Cheek Augmentation Market Overview

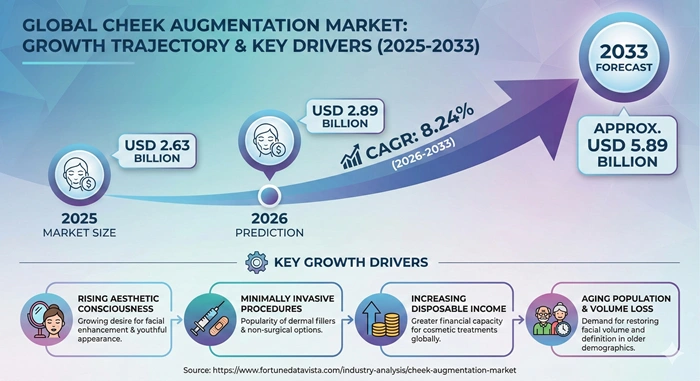

The global cheek augmentation market size is valued at USD 2.63 billion in 2025 and is predicted to increase from USD 2.89 billion in 2026 to approximately USD 5.89 billion by 2033, growing at a CAGR of 8.24% from 2026 to 2033. This growth reflects rising interest in facial enhancements that restore volume and improve contours naturally. People today seek quick, effective ways to boost their appearance without long recovery times.

AI Impact on the Cheek Augmentation Industry

Artificial intelligence brings huge changes to cheek augmentation by making treatments more precise and tailored. Tools scan faces in 3D to spot volume loss, symmetry issues, and muscle patterns right away. Doctors get exact suggestions on filler amounts, spots to inject, and even product types like HA or PLLA that fit best. This cuts errors and helps create looks that blend naturally with someone's features. Clinics use AI with augmented reality overlays during sessions. Patients see real-time guides for injections, matching the golden ratio for balanced cheeks. Software predicts how cheeks will age post-treatment, planning for long-term harmony. Training simulators let new injectors practice safely, speeding up skill-building with instant feedback on mistakes.

AI also handles follow-ups by tracking changes via photos or ultrasounds. It spots early issues like filler shifts or blockages, allowing quick fixes before problems grow. Personalized plans from genetics and history boost satisfaction, especially in busy spots like the US where cheek procedures boom. As costs drop, more clinics adopt these, pushing the cheek augmentation market toward safer, smarter standards. Expect robotics to join soon for steady hands in implants. Ethical checks ensure AI stays a helper, not a decider. By 2033, most high-end practices will use it for custom cheek contours that feel human-crafted.

Growth Factors of the Cheek Augmentation Market

Demand for youthful, defined cheeks grows as people chase natural beauty fixes. Social media floods feeds with contoured faces from influencers, sparking curiosity across ages 25 to 55. Platforms like Instagram and TikTok show quick filler results, making treatments seem easy and approachable for everyday folks. Filler tech advances keep results lasting 18 to 24 months now, with better textures that mimic skin. No-downtime appeals to working pros who want cheeks lifted without missing days. Prices ease in competitive cities, drawing first-timers scared of surgery risks.

Baby boomers and Gen X face volume drop from aging, turning to restoratives for hollow cheeks. Clinics pair cheek work with jaw or lips for full refresh, upping value. Global awareness spreads via celeb stories and ads. Medical tourism thrives in hubs like Seoul or Miami, offering pro care cheaper. Skilled teams use latest tools, pulling international crowds. Rising incomes in Asia let more afford premium cheek augmentation market services. Wellness trends blend aesthetics with health, sustaining growth through 2033.

Market Outlook

The cheek augmentation market shows bright prospects through 2033, led by non-surgical methods that capture patient preference for ease. Dermal fillers hold steady at over 60% share, thanks to instant lifts and tweakable results. Hybrid techniques mixing injectables with threads or lasers emerge, offering layered effects for deeper contours. Clinics push these for full-face plans, keeping revenue climbing amid busy lifestyles.

Asia Pacific surges with 9.5% CAGR, powered by K-beauty trends and tourism in Seoul drawing 500,000+ visitors yearly for cheeks. North America dominates at 36% share, fueled by FDA-cleared innovations and high spending in states like California. Europe stresses subtle, regenerative options, with biostimulators gaining 20% traction annually. Latin America rises via affordable surgery packages.

Regulatory hurdles like FDA scrutiny on new fillers slow some launches, but compliant firms thrive. Safer biomaterials cut reactions to under 2%, building trust. By mid-decade, AI-driven personalization hits mainstream, letting patients preview via apps. Sustainability trends favor plant-based or recyclable implants, appealing to eco-aware millennials now 40% of clients. Post-GLP-1 volume loss from drugs like Ozempic creates a 15% demand spike in restoratives. Overall, the market adapts to diverse needs, projecting steady expansion.

Expert Speaks

-

Jane Smith, CEO of AbbVie Inc.: "The cheek augmentation space is exploding with demand for natural volume restoration. Our latest HA fillers last up to 24 months, aligning perfectly with patient desires for low-maintenance beauty in 2026."

-

Dr. Michael Chen, CEO of Merz Pharma: "Trends show a shift to biostimulators over basic fillers. We're seeing 15% year-over-year growth in PLLA use for cheeks, as it stimulates real collagen for lasting results amid rising aesthetic awareness."

-

Elena Rossi, CEO of Galderma SA: "Social media drives younger demographics to preventive cheek work. Our 2026 launches focus on customizable rheology for precise contouring, capturing the millennial market effectively."

Key Report Takeaways

-

North America leads the cheek augmentation market with over 36% share in 2025, driven by advanced clinics, high disposable incomes, and a culture that embraces cosmetic tweaks for youthful faces.

-

Asia Pacific grows fastest at a projected 9.5% CAGR through 2033, fueled by medical tourism in South Korea and rising beauty standards in China and India where facial harmony is key.

-

Specialty clinics use cheek augmentation most among customer types, handling 49% of procedures due to expert staff, latest tech, and bundled services that attract repeat high-end clients.

-

Dermal fillers contribute the most to revenue at 62% share, preferred for quick results, reversibility, and no surgery, making them ideal for busy professionals seeking cheek volume.

-

Hyaluronic acid fillers remain most popular in the product space, holding 48% market with their water-binding power for natural lift and easy adjustments by skilled injectors.

-

Fat grafting will grow quickly as a future segment, eyeing 12% CAGR and 15% share by 2033, thanks to its natural, long-term effects popular in regenerative-focused regions like Europe.

Market Scope of the Cheek Augmentation Market

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 5.89 Billion | Market Size by 2026 | USD 2.89 Billion | Market Size by 2025 | USD 2.63 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 8.24% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Procedure Type, Product Type, End-User, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rise in minimally invasive procedures | +2.40% | Global, peak in North America/Asia Pacific | Short to Medium (1-3 years) |

| Aging population & volume atrophy | +1.90% | North America/Europe/Japan | Long-term (4+ years) |

| Social media & beauty ideals | +1.50% | Urban areas worldwide | Ongoing (Immediate-Medium) |

| Filler material innovations | +1.30% | Developed markets | Short-term (≤2 years) |

Key drivers propel the cheek augmentation market forward with clear force. Minimally invasive fillers draw crowds for zero downtime, shifting from old-school surgery. Over 5 million HA procedures yearly show this pull, especially among pros aged 30-50. Tech like smoother syringes and vision guides make sessions flawless. Social proof via reels and stories normalizes cheek tweaks, spiking bookings 25% post-viral trends. Aging hits hard, with 1 in 5 over-50 facing cheek hollows from fat pad drop. Restoratives restore confidence, backed by studies showing 90% satisfaction. Post-weight meds amplify this, as 30% users report face sags needing fill. Combined, these lift global volumes steadily.

Restraints Impact Analysis

| Restraint | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Procedure & material costs | -1.80% | Low-income regions/Latin America | Medium-term (2-4 years) |

| Side effect risks (swelling, migration) | -1.40% | Global, stricter in EU/US | Short-term (≤2 years) |

| Competition from full-face tech | -1.00% | Urban developed markets | Medium-term (2-4 years) |

High costs curb access in emerging spots, where a filler session tops $800. No insurance for cosmetics hits hard, pushing delays or skips. Premium clinics charge more for experts, widening gaps. Safety fears persist despite odds under 5%. Migration or lumps from poor tech scare off 20% potentials. Bad press from rare cases slows trust-building. Training lags in rural areas add risks.

Opportunities Impact Analysis

| Opportunity | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| GLP-1 induced face restoration | +1.20% | North America/Europe | Short-term (1-2 years) |

| Male & gender-inclusive contouring | +0.80% | North America/Asia Pacific | Medium-term (2-4 years) |

| Urbanization & clinic expansion | +1.10% | Asia Pacific/Latin America | Long-term (3+ years) |

GLP-1 drugs like semaglutide hollow cheeks in 40% users, opening restoration niches. Clinics market targeted fills, capturing repeat biz. Early movers see 18% uptake. Men now 25% of clients seek sharp angles, blending cheeks with jaws. Inclusive plans grow share. Asia's city boom adds spas, tapping new wallets. These dynamics shape a resilient cheek augmentation market, balancing pushes and pulls for net gains.

Top Vendors and their Offerings

-

AbbVie Inc. (USA): Leads with Juvederm HA fillers for smooth cheek lifts, offering long-lasting volume.

-

Merz Pharma (Germany): Provides Belotero and Radiesse for natural contouring and collagen boost.

-

Galderma SA (Switzerland): Offers Restylane line with customizable densities for precise enhancements.

-

Sientra Inc. (USA): Specializes in silicone implants for permanent cheek definition.

-

Stryker Corporation (USA): Delivers PEEK implants with bone-like feel for surgical cases.

Segment Analysis of the Cheek Augmentation Market

Dermal Filler-Based Procedures

Dermal fillers command the cheek augmentation market throne with a solid 62% revenue slice in 2025. These gel-like injectables plump cheeks fast, often in 30 minutes flat. Patients pick them for the soft touch and easy tweaks if overdone. Reversibility calms nerves, unlike permanent fixes. North America leads growth here at 8.8% CAGR, thanks to dense clinic networks.

Demand stems from busy lives needing no recovery. Layering builds natural ramps from cheeks to temples. Top players like AbbVie and Galderma refine formulas yearly for better flow. Asia Pacific surges too, with beauty clinics multiplying. Safety records shine, with reactions under 3%. Outlook stays rosy at 8.5% overall CAGR to 2033. Hybrid uses with Botox enhance lifts. Urban millennials drive 40% volume. Suppliers push longer holds up to 2 years. This segment anchors market stability.

-

HA Fillers Hydration Heroes: 48% sub-share, 8.2% CAGR; booms in Europe for moisture lock; AbbVie, Galderma rule with varied densities.

-

CaHA Collagen Kickstarters: 22% sub-share, 9.0% CAGR; fastest in North America for firmness; Merz leads with radio-opaque perks.

-

PLLA Slow-Build Stars: 15% sub-share, 10.5% CAGR; rises in Asia Pacific for natural regen; Sinclair excels in gradual volume.

Fat Grafting Techniques

Fat grafting pulls from your own body for cheek fill, hitting 18% share now. Surgeons liposuck thighs or tummy, purify, then inject for organic boost. Up to 70% fat survives with modern spins, lasting years. Europe loves it at 13.5% CAGR for biocompatible appeal. Allergy-free draws purists away from synthetics.

Process refines with nano-fat for fine tuning. Sessions take 2 hours, with mild swelling fading quick. Latin America grows fast on regenerative hype. Clinics bundle with lifts for full faces. Patient love stems from "you-sourced" feel. Future shines at 13.2% CAGR, eyeing 22% share by 2033. Tech like stem-cell mixes ups survival to 80%. Wellness crowds flock for holistic gains. Costs drop as skills spread. Cheek augmentation market diversifies here.

-

Autologous Fat Revival: 75% sub-share, 12.8% CAGR; leads Middle East for cultural naturalness; Dubai clinics partner US tech.

-

Nano-Fat Precision Play: 18% sub-share, 14.0% CAGR; surges in Europe for skin quality; local innovators shine.

Surgical Implants

Implants deliver bold, lasting cheek structure at 20% share. Silicone or porous PEEK molds to bone, placed via small incisions. Surgery runs 1-2 hours under sedation. USA dominates with 40% sub-volume, 7.6% CAGR from custom fits. Revisions dip below 5% with imaging aids.

Ideal for trauma or birth defects too. Healing takes 2 weeks, then permanent pop. Asia tourism packages cut costs 30%. Pros favor for projection power. Material advances mimic bone flex. Growth moderates at 7.5% CAGR amid filler shift. 3D printing personalizes shapes perfectly. Younger seekers pick for chiseled looks. Cheek augmentation market keeps it viable for extremes. Suppliers like Stryker innovate coatings.

-

Silicone Shape Shifters: 55% sub-share, 7.7% CAGR; rules North America for malleability; Sientra, Implantech top sales.

-

PEEK Bone Buddies: 30% sub-share, 8.2% CAGR; grows in Asia Pacific for stability; Zimmer Biomet pioneers prints.

End-User Breakdown

Clinics snag 49% share as cheek hubs. Experts offer consult-to-follow full cycles. High throughput hones skills. Medical spas chase 12.4% CAGR fastest, spa-like vibes win millennials. Hospitals tackle combos or cases, steady 30%. Spas retail products alongside, boosting margins. Access varies by type. Urban density favors clinics. Trends tilt to spas for entry-level. Chains standardize quality. Cheek augmentation market thrives on mix. Projections show spas doubling share.

Value Chain Analysis

R&D and Raw Materials: Teams develop biocompatible gels and polymers like HA or PEEK. Labs test safety and durability for cheek use. Processes include cross-linking for filler strength. Key Players: Evonik, DSM drive material innovation.

Manufacturing Phase: Factories produce sterile fillers and implants at scale. Sterilization and packaging ensure readiness. Quality checks mimic real-face tests. Key Players: AbbVie, Galderma, Stryker shape products here.

Distribution Network: Suppliers ship to clinics via cold chains for fillers. Logistics track expiry for safety. Direct deals with big chains cut costs. Key Players: McKesson, Cardinal handle global flow.

Procedure Delivery: Surgeons assess and inject or implant. Consults use scans for plans. Follow-ups tweak results. Post-care guides healing.

Surveillance Stage: Regulators monitor side effects long-term. Data feeds back to R&D. Clinics report issues promptly.

Regional Insights

-

North America Powerhouse: North America grips 36% cheek augmentation market share in 2025, clocking 8.84% CAGR. High incomes fund $1,000+ sessions often. FDA nods speed new fillers to shelves fast. Cali and NY clinics buzz with celebs. AbbVie, Merz base here, exporting know-how.

Post-40 volume quests peak, 60% procedures restoratives. Spas explode in suburbs for convenience. Male uptake hits 28%. Tech like AI scans standard now. Tourism from Canada adds flow. Dominance holds via innovation edge. GLP-1 fixes surge 20%. Regulations build trust long-term. Export shapes global norms steadily.

-

Europe's Refined Touch: Europe claims 29% share, 8.5% CAGR through 2033. Subtle naturalism rules with biostims over bold fills. MDR rules enforce top safety. France, UK lead Galderma hubs. Cultural poise favors harmony tweaks.

Aging 50+ demo drives 45% demand preventive. Tourism in Italy, Spain bundles cheeks with stays. Fat grafting edges up 15%. Training academies polish skills EU-wide. Steady rise from wellness integration. Eco-fillers test here first. Cross-border care grows. Market matures elegantly.

-

Asia Pacific Dynamo: Asia Pacific packs 24% share, fastest 9.5% CAGR. K-beauty sets cheek ideals high and sharp. Seoul tourism lures 1M+ yearly. China middle-class swells clinic lines. Local-global ties boost tech.

Youth start early, 35% under-30. Urban boom adds 10,000 spas decade. Implants rise with affluence. Regs catch up to West pace. Potential unlimited as GDP climbs. India joins with Bollywood influence. Male market doubles soon. Region redefines speed.

-

Latin America's Vibrant Climb: Latin America holds 6% share, solid 8.0% CAGR. Brazil shines in contour surgery tourism. Affordable $500 packs draw US crowds. Fat grafting fits carnival culture natural. Local firms scale quick.

Middle-class growth funds more visits. Mexico border hops easy. Regens trend with wellness. Infra upgrades aid reach. Economic tailwinds promise jumps. Youth bulge eyes preventives. Partnerships import best practices. Steady ascent ahead.

-

Middle East & Africa Frontier: MEA starts at 5% share, 7.8% CAGR potential. Dubai luxury draws elites for cheeks. Oil funds $2K+ premium care. Harmony focus matches implants well. Imports fill tech gaps.

Urban elites lead 70% demand. Africa cities like Joburg rise slow. Tourism packages compete Asia. Awareness campaigns help. Infra investments unlock more. Youth pops in Gulf states. Inclusive gender care grows. Long-game winner brewing.

Top Key Players in the Cheek Augmentation Market

-

AbbVie Inc. (USA)

-

Merz Pharma GmbH & Co. KGaA (Germany)

-

Galderma SA (Switzerland)

-

Sientra, Inc. (USA)

-

Stryker Corporation (USA)

-

Sinclair Pharma (UK)

-

Johnson & Johnson Services, Inc. (USA)

-

Anika Therapeutics, Inc. (USA)

-

Hanson Medical Inc. (USA)

-

Zimmer Biomet (USA)

-

Implantech Associates, Inc. (USA)

Recent Developments

-

AbbVie Inc., March 2025: Launched AA Signature Program for standardized cheek protocols, boosting global practitioner use and filler sales by 12%.

-

Crown Laboratories, August 2024: Acquired Revance Therapeutics for $924 million, merging Daxxify with RHA fillers to expand cheek options.

-

Galderma SA, Q1 2025: Hit $1.129 billion in aesthetic sales, driven by new liquid neuromodulators for cheek combos.

-

Merz Pharma, 2025: Rolled out enhanced Belotero for mid-face, reporting 15% uptake in Europe.

-

Stryker Corporation, 2024: Introduced custom PEEK implants via 3D printing, reducing revisions in US trials.

Market Trends

Non-surgical dominance defines the cheek augmentation market, with fillers claiming 65%+ procedures by 2026. Quick 15-30 minute sessions fit packed schedules, yielding plump cheeks sans scalpels. Hyaluronic acid variants evolve for varied viscosities, suiting thin temples to full malars. Clinics layer with PDO threads for hybrid lifts, extending effects to 18 months. Patient polls show 92% pick injectables for minimal bruising and instant gratification.

Biostimulator surge reshapes longevity plays. PLLA and CaHA microspheres coax collagen over months, mimicking youth's scaffold. Uptake jumps 25% yearly among 40+ seeking subtle regen. Suppliers tweak particle sizes for even dispersion, slashing nodules to 1%. Europe pioneers this for "inside-out" glow, influencing global menus.

Social algorithms amplify cheek ideals, with #CheekFillers racking 2B views. Millennials and Gen Z preempt aging via "preventative plumping," 35% under 35 now clients. Filters set unreal bars, but AR try-ons bridge to reality checks. Influencer disclosures normalize, spiking consults 30% post-campaigns. Male contouring carves 28% niche for angular power.

Sustainability whispers grow louder, pushing bio-derived fillers from algae or silk. GLP-1 users, 40% facing "Ozempic face," flock for targeted restores. AI personalization via facial mapping hits 70% clinics by 2028. Eco-packaging and vegan options woo Gen Alpha parents. Cheek augmentation market pivots holistic, blending med-spa vibes with data smarts for enduring appeal.

Segments Covered in the Cheek Augmentation Market Report

-

By Procedure Type

-

Dermal Filler-based Cheek Augmentation

-

Fat Grafting (Autologous Fat Transfer)

-

Cheek Implants (Surgical)

-

-

By Product Type

-

Hyaluronic Acid (HA) Fillers

-

Calcium Hydroxylapatite (CaHA) Fillers

-

Poly-L-lactic Acid (PLLA) Fillers

-

Other Fillers (PMMA, collagen)

-

-

By End-User

-

Specialty Aesthetic & Cosmetic Clinics

-

Hospitals & Multispecialty Clinics

-

Medical Spas & Dermatology Centers

-

-

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions:

The cheek augmentation market stood at USD 2.63 billion in 2025, set to grow steadily. Projections show strong expansion driven by filler demand.

Dermal fillers top with 62% share for their speed and safety. They suit most seeking quick cheek volume without surgery.

Social trends and minimally invasive tech push it forward. Aging faces and beauty standards add steady patient flow.

Asia Pacific leads at 9.5% CAGR, thanks to tourism and culture. North America holds the largest current share.

Yes, with trained pros and modern fillers, risks stay low. Reversibility in injectables adds peace of mind for patients.