Earthquake Insurance Market Overview

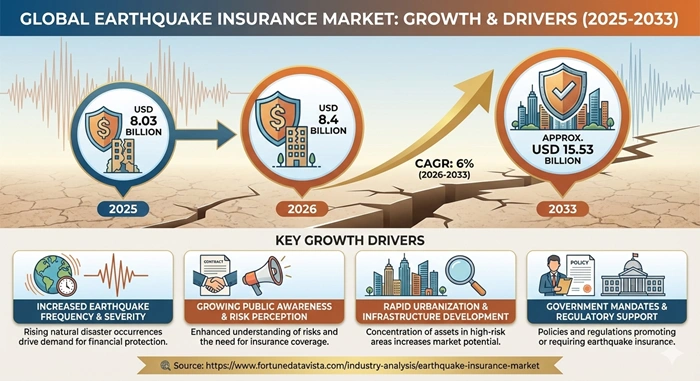

The global earthquake insurance market size is valued at USD 8.03 billion in 2025 and is predicted to increase from USD 8.4 billion in 2026 to approximately USD 15.53 billion by 2033, growing at a CAGR of 6% from 2026 to 2033. These add-on policies guard against shakes that wreck homes and shops. Standard home covers skip quake damage, leaving owners exposed big. Fault zones see steady buys as scares remind folks.

AI Impact on the Earthquake Insurance Industry

AI maps risks sharp in the earthquake insurance industry by blending seismic logs with builds data. Insurers spot weak spots like soft soil zones fast. Premiums fit true, firms dodge bad pools. Claims fly via app pics and sensors ping shakes live. Adjusters skip sites if drones scan cracks clear. Fraud drops as patterns flag odd claims quick. Models test mega quakes virtual, reinsurers plan caps smart. Small carriers grab cloud AI cheap now. Speed builds trust post big events.

Earthquake Insurance Market Growth Factors

Urban sprawl hugs faults tight, amps quake stakes high. LA suburbs insure homes full now. Awareness spikes after events like Morocco 2023. New codes mandate quake riders on loans for banks. Japan pools cover most homes low cost. Climate may stir more slips, firms push covers broad. Property booms lift rebuild tabs, owners eye shields firm. Brokers bundle easy with fire riders smart.

Market Outlook

Parametric triggers pay on shake force alone in the earthquake insurance market, no damage proofs slow. Sensors net homes for instant cash. Asia faults draw reinsurers global. Digital portals quote personal lines mobile quick. Europe retrofits drop rates green. Penetration climbs slow but sure from scares. By 2033, apps hit SMEs with micro covers cheap. Cyber locks guard data as hacks eye. Uptake from mandates steady. Hybrids mix comp with cat for flex. Education campaigns lift buys post quakes.

Expert Speaks

- Warren Buffett, CEO of Berkshire Hathaway (USA): "Quake risks need deep reinsurance to weather the big ones without breaks."

- Michael Tipsord, CEO of State Farm (USA): "Educating families in fault zones builds coverage that lasts through tremors."

- Tom Wilson, CEO of Allstate (USA): "Smart models price quake protection right for homes standing tall."

Earthquake Insurance Market Key Report Takeaways

- North America commands the earthquake insurance market holding 38% share via California CEA pools that back millions of homes against San Andreas threats.

- Asia Pacific accelerates fastest with 7.5% CAGR from Ring of Fire mandates in Japan and Indonesia where urban towers insure heavy.

- Individuals dominate purchases safeguarding family homes in suburb faults from total loss rebuilds.

- Comprehensive coverage drives revenue shielding structures and contents full against cracks and slides.

- Agents lead distribution fostering trust in high-risk chats for rider adds.

- Commercial lines leap forward reaching 33% share by 2033 at 7.2% CAGR as factories and malls cover in emerging shakes.

Earthquake Insurance Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 15.53 Billion | Market Size by 2026 | USD 8.4 Billion | Market Size by 2025 | USD 8.03 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 6% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Coverage Type, Distribution Channel, Application, End-User, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Earthquake Insurance Market Dynamics

Drivers Impact Analysis

|

Driver |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Seismic Activity Rise |

+2.6% |

Global, Asia Pacific |

Short (≤2 yrs) |

|

Property Value Surge |

+2.1% |

North America, Europe |

Medium (2-4 yrs) |

|

Regulatory Mandates |

+1.7% |

Asia Pacific |

Medium (2-4 yrs) |

|

Risk Awareness |

+1.4% |

North America |

Short (≤2 yrs) |

Drivers thrust the earthquake insurance market forward as quakes jar cities more from deep faults wake. Homes insure or face loan halts sharp. Pools like Japan's GYORUI spread loads low. Builds climb values high in the earthquake insurance market. Towers need comp shields now. Mandates post events lock riders firm. Education after rumbles lifts personal buys quick.

Restraints Impact Analysis

|

Restraint |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Premium Affordability |

-2.0% |

Global |

Short (≤2 yrs) |

|

Underestimated Risks |

-1.5% |

Europe, Latin America |

Medium (2-4 yrs) |

|

Reinsurer Limits |

-1.2% |

Asia Pacific |

Medium (2-4 yrs) |

Restraints temper the earthquake insurance market with high tabs in red zones like SF. Skippers see odds low still. Perception gaps slow quiet belts in the earthquake insurance market. Reinsurers cap after payouts fat. Models lag new faults fresh.

Opportunities Impact Analysis

|

Opportunity |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Parametric Innovations |

+2.3% |

Global |

Short (≤2 yrs) |

|

Online Distribution |

+1.8% |

North America, Europe |

Medium (2-4 yrs) |

|

Mitigation Discounts |

+1.5% |

Asia Pacific |

Medium (2-4 yrs) |

Opportunities beckon the earthquake insurance market via parametric hits on intensity pure. No proofs, cash flows fast. Apps slash agent costs low. Bolts earn rate cuts green.

Top Vendors and their Offerings

- State Farm (USA) offers home riders with CEA ties for California quake peace.

- Allstate (USA) prices via advanced models, flex deducts for fault homes.

- GeoVera (USA) leads CEA pools, mass covers for high-risk clusters.

- Chubb (Switzerland) tailors business quake for warehouses tough.

- Zurich (Switzerland) parametric quick pays global shakes.

Earthquake Insurance Market Segment Analysis

By Coverage Type

Comprehensive Coverage

Comprehensive Coverage commands 67% share with 6.2% CAGR, thriving in North America where full rebuilds worry owners post 1994 Northridge. State Farm bundles seamless on policies base. Covers shakes plus fires from gas breaks common. Deducts 15% average suit mid homes fine. Claims mend roofs to slabs total. Allstate adds contents like cabinets cracked.

Catastrophic Coverage

Catastrophic Coverage takes 33% share, 5.8% CAGR in Europe for basics cheap.

By Distribution Channel

Agents

Agents holds 44% share at 6.1% CAGR, booming in Asia Pacific where trust wins Japan mandates. Tokio Marine agents explain riders door-to-door. Chats build loyalty long. Digital aids but faces close sales high. Post-quake surges favor personal touch warm.

By Application

Personal Lines

Personal Lines grabs 61% share, 6.3% CAGR in North America for family shields.

By End-User

Individuals

Individuals leads 57% share, 6% CAGR global for nests safe.

Value Chain Analysis

- Risk Modeling & Underwriting → Crunch seismic data into odds true. Actuaries build cat models with fault maps fresh. Description: Fault lines, soil amps, builds tie premiums right. AI sims test mega quakes virtual. Key Players: RMS, Swiss Re.

- Policy Sales & Issuance → Quote riders fit on homes quick. Brokers pitch deducts low. Description: Portals bundle fire-quake easy. Agents eye local risks sharp. Apps speed approvals day. Key Players: State Farm, brokers indie.

- Claims Adjudication & Payout → Verify damage snaps from drones fast. Adjusters field cracks deep. Description: Parametric skips proofs pure. Sensors ping shakes live. Fraud nets flag outliers quick. Key Players: Allstate, GeoVera.

Earthquake Insurance Market Regional Insights

North America

North America seizes 38% share at 6% CAGR. State Farm floods CA homes steady. GeoVera powers CEA for millions covered. San Andreas faults nudge buys post minor shakes. Disclosure laws bare risks real to buyers. Penetration hovers 12% but urban spikes sharp.

Europe

Europe nets 20% share with 5.8% CAGR. Zurich bolsters Greece homes sturdy. Allianz aids Turkey retrofits post 2023. TCIP pools mandate Ankara towers. Rare quakes sting big when hit. Exports demand comp covers full.

Asia Pacific

Asia Pacific rockets 26% share, 7.5% CAGR. Tokio Marine mandates Japan riders vast. Munich Re reinsures Manila booms fast. Ring faults wake cities dense. China quake funds pilot pools new. Skyscrapers insure or stall loans tight.

Latin America

Latin America climbs 9% share at 6.5% CAGR. Chubb shields Chile ports deep. Mexico City faults lift condo buys slow. Andes slips hit mines hard. Builds coastal amp exposures fresh. Pacts open reinsurer flows wide.

Middle East & Africa

Middle East & Africa claims 7% share, 6.8% CAGR. AXA mends Iranian rebuilds tough. Africa mines cover rumbles rare but dear. UAE towers bolt premium low. Funds quake-proof infra new. Desert faults stir first pools now.

Earthquake Insurance Market Top Key Players

- State Farm (USA)

- Allstate Corporation (USA)

- GeoVera Holdings (USA)

- Chubb Limited (Switzerland)

- Zurich Insurance Group (Switzerland)

- Berkshire Hathaway (USA)

- Liberty Mutual Insurance (USA)

- Farmers Insurance Group (USA)

- USAA (USA)

- Tokio Marine Holdings (Japan)

Recent Developments

- State Farm (2025): Deepened CEA capacity 25% for CA surge post minor quakes.

- Allstate (2025): AI risk tool slashed premiums 12% precise in PNW faults.

- GeoVera (2024): Acquired by SageSure, quake pool scale doubled fast.

- Chubb (2025): Parametric launch Asia, intensity pays instant no claims.

- Zurich (2025): Partnered CoreLogic for Euro quake data deep.

Earthquake Insurance Market Trends

Earthquake insurance market taps sensors home for shake alerts live. Policies trigger deduct cuts early. Clouds refresh models hourly cheap. Parametric spreads no-fuss pays quick to SMEs. Apps quote bundles fire-quake smooth. Bolts earn 25% discounts smart retrofits. Earthquake insurance market links climate to slips subtle. Gov pools blend private for low-income shields.

Earthquake Insurance Market Segments Covered in the Report

- By Coverage Type

- Comprehensive Coverage

- Catastrophic Coverage

- By Distribution Channel

- Banks

- Agents

- Brokers

- Retailers

- Other Distribution Channels

- By Application

- Personal Lines

- Commercial Lines

- By End-User

- Individuals

- Businesses

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions:

Fault builds and quake scares propel the earthquake insurance market for covers firm.

North America rules via CEA might huge.

6% CAGR charts 2026-2033 course true.

Full shields mend homes contents deep.

High costs deter low-risk buyers still.