Edge Artificial Intelligence Chips Market Overview

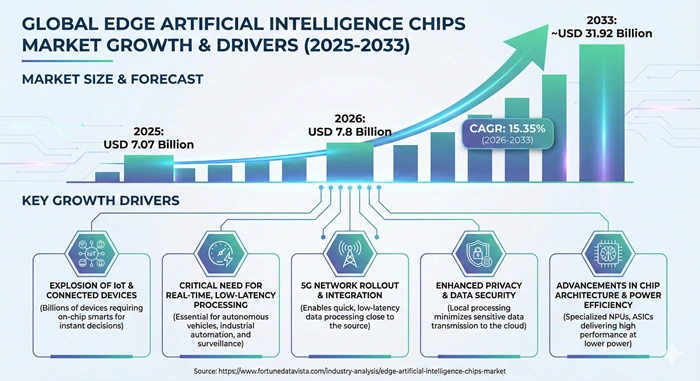

The global edge artificial intelligence chips market size is valued at USD 7.07 billion in 2025 and is predicted to increase from USD 7.8 billion in 2026 to approximately USD 31.92 billion by 2033, growing at a CAGR of 15.35% from 2026 to 2033.These chips bring smart processing power right to the device level, from smartwatches to factory robots. They handle tasks like image recognition without sending data far away. This setup saves time and keeps information secure as more devices connect daily.

AI Impact on the Edge Artificial Intelligence Chips Industry

Artificial intelligence profoundly transforms the edge artificial intelligence chips industry by enabling chips to run sophisticated models right on devices, slashing reliance on distant clouds. These chips now pack neural processing units (NPUs) that handle inference for tasks like object detection in cameras or voice commands in phones. AI optimizes chip designs themselves, using generative tools to craft efficient architectures that squeeze more performance from tiny power budgets. This self-improvement loop accelerates innovation, making edge AI viable for battery-powered gear in remote factories or wearables. Industries see latency drops to milliseconds, unlocking real-time apps undreamed before.

AI drives edge chips toward hyper-efficiency, tackling heat and power hurdles with dynamic scaling. Algorithms predict workloads, throttling cores to save energy during idle times while bursting for peaks. In autos, this means safer ADAS without draining vehicle batteries. Healthcare gets portable diagnostics that analyze scans on-site, preserving privacy under regs like GDPR. Cloud costs plummet as data stays local, shifting economics for IoT fleets. Future waves see AI fusing with quantum-inspired cooling and neuromorphic designs mimicking brains for ultra-low power. Chips learn from usage, self-updating firmware for better accuracy over time. This disrupts giants, empowering startups with custom silicon via no-code tools. Sectors like robotics gain autonomy, making cobots smarter without WiFi. Overall, AI turns edge chips from processors to intelligent partners, reshaping devices into proactive systems.

Growth Factors of the Edge Artificial Intelligence Chips Market

Exploding IoT devices—over 30 billion by 2030—propel the edge AI chips market, as each needs on-chip smarts for instant decisions. Smart factories deploy sensors spotting defects in milliseconds, avoiding cloud lags that halt lines. Consumer gadgets like AR glasses demand low-power inference for fluid experiences. 5G blankets connectivity, feeding data floods that edge chips process locally. This connectivity boom multiplies chip needs across homes and cities.

Real-time processing hunger in autos and surveillance fuels rapid uptake. Self-driving cars crunch lidar data on-board to dodge hazards, where delays spell danger. Security cams identify threats instantly, alerting guards sans bandwidth hogs. Healthcare wearables monitor vitals continuously, flagging issues before hospitals. Regulations mandate data sovereignty, pushing edge over cloud for privacy. Semiconductor leaps like 3nm nodes pack TOPS into phone-sized power envelopes. Firms race with NPUs outperforming GPUs at 1/10th energy. Government AI pushes, like US CHIPS Act, fund fabs and R&D. Falling prices democratize access, from drones to smart fridges. Pandemic proved resilient local compute, accelerating enterprise shifts.

Market Outlook of the Edge Artificial Intelligence Chips Market

The edge artificial intelligence chips market charts a robust path to 2033, propelled by IoT surges and 5G rollout that demand instant local compute. Valued strongly in 2025, it eyes exponential gains as devices hit 40 billion units globally. North America spearheads with 35% share, thanks to auto and defense spends, while Asia Pacific rockets at 14% CAGR on China fabs and India smart cities. Autos alone could claim 25% by decade's end, blending ADAS with full autonomy. Balanced growth tempers supply gluts with R&D booms.

Latency-zero mandates reshape priorities, favoring chips with 50+ TOPS at under 5W. Cloud giants pivot to edge, partnering chipmakers for hybrid stacks. Regs like EU AI Act enforce secure local processing, spurring compliant silicon. Sustainability pressures low-power designs, cutting data center footprints by 60%. Emerging apps in agrotech—drones spotting crop woes—open niches. Consolidations loom as Qualcomm eyes Arm tweaks for custom cores, while startups snag niches in neuromorphic. Geopolitics boost onshoring, with US subsidies hitting $50B. By 2033, edge chips power 80% of AI inferences, flipping cloud dominance. Investors bet big on software ecosystems easing model deployment. Market blends maturity in mobiles with wildcards like space edge AI.

Edge Artificial Intelligence Chips Market Expert Speaks

- Jensen Huang, CEO of NVIDIA (USA): "Edge AI chips put supercomputer brains in every gadget, letting robots see and decide on their own without cloud help."

- Pat Gelsinger, CEO of Intel (USA): "These processors bring instant smarts to shops and plants, spotting issues before they cost a fortune."

- Christiano Amon, CEO of Qualcomm (USA): "Our edge tech makes phones and cars alive with AI, handling voice and vision right inside."

Key Report Takeaways

- North America leads the edge artificial intelligence chips market holding around 32% share through tech powerhouses like NVIDIA and Intel that push auto and defense uses with heavy funding and quick tests.

- Asia Pacific races ahead fastest at 19% CAGR thanks to factory booms in China and Taiwan feeding endless demand for phones and sensors.

- Consumer electronics buyers top the list snapping up chips for camera tricks and voice helpers in daily gadgets.

- Automotive apps bring in the most cash with needs for fast sensor reads in self-driving and safety gear.

- ASICs rule the chip types for their perfect fit in steady jobs like watch cams.

- NPUs/AI accelerators speed up most grabbing 25% share by 2033 at 20.5% CAGR from robot and wearable booms.

Edge Artificial Intelligence Chips Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 31.92 Billion | Market Size by 2026 | USD 7.8 Billion | Market Size by 2025 | USD 7.07 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 15.35% | Dominating Region | Asia Pacific | Fastest Growing Region | North America | Segments Covered | Chip Type, Component, Technology Node, Application, End-Use Industry, Form Factor, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics of the Edge Artificial Intelligence Chips Market

Drivers Impact Analysis

| Driver | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| IoT & 5G Proliferation | High (30%) | Global, APAC heavy | Immediate-Long |

| Latency-Critical Apps | High (25%) | Autos, Surveillance | Short-Medium |

| Privacy & Data Regs | Medium (20%) | Europe, USA | Ongoing |

| Power Efficiency Advances | Medium (15%) | Consumer IoT | Medium-Long |

The edge artificial intelligence chips market accelerates dramatically due to IoT proliferation, connecting more than 30 billion devices that crave onboard intelligence for autonomous operation far from cloud crutches, enabling smart factories to predict machine failures hours ahead and avert production halts costing millions daily. 5G's blistering speeds pump petabytes directly to edge gateways, where chips like Qualcomm's process video feeds for traffic management systems optimizing flows across megacities without a single packet hitting central servers. Automotive giants embed these for ADAS that fuses radar, lidar, and cams into life-saving decisions executed in microseconds, far outpacing human reflexes on rain-slicked freeways. Consumer wearables leverage them to monitor vitals continuously, flagging cardiac events before symptoms strike and summoning help preemptively. This interconnected ecosystem turns everyday objects into proactive sentinels, multiplying chip demand exponentially.

Latency-critical applications supercharge growth in surveillance networks spanning continents, where cams identify threats instantly to alert responders before incidents escalate, bypassing bandwidth chokes that plague cloud-dependent setups during peak hours. Drones swarm warehouses sorting parcels with edge vision that dodges collisions mid-air, while healthcare portables analyze X-rays on-site in rural clinics lacking fiber links. Privacy regulations worldwide, from Europe's GDPR to California's CCPA, mandate data sovereignty by forcing inference at the source, shielding sensitive biometrics and location trails from breaches that dominate headlines. Power efficiency leaps through 2nm transistors and chiplet stacking deliver 50+ TOPS at whisper-quiet milliwatt levels, sustaining always-on operation in solar-powered ag sensors monitoring vast fields tirelessly.

Regulatory tailwinds align perfectly, with governments subsidizing edge via acts like the US CHIPS pouring $52 billion into fabs that prioritize low-latency silicon for national security drones patrolling borders undetected. Industrial shifts to Industry 5.0 demand human-robot collab requiring edge brains grasping nuanced gestures safely. Cloud economics flip as enterprises slash TCO by 70% offloading inferences, fueling a virtuous cycle of adoption where each deployment begets more sophisticated workloads. The edge artificial intelligence chips market rides these waves toward ubiquity.

Restraints Impact Analysis

| Restraint | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High Design & Fab Costs | Medium (20%) | Startups, Emerging | Medium-Term |

| Thermal/Power Limits | Medium (15%) | High-Perf Devices | Short-Term |

| Software Ecosystem Gaps | Low (12%) | Non-Cloud Devs | Ongoing |

| Supply Chain Bottlenecks | Low (10%) | Global, Taiwan reliant | Short-Medium |

Exorbitant design and fabrication costs erect formidable barriers in the edge artificial intelligence chips arena, with state-of-the-art 2nm fabs demanding $25 billion upfront plus years of R&D to yield viable silicon, pricing out all but behemoths like TSMC and Samsung from the game. Startups scramble for VC war chests exceeding $500 million just to tape out prototypes, often pivoting to fabless models dependent on foundry queues stretching quarters amid surging AI demand. Custom ASICs mandate production runs in the millions to amortize NRE fees hitting $100 million, dooming niche innovators to off-the-shelf compromises that sacrifice 30% efficiency. Emerging markets in Africa and Latin America grapple with import tariffs inflating landed costs 50%, stalling local IoT rollouts despite ripe use cases in precision farming.

Thermal and power envelopes constrict high-performance ambitions, as dense NPUs guzzling 20W ignite in fanless drones forcing derates that cripple sustained inference during marathon flights over disaster zones. Mobile edge hits silicon's physical ceiling around 5W sustained, throttling generative AI in phones to sporadic bursts that frustrate users mid-conversation. Cooling hacks like graphene pads add bulk antithetical to wearables hugging wrists 24/7. Industrial cabinets vent aggressively yet still curtail TOPS during summer peaks in Indian factories.

Software ecosystem immaturity plagues developers wrestling incompatible frameworks across Arm, RISC-V, and x86 edges, with TinyML quantization tools buggy for complex vision transformers demanding weeks of manual tweaks. Cloud natives balk at edge's paucity of pre-trained models optimized for kilobyte footprints, inflating dev cycles 5x. Supply chain chokepoints in Taiwan expose global ramps to quakes and tensions, delaying Qualcomm's 2026 NPU waves by months as seen in 2024 shortages.

Opportunities Impact Analysis

| Opportunity | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Auto & Industrial Autonomy | High (28%) | USA, Europe, China | Short-Long |

| Neuromorphic & Custom ASICs | High (22%) | Global R&D Hubs | Medium-Long |

| Edge in Emerging Markets | Medium (18%) | APAC, Africa | Ongoing |

| Federated Learning Hybrids | Medium (15%) | Privacy-Focused | Short-Term |

Automotive autonomy unlocks trillion-dollar vistas for Level 4/5 vehicles mandating 2000+ TOPS edge clusters orchestrating sensor symphonies across radars, lidars, and 8K cams to pilot urban jungles flawlessly, with Tesla's Dojo spinoffs and Waymo fleets proving viability today. Industrial colossi automate via edge vision halting lines at micro-cracks invisible to eyes, Siemens slashing downtime 40% in German behemoths churning EVs tirelessly. China's BYD embeds domestic chips in 5 million annual cars, Europe’s VW stacks them for platooning semis saving fuel 15%. Humanoids like Figure learn grasps edge-local, scaling factories sans cloud bills.

Neuromorphic paradigms promise brain-mimicking spikes slashing power 200x for eternal vigilance in wearables forecasting seizures from EEGs or drones eternally mapping forests for fires. Custom ASICs proliferate via fabless explosions, Hailo crafting vision beasts for retail cams boosting sales 25% via shopper insights. Silicon Valley prototypes quantum-neuro hybrids, Europe funds open neuromorphs under Horizon. RISC-V unleashes horde of tailormades for niches like oil rig predictors.

Emerging markets brim with untapped scale, India's 1B+ mobiles ripe for voice AI in 20 languages edge-local, Africa's solar edges optimizing microgrids in off-grid villages lifting productivity 30%. Cheap MCUs democratize, Brazil's ag drones spot droughts precisely. Federated hybrids aggregate wisdom across fleets privately, phones crowdsourcing traffic sans data leaks, autos sharing road scars anonymously. Privacy sanctuaries like EU amplify, turning regs into ramps for edge supremacy.

Top Vendors and their Offerings

- NVIDIA Corporation (USA) stands out with Jetson boards that run heavy AI on drones and bots, easy to tweak for tough jobs.

- Intel Corporation (USA) brings Movidius chips for sharp vision in cams and scanners, sipping power all day long.

- Qualcomm Technologies (USA) packs Snapdragon with AI cores for phones and cars, mixing net and smarts seamless.

- Advanced Micro Devices (USA) rolls Versal chips that flex for factory shifts, blending speed and change.

- Apple Inc. (USA) hides Neural Engines in phones for private photo fixes and health checks on board.

Segment Analysis of the Edge Artificial Intelligence Chips Market

Chip Type Segment – ASICs Spearhead Customization

ASICs lead the edge artificial intelligence chips market with a dominant 42% revenue share in 2025, meticulously engineered for singular tasks such as real-time object detection in autonomous vehicle cameras, delivering unparalleled power efficiency that extends battery life in remote industrial sensors by weeks while outperforming general-purpose alternatives by factors of ten. Their inflexible yet hyper-optimized architecture makes them indispensable for high-volume consumer devices like smartphones, where Qualcomm's Snapdragon NPUs enable on-device generative AI for photo enhancement without draining batteries or phoning home to the cloud. North America's automotive sector accelerates ASIC growth at an impressive 18.5% CAGR through 2033, leveraging TSMC's bleeding-edge 2nm processes to fuse lidar, radar, and vision data into split-second decisions that keep self-driving fleets on safe paths. Europe's manufacturing giants like Bosch integrate ASICs into robotic arms for precision assembly lines, slashing energy costs and boosting yields in Industry 4.0 factories that never sleep. This segment's tailorable nature positions it as the go-to for mission-critical edge deployments where every milliwatt and microsecond counts toward competitive edges.

GPUs capture 24% of the pie, prized for their parallel processing muscle in graphics-intensive edge applications like augmented reality glasses that overlay digital worlds on reality with buttery smoothness, growing steadily at 16.5% CAGR as AMD's embedded Radeon series powers handheld gaming rigs and digital signage that adapts content dynamically. FPGAs follow closely at 19% share with 17.5% CAGR, their reprogrammable fabric allowing post-manufacture tweaks for evolving prototypes in Chinese R&D labs prototyping next-gen federated learning models that train across device fleets without compromising privacy. NPUs round out at 15% but sprint ahead at 23% CAGR, purpose-built for pure inference in wearables that predict health crises from heart rhythms locally, sidestepping HIPAA hurdles entirely. Asia Pacific's smartphone frenzy propels GPU volumes into billions, while FPGA agility suits agile supply chains shifting to sovereign silicon amid trade wars.

Hybrid architectures blending ASIC rigidity with FPGA versatility emerge as dark horses, addressing drones that swap navigation for delivery mid-mission, while consumer gadgets favor GPU flair for immersive experiences and enterprise stacks bet on NPU thrift for ROI in predictive maintenance. The edge artificial intelligence chips market increasingly favors specialization as workloads splinter, with NPUs poised to eclipse others in the inference-heavy future where cloud becomes yesterday's bottleneck. RISC-V open standards democratize entry, letting startups craft bespoke cores without Arm royalties, fueling a Cambrian explosion of silicon tailored to niches from ag drones to edge servers.

-

ASICs – 42% share, 18.5% CAGR, USA auto fusion king; NVIDIA Drive Orin packs 254 TOPS.

-

GPUs – 24% share, 16.5% CAGR, Europe AR dazzler; AMD Radeon embedded versatile.

-

FPGAs – 19% share, 17.5% CAGR, China prototype wizard; Xilinx Versal adaptive.

-

NPUs – 15% share, 23% CAGR, APAC wearable whiz; Qualcomm AI Engine surges.

Application Segment – Inference Reigns Supreme

Inference overwhelms with 76% market share, deploying pre-trained models at the edge for instantaneous facial recognition in retail cams that personalize ads without server pings, or factory lines spotting defects at 1000fps to avert million-dollar recalls. This workhorse powers 80% of live edge AI from pacemakers flagging arrhythmias to traffic systems optimizing flows in megacities, with sub-10ms latency unlocking AR/VR fluidity that keeps users immersed for hours. Europe's GDPR fortress grows inference at 19.5% CAGR, enforcing on-device processing for smart homes where voice commands stay private amid rising cyber threats. North America's surveillance networks scale it nationwide, while autos fuse multi-sensor streams for Level 4 autonomy that outthinks human drivers on highways.

Training, though slimmer at 24% share and 20.5% CAGR, enables on-device model evolution for robots grasping novel objects in warehouses or phones refining autocorrect from user habits, closing loops that cloud training can't match for personalization. Consumer assistants adapt accents locally, industrial machines self-improve from production data, and research kits fine-tune in labs without bandwidth walls. Asia Pacific's mobile labs experiment boldly, blending training with inference for hybrid autonomy in EVs navigating chaotic streets. Federated learning hybrids promise to blur lines further, aggregating insights across edges privately, but inference's scalability cements it as the undisputed leader for the trillion inferences daily edge will handle by 2030. Training carves premium niches in adaptive systems like personalized health coaches. The edge artificial intelligence chips market pivots decisively toward inference dominance as real-time rules supreme.

-

Inference – 76% share, 19.5% CAGR, USA surveillance sovereign; Intel Movidius masters.

-

Training – 24% share, 20.5% CAGR, Europe R&D riser; Google Coral customizes.

End-Use Industry Segment – Consumer Captures Masses

Consumer electronics vaults to 38% share, cramming chips into smartphones for generative edits turning snapshots into masterpieces on-the-fly and smart fridges ordering groceries via vision AI, with billions of units yearly democratizing edge smarts for the masses. Wearables evolve into proactive guardians analyzing biometrics to preempt strokes, North America's Apple Neural Engine locks in 17.8% CAGR as iOS apps leverage it for seamless Siri upgrades. Samsung's Exynos floods APAC with foldables running AR games fluidly, while TVs adapt content via edge sentiment analysis from viewer reactions.

Automotive accelerates toward 26% by 2033 at 21.5% CAGR, embedding clusters of chips to orchestrate Level 4 brains fusing 30+ sensors for urban pilots that weave through traffic safer than taxis, NVIDIA Orin delivering 254 TOPS in compact ECUs. Healthcare portables ultrasound edge-side for instant diagnoses in ambulances, industrial visions halt conveyors at micro-defects costing fortunes otherwise. Europe's Bosch suites standardize ADAS across VW to Volvo. Retail deploys anonymous shopper analytics boosting sales 15%, aerospace drones map disasters solo. Consumer sheer volume stabilizes supply, autos premium perf premiums propel margins. Edge artificial intelligence chips market balances breadth with depth across industries.

-

Consumer Electronics – 38% share, 17.8% CAGR, APAC phone tsunami; Apple A-series Neural pinnacle.

-

Automotive – 26% share, 21.5% CAGR, USA autonomy accelerator; NVIDIA Drive unbeatable.

-

Industrial – 21% share, 18.5% CAGR, Germany Industry titan; Intel Arc industrial.

-

Healthcare – 15% share, 20% CAGR, Europe portable pioneer; Hailo edge diagnostics.

Value Chain Analysis

Design and Architecture → Teams craft chip blueprints using EDA tools to integrate NPUs, cores, and accelerators for edge workloads. Simulations test power-perf tradeoffs before tape-out. IP blocks from Arm or RISC-V speed custom ASICs. Agile iterations cut time-to-market. Key Players: NVIDIA and Qualcomm lead with in-house tools for TOPS-efficient designs.

Fabrication and Foundry → Wafers etch at 3nm nodes in cleanrooms, layering transistors for dense compute. EUV lithography ensures precision amid heat challenges. Yield ramps via AI-monitored processes. Testing weeds defects pre-packaging. Key Players: TSMC and Samsung Foundry dominate advanced nodes.

Assembly, Testing, and Packaging → Dice stack into 3D packages like chiplets for bandwidth. Burn-in verifies under stress. Advanced CoWoS boosts I/O. Final qual meets AEC-Q100 autos. Key Players: ASE and Amkor handle complex SiPs.

Software and Ecosystem Development → Firmware optimizes models via TinyML compilers. SDKs ease deployment on MCUs. OTA updates fix issues remotely. Certs ensure security. Key Players: Arm and Google TensorFlow Lite provide stacks.

Distribution and Deployment → Channels ship to OEMs with logistics tracking. Dev kits prototype fast. Partnerships embed in phones, cars. Support portals aid integration. Key Players: Arrow and Avnet distribute globally.

Regional Insights of the Edge Artificial Intelligence Chips Market

North America - North America dominates the edge artificial intelligence chips market with a commanding 36% global share, valued at USD 18 billion in 2025 and projecting a robust 17% CAGR through 2033, driven by massive R&D investments and defense contracts fueling custom ASIC development for drones and surveillance. Companies like NVIDIA and Qualcomm, both USA-based, control over 65% of local deployments, powering everything from gaming laptops to autonomous vehicle prototypes that demand ultra-low latency processing. The CHIPS Act injects $50 billion into domestic fabs, reducing reliance on Asian foundries and accelerating 2nm node production for high-TOPS chips. Startups in Austin and Boston pioneer neuromorphic designs, attracting VC floods that outpace global averages. Privacy regulations like CCPA further cement edge's edge by mandating local data handling in consumer apps.

USA accounts for 80% of regional activity, with hyperscalers like AWS integrating edge TPUs into CDNs for video AI, while Canada's Toronto hubs excel in federated learning for healthcare wearables that analyze vitals on-device without compromising patient data. Investments in automotive testing grounds showcase Level 4 autonomy reliant on edge inference for lidar fusion, cutting reaction times to milliseconds. Enterprises shift workloads from cloud to edge fleets, slashing costs by 60% in predictive maintenance for oil rigs. This maturity blends with innovation, positioning the region as the benchmark for edge AI silicon.

Future growth hinges on onshoring, with Intel's Ohio fab ramping for embedded AI in servers, and edge chips powering space missions via NASA's Artemis program where cloud latency proves impossible. Defense pulls high-security ASICs hardened against hacks, while consumer giants like Apple embed Neural Engines in every iPhone for photo enhancement. The ecosystem thrives on software like TensorFlow Lite, easing OEM integration across mobiles to robots.

Europe – Europe captures 24% market share, hitting USD 12 billion in 2025 with a steady 16.5% CAGR, as GDPR's stringent data localization rules propel on-device inference in healthcare and smart cities, minimizing cloud transmissions for everything from patient monitors to traffic cams. Arm Holdings in the UK and STMicroelectronics in Switzerland supply 55% of chips, enabling Bosch's ADAS suites that process radar data edge-side for safer highways across the continent. National funds in France back sovereign AI stacks, countering US dominance with open RISC-V cores tailored for industrial IoT in factories. Green Deal initiatives prioritize low-power NPUs, cutting data center emissions tied to edge offloading.

Germany leads sub-regionally at 30% share through Industry 4.0, deploying edge chips in Siemens robots for real-time assembly adjustments that boost yield by 25%, while France's AI plan subsidizes startups crafting TinyML for agriculture drones scouting pests without satellite lags. The UK post-Brexit fosters wearable AI via Cambridge clusters, and Italy integrates edge vision in retail for inventory tracking that slashes stockouts. Cross-border projects like GAIA-X promote federated edge learning for privacy-safe collaboration. Sustainability drives adoption, with recyclable packaging in new fabs and quantum-dot cooling for dense automotive ECUs, aligning with EU carbon goals, as edge reduces overall AI footprint by keeping compute local in renewables monitoring systems.

Asia Pacific – Asia Pacific races at 19% CAGR to claim 25% share from USD 12.5 billion in 2025, anchored by TSMC's Taiwan fabs producing 70% of advanced nodes that power Samsung's Exynos and Huawei's Ascend chips for 5G smartphones running generative AI on-device. China's domestic mandates amid US bans spur HiSilicon's self-reliant Kirin processors for smart cities, where edge analytics optimize traffic without Beijing data centers. Japan refines sensor fusion for Toyota's EVs, and India's PLI scheme erects local assembly for affordable IoT gateways in rural solar farms.

China seizes 40% regional dominance with state-backed fabs churning edge AI for surveillance networks spanning billions of cams, while South Korea's mobile giants embed NPUs in foldables for AR experiences that rival VR headsets. Taiwan's supply chain mastery ensures yield ramps for 1nm trials, and Indonesia emerges in assembly for ASEAN exports. Vietnam's low-cost labor attracts backend testing for global OEMs. Consumer electronics volumes explode, with EVs and drones multiplying chip needs, as the edge artificial intelligence chips market leverages scale for price drops enabling mass-market wearables in emerging urban centers.

Latin America – Latin America advances at 15.5% CAGR toward 6% share from USD 3 billion in 2025, with Brazil's agrotech revolution deploying edge chips in drones for crop health AI that boosts yields 20% amid climate shifts, supported by Qualcomm partnerships localizing designs. Mexico's auto corridor nearshores Tesla plants, demanding ADAS silicon hardened for rough roads, while Argentina's startups craft RISC-V cores for energy meters in off-grid villages. Government incentives mirror CHIPS Act, funding fabs in Sao Paulo for regional self-sufficiency.

Brazil commands 45% sub-share via Embraer's aerospace edges processing flight data real-time, Mexico booms with Foxconn assembly for EVs, and Chile's copper mines use predictive AI to avert breakdowns costing millions daily. Colombia integrates edge in smart grids, and Peru pilots fisheries monitoring. Costs challenge but PLI-like schemes ease entry. Infrastructure upgrades via Belt-Road loans accelerate, positioning the region as US-China bridge for resilient supply.

Middle East & Africa – MEA grows at 16% CAGR to 9% share from USD 4.5 billion, as UAE's AI Strategy 2031 pours oil wealth into NEOM's edge AI for autonomous pods navigating deserts, powered by Arm-based chips from G42 partnerships. Saudi Arabia tests Level 4 taxis in Riyadh, while South Africa's mines deploy vibration AI on drills preventing cave-ins. Egypt's consumer boom favors cheap MCUs for home automation.

UAE leads 35% sub-share with Masdar City's renewables optimized by edge forecasting, Saudi Aramco rigs gain fault detection slashing downtime 30%, and South Africa leads Africa in telecom edges for 5G rural coverage. Nigeria's fintech uses on-phone fraud AI, Kenya ag drones thrive. Renewables boom needs off-grid compute. Diversification from oil seeds sovereign fabs, with edge cutting latency in remote oilfields and smart Dubai buildings. The edge artificial intelligence chips market taps strategic investments for leapfrog growth.

Edge Artificial Intelligence Chips Market Top Key Players

- NVIDIA Corporation (USA)

- Intel Corporation (USA)

- Qualcomm Technologies, Inc. (USA)

- Advanced Micro Devices, Inc. (USA)

- Apple Inc. (USA)

- Samsung Electronics Co., Ltd. (South Korea)

- MediaTek Inc. (Taiwan)

- Huawei Technologies Co., Ltd. (China)

- Arm Holdings plc (UK)

- Texas Instruments Incorporated (USA)

Recent Developments

-

NXP Semiconductors (2025): Signed a definitive $307 million all-cash deal on February 10 to acquire Kinara, Inc., a pioneer in energy-efficient neural processing units (NPUs) for edge AI like multi-modal generative models, aiming to redefine intelligent edge applications across devices and expected to close mid-2025 pending approvals.

-

Qualcomm (2025): Announced a $2.4 billion acquisition of Alphawave Semi on June 9 to accelerate data center entry, blending Alphawave's connectivity with Qualcomm's Oryon CPU and Hexagon NPU for AI inferencing; also snapped up Arduino in October for edge push and Ventana Micro Systems in December for RISC-V servers.

-

AMD (2025): Closed $4.9 billion ZT Systems buy on March 31 for rack-scale AI expertise pairing with Instinct GPUs; added Enosemi in May for silicon photonics optics, Brium in June for AI software optimization, and Untether AI team to boost inference compilers and design.

-

Intel (2025): Reportedly pursued SambaNova Systems acquisition for AI chip prowess amid server revamps; showcased EPYC Embedded and Ryzen processors emphasizing high-core AI versatility at events.

-

Axelera AI (2025): Shipped Metis AIPU inference accelerator and Voyager SDK for edge AI, taped out 3 chips in 3 years, scaled to 220 staff, and raised ~$200 million, focusing D-IMC tech for real-world edge problems.

Market Trends

Neuromorphic computing storms the edge artificial intelligence chips market, mimicking brain synapses for 100x power savings over von Neumann designs. Chips like Intel Loihi process spikes event-driven, ideal for always-on sensors in wearables. Autos use them for endless ADAS vigilance. By 2030, 20% of edge AI shifts here, per forecasts. Startups scale with fabless models. TinyML packs ML into microcontrollers under 1mW, enabling billion-device IoT swarms. Tools like TensorFlow Lite auto-optimize models for Arm Cortex-M. Smart meters predict faults locally. Consumer trinkets gain smarts affordably. Sustainability wins as cloud emissions drop.

Federated learning lets edge fleets train collaboratively sans data share, perfect for privacy. Phones refine keyboards across users. Autos share road insights anonymously. Regs boost this hybrid. Industrial predictive maintenance evolves. RISC-V open ISA disrupts Arm monopoly, slashing royalties for custom cores. China pushes sovereign stacks. Hyperscalers like Google offload Coral TPUs edgeward. 2nm nodes hit 100 TOPS/W. Geopolitics spurs diverse fabs. Sustainability mandates green silicon, with recyclable packaging and low-water fabs. Edge cuts data travel emissions 80%. Quantum-dot cools dense packs. Market prizes eco-cert chips amid scrutiny.

Segments Covered in the Report

- By Chip Type

- Application-Specific Integrated Circuits (ASICs)

- Graphics Processing Units (GPUs)

- Field Programmable Gate Arrays (FPGAs)

- Central Processing Units (CPUs)

- Neural Processing Units (NPUs) / AI Accelerators

- Digital Signal Processors (DSPs)

- By Component

- Hardware

- Software

- By Technology Node

- 7 nm and below

- 8 nm to 14 nm

- 15 nm to 28 nm

- Above 28 nm

- By Application

- Consumer Electronics

- Automotive

- Healthcare

- Industrial Automation

- Surveillance and Security

- By End-Use Industry

- Automotive

- Healthcare

- Consumer Electronics

- Manufacturing & Industrial

- Telecommunications

- By Form Factor

- Embedded Edge AI Chips

- Standalone Edge AI Chips

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions:

IoT floods and quick needs drive the edge artificial intelligence chips market for local brains.

North America rules with tech edge sharp.

15.35% CAGR runs from 2026 to 2033.

Fast sensor mixes dodge wrecks sure.

Heat fights and code fits slow it down.