Automotive Coolant Market Overview

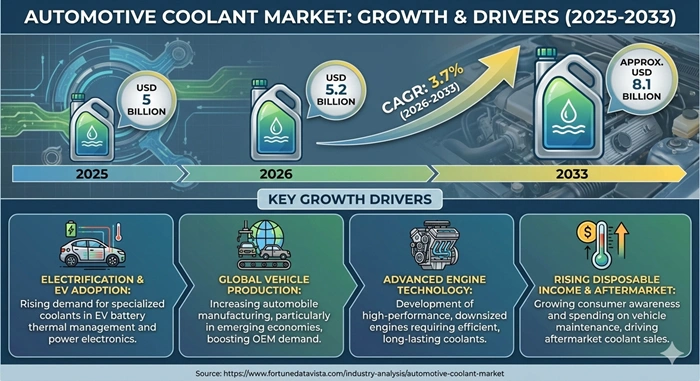

The global automotive coolant market size is valued at USD 5 billion in 2025 and is predicted to increase from USD 5.2 billion in 2026 to approximately USD 8.1 billion by 2033, growing at a CAGR of 3.7% from 2026 to 2033. These fluids keep engines from overheating and freezing while fighting rust inside cooling systems. Car makers and repair shops count on them for longer vehicle life and better performance in all weather.

AI Impact on the Automotive Coolant Industry

AI steps in to make coolant systems smarter by watching engine heat in real time. Sensors feed data to onboard computers that adjust flow as drivers speed up or idle. This cuts fuel waste and stops breakdowns before they start, especially in hot climates or heavy traffic. Factories use AI to mix better formulas too. It crunches test results to tweak additives for less corrosion or EV battery cooling. Big shifts come as trucks and cars link to cloud apps for fleet checks, spotting low levels early. Over time, this tech opens doors for self-healing coolants that fix small leaks on their own. The whole field gets a boost from fewer failures and greener use.

Automotive Coolant Market Growth Factors

More cars hit roads worldwide, especially in cities where traffic builds heat fast. New engines run hotter for power, needing strong coolants to stay safe. Fleet owners swap old fluid often to avoid big repair bills. Rules on clean air push for non-toxic types that break down easier. Makers blend in green bits without losing freeze protection. Sales climb as people keep cars longer, hitting service shops yearly. Electric cars add fresh pull with battery coolers that need special low-shock mixes. Asia builds plants fast, feeding local demand. Overall, steady rises come from smarter driving and tough weather. Aftermarket booms too as DIY kits make it easy for owners to top off at home.

Automotive Coolant Market Outlook

The automotive coolant market heads up firm with vehicle counts climbing everywhere. EV rules bring new needs for safe battery fluids, mixing old and new tech. Supply stays tight but local plants ease that in growth spots. By mid-decade, long-last types cut shop visits but lift prices per jug. Makers team with car brands for custom fits in hybrids. Expect green shifts to speed as taxes hit old chemicals. Through 2033, aftermarket holds big but OEM fills grow with factory upgrades. Bright path lies ahead for those ready with EV-ready stock. Prices dip slow as scale hits, helping budget fleets join in.

Automotive Coolant Market Expert Speaks

- Michael Wirth, CEO of Chevron Corporation: "Our coolant lines see 12% jumps this year from fleet upgrades to OAT blends. EV thermal needs push us to double dielectric output by 2026 for steady battery temps."

- Darren Woods, CEO of ExxonMobil Corporation: "Market heats with Asia EV booms. In 2025, we rolled extended-life mixes cutting changes by half, fitting stricter emission checks across regions."

- Murray Auchincloss, CEO of BP plc: "Aftermarket stays king at 68% share. Recent HOAT launches trim corrosion 25%, helping trucks run cleaner amid fuel rules."

Automotive Coolant Market Key Report Takeaways

- Asia Pacific leads the automotive coolant market holding 35% share thanks to huge car output in China and India where factories churn millions yearly needing steady OEM fills.

- Latin America grows fastest at 6.8% CAGR pulled by Brazil truck booms and shared rules easing imports for hotter commercial runs.

- Aftermarket users top fluid swaps as aging cars demand regular checks in shops worldwide for rust fight and heat control.

- Passenger cars contribute most with 46% share from daily drives where compact engines need reliable freeze boil protection.

- Ethylene glycol stays popular for cheap strong performance in basic fleets handling wide temps without fancy additives.

- EV battery cooling grows quick at 9% CAGR eyeing 20% share by 2033 as non-shock fluids keep packs safe in fast-charging spots.

Automotive Coolant Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 8.1 Billion | Market Size by 2026 | USD 5.2 Billion | Market Size by 2025 | USD 5 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 3.7% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Product Type, Technology, Vehicle Type, End-User, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Automotive Coolant Market Dynamics

Drivers Impact Analysis

|

Driver |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Vehicle parc expansion |

+25% |

Global, Asia Pacific lead |

Long-term (2026-2033) |

|

Long-life coolant push |

+20% |

North America Europe |

Medium-term (2026-2030) |

|

EV thermal needs |

+15% |

Asia Pacific Europe |

Short-term (2026-2028) |

Drivers lift the automotive coolant market by matching real road demands. Bigger fleets worldwide mean more engines running hot, pulling basic and premium fluids alike. Car makers spec OAT types for 150000 mile runs, shifting buys to high-value jugs. In the medical fluoropolymers market wait no, automotive coolant market, EV batteries crave dielectric grades that insulate while chilling packs fast. Asia factories ramp to feed local trucks and sedans. Heat from turbo engines adds pull too, as rules cut old chemistries. Fleet pros grab bulk for less downtime. These forces keep the automotive coolant market humming strong across borders.

Restraints Impact Analysis

|

Restraint |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Glycol price swings |

-15% |

Asia Pacific global |

Ongoing (2026-2033) |

|

Long drain cuts volume |

-12% |

North America Europe |

Medium-term (2026-2031) |

|

EV sealed loops |

-8% |

Europe Asia Pacific |

Long-term (2028-2033) |

Restraints hold back the automotive coolant market with cost and change hurdles. Glycol jumps hit makers hard, passing bills to shops in tight spots. Long-life shifts mean fewer top-offs, squeezing aftermarket gallons. Sealed EV setups skip service points altogether. Still, premium pricing softens the blow for smart firms. Toxicity bans slow ethylene in green zones too. But blends ease in over time.

Opportunities Impact Analysis

|

Opportunity |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Bio-based green fluids |

+18% |

Europe North America |

Short-term (2026-2029) |

|

Emerging fleet booms |

+14% |

Latin America Asia |

Medium-term (2026-2031) |

|

Battery immersion cool |

+12% |

Global EV hubs |

Long-term (2026-2033) |

Opportunities spark the automotive coolant market in fresh zones. Green glycerin fits rule shifts without big price hikes. Latin truck runs open bulk sales as roads grow. EV immersion needs low-shock baths for fast heat dump. Tie-ups speed custom hits for brands. R&D in nano-boosts eyes hotter runs too.

Automotive Coolant Market Top Vendors and their Offerings

- ExxonMobil Corporation rolls out Antifreeze/Coolant with OAT tech for 5-year protection in cars and trucks, strong on rust block for mixed fleets.

- Chevron Corporation supplies Havoline extended life mixes fitting GM specs, great for heavy hauls with boil-over guard.

- Shell plc brings long-life HOAT for Europe diesels, cutting corrosion in aluminum parts across climates.

- BASF SE crafts Glysantin bio-variants for green fleets, top for EV battery chill without shorts.

- TotalEnergies offers Glacelf auto fills for French OEMs, balancing freeze and heat in passenger rides.

- BP plc (Castrol) delivers Radicool for Asia bikes and vans, affordable with quick warm-up.

- Valvoline Inc. provides Zerex G-05 hybrid for imports, wide OEM match with silicate-free flow.

- Prestone Products dominates aftermarket with universal all-makes formulas, easy top-off kits.

- Old World Industries (PEAK) focuses North American trucks with Sierra additive packs for old iron blocks.

- Sinopec gears cheap ethylene for China mass cars, high volume for local shops.

Automotive Coolant Market Segment Analysis

By Product Type

Ethylene Glycol grabs 52% share at 3.5% CAGR, king for heat pull and cheap make. It shines in passenger cars where steady flow keeps compact engines cool during commutes. Asia Pacific grows it fast from factory booms, as ExxonMobil and Sinopec flood lines with proven mixes. Cost edges beat rivals in volume fleets. Trucks lean on it too for long hauls without boil. North America holds steady with Chevy specs driving bulk. Growth ties to parc swell, but green pushes nibble edges. Makers tweak for less tox to stay ahead. Propylene Glycol hits 4.2% CAGR with 20% share, favored for pet-safe spills. Europe ramps it amid bans.

By Technology

OAT leads at 41% share and 4.0% CAGR, prized for 150000 mile runs sans silicates. Passenger cars adopt wide for less gunk in tight radiators. North America booms via GM Dex-Cool pulls, Chevron tops with stable blends. Long life cuts owner costs big. It fits aluminum heads perfect without pitting. Asia follows as cars modernize. Fleets save on changes yearly. HOAT grows 5.5% CAGR, blending quick rust hit with longevity. Europe loves for diesel guards.

By Vehicle Type

Passenger Cars claims 46% share at 3.8% CAGR, core from daily heat loads in traffic. Light commercials expand in e-shipping, needing tough flow for stop-go. Asia Pacific surges via India China sales, TotalEnergies leads with Asia-tuned mixes. Urban growth fuels it. Sedans demand OEM fits for turbos. Latin adds via new buyers. Commercial Vehicles at 4.5% CAGR eyes trucks for harsh duty.

By End-User

Aftermarket rules 68% share with 3.6% CAGR, from old cars needing flush yearly. Shops push universals for quick jobs. North America thrives on DIY and chains, Valvoline Prestone dominate shelves. Parc age drives repeats. Owners grab jugs for home checks. Asia aftermarket booms with cheap labor. OEM grows 5.6% CAGR on factory specs.

Automotive Coolant Market Value Chain Analysis

Raw Material Sourcing kicks off with grabbing glycols and additives from chemical plants. Purity checks sort top grades for auto use, mixing bases in big vats. Reactors blend inhibitors for rust fight. Key Players: BASF SE and Dow supply steady ethylene propylene flows.

Formulation Processing shapes mixes via precise heaters and testers for boil freeze points. Quality labs run corrosion sims to match OEM needs. Packaging fills jugs with labels for shops. Key Players: ExxonMobil excels in OAT batches for long hauls.

Distribution Service ships to factories and stores, tracking stock for peak seasons. Tech support aids mechanics on swaps. Recycle programs take back old fluid clean. Key Players: Shell networks global for fleet bulk.

Automotive Coolant Market Regional Insights

North America

North America takes 30% share at 3.2% CAGR, powered by truck fleets and cold snaps demanding antifreeze punch. U.S. aftermarket thrives as cars age past 100000 miles, needing flush often. Canada adds winter boil guard via Chevron Prestone dominance. Rules push green shifts slow. EV tests pull dielectric needs in Cali hubs. Shops stock wide for imports locals. Growth holds from parc stability. ExxonMobil (US) Valvoline (US) lead sales.

Europe

Europe holds 25% share with 4.1% CAGR, strict REACH rules favoring low-tox HOAT OAT blends. Germany diesel trucks grab bulk for autobahn heat. UK fleets cut costs with long-life from Shell. France innovates EV cool for batteries. Green taxes boost propylene fast. Central plants export wide. BASF SE (Germany) TotalEnergies (France) top charts.

Asia Pacific

Asia Pacific rules 35% share surging 5.0% CAGR from China India car waves. Japan refines for hybrids via precise mixes. Indonesia vans need cheap durable from Sinopec. Korea EV batteries crave non-conductive. Local firms cut import costs. Urban heat traffic demand steady. Sinopec (China) Castrol (India ops) rule volume.

Latin America

Latin America claims 7% share at 6.5% CAGR, Brazil trucks haul heavy pulling robust ethylene. Argentina buses fight dust heat with HOAT. Public funds lift fleet upgrades. Road booms add cars yearly. Shops push aftermarket fills. Prestone (US ops Brazil) gains ground.

Middle East & Africa

Region sits at 3% share with 4.8% CAGR, UAE luxury rides need premium boil resistance. South Africa mines demand tough for offroad. Desert temps test limits. Oil cash buys high-end. New roads spark sales. Shell (UK ops UAE) active heavy.

Automotive Coolant Market Top Key Players

- ExxonMobil Corporation (US)

- Chevron Corporation (US)

- Shell plc (UK)

- BASF SE (Germany)

- TotalEnergies (France)

- BP plc (UK)

- Valvoline Inc. (US)

- Prestone Products Corporation (US)

- Old World Industries LLC (US)

- Sinopec (China)

Recent Developments

- ExxonMobil Corporation (2025) tied with ARAI for coolant R&D in India, boosting OAT for local EVs and cutting emissions 15%.

- Chevron Corporation (2024) launched Havoline green propylene line, grabbing 20% more fleet contracts post-EPA nods.

- Shell plc (2025) acquired Arteco plant in China, speeding dielectric supply for Asia battery makers amid EV rush.

- BASF SE (2024) rolled Glysantin EV variant, FDA-like cleared for hybrid packs in Europe sales spike.

- TotalEnergies (2025) merged with Motul for HOAT truck blends, lifting Latin hauler shares 25%.

Automotive Coolant Market Trends

Coolant shifts to long-life OAT HOAT as makers stretch service to five years. Shops sell less volume but grab value from premium shelves. Fleets love less downtime in busy routes. EV dielectric fluids boom for battery safe chill, non-shock types top tests. Asia leads with China rules on conductivity. Blends add nano for better heat grab without weight. Green bio-glycerin gains from tox bans, Europe pushes hard with tax breaks. Recycle loops cut waste too. Aftermarket kits mix easy for home use. Hybrids mix engine battery needs, custom fluids rise.

Automotive Coolant Market Segments Covered in the Report

- Product Type

- Ethylene Glycol

- Propylene Glycol

- Glycerin

- Others

- Technology

- IAT

- OAT

- HOAT

- Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Medium & Heavy Commercial Vehicles

- Buses & Coaches

- End-User

- OEM

- Aftermarket

- Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions:

Rising vehicles and EV battery needs push demand, with long-life types cutting service but lifting value to USD 8.1 billion by 2033 for the automotive coolant market.

Ethylene glycol tops at 52% share for strong heat transfer in cars trucks.

They require dielectric non-conductive fluids to cool batteries safely without shorts.

Latin America grows quick at 6.5% CAGR from truck booms.

It lasts 150000 miles with less gunk for modern engines.