Food Manufacturing Software Market Overview

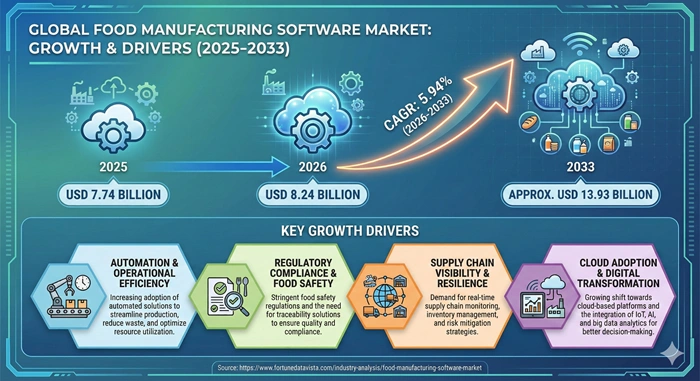

The global food manufacturing software market size is valued at USD 7.74 billion in 2025 and is predicted to increase from USD 8.24 billion in 2026 to approximately USD 13.93 billion by 2033, growing at a CAGR of 5.94% from 2026 to 2033. These tools help factories run smooth from mixing batches to shipping boxes. Plants track ingredients and spot issues fast to meet safety rules. Demand rises as shoppers want fresh, safe food quick.

AI Impact on the Food Manufacturing Software Industry

AI shakes up food manufacturing software by guessing machine breakdowns before they hit. Ovens and mixers send data live, so software flags worn parts early. This cuts stops and waste in busy plants. Recipe tweaks happen smart with AI testing flavors virtual first. Factories cut trials that spoil batches. Trace tools follow ingredients farm to store, pulling bad lots quick if alerts pop. Big firms layer AI on old systems for yield boosts. Small shops get cloud AI cheap now. Safety jumps as cameras scan for dirt or wrong mixes instant.

Food Manufacturing Software Market Growth Factors

Tough food laws push factories to log every step tight. Software prints labels right and recalls safe. Big recalls cost millions, so plants pay up front. Plants make more ready meals and snacks now. Tools plan shifts and stock to match orders. Waste drops when software eyes shelf life sharp. Labor runs short, so apps guide workers on phones. Clouds link suppliers for just-right deliveries. Green rules track water and power use daily. Costs fall on cloud picks, pulling mid shops in. Mobile views let bosses check runs remote easy.

Food Manufacturing Software Market Outlook

Clouds rule the food manufacturing software market with easy scales for growing plants. Old servers fade as updates roll auto. Asia builds factories fast, grabbing tools cheap. AI mixes with basics for smart forecasts on sales dips. Europe tightens waste rules, favoring track pros. Funds hit startups for pet food niches. By 2033, most lines link end-to-end for zero waste. Cyber guards grow as hacks eye recipes. Climb stays firm with fresh needs. Hybrids blend cloud brains with house data safe. Training apps skill staff quick. Road ahead clear with tech fits.

Expert Speaks

- Doug McMillon, CEO of Walmart (USA): "Digital tools in food plants ensure fresh stock fast, key to our supply chain strength."

- Ramon Laguarta, CEO of PepsiCo (USA): "Software optimizes our recipes and runs, cutting waste while hitting taste right every time."

- Thasunda Brown Duckett, CEO of TIAA (USA, food investments): "Tech tracks sustainability in manufacturing, vital for investor trust in food futures."

Key Report Takeaways

- North America leads the food manufacturing software market grabbing 37% share through tech-ready plants and FDA pushes that demand trace tools from Infor and SAP.

- Asia Pacific speeds fastest at 7% CAGR from factory booms in China and India where ready meals need quick batch shifts.

- Production ops users top the chart running lines non-stop with real-time tweaks for yield.

- ERP functionality pulls most weight tying inventory to sales for smooth flows.

- Cloud deployment holds strong for scales in big dairies.

- Compliance & traceability jumps quick claiming 25% share by 2033 at 6.8% CAGR amid recall fears.

Food Manufacturing Software Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 13.93 Billion | Market Size by 2026 | USD 8.24 Billion | Market Size by 2025 | USD 7.74 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 5.94% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Deployment Mode, Functionality, Food Category, Enterprise Size, End-User Department, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Food Manufacturing Software Market Dynamics

Drivers Impact Analysis

|

Driver |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Safety Regulation Push |

+2.2% |

Global, North America |

Short (≤2 yrs) |

|

Supply Chain Complexity |

+1.8% |

Europe, Asia Pacific |

Medium (2-4 yrs) |

|

Waste Reduction Needs |

+1.5% |

Global |

Short (≤2 yrs) |

|

Automation Trends |

+1.3% |

Asia Pacific |

Medium (2-4 yrs) |

Drivers lift the food manufacturing software market as laws demand full traces on meat to shelf. Plants log batches auto to dodge fines big. Recalls shrink with instant pulls. Chains stretch global, so software links farms to trucks smooth in the food manufacturing software market. Delays cost fresh sales quick. Waste rules hit hard, but tools eye spoilage early. Yields climb 10% in dairies smart.

Restraints Impact Analysis

|

Restraint |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

High Setup Fees |

-1.6% |

Global |

Medium (2-4 yrs) |

|

Data Breach Fears |

-1.1% |

North America, Europe |

Short (≤2 yrs) |

|

Old System Clashes |

-0.9% |

Asia Pacific |

Medium (2-4 yrs) |

Restraints curb the food manufacturing software market with fat bills for full swaps. Small bakeries balk at tags. Clouds help but train times drag. Hacks scare recipe guards in the food manufacturing software market. Plants hoard data house still. Legacy gear fights new apps, slowing shifts in old candy lines.

Opportunities Impact Analysis

|

Opportunity |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

SME Cloud Uptake |

+1.9% |

Asia Pacific, Latin America |

Short (≤2 yrs) |

|

Trace for Exports |

+1.4% |

Europe |

Medium (2-4 yrs) |

|

Green Metric Tools |

+1.1% |

North America |

Medium (2-4 yrs) |

Opportunities bloom in the food manufacturing software market for small shops on cheap clouds. Modular picks fit budgets tight. Exports need traces full, big for fruit packers. Sustainability apps log carbon low for brand wins.

Top Vendors and their Offerings

- Aptean (USA) rolls JustFood ERP for batch tracks and allergen flags in meats and dairy.

- BatchMaster Software (USA) tunes formulas auto for bakers with yield boosts quick.

- Infor (USA) links MES to lines for real-time shifts in snack plants.

- Plex Systems (USA) clouds full views from mix to pack for pet foods.

- SAP SE (Germany) scales ERP huge for global drink giants.

Food Manufacturing Software Market Segment Analysis

By Deployment Mode

Cloud-Based

Cloud-Based claims 52% share at 6.5% CAGR, surging in Asia Pacific where new plants scale fast without server buys. India snack makers grab SaaS for remote checks. Oracle NetSuite leads with mobile dashboards. Costs stay low as users grow batches. No big upfronts pull SMEs in quick. Updates roll night auto safe.

On-Premises

On-Premises holds 28% share, 5.5% CAGR in Europe for data locks tight.

By Functionality

Enterprise Resource Planning (ERP)

ERP grabs 27% share with 6.2% CAGR, hot in North America from FDA traces deep. Infor ties stock to sales seamless. Plants cut dupes 20%. SAP fits big dairies multi-site. Dashboards eye runs live sharp. AI forecasts sales dips true.

By Food Category

Meat Poultry & Seafood

Meat Poultry & Seafood nets 21% share, 6.8% CAGR in Europe under hygiene rules stiff. Aptean tracks cold chains end-to-end. Recalls drop fast with lot pins. Shelf watch stops spoilage sure.

By Enterprise Size

Large Enterprises

Large Enterprises rules 64% share, 5.8% CAGR worldwide for globals.

By End-User Department

Production Operations

Production Operations leads 31% share, 6% CAGR for line tweaks daily.

Value Chain Analysis

Coders build cores for batches first. Tests mimic plant heat and flow. Clouds host scales big. Packers add apps for phones and prints. Safety scans catch bugs pre-ship. Sellers demo to plants with pilots free. Trainers skill staff week one. Loops from users fix flaws next.

Food Manufacturing Software Market Regional Insights

North America

North America grips 37% share at 5.7% CAGR. Infor powers US baker nets vast. Plex fits Canadian snacks remote. FDA bites hard on traces full. Plants test AI first here safe. E-com booms need fast packs now. Tech hubs spark custom tweaks.

Europe

Europe bags 25% share with 6% CAGR. SAP guards German meats cold. BatchMaster aids French cheeses true. Green laws track waste low. Exports eye global stamps quick. Co-ops link farms tight digital.

Asia Pacific

Asia Pacific claims 24% share, 7% CAGR. Aptean eyes China ready meals wild. JustFood scales India pet lines cheap. Factories sprout roads new. Urban eats pull batch speeds high. Gov cash backs digital shifts big.

Latin America

Latin America lifts 7% share at 6.2% CAGR. Plex helps Brazil fruits fresh long. Local rules tighten safety slow. Trades open doors for clouds now.

Middle East & Africa

Middle East & Africa holds 7% share, 6.5% CAGR. Infor lights UAE dairy smart. Africa snacks fight spoilage far. Cash builds plants modern tough. Deserts need dry store tricks.

Food Manufacturing Software Market Top Key Players

- Aptean (USA)

- BatchMaster Software (USA)

- Infor (USA)

- Plex Systems (USA)

- SAP SE (Germany)

- Oracle (USA)

- Microsoft (USA)

- QAD (USA)

- SYSPRO (South Africa)

- Sage Group (UK)

Recent Developments

- Aptean (2025): Boosted JustFood with AI yields up 15% in dairy tests.

- BatchMaster (2025): Added cloud for small bakers, cutting costs half.

- Infor (2024): Merged MES with IoT for meat lines live.

- Plex (2025): Grabbed pet food firm for recipe tools sharp.

- SAP (2025): Rolled green track for Europe snacks full.

Food Manufacturing Software Market Trends

Food manufacturing software market grabs IoT for oven pings live. Lines halt if temps stray safe. Clouds crunch yields for bosses night. Ready meals boom needs batch swaps quick. Apps test flavors sim first cheap. Cyber nets guard recipes tight. Food manufacturing software market adds block for traces true. Green apps log water cuts for badges proud.

Food Manufacturing Software Market Segments Covered in the Report

- By Deployment Mode

- On-Premises

- Cloud-Based

- Hybrid

- By Functionality

- Enterprise Resource Planning (ERP)

- Manufacturing Execution Systems (MES)

- Quality Management Systems (QMS)

- Inventory & Warehouse Management

- Supply Chain & Logistics Management

- Recipe/Formulation Management

- Compliance & Traceability

- Production Planning & Scheduling

- Customer Relationship Management (CRM)

- Laboratory Information Management Systems (LIMS)

- By Food Category

- Beverages

- Dairy Products

- Bakery & Confectionery

- Meat, Poultry & Seafood

- Fruits & Vegetables

- Canned & Preserved Foods

- Ready-to-Eat/Ready-to-Cook Meals

- Frozen Foods

- Snack Foods

- Pet Food

- By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

- By End-User Department

- Production Operations

- R&D/Formulation

- Quality Control/Assurance

- Supply Chain & Procurement

- Sales & Distribution

- Regulatory & Compliance

- IT/Systems Management

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions:

Safety rules and waste cuts drive the food manufacturing software market for traces deep.

North America tops with tech plants ripe.

5.94% CAGR pushes 2026 to 2033 strong.

Cold chains track end-to-end recall free.

Fees high scare small shops still.