. Singapore leads smart city integrations.

Latin America

12% share at 7.9% CAGR as Brazil modernizes ag exports. Open docks suit flatbeds for soy loads. Cost drops make entry viable now. Joloda (LATAM partners) supplies rugged units for rough roads ensuring reliability. Mexico's auto plants near US adopt fast conveyors syncing supply chains.

Middle East & Africa

Emerging with 8.5% CAGR focused on Dubai's hubs using climate docks for dates. Oil wealth funds pilots scaling quick. Ancra outfits temp-controlled lines. Africa grows via port upgrades handling minerals safely.

Automated Truck Loading System Market Top Key Players

- Dematic (USA)

- BEUMER Group (Germany)

- Joloda Hydraroll (UK)

- Haver & Boecker OHG (Germany)

- Ancra Systems B.V. (Netherlands)

- Asbreuk Service B.V. (Netherlands)

- Cargo Floor B.V. (Netherlands)

- Europa Systems (Poland)

- Actiw Ltd. (Finland)

- CLSi Logispeed (USA)

- GEBHARDT Fördertechnik (Germany)

- Secon Components (Spain)

Automated Truck Loading System Market Recent Developments

- Dematic (2025) launched AI-enhanced AGVs integrating with TMS software for 25% faster dock cycles tested in US fulfillment centers boosting partner throughput.

- BEUMER Group (2024) acquired a Dutch conveyor firm expanding modular offerings into Asia with 300-unit deal for Chinese ports enhancing bulk handling speed.

- Joloda Hydraroll (2025) partnered with FedEx rolling out hydraulic skates across Europe cutting injury claims 35% in parcel ops amid labor rules.

- Haver & Boecker (2024) unveiled dust-free chain systems for pharma winning Indian contract for 500K bags daily without contamination.

- Ancra Systems (2025) merged with robotics startup adding vision tech to skates for auto unloads now live in German factories trimming times 20%.

Automated Truck Loading System Market Trends

Warehouses blend loading with sorting arms creating end-to-end auto lines where robots hand off to conveyors seamlessly. This cuts steps letting one system manage inbound to outbound flows. Firms experiment with wireless charging AGVs ditching cords for fluid ops in tight spaces. Sustainability trends spotlight low-energy rollers using regen brakes recapturing power. Governments tax high-idle ops pushing electric hybrids that sip juice yet lift tons. Data shows 15% emission drops drawing eco-buyers.

Customization surges with plug-in modules swapping belts for skates overnight. Cloud dashboards let managers tweak from phones tracking ROI live. Small firms enter via SaaS models renting capacity sans big buys. Edge AI spots cargo shifts mid-load halting before mishaps saving millions in damages yearly. Integration with drone scouting plans dock traffic avoiding pileups. These shifts make loading proactive not reactive.

Automated Truck Loading System Market Segments Covered in the Report

- Loading Dock Type

- Flush Docks

- Enclosed Docks

- Sawtooth Docks

- Climate-Controlled Docks

- Others

- Truck Type

- Non-Modified Trucks

- Modified Trucks

- System Type

- Belt Conveyor System

- Chain Conveyor System

- Slat Conveyor System

- Skate Conveyor System

- Roller Track System

- Automated Guided Vehicles

- Loading Plate System

- Industry

- Automotive and Transportation

- FMCG

- Aviation

- Cement

- Paper

- Post & Parcel

- Textile

- Pharmaceutical

- Others

- Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions:

The automated truck loading system market stands at USD 2.95 billion in 2025 set to hit USD 6.51 billion by 2033 with 8.3% CAGR from 2026. Drivers like e-commerce fuel this as firms chase faster docks.

AGVs lead growth at 11.5% CAGR for wireless flexibility while belts hold steady share for simple reliability suiting varied loads across industries in the automated truck loading system market.

Europe leads with 42% share due to advanced manufacturing but Asia Pacific races ahead at 9.8% CAGR from logistics booms in the automated truck loading system market.

Labor shortages and efficiency needs push uptake cutting times 50% with AI planning optimal loads reducing trips for the automated truck loading system market.

AI optimizes space and predicts issues enabling predictive maintenance that boosts uptime 20% across global hubs in the automated truck loading system market.