Benzene Market Overview

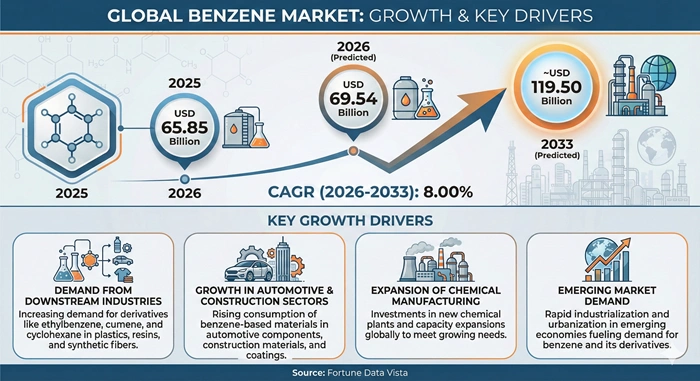

The global benzene market size is valued at USD 65.85 billion in 2025 and is predicted to increase from USD 69.54 billion in 2026 to approximately USD 119.50 billion by 2033, growing at a CAGR of 8.00% from 2026 to 2033. Benzene serves as a fundamental petrochemical building block used extensively across industries including plastics, synthetic fibers, resins, pharmaceuticals, and automotive manufacturing. The expanding demand for benzene derivatives like ethylbenzene, cumene, and cyclohexane continues driving substantial market expansion globally.

Benzene is an aromatic hydrocarbon compound consisting of six carbon atoms arranged in a stable ring structure, making it highly valuable for industrial chemical synthesis. This colorless, volatile liquid plays a critical role in producing styrene polymers for packaging applications, phenolic resins for construction materials, and various pharmaceutical intermediates. Growing consumption patterns in emerging economies combined with technological improvements in production efficiency have positioned the benzene market for sustained growth throughout the forecast period.

AI Impact on the Benzene Industry

Transforming Production Efficiency and Supply Chain Optimization Through Advanced Technologies

Artificial intelligence is revolutionizing benzene production by enabling predictive maintenance systems that minimize unplanned downtime in refineries and petrochemical plants. Machine learning algorithms analyze real-time sensor data from catalytic reforming and steam cracking units, identifying potential equipment failures before they occur and optimizing operational parameters for maximum yield efficiency. These intelligent systems help producers reduce energy consumption by 8-12% while improving benzene extraction rates from naphtha feedstocks, directly impacting profitability across the benzene market landscape.

Advanced AI-driven demand forecasting models are transforming how benzene manufacturers manage inventory levels and distribution networks. Natural language processing tools scan global news, regulatory updates, and economic indicators to predict downstream consumption patterns in styrene, cumene, and cyclohexane sectors with unprecedented accuracy. This technological integration allows benzene market participants to respond proactively to supply disruptions, optimize pricing strategies, and maintain competitive advantages in volatile market conditions while ensuring consistent product availability for end-use industries.

Growth Factors

Rising Automotive Sector Demand and Expanding Packaging Applications Fueling Market Expansion

The automotive industry's rapid growth, particularly in electric vehicle manufacturing, is creating substantial demand for benzene derivatives used in lightweight composite materials, synthetic rubber components, and interior finishing products. Ethylbenzene derived from benzene serves as the primary precursor for styrene production, which finds extensive application in manufacturing durable automotive parts, shock-absorbing materials, and aesthetic components. The benzene market benefits significantly from this automotive sector expansion, with Asia Pacific leading global vehicle production volumes and driving corresponding raw material requirements.

E-commerce expansion and modern retail packaging requirements are generating unprecedented demand for polystyrene materials, a key benzene derivative used in protective packaging solutions. Online retailers depend heavily on polystyrene foam containers, cushioning materials, and insulation products to safely transport fragile items across continents. The benzene market is experiencing accelerated growth as packaging industries seek cost-effective, lightweight materials that provide excellent moisture resistance and structural integrity. This trend intensifies particularly in Southeast Asian and North American regions where e-commerce penetration rates continue climbing rapidly, creating sustained upward pressure on benzene consumption volumes.

Market Outlook

Strategic Industry Positioning Amid Regulatory Challenges and Sustainability Transitions

The benzene market faces an evolving landscape shaped by increasingly stringent environmental regulations governing aromatic hydrocarbon emissions and workplace exposure limits. North American and European producers navigate complex compliance requirements, with OSHA mandating benzene exposure limits below 1 ppm in occupational settings, adding operational costs estimated at USD 5-10 per ton. These regulatory pressures are prompting industry consolidation, with smaller production facilities shutting down while larger integrated complexes invest in advanced emission control technologies and closed-loop systems that minimize environmental impact while maintaining production efficiency.

Innovation in sustainable benzene production methods is gaining momentum as petrochemical companies explore bio-based feedstock alternatives and circular economy approaches. Research initiatives focus on developing benzene from renewable sources including biomass pyrolysis and catalytic conversion of plant-derived aromatics, potentially reducing dependence on fossil fuel feedstocks. The benzene market is witnessing increased investment in green chemistry applications, with major producers committing resources to develop environmentally responsible production pathways that align with global decarbonization goals while meeting growing derivative demand from construction, pharmaceutical, and consumer goods sectors through 2033.

Expert Speaks

-

Markus Kamieth, CEO of BASF SE, emphasized that "Chemical production must balance profitability with sustainability, and investments in circular economy solutions will define industry leaders in the coming decade as regulatory landscapes evolve globally."

-

Darren Woods, CEO of ExxonMobil Corporation, stated that "Petrochemical demand growth in Asia Pacific remains robust, and our strategic expansions in integrated facilities position us to capture emerging market opportunities while optimizing operational efficiencies."

-

Yousef Al-Benyan, CEO of Saudi Basic Industries Corporation (SABIC), highlighted that "Innovation in feedstock flexibility and downstream integration creates resilience against market volatility, enabling sustained value creation across aromatics and derivatives value chains."

Key Report Takeaways

-

Asia Pacific dominates the benzene market with a commanding 48.5% revenue share, driven by China's massive consumption in automotive and construction sectors alongside South Korea's strong export capabilities

-

Asia Pacific represents the fastest-growing region with substantial CAGR expansion fueled by rapid industrialization, infrastructure development projects, and growing middle-class consumer demand patterns

-

Ethylbenzene derivative segment captures the largest market share at 55.80% due to extensive styrene production applications in electronics, plastics, rubber manufacturing, and automobile component industries

-

Catalytic reforming production process leads with 52.6% market share, delivering high aromatic hydrocarbon yields and valuable hydrogen byproducts that enhance overall refinery economics

-

Packaging and automotive applications contribute most significantly to benzene consumption, with styrene-based polymers addressing growing e-commerce packaging needs and lightweight vehicle manufacturing requirements

-

Cumene segment projected as fastest-growing derivative with accelerating demand from paints, coatings, chemicals, construction, and electronics sectors driving double-digit CAGR expansion through 2033

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 119.50 Billion | Market Size by 2026 | USD 69.54 Billion | Market Size by 2025 | USD 65.85 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 8.00% | Dominating Region | Asia Pacific | Fastest Growing Region | Asia Pacific | Segments Covered | Derivative, Production Process, End-Use, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

Expanding Styrene Polymer Demand and Pharmaceutical Intermediate Requirements

| Factor | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rising Styrene Polymer Consumption | +2.8% | Global (Asia Pacific dominant) | 2026-2033 |

| Pharmaceutical Intermediate Growth | +1.5% | North America, Europe, Asia Pacific | 2026-2033 |

| Automotive Sector Expansion | +1.9% | Asia Pacific, North America | 2026-2033 |

Styrene-based polymers represent one of the most significant growth drivers for the benzene market, with applications spanning packaging materials, automotive components, electronic housings, and construction products. Polystyrene production consumes approximately 55-60% of global ethylbenzene output, creating direct demand linkages between benzene procurement and downstream polymer manufacturing volumes. The benzene market experiences sustained upward momentum as packaging industries adopt lightweight, moisture-resistant materials for food service applications, while automotive manufacturers increasingly specify styrene polymers for interior trim components, dashboard elements, and structural reinforcements that reduce vehicle weight and improve fuel efficiency.

Pharmaceutical companies rely extensively on benzene derivatives as starting materials and intermediates in synthesizing complex drug molecules, antibiotics, analgesics, and specialty medications. Nitrobenzene serves as a precursor for aniline production, which feeds into pharmaceutical synthesis pathways for active ingredients in pain relievers, antibiotics, and agricultural chemicals. The benzene market benefits from pharmaceutical industry growth in both developed and emerging markets, with increasing healthcare access, aging populations, and chronic disease prevalence driving sustained demand for benzene-based intermediates throughout the forecast period, particularly in regions with expanding generic drug manufacturing capabilities.

Restraints Impact Analysis

Environmental Regulations and Health Concerns Limiting Market Growth

| Factor | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Strict Emission Regulations | -1.2% | North America, Europe | 2026-2033 |

| Toxicity and Carcinogenicity Concerns | -0.8% | Global | 2026-2033 |

| Volatile Feedstock Prices | -1.0% | Global | 2026-2033 |

Increasingly stringent environmental regulations governing benzene emissions and workplace exposure present significant operational challenges for benzene market participants, particularly in developed regions. OSHA regulations in North America mandate exposure limits below 1 ppm in occupational settings, requiring costly engineering controls, continuous monitoring systems, and personal protective equipment that add USD 5-10 per ton to production costs. European Union directives impose strict ambient air quality standards for benzene concentrations, prompting refinery upgrades and emission control investments that impact profit margins and discourage capacity expansions in mature markets.

Benzene's classification as a known human carcinogen creates ongoing health concerns that limit its direct consumer applications and drive substitution efforts in certain end-use segments. Prolonged benzene exposure is linked to blood disorders, bone marrow damage, and increased leukemia risk, necessitating strict handling protocols and limiting its use in consumer products where safer alternatives exist. These health considerations influence the benzene market by constraining demand growth in solvent applications while accelerating research into bio-based alternatives and closed-loop production systems that minimize worker exposure and environmental releases throughout the petrochemical value chain.

Opportunities Impact Analysis

Bio-Based Production and Emerging Market Expansion Creating Growth Avenues

| Factor | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Bio-Based Benzene Development | +0.9% | North America, Europe | 2028-2033 |

| Infrastructure Development in Emerging Markets | +1.7% | Asia Pacific, Latin America, Middle East | 2026-2033 |

| Circular Economy Initiatives | +0.7% | Global | 2027-2033 |

Development of bio-based benzene production pathways represents a transformative opportunity for the benzene market, addressing sustainability concerns while maintaining chemical functionality in downstream applications. Research initiatives explore catalytic pyrolysis of lignocellulosic biomass, enzymatic conversion of plant aromatics, and microbial fermentation routes that produce benzene from renewable feedstocks without relying on fossil fuel derivatives. These technological advances position benzene market participants to capture premium pricing in green chemistry applications while satisfying corporate sustainability commitments from automotive, packaging, and construction sectors seeking lower-carbon raw materials throughout their supply chains.

Massive infrastructure investments across emerging economies in Asia Pacific, Middle East, and Latin America are creating unprecedented demand opportunities for benzene market participants. Construction projects require phenolic resins for adhesives and binders, nylon-6 fibers for geotextiles and reinforcement materials, and polystyrene insulation products for energy-efficient buildings. The benzene market stands to benefit substantially from urbanization trends, with an estimated 2.5 billion people expected to move into urban areas by 2030, primarily in developing regions where infrastructure gaps remain substantial and construction activity maintains robust growth trajectories throughout the forecast period.

Segment Analysis

Ethylbenzene Derivative

Dominant Market Position Driven by Styrene Polymer Applications

Ethylbenzene commands the largest share in the benzene market at 55.80%, functioning as the essential precursor for styrene monomer production that feeds diverse industrial applications. This derivative segment maintains its leadership position through deep integration into manufacturing value chains spanning packaging materials, automotive components, electronic device housings, and construction products. Asia Pacific dominates ethylbenzene consumption with approximately 62% regional share, driven by China's massive styrene production capacity exceeding 10 million tons annually and expanding polystyrene demand from e-commerce packaging sectors. Major producers including BASF SE, LyondellBasell Industries, and China Petrochemical Corporation operate large-scale integrated facilities in coastal Chinese provinces, capitalizing on proximity to downstream styrene polymerization plants and export terminals serving Southeast Asian markets.

The ethylbenzene segment demonstrates exceptional resilience in the benzene market due to styrene's irreplaceable properties in producing expandable polystyrene (EPS) and solid polystyrene (GPPS) grades used across construction insulation, protective packaging, and consumer goods applications. North American ethylbenzene production concentrates along the U.S. Gulf Coast, where integrated petrochemical complexes operated by Chevron Phillips Chemical Company and ExxonMobil Corporation process benzene feedstocks into styrene for regional automotive and appliance manufacturing sectors. The segment maintains projected CAGR of 6.9% through 2033, supported by lightweight material adoption in electric vehicle production, growing food service packaging requirements, and expanding electronic device manufacturing throughout Asia Pacific economies experiencing rising middle-class consumption patterns.

Cumene Derivative

Fastest-Growing Segment Propelled by Phenol and Acetone Demand

Cumene represents the fastest-expanding derivative in the benzene market, capturing 19.8% market share with projected CAGR of 9.2% through 2033 as phenol and acetone demand accelerates across multiple industrial sectors. This derivative serves as the exclusive precursor for cumene-to-phenol-acetone production processes, making it indispensable for manufacturing phenolic resins, bisphenol-A, caprolactam, and acetone-based solvents used extensively in paints, coatings, adhesives, and engineered plastics. Europe maintains significant cumene production capacity with facilities concentrated in Netherlands, Germany, and Belgium operated by INEOS Group and Royal Dutch Shell, serving regional automotive coating manufacturers and construction material producers requiring high-performance phenolic resin systems for plywood, oriented strand board, and insulation products.

Asia Pacific emerges as the fastest-growing region for cumene in the benzene market, with India and Southeast Asian countries expanding production capacity to meet surging domestic demand from construction, automotive, and electronics industries. Companies including Reliance Industries Limited and SABIC have commissioned new cumene production units in India and Middle East respectively, strategically positioned to capture growing phenol requirements for polycarbonate production used in automotive glazing, electronic device screens, and construction panels. The cumene segment benefits from accelerating infrastructure development across emerging economies, where phenolic resins find application in moisture-resistant plywood for tropical climates, while acetone co-product serves expanding pharmaceutical and cosmetic manufacturing sectors throughout the forecast period.

Regional Insights

Asia Pacific

Market Leadership Through Integrated Production Complexes and Massive Downstream Consumption

Asia Pacific dominates the benzene market with commanding 48.5% global revenue share, anchored by China's position as the world's largest benzene consumer and South Korea's status as a leading exporter. The region benefits from integrated crude-to-chemicals complexes that optimize production economics through feedstock flexibility, while massive downstream styrene, phenol, and cyclohexane capacity absorbs regional benzene output and drives import requirements. Chinese benzene consumption exceeds 15 million tons annually, supporting automotive manufacturing clusters in Guangdong and Jiangsu provinces, construction material production throughout inland regions, and extensive petrochemical derivatives manufacturing in coastal economic zones. Major benzene market participants including China Petrochemical Corporation (Sinopec), China National Petroleum Corporation, and LG Chem operate large-scale production facilities across China, South Korea, and Southeast Asia, capturing economies of scale and logistics advantages serving regional demand centers.

The benzene market in Asia Pacific maintains projected regional CAGR of 8.5% through 2033, representing the fastest global growth rate driven by continued urbanization, infrastructure investments, and rising middle-class consumption patterns. India emerges as a particularly dynamic market, with benzene consumption growing at double-digit rates supporting expanding automotive assembly operations, pharmaceutical API manufacturing, and construction material production for residential and commercial development projects. Key regional players including Reliance Industries Limited, BASF SE's Asian operations, and ExxonMobil Asia Pacific capitalize on favorable demographics, growing industrial base, and government initiatives promoting domestic manufacturing capabilities that sustain robust benzene market expansion throughout the forecast period.

North America

Mature Market Characterized by Integrated Petrochemical Infrastructure and Regulatory Compliance

North America represents a significant benzene market with established production infrastructure concentrated along the U.S. Gulf Coast where integrated petrochemical complexes benefit from abundant shale gas-derived ethane and propane feedstocks. The region maintains 23.7% global market share with mature styrene and cumene derivative industries serving automotive, construction, packaging, and pharmaceutical sectors throughout United States and Canada. U.S. benzene production leverages catalytic reforming units at major refineries operated by ExxonMobil Corporation, Chevron Phillips Chemical Company, Marathon Petroleum Corporation, and LyondellBasell Industries, generating approximately 6 million tons annually to supply domestic downstream consumption while maintaining modest export capacity to Latin American markets.

The North American benzene market demonstrates steady projected CAGR of 6.8% through 2033, supported by automotive sector recovery, residential construction activity, and specialty chemical manufacturing growth despite facing regulatory headwinds from strict environmental and occupational safety standards. Companies including Dow Chemical Company and Royal Dutch Shell operate integrated benzene-to-styrene value chains serving regional polystyrene producers supplying packaging materials for food service and e-commerce applications throughout the continent. Regional market dynamics reflect increasing focus on sustainability initiatives, with producers investing in emission reduction technologies and exploring bio-based benzene pathways that align with corporate environmental commitments while maintaining competitive cost structures in the global benzene market landscape.

Top Key Players

-

BASF SE (Germany)

-

China Petrochemical Corporation (Sinopec) (China)

-

China National Petroleum Corporation (China)

-

ExxonMobil Corporation (United States)

-

Saudi Basic Industries Corporation (SABIC) (Saudi Arabia)

-

Royal Dutch Shell plc (Netherlands)

-

Dow Chemical Company (United States)

-

LyondellBasell Industries Holdings B.V. (Netherlands)

-

Chevron Phillips Chemical Company LLC (United States)

-

Reliance Industries Limited (India)

-

LG Chem (South Korea)

-

INEOS Group (United Kingdom)

-

Marathon Petroleum Corporation (United States)

-

DuPont (United States)

-

TotalEnergies SE (France)

Recent Developments

-

BASF SE announced in 2024 a strategic investment of EUR 850 million to upgrade its Ludwigshafen production complex with advanced catalytic reforming technology, targeting 15% improvement in benzene yield efficiency and significant emission reductions aligned with European Green Deal objectives.

-

China Petrochemical Corporation (Sinopec) completed in 2024 the commissioning of a 1.2 million ton per year integrated benzene-to-styrene complex in Zhejiang Province, expanding its production capacity to serve growing domestic packaging and automotive sectors throughout China's eastern industrial corridor.

-

ExxonMobil Corporation and SABIC finalized in 2025 their joint venture expansion at the Gulf Coast Growth Ventures facility in Texas, adding 500,000 tons of annual benzene production capacity integrated with downstream ethylbenzene and styrene manufacturing units.

-

LyondellBasell Industries acquired in 2024 a specialty benzene derivatives production facility in Singapore for USD 620 million, strengthening its Asia Pacific market position and enhancing supply chain capabilities serving Southeast Asian styrene polymer manufacturers.

-

Reliance Industries Limited inaugurated in 2025 a state-of-the-art cumene production unit at its Jamnagar complex in India with 450,000 tons annual capacity, featuring advanced process technology that reduces energy consumption by 18% compared to conventional production methods.

Market Trends

Sustainability Transitions and Digital Transformation Reshaping Industry Practices

The benzene market is witnessing accelerating adoption of circular economy principles, with major producers exploring chemical recycling pathways that recover benzene from post-consumer polystyrene waste and other aromatic-containing materials. Companies are investing in pyrolysis technologies and solvent-based depolymerization processes that break down styrenic polymers back into constituent monomers and benzene feedstocks, creating closed-loop systems that reduce fossil fuel dependence. This trend gains particular momentum in Europe where Extended Producer Responsibility regulations mandate minimum recycled content in packaging materials, while North American producers respond to corporate sustainability commitments from major brand owners seeking lower-carbon raw material alternatives for the benzene market.

Digital transformation initiatives are revolutionizing operational efficiency throughout the benzene market, with producers implementing industrial Internet of Things sensors, advanced process control algorithms, and artificial intelligence-powered predictive maintenance systems across production facilities. These technologies enable real-time optimization of catalytic reforming units, precise monitoring of benzene quality parameters, and proactive identification of equipment degradation patterns before failures occur. Integration of blockchain-based supply chain tracking systems enhances transparency for downstream customers requiring verified sustainable sourcing credentials, while cloud-based market intelligence platforms provide benzene market participants with enhanced price forecasting capabilities and demand pattern recognition tools that support strategic procurement and capacity utilization decisions throughout the forecast period.

Segments Covered in the Report

By Derivative:

-

Ethylbenzene

-

Cumene

-

Cyclohexane

-

Nitrobenzene

-

Alkylbenzene

-

Others

By Production Process:

-

Catalytic Reforming

-

Steam Cracking

-

Toluene Hydrodealkylation

-

Others

By End-Use:

-

Plastics & Polymers

-

Resins

-

Synthetic Fibers

-

Rubber

-

Detergents

-

Pharmaceuticals

-

Agrochemicals

-

Paints & Coatings

-

Others

By Region:

-

North America (United States, Canada, Mexico)

-

Europe (Germany, United Kingdom, France, Italy, Spain, Netherlands, Belgium, Rest of Europe)

-

Asia Pacific (China, India, Japan, South Korea, Southeast Asia, Australia, Rest of Asia Pacific)

-

Latin America (Brazil, Argentina, Rest of Latin America)

-

Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of Middle East & Africa)

Frequently Asked Questions:

Answer: The global benzene market is projected to reach USD 119.50 billion by 2033. This growth reflects expanding demand from automotive, packaging, construction, and pharmaceutical industries worldwide.

Answer: Asia Pacific leads the benzene market with 48.5% global share. China's massive consumption and South Korea's strong production capacity drive this regional dominance.

Answer: The benzene market is expected to grow at a CAGR of 8.00% from 2026 to 2033. Rising styrene polymer demand and pharmaceutical intermediate requirements fuel this expansion.

Answer: Ethylbenzene captures the largest benzene market share at 55.80%. Its dominance stems from extensive use in styrene production for packaging and automotive applications.

Answer: Key benzene market growth drivers include expanding automotive manufacturing, e-commerce packaging demand, pharmaceutical intermediate requirements, and infrastructure development. Asia Pacific's rapid industrialization particularly accelerates consumption patterns.