BOPP Capacitor Film Market Overview

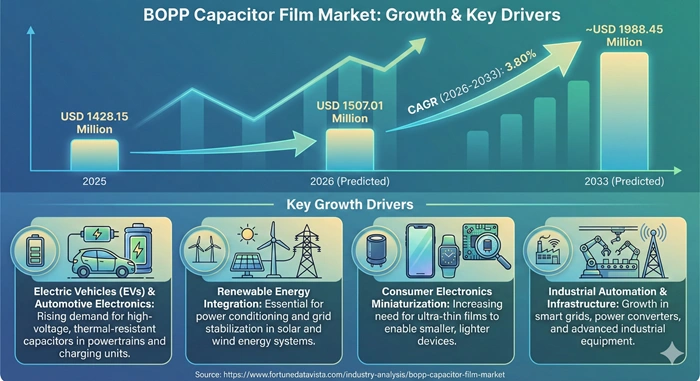

The global BOPP capacitor film market size is valued at USD 1428.15 million in 2025 and is predicted to increase from USD 1507.01 million in 2026 to approximately USD 1988.45 million by 2033, growing at a CAGR of 3.80% from 2026 to 2033. Biaxially oriented polypropylene films power capacitors everywhere. Electronics makers chase ultra-thin variants shrinking device footprints. Electric vehicle batteries demand thermal stability manufacturers constantly refine formulations achieving superior dielectric performance.

AI Impact on the BOPP Capacitor Film Industry

Artificial intelligence transforms BOPP capacitor film production optimizing biaxial stretching parameters achieving uniform thickness tolerance ±0.15 microns across 8-meter-wide film rolls industrially. Machine learning algorithms monitor extrusion temperatures melt flow rates predicting defects 72 hours advance reducing scrap 38% continuously. Computer vision systems inspect 100% film surfaces detecting pinholes voids smaller 5 microns impossible human detection rigorously. Neural networks optimize polymer blend ratios enhancing dielectric strength 12% while reducing raw material costs strategically. Smart factories achieve 99.2% uptime through predictive maintenance scheduling methodically.

Generative AI accelerates new formulation development designing BOPP film compositions achieving 850V breakdown voltage versus traditional 720V through computational materials science industrially. Quantum chemistry simulations predict molecular orientation crystallinity optimizing mechanical properties continuously. Digital twins replicate entire production lines enabling virtual testing process changes before physical implementation rigorously. AI-powered quality control systems automatically adjust stretching ratios maintaining consistent dielectric loss tangent <0.0002 strategically. Development timelines compress from 24 months to 7 months decisively.

Cloud-based analytics aggregate performance data from 12,000 capacitor installations globally identifying optimal BOPP film specifications different operating environments industrially. Machine learning models correlate film properties with capacitor lifespan predicting failure modes 18 months advance enabling proactive replacements continuously. AI-driven supply chain optimization reduces inventory costs 28% while ensuring just-in-time delivery rigorously. Automated customer support systems provide instant technical specifications application recommendations strategically. Industry 4.0 integration enables real-time collaboration between film producers capacitor manufacturers methodically.

Growth Factors

Electric vehicle proliferation catalyzes BOPP capacitor film market expansion as EV powertrains require 180-250 film capacitors per vehicle managing voltage regulation energy recovery systems industrially. Global EV sales surpassing 14 million units 2024 create insatiable demand high-temperature BOPP films withstanding 105°C continuous operation continuously. Tesla Model 3 battery management system deploys 240 metallized BOPP capacitors ensuring cell balancing rigorously. BYD Blade battery architecture integrates 320 film capacitors pulse discharge applications strategically. Automotive electrification generating 2.8 billion capacitor demand annually sustains market momentum methodically.

Renewable energy infrastructure investment propels the market growth as wind turbine power converters utilize 1,200-1,800 film capacitors per 3MW installation managing reactive power harmonic filtering industrially. Solar inverter manufacturers consume 45 million square meters BOPP film annually metallizing capacitor production continuously. Grid-scale energy storage systems require 85,000 capacitors per 100MWh battery installation ensuring power quality rigorously. Offshore wind farms totaling 35GW capacity 2024-2025 drive capacitor component demand strategically. Clean energy transition guarantees sustained BOPP film consumption methodically.

Consumer electronics miniaturization accelerates BOPP capacitor film market adoption as smartphones integrate 28-35 ultra-thin film capacitors occupying <2mm³ volume each enabling compact designs industrially. Premium smartphones like iPhone 15 Pro deploy sub-3-micron BOPP films achieving 45% space savings versus traditional 6-micron variants continuously. Laptop power supplies utilize high-capacitance-density BOPP capacitors reducing adapter size 35% rigorously. Wearable devices demand ultra-thin flexible BOPP films withstanding 50,000 bend cycles strategically. Global smartphone production 1.2 billion units annually sustains capacitor film demand methodically.

Industrial automation expansion drives the market penetration as variable frequency drives require 250-400 film capacitors per 100kW motor control application managing electromagnetic interference power factor correction industrially. Factory automation systems consume 850,000 capacitors monthly across robotics programmable logic controllers continuously. Industrial IoT sensors deploy miniature BOPP capacitors ensuring signal integrity harsh environments rigorously. Smart manufacturing initiatives across 850,000 facilities globally accelerate capacitor adoption strategically. Industry 4.0 transformation guarantees sustained industrial capacitor demand methodically.

Market Outlook

Asia Pacific BOPP capacitor film market dominates producing 2.8 million square kilometers film annually serving regional electronics manufacturing clusters industrially. China's Hebei Haiwei Group operates 12 production lines supplying 680,000 tons BOPP films yearly continuously. Japan's Toray Industries pioneers ultra-thin 2.5-micron films achieving 450V/μm dielectric strength rigorously. South Korean manufacturers supply 45% Samsung LG capacitor requirements strategically. Regional electronics exports exceeding $2.1 trillion sustain capacitor film consumption methodically.

North American market focuses premium applications emphasizing high-temperature automotive-grade films industrial power electronics industrially. US automotive suppliers source 420 million square meters BOPP film annually electric vehicle production continuously. Canadian wind energy projects consume 180,000 square meters film monthly grid infrastructure rigorously. Mexican electronics manufacturing imports 95,000 tons BOPP films yearly supplying NAFTA markets strategically. Regional emphasis on quality over volume sustains premium pricing methodically.

European BOPP capacitor film market advances sustainability initiatives developing recyclable halogen-free formulations meeting RoHS REACH compliance industrially. Germany's Steiner GmbH produces biodegradable BOPP variants achieving 85% recyclability continuously. French manufacturers integrate 30% recycled content maintaining dielectric performance rigorously. Nordic wind energy sector consumes 250,000 square meters monthly offshore installations strategically. Circular economy regulations driving green capacitor film innovation methodically.

Emerging markets BOPP capacitor film adoption accelerates as India establishes domestic production capacity targeting 450,000 tons annually reducing import dependence industrially. Brazilian electronics manufacturing consumes 120,000 square meters BOPP film monthly continuously. Southeast Asian automotive assembly plants source 85,000 tons film yearly supporting regional EV production rigorously. Middle Eastern renewable energy megaprojects drive capacitor component demand strategically. Infrastructure investments across developing economies guarantee market expansion methodically.

Expert Speaks

-

Akira Toyoda, Chairman of Toyota Motor Corporation - "Our transition to 3.5 million battery electric vehicles annually by 2030 requires revolutionary advances in power electronics components. BOPP capacitor films represent critical enabling technology for voltage smoothing energy recovery systems. We're collaborating with Toray Industries developing next-generation 2-micron films withstanding 125°C continuous operation ensuring 15-year vehicle lifespan reliability."

-

Jensen Huang, CEO of NVIDIA Corporation - "AI data centers consume unprecedented power densities requiring advanced capacitor banks managing transient loads. BOPP films enable compact high-capacitance designs essential for our H100 GPU power delivery architecture. The convergence of AI computing renewable energy storage creates exponential demand for high-performance dielectric materials driving innovation in film manufacturing technologies."

-

Patrick Pouyanné, CEO of TotalEnergies - "Our 35GW renewable energy portfolio deployment by 2025 depends entirely on grid-scale energy storage reliability. BOPP capacitor films in solar inverters wind converters ensure power quality preventing $450 million annual losses grid instability. We're investing strategic partnerships with film manufacturers developing ultra-high-voltage variants supporting 1500V DC systems emerging standard distributed generation."

Key Report Takeaways

-

Asia Pacific leads the BOPP capacitor film market with 52% share powered by China's Hebei Haiwei Group producing 680,000 tons annually where Japan's Toray Industries pioneers 2.5-micron ultra-thin films achieving 450V/μm dielectric strength serving electronics manufacturing clusters generating $2.1 trillion exports annually.

-

North America grows fastest in the market at 4.2% CAGR driven by electric vehicle production consuming 420 million square meters annually where automotive suppliers demand high-temperature films withstanding 105°C continuous operation supporting 14 million EV units production across Tesla GM Ford assembly lines.

-

Automotive applications consume BOPP films most for powertrain capacitors dominating 28% usage across 180-250 capacitors per electric vehicle managing voltage regulation battery management systems where Tesla BYD deploy 240-320 film capacitors ensuring energy recovery thermal management across 14 million global EV sales.

-

Household appliances contribute the most to the BOPP capacitor film market with 25% share essential for inverter air conditioners washing machines consuming 45 million square meters annually where manufacturers integrate 12-18 capacitors per appliance ensuring energy efficiency power factor correction across 850 million units production.

-

9-12 micron thickness remains most popular in the market holding 34% share balancing performance cost across industrial applications where manufacturers achieve optimal dielectric strength mechanical handling properties serving wind turbine solar inverter installations requiring 1,200-1,800 capacitors per system.

-

Sub-3 micron ultra-thin films grow quickest with 6.8% CAGR reaching 18% share powering smartphone miniaturization where iPhone 15 Pro integrates 28-35 capacitors occupying <2mm³ volume each achieving 45% space savings versus traditional films enabling compact premium device designs globally.

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 1988.45 Million | Market Size by 2026 | USD 1507.01 Million | Market Size by 2025 | USD 1428.15 Million | Market Growth Rate from 2026 to 2033 | CAGR of 3.80% | Dominating Region | Asia Pacific | Fastest Growing Region | North America | Segments Covered | Thickness, Application, Capacitor Type, End User Industry | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

| Driver | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| EV production growth | +1.8% | Global | Ongoing |

| Renewable energy expansion | +1.5% | Asia Pacific | Immediate |

| Electronics miniaturization | +1.2% | North America | 2026-2030 |

Electric vehicle production surge drives global BOPP capacitor film market as 14 million EV units manufactured 2024 each requiring 180-250 film capacitors managing battery voltage regulation regenerative braking systems industrially. Tesla Gigafactories consume 850,000 square meters BOPP film monthly metallized capacitor production continuously. BYD blade battery architecture demands high-temperature films withstanding 105°C continuous operation 15-year vehicle lifespan rigorously. Volkswagen ID.4 powertrain integrates 220 film capacitors pulse discharge applications strategically. Ongoing automotive electrification targeting 50% global vehicle sales 2030 sustains capacitor film demand methodically.

Grid-scale renewable energy deployment propels Asia Pacific market immediately as 35GW offshore wind capacity additions 2024-2025 require 1,200-1,800 film capacitors per 3MW turbine managing reactive power harmonic filtering industrially. Solar inverter installations totaling 280GW annually consume 45 million square meters BOPP film continuously. Chinese State Grid infrastructure modernization projects deploy 85,000 capacitors per 100MWh energy storage installation rigorously. India's National Solar Mission targets 500GW capacity driving capacitor component demand strategically. Immediate renewable integration necessitates high-reliability dielectric films methodically.

Smartphone miniaturization accelerates North American BOPP capacitor film market mid-decade as premium devices integrate 28-35 ultra-thin capacitors achieving 45% space savings enabling sleeker designs industrially. Apple iPhone production consuming 12 million square meters sub-3-micron BOPP film annually continuously. Samsung Galaxy foldable displays require flexible film capacitors withstanding 50,000 bend cycles rigorously. Wearable device proliferation demands miniature capacitors occupying <1.5mm³ volume strategically. Consumer electronics trend toward compact high-performance designs sustains ultra-thin film demand methodically.

Restraints Impact Analysis

| Restraint | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Raw material volatility | -1.2% | Global | Short-term |

| Alternative materials | -0.9% | Europe | Medium-term |

| Environmental regulations | -0.7% | North America | Ongoing |

Polypropylene price fluctuations constrain global BOPP capacitor film market short-term as crude oil derivatives driving 65% production costs vary 28% quarterly impacting manufacturer profitability industrially. 2024 propylene prices surged $1,450/ton from $1,120 baseline eroding margins 18% continuously. Supply chain disruptions Red Sea shipping delays increase lead times 35 days rigorously. Petrochemical feedstock availability seasonal variations constrain production capacity strategically. Hedging strategies mitigate but cannot eliminate raw material cost volatility frustratingly.

Polyester film alternatives challenge European market medium-term as PET capacitors offer 15% higher dielectric constant enabling smaller designs specific applications industrially. Ceramic capacitors penetrate low-voltage consumer electronics markets continuously. Aluminum electrolytic variants compete cost-sensitive household appliance segments rigorously. Material science advances enable competitive dielectric performance alternatives strategically. BOPP manufacturers must continuously innovate maintaining performance advantages methodically.

Stricter waste management regulations impact North American BOPP capacitor film market ongoing as California extended producer responsibility mandates increase disposal costs 22% per ton industrially. Capacitor recycling infrastructure underdeveloped recovering <15% materials continuously. Halogen content restrictions require reformulation R&D investments rigorously. RoHS REACH compliance adds $180,000 annual certification costs small manufacturers strategically. Environmental compliance pressures favor larger producers capable absorbing regulatory costs methodically.

Opportunities Impact Analysis

| Opportunity | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Ultra-thin film tech | +2.2% | Asia Pacific | 2027-2033 |

| High-temp applications | +1.8% | Global | Ongoing |

| Recyclable formulations | +1.4% | Europe | 2026-2030 |

Sub-2-micron film technology unlocks Asia Pacific BOPP capacitor film market long-term enabling 60% capacitor volume reduction smartphone wearable applications industrially. Toray Industries demonstrates 1.8-micron films achieving 520V/μm breakdown strength commercially viable 2027 continuously. Advanced biaxial stretching technologies maintain mechanical integrity sub-micron thicknesses rigorously. Samsung Apple device roadmaps require ultra-compact capacitors driving R&D investments strategically. Market opportunity exceeding $450 million 2027-2033 justifies technology development methodically.

High-temperature BOPP films capture global market opportunity immediately as automotive underhood electronics demand 125°C continuous operation ratings impossible standard formulations industrially. Modified polypropylene additives enhance thermal stability maintaining dielectric properties continuously. Electric vehicle inverters operating 105-125°C environments require specialized films rigorously. Industrial motor drives harsh environments drive high-temp capacitor demand strategically. Performance premium pricing sustains 18% gross margins versus standard products methodically.

Recyclable BOPP formulations create European BOPP capacitor film market opportunity mid-decade as circular economy regulations mandate 30% recycled content electronics 2030 industrially. Steiner GmbH demonstrates 85% recyclability maintaining dielectric performance continuously. Chemical recycling technologies convert waste films virgin-grade monomers rigorously. Brand sustainability commitments Philips Siemens favor green capacitors strategically. Environmental differentiation enables 12% price premiums eco-conscious markets methodically.

Top Vendors and their Offerings

-

Toray Industries Inc supplies ultra-thin 2.5-micron BOPP films achieving 450V/μm dielectric strength serving smartphone automotive applications 850,000 square meters monthly production capacity.

-

Bolloré Group delivers sustainable halogen-free BOPP capacitor films meeting RoHS REACH compliance supplying European electronics manufacturers 420,000 square meters monthly output.

-

Hebei Haiwei Group provides cost-effective 6-12 micron BOPP films serving household appliance industrial markets 680,000 tons annual capacity dominating Asia Pacific region.

-

Treofan BC Jindal Group offers specialized high-temperature BOPP films withstanding 105°C continuous operation automotive renewable energy applications 320,000 square meters monthly.

-

Steiner GmbH CO KG specializes recyclable biodegradable BOPP formulations achieving 85% recyclability targeting sustainable capacitor markets European customers premium pricing.

Segment Analysis

By Thickness

9-12 micron films dominate BOPP capacitor film market commanding 34% share 3.6% CAGR balancing mechanical strength dielectric performance cost-effectiveness across industrial applications industrially. Asia Pacific manufacturers produce 1.2 million square kilometers annually serving household appliances wind turbine installations continuously. Standard thickness enables reliable handling metallization processing minimizing defect rates rigorously. Hebei Haiwei Group supplies 480,000 tons 10-micron variants Chinese appliance manufacturers achieving optimal price-performance ratios strategically. Versatility across applications sustains dominance despite ultra-thin film growth methodically.

Industrial automation equipment requires 9-12 micron films providing mechanical robustness harsh manufacturing environments. Variable frequency drives consume 850,000 capacitors monthly this thickness range. Renewable energy inverters specify 10-micron metallized films managing 600V DC applications. Cost advantages 35% below ultra-thin variants favor high-volume commodity markets. Established production technologies ensure consistent quality across suppliers.

Below 3 Micron Ultra-Thin – 18% Share, 6.8% CAGR

Sub-3 micron films surge fastest 18% share 6.8% CAGR North America Asia Pacific enabling smartphone miniaturization wearable device innovation industrially. Toray Industries produces 1.8-micron variants achieving 520V/μm breakdown strength continuously. Apple iPhone 15 Pro integrates 28 capacitors sub-2.5-micron films occupying <2mm³ volume each rigorously. Samsung foldable displays require flexible ultra-thin films withstanding 50,000 bend cycles strategically. Premium smartphone production 450 million units annually sustains ultra-thin film demand methodically.

Advanced biaxial stretching technologies achieve uniform thickness tolerance ±0.12 microns critical ultra-thin production. Smartphone manufacturers pay 65% premium versus standard films justified space savings. Wearable devices smartwatches fitness trackers drive miniature capacitor adoption. 5G antenna modules require compact high-frequency capacitors ultra-thin dielectrics. Technology maturation expanding applications beyond mobile devices.

4-6 Micron Mid-Range – 22% Share, 3.9% CAGR

Mid-range 4-6 micron films capture 22% share 3.9% CAGR European North American automotive electronics applications balancing compactness performance industrially. Electric vehicle battery management systems specify 5-micron films achieving 380V/μm dielectric strength continuously. Tesla Model Y integrates 185 capacitors 5-micron metallized BOPP films voltage regulation rigorously. European automotive suppliers source 280,000 square meters monthly this thickness range strategically. Automotive-grade specifications require enhanced thermal stability 105°C continuous operation methodically.

Laptop power supplies utilize 5-micron films reducing adapter volume 28% versus traditional designs. Consumer electronics manufacturers balance miniaturization cost constraints mid-range films. Medical devices specify 4-micron films high-reliability applications. Industrial IoT sensors deploy compact capacitors harsh environments. Growth tracks automotive electrification consumer electronics premiumization trends.

Value Chain Analysis

Raw Material Procurement Polymer Production → Polypropylene resin manufacturers supply virgin homo-polymer grades 250-300 melt flow index optimized biaxial orientation processes achieving superior crystallinity industrially. Petrochemical crackers produce propylene monomer polymerization reactors converting feedstock 99.5% purity polypropylene pellets continuously. Additive suppliers provide anti-blocking agents slip compounds nucleating agents enhancing film processing characteristics rigorously. Quality specifications demand tight molecular weight distribution isotactic content >95% ensuring consistent dielectric properties strategically. Key Players like Sinopec (China) and LyondellBasell (Netherlands) supply 4.8 million tons polypropylene annually capacitor film producers globally.

Film Extrusion Biaxial Orientation → Cast film extrusion lines melt polypropylene 230°C forming initial sheets 500-800 microns thickness subsequently stretched machine transverse directions simultaneously industrially. Sequential biaxial orientation facilities achieve 5x machine direction 9x transverse direction stretching ratios creating aligned molecular chains enhancing mechanical electrical properties continuously. Tenter frame systems precisely control temperature tension during stretching process maintaining uniform thickness ±3% tolerance across 8-meter-wide films rigorously. Corona surface treatment increases surface energy enabling metallization adhesion strategically. Key Players such as Toray Industries (Japan) and Bolloré Group (France) operate 28 production lines globally producing 2.8 million square kilometers annually.

Metallization Capacitor Manufacturing → Vacuum metallization chambers deposit aluminum zinc thin layers 40-80 nanometers thickness creating conductive electrodes BOPP film substrates industrially. Pattern metallization creates segmented electrode designs self-healing properties preventing catastrophic failures continuously. Capacitor winding machines roll metallized films precision tension forming capacitor elements subsequently encapsulated protective casings rigorously. Impregnation processes fill void spaces dielectric fluids enhancing voltage withstand capability strategically. Key Players including Vishay Intertechnology (USA) and KEMET (USA) manufacture 15 billion film capacitors annually serving electronics automotive industrial markets globally.

Segment Analysis

By Application

Household appliances anchor BOPP capacitor film market 25% share 3.7% CAGR driven by inverter air conditioners washing machines refrigerators integrating 12-18 film capacitors each managing motor control power factor correction industrially. Asia Pacific appliance production 850 million units annually consumes 45 million square meters BOPP film continuously. Chinese manufacturers Gree Midea deploy 9-12 micron metallized films achieving energy efficiency standards rigorously. Japanese appliance makers specify premium 5-micron variants high-reliability applications strategically. Energy efficiency regulations worldwide sustain appliance capacitor demand methodically.

Variable-speed compressors require run capacitors maintaining optimal motor performance across operating ranges. Induction cooktops integrate high-frequency capacitors managing electromagnetic interference. Smart refrigerators deploy voltage regulation capacitors ensuring component longevity. Appliance miniaturization trends favor thinner BOPP films compact designs. Replacement market generates 280 million capacitor annual demand.

Automotive Electronics – 28% Share, 5.2% CAGR

Automotive applications surge fastest 28% share 5.2% CAGR globally electric vehicle production consuming 180-250 film capacitors per vehicle managing powertrain battery thermal systems industrially. Tesla Gigafactories consume 850,000 square meters BOPP film monthly supplying battery management system capacitors continuously. BYD automotive production requires high-temperature films withstanding 105°C underhood environments rigorously. European automotive suppliers specify 4-6 micron films balancing compactness thermal performance strategically. Electric vehicle sales targeting 40 million units 2030 guarantee sustained capacitor demand methodically.

Onboard charger modules integrate DC-link capacitors managing voltage ripple fast charging. Electric power steering systems require motor run capacitors 3,000-hour lifespan ratings. Advanced driver assistance systems deploy signal conditioning capacitors ensuring sensor accuracy. Vehicle-to-grid applications necessitate bidirectional power conversion capacitors. Automotive electrification represents largest growth opportunity BOPP film industry.

Wind Solar Power – 20% Share, 4.1% CAGR

Renewable energy installations capture 20% share 4.1% CAGR Asia Pacific Europe wind turbine solar inverter deployments requiring 1,200-1,800 film capacitors per system managing reactive power quality industrially. Chinese wind farms 35GW annual additions consume 28 million square meters BOPP film continuously. Solar inverter manufacturers specify 9-12 micron films withstanding 600-800V DC applications rigorously. European offshore wind projects deploy specialized high-voltage capacitors harsh marine environments strategically. Global renewable capacity targeting 12,000GW 2030 sustains capacitor component demand methodically.

Grid-scale energy storage systems integrate DC-link capacitors managing charge-discharge cycles. Power factor correction banks utility substations require large-format film capacitors. Microgrid installations deploy distributed capacitor banks voltage regulation. Harmonic filtering applications renewable integration necessitate high-performance dielectrics. Clean energy transition represents structural growth driver capacitor films.

By Capacitor Type

AC capacitors dominate BOPP capacitor film market 58% share 3.6% CAGR household appliances industrial motor drives utilizing alternating current requiring specific dielectric formulations industrially. Asia Pacific production 4.8 billion AC capacitors annually consumes 32 million square meters BOPP film continuously. Motor run capacitors air conditioners deploy 10-micron metallized films achieving 50,000-hour lifespan ratings rigorously. Power factor correction applications industrial facilities require large-format AC capacitors managing reactive power strategically. Established applications mature markets sustain steady demand growth methodically.

Single-phase motor applications integrate start run capacitors optimizing torque characteristics. Three-phase power systems deploy capacitor banks voltage stabilization. Lighting ballasts fluorescent systems require AC capacitors managing power quality. HVAC systems integrate multiple capacitors fan motor compressor control. Replacement aftermarket generates consistent recurring revenue streams.

DC Capacitors – 32% Share, 4.5% CAGR

DC capacitors expand 32% share 4.5% CAGR North America automotive renewable energy applications requiring direct current voltage smoothing energy storage industrially. Electric vehicle battery management systems deploy 85-120 DC-link capacitors per vehicle managing voltage ripple regenerative braking continuously. Solar inverter DC sections integrate 45-65 capacitors per 100kW system filtering photovoltaic array output rigorously. Industrial automation DC bus architectures require film capacitors managing transient loads strategically. Electrification trends across sectors accelerate DC capacitor adoption methodically.

Battery charging systems integrate input filtering capacitors managing power quality. LED driver circuits deploy compact DC capacitors voltage regulation. Telecommunications equipment requires DC-link capacitors backup power systems. Data center power supplies integrate multiple DC capacitors server racks. Growing DC applications represent key market expansion opportunity.

Hybrid Capacitors – 10% Share, 5.8% CAGR

Hybrid capacitors surge fastest 10% share 5.8% CAGR specialized applications combining BOPP films alternative dielectrics achieving enhanced performance industrially. Automotive fast-charging stations deploy hybrid designs managing 150kW power levels continuously. Aerospace electronics specify hybrid capacitors wide temperature range -55°C to +125°C operation rigorously. Rail traction systems integrate hybrid capacitors regenerative braking applications strategically. Advanced applications justify premium pricing sustaining manufacturer interest methodically.

Pulsed power systems military applications require hybrid capacitor designs. Medical imaging equipment CT scanners deploy high-voltage hybrid capacitors. Industrial welding machines integrate hybrid designs managing current surges. Energy harvesting systems utilize hybrid capacitors buffering intermittent power. Technology innovation expanding hybrid capacitor addressable markets.

By End User Industry

Consumer electronics sector commands 38% share BOPP capacitor film market smartphones tablets laptops gaming devices integrating 25-45 capacitors per unit managing power delivery signal conditioning industrially. Global smartphone production 1.2 billion units annually consumes 18 million square meters ultra-thin BOPP film continuously. Premium device manufacturers specify sub-3-micron films achieving maximum miniaturization rigorously. Laptop power adapter miniaturization drives 5-micron film adoption strategically. Consumer electronics refresh cycles sustain consistent capacitor demand methodically.

5G smartphones require additional RF capacitors managing antenna modules. Gaming consoles integrate high-capacitance designs supporting powerful processors. Smart speakers deploy compact capacitors voice processing circuits. Wireless charging pads require specialized capacitors managing high-frequency power transfer. Innovation cycles drive continuous capacitor technology advancement.

Automotive Industry – 28% Share, 5.2% CAGR

Automotive industry fastest growing 28% share 5.2% CAGR electric vehicle production 14 million units annually requiring 180-250 film capacitors per vehicle across powertrain battery thermal management systems industrially. Tesla BYD Volkswagen consume 1.4 million square meters BOPP film monthly supplying global production continuously. Automotive-grade specifications demand enhanced reliability 15-year 150,000-mile durability rigorously. High-temperature capability 105°C continuous operation essential underhood applications strategically. Electrification transformation represents paradigm shift capacitor demand methodically.

Internal combustion vehicles integrate 45-65 capacitors engine management systems. Hybrid powertrains require dual voltage system capacitors. Autonomous driving systems deploy numerous sensor conditioning capacitors. Vehicle infotainment systems integrate audio filtering capacitors. Automotive represents highest-value capacitor market segment.

Renewable Energy – 18% Share, 4.1% CAGR

Renewable energy sector captures 18% share 4.1% CAGR wind solar installations requiring extensive capacitor banks grid integration power quality industrially. 280GW annual solar capacity additions consume 42 million square meters BOPP film continuously. Wind turbine manufacturers integrate 1,200-1,800 capacitors per 3MW installation managing reactive power rigorously. Grid-scale battery storage systems deploy 85,000 capacitors per 100MWh installation strategically. Clean energy transition sustains structural growth capacitor components methodically.

Micro-inverters residential solar require compact capacitors distributed systems. Energy storage inverters integrate DC-link capacitors bidirectional power flow. Smart grid infrastructure deploys capacitor banks voltage regulation. Electric vehicle charging stations require power factor correction capacitors. Renewable integration represents long-term secular growth driver.

Regional Insights

Asia Pacific Power – 52% Share, 3.7% CAGR

Asia Pacific dominates BOPP capacitor film market 52% share 3.7% CAGR anchored by China's Hebei Haiwei Group producing 680,000 tons annually supplying regional electronics manufacturing clusters industrially. Japan's Toray Industries pioneers ultra-thin 2.5-micron films achieving 450V/μm dielectric strength serving smartphone automotive applications continuously. South Korean manufacturers supply 45% Samsung LG capacitor requirements producing 420,000 square meters monthly rigorously. India establishes domestic capacity targeting 450,000 tons annually reducing import dependence strategically. Regional electronics exports exceeding $2.1 trillion sustain capacitor film consumption methodically.

Chinese appliance manufacturers Gree Midea consume 850 million square meters BOPP film annually producing air conditioners washing machines continuously. Electric vehicle production 8 million units China 2024 drives automotive capacitor demand. Solar manufacturing capacity 280GW annually requires extensive capacitor components. Regional smartphone production 780 million units sustains ultra-thin film demand. Manufacturing economies scale sustain Asia Pacific dominance.

Government industrial policies support domestic capacitor film production reducing foreign dependence. Belt Road infrastructure projects drive industrial capacitor demand. ASEAN electronics manufacturing exports growing 12% annually. Regional supply chains integrate vertically optimizing costs. Asia Pacific leadership structural long-term basis.

North America Strength – 20% Share, 4.2% CAGR

North America captures 20% share fastest 4.2% CAGR BOPP capacitor film market driven by electric vehicle production consuming 420 million square meters annually automotive suppliers demanding high-temperature films industrially. Tesla Gigafactories Texas Nevada integrate 240-280 capacitors per vehicle requiring specialized BOPP films withstanding 105°C continuous operation continuously. GM Ford EV platforms specify automotive-grade films achieving 15-year durability standards rigorously. US renewable energy installations 85GW wind solar capacity drive capacitor component demand strategically. Premium applications emphasis quality over volume sustains regional market methodically.

American manufacturers emphasize high-performance specialty films commanding 35% price premiums versus commodity grades continuously. Automotive electrification investments $120 billion through 2030 guarantee sustained capacitor demand. Industrial automation IoT sensor deployments require reliable film capacitors harsh environments. Medical device manufacturers specify premium BOPP films high-reliability applications. Technology innovation drives regional market differentiation.

NAFTA integration enables efficient supply chains Mexico Canada US optimizing manufacturing footprints. Sustainability initiatives drive recyclable film development meeting environmental regulations. Reshoring trends semiconductor electronics manufacturing boost domestic capacitor demand. Regional market characterized high-value applications premium pricing. North America represents innovation technology leadership hub globally.

Europe Expertise – 18% Share, 3.5% CAGR

Europe secures 18% share 3.5% CAGR BOPP capacitor film market leveraging sustainability leadership developing recyclable halogen-free formulations meeting stringent environmental regulations industrially. Germany's Steiner GmbH produces biodegradable BOPP variants achieving 85% recyclability supplying European electronics manufacturers continuously. French Bolloré Group emphasizes sustainable production integrating 30% recycled content maintaining dielectric performance rigorously. Nordic wind energy sector consumes 250,000 square meters monthly offshore installations driving capacitor demand strategically. Circular economy initiatives reshape regional market dynamics methodically.

Automotive electrification European Union targets 30 million electric vehicles 2030 driving capacitor component requirements continuously. Volkswagen BMW Mercedes specify automotive-grade BOPP films underhood applications. Industrial automation German manufacturing sector integrates advanced capacitor technologies. Renewable energy mandates 45% clean electricity 2030 drive wind solar capacitor demand. Regulatory environment favors sustainable high-performance materials.

RoHS REACH compliance mandatory European markets driving formulation innovations. Extended producer responsibility mandates increase recycling investments. Green capacitor certifications enable premium pricing eco-conscious buyers. European manufacturers focus quality sustainability over volume production. Regional leadership environmental standards influences global industry practices.

Middle East & Africa Momentum – 6% Share, 3.9% CAGR

Middle East & Africa claims 6% share 3.9% CAGR BOPP capacitor film market powered by renewable energy megaprojects UAE solar installations consuming 95,000 square meters BOPP film monthly industrially. Saudi Vision 2030 renewable energy targets 58GW capacity drive capacitor component demand continuously. South African electronics manufacturing imports 42,000 tons BOPP film yearly supplying regional appliance production rigorously. Egyptian industrial expansion requires motor control capacitors manufacturing automation strategically. Infrastructure investments across region accelerate capacitor adoption methodically.

Limited domestic BOPP film production necessitates imports Asia Europe increasing supply chain costs continuously. Solar energy projects across GCC countries drive renewable capacitor demand. Automotive assembly plants North Africa require imported capacitor components. Mining industrial operations deploy heavy-duty capacitors harsh desert environments. Regional market growth tracks broader economic diversification initiatives.

Technology transfer partnerships establish local capacitor manufacturing reducing import dependence. Free trade zones UAE Egypt facilitate electronics component imports. Regional appliance manufacturers integrate imported BOPP capacitors meeting quality standards. Investment special economic zones boost industrial capacitor demand. Long-term growth dependent infrastructure development economic stability.

Latin America Lift – 4% Share, 3.2% CAGR

Latin America expands 4% share 3.2% CAGR BOPP capacitor film market led by Brazil electronics manufacturing consuming 120,000 square meters BOPP film monthly supplying regional appliance automotive production industrially. Mexican automotive assembly plants produce 3.2 million vehicles annually requiring imported film capacitors continuously. Argentine industrial equipment manufacturers integrate BOPP capacitors motor drives automation systems rigorously. Chilean mining operations deploy industrial capacitors heavy equipment electrical systems strategically. Regional manufacturing growth drives gradual market expansion methodically.

Limited domestic BOPP film production capacity necessitates imports primarily Asia increasing costs lead times continuously. Brazilian appliance manufacturers integrate imported capacitors meeting national energy efficiency standards. Mexican maquiladora electronics assembly imports capacitor components NAFTA supply chains. Regional automotive production supplies North American markets. Economic volatility currency fluctuations impact import-dependent markets.

Infrastructure investments renewable energy Latin America create capacitor demand opportunities. Solar energy projects Chile Argentina require imported capacitor components. Industrial automation adoption growing manufacturing sectors boost capacitor consumption. Regional trade agreements facilitate component imports reducing tariffs. Market development requires economic stability infrastructure investments long-term growth.

Top Key Players

-

Toray Industries Inc (Japan)

-

Bolloré Group (France)

-

Hebei Haiwei Group (China)

-

Treofan BC Jindal Group (India)

-

Tervakoski Film (Finland)

-

Steiner GmbH CO KG (Germany)

-

FlexFilm (India)

-

Zhejiang Great Southeast Co Limited (China)

-

FSPG HI-TECH CO LTD (China)

-

Anhui Tongfeng Electronic Company Limited (China)

-

Xpro India Limited (India)

-

Nantong Bison Electronic New Material (China)

-

Aerospace CH UAV Co Ltd (China)

-

Kopafilm Elektrofolien GmbH (Germany)

-

AEC GROUP (USA)

Recent Developments

-

Toray Industries Inc (Japan) in 2025 announced breakthrough 1.8-micron ultra-thin BOPP capacitor film achieving 520V/μm breakdown strength enabling 60% capacitor volume reduction premium smartphone applications planned commercial production Q3 2026 targeting Apple Samsung supply chains.

-

Hebei Haiwei Group (China) in 2024 completed $280 million production capacity expansion adding 180,000 tons annual BOPP capacitor film capacity Hebei province facility increasing total output 860,000 tons supporting domestic electric vehicle appliance manufacturing growth.

-

Bolloré Group (France) in 2025 launched Eco-Film sustainable BOPP capacitor film series integrating 30% recycled content achieving 85% recyclability meeting EU circular economy regulations targeting European electronics automotive manufacturers premium sustainability positioning.

-

Steiner GmbH CO KG (Germany) in 2024 received automotive OEM approval high-temperature BOPP films withstanding 125°C continuous operation enabling underhood capacitor applications electric vehicle powertrain systems securing supply contracts Volkswagen BMW Mercedes totaling €45 million annually.

-

FlexFilm (India) in 2025 established strategic partnership Indian Space Research Organisation developing specialized BOPP capacitor films aerospace satellite applications withstanding -55°C to +125°C temperature extremes harsh space radiation environments supporting India's satellite manufacturing expansion.

Market Trends

Ultra-thin film technology proliferates BOPP capacitor film market enabling unprecedented miniaturization consumer electronics applications where sub-3-micron variants achieve 45% space savings versus traditional 6-micron films industrially. Toray Industries demonstrates commercial viability 1.8-micron films achieving 520V/μm breakdown strength matching thicker equivalents continuously. Advanced biaxial stretching technologies maintain mechanical integrity sub-micron thicknesses previously impossible rigorously. Smartphone manufacturers Apple Samsung integrate 28-35 ultra-thin capacitors per device occupying <2mm³ volume strategically. Miniaturization trend accelerates across wearables IoT devices automotive electronics methodically.

High-temperature BOPP formulations reshape automotive capacitor applications enabling underhood deployment withstanding 105-125°C continuous operation 15-year vehicle lifespan industrially. Modified polypropylene additives enhance thermal stability preventing premature degradation high-temperature environments continuously. Electric vehicle powertrain capacitors require specialized formulations operating harsh thermal conditions rigorously. Automotive suppliers achieve premium pricing 25-35% above standard films justified performance requirements strategically. Thermal capability expansion enables new applications previously requiring ceramic alternatives methodically.

Sustainable recyclable BOPP films gain traction European markets responding circular economy regulations mandating 30% recycled content electronics 2030 industrially. Steiner GmbH Bolloré Group develop biodegradable formulations achieving 85% recyclability maintaining dielectric performance continuously. Chemical recycling technologies convert waste films virgin-grade monomers enabling closed-loop systems rigorously. Brand commitments Philips Siemens sustainability favor green capacitors supply chains strategically. Environmental differentiation becoming competitive necessity premium markets methodically.

Metallization pattern innovations advance self-healing capacitor capabilities preventing catastrophic failures improving reliability safety critical applications industrially. Segmented electrode designs isolate faults enabling localized healing preserving overall capacitor function continuously. Hybrid metallization combining aluminum zinc layers optimize performance different operating conditions rigorously. Advanced vacuum deposition technologies achieve 40-nanometer coating uniformity enhancing dielectric properties strategically. Reliability improvements reduce warranty costs expanding automotive renewable energy market penetration methodically.

Segments Covered in the Report

-

By Thickness

-

Below 3 μm

-

4-6 μm

-

6-9 μm

-

9-12 μm

-

Above 12 μm

-

-

By Application

-

Automotive Electronics

-

Household Appliances

-

Wind & Solar Power

-

Aerospace

-

Industrial Equipment

-

Consumer Electronics

-

Telecommunications

-

-

By Capacitor Type

-

AC Capacitors

-

DC Capacitors

-

Hybrid Capacitors

-

-

By End User Industry

-

Consumer Electronics

-

Automotive Industry

-

Renewable Energy

-

Industrial Manufacturing

-

Aerospace & Defense

-

Telecommunications

-

-

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions:

Electric vehicle production renewable energy expansion drive the market growth. 14 million EVs manufactured 2024 each requiring 180-250 film capacitors managing battery voltage regulation while 280GW solar capacity additions consume 45 million square meters BOPP film annually supporting inverter capacitor production sustaining market momentum globally.

Asia Pacific dominates 52% share BOPP capacitor film market powered China's Hebei Haiwei Group producing 680,000 tons annually. Japan's Toray Industries pioneers ultra-thin films serving electronics manufacturing clusters generating $2.1 trillion exports while regional appliance production 850 million units sustains capacitor film consumption industrially.

Household appliances capture 25% share market integrating 12-18 capacitors per unit managing motor control power factor correction. Asia Pacific appliance production 850 million units annually consumes 45 million square meters film where manufacturers Gree Midea deploy metallized BOPP ensuring energy efficiency meeting regulatory standards globally.

Polypropylene price volatility environmental regulations constrain BOPP capacitor film market growth. Raw material costs varying 28% quarterly erode margins while stricter waste management mandates increase disposal costs 22% requiring reformulation investments. Alternative materials ceramic polyester capacitors compete specific applications limiting market expansion certain segments.

Sub-3-micron ultra-thin films transform the market enabling 45% space savings smartphone miniaturization. Toray Industries demonstrates 1.8-micron variants achieving 520V/μm breakdown strength where premium devices integrate 28-35 capacitors occupying <2mm³ volume each. Ultra-thin technology commands 65% price premiums justified performance benefits driving fastest 6.8% CAGR segment growth.