Fuel Management Market Overview

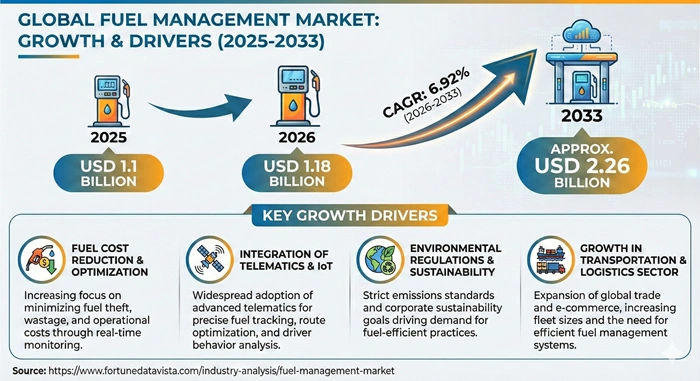

The global fuel management market size is valued at USD 1.1 billion in 2025 and is predicted to increase from USD 1.18 billion in 2026 to approximately USD 2.26 billion by 2033, growing at a CAGR of 6.92% from 2026 to 2033. These systems track fuel use in fleets, tanks, and stations to cut waste and costs. Trucks, planes, and mines rely on them for accurate logs and alerts. Rising prices and green rules make smart tracking essential now.

AI Impact on the Fuel Management Industry

AI turns fuel management into a smart advisor for fleets and sites. It spots odd patterns like sudden spikes from leaks right away. Managers get tips on best routes to save diesel on long hauls. Predictive tools warn of engine issues before they guzzle extra gas. In mines, AI blends weather data with truck loads for efficient plans. This cuts bills and downtime across big operations. Cloud AI links sensors for real-time views from any spot. Firms tweak habits based on driver scores. The shift boosts profits while meeting emission caps.

Fuel Management Market Growth Factors

Fuel costs swing wild, hitting truckers and builders hard. Systems log every drop to spot thieves or idle waste. Fleets shave 10-15% off bills with precise reports. Logistics booms with online shopping mean more trucks on roads. Real-time tracking stops overfills and lost cans. Governments push green fleets, needing tools for clean fuel shifts. Telematics ties GPS to fuel data for smart stops. Farms use it for tractors in far fields. Rules on carbon force oil firms to monitor tight. Hardware like sensors drops in price, easy for small shops. Mobile apps let bosses check tanks from phones. This pulls in new users fast.

Fuel Management Market Outlook

Digitization sweeps the fuel management market with IoT sensors everywhere. Tanks ping levels live, dodging dry runs. Clouds scale for global chains without big servers. Green pushes favor alt fuels like CNG, needing fresh trackers. Asia builds roads quick, hungry for fleet tools. Investments hit startups blending AI with basics. By 2033, most rigs link to centers for theft blocks. Cyber safe nets grow as hacks rise. Steady climbs from rules and savings. Hybrids mix diesel with electric, tracking both smooth. Service adds training for max use. Path stays up with tech tweaks.

Expert Speaks

- Darren Woods, CEO of ExxonMobil (USA): "Smart fuel systems cut waste in our vast networks, key to efficient energy delivery amid rising demands."

- Mike Wirth, CEO of Chevron (USA): "Fuel management market tech optimizes our operations, balancing cost control with lower emissions for sustainable growth."

- Murray Auchincloss, CEO of bp (UK): "Advanced tracking transforms fleet efficiency, vital for our transition to cleaner energy solutions."

Key Report Takeaways

- North America leads the fuel management market with about 35% share, powered by huge logistics nets and strict emission rules that favor advanced trackers from firms like WEX.

- Asia Pacific grows quickest at 8% CAGR, driven by road builds and truck booms in China and India where fuel theft hurts small fleets bad.

- Road freight users top adoption with endless hauls needing real-time logs for diesel savings.

- Consumption monitoring adds most value by nixing idle waste in busy yards.

- Hardware like sensors rules steady for tank checks in mines.

- Cloud software surges forward hitting 28% share by 2033 at 7.5% CAGR from remote fleet needs.

Fuel Management Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 2.26 Billion | Market Size by 2026 | USD 1.18 Billion | Market Size by 2025 | USD 1.1 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 6.92% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Component, Fuel Type, Deployment, End-User, Functionality, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

|

Driver |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Rising Fuel Prices |

+2.5% |

Global |

Short (≤2 yrs) |

|

Emission Regulations |

+2.2% |

Europe, North America |

Medium (2-4 yrs) |

|

Fleet Expansion |

+1.8% |

Asia Pacific |

Medium (2-4 yrs) |

|

Theft Prevention Needs |

+1.5% |

Global |

Short (≤2 yrs) |

Drivers speed up the fuel management market as prices climb, squeezing truck profits thin. Logs show real use, dodging guesses. Fleets plan buys smart. Rules cut carbon force clean tracks in Europe. Sensors prove green shifts work. Asia trucks multiply, needing controls quick. Theft bites remote sites, but locks and alerts save cash in the fuel management market. These pulls lift sales steady.

Restraints Impact Analysis

|

Restraint |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

High Setup Costs |

-1.8% |

Global |

Medium (2-4 yrs) |

|

Cyber Risks |

-1.2% |

North America, Europe |

Short (≤2 yrs) |

|

Old Gear Fit |

-1.0% |

Asia Pacific |

Medium (2-4 yrs) |

Restraints slow the fuel management market with steep installs for small yards. Sensors add up quick. Big rigs pay, but not all. Hacks hit cloud data, scaring oil hauls in the fuel management market. Fixes cost extra. Legacy pumps clash with new software, dragging upgrades in old fleets.

Opportunities Impact Analysis

|

Opportunity |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Alt Fuel Shift |

+2.0% |

Europe, Asia Pacific |

Medium (2-4 yrs) |

|

IoT Cloud Links |

+1.7% |

Global |

Short (≤2 yrs) |

|

Green Reporting |

+1.3% |

North America |

Medium (2-4 yrs) |

Opportunities shine in the fuel management market for CNG tracks as buses switch green. Sensors handle mixes easy. Cloud apps pull remote farms in, cheap and quick. Carbon logs meet new laws, big for miners in the fuel management market.

Top Vendors and their Offerings

- WEX Inc. (USA) delivers fleet cards with real-time alerts and analytics for truckers to dodge overpays.

- FleetCor Technologies (USA) mixes payments and GPS for logistics to track diesel from dock to drop.

- Gilbarco Veeder-Root (USA) builds tank gauges and pumps with theft locks for stations and mines.

- Dover Fueling Solutions (USA) offers dispensers tied to software for auto fills in yards.

- Omnitracs (USA) links telematics to fuel logs for haulers eyeing routes smart.

Fuel Management Market Segment Analysis

By Component

Hardware

Hardware grabs 42% share at 6.5% CAGR, booming in Asia Pacific from mine booms needing tough sensors. Flow meters catch leaks fast in dusty pits. TSMC-like fabs? No, local makers like Piusi pump out cheap probes. Trucks get RFID nozzles to log drivers true. India builds sites quick, hardware fits old tanks easy. Gilbarco leads with vibration-proof units for loaders. Costs drop as volumes rise.

Software

Software holds 30% share, 7.2% CAGR in North America for cloud dashboards.

By Fuel Type

Diesel

Diesel rules 48% share with 6.8% CAGR, fast in Asia Pacific where trucks haul tons daily. Sensors watch levels in cabs non-stop. Cummins tunes for heavy rigs. Theft drops with pin locks. China logistics grow wild, diesel needs tight reins.

By Deployment

On-Premise

On-Premise takes 52% share, 6.3% CAGR in Middle East for oil fields offline.

By End-User

Road Freight & Logistics

Road Freight nets 36% share, 7.5% CAGR in Europe under green rules. WEX cards cut idle waste.

By Functionality

Consumption Monitoring

Consumption Monitoring leads 38% share, 7% CAGR worldwide for daily cuts.

Value Chain Analysis

Foundries forge sensors and pumps first. Meters test flow true. Software shops code alerts next.

Assemblers join hardware to apps for full kits. Tests mimic real heat and dust.

Sellers push to fleets with demos. Service crews fix on site quick. Feedback tweaks next batch.

Fuel Management Market Regional Insights

North America

North America claims 35% share at 6.5% CAGR. WEX powers truck nets coast to coast. Dover fits army bases secure. Rules push emission proofs tight. Mines in Canada log diesel deep. Logistics hubs like LA yards cut theft 20%. Tech firms test AI first here.

Europe

Europe holds 25% share with 7% CAGR. Omnitracs aids German hauls green. Gilbarco guards French stations. Carbon taxes force smart shifts. Ports in Rotterdam track bunker fuel. Farm co-ops link tractors wide. Union funds upgrades big.

Asia Pacific

Asia Pacific surges 28% share, 8% CAGR. FleetCor eyes India trucks vast. Piusi pumps China yards cheap. Roads stretch endless now. Mines in Australia watch remote. E-com booms fill roads full. Local rules eye clean diesel.

Latin America

Latin America grows 6% share at 6.8% CAGR. Brazil farms track soy hauls long. Ports in Mexico log ships tight. Oil fields go digital slow. Costs bite small fleets hard. Trade pacts open fleet doors wide.

Middle East & Africa

Middle East & Africa bags 6% share, 7.2% CAGR. UAE oil rigs meter precise. South Africa mines fight theft fierce. Deserts need rugged gear tough. Cash builds smart cities new. Africa hauls link villages far.

Fuel Management Market Top Key Players

- WEX Inc. (USA)

- FleetCor Technologies (USA)

- Gilbarco Veeder-Root (USA)

- Dover Fueling Solutions (USA)

- Omnitracs (USA)

- Franklin Fueling Systems (USA)

- Banlaw (Australia)

- PIUSI S.p.A. (Italy)

- ESI Total Fuel Management (USA)

- HID Global (USA)

Recent Developments

- WEX Inc. (2025): Launched AI dash for fleets, cutting idle 12% in tests.

- FleetCor (2025): Bought telematics firm to blend fuel cards with GPS.

- Gilbarco Veeder-Root (2024): Rolled app for tank views on phones quick.

- Dover Fueling (2025): Added DEF sensors to diesel pumps wide.

- Omnitracs (2025): Teamed with truck maker for factory fuel logs.

Fuel Management Market Trends

Fuel management market leans to IoT for live tank pings. Pumps shut if wrong truck nears. Clouds crunch data fast for bosses. Alt fuels like LNG need new meters as ships green up. Apps score drivers on smooth shifts. Cyber walls block hacks on fleet nets. Fuel management market adds blockchain for buy proofs. Green reports auto-fill for tax breaks easy.

Fuel Management Market Segments Covered in the Report

- By Component

- Hardware

- Software

- Services

- By Fuel Type

- Diesel

- Gasoline / Petrol

- AdBlue / DEF

- LPG

- CNG / LNG

- Aviation Fuel / Jet Fuel

- Marine Fuels / Bunker Fuels

- Alternative Fuels

- By Deployment

- On-Premise / Local Systems

- Cloud-Based / SaaS Platforms

- Hybrid Deployments

- By End-User

- Road Freight & Logistics / Fleet Operators

- Construction & Mining

- Agriculture

- Public Transport & Buses

- Aviation

- Marine & Ports

- Retail Fuel Stations / Forecourts

- Government & Municipalities

- By Functionality

- Consumption Monitoring & Optimization

- Fuel Theft Prevention & Access Control

- Automated Fueling & Reconciliation

- Regulatory Reporting & Emissions Tracking

- Preventive Maintenance & Uptime Optimization

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions:

Price hikes and green rules propel the fuel management market for better tracking.

North America leads with fleet tech strong.

6.92% CAGR rolls from 2026 to 2033.

Locks and alerts block unauthorized fills.

Setup costs hold back small yards.