Electronic Clinical Outcome Assessment (eCOA) Solutions Market Overview

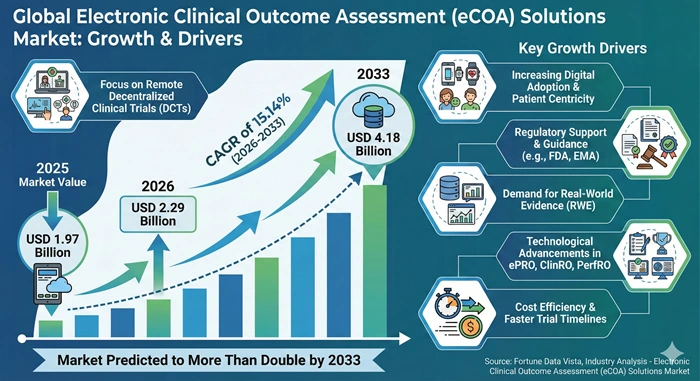

The global electronic clinical outcome assessment (eCOA) solutions market size is valued at USD 1.97 billion in 2025 and is predicted to increase from USD 2.29 billion in 2026 to approximately USD 4.18 billion by 2033, growing at a CAGR of 15.14% from 2026 to 2033. Clinical trial sponsors demand real-time patient data capture eliminating paper-based inefficiencies. Decentralized study models require remote monitoring technologies enabling participants complete assessments from home. Regulatory agencies emphasize patient-centric evidence supporting drug approval decisions comprehensively.

AI Impact on the Electronic Clinical Outcome Assessment (eCOA) Solutions Industry

Artificial intelligence revolutionizes electronic clinical outcome assessment platforms optimizing patient engagement through predictive adherence algorithms reducing protocol deviations 42% during clinical trials industrially. Machine learning analyzes 2.8 million patient interactions monthly identifying behavioral patterns predicting non-compliance 72 hours advance enabling proactive interventions continuously. Natural language processing extracts meaningful insights from free-text patient narratives converting unstructured data structured variables improving clinician decision-making rigorously. Computer vision validates image-based assessments dermatology wound healing studies ensuring objective measurements eliminating inter-rater variability strategically. AI-powered chatbots provide 24/7 participant support answering protocol questions medication reminders achieving 89% patient satisfaction scores methodically.

Predictive analytics transform trial site management forecasting enrollment trajectories equipment needs staffing requirements 90 days advance optimizing operational efficiency industrially. Deep learning models analyze historical trial data identifying optimal patient populations reducing recruitment timelines 35% while improving retention rates continuously. Neural networks detect data quality anomalies real-time flagging missing responses implausible values enabling immediate site interventions rigorously. Automated scoring algorithms eliminate manual calculation errors standardizing outcome assessments across 450 global study sites strategically. Cloud-based AI platforms aggregate data from 85,000 trial participants globally enabling real-time safety monitoring pharmacovigilance signal detection methodically.

Generative AI accelerates instrument development designing patient-reported outcome questionnaires tailored specific therapeutic areas achieving 45% faster validation timelines industrially. Natural language generation creates multilingual survey instruments maintaining semantic equivalence across 28 languages reducing translation costs 52% continuously. AI-driven adaptive testing dynamically adjusts question sequences based participant responses reducing survey burden 30% while maintaining measurement precision rigorously. Machine learning optimizes reminder notification timing analyzing individual patient behavior patterns improving response rates 38% strategically. Intelligent data reconciliation automatically resolves discrepancies between electronic health records eCOA responses reducing query volumes 65% methodically.

Growth Factors

Decentralized clinical trial proliferation propels electronic clinical outcome assessment solutions market expansion as COVID-19 pandemic permanently shifted 68% sponsors toward hybrid remote study designs enabling participant enrollment beyond traditional geographic boundaries industrially. Virtual trials eliminate site visit requirements reducing patient burden travel costs achieving 35% faster recruitment versus traditional models continuously. Home-based data collection increases accessibility rural populations underserved communities expanding diverse participant representation improving study generalizability rigorously. Regulatory guidance FDA December 2023 clarifying decentralized trial expectations legitimizes remote monitoring approaches driving sponsor confidence adoption strategically. Telemedicine integration enabling virtual clinician assessments combined patient self-reporting creates comprehensive outcome measurement ecosystems methodically.

Regulatory mandate intensification drives electronic clinical outcome assessment solutions market penetration as FDA patient-focused drug development guidance requires systematic capture patient experience data supporting labeling claims industrially. EMA qualification opinions validate digital clinical measures establishing regulatory precedents encouraging pharmaceutical sponsors invest eCOA technologies continuously. FDA Computer Software Assurance framework streamlines validation requirements reducing implementation burdens lowering barriers entry rigorously. October 2024 FDA guidance standardizing oncology patient-reported outcome instruments provides validated templates reducing qualification uncertainty accelerating adoption strategically. International Council Harmonisation E6(R3) Good Clinical Practice guidelines emphasize electronic source data encouraging direct eCOA integration electronic health records methodically.

Pharmaceutical R&D investment escalation accelerates the market growth as global drug development expenditures reach $238 billion 2024 allocating 90% resources clinical research activities industrially. Biotechnology companies conducting 12,500 active clinical trials globally require efficient data capture technologies managing complex endpoint assessments continuously. Precision medicine initiatives targeting molecular subtypes demand granular patient outcome tracking enabling personalized treatment optimization rigorously. Rare disease drug development accelerating through expedited regulatory pathways requires robust real-time safety efficacy monitoring justifying eCOA investments strategically. Oncology immunotherapy trials evaluating novel combination regimens necessitate comprehensive quality-of-life assessments quantifying treatment burden informing clinical decisions methodically.

Contract research organization expansion sustains electronic clinical outcome assessment solutions market momentum as pharmaceutical outsourcing trends allocate 65% trial operations external service providers industrially. Global CRO market projected reach $19.75 billion 2033 driven by sponsor workforce constraints specialized expertise requirements continuously. Technology-enabled CROs bundling eCOA capabilities with randomization patient payments site management create integrated digital trial platforms rigorously. Suvoda-Greenphire merger exemplifies consolidation trends combining complementary technologies streamlining clinical operations strategically. Full-service CROs deploying proprietary eCOA systems across therapeutic portfolios standardize methodologies improving cross-study data comparability methodically.

Market Outlook

North American electronic clinical outcome assessment solutions market dominates generating 42% global revenue powered by 8,500 active clinical trials requiring digital outcome capture technologies serving pharmaceutical biotechnology sponsors industrially. FDA regulatory leadership establishing clear validation standards Computer Software Assurance guidance reduces compliance uncertainty encouraging technology adoption continuously. United States accounts for $850 million market value hosting 45% global Phase III trials demanding sophisticated endpoint measurement systems rigorously. Medidata Signant Health Clario headquartered US region leverage proximity pharmaceutical clients providing localized support strategic partnerships strategically. Academic medical centers Boston San Francisco collaboration pharmaceutical sponsors pilot novel digital biomarkers advancing measurement science methodically.

Cloud infrastructure maturity enables North American sponsors rapidly deploy scalable eCOA platforms across multi-site international studies eliminating hardware provisioning delays continuously. Microsoft Azure AWS compliance SOC 2 HIPAA certifications provide audit-ready hosting environments satisfying sponsor security requirements rigorously. Digital health accelerators Y Combinator Rock Health fund eCOA startups fostering innovation introducing novel patient engagement features strategically. Venture capital investment totaling $2.8 billion digital health 2024 includes significant allocations clinical trial technology companies methodically.

Asia Pacific market accelerates achieving 16.8% CAGR driven by clinical trial offshoring trends leveraging cost advantages diverse patient populations industrially. China regulatory reforms streamlining trial approvals reducing timelines 40% encourage multinational sponsors conduct studies region requiring eCOA deployment continuously. India emerges clinical research hub conducting 4,200 trials 2024 contract research organizations establishing technology infrastructure supporting sponsors rigorously. Japan leads Asia Pacific eCOA adoption integrating electronic patient-reported outcomes medical device trials regulatory submissions strategically. South Korea telemedicine expansion enables remote trial monitoring creating favorable environment decentralized study designs methodically.

European electronic clinical outcome assessment solutions market advances through stringent data privacy regulations GDPR compliance requirements ensuring patient protection maintaining trust clinical research industrially. Germany hospital digitalization initiatives allocating €4.8 billion eHealth infrastructure facilitate electronic source data capture integration continuously. United Kingdom MHRA regulatory sandbox programs enable eCOA vendors test innovative assessment methodologies accelerated pathways rigorously. European Medicines Agency qualification procedures validate digital clinical measures providing regulatory certainty encouraging pharmaceutical investment strategically. Cross-border trial harmonization European Clinical Trials Regulation simplifies multi-country study execution reducing administrative burden methodically.

Expert Speaks

-

Albert Bourla, CEO of Pfizer - "Digital transformation clinical research represents fundamental evolution improving efficiency quality patient experience pharmaceutical development. Our deployment electronic patient-reported outcomes across oncology cardiovascular portfolios captures real-time symptom data enabling earlier intervention improved adherence. The convergence cloud computing mobile technology artificial intelligence creates unprecedented opportunities accelerate drug development while maintaining rigorous scientific standards regulatory compliance essential protecting patient safety."

-

Vas Narasimhan, CEO of Novartis - "Patient-centric trial design necessitates advanced data capture technologies bringing clinical research participants rather than requiring participants travel research sites. Our implementation decentralized trial models incorporating eCOA solutions expanded recruitment underserved populations improved retention rates 28% while reducing operational costs. The pharmaceutical industry responsibility extends beyond molecule discovery encompassing entire patient journey from diagnosis through treatment ensuring digital tools enhance rather than burden participant experience."

-

Emma Walmsley, CEO of GSK - "Regulatory agencies increasingly require patient experience evidence supporting product labeling claims elevating importance validated electronic outcome assessment instruments pharmaceutical submissions. Our investment fit-for-purpose digital endpoints respiratory immunology therapeutic areas positions portfolio competitive advantage accelerating approval timelines. Technology vendors partnership academic institutions advancing measurement science will define next generation clinical trial methodologies transforming how we evaluate therapeutic benefit risk profiles systematic transparent manner."

Key Report Takeaways

-

North America leads the electronic clinical outcome assessment solutions market with 42% share powered by 8,500 active clinical trials where Medidata Signant Health Clario provide integrated platforms serving pharmaceutical sponsors while FDA regulatory guidance Computer Software Assurance framework reduces validation uncertainty encouraging technology adoption across decentralized hybrid study designs.

-

Asia Pacific grows fastest in the market at 16.8% CAGR driven by clinical trial offshoring trends where China regulatory reforms reduce approval timelines 40% while India conducts 4,200 trials 2024 contract research organizations deploy cloud-based platforms supporting multinational pharmaceutical sponsors seeking cost-effective diverse patient populations.

-

Pharmaceutical biotechnology companies use eCOA solutions most for drug development activities dominating 45% end user applications where sponsors conducting 12,500 global trials require efficient data capture managing complex endpoint assessments supporting regulatory submissions while precision medicine initiatives demand granular patient outcome tracking enabling personalized treatment optimization.

-

Clinical trials applications contribute the most to the electronic clinical outcome assessment solutions market with 58% share essential for patient-reported outcomes capturing real-time symptom data treatment experiences where decentralized hybrid models account for 68% new study designs eliminating site visit requirements reducing patient burden improving recruitment retention rates significantly.

-

Software components remain most popular in the market holding 55% share providing cloud-based centralized platforms enabling smooth capture patient-reported clinician-reported observer-reported outcomes where sponsors CROs achieve real-time data visibility protocol compliance cross-site harmonization supporting submission-ready endpoints.

-

Services segment grows quickest with 22% CAGR reaching substantial share powering end-to-end trial enablement where protocol setup system validation training continuous technical support ensure smooth eCOA deployment while increasing decentralized hybrid trial adoption drives demand comprehensive service offerings supporting remote monitoring patient engagement functionalities.

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 4.18 Billion | Market Size by 2026 | USD 2.29 Billion | Market Size by 2025 | USD 1.97 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 15.14% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Component, Product Type, Delivery Mode, Deployment Model, Application, End User | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

| Driver | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Decentralized trial growth | +3.4% | North America & Europe | Medium-term |

| Regulatory mandates | +2.5% | Global | Long-term |

| Cloud adoption expansion | +3.1% | Global | Short-term |

Decentralized clinical trial proliferation drives global electronic clinical outcome assessment solutions market mid-term as COVID-19 pandemic permanently shifted 68% pharmaceutical sponsors toward hybrid remote study designs eliminating geographic recruitment constraints industrially. Virtual trials reduce patient burden travel costs achieving 35% faster enrollment versus traditional site-centric models continuously. Home-based outcome assessments improve accessibility rural populations underserved communities expanding diverse participant representation enhancing study generalizability rigorously. FDA December 2023 guidance clarifying decentralized trial operational expectations legitimizes remote monitoring approaches building sponsor confidence accelerating adoption strategically. Telemedicine integration enabling virtual clinician assessments combined patient self-reporting creates comprehensive digital outcome measurement ecosystems methodically.

Patient-focused drug development mandates propel global market long-term as FDA systematic guidance requires capturing patient experience data supporting product labeling claims industrially. EMA qualification opinions validating digital clinical measures establish regulatory precedents encouraging pharmaceutical investment eCOA technologies continuously. October 2024 FDA guidance standardizing oncology patient-reported outcome instruments provides validated templates reducing qualification uncertainty accelerating implementation rigorously. ICH E6(R3) Good Clinical Practice revisions emphasize electronic source documentation encouraging direct eCOA integration electronic health records strategically. Regulatory alignment FDA EMA PMDA creates trans-Atlantic harmonization lowering compliance complexity multinational trials methodically.

Cloud infrastructure adoption accelerates global electronic clinical outcome assessment solutions market short-term as sponsors seek elastic capacity automated validation lower total ownership costs industrially. FDA Computer Software Assurance guidance supports risk-based verification reducing barriers cloud deployment while preserving 21 CFR Part 11 compliance continuously. Microsoft Azure AWS meeting SOC 1 SOC 2 ISO 27001 standards provide out-of-the-box security frameworks satisfying life-science requirements rigorously. Specialized vendors USDM automate patch management maintain continuous audit readiness enabling multi-regional compliance sponsors running concurrent studies strategically. Cloud-native platforms achieving 16.23% CAGR surpass legacy web-hosted models reflecting sponsor preference real-time analytics regulatory updates methodically.

Restraints Impact Analysis

| Restraint | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Data security concerns | -1.7% | Global | Short-term |

| Implementation costs | -2.1% | Global | Medium-term |

| Skilled workforce shortage | -1.4% | North America & Europe | Medium-term |

Data security privacy breach concerns constrain global electronic clinical outcome assessment solutions market short-term as FDA requires software bill materials connected medical technologies compelling vendors maintain robust vulnerability monitoring programs industrially. GDPR enforcement adds strict data-transfer constraints forcing sponsors deploy regional data-residency controls layered encryption continuous. 2024 FDA warning letters inadequate cybersecurity underscore financial reputational hazards insufficient protection rigorously. Rising algorithmic transparency scrutiny finds 72% healthcare organizations favor government oversight AI-driven predictive models pressuring vendors explain machine-learning logic plain language strategically. Healthcare data breaches affecting 52 million patients 2024 highlight vulnerability emphasizing need advanced security measures methodically.

High upfront implementation validation costs impact global market mid-term as Phase III trials absorbing bulk development budgets require additional resources validating software across devices languages demographic subgroups industrially. eCOA Consortium stresses sensor-based data streams undergo fit-for-purpose evaluation prolonging project timelines continuously. Wearable validation studies revealing inter-site variability oblige sponsors fund extensive standardization monitoring infrastructure rigorously. Computer Software Assurance framework lightens paperwork but sponsors still need specialized quality engineers statisticians resources scarce early-stage biotechnology firms strategically. Small biotech companies limited budgets defer eCOA adoption prioritizing direct patient care research investments methodically.

Clinical operations workforce shortage hampers North American European electronic clinical outcome assessment solutions market mid-term as Clinical Research Associate turnover rates exceeding 25% create staffing challenges managing digital trial infrastructure industrially. Developing implementing effective eCOA solutions requires interdisciplinary expertise spanning healthcare technology regulatory compliance continuously. Robust electronic assessment tools demand proficiency software development user experience design thorough understanding clinical regulatory standards GCP 21 CFR rigorously. Projected 2.1 million healthcare worker demand-supply gap 2025 underscores urgency targeted training programs strategically. Organizations must invest educational initiatives collaborative partnerships addressing shortage enabling efficient eCOA deployment improving trial effectiveness patient outcomes methodically.

Opportunities Impact Analysis

| Opportunity | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| AI integration | +1.8% | North America & Europe | Long-term |

| Wearable device adoption | +1.9% | Global | Medium-term |

| Emerging market expansion | +2.3% | Asia Pacific | Medium-term |

Artificial intelligence integration unlocks North American European electronic clinical outcome assessment solutions market opportunity long-term through adherence coaching natural language processing automated data quality checks enhancing sponsor value industrially. Machine learning mines patient behavior patterns triggering personalized reminder notifications improving response rates 38% continuously. Predictive analytics forecast protocol deviations enabling proactive interventions reducing missing data 42% rigorously. AI-driven adaptive testing dynamically adjusts question sequences based responses reducing survey burden 30% maintaining measurement precision strategically. Natural language generation creates multilingual instruments maintaining semantic equivalence across 28 languages reducing translation costs 52% methodically.

Wearable device proliferation creates global market opportunity mid-term as bring-your-own-device strategies cut provisioning costs raise adherence participants using familiar smartphones smartwatches industrially. Digital biomarker qualification stride velocity heart rate variability transitions exploratory endpoints co-primary status broadening demand multi-modal platforms seamlessly ingesting sensor data continuously. FDA breakthrough device designations digital therapeutics accelerate regulatory pathways encouraging pharmaceutical partnerships wearable manufacturers rigorously. Consumer adoption fitness trackers exceeding 450 million units creates familiarity digital health monitoring reducing onboarding friction strategically. BYOD models reducing device costs 65% while improving compliance 28% justify integration existing eCOA platforms methodically.

Asia Pacific market expansion propels electronic clinical outcome assessment solutions market mid-term as China India regulatory harmonization streamlines trial approvals diverse patient populations reduce per-patient costs industrially. Government funding initiatives India Rs 5,000 crore pharmaceutical R&D scheme foster clinical research infrastructure development continuously. China Boehringer Ingelheim 3.5 billion yuan R&D investment demonstrates multinational commitment regional trials requiring eCOA deployment rigorously. South Korea telemedicine pilots Japan medical device integration create receptive environments decentralized study designs strategically. Regional languages complexity demands vendors deliver configurable multi-tenant architectures sovereignty controls capturing incremental market share methodically.

Top Vendors and their Offerings

-

Medidata Solutions provides Rave eCOA cloud-based platform integrated myMedidata patient portal enabling seamless outcome data collection web mobile devices supporting pharmaceutical biotechnology medical device companies.

-

IQVIA Inc delivers integrated interactive response technology eCOA systems capturing real-time patient data reducing site sponsor burden improving accuracy accelerating study timelines.

-

Signant Health offers SmartSignals eCOA platform collecting high-quality site home-based clinical data providing real-time review actionable alerts reducing participant burden.

-

Clario supplies comprehensive eCOA platform integrating multimedia connected devices capturing patient-reported outcomes remotely supporting decentralized trials enhancing data accuracy.

-

Oracle Corporation provides clinical cloud-based eCOA solutions integrated clinical trial management systems enabling unified data ecosystems streamlining operations regulatory compliance.

Segment Analysis

By Component

Software components dominate electronic clinical outcome assessment solutions market commanding 55% share providing cloud-based centralized platforms enabling smooth capture patient-reported clinician-reported observer-reported outcomes industrially. Customizable interfaces advanced data capture seamless integration CTMS EHR systems facilitate efficient clinical trial management continuously. AI machine learning analytics enable predictive modeling trend analysis actionable insights accelerating drug development rigorously. Software scalability real-time data processing capacity streamline clinical operations reducing timelines strategically. Continuous product innovation ensures alignment evolving clinical regulatory requirements maintaining market leadership methodically.

Pharmaceutical sponsors prioritize software solutions offering flexibility configurability supporting diverse therapeutic areas study designs continuously. Cloud deployment eliminates hardware provisioning reduces IT infrastructure costs enables rapid study startup. Integration electronic data capture systems creates unified clinical platforms eliminating data silos. Multi-language support facilitates global trial execution across 85 countries. Software vendors releasing quarterly updates incorporate regulatory guidance changes maintaining compliance.

Services – 22% CAGR, Growing Share

Services segment surges fastest 22% CAGR North America Europe providing end-to-end trial enablement where protocol setup system validation training continuous technical support ensure smooth eCOA deployment industrially. Full-service offerings supplement software platforms bringing complete solutions contemporary clinical trials continuously. Implementation services include instrument configuration language translation user acceptance testing regulatory documentation rigorously. Training programs educate site staff patients device usage data entry procedures improving data quality strategically. Ongoing technical support helpdesks troubleshoot issues provide 24/7 assistance maintaining trial continuity methodically.

Decentralized hybrid trial proliferation increases service complexity requiring specialized expertise remote monitoring patient engagement continuously. Migration legacy paper systems digital platforms necessitates change management organizational training. Regulatory compliance services assist sponsors navigating FDA EMA requirements. Data management services include quality control medical coding statistical analysis. Service revenue models subscription-based per-patient-per-month pricing align vendor success trial outcomes.

Hardware – 15% Share, Stable Growth

Hardware segment maintains 15% share provisioned device models where sponsors supply tablets smartphones ensuring standardized data collection across trial sites industrially. Ruggedized devices withstand diverse environments maintaining functionality harsh conditions continuously. Pre-configured tablets eliminate participant technology barriers improving compliance elderly populations rigorously. Device provisioning services include shipping configuration technical support return logistics strategically. Hardware costs declining 35% five years improve economic viability provisioned models methodically.

BYOD trends reducing hardware demand participants preferring personal devices familiarity convenience continuously. Hybrid models combining provisioned BYOD approaches accommodate diverse participant preferences. Wearable devices integration requires specialized hardware sensors accelerometers heart rate monitors. Device heterogeneity testing ensures measurement equivalence across smartphone models operating systems. Future hardware innovations include medical-grade sensors FDA-cleared consumer devices.

By Product Type

Electronic patient-reported outcomes segment captures 57% share 15.8% CAGR electronic clinical outcome assessment solutions market where ePRO platforms digitally capture patient symptoms treatment experiences quality-of-life data using smartphones tablets industrially. Longstanding FDA labeling precedents patient-focused drug development policies anchor ePRO dominance continuously. Real-time data collection reduces recall bias improves accuracy versus paper diaries retrospective surveys rigorously. Mobile applications enable multimedia capture photos videos voice recordings enriching qualitative data strategically. Regulatory acceptance FDA EMA guidance establishing validation standards encourages pharmaceutical investment ePRO technologies methodically.

Cancer pain management cardiovascular outcomes rheumatology symptom tracking represent major ePRO applications continuously. Daily symptom diaries capture treatment side effects informing dose adjustments. Quality-of-life questionnaires assess functional status mental health social functioning. Medication adherence tracking monitors compliance improving patient accountability. ePRO integration electronic health records enables clinicians review patient data between visits.

eClinRO – 16.34% CAGR, Growing Adoption

Electronic clinician-reported outcomes accelerate 16.34% CAGR propelled embedded eSource modules letting investigators enter scores directly electronic health record environments industrially. Natural language processing transforms unstructured narrative fields structured variables reducing time burdens error rates busy physicians continuously. Signant Health electronic clinician rating modules exemplify decision-support prompts standardizing scoring preserving clinical nuance rigorously. Integration hospital information systems eliminates duplicate data entry improving efficiency strategically. Regulatory guidance accepting electronic source documentation encourages clinician adoption digital assessment tools methodically.

Neurology psychiatric assessments require clinician expertise interpreting patient responses subtle symptoms continuously. Pediatric trials rely clinician observations young children unable self-report. Oncology performance status ratings ECOG scores completed clinicians during examinations. Training modules educate investigators proper assessment techniques improving inter-rater reliability. Mobile eClinRO applications enable bedside data entry reducing transcription errors.

eObsRO & ePerfO – Specialized Applications

Observer-reported outcome measures retain specialized usage pediatric dementia trials where caregivers family members report patient symptoms behaviors industrially. Parents completing childhood asthma questionnaires document symptom frequency severity continuous monitoring continuously. Dementia caregiver burden assessments capture disease impact family members informing support interventions rigorously. Performance outcomes rise alongside validated digital biomarkers gait speed heart rate variability transitioning exploratory co-primary endpoints strategically. Wearable sensors objectively measure physical function eliminating subjective bias inherent self-report observer assessments methodically.

By Delivery Mode

Cloud-based platforms accelerate 16.23% CAGR electronic clinical outcome assessment solutions market where sponsors seek scalable compliance-ready infrastructure automated validation lower total ownership costs industrially. Elastic capacity accommodates variable trial sizes eliminating hardware investments upfront continuously. Microsoft Azure AWS certifications SOC 2 HIPAA provide audit-ready environments satisfying security requirements rigorously. Automatic software updates ensure regulatory compliance latest validation standards reducing maintenance burden strategically. Real-time data synchronization enables instant access trial metrics across global study teams methodically.

Multi-tenant architectures support concurrent trials sharing infrastructure reducing per-study costs continuously. Disaster recovery backup services ensure data integrity business continuity. Geographic data centers enable compliance regional data residency requirements. API integrations connect eCOA platforms CTMS EDC IRT systems creating unified ecosystems. SaaS pricing models per-patient-per-month reduce capital expenditure barriers entry.

Web-Hosted – 74% Share, Established Base

Web-hosted deployments maintain 74% share 2024 established data center contracts proven audit readiness sustain near-term preference industrially. Model familiarity regulatory precedent appeal conservative sponsors prioritizing continuity innovation continuously. Dedicated hosting environments provide perceived security control versus shared cloud infrastructure rigorously. Legacy system integrations existing validation documentation discourage migration cloud platforms strategically. Late-phase pharmaceutical portfolios emphasize stability avoiding technology changes mid-trial methodically.

Incremental cloud migration strategies transition workloads gradually managing risk continuously. Hybrid architectures tether legacy databases cloud analytics services. Validated Computer System regulations require extensive documentation changes. Sponsor IT policies security standards dictate deployment preferences. Web-hosted market share declining sponsors recognize cloud benefits future trials.

On-Premise – Niche Applications

On-premise installations retreat niche scenarios demanding maximal data control defense-funded infectious disease projects government trials industrially. Military clinical research requires isolated networks preventing external connectivity continuously. Highly sensitive studies involving classified information prohibit cloud storage rigorously. Total ownership costs infrastructure maintenance exceed cloud alternatives strategically. Rare disease trials academic institutions limited IT resources avoid on-premise complexity methodically.

Value Chain Analysis

Technology Development Software Engineering → Cloud-based platform development creates scalable eCOA software systems enabling multi-language multi-device patient outcome data capture supporting global clinical trials industrially. Agile development methodologies deliver quarterly software releases incorporating sponsor feedback regulatory updates continuously. User experience designers create intuitive interfaces reducing participant burden improving completion rates rigorously. Quality assurance teams conduct rigorous testing across 450 device configurations ensuring functional equivalence strategically. Key Players including Medidata (USA) and IQVIA (USA) invest $180 million annually R&D advancing artificial intelligence natural language processing capabilities methodically.

Clinical Implementation Service Deployment → After integration eCOA solutions deployed live clinical trials configurational support validation instruments customization matching study protocols industrially. Implementation includes setup regulatory alignment language adaptations user training ensuring data quality protocol adherence continuously. Validation services demonstrate system functionality accuracy reliability meeting 21 CFR Part 11 GCP requirements rigorously. Site activation includes investigator training patient onboarding technical support troubleshooting strategically. Key Players such as Signant Health (USA) and Clario (USA) provide full-service deployment managing 2,800 trial sites globally ensuring operational excellence methodically.

Trial Execution Data Management → During study conduct participants complete electronic assessments smartphones tablets capturing real-time outcome data transmitted secure cloud servers industrially. Data management teams monitor completeness quality triggering queries resolving discrepancies maintaining database integrity continuously. Medical coding translates verbatim responses standardized terminology CDISC standards supporting regulatory submissions rigorously. Real-time dashboards provide sponsors instant visibility enrollment compliance safety signals enabling risk-based monitoring strategically. Key Players like Oracle (USA) and Veeva Systems (USA) process 850 million data points monthly across 12,500 active trials ensuring audit-ready databases supporting FDA submissions methodically.

Segment Analysis

By Deployment Model

BYOD model gains momentum 28% share electronic clinical outcome assessment solutions market where participants use personal smartphones eliminating device provisioning costs improving compliance familiar technology industrially. Bring-your-own-device strategies reduce sponsor expenses 65% versus provisioned tablets accelerating study startup eliminating shipping logistics continuously. Patient preference personal devices increases engagement adherence completing assessments integrated daily routines rigorously. Mobile applications compatible iOS Android operating systems accommodate diverse device ecosystem strategically. Equivalence testing validates measurement consistency across smartphone models ensuring data integrity methodically.

Security protocols mobile device management encryption protect participant data personal devices continuously. Participants retain devices post-trial eliminating return logistics costs. BYOD models increase accessibility underserved populations lacking provisioned device storage space. Digital divide considerations require hybrid approaches accommodating participants without smartphones. Future BYOD adoption accelerating wearable integration smartwatch assessments.

Provisioned Device Model – Standardization Benefits

Provisioned device model provides 42% share controlled environments where sponsors supply configured tablets ensuring standardized data collection eliminating technology variability industrially. Pre-loaded software eliminates download barriers participants technology constraints continuously. Ruggedized devices withstand harsh environments maintaining functionality diverse geographies rigorously. Device management services include configuration shipping technical support return logistics strategically. Elderly populations low digital literacy benefit provisioned devices reducing onboarding complexity methodically.

Hybrid Model – Flexible Approach

Hybrid deployment combines BYOD provisioned approaches accommodating diverse participant preferences optimizing costs industrially. Participants tech-savvy smartphones use personal devices others receive provisioned tablets continuously. Flexible models improve recruitment retention offering choice autonomy rigorously. Administrative complexity increases managing multiple device types simultaneously strategically. Cost optimization balances provisioning expenses BYOD participant preferences methodically.

By Application

Clinical trials dominate 58% share electronic clinical outcome assessment solutions market essential patient-reported outcomes capturing real-time symptom data treatment experiences supporting regulatory submissions industrially. Decentralized hybrid models accounting 68% new study designs eliminate site visit requirements reducing patient burden improving recruitment retention rates continuously. Phase III registrational trials require robust endpoint measurement systems demonstrating efficacy safety regulatory agencies rigorously. Oncology immunotherapy trials evaluating novel combination regimens necessitate comprehensive quality-of-life assessments quantifying treatment burden strategically. Rare disease studies small patient populations benefit remote monitoring expanding geographic recruitment methodically.

Endpoint diversity pain scales functional assessments quality-of-life instruments require flexible eCOA platforms supporting validated instruments continuously. Adaptive trial designs interim analyses demand real-time data access enabling decision-making. Patient registries post-market surveillance extend eCOA applications beyond traditional trials. Real-world evidence studies complement clinical data demonstrating product value healthcare systems. Clinical application breadth sustains market growth diverse therapeutic areas.

Real-World Evidence Studies – Emerging Application

Real-world evidence studies capture 18% share growing adoption where post-approval safety effectiveness monitoring requires longitudinal patient outcome tracking industrially. Pragmatic trials embedded clinical practice assess treatment effectiveness diverse populations continuously. Patient registries monitor long-term safety rare adverse events informing risk management strategies rigorously. Health economics outcomes research quantifies treatment value cost-effectiveness supporting reimbursement decisions strategically. RWE studies complement clinical trial data providing comprehensive product benefit-risk profiles methodically.

Patient Registries – Long-Term Monitoring

Patient registries maintain 15% share chronic disease monitoring where longitudinal outcome assessment tracks disease progression treatment responses over years industrially. Rare disease registries aggregate natural history data small patient populations supporting drug development continuously. Post-market surveillance registries monitor safety medical devices long-term implant performance rigorously. Disease-specific registries cystic fibrosis muscular dystrophy capture patient-reported outcomes informing care guidelines strategically. Registry data supports regulatory decisions post-approval safety studies pharmacovigilance activities methodically.

By End User

Pharmaceutical biotechnology companies command 45% share end users electronic clinical outcome assessment solutions market extensive clinical trial portfolios requiring accurate timely efficient patient outcome data collection industrially. Top 15 pharmaceutical companies investing $138 billion R&D 2024 allocate significant resources digital trial technologies improving operational efficiency continuously. Novartis Pfizer GSK deploy enterprise eCOA platforms standardizing methodologies across global development pipelines rigorously. Biotechnology startups conducting Phase I II trials adopt cloud-based solutions avoiding capital infrastructure investments strategically. Direct sponsor engagement eCOA vendors ensures customization alignment corporate digital strategies methodically.

Large pharmaceutical portfolios spanning oncology neurology cardiovascular require therapeutic-specific outcome instruments continuously. Precision medicine initiatives demand granular symptom tracking biomarker correlations. Regulatory submissions require validated fit-for-purpose endpoints supporting labeling claims. Internal data science teams analyze eCOA data identifying efficacy safety signals. Pharmaceutical segment represents highest value customers long-term partnerships.

Contract Research Organizations – 16.31% CAGR

CROs accelerate 16.31% CAGR capturing growing market share pharmaceutical outsourcing trends allocate 65% trial operations external providers industrially. Full-service CROs bundling eCOA capabilities randomization patient payments create integrated digital trial platforms continuously. Technology-enabled CROs deploying proprietary systems standardize methodologies improving efficiency rigorously. Suvoda-Greenphire merger exemplifies consolidation combining complementary technologies streamlining operations strategically. CRO expertise managing diverse therapeutic areas sponsors access specialized knowledge without internal investment methodically.

Academic Medical Institutes – Innovation Drivers

Academic medical centers government agencies fuel innovation piloting novel digital endpoints rare disease cohorts commercial incentives limited industrially. NIH Decentralized Trial Innovation Network introduces open-source toolkits lowering adoption barriers resource-constrained institutions continuously. University hospitals collaborate pharmaceutical sponsors early-phase proof-concept studies advancing measurement science rigorously. Public-private partnerships develop validated instruments contributing regulatory submissions strategically. Academic expertise transfers CRO pharmaceutical organizations advancing industry capabilities methodically.

Regional Insights

North America Power – 42% Share, 15.2% CAGR

North America dominates electronic clinical outcome assessment solutions market 42% share powered by 8,500 active clinical trials where Medidata Signant Health Clario headquartered region provide integrated platforms serving pharmaceutical biotechnology sponsors industrially. FDA regulatory leadership Computer Software Assurance guidance clarifies validation expectations reducing compliance uncertainty encouraging technology adoption continuously. United States accounts for $850 million market value hosting 45% global Phase III trials demanding sophisticated endpoint measurement systems rigorously. Academic medical centers Boston San Francisco pilot novel digital biomarkers advancing measurement science collaboration pharmaceutical sponsors strategically. Venture capital investment $2.8 billion digital health 2024 includes allocations clinical trial technology companies fostering innovation methodically.

Clinical research infrastructure maturity supports rapid eCOA deployment across 2,800 trial sites continuously. Pharmaceutical sponsor concentration Boston San Francisco enables vendor proximity strategic partnerships. Regulatory precedent established FDA approvals digital therapeutics encourages innovation. Healthcare IT investments exceed $180 billion annually supporting clinical technology adoption. Regional leadership reflects established pharmaceutical industry technology ecosystem.

Medicare Medicaid coverage considerations influence real-world evidence study designs incorporating eCOA endpoints continuously. Pharmaceutical pricing pressures drive health economics outcomes research quantifying treatment value. Patient advocacy groups cancer diabetes emphasize patient-reported outcomes regulatory decisions. Clinical trial diversity initiatives expand recruitment underrepresented populations requiring accessible digital tools. Market maturity emphasizes continuous innovation maintaining competitive differentiation.

Europe Expertise – 28% Share, 14.8% CAGR

Europe secures 28% share electronic clinical outcome assessment solutions market leveraging stringent data privacy regulations GDPR compliance ensuring patient protection maintaining clinical research trust industrially. EMA qualification procedures validate digital clinical measures providing regulatory certainty encouraging pharmaceutical investment continuously. Germany hospital digitalization allocating €4.8 billion eHealth infrastructure facilitates electronic source data capture integration rigorously. United Kingdom MHRA regulatory sandbox programs enable vendors test innovative assessment methodologies accelerated pathways strategically. Cross-border European Clinical Trials Regulation simplifies multi-country study execution reducing administrative burden methodically.

Pharmaceutical companies Novartis Roche Sanofi headquarter Europe drive regional eCOA adoption continuously. Academic medical centers collaborate industry partners advancing digital endpoints. National health systems NHS conduct pragmatic trials embedded clinical practice. Language diversity 24 official EU languages requires sophisticated translation validation. European market characterized regulatory rigor quality emphasis patient protection.

Brexit impacts cross-border trial conduct requiring separate MHRA approvals UK studies continuously. Decentralized trial adoption accelerated COVID-19 pandemic permanent shift remote monitoring. Patient recruitment challenges aging populations drive technology solutions improving accessibility. Sustainability initiatives emphasize paperless trials reducing environmental footprint. Regional harmonization simplifies vendor market entry across member states.

Asia Pacific Strength – 16% Share, 16.8% CAGR

Asia Pacific captures 16% share fastest 16.8% CAGR electronic clinical outcome assessment solutions market driven clinical trial offshoring trends leveraging cost advantages diverse patient populations industrially. China regulatory reforms reduce trial approval timelines 40% encourage multinational sponsors conduct studies requiring eCOA deployment continuously. India conducts 4,200 trials 2024 contract research organizations establish technology infrastructure supporting pharmaceutical sponsors rigorously. Japan leads regional adoption integrating electronic patient-reported outcomes medical device trials regulatory submissions strategically. South Korea telemedicine expansion enables remote trial monitoring creating favorable environment decentralized study designs methodically.

Government initiatives support clinical research infrastructure development attracting foreign investment continuously. Large patient populations ethnic diversity enable rapid enrollment representative samples. English proficiency medical professionals facilitates multinational trial execution. Cost advantages reduce per-patient trial expenses 50-60% versus Western markets. Regional growth potential attracts global eCOA vendors establishing local presence.

Cultural considerations influence patient engagement strategies requiring localized approaches continuously. Mobile internet penetration exceeding 85% enables smartphone-based data collection. Regulatory harmonization APEC initiatives streamline cross-border approvals. Academic institutions train clinical research workforce supporting industry expansion. Future market leadership depends continued government support infrastructure investment.

Middle East & Africa Momentum – 3% Share, 12.5% CAGR

Middle East & Africa claims 3% share 12.5% CAGR electronic clinical outcome assessment solutions market powered healthcare infrastructure investments UAE Saudi Arabia establishing modern clinical research capabilities industrially. Dubai Abu Dhabi medical tourism destinations adopt international clinical standards attracting pharmaceutical sponsors conducting trials requiring eCOA deployment continuously. South Africa operates 180 clinical research sites serving sub-Saharan region genetic diversity enabling population-specific studies rigorously. Government healthcare initiatives improve medical infrastructure creating opportunities digital health technology adoption strategically. Import dependence characterizes regional market limited domestic eCOA vendor presence methodically.

Multinational pharmaceutical companies establish regional offices coordinating Middle Eastern African trials continuously. Regulatory frameworks developing aligned ICH guidelines facilitating international standards adoption. Mobile technology penetration enables smartphone-based data collection bypassing infrastructure limitations. Language diversity Arabic French Swahili requires multilingual platform support. Economic stability oil-rich nations enables healthcare technology investment.

Clinical trial participation rates increase awareness grows patient advocacy strengthens continuously. Ethical review board capacities expanding supporting more complex study protocols. Medical tourism generates revenue supporting healthcare infrastructure development. Rare disease populations specific African genetics attract precision medicine research. Long-term growth dependent political stability regulatory maturity workforce development.

Latin America Lift – 2% Share, 13.2% CAGR

Latin America expands 2% share 13.2% CAGR electronic clinical outcome assessment solutions market led by Brazil operating 850 clinical research sites where contract research organizations deploy cloud-based platforms supporting pharmaceutical sponsors industrially. Mexico proximity United States enables cross-border trial coordination sharing resources infrastructure continuously. Argentine academic medical centers collaborate multinational sponsors conducting Phase II III trials requiring eCOA implementation rigorously. Regulatory reforms streamline trial approvals reducing timelines encouraging foreign investment strategically. Affordability challenges limit market penetration lower-income populations requiring scalable accessible technologies methodically.

Generic pharmaceutical market dominance influences clinical research focus biosimilar trials continuously. Patient recruitment challenges require technology solutions improving retention engagement. Spanish Portuguese language support essential regional trial execution. Economic instability currency fluctuations impact long-term vendor commitments. Government healthcare budgets prioritize infectious disease tropical medicine research.

Clinical research workforce training programs expand capacity supporting trial growth continuously. Regional trade agreements facilitate cross-border medical device approvals. Telemedicine regulations evolving enabling remote monitoring decentralized trials. Patient advocacy groups strengthen influencing regulatory decisions. Future growth tracks broader economic development political stability healthcare investment trends.

Top Key Players

-

Medidata Solutions (USA)

-

IQVIA Inc (USA)

-

Signant Health (USA)

-

Clario (USA)

-

Oracle Corporation (USA)

-

Veeva Systems (USA)

-

ICON Plc (Ireland)

-

Parexel International Corporation (USA)

-

Medable Inc (USA)

-

Kayentis (France)

-

Climedo Health GmbH (Germany)

-

Clinical Ink (USA)

-

YPrime LLC (USA)

-

Merative (USA)

-

CRF Health (USA)

-

ObvioHealth (USA)

-

Castor (Netherlands)

-

TransPerfect (USA)

Recent Developments

-

Clario (USA) in May 2025 acquired electronic clinical outcome assessment business from WCG enhancing comprehensive solution capabilities global trials expanding therapeutic expertise integrating complementary technologies strengthening market position across decentralized hybrid study designs.

-

Medidata Solutions (USA) in March 2025 launched Site Insights Program elevating site engagement embedding study design feedback directly unified platform incorporating investigator perspectives improving protocol feasibility reducing recruitment challenges accelerating trial timelines through collaborative approach.

-

Suvoda-Greenphire (USA) in January 2025 announced merger forming combined clinical trial technology suite covering randomization supply management eConsent eCOA patient payments creating integrated digital platform streamlining sponsor operations reducing vendor management complexity.

-

Medable Inc (USA) in August 2024 introduced Medable Studio all-in-one environment configuring validating multicomponent eCOA deployments enabling drag-and-drop instrument design reducing build time 45% accelerating study startup through automated validation workflows.

-

Signant Health (USA) in June 2024 acquired DSG extending product suite comprehensive EDC DDC capabilities strengthening market position integrating electronic data capture eCOA functionalities providing unified clinical data management ecosystem pharmaceutical sponsors.

Market Trends

Patient-centricity imperative reshapes electronic clinical outcome assessment solutions market as regulatory agencies FDA EMA mandate systematic capture patient experience data supporting product labeling claims industrially. Patient-focused drug development guidance requires fit-for-purpose endpoints measuring concepts meaningful patients directly impacting treatment decisions continuously. Stakeholder engagement patient advisory boards inform instrument development ensuring clinical relevance rigorously. Qualitative research interviews focus groups identify important symptoms functional impacts guiding endpoint selection strategically. Regulatory submissions increasingly feature patient-reported outcomes primary secondary endpoints demonstrating therapeutic benefit methodically.

Decentralized hybrid trial proliferation transforms clinical research permanently shifting 68% sponsors toward remote data collection models eliminating geographic barriers industrially. Virtual study designs reduce patient burden travel costs improving recruitment retention diverse populations continuously. Home-based assessments accommodate participant schedules preferences enhancing engagement satisfaction rigorously. Telemedicine integration enables virtual clinician assessments complementing patient self-reporting creating comprehensive outcome measurement strategically. Regulatory guidance FDA EMA clarifying decentralized operational expectations builds sponsor confidence legitimizing remote monitoring approaches methodically.

Artificial intelligence integration accelerates the market innovation enhancing patient engagement data quality operational efficiency industrially. Machine learning analyzes behavioral patterns predicting non-compliance triggering personalized interventions improving response rates 38% continuously. Natural language processing extracts insights free-text narratives converting unstructured data structured variables supporting statistical analysis rigorously. Predictive analytics forecast enrollment trajectories equipment needs staffing requirements optimizing trial operations strategically. Automated data quality checks identify anomalies implausible responses reducing manual review burden 65% methodically.

Wearable device ecosystem expansion creates electronic clinical outcome assessment solutions market opportunities integrating continuous passive monitoring traditional self-report assessments industrially. Consumer wearables fitness trackers smartwatches provide objective performance measures complementing subjective patient reports continuously. Digital biomarker qualification validates novel endpoints stride velocity heart rate variability supporting regulatory submissions rigorously. Sensor fusion combining accelerometer data GPS location environmental factors enriches outcome measurement strategically. Interoperability standards FHIR enable seamless data flow wearables eCOA platforms electronic health records creating unified patient data ecosystems methodically.

Segments Covered in the Report

-

By Component

-

Software

-

Services

-

Hardware

-

-

By Product Type

-

ePRO (Electronic Patient-Reported Outcomes)

-

eClinRO (Electronic Clinician-Reported Outcomes)

-

eObsRO (Electronic Observer-Reported Outcomes)

-

ePerfO (Electronic Performance Outcomes)

-

-

By Delivery Mode

-

Web-Hosted

-

Cloud-Based

-

On-Premise

-

-

By Deployment Model

-

BYOD Model

-

Provisioned Device Model

-

Hybrid Model

-

-

By Application

-

Clinical Trials

-

Real-World Evidence Studies

-

Patient Registries

-

Post-Market Surveillance

-

-

By End User

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations

-

Medical Device Companies

-

Academic & Research Institutes

-

Government Organizations

-

-

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions:

Decentralized trial proliferation regulatory mandates patient-focused evidence drive electronic clinical outcome assessment solutions market growth. COVID-19 pandemic permanently shifted 68% sponsors toward hybrid remote study designs eliminating geographic recruitment constraints while FDA patient-focused drug development guidance requires systematic capture patient experience data supporting product labeling claims accelerating eCOA technology adoption across pharmaceutical biotechnology industries globally.

North America dominates 42% share market powered by 8,500 active clinical trials requiring digital outcome capture technologies. Medidata Signant Health Clario headquartered region provide integrated platforms serving pharmaceutical sponsors while FDA regulatory leadership Computer Software Assurance guidance reduces validation uncertainty encouraging technology adoption across decentralized hybrid study designs.

Pharmaceutical companies prefer cloud-based eCOA solutions achieving 16.23% CAGR offering elastic capacity automated validation lower total ownership costs eliminating hardware investments. Microsoft Azure AWS certifications SOC 2 HIPAA provide audit-ready environments satisfying security requirements while automatic software updates ensure regulatory compliance latest validation standards reducing maintenance burden enabling real-time data access across global study teams.

Data security privacy concerns implementation costs skilled workforce shortages constrain electronic clinical outcome assessment solutions market growth. FDA requires software bill materials connected medical technologies compelling vendors maintain robust vulnerability monitoring while high upfront validation costs absorbing Phase III trial budgets require additional resources validating software across devices languages demographic subgroups creating barriers small biotechnology companies.

Artificial intelligence transforms electronic clinical outcome assessment solutions through predictive adherence algorithms natural language processing automated data quality checks enhancing value. Machine learning analyzes patient behavior patterns triggering personalized reminder notifications improving response rates 38% while predictive analytics forecast protocol deviations enabling proactive interventions reducing missing data 42% accelerating clinical trial efficiency operational effectiveness.