Cerebral Angiography Market Overview

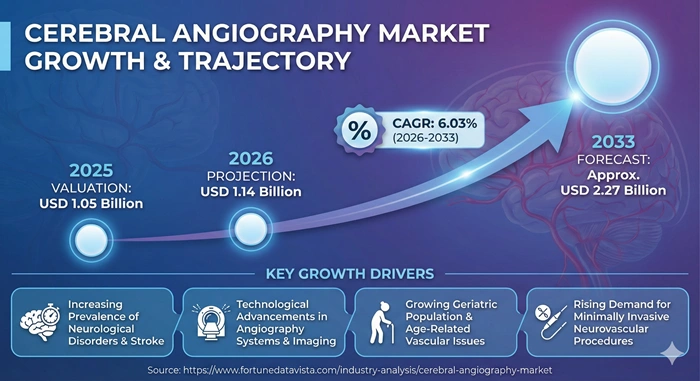

The global cerebral angiography market size is valued at USD 1.05 billion in 2025 and is predicted to increase from USD 1.14 billion in 2026 to approximately USD 2.27 billion by 2033, growing at a CAGR of 6.03% from 2026 to 2033.This diagnostic imaging technique has become fundamental in detecting and treating complex neurovascular conditions including stroke, cerebral aneurysms, arteriovenous malformations, and vascular tumors. The procedure uses specialized contrast dye and advanced imaging equipment to visualize blood vessels in the brain with exceptional clarity, enabling physicians to make accurate diagnoses and guide minimally invasive treatments. Growth in this sector stems from the rising global burden of cerebrovascular diseases, technological breakthroughs in imaging modalities, and the shift toward less invasive diagnostic and therapeutic approaches that reduce patient recovery time and procedural risks.

AI Impact on the Cerebral Angiography Industry

Artificial intelligence has emerged as a transformative force in the cerebral angiography market, fundamentally changing how clinicians diagnose and treat neurovascular conditions. AI-assisted imaging platforms now enhance vessel visibility, automate lesion identification, and streamline radiological workflows, resulting in faster diagnoses and more effective treatment of complex neurovascular cases. Machine learning algorithms can analyze angiographic images in real time, flagging abnormalities such as aneurysms or occlusions that might require immediate attention, thereby reducing the time from imaging to intervention.

Advanced AI integration is particularly evident in stroke care, where every minute counts for patient outcomes. AI-powered detection systems automatically identify stroke patterns on CT angiography and alert specialized teams, cutting treatment times by more than an hour in many cases. These systems have been deployed across thousands of hospitals globally, demonstrating measurable improvements in patient survival and recovery rates. Beyond emergency applications, AI tools are being incorporated into procedural planning, helping surgeons map complex vascular anatomy and simulate interventions before performing actual procedures.

Leading medical imaging manufacturers are racing to embed AI capabilities across their cerebral angiography platforms. Recent innovations include live noise reduction algorithms that improve image clarity during fluoroscopy and angiography while simultaneously reducing radiation exposure to patients. AI systems now automatically optimize exposure parameters such as tube voltage, current, and pulse width based on patient anatomy and real-time positioning, ensuring diagnostic-quality images with minimal radiation dose. This technological evolution is making cerebral angiography safer and more accessible, particularly for vulnerable populations including pediatric and geriatric patients who require special radiation protection considerations.

Growth Factors

The cerebral angiography market expansion is propelled by several interconnected factors that address both clinical needs and technological capabilities. Rising stroke incidence worldwide represents the primary driver, as cerebrovascular accidents have become a leading cause of death and disability across all age groups. Population aging in developed and emerging economies has created a larger patient pool susceptible to cerebral aneurysms, arteriovenous malformations, and other vascular brain conditions that require precise imaging for diagnosis and treatment planning. Healthcare systems are responding by expanding interventional radiology and neurointerventional services, which directly increases demand for advanced cerebral angiography equipment.

Technological innovation continues to reshape the market landscape through the development of sophisticated imaging modalities. Digital subtraction angiography systems with flat-panel detectors deliver unprecedented image resolution while reducing procedure time and radiation exposure compared to older generation equipment. Real-time three-dimensional imaging capabilities allow clinicians to visualize complex vascular structures from multiple angles during a single procedure, improving diagnostic accuracy and enabling more precise interventional treatments. The integration of hybrid imaging systems that combine angiography with magnetic resonance imaging or computed tomography provides comprehensive anatomical and functional information in a single examination.

The global shift toward minimally invasive medical procedures has created substantial momentum for cerebral angiography adoption. Patients increasingly prefer diagnostic and therapeutic options that involve smaller incisions, shorter hospital stays, and faster recovery periods. Cerebral angiography perfectly aligns with this preference, as catheter-based approaches can diagnose vascular abnormalities and deliver treatments such as coiling or stenting through small arterial access points. Healthcare providers benefit from reduced complications and improved patient satisfaction, while payers see lower total costs compared to traditional open surgical approaches.

Government healthcare investments and infrastructure development in emerging markets are opening new avenues for market expansion. Countries across Asia Pacific, Latin America, and the Middle East are establishing specialized neurology and stroke centers equipped with state-of-the-art imaging technology as part of broader healthcare modernization initiatives. These facilities require comprehensive cerebral angiography capabilities to deliver world-class neurovascular care, creating substantial equipment demand in regions that previously had limited access to advanced diagnostic imaging. International medical device manufacturers are responding with region-specific product offerings and strategic partnerships with local healthcare providers and distributors.

Market Outlook

The cerebral angiography market outlook remains highly positive through the forecast period, supported by robust fundamentals and favorable industry trends. Healthcare spending continues to rise globally, with neurological care receiving increased priority due to the substantial disease burden and economic impact of cerebrovascular conditions. Insurance coverage for advanced imaging procedures is expanding in many markets, improving patient access and reducing out-of-pocket costs that previously limited utilization. Regulatory agencies are accelerating approval processes for innovative imaging technologies, enabling manufacturers to bring new products to market more quickly.

Regional growth patterns reflect varying healthcare infrastructure maturity and disease burden distribution. North America maintains market leadership based on well-established healthcare systems, high per-capita healthcare expenditure, and widespread adoption of cutting-edge medical technology. The region benefits from strong reimbursement frameworks that support the use of advanced imaging for both diagnostic and interventional procedures. However, growth rates in mature markets are moderating as equipment penetration reaches saturation levels in major urban centers.

Asia Pacific represents the fastest-growing region for cerebral angiography, driven by massive population bases, rising disease prevalence, and aggressive healthcare infrastructure expansion. Countries including China, India, and Southeast Asian nations are investing heavily in specialty hospitals and imaging centers to address previously unmet needs for neurovascular care. The region's growth trajectory benefits from medical tourism, as patients from neighboring countries seek high-quality diagnostic and treatment services at competitive prices. Local and international manufacturers are establishing production facilities and distribution networks to serve this dynamic market.

Europe demonstrates steady market growth characterized by early adoption of next-generation technologies and strong emphasis on stroke prevention and intervention strategies. The region's healthcare systems prioritize evidence-based medicine and cost-effectiveness, driving demand for imaging solutions that deliver superior diagnostic performance and procedural efficiency. Collaborative research initiatives between medical device companies and academic medical centers are advancing the science of cerebral angiography and expanding clinical applications. Stringent regulatory standards ensure high quality and safety, though they can extend the timeline for new product introductions.

Expert Speaks

Bryan Mock, General Manager of GE HealthCare's Premium MR Segment: "We're dedicated to making every interaction smooth, fast and patient centric by using predictive technology that boosts efficiency. Our advanced imaging platforms are designed to simplify complex procedures and improve efficiency for experienced users while aiming to shorten the learning curve for new clinicians entering interventional fields".

Carsten Bertram, Head of Advanced Therapies at Siemens Healthineers: "The growing need for earlier-stage treatments raises the bar for image quality, and this is where artificial intelligence comes into play. With our latest AI imaging innovations, we are unlocking AI's potential for a new generation of interventional systems and bringing advanced capabilities to all clinical fields including neurovascular care".

Dan Xu, CT Business Leader at Philips: "Our spectral CT technology has been a clinical workhorse for more than a decade and delivers exceptional clinical outcomes while standing up to the most demanding throughput requirements. We're focused on making advanced diagnostic capabilities accessible to healthcare providers and patients who were previously out of reach due to cost or geographic constraints".

Key Report Takeaways

-

North America leads the cerebral angiography market with approximately 41% market share in 2025, supported by advanced healthcare infrastructure, high healthcare expenditure, and widespread adoption of state-of-the-art neurovascular imaging technologies across hospitals and specialized imaging centers

-

Asia Pacific emerges as the fastest-growing region with an expected CAGR of 7.4% between 2026 and 2033, driven by massive healthcare infrastructure investments, rising cerebrovascular disease prevalence, population aging, and government initiatives to expand access to advanced diagnostic imaging services

-

Hospitals represent the dominant end-user segment accounting for 63.9% of market share in 2025, as these facilities serve as primary centers for emergency stroke care, complex neurovascular procedures, and comprehensive imaging services that require specialized equipment and trained personnel

-

Digital subtraction angiography technology holds the largest market share at 46.7% in 2025, valued for its superior image quality, real-time visualization capabilities, and ability to clearly differentiate blood vessels from surrounding tissue during both diagnostic and interventional procedures

-

Diagnostic cerebral angiography procedures dominate with 57.2% market share in 2025, though interventional applications are growing rapidly at 6.8% CAGR as minimally invasive treatments for aneurysms, stroke, and arteriovenous malformations become standard of care

-

Angiography catheters segment shows strong growth momentum with an expected CAGR of 6.90% from 2026 to 2033, reflecting increased procedural volumes and ongoing innovations in catheter design that enhance navigation through tortuous cerebral vasculature and improve patient outcomes

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 2.27 Billion | Market Size by 2026 | USD 1.14 Billion | Market Size by 2025 | USD 1.05 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 6.03% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Product Type, Technology, Procedure Type, End User, Indication, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

The cerebral angiography market experiences substantial momentum from multiple drivers that collectively shape its growth trajectory and clinical adoption patterns. Rising prevalence of cerebrovascular diseases stands as the most significant growth catalyst, as stroke, aneurysms, and related conditions affect millions of patients annually worldwide. The aging global population inherently carries higher risk for these neurological complications, creating sustained demand for accurate diagnostic imaging that can guide treatment decisions and improve patient outcomes. Healthcare providers increasingly recognize that early detection through advanced imaging can prevent catastrophic events and reduce long-term disability, justifying investments in sophisticated angiography equipment.

Minimally invasive procedural adoption represents another powerful driver transforming the cerebral angiography market landscape. Endovascular techniques for treating cerebrovascular conditions have largely replaced traditional open surgery in appropriate cases, as catheter-based approaches deliver comparable or superior clinical results with significantly lower procedural risk and faster patient recovery. These interventions require high-quality real-time imaging for precise catheter navigation and device placement, directly driving demand for advanced angiography systems. Hospitals are expanding interventional neuroradiology departments to meet patient needs and capture profitable procedural volumes, necessitating comprehensive imaging capabilities.

Technological advancement in imaging modalities continues accelerating market growth through enhanced diagnostic performance and improved clinical workflows. Next-generation flat-panel detector systems deliver exceptional image resolution while reducing radiation dose, addressing longstanding concerns about patient safety during fluoroscopic procedures. Three-dimensional rotational angiography provides comprehensive vascular visualization from a single injection, eliminating the need for multiple projections and reducing procedure time and contrast volume. Integration of artificial intelligence for automated image analysis, lesion detection, and workflow optimization further enhances the value proposition of modern cerebral angiography platforms.

| Driver | Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rising cerebrovascular disease prevalence | ~2.5% | Global, particularly Asia Pacific and aging populations | 2026-2033 |

| Minimally invasive procedure adoption | ~1.8% | North America, Europe, Urban Asia Pacific | 2026-2033 |

| AI and imaging technology advancement | ~1.2% | Developed markets expanding to emerging regions | 2026-2033 |

| Healthcare infrastructure expansion | ~0.8% | Asia Pacific, Middle East, Latin America | 2026-2033 |

Restraints Impact Analysis

Despite strong growth fundamentals, the cerebral angiography market faces several restraints that could moderate expansion and limit accessibility in certain markets. High equipment costs represent the most significant barrier, as advanced angiography systems with cutting-edge imaging capabilities require substantial capital investments often exceeding several million dollars. Smaller hospitals and healthcare facilities in resource-constrained regions struggle to justify these expenditures, particularly when patient volumes may not support full equipment utilization. The total cost of ownership extends beyond initial purchase to include ongoing maintenance, software upgrades, and replacement parts that add to the financial burden.

Shortage of skilled operators poses another meaningful restraint limiting market penetration and utilization. Cerebral angiography procedures require specialized training in interventional radiology or neurointerventional techniques, areas where qualified practitioners remain in short supply globally. The learning curve for safe and effective angiographic imaging is substantial, requiring extensive supervised practice to develop proficiency in catheter manipulation, radiation safety, and emergency complication management. Healthcare systems in emerging markets particularly struggle to recruit and retain specialists with appropriate credentials, constraining their ability to offer comprehensive neurovascular services even when equipment is available.

Procedural risks and potential complications, though relatively uncommon, create hesitation among some physicians and patients regarding cerebral angiography utilization. The procedure involves arterial puncture, catheter insertion into brain vessels, and injection of iodinated contrast media, each carrying inherent risks including bleeding, stroke, allergic reactions, and kidney damage. While complication rates have declined with modern equipment and techniques, the possibility of adverse events requires careful patient selection and informed consent discussions. Alternative non-invasive imaging modalities such as magnetic resonance angiography and computed tomography angiography have gained acceptance for certain indications where diagnostic information can be obtained without arterial catheterization.

| Restraint | Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High equipment and procedural costs | ~-1.2% | Emerging markets, rural areas, small facilities | 2026-2033 |

| Shortage of trained specialists | ~-0.8% | Africa, Southeast Asia, rural regions globally | 2026-2033 |

| Procedural risks and complications | ~-0.5% | Global, particularly risk-averse markets | 2026-2033 |

Opportunities Impact Analysis

The cerebral angiography market presents substantial opportunities for stakeholders willing to address unmet needs and capitalize on emerging trends. Artificial intelligence integration offers the most transformative opportunity, as machine learning algorithms can enhance every aspect of the angiographic workflow from automated patient positioning to real-time image optimization to automated report generation. AI-powered stroke detection systems have already demonstrated dramatic improvements in treatment times and patient outcomes, creating strong demand for these capabilities. Manufacturers who successfully embed sophisticated AI throughout their platforms will gain competitive advantages in accuracy, efficiency, and clinical value delivery.

Hybrid operating room expansion creates significant opportunities for advanced angiography system deployment. These sophisticated facilities combine traditional surgical capabilities with state-of-the-art imaging equipment, enabling seamless transitions between diagnostic imaging and therapeutic intervention within a single sterile environment. Hospitals are investing in hybrid suites specifically for complex neurovascular procedures where the ability to perform open surgery and endovascular treatment in rapid succession can be lifesaving. This trend drives demand for premium angiography systems with advanced features including robotic positioning, large-format imaging, and integration with surgical navigation systems.

Emerging market penetration represents a massive opportunity as healthcare infrastructure develops in populous regions with growing middle classes. Countries including India, Indonesia, Brazil, and Nigeria are experiencing rapid urbanization and rising healthcare expectations, yet current access to advanced neurovascular imaging remains extremely limited. Strategic partnerships between international medical device manufacturers and local healthcare providers can accelerate market development through technology transfer, training programs, and creative financing models. Mobile angiography units and refurbished equipment options may provide cost-effective pathways to expand service availability in underserved areas.

| Opportunity | Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| AI integration and automation | ~1.5% | Global, led by North America and Europe | 2026-2033 |

| Hybrid operating room adoption | ~1.0% | Developed markets, major urban centers | 2026-2033 |

| Emerging market expansion | ~0.9% | Asia Pacific, Latin America, Middle East | 2027-2033 |

| Personalized medicine and precision imaging | ~0.6% | Advanced healthcare systems | 2028-2033 |

Top Vendors and Their Offerings

Siemens Healthineers - Offers the Artis series of angiography systems featuring advanced imaging chains, AI-powered dose optimization, robotic positioning, and integration with interventional planning software for comprehensive neurovascular care

GE HealthCare - Provides the Innova and Allia lines of interventional imaging systems with advanced visualization, dose management technologies, and mobile solutions designed for flexibility in various clinical settings

Philips Healthcare - Delivers the Azurion platform with integrated advanced visualization, AlluraClarity dose reduction technology, and seamless workflow integration for interventional procedures

Canon Medical Systems - Manufactures the Alphenix series combining high-quality imaging with ergonomic design and advanced application packages specifically optimized for neurovascular interventions

Shimadzu Corporation - Supplies angiography systems focused on exceptional image quality, compact footprints suitable for space-constrained facilities, and cost-effective solutions for emerging markets

Boston Scientific Corporation - Provides comprehensive portfolios of angiography catheters, guidewires, and accessories specifically designed for cerebral vessel navigation and intervention

Medtronic - Offers neurovascular intervention devices including embolic coils, flow diverters, and stents used in conjunction with angiographic imaging for aneurysm and stroke treatment

Stryker Neurovascular - Delivers advanced thrombectomy devices, balloon catheters, and access systems that enable minimally invasive stroke treatment under angiographic guidance

Segment Analysis

By Product Type

Cerebral Angiography Systems - Market Leadership in Advanced Imaging Platforms

Cerebral angiography systems dominate the product type segment with 38.4% market share in 2025, reflecting their position as the foundational equipment for all neurovascular imaging procedures. These sophisticated platforms integrate X-ray generators, flat-panel detectors, patient tables, and advanced image processing computers into cohesive systems capable of real-time vessel visualization during diagnostic evaluation and interventional treatment. The segment encompasses fixed installation systems found in dedicated angiography suites as well as mobile C-arm units that provide imaging flexibility across multiple procedure rooms. North America leads in system installations due to high capital equipment budgets and continuous technology refresh cycles at major medical centers.

Premium system segments are experiencing robust growth as hospitals seek cutting-edge capabilities including robotic positioning, dose optimization algorithms, and artificial intelligence integration that enhance procedural efficiency and patient safety. Manufacturers including Siemens Healthineers, GE HealthCare, and Philips compete intensely in this space, differentiating through imaging quality, workflow features, and ecosystem integration. Mid-tier systems targeting smaller hospitals and emerging markets balance core imaging functionality with affordable pricing, creating accessible entry points for facilities expanding neurovascular service lines. Refurbished equipment represents an important subsegment providing cost-conscious buyers access to proven technology at substantial discounts.

The cerebral angiography systems segment benefits from extended replacement cycles, as properly maintained equipment can deliver clinical value for a decade or more before requiring replacement. However, rapid technological advancement creates pressure for earlier upgrades when new capabilities such as AI-assisted imaging or spectral imaging become standard of care. Service contracts and software licensing generate recurring revenue streams for manufacturers beyond initial equipment sales. The segment shows particular strength in regions investing heavily in stroke center development and interventional neurology program expansion.

Angiography Catheters - Rapid Growth in Specialized Navigation Tools

Angiography catheters represent the fastest-growing product type segment with an expected CAGR of 6.90% from 2026 to 2033, driven by increasing procedural volumes and continuous product innovation. These specialized devices enable physicians to navigate from femoral or radial artery access points through the complex vascular anatomy to reach cerebral vessels for contrast injection and interventional treatments. Modern cerebral catheters incorporate advanced materials, hydrophilic coatings, and optimized shapes that facilitate safe passage through tortuous arteries while minimizing vessel trauma. The segment includes diagnostic catheters for contrast delivery and guide catheters that provide stable platforms for delivering interventional devices.

Product development focuses on enhancing trackability through challenging anatomy, improving torque response for precise positioning, and reducing profile to access distal vessels previously unreachable with conventional catheters. Manufacturers are introducing specialized designs for specific procedures such as stroke thrombectomy, aneurysm coiling, and arteriovenous malformation embolization, creating expanding product portfolios that address diverse clinical needs. Asia Pacific shows particularly strong growth as interventional neurology procedure volumes surge with healthcare access expansion. Leading companies including Boston Scientific, Medtronic, and Stryker Neurovascular maintain dominant positions through extensive product lines and strong physician relationships.

Catheter segment economics favor recurring revenue as these single-use devices must be replaced for every procedure, creating predictable consumption patterns tied to procedural volumes. Unlike capital equipment purchases that face budget constraints and approval processes, catheter procurement occurs through routine supply chain management with lower decision barriers. The shift toward radial artery access for cerebral angiography is driving innovation in longer catheter lengths and specialized introducer systems. Combination devices that integrate catheter and guidewire features are gaining traction by simplifying procedure setup and reducing inventory complexity.

Contrast Media - Essential Consumables Driving Market Value

Contrast media forms a critical consumable segment within the cerebral angiography market, as these iodinated compounds enable vessel visualization by creating radiographic contrast between blood and surrounding tissues. The segment includes both ionic and non-ionic contrast agents, with non-ionic low-osmolar and iso-osmolar formulations dominating due to superior safety profiles and reduced adverse reaction rates. Contrast manufacturers continuously refine formulations to minimize nephrotoxicity risk, allergic reactions, and patient discomfort during injection. Volume consumption correlates directly with procedure numbers, making this segment highly sensitive to overall cerebral angiography market growth.

Product differentiation occurs through concentration levels, viscosity characteristics, and safety profiles optimized for specific patient populations including those with renal impairment or contrast allergies. Prefilled syringes and power injector-compatible packaging have improved workflow efficiency and reduced medication errors. North America and Europe demonstrate the highest per-procedure contrast utilization due to comprehensive imaging protocols, while emerging markets show growth potential as procedural volumes expand. Major pharmaceutical companies including GE Healthcare, Bracco Imaging, and Bayer compete in this established segment where regulatory barriers and manufacturing scale create competitive moats.

Guidewires and Accessories - Supporting Products Enabling Procedure Success

Guidewires, introducers, and various procedural accessories complete the cerebral angiography product ecosystem by enabling safe vascular access and catheter manipulation. Guidewires serve as rails over which catheters advance, with specialized hydrophilic coatings and shapeable tips facilitating navigation through tortuous anatomy. The segment includes access needles, introducer sheaths, hemostatic valves, and manifolds that manage multiple device interactions during complex procedures. These products typically represent smaller individual transaction values but collectively contribute meaningful revenue due to multi-unit consumption per procedure.

Innovation focuses on improving pushability and torque transmission while maintaining flexibility to navigate challenging anatomy without causing vessel injury. Radiopaque markers enhance visibility under fluoroscopy, enabling precise positioning confirmation. The segment benefits from procedure complexity increases as interventional techniques advance, requiring more sophisticated support devices. Asia Pacific growth outpaces other regions as procedural volumes and technique sophistication increase simultaneously. Established vascular access device manufacturers leverage existing distribution relationships to maintain strong positions in this fragmented segment.

By Technology

Digital Subtraction Angiography - Gold Standard for Real-Time Vascular Imaging

Digital subtraction angiography technology commands the largest market share at 46.7% in 2025, maintaining its position as the gold standard for cerebral vascular imaging due to exceptional image quality and real-time visualization capabilities. The technique acquires images before and after contrast injection, then digitally subtracts the pre-contrast mask from contrast-enhanced images to eliminate bone and soft tissue, leaving only vessel structures visible. This approach delivers unparalleled clarity for evaluating vascular anatomy, detecting abnormalities, and guiding catheter-based interventions. Modern DSA systems utilize flat-panel detectors that provide superior spatial and contrast resolution compared to older image intensifier technology.

DSA technology dominates in both diagnostic and interventional applications because it enables real-time procedural guidance that cannot be matched by non-invasive alternatives. Physicians can visualize contrast flow through cerebral vessels, assess hemodynamics, and immediately confirm treatment success during aneurysm coiling or stroke thrombectomy procedures. Advancements including three-dimensional rotational angiography build upon DSA foundations by acquiring data during contrast injection and reconstructing three-dimensional vessel models for comprehensive anatomical understanding. North America and Europe maintain the highest DSA utilization rates due to well-established interventional neuroradiology practices and strong reimbursement support.

The segment faces ongoing pressure to reduce radiation exposure, driving innovation in dose reduction technologies including AI-powered noise reduction and real-time dose monitoring. Manufacturers are implementing sophisticated algorithms that maintain diagnostic image quality while reducing radiation by substantial percentages compared to conventional techniques. Training initiatives focus on ALARA principles (As Low As Reasonably Achievable) to minimize unnecessary radiation while maintaining procedural safety and effectiveness. Despite competition from non-invasive modalities, DSA remains irreplaceable for complex interventional procedures requiring instant feedback and precise device positioning.

Magnetic Resonance Angiography - Non-Invasive Alternative Gaining Clinical Acceptance

Magnetic resonance angiography represents an important non-invasive alternative for cerebral vascular imaging, utilizing magnetic fields and radiofrequency pulses to visualize blood vessels without ionizing radiation or arterial catheterization. Time-of-flight and contrast-enhanced techniques provide excellent anatomical detail for screening cerebral aneurysms, assessing stenosis, and evaluating vascular malformations in patients where invasive catheter angiography may not be necessary. The technology appeals to patients preferring to avoid radiation exposure and arterial puncture when diagnostic information can be obtained through less invasive means.

MRA technology continues advancing through higher field strengths, improved coil designs, and accelerated acquisition sequences that reduce scan times while maintaining image quality. The cerebral angiography market benefits from MRA availability as it expands the total addressable patient population by providing screening capabilities that identify candidates requiring subsequent DSA intervention. However, MRA cannot provide real-time imaging for interventional procedures and may miss small vessel abnormalities visible on high-resolution DSA. The modality shows particular strength in Europe where healthcare systems emphasize non-invasive diagnostics when clinically appropriate.

Computed Tomography Angiography - Rapid Imaging for Emergency Assessment

Computed tomography angiography has become indispensable for emergency stroke evaluation, providing rapid vascular imaging that identifies vessel occlusions requiring immediate intervention. The technique acquires volumetric data during contrast bolus transit through cerebral vessels, enabling reconstruction of detailed vascular anatomy within minutes. CTA's speed advantage over MRA makes it the preferred modality in acute settings where time-critical decisions determine patient outcomes. Modern multi-detector CT scanners can image the entire cerebrovascular system from aortic arch to intracranial vessels in a single acquisition.

The technology serves as a crucial screening tool that determines which patients require catheter-based DSA intervention for stroke treatment or aneurysm repair. AI-powered analysis tools now automatically identify large vessel occlusions and alert stroke teams, accelerating treatment pathways. While CTA involves radiation exposure and iodinated contrast administration, the benefits in emergency scenarios overwhelmingly justify these risks. The segment shows robust growth in Asia Pacific where CT scanner penetration exceeds that of MRI systems, making CTA the most accessible advanced vascular imaging option.

By Procedure Type

Diagnostic Cerebral Angiography - Foundation for Accurate Neurovascular Assessment

Diagnostic cerebral angiography captures the largest procedure type segment with 57.2% market share in 2025, reflecting its fundamental role in evaluating suspected cerebrovascular abnormalities before treatment planning. The procedure involves selective catheterization of cerebral arteries followed by contrast injection and imaging to characterize vessel anatomy, identify pathology, and assess collateral circulation. Diagnostic angiography provides gold-standard visualization that often cannot be replicated by non-invasive alternatives, particularly for subtle abnormalities or complex vascular anatomy requiring detailed assessment before intervention.

Common indications include investigating transient ischemic attacks, characterizing incidentally discovered aneurysms, evaluating arteriovenous malformations, and assessing vasculitis or other inflammatory vascular conditions. The procedure typically requires conscious sedation rather than general anesthesia, enabling same-day discharge for uncomplicated cases. Diagnostic volumes correlate strongly with overall stroke incidence and awareness of cerebrovascular disease screening recommendations. North America maintains high diagnostic procedure rates supported by comprehensive insurance coverage and low-threshold referral patterns from neurology and primary care physicians.

Technological improvements including smaller catheter profiles, improved contrast agents, and radiation dose reduction have enhanced the safety profile of diagnostic cerebral angiography over time. Many patients initially evaluated with non-invasive imaging require subsequent catheter angiography for definitive diagnosis and treatment planning, creating a referral pathway that sustains diagnostic procedure volumes. The segment shows stable growth tracking overall cerebrovascular disease prevalence, though some diagnostic procedures are being displaced by high-quality non-invasive alternatives in appropriate clinical scenarios.

Interventional Cerebral Angiography - Rapidly Expanding Therapeutic Applications

Interventional cerebral angiography demonstrates robust growth at 6.8% CAGR between 2026 and 2033 as minimally invasive treatments become standard of care for cerebrovascular conditions previously requiring open surgery. These procedures combine diagnostic imaging with therapeutic interventions delivered through catheters under real-time fluoroscopic guidance. Major applications include mechanical thrombectomy for acute ischemic stroke, endovascular coiling or flow diversion for cerebral aneurysms, and embolization of arteriovenous malformations. The segment benefits from expanding clinical evidence demonstrating superior outcomes with endovascular approaches compared to medical management or surgery for selected conditions.

Stroke thrombectomy has experienced explosive growth following landmark clinical trials proving dramatic benefits when performed within appropriate time windows. Comprehensive stroke centers have invested heavily in 24/7 interventional capabilities to deliver this time-sensitive treatment, driving equipment purchases and procedural volume increases. Aneurysm treatment is steadily shifting toward endovascular approaches as device technology improves, with flow diverters enabling treatment of wide-necked and complex aneurysms previously requiring surgical clipping. Asia Pacific shows the fastest interventional growth as newly established stroke centers ramp up procedural volumes.

Interventional procedures generate substantially higher revenue per case compared to diagnostic studies due to longer procedure times, greater device utilization, and increased technical complexity. Reimbursement typically reflects this value differential, creating strong economic incentives for hospitals to develop interventional capabilities. The segment requires specialized physician training in neurointerventional techniques, limiting geographic availability to centers with sufficient case volumes to maintain operator proficiency. Partnerships between device manufacturers and medical societies support training initiatives that expand the interventional workforce and drive market growth.

By End User

Hospitals - Dominant Service Delivery Venues for Cerebral Angiography

Hospitals command 63.90% of the end-user segment in 2025, serving as the primary locations where cerebral angiography procedures occur due to infrastructure requirements and emergency care integration. Dedicated angiography suites within hospitals provide the controlled environments, specialized equipment, and immediate access to emergency services necessary for safe cerebral vascular imaging and intervention. Large tertiary care centers and comprehensive stroke centers maintain the highest procedure volumes, justifying investments in premium imaging systems and full-time interventional teams. The segment encompasses both inpatient procedures for acutely ill patients and outpatient studies for stable individuals requiring diagnostic evaluation.

Hospital-based cerebral angiography benefits from multidisciplinary team availability including anesthesiologists, neurosurgeons, and intensivists who provide backup support when complications arise during procedures. Emergency departments serve as key referral sources for stroke patients requiring urgent imaging and intervention, creating seamless care pathways within hospital systems. Capital equipment purchasing power concentrates in hospitals, where budgets can accommodate multi-million dollar angiography system investments and ongoing maintenance costs. North America demonstrates the highest hospital procedure concentration due to healthcare delivery models favoring hospital-based specialty services.

Market growth within the hospital segment tracks overall healthcare infrastructure expansion, particularly stroke center proliferation mandated by certification requirements and public health initiatives. Hybrid operating rooms combining angiography with surgical capabilities represent a key investment area for hospitals managing complex neurovascular cases. Competition among hospital systems to attract patient referrals drives continuous technology upgrades and service expansion. The segment shows resilience through economic cycles as emergency stroke care and aneurysm treatment cannot be deferred, sustaining procedure volumes regardless of macroeconomic conditions.

Diagnostic Imaging Centers - Specialized Outpatient Alternatives

Diagnostic imaging centers represent a growing end-user segment focused on elective outpatient cerebral angiography in non-emergency settings. These specialized facilities offer lower-cost alternatives to hospital-based procedures for stable patients requiring diagnostic studies or planned interventions. The segment benefits from efficient workflows optimized specifically for imaging procedures without the overhead costs associated with comprehensive hospital operations. Imaging centers typically maintain relationships with referring physicians and hospitals, accepting patient transfers for procedures and returning them to referring facilities for ongoing care.

Geographic availability concentrates in urban areas with sufficient population density to support specialized facilities and in regions where outpatient procedure reimbursement creates favorable economics compared to hospital settings. The segment shows particular strength in the United States where freestanding imaging centers have proliferated under physician ownership models. Equipment investments typically favor mid-range angiography systems balancing capability and cost, as imaging centers serve less complex patients than tertiary hospitals. Asia Pacific demonstrates emerging growth as private specialty clinics expand to serve middle-class populations seeking alternatives to crowded public hospitals.

Ambulatory Surgical Centers - Emerging Venues for Select Procedures

Ambulatory surgical centers represent an emerging end-user segment for cerebral angiography as procedure safety improves and reimbursement policies evolve to support outpatient interventional treatments. These facilities combine the efficiency of imaging centers with procedural capabilities that enable certain interventional treatments in cost-effective outpatient settings. The segment remains limited by patient acuity considerations, as complex cases and unstable patients require hospital-based management. However, straightforward diagnostic studies and select interventions including aneurysm coiling in stable patients may shift to ambulatory settings as clinical protocols mature.

By Indication

Stroke - Primary Driver of Cerebral Angiography Utilization

Stroke represents the leading indication for cerebral angiography procedures, encompassing both acute intervention for large vessel occlusions and diagnostic evaluation of stroke etiology. Mechanical thrombectomy under angiographic guidance has revolutionized acute ischemic stroke treatment, with clinical trials demonstrating dramatic improvements in functional outcomes when performed within appropriate time windows. This application drives substantial equipment investment and procedural volume growth as hospitals establish comprehensive stroke programs capable of delivering 24/7 interventional care. Post-stroke diagnostic angiography evaluates underlying vascular abnormalities including stenosis, dissection, or vasculitis that may have contributed to the event.

The stroke indication segment benefits from strong public health initiatives promoting rapid emergency response and specialized center development worldwide. Aging populations experience higher stroke rates, creating sustained demand growth for related imaging and intervention services. AI-powered stroke detection systems have accelerated treatment times by automatically identifying large vessel occlusions and alerting interventional teams, improving outcomes and reinforcing the value of comprehensive angiography capabilities. North America and Europe maintain the most developed stroke care systems, while Asia Pacific shows rapid growth as awareness and treatment capacity expand.

Cerebral Aneurysm - Critical Application for Treatment Planning

Cerebral aneurysms drive substantial cerebral angiography utilization for both planned treatment of discovered lesions and emergency management of ruptured cases. Angiography provides detailed anatomical characterization essential for determining whether endovascular coiling, flow diversion, surgical clipping, or observation represents the optimal management strategy. Unruptured aneurysm screening in high-risk populations including those with family history or genetic conditions creates a steady stream of diagnostic procedures. The segment benefits from growing awareness of aneurysm prevalence and improving detection through incidental findings on brain imaging performed for unrelated indications.

Endovascular treatment options have dramatically expanded with flow diverter technology enabling treatment of complex wide-necked aneurysms previously requiring surgery. The procedural shift toward endovascular approaches directly drives angiography demand, as these minimally invasive techniques require high-quality imaging for device delivery and positioning confirmation. Ruptured aneurysm cases represent neurosurgical emergencies requiring immediate angiographic diagnosis and intervention to prevent rebleeding. The indication shows consistent growth across all regions as aneurysm treatment capacity expands globally.

Arteriovenous Malformations - Complex Lesions Requiring Detailed Imaging

Arteriovenous malformations represent complex vascular abnormalities where arteries connect directly to veins without intervening capillaries, creating abnormal shunting and hemorrhage risk. Cerebral angiography serves as the gold standard for AVM characterization, defining feeding arteries, draining veins, and nidus architecture essential for treatment planning. Management options include surgical resection, stereotactic radiosurgery, and endovascular embolization, with many cases requiring multimodality approaches guided by detailed angiographic mapping. The indication demonstrates steady utilization as improved imaging detection identifies more asymptomatic cases requiring evaluation.

Brain Tumors - Vascular Assessment and Preoperative Planning

Brain tumors drive cerebral angiography procedures for assessing vascular supply patterns, identifying feeding vessels for potential preoperative embolization, and distinguishing tumor from vascular malformations. Highly vascular tumors including meningiomas may benefit from preoperative embolization to reduce intraoperative bleeding and facilitate safer resection. Angiography can differentiate vascular tumors from arteriovenous malformations or aneurysms, influencing treatment strategies. The indication represents a smaller market share compared to stroke and aneurysm applications but contributes to overall procedural diversity.

Value Chain Analysis

Research and Development

Medical device manufacturers invest heavily in advancing imaging technologies, detector systems, and software algorithms that enhance cerebral angiography capabilities. Research teams collaborate with academic medical centers to identify unmet clinical needs and validate new features through clinical studies. Engineers develop prototypes incorporating innovations such as AI-assisted imaging, dose reduction algorithms, and robotic positioning systems that differentiate products in competitive markets.

Key Players: Siemens Healthineers, GE HealthCare, Philips, Canon Medical Systems invest substantial R&D budgets exceeding hundreds of millions annually to maintain technological leadership and pipeline development.

Manufacturing and Quality Control

Sophisticated manufacturing facilities produce cerebral angiography systems, catheters, and accessories under strict regulatory oversight ensuring quality and safety. Production processes incorporate precision machining, clean room assembly, and extensive testing protocols that verify performance specifications before product release. Supply chain management coordinates global component sourcing while maintaining inventory buffers that prevent production disruptions. Quality systems following ISO 13485 and other medical device standards ensure consistent output meeting regulatory requirements.

Key Players: Major equipment manufacturers operate global production networks with facilities in Germany, United States, Japan, China, and other locations optimizing costs while maintaining quality standards.

Regulatory Approval and Certification

Regulatory affairs teams navigate complex approval processes across multiple jurisdictions including FDA clearance in the United States, CE marking in Europe, and NMPA approval in China. Clinical data packages demonstrate safety and effectiveness through well-designed studies meeting regulatory standards. Post-market surveillance systems monitor real-world performance and report adverse events as required by regulations. Regulatory strategy determines market entry timing and geographic expansion sequencing based on approval complexity and commercial priorities.

Key Players: Regulatory agencies including FDA, European Medicines Agency, and country-specific bodies govern market access while manufacturers maintain dedicated regulatory departments managing compliance.

Distribution and Sales

Direct sales forces and distribution partnerships deliver equipment and consumables to end-user facilities worldwide. Sales representatives provide technical consultation during purchase decisions, demonstrating equipment capabilities and addressing customer requirements. Distributor networks extend geographic reach in markets where direct presence is impractical, particularly in emerging economies. Channel partners provide local expertise including regulatory knowledge, customer relationships, and service capabilities that facilitate market penetration.

Key Players: Manufacturers maintain regional sales organizations while partnering with specialized medical equipment distributors such as Medline, Cardinal Health, and regional specialists for consumable products.

Installation and Training

Field service engineers install cerebral angiography systems, performing complex integration with hospital infrastructure including electrical, cooling, and network connections. Comprehensive training programs educate physicians, technologists, and nursing staff on equipment operation, procedural workflows, and safety protocols. Applications specialists provide ongoing support during initial case experiences, helping clinical teams optimize imaging parameters and develop procedural confidence. Customer education continues throughout the product lifecycle as software updates introduce new capabilities.

Key Players: Equipment manufacturers maintain field service organizations providing installation and training services, supplemented by third-party service providers in some markets.

Clinical Application and Patient Care

Healthcare providers utilize cerebral angiography equipment to diagnose and treat patients with cerebrovascular conditions in hospital and imaging center settings. Interventional neuroradiologists, neurosurgeons, and supporting teams perform procedures following established clinical protocols and safety guidelines. Patient outcomes depend on operator skill, equipment performance, and institutional care pathways surrounding the procedure. Quality metrics including complication rates, radiation doses, and diagnostic accuracy guide continuous improvement initiatives.

Key Players: Hospitals, medical centers, and imaging facilities represent the end users delivering patient care, with major academic centers and comprehensive stroke centers performing the highest procedure volumes.

Maintenance and Lifecycle Management

Ongoing equipment maintenance through service contracts ensures optimal performance and minimizes downtime that disrupts clinical operations. Preventive maintenance schedules address wear items and software updates before failures occur. Repair services provide rapid response when unexpected malfunctions interrupt procedures. Lifecycle management strategies determine optimal timing for equipment upgrades balancing depreciation, technological obsolescence, and emerging clinical capabilities that justify capital reinvestment.

Key Players: Original equipment manufacturers provide service contracts and parts support, while independent service organizations offer alternative maintenance options for older equipment.

Regional Insights

North America - Market Leadership Through Advanced Infrastructure

North America dominates the cerebral angiography market with approximately 41% share in 2025, supported by highly developed healthcare systems, substantial medical device spending, and widespread adoption of cutting-edge neurovascular imaging technologies. The region benefits from the world's highest per-capita healthcare expenditure, enabling hospitals to invest in premium angiography systems and maintain frequent technology refresh cycles that keep equipment portfolios current. Comprehensive stroke center networks spanning the United States and Canada provide 24/7 interventional capabilities serving large geographic areas, driving consistent procedure volumes and equipment utilization.

Strong reimbursement frameworks from Medicare, Medicaid, and commercial insurers support cerebral angiography procedures for both diagnostic and interventional indications, removing financial barriers that might otherwise limit utilization. Clinical guidelines from professional societies including the American Heart Association and American Stroke Association establish evidence-based standards promoting appropriate cerebral angiography use. Major medical device manufacturers maintain headquarters and substantial operations in North America, providing direct access to the latest innovations and responsive technical support. The region serves as the primary market for new product launches, with early adopter institutions participating in clinical trials and first-in-human studies.

The United States accounts for the dominant share within North America, with over 420 million in market value during 2025 reflecting its massive healthcare economy and technological sophistication. Major academic medical centers and comprehensive stroke centers across metropolitan areas maintain multiple angiography suites and perform thousands of procedures annually. However, rural areas face access challenges due to specialist shortages and limited advanced imaging availability. Canada demonstrates strong cerebral angiography capabilities concentrated in provincial academic centers, though capacity constraints create waitlists for elective procedures. Mexico represents an emerging market within the region with growing private hospital sector investments in neurovascular services.

Key Players: GE HealthCare (United States), Boston Scientific (United States), Medtronic (United States), Stryker Neurovascular (United States) maintain strong market positions leveraging domestic manufacturing and distribution advantages.

Europe - Sophisticated Markets Emphasizing Clinical Evidence

Europe demonstrates steady cerebral angiography market growth characterized by early adoption of innovative technologies and strong emphasis on evidence-based medicine and cost-effectiveness. The region encompasses diverse healthcare systems ranging from predominantly public models in the United Kingdom and Scandinavian countries to mixed public-private systems in Germany and France. Stroke prevention and acute intervention programs receive substantial public health investment, driving cerebral angiography capacity development across the continent. European regulatory pathways often enable earlier market access compared to the United States, making the region attractive for new product launches.

Germany, France, and the United Kingdom represent the largest individual country markets with well-established interventional neuroradiology practices and comprehensive neurovascular service networks. Eastern European countries show strong growth potential as healthcare infrastructure modernization continues and EU structural funds support medical equipment investments. Private healthcare sectors in countries including Spain and Italy are expanding advanced imaging capabilities to serve both domestic patients and medical tourists from outside Europe. The region demonstrates particular interest in radiation dose reduction technologies and sustainable healthcare practices that minimize environmental impact.

Collaborative research initiatives between medical device companies, academic medical centers, and European professional societies advance cerebral angiography science and expand clinical applications. Multi-center registries track real-world outcomes and inform treatment guidelines that influence clinical practice patterns. The region maintains stringent quality standards through CE marking requirements and post-market surveillance systems. Market access decisions increasingly incorporate health technology assessment evaluating clinical benefits relative to costs, influencing pricing and reimbursement levels.

Key Players: Siemens Healthineers (Germany), Philips Healthcare (Netherlands), and other European manufacturers leverage local market knowledge and regulatory expertise to maintain strong competitive positions.

Asia Pacific - Fastest Growth Through Infrastructure Expansion

Asia Pacific emerges as the fastest-growing cerebral angiography market with an expected CAGR of 7.4% between 2026 and 2033, driven by massive population bases, rising cerebrovascular disease burden, and aggressive healthcare infrastructure investments. Countries including China, India, Japan, South Korea, and Australia are expanding specialty hospital capacity and establishing stroke centers equipped with advanced neurovascular imaging capabilities. Government healthcare initiatives prioritize non-communicable disease management including stroke prevention and treatment, creating policy support for technology adoption and service development.

China represents the largest and fastest-growing market within Asia Pacific, with 7.4% projected CAGR reflecting enormous healthcare system expansion and rising middle-class demand for advanced medical services. National stroke center certification programs are driving equipment purchases across provincial capitals and major cities. India demonstrates substantial growth potential as private hospital chains invest in neurosciences centers of excellence that attract both domestic patients and medical tourists from neighboring countries. Japan maintains the most developed cerebral angiography capabilities in the region with established interventional practices and high per-capita equipment availability, though growth rates are moderating as markets mature.

Healthcare financing improvements including expanded insurance coverage and rising out-of-pocket payment capacity among middle-class populations are increasing access to advanced imaging services previously available only to wealthy individuals. Medical tourism flows bring patients from across the region to centers of excellence in Singapore, Thailand, and South Korea, supporting equipment investments and procedural volume growth. However, the region faces challenges including limited specialist availability, urban-rural disparities in access, and varying reimbursement frameworks that influence market development trajectories across different countries.

Key Players: Siemens Healthineers, GE HealthCare, Philips Healthcare, and Canon Medical Systems maintain strong regional presence through local manufacturing, sales organizations, and partnerships with regional distributors and hospital groups.

Latin America - Emerging Markets with Growing Capabilities

Latin America demonstrates moderate cerebral angiography market growth as healthcare systems modernize and private hospital sectors expand neurovascular service capabilities. Brazil and Mexico represent the largest country markets with substantial populations and growing middle classes demanding access to advanced medical technologies. Major urban centers including São Paulo, Mexico City, and Buenos Aires concentrate cerebral angiography capabilities in large hospitals and specialty clinics serving regional populations. However, significant access disparities exist between urban and rural areas, with advanced imaging largely unavailable outside major metropolitan regions.

Public healthcare systems face budget constraints limiting technology investments, creating opportunities for private hospital groups and international hospital chains expanding in the region. Medical device manufacturers typically serve Latin American markets through regional distributors with local regulatory expertise and customer relationships. Regulatory approval processes vary by country, with some markets requiring extensive local clinical data while

others accepting approvals from reference regulatory agencies. Economic volatility and currency fluctuations can impact pricing and purchasing decisions, requiring flexible commercial strategies.

The region shows growing interest in refurbished and mid-tier equipment options that provide essential cerebral angiography capabilities at more accessible price points compared to premium new systems. Training partnerships between international manufacturers and local medical societies support physician education and procedural technique development. Brazil leads regional growth with approximately 5.8% CAGR supported by both public system investments and robust private healthcare sector expansion. The segment benefits from increasing stroke awareness and growing adoption of minimally invasive treatment approaches.

Key Players: International manufacturers including Siemens Healthineers, GE HealthCare, and Philips serve Latin American markets through regional distribution partnerships and direct sales offices in major countries.

Middle East & Africa - Developing Markets with Strategic Investments

Middle East & Africa represents an emerging cerebral angiography market characterized by substantial variation in healthcare infrastructure and technology adoption across different countries and regions. Gulf Cooperation Council countries including Saudi Arabia, United Arab Emirates, and Qatar lead regional development with substantial healthcare investments supporting world-class medical facilities equipped with cutting-edge imaging technology. These nations attract international patients through medical tourism initiatives, creating demand for comprehensive neurovascular capabilities including advanced cerebral angiography.

Saudi Arabia demonstrates particularly strong growth momentum through Vision 2030 healthcare transformation initiatives that prioritize specialty care development and medical device sector growth. The kingdom is establishing stroke centers across major cities and investing in physician training programs that expand interventional neurology capacity. United Arab Emirates maintains sophisticated healthcare infrastructure in Dubai and Abu Dhabi with private hospital groups operating facilities comparable to leading Western medical centers. South Africa represents the most developed market in sub-Saharan Africa with established neurovascular programs at major academic hospitals.

However, most African countries face significant challenges including limited healthcare budgets, specialist shortages, and infrastructure constraints that restrict cerebral angiography availability to a small number of urban centers. International development organizations and government partnerships are supporting medical equipment donations and training programs that gradually expand access. The region shows interest in mobile angiography solutions and refurbished equipment that can deliver essential capabilities at reduced costs. Market development requires long-term perspectives and creative business models addressing unique regional challenges.

Key Players: Siemens Healthineers, GE HealthCare, and Philips maintain presence in major Middle Eastern markets through regional offices and distributor networks, while sub-Saharan Africa is primarily served through distributors and equipment donation programs.

Top Key Players

Siemens Healthineers (Germany)

GE HealthCare (United States)

Philips Healthcare (Netherlands)

Canon Medical Systems (Japan)

Shimadzu Corporation (Japan)

Boston Scientific Corporation (United States)

Medtronic (Ireland)

Stryker Neurovascular (United States)

Terumo Corporation (Japan)

AngioDynamics (United States)

Merit Medical Systems (United States)

Cook Medical (United States)

Guerbet Group (France)

Bracco Imaging (Italy)

Recent Developments

Siemens Healthineers (2024-2025)

-

Launched advanced AI-powered dose optimization algorithms for the Artis angiography platform in 2024, enabling up to 60% radiation dose reduction while maintaining diagnostic image quality for cerebral procedures

-

Introduced robotic positioning enhancements to the Artis icono system in 2025, improving workflow efficiency and reducing procedure times for complex neurovascular interventions

-

Announced strategic partnerships with leading stroke centers in 2024 to develop AI-assisted stroke detection and triage systems integrated with angiography platforms

GE HealthCare (2024-2025)

-

Received FDA clearance in 2024 for advanced visualization software enabling real-time three-dimensional roadmapping during cerebral angiography procedures

-

Launched mobile angiography solutions in 2025 specifically designed for emerging markets, offering essential cerebral imaging capabilities at accessible price points

-

Announced collaboration with multiple AI technology companies in 2024 to integrate automated anatomy detection and procedural planning tools across the Innova platform

Philips Healthcare (2024-2025)

-

Introduced next-generation spectral imaging capabilities for the Azurion platform in 2025, enabling enhanced tissue characterization during neurovascular procedures

-

Expanded AlluraClarity dose reduction technology portfolio in 2024 with specialized protocols for pediatric cerebral angiography reducing radiation exposure by up to 75%

-

Announced strategic acquisition of AI imaging startup in 2024 to accelerate development of automated stroke detection and quantification capabilities

Medtronic (2024-2025)

-

Received regulatory approvals in multiple markets during 2024-2025 for next-generation flow diverter devices used in cerebral aneurysm treatment under angiographic guidance

-

Announced expansion of neurovascular manufacturing capacity in 2024 to meet growing global demand for stroke thrombectomy devices and cerebral stents

-

Launched comprehensive physician training programs in 2025 across Asia Pacific to support expanding interventional neurology capabilities in emerging markets

Stryker Neurovascular (2024-2025)

-

Introduced advanced aspiration catheter technology in 2024 designed for improved first-pass recanalization rates during stroke thrombectomy procedures

-

Announced acquisition of specialized guidewire manufacturer in 2025 to expand product portfolio for cerebral vessel navigation

-

Launched digital education platform in 2024 providing virtual reality simulation training for cerebral angiography procedures and neurovascular interventions

Market Trends

The cerebral angiography market is experiencing transformative shifts driven by technological convergence, changing care delivery models, and evolving patient expectations. Artificial intelligence integration represents the most significant trend, with machine learning algorithms now embedded throughout the imaging workflow from automated patient positioning to real-time image optimization to automated report generation. AI-powered stroke detection systems have demonstrated dramatic improvements in treatment times by automatically identifying large vessel occlusions on CT angiography and alerting specialized intervention teams, cutting door-to-treatment times by more than an hour in many implementations. These capabilities are transitioning from research curiosities to standard features that physicians expect on modern cerebral angiography platforms.

Radiation dose reduction continues as a paramount concern driving innovation across the market. Manufacturers are implementing sophisticated noise reduction algorithms, real-time dose monitoring, and automated exposure optimization that collectively reduce radiation while maintaining or improving diagnostic image quality. Regulatory bodies and professional societies are establishing dose reference levels that create accountability for excessive radiation use, accelerating adoption of dose-conscious imaging practices. Pediatric cerebral angiography particularly benefits from these advances, as children face heightened radiation sensitivity requiring specialized protocols that minimize exposure while delivering adequate diagnostic information.

Hybrid operating room adoption is accelerating as hospitals seek comprehensive capabilities for managing complex neurovascular cases requiring seamless transitions between endovascular and open surgical approaches. These sophisticated environments combine state-of-the-art angiography systems with traditional surgical infrastructure, sterile airflow, and integrated visualization technologies that support multidisciplinary teams. Hybrid suite investments enable single-stage procedures that would previously require patient transfers between angiography and surgical suites, reducing anesthesia time, infection risk, and overall procedural costs while improving patient safety.

Personalized medicine principles are influencing cerebral angiography through patient-specific imaging protocols, anatomical modeling, and treatment planning tools that optimize approaches for individual vascular anatomy. Three-dimensional printing of patient-specific vascular models enables procedural rehearsal and device selection before actual interventions, potentially reducing complications and improving outcomes. Advanced visualization software creates virtual angiography from non-invasive imaging studies, helping determine which patients truly require catheter-based confirmation and which can proceed to treatment based on CT or MR angiography alone. These capabilities promise to reduce unnecessary invasive procedures while ensuring appropriate patients receive definitive diagnostic evaluation.

Segments Covered in the Report

By Product Type

-

Cerebral Angiography Systems

-

Fixed Installation Systems

-

Mobile C-arm Systems

-

-

Angiography Catheters

-

Diagnostic Catheters

-

Guide Catheters

-

-

Contrast Media

-

Ionic Contrast Agents

-

Non-ionic Contrast Agents

-

-

Guidewires

-

Accessories

-

Introducers and Sheaths

-

Manifolds and Stopcocks

-

Other Accessories

-

By Technology

-

Digital Subtraction Angiography (DSA)

-

Magnetic Resonance Angiography (MRA)

-

Computed Tomography Angiography (CTA)

-

X-ray Angiography

By Procedure Type

-

Diagnostic Cerebral Angiography

-

Interventional Cerebral Angiography

-

Stroke Thrombectomy

-

Aneurysm Coiling

-

Arteriovenous Malformation Embolization

-

Other Interventions

-

By End User

-

Hospitals

-

Comprehensive Stroke Centers

-

Primary Stroke Centers

-

General Hospitals

-

-

Diagnostic Imaging Centers

-

Ambulatory Surgical Centers

By Indication

-

Stroke

-

Ischemic Stroke

-

Hemorrhagic Stroke

-

-

Cerebral Aneurysm

-

Ruptured Aneurysm

-

Unruptured Aneurysm

-

-

Arteriovenous Malformations

-

Brain Tumors

-

Other Indications

By Region

-

North America

-

United States

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

United Kingdom

-

Italy

-

Spain

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates

-

South Africa

-

Rest of Middle East & Africa

-

Frequently Asked Questions:

The global cerebral angiography market is expected to reach approximately USD 2.27 billion by 2033, growing from USD 1.14 billion in 2026 at a compound annual growth rate of 6.03% during the forecast period from 2026 to 2033. This growth is driven by rising cerebrovascular disease prevalence, technological advancements in imaging systems, increasing adoption of minimally invasive interventional procedures, and expanding healthcare infrastructure in emerging markets particularly across Asia Pacific.

North America dominates the cerebral angiography market with approximately 41% market share in 2025, supported by advanced healthcare infrastructure, comprehensive stroke center networks, high per-capita healthcare expenditure, and strong reimbursement frameworks. The region benefits from early adoption of innovative technologies, extensive interventional neurology training programs, and favorable regulatory environments. However, Asia Pacific is emerging as the fastest-growing region with 7.4% expected CAGR from 2026 to 2033 due to massive population bases, rising disease burden, and aggressive healthcare system expansion.

The cerebral angiography market is propelled by multiple key drivers including rising global stroke incidence as populations age, increasing adoption of minimally invasive endovascular treatments for cerebrovascular conditions, and continuous technological innovations in imaging modalities and AI integration. Additional drivers include expanding healthcare infrastructure in emerging markets, growing awareness of cerebrovascular disease screening and prevention, improved reimbursement policies supporting advanced imaging procedures, and development of comprehensive stroke center networks requiring sophisticated angiography capabilities for 24/7 emergency intervention services.

Digital subtraction angiography technology commands the largest market share at 46.7% in 2025, maintaining its position as the gold standard for cerebral vascular imaging. DSA delivers exceptional image quality by digitally subtracting pre-contrast images from contrast-enhanced acquisitions, leaving only vessel structures visible with unparalleled clarity. The technology dominates both diagnostic and interventional applications because it enables real-time procedural guidance essential for catheter navigation and device placement during complex neurovascular interventions including stroke thrombectomy and aneurysm coiling procedures.

The cerebral angiography market faces several significant challenges including high equipment costs that create barriers for smaller hospitals and facilities in resource-constrained regions, shortage of trained interventional specialists limiting service availability particularly in emerging markets and rural areas, and procedural risks including radiation exposure and potential complications. Additional challenges include competition from non-invasive imaging alternatives for certain diagnostic applications, complex regulatory approval processes for new technologies, and reimbursement pressures in cost-conscious healthcare systems requiring continuous demonstration of clinical value and cost-effectiveness.