Electric Vehicle Charging Station Market Overview

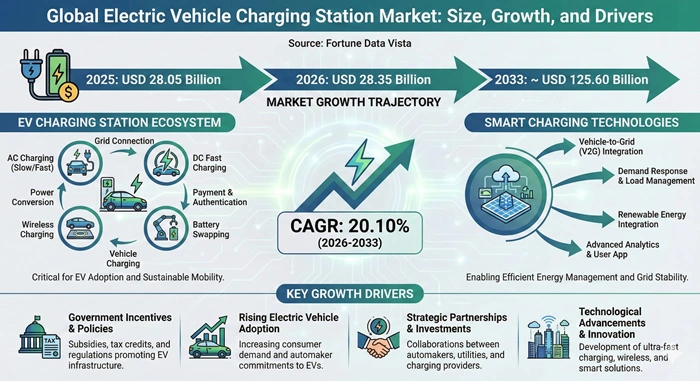

The global electric vehicle charging station market size is valued at USD 28.05 billion in 2025 and is predicted to increase from USD 28.35 billion in 2026 to approximately USD 125.60 billion by 2033, growing at a CAGR of 20.10% from 2026 to 2033. This remarkable expansion reflects the accelerating shift toward sustainable transportation solutions and the urgent need for comprehensive charging infrastructure to support the growing number of electric vehicles worldwide. The market encompasses a diverse range of charging solutions including alternating current stations, direct current fast chargers, and emerging wireless charging technologies that cater to residential, commercial, and public charging needs across global markets.

The increasing penetration of battery electric vehicles and plug-in hybrid electric vehicles into mainstream automotive markets has created unprecedented demand for accessible and efficient charging infrastructure. Governments across major economies are implementing supportive policies, financial incentives, and regulatory frameworks to accelerate the deployment of charging networks, while automotive manufacturers are committing billions toward electrification strategies that require corresponding infrastructure development. The electric vehicle charging station market is experiencing technological innovation with ultra-fast charging capabilities, smart grid integration, and renewable energy-powered solutions that address range anxiety concerns and enhance user experience for electric vehicle owners.

AI Impact on the Electric Vehicle Charging Station Industry

Transforming Infrastructure Management and User Experience Through Intelligent Technology Solutions

Artificial intelligence is revolutionizing the electric vehicle charging station market by enabling predictive maintenance, dynamic load management, and personalized user experiences that optimize infrastructure utilization. AI-powered charging networks analyze real-time data from thousands of charging sessions to predict equipment failures before they occur, reducing downtime and maintenance costs while improving reliability for electric vehicle owners. Machine learning algorithms optimize energy distribution across charging stations based on grid capacity, electricity pricing, and user demand patterns, ensuring efficient power allocation during peak usage periods. The integration of AI into the market facilitates intelligent route planning applications that guide drivers to available charging points, estimate accurate charging times, and recommend optimal charging strategies based on battery condition and travel requirements.

Advanced neural networks are enabling vehicle-to-grid technology that transforms electric vehicles into mobile energy storage units capable of supplying power back to the electrical grid during high-demand periods. AI systems monitor battery health, charging patterns, and user behavior to deliver customized charging recommendations that extend battery lifespan and reduce energy costs for electric vehicle owners. The electric vehicle charging station market benefits from AI-driven demand forecasting that helps infrastructure operators identify optimal locations for new installations, predict future capacity requirements, and allocate capital investments strategically. Natural language processing enables voice-activated charging station interactions, while computer vision technology enhances security through license plate recognition and automated payment processing that streamlines the charging experience for millions of users worldwide.

Growth Factors

Rising Electric Vehicle Adoption and Government Support Driving Unprecedented Infrastructure Expansion

The explosive growth in electric vehicle sales represents the primary catalyst propelling the electric vehicle charging station market forward across all geographic regions. Global electric vehicle registrations have surpassed critical mass thresholds, creating network effects where increased vehicle adoption necessitates more charging infrastructure, which subsequently reduces range anxiety and encourages further electric vehicle purchases. Governments worldwide are implementing ambitious electrification targets with many countries announcing plans to phase out internal combustion engine vehicles within the next two decades, directly stimulating massive investments in the market. Financial incentives including tax credits, rebates, and subsidies for both electric vehicle purchases and charging infrastructure installation are lowering adoption barriers for consumers and businesses, accelerating market penetration rates significantly.

Technological advancements in charging technologies are addressing historical limitations that previously hindered electric vehicle adoption and expanding the market. Ultra-fast charging stations capable of delivering 350 kilowatts or more can replenish electric vehicle batteries to 80 percent capacity in under 15 minutes, making long-distance travel increasingly viable and competitive with conventional refueling experiences. The development of standardized charging protocols and universal connector systems is improving interoperability across different vehicle manufacturers and charging networks, enhancing convenience for users and reducing infrastructure complexity. Corporate sustainability commitments from major automakers, technology companies, and energy providers are channeling substantial capital into the electric vehicle charging station market, with several Fortune 500 companies pledging to electrify their commercial fleets and establish workplace charging facilities that serve both employees and the general public.

Market Outlook

Favorable Policy Environment and Technological Innovation Positioning Market for Sustained Long-Term Growth

The electric vehicle charging station market is positioned at the intersection of multiple powerful trends including decarbonization imperatives, energy transition dynamics, and digital transformation that collectively create favorable conditions for sustained expansion. International climate agreements and national carbon neutrality commitments are driving regulatory pressures that mandate significant reductions in transportation emissions, effectively requiring wholesale transformation of automotive infrastructure over the next decade. The declining cost of renewable energy generation is enabling the deployment of solar-powered and wind-powered charging stations that reduce operational expenses and enhance the environmental credentials of electric mobility solutions. Integration with smart grid technologies and energy storage systems is creating new revenue opportunities for charging station operators through demand response programs, grid stabilization services, and dynamic pricing strategies that optimize energy utilization.

Investment patterns indicate robust confidence in the long-term prospects of the market with billions of dollars flowing from venture capital, private equity, infrastructure funds, and strategic corporate investors. Consolidation activity is accelerating as established energy companies, utilities, and automotive manufacturers acquire charging network operators to secure strategic positions in the evolving mobility ecosystem. The electric vehicle charging station market is experiencing geographic expansion beyond traditional early-adopter markets with emerging economies implementing supportive policies and attracting infrastructure investments that democratize access to electric mobility. Technological convergence between charging infrastructure, renewable energy systems, battery storage, and digital payment platforms is creating integrated solutions that deliver superior user experiences while generating multiple revenue streams for operators and stakeholders throughout the value chain.

Expert Speaks

-

Jim Farley, CEO of Ford Motor Company, stated that accelerating electric vehicle infrastructure deployment is critical for achieving mass market adoption, emphasizing that convenient and reliable charging networks will determine the success of the automotive industry's electrification transition and expressing confidence that public-private partnerships will deliver the necessary infrastructure expansion.

-

Mary Barra, CEO of General Motors, highlighted that General Motors is investing heavily in charging infrastructure partnerships to support its commitment to an all-electric future, noting that accessible charging solutions remove barriers to electric vehicle adoption and stressing the importance of fast-charging capabilities for customer satisfaction and market growth.

-

Herbert Diess, Former CEO of Volkswagen Group, emphasized that the electric vehicle revolution requires parallel infrastructure development at unprecedented scale, pointing to the need for millions of charging points globally and advocating for standardized technologies and collaborative industry approaches to accelerate the buildout of comprehensive charging networks.

Key Report Takeaways

-

North America leads the electric vehicle charging station market with approximately 45 to 49 percent market share driven by substantial government funding through programs like the National Electric Vehicle Infrastructure initiative, aggressive private sector investments from major charging network operators, and strong electric vehicle adoption rates particularly in the United States and Canada.

-

Asia Pacific represents the fastest growing region in the market with anticipated compound annual growth rates exceeding 25 percent as China, Japan, South Korea, and India rapidly expand charging infrastructure to support massive electric vehicle deployments and government electrification mandates.

-

Commercial applications dominate current infrastructure deployment accounting for over 55 percent of the market as businesses, retail locations, hospitality venues, and fleet operators install charging facilities to serve customers, employees, and operational requirements while residential charging solutions continue expanding steadily.

-

DC fast charging represents the fastest growing segment with projected compound annual growth rates approaching 27 to 30 percent as consumers demand rapid charging capabilities for long-distance travel, and charging station operators deploy high-power infrastructure along highways, urban corridors, and strategic locations.

-

Level 2 charging stations maintain the largest market share currently representing approximately 60 percent of installations due to their optimal balance of charging speed, infrastructure cost, and suitability for overnight residential charging and workplace applications where vehicles remain parked for extended periods.

-

The fixed charger segment will experience accelerated growth with market share expected to reach 70 percent by 2033 and compound annual growth rate of 22 percent driven by permanent installations at commercial locations, public facilities, and dedicated charging plazas that provide reliable infrastructure for high-utilization applications.

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 125.60 Billion | Market Size by 2026 | USD 28.35 Billion | Market Size by 2025 | USD 28.05 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 20.10% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Charging Type, Installation Type, Application, Vehicle Type, Power Output, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Driver Impact Analysis

Accelerating Electric Vehicle Adoption and Supportive Government Policies

| Factor | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rising Electric Vehicle Sales | 35-40% | Global | 2026-2033 |

| Government Incentives and Regulations | 25-30% | North America, Europe, Asia Pacific | 2026-2033 |

| Corporate Sustainability Commitments | 15-20% | North America, Europe | 2027-2033 |

The unprecedented surge in electric vehicle sales worldwide represents the most significant driver propelling the electric vehicle charging station market forward with exponential impact on infrastructure requirements. Global electric vehicle registrations have reached inflection points where mainstream consumers are increasingly choosing electric options over conventional vehicles, driven by improved vehicle performance, expanding model availability, declining total cost of ownership, and growing environmental consciousness. This fundamental shift in automotive preferences creates corresponding demand for accessible charging infrastructure across residential, workplace, and public locations, establishing a powerful growth engine for the market. Major automotive manufacturers have announced commitments to transition their entire product portfolios to electric powertrains within the next decade, representing production commitments for tens of millions of electric vehicles annually that will require proportional charging infrastructure deployment to support operational viability and consumer acceptance.

Government policies and regulatory frameworks are providing critical support mechanisms that accelerate infrastructure development and reduce financial barriers in the market. National governments are allocating billions of dollars in direct funding for charging infrastructure buildout through dedicated programs such as the United States National Electric Vehicle Infrastructure initiative, European Union Alternative Fuels Infrastructure Regulation, and China's New Energy Vehicle subsidy schemes that provide capital for installation, operation, and maintenance of charging networks. Regulatory mandates requiring minimum charging infrastructure ratios for new construction projects, parking facilities, and commercial developments are creating automatic demand for charging equipment across property development sectors. Tax incentives, accelerated depreciation schedules, and direct rebates for charging station installation significantly improve project economics for businesses and property owners, catalyzing private sector investment that complements public funding and expands the electric vehicle charging station market infrastructure base rapidly across diverse geographic markets and application segments.

Restraints Impact Analysis

High Infrastructure Costs and Grid Capacity Limitations

| Factor | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High Installation and Equipment Costs | -15 to -20% | Global | 2026-2029 |

| Electrical Grid Capacity Constraints | -10 to -15% | Developing Markets | 2026-2030 |

| Lack of Standardization | -8 to -12% | Global | 2026-2028 |

The substantial capital requirements for installing and operating charging infrastructure represent a significant restraint limiting the pace of expansion in the electric vehicle charging station market particularly for small operators and emerging markets. DC fast charging stations require investments ranging from one hundred thousand to several hundred thousand dollars per unit including equipment procurement, site preparation, electrical infrastructure upgrades, and permitting costs that create financial barriers for potential market entrants. The ongoing operational expenses for electricity consumption, network connectivity, maintenance, and customer support create challenging unit economics, especially in early-stage markets where utilization rates remain below breakeven thresholds and revenue generation insufficient to cover fixed costs. Property owners and businesses often face extended payback periods for charging infrastructure investments, particularly in locations with lower electric vehicle penetration rates, reducing investment attractiveness and slowing deployment velocity across the market.

Electrical grid capacity limitations and the need for extensive utility infrastructure upgrades constrain the deployment speed and geographic distribution of charging stations in the market. High-power DC fast charging installations require substantial electrical service capacity that frequently exceeds existing grid infrastructure capabilities at desired locations, necessitating costly utility upgrades, transformer installations, and service panel modifications that extend project timelines and increase capital requirements. Rural areas and secondary markets often lack the robust electrical infrastructure necessary to support multiple high-power charging stations, creating geographic disparities in charging access and limiting market expansion beyond urban centers with existing grid capacity. The technical complexity of integrating large-scale charging infrastructure with electrical grids requires coordination between charging operators, utility companies, and regulatory authorities, introducing project delays and administrative burdens that slow the buildout of the electric vehicle charging station market infrastructure necessary to support anticipated electric vehicle adoption trajectories across diverse geographic regions.

Opportunities Impact Analysis

Technological Innovation and Emerging Business Models

| Factor | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Ultra-Fast Charging Technology | 20-25% | North America, Europe, Asia Pacific | 2027-2033 |

| Renewable Energy Integration | 15-18% | Global | 2026-2033 |

| Vehicle-to-Grid Technology | 12-15% | North America, Europe | 2028-2033 |

The development and commercialization of ultra-fast charging technologies represent transformative opportunities that could dramatically accelerate adoption and expand addressable markets for the electric vehicle charging station market. Next-generation charging systems capable of delivering 350 kilowatts to 600 kilowatts or more can replenish electric vehicle batteries to 80 percent capacity in 10 to 15 minutes, approaching the convenience of conventional refueling and eliminating range anxiety barriers that historically limited long-distance electric vehicle travel. These technological advances enable new use cases including highway corridor charging, urban fast-charging hubs, and commercial fleet applications where vehicle downtime directly impacts operational efficiency and economic viability. The market benefits from collaborative development efforts between automotive manufacturers, charging equipment suppliers, and energy companies that are establishing technical standards, optimizing battery charging protocols, and deploying pilot networks that demonstrate ultra-fast charging capabilities and pave the way for mainstream commercial deployment.

Integration of renewable energy generation and energy storage systems with charging infrastructure creates compelling opportunities for differentiation and sustainable business models in the market. Solar-powered charging stations equipped with battery storage can operate independently from electrical grids, enabling deployment in remote locations, reducing operational costs through self-generated electricity, and delivering genuine zero-emission mobility solutions that appeal to environmentally conscious consumers and corporate sustainability programs. Vehicle-to-grid technology represents a paradigm-shifting opportunity where electric vehicles function as distributed energy storage assets that can discharge electricity back to power grids during peak demand periods, creating additional revenue streams for vehicle owners and charging station operators while providing valuable grid stabilization services. The electric vehicle charging station market stands to benefit from innovative business models including charging-as-a-service offerings, subscription-based access programs, and dynamic pricing strategies that optimize utilization, enhance customer value propositions, and improve financial returns for infrastructure operators.

Segment Analysis

By Charging Type

DC Fast Charging Dominates Growth with Rapid Expansion Across Highway and Urban Corridors

The DC fast charging segment is experiencing explosive growth in the electric vehicle charging station market and is projected to expand at a compound annual growth rate exceeding 27 percent during the forecast period, driven by consumer demand for convenient rapid charging solutions that enable long-distance travel. This charging type delivers high-power direct current electricity directly to vehicle batteries, bypassing onboard chargers and dramatically reducing charging times to 15 to 30 minutes for most electric vehicles, making it the preferred solution for highway corridors, urban charging hubs, and commercial applications where rapid vehicle turnover maximizes infrastructure utilization. North America leads DC fast charging deployment with companies like Tesla, Electrify America, EVgo, and ChargePoint investing billions in expanding ultra-fast charging networks along major interstate highways and metropolitan areas, supported by federal infrastructure funding through the National Electric Vehicle Infrastructure program. The market for DC fast charging is attracting significant capital from energy companies including Shell, BP, and TotalEnergies that are integrating high-power chargers into existing fuel station networks, leveraging established locations and customer relationships to capture emerging electric mobility markets.

AC charging maintains the largest overall market share in the market currently representing approximately 60 percent of global installations due to lower equipment costs, simpler installation requirements, and suitability for applications where vehicles remain parked for extended periods. Level 2 AC chargers operating at 240 volts deliver charging power ranging from 7 kilowatts to 22 kilowatts, providing complete overnight charging for most residential users and adequate replenishment for workplace parking scenarios where employees park for eight hours or more during business days. The residential AC charging segment dominates in markets with high rates of single-family home ownership where dedicated garage or driveway parking enables straightforward installation of private charging equipment, particularly across North American and European suburban markets. Asia Pacific represents the fastest growing region for AC charging infrastructure in the electric vehicle charging station market as governments in China, Japan, and South Korea mandate charging installation in new residential developments and provide subsidies that reduce consumer costs, while major equipment manufacturers including Schneider Electric, ABB, and Siemens expand production capacity to serve growing demand across the region.

By Application

Commercial Installations Lead Market While Residential Segment Expands with Rising EV Ownership

Commercial applications currently dominate the electric vehicle charging station market accounting for approximately 55 to 60 percent of total installations as businesses recognize charging infrastructure as essential customer amenities and revenue-generating opportunities. Retail locations including shopping malls, grocery stores, and entertainment venues are deploying charging stations to attract electric vehicle owners who spend more time and money at establishments while their vehicles charge, creating competitive advantages and enhanced customer experiences. The hospitality sector including hotels, restaurants, and tourist destinations views charging infrastructure as mandatory amenities for capturing the growing electric vehicle owner demographic, with many properties advertising charging availability as key selling points in marketing materials. Fleet operators represent a rapidly expanding commercial segment within the market as logistics companies, delivery services, ride-sharing platforms, and municipal transportation agencies electrify vehicle fleets and install dedicated charging facilities optimized for operational requirements, with companies like Amazon, FedEx, and UPS deploying thousands of electric delivery vehicles supported by proprietary charging networks.

The residential charging segment is experiencing accelerated growth in the market projected to expand at a compound annual growth rate of 21 percent as personal electric vehicle ownership increases and homeowners invest in private charging solutions. Single-family homes with dedicated parking represent the primary residential charging market where Level 2 AC chargers provide convenient overnight charging that fully replenishes vehicle batteries while owners sleep, eliminating the need for frequent visits to public charging stations and delivering superior convenience compared to conventional refueling patterns. Multi-family residential buildings including apartment complexes, condominiums, and housing cooperatives represent an emerging opportunity in the electric vehicle charging station market as property developers and management companies respond to tenant demand by installing shared charging facilities in parking structures and designated spaces. Europe leads in multi-family residential charging deployment with countries like Norway, Netherlands, and Germany implementing regulatory requirements and financial incentives that accelerate installation in existing buildings, while North American markets are beginning similar programs supported by utility rebates and building code modifications that facilitate charging infrastructure integration across diverse residential property types.

Regional Insights

North America

Dominant Market Position Driven by Federal Infrastructure Investment and Mature EV Ecosystem

North America maintains the leading position in the global electric vehicle charging station market with approximately 45 to 49 percent market share and market valuation exceeding 12 billion dollars in 2026, driven by comprehensive federal funding programs, robust private sector investment, and high electric vehicle adoption rates particularly in the United States. The region benefits from the National Electric Vehicle Infrastructure program allocating 5 billion dollars specifically for building out DC fast charging corridors along interstate highways connecting all major metropolitan areas and ensuring no American lives more than 50 miles from rapid charging access. The United States hosts over 180000 public charging points as of 2026 representing the world's second-largest charging network after China, with California alone accounting for more than 30 percent of national installations supported by aggressive state-level incentives and zero-emission vehicle mandates. The market in North America is characterized by strong competition among charging network operators including ChargePoint with over 250000 charging points, Tesla Supercharger network exceeding 45000 connectors, Electrify America deploying 850 charging stations with multiple high-power dispensers, and EVgo operating across 1400 locations in major metropolitan regions.

Major energy companies and utilities are making substantial commitments to the North American market with Shell, BP, and ExxonMobil integrating charging infrastructure into existing fuel station networks while electric utilities including Duke Energy, Southern Company, and Pacific Gas & Electric investing billions in grid upgrades and charging programs. Canada represents a high-growth market within the region with the federal government committing 1 billion Canadian dollars toward charging infrastructure through the Zero Emission Vehicle Infrastructure Program and provincial incentives in British Columbia, Quebec, and Ontario accelerating deployment across urban and rural areas. The electric vehicle charging station market in North America is projected to grow at a compound annual growth rate of 22 percent during the forecast period supported by the Inflation Reduction Act providing tax credits for charging equipment, automotive manufacturer commitments to launch dozens of new electric vehicle models, and corporate fleet electrification programs from companies including Amazon, Walmart, and major logistics providers that require extensive private charging networks to support operational requirements.

Asia Pacific

Fastest Growing Region Propelled by China's Leadership and Aggressive Government Electrification Targets

Asia Pacific represents the fastest growing region in the global electric vehicle charging station market with anticipated compound annual growth rates exceeding 25 percent and market valuation projected to surpass 35 billion dollars by 2033, driven primarily by China's dominant position as the world's largest electric vehicle market and most extensive charging network. China operates over 2.5 million public charging points representing more than 60 percent of global public charging infrastructure, supported by comprehensive government subsidies, municipal deployment mandates, and massive private sector investment from companies including State Grid Corporation, China Southern Power Grid, and private operators like Star Charge and TELD that collectively manage hundreds of thousands of charging stations across urban and highway locations. The Chinese government has established ambitious targets requiring charging infrastructure to support 20 million electric vehicles by 2025 and mandating charging station installation as prerequisite for new real estate development approvals in major cities, creating automatic demand that propels the market forward rapidly.

Japan and South Korea represent mature markets within the Asia Pacific market characterized by advanced technology deployment, high power charging networks, and strong automotive industry participation from manufacturers including Toyota, Nissan, Honda, Hyundai, and Kia that are investing heavily in charging infrastructure to support electric vehicle product launches. India emerges as a high-potential growth market in the region with the government launching the Faster Adoption and Manufacturing of Electric Vehicles program providing subsidies for charging infrastructure deployment, and major conglomerates including Tata Power, Adani, and Reliance announcing plans to install thousands of charging stations across highways and urban centers. Southeast Asian nations including Thailand, Indonesia, and Vietnam are implementing electric vehicle promotion policies and attracting foreign investment from Chinese charging equipment manufacturers and international operators seeking to establish early-mover advantages in emerging markets. The electric vehicle charging station market across Asia Pacific benefits from aggressive renewable energy integration with solar-powered charging stations proliferating in sunny climates, government-mandated interoperability standards reducing consumer confusion, and mobile payment integration providing seamless user experiences that accelerate adoption across diverse consumer segments and geographic markets.

Top Key Players

-

ABB Ltd. (Switzerland)

-

ChargePoint Holdings Inc. (United States)

-

Tesla Inc. (United States)

-

BYD Company Limited (China)

-

Schneider Electric SE (France)

-

Siemens AG (Germany)

-

EVBox BV (Netherlands)

-

Blink Charging Co. (United States)

-

Shell plc (United Kingdom)

-

BP plc (United Kingdom)

-

Webasto SE (Germany)

-

Eaton Corporation plc (Ireland)

-

Delta Electronics Inc. (Taiwan)

-

EVgo Services LLC (United States)

-

Electrify America LLC (United States)

-

Allego BV (Netherlands)

-

ENGIE SA (France)

-

Volkswagen AG (Germany)

-

Tritium DCFC Limited (Australia)

-

Wallbox N.V. (Spain)

Recent Developments

-

ChargePoint Holdings announced in 2025 the development of its next-generation Express Grid DC fast charging platform featuring 600-kilowatt charging capacity in partnership with Eaton Corporation, with component deliveries scheduled to commence in late 2026, representing a breakthrough in ultra-fast charging technology that can replenish electric vehicle batteries to 80 percent in approximately 10 minutes and significantly reduce infrastructure footprint relative to power output.

-

EDF Energy completed the acquisition of Pod Point in 2025 for 10.6 million pounds sterling, securing control of a leading United Kingdom charging network with over 250000 charging points installed across residential and commercial locations, enabling deeper integration with EDF's energy services portfolio and accelerating progress toward net-zero carbon emissions objectives through expanded electric mobility infrastructure.

-

Tesla Inc. expanded its Supercharger V4 network throughout 2024 and 2025 deploying 350-kilowatt charging stations across North America and Europe that facilitate rapid long-distance travel, while simultaneously opening portions of its proprietary charging network to non-Tesla electric vehicles through partnerships with major automotive manufacturers including Ford and General Motors that adopted Tesla's North American Charging Standard connector.

-

Rivian Automotive launched the Rivian Adventure Network in 2024 through collaboration with EVgo, strategically positioning DC fast charging stations along major outdoor recreation routes and off-road destinations to serve its adventure-oriented customer base, while also investing in portable charging solutions and remote location infrastructure that differentiate its charging ecosystem from competitors.

-

ABB Ltd. announced in 2025 the global rollout of its Terra 360 modular charging system capable of simultaneously charging four vehicles with dynamic power distribution up to 360 kilowatts, targeting commercial fleet applications, highway corridors, and urban charging hubs while incorporating renewable energy integration capabilities and grid stabilization features that optimize energy management and reduce operational costs for charging station operators.

Market Trends

Integration of Renewable Energy and Smart Technologies Reshaping Infrastructure Deployment

The electric vehicle charging station market is experiencing fundamental transformation driven by integration of renewable energy sources, energy storage systems, and advanced digital technologies that optimize performance and sustainability. Solar-powered charging stations equipped with photovoltaic panels and battery storage systems are proliferating across markets where sunshine levels support economic viability, enabling off-grid operation, reducing electricity costs, and delivering authentic zero-emission mobility solutions that resonate with environmentally conscious consumers and corporate sustainability programs. Vehicle-to-grid technology is advancing beyond pilot phases toward commercial deployment, enabling electric vehicles to function as distributed energy storage assets that discharge electricity back to power grids during peak demand periods, creating additional revenue opportunities for vehicle owners and providing valuable grid stabilization services that enhance electrical system reliability. The market benefits from artificial intelligence and machine learning applications that optimize charging schedules based on electricity pricing, predict maintenance requirements before equipment failures occur, and provide personalized user experiences through mobile applications that guide drivers to available charging points, estimate accurate charging times, and facilitate seamless payment processing.

Consolidation and strategic partnerships are accelerating across the market as established energy companies, automotive manufacturers, and technology firms acquire charging network operators or form joint ventures to secure strategic positions in evolving mobility ecosystems. Major oil and gas companies including Shell, BP, TotalEnergies, and ExxonMobil are investing billions in charging infrastructure as part of energy transition strategies, leveraging existing fuel station networks, real estate portfolios, and customer relationships to rapidly scale charging operations and diversify revenue sources beyond fossil fuels. Automotive manufacturers are moving beyond vehicle production to establish proprietary charging networks and software platforms that provide integrated mobility solutions, with companies like Tesla, Rivian, General Motors, and Volkswagen deploying brand-specific charging infrastructure that delivers premium experiences for customers and creates competitive differentiation in crowded electric vehicle markets. The electric vehicle charging station market is witnessing standardization efforts gaining momentum with industry coalitions working toward universal connector types, interoperable payment systems, and common communication protocols that simplify user experiences, reduce infrastructure complexity, and accelerate mainstream adoption across diverse consumer segments and geographic markets worldwide.

Segments Covered in the Report

By Charging Type

-

AC Charging

-

DC Fast Charging

-

Wireless Charging

By Installation Type

-

Portable Chargers

-

Fixed Chargers

By Application

-

Residential

-

Commercial

-

Public

By Vehicle Type

-

Battery Electric Vehicles

-

Plug-in Hybrid Electric Vehicles

By Power Output

-

Level 1 (120 Volts)

-

Level 2 (240 Volts)

-

Level 3 (DC Fast Charging)

By Region

-

North America (United States, Canada, Mexico)

-

Europe (Germany, United Kingdom, France, Italy, Spain, Netherlands, Rest of Europe)

-

Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

-

Latin America (Brazil, Argentina, Rest of Latin America)

-

Middle East & Africa (United Arab Emirates, Saudi Arabia, South Africa, Rest of Middle East & Africa)

Frequently Asked Questions:

Answer: The global electric vehicle charging station market is projected to reach USD 125.60 billion by 2033, growing from USD 28.35 billion in 2026. This represents substantial expansion driven by increasing electric vehicle adoption and supportive government policies worldwide.

Answer: North America currently leads the electric vehicle charging station market with approximately 45 to 49 percent market share. The region benefits from substantial federal infrastructure funding and mature electric vehicle ecosystems particularly in the United States.

Answer: The electric vehicle charging station market is expected to grow at a compound annual growth rate of 20.10 percent from 2026 to 2033. This growth reflects accelerating electric vehicle adoption and expanding charging infrastructure globally.

Answer: DC fast charging represents the fastest growing segment in the electric vehicle charging station market with projected growth rates exceeding 27 percent. This segment benefits from consumer demand for rapid charging solutions that enable convenient long-distance electric vehicle travel.

Answer: Rising electric vehicle sales, government incentives and regulations, and corporate sustainability commitments represent the primary factors driving the electric vehicle charging station market. These elements combine to create unprecedented demand for accessible and efficient charging infrastructure worldwide.