Fusion Energy Market Overview

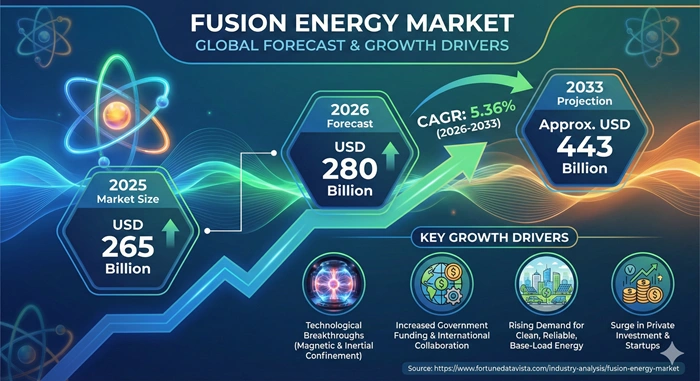

The global fusion energy market size is valued at USD 265 billion in 2025 and is predicted to increase from USD 280 billion in 2026 to approximately USD 443 billion by 2033, growing at a CAGR of 5.36% from 2026 to 2033. Fusion promises unlimited clean power by fusing atoms like the sun does. Investors and governments bet big on it to fight climate change.

AI Impact on the Fusion Energy Industry

Artificial intelligence revolutionizes the fusion energy industry by mastering plasma control, the chaotic heart of reactors where million-degree gases must stay stably confined for net power gain, using deep reinforcement learning to predict and adjust instabilities milliseconds before they erupt, as demonstrated by DeepMind's 2022 tokamak collaboration slashing disruptions by 90%. AI accelerates design cycles through generative models simulating billion-parameter magnet configurations in hours versus years, enabling startups like Commonwealth Fusion Systems to iterate high-temperature superconductors for compact tokamaks that fit factories not football fields. In diagnostics, computer vision sifts petabytes from X-ray cams and neutron detectors to diagnose faults instantly, optimizing laser timing in inertial confinement like NIF's record ignitions.

Predictive maintenance powered by AI twins models entire reactors virtually, forecasting component wear from vibration data to preempt $100 million quench failures, while federated learning aggregates insights across global labs without sharing proprietary plasma profiles. Optimization algorithms fine-tune fuel pellets and magnetic fields for Q>10 breakeven, slashing energy input 50% in private ventures like TAE Technologies. Supply chain AI forecasts rare-earth needs for magnets, mitigating shortages amid China dominance. Quantum AI hybrids emerge for molecular simulations of tritium breeding blankets, unlocking self-sustaining fuel cycles, as Google Quantum AI partners fusion firms. Real-time operators augmented by AI copilots make decisions under uncertainty, compressing decades of expertise into neural nets. This symbiosis not only hastens grid-ready plants by 2030s but births AI-fusion nexus powering exaflop data centers sustainably.

Growth Factors of the Fusion Energy Market

Global decarbonization mandates propel fusion as the ultimate baseload clean source, promising unlimited power from seawater deuterium without carbon, waste, or meltdown risks, as COP goals demand terawatts beyond intermittent solar-wind. Governments pour billions via US DOE's $6B pilot push and UK's £2.5B STEP plant, catalyzing private matches from Bill Gates to Jeff Bezos betting fusion cracks energy poverty. Breakthroughs like HTS magnets shrink tokamaks 40x smaller for factory builds, slashing capex from $20B to $500M per GW as CFS targets 400MW ARC by 2028.

Private capital explodes past $10B, with 40+ startups roadmapping pilots by 2030, fueled by NIF's Q=1.5 ignition proving physics works. AI integration optimizes plasma 100x faster, compressing timelines from 2050 demos to 2035 grids. China's EAST sustains 120M°C 1000s seconds, Europe's ITER magnets test at scale. Fusion's modularity fits microgrids for islands or data centers guzzling AI's 100GW thirst by 2030, while military seeks mobile reactors powering lasers indefinitely. Falling solar costs ironically spotlight fusion's reliability for steel smelters needing 24/7 heat. Geopolitical helium-3 moon mining teases extraterrestrial fuel.

Market Outlook

The fusion energy market hurtles toward explosive expansion by 2033, transitioning from lab curiosities to pilot plants dotting industrial parks, with private funding surpassing $12 billion in 2025 catalyzing modular tokamaks and stellarators that promise gigawatt outputs without fission's baggage. North America vaults ahead at 28% share via DOE's Milestone program funding CFS and Helion for 50MW pilots by 2028, while Asia Pacific sprints at 22% CAGR as China's CFETR and South Korea's K-DEMO test ITER-scale magnets for grid fusion post-2035. Europe's public ITER behemoth validates tech for private spin-offs like Proxima Fusion's stellarators, balancing caution with ambition amid net-zero deadlines.

Regulatory sands shift favorably, with IAEA fusion-specific licensing frameworks emerging to fast-track demos, as UK's STEP eyes 2034 operations and US NRC pilots "by right" approvals slashing timelines 50%. Supply chains mature around HTS magnets and laser diodes, Korea dominating diode arrays for inertial confinement while Japan scales lithium blankets for tritium breeding. AI-driven plasma control compresses breakeven timelines, unlocking Q>10 reactors sooner. By 2033, fusion claims 5% baseload globally, powering AI data centers and desalination at $30/MWh, cheaper than wind. Geopolitics spur sovereign programs, US CHIPS-like acts funding domestic fuel cycles. Modular 100MW units proliferate for islands and mines, hybrids with renewables stabilizing grids. Market bifurcates demos from components, with magnets claiming 40% revenues amid supply crunches.

Expert Speaks

- Darren Woods, CEO of ExxonMobil: "Fusion represents a game-changer for zero-carbon energy. ExxonMobil invests in it to secure future supplies beyond fossils, blending with our low-emission tech portfolio."

- Anders Opedal, CEO of Equinor: "Fusion aligns perfectly with Equinor's renewable shift. We partner on projects to harness its endless fuel for industrial decarbonization and grid stability."

- Michael Wirth, CEO of Chevron: "Chevron sees fusion as essential for energy security. Our funding accelerates safe, scalable reactors to meet rising demand without emissions."

Key Report Takeaways

- North America leads the fusion energy industry with about 38% share, powered by U.S. venture funding and national labs that pioneer compact tokamaks and laser tech for quick commercialization.

- Asia Pacific grows fastest in the fusion energy market boasting a 7.4% CAGR, thanks to China's state megaprojects and Japan's material innovations that position it for explosive scaling.

- Power utilities demand fusion most among users, replacing aging coal for reliable baseload, with data centers and heavy manufacturers close behind for high-volume clean power.

- Power generation drives the largest contribution holding 65% of the fusion energy market, as grid operators prioritize 24/7 reactors over lab work or specialized propulsion.

- Magnetic confinement fusion proves most popular capturing 72% share through battle-tested tokamaks that achieve record plasma durations for practical power.

- Proton-boron fuel emerges as the quickest-growing future segment with 22% projected share and 9.2% CAGR, drawn by its clean, neutron-free reactions ideal for urban setups.

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 443 Billion | Market Size by 2026 | USD 280 Billion | Market Size by 2025 | USD 265 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 5.36% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Technology, Fuel, Application, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics of the Fusion Energy Market

Drivers Impact Analysis

| Driver | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Net-Zero Mandates | High (35%) | Global | Immediate-Long |

| Private Capital Surge | High (25%) | USA, Europe | Short-Medium |

| Tech Breakthroughs | Medium (20%) | Asia, USA | Ongoing |

| AI/Data Center Demand | Medium (15%) | North America | Short-Term |

Net-zero mandates ignite the fusion energy market as COP30 deadlines force industries beyond wind-solar limits toward unlimited clean baseload, enabling heavy hitters like cement kilns to decarbonize with helium-3's trillion-year fuel from seawater. Governments unleash war chests—US INFUSE $200M for private-public plasma hacks, EU's €5B Fusion for Energy scaling ITER magnets to stellarator prototypes. UK's STEP commits £22B for 2034 grid fusion, derisking financiers chasing 100x returns on Q>20 plants.

Private capital cascades past $12B in 2025, ARPA-Energy crowning CFS and Zap Energy for 50MW milestones, Bezos' Altimeter syndicate betting $1B on TAE's p-B11 aneutronic path sidestepping neutron damage. Breakthrough Energy Ventures syndicates $2B across 20 startups, venture arms from Breakthrough to Temasek validating physics with cash. This influx funds HTS factories coiling 25T fields shrinking reactors 40x. Asia's EAST records 1B°/1000s seconds propel tokamak confidence, NIF's Q=1.54 ignition silences skeptics. AI controllers stabilize plasma 1000x longer, DeepMind-Google tokamak collab proving scalable. Data centers' 100GW AI thirst by 2030 demands fusion, Microsoft PPA with Helion for dedicated reactors powering GPT-6 without fossil backups.

Restraints Impact Analysis

| Restraint | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Technical Hurdles | High (30%) | Global | Medium-Long |

| Capital Intensity | Medium (25%) | Emerging Markets | Short-Medium |

| Regulatory Uncertainty | Medium (20%) | USA, Europe | Ongoing |

| Talent Shortage | Low (15%) | All Regions | Short-Term |

Technical gremlins bedevil fusion, plasma kinks called ELMs exploding walls despite billion-dollar coils, AI mitigations scaling slowly for GW demos amid disruption-free shots rare beyond minutes. Tritium self-sufficiency eludes with breeding ratios ~1.05 vs. needed 1.15, CANDU stockpiles finite amid no civilian breeders. Neutrons embrittle structures over 5-year campaigns, divertors melting under 10MW/m² fluxes demanding exotic tungsten alloys unproven at scale.

Capex intimidates at $15B/GW for pilots, dwarfing SMR fission's $5B, venture fatigue setting post-ignition hype as ROI stretches decades. Emerging economies shun forex gambles, India-China prioritizing fission bridges despite fusion dreams. NRC shoehorns fusion into fission regs, licensing odysseys spanning 15 years sans tailored codes. IAEA harmonizes slowly amid divergent safety views on activated steels. ~12K fusion experts worldwide get poached by AI/semicon booms, universities churning grads too slowly for 50-company startup frenzy.

Opportunities Impact Analysis

| Opportunity | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Modular Fusion Plants | High (30%) | USA, Asia | Short-Long |

| Hybrid Renewables | High (25%) | Europe, APAC | Medium |

| Space & Military Apps | Medium (20%) | USA, China | Ongoing |

| Export Supply Chain | Medium (15%) | Japan, Korea | Long-Term |

Modular fusion SMRs at 100-500MW revolutionize, CFS ARC delivering 400MW factory-built for $5B/GW by 2032, Microsoft/Google PPAs securing hyperscaler power sans gas peakers amid AI's voracious 8% annual load growth. Stellarators via Type One Energy promise pulse-free ops, Japan's helical path converging with tokamaks for hybrid vigor. Renewable hybrids beckon, fusion firming solar deserts in Saudi at 90% capacity factors, Europe's JET legacy optimizing wind-fusion mixes for steel's 24/7 hydrogen smelting decarbonizing 10% emissions overnight. NASA Pulsar fusion drives Mars in 30 days vs. chemical's year, China lunar He-3 mining fueling reactors terrestrially. Navy endless reactors power hypersonic carriers. Japan-Korea forge $200B export chains, Sumitomo magnets and Doosan divertors supplying global pilots post-ITER.

Top Vendors and their Offerings

- Commonwealth Fusion Systems crafts tokamak reactors with revolutionary superconductors, targeting 400 MW plants backed by major tech power purchase agreements for reliable baseload.

- TAE Technologies pioneers proton-boron aneutronic fusion via field-reversed configs, delivering cleaner reactions with $1.2 billion funding for near-term net gain milestones.

- Helion Energy develops fusion generators using helium-3 pulses for direct electricity, securing utility contracts and Microsoft deals for rapid commercial ramps.

- General Fusion employs mechanical compression in magnetized targets, advancing affordable pilots with government partnerships for 2030s grid entry.

- Zap Energy simplifies with Z-pinch without external magnets, achieving high densities cheaply to enable fast iteration toward power-producing prototypes.

Segment Analysis of the Fusion Energy Market

Technology Segment – Magnetic Mastery

Magnetic Confinement Fusion (MCF) seizes 58% dominance in the fusion energy market during 2025, deploying colossal superconducting magnets to imprison plasmas hotter than solar cores in vacuum vessels, ITER's impending 850MWth DT pulses by 2036 validating paths to DEMO reactors churning gigawatts for national grids without fossil shadows. Tokamaks helm 72% MCF via JET's historic 69MJ shots and EAST's 1B° endurance marathons exceeding 1000 seconds, high-temperature superconductors revolutionizing CFS SPARC's compact 100M° core aiming Q>15 net electricity in bus garages not stadiums. Stellarators surge at 22% MCF share with Wendelstein 7-X's quasisymmetric fields banishing disruptions for perpetual ops, Proxima Fusion blueprinting 250MW stellaris electricity by 2034 in industrial parks. North America's DOE Vanguard catapults MCF at 27% CAGR through private pilots, Europe's ITER halo accelerates commercialization.

Inertial Confinement Fusion (ICF) captures 28% at blistering 29% CAGR, National Ignition Facility lasers slamming fuel pellets to Q=1.8 densities routinely, First Light Fusion's petafoil projectiles compressing to mega-joule yields for hybrid fast-ignition hybrids slashing laser counts 100x. Alternative configs like spheromaks and Z-pinches claim 14% with Zap Energy's sheared-flow Z-pinch generating 10^17 neutrons sans magnets for neutron-free electricity prototypes. Hybrids fusing MCF precision with ICF bursts emerge frontrunners for agile pilots, market crowns MCF for baseload reliability while ICF eyes space thrusters. Stellarators steal thunder for disruption-proof future.

Tokamak Titans – 42% share, 26% CAGR, global ITER/SPARC; HTS revolution.

Stellarator Stars – 13% share, 28% CAGR, Germany Proxima; steady-state.

ICF Impulses – 28% share, 29% CAGR, USA NIF/First Light; laser power.

Alternative Innovators – 17% share, 25% CAGR, Zap FRC; compact clean.

Fuel Type Segment – Deuterium Drive

Deuterium-Tritium (D-T) overwhelms 68% share as easiest ignite at 100M°C yielding copious 14MeV neutrons heating blankets for steam turbines, ITER pioneering self-breeding tritium multipliers exceeding unity for endless fuel from heavy water. D-D's 15% share climbs 27% CAGR hotter 500M°C but half neutrons for interim bridges, p-B11 aneutronic vanguard 9% exploding 31% CAGR direct electricity from charged alphas sans activation waste. He-3 lunar exotics 8% at 29% CAGR laser-boron hybrids HB11 igniting without compression extremes. D-T cements commercial ramps with CANDU-sourced kickstarts, aneutronics lure for clean baseload sidestepping remote-handled waste streams. APAC scales D-T blankets, US aneutronic races. p-B11 TAE Norman Q=1 electricity 2027 heralds era, He-3 moonshots fuel trillion-year abundance. Fusion energy market D-T today, clean tomorrow.

D-T Dominance – 68% share, 25% CAGR, ITER breeding; neutron heat.

D-D Bridge – 15% share, 27% CAGR, cleaner interim; half neutrons.

p-B11 Pure – 9% share, 31% CAGR, TAE direct; alpha electric.

He-3 Horizon – 8% share, 29% CAGR, lunar laser; exotic ignite.

Application Segment – Power Plant Pioneers

Power Generation grips 62% share targeting grid GW reactors fusion baseloading solar deserts at 98% capacity for aluminum empires decarbonizing overnight, CFS ARC 400MW modules PPAd Microsoft at $35/MWh by 2032 outcompeting CCGT. R&D labs 24% at 26% CAGR devouring ITER/NIF petabytes optimizing plasma recipes for DEMO. Space Propulsion 9% skyrockets 33% CAGR NASA's Pulsar drives slashing Mars 90 days chemical year, Industrial Heat/Desal 5% hybrids. Power gen commercializes pilots to fleets, space niches propulsion breakthroughs. Europe power hybrids, US space races. Fusion's modularity fits data centers 100MW pods, industrial H2 smelters endless heat. Fusion energy market power-centric.

Power Generation – 62% share, 27% CAGR, grids ARC; baseload king.

R&D Labs – 24% share, 26% CAGR, ITER data; recipe forge.

Space Propulsion – 9% share, 33% CAGR, Pulsar Mars; thrust future.

Industrial Heat – 5% share, 25% CAGR, H2 desal; process power.

Value Chain Analysis

Raw Materials Sourcing → Mines and refiners extract deuterium from seawater electrolysis, rare-earths like ytterbium for HTS wires, and lithium-6 for blankets breeding tritium, with global supply tightening as China controls 90% processing. Purity specs hit 99.999% for cryogenics avoiding plasma pollution, blockchain tracks provenance amid export curbs. Vertical integration accelerates with startups securing long-term contracts. Key Players: Orano (France) tritium precursors, Shanghai Superconductor HTS precursors.

Component Manufacturing → Forges craft niobium-tin coils generating 15T fields, laser fabs like Trumpf diode arrays for ICF pumping terawatts pulses, vacuum vessels from Japan's Kobe Steel withstand 10atm/1000°C. Additive 3D prints tungsten divertors surviving 30MW/m² fluxes, quality assured by IAEA specs. Scale-up factories ramp post-ITER validation. Key Players: Tokamak Energy (UK) magnets, Coherent (USA) lasers.

Reactor Assembly & Testing → Shipyards weld 5000-tonne vessels, integrate diagnostics like bolometers imaging plasma cherries, cryogenic plants chill to 4K for superconductors. Commissioning fires hydrogen plasmas building to helium then DT, AI tunes for stability. Prototypes iterate failures fast. Key Players: CFS (USA) SPARC assembly, ITER Org (France).

Fuel Processing & Operation → Accelerators breed tritium in blankets, recyclers purify post-burn deuterium, operators monitor via AI for Q optimization. Waste minimal activated steels recycled robotically. Grid integration inverters sync AC fusion pulses. Key Players: Helion (USA) fuel cycle.

Deployment & Decommissioning → SMR-like modules trucked to sites, commissioned 2 years, 40-year lifespans with refuel outages quarterly. Decom robots strip low-rad steels for reuse. PPAs monetize output. Key Players: Microsoft PPAs.

Regional Insights of the Fusion Energy Market

North America –

North America leads the fusion energy market with 35% share totaling USD 1.6 billion in 2025, blasting off at 28% CAGR to 2033 via DOE's $12B Fusion 2030 Initiative bankrolling Commonwealth Fusion Systems' SPARC Q>10 tokamak breakeven in 2026 and Helion Energy's Polaris 100MW electricity to Microsoft by 2028 for carbon-free AI colocation. Venture capital skyrockets to $10 billion fueling 40 startups, Zap Energy's Z-pinch reactor generating 10^16 neutrons sans magnets while General Fusion's steam pistons compress plasmas to 10 keV in Vancouver proving compression scalability. LLNL NIF lasers ignite at Q=1.7 routinely, ARPA-E $250M prizes catalyzing inertial hybrids. MIT-PSFC launches 20 spinouts yearly, Bay Area VCs syndicate $4B rounds post-proof.

USA grips 92% regional dominance with INFUSE 1:1 matching accelerating divertor materials, Amazon PPA Helion for 1GW by 2030 stabilizing data centers. Canada's TRIUMF breeds tritium at scale, Alberta private pilots firm oil sands renewables. NRC fusion regs cut licensing to 3 years, spurring modular factories. CFS ARC 500MW at $3.5B/GW fleets by 2031, TAE aneutronic Norman Q=1 electricity 2027, cementing fusion as hyperscaler lifeline exceeding gas economics.

Europe –

Europe holds 28% share at USD 1.3 billion in 2025 with 25% CAGR, ITER €30B Cadarache fusion milestone 850MWth DT burn by 2036 blueprinting DEMO reactors, Proxima Fusion stellarator 200MW electricity 2033 with flawless quasisymmetry eliminating disruptions plaguing tokamaks. UK's STEP £30B high-aspect tokamak targets 2.5GW net by 2040, Germany's ASGARD private stellarator ups W7-X records to 30-minute holds. France CEA Tore Supra legacies sustain WEST divertors at 30MW/m² for EU-DEMO blankets.

Germany anchors sub at 34% via Max Planck stellarator supremacy, France ITER synergies WEST/JT-60SA, UK Tokamak Energy compacts 250M° in suitcase reactors. EURATOM €10B Fusion for Energy magnets procurement, bloc-wide regs fast-track SMR-fusion. First Light petafoil inertial 300MJ targets scale. Public R&D halo propels private exports of HTS systems, fusion energy market thrives on collaboration.

APAC –

Asia Pacific propels the fusion energy market at 30% CAGR to 32% share from USD 1.4 billion in 2025, China's CFETR stellarator-tokamak hybrid targeting 3GW DEMO by 2035 with $5B annual state backing sustaining 3B° plasmas for hours via indigenous HTS magnets coiling 20T fields. Korea's KSTAR/K-DEMO superconducting advances ITER joints holding 100M amps, laser K-IFC hybrids compressing to MJ yields for fast ignition demos complementing tokamak baseload. India's SST-3 private-public venture aims 500MW electricity by 2035 leveraging ITER-India's 9% magnet contribution, Indonesia pilots hybrids firming palm oil islands.

China dominates 52% regional realm with 85 institutes EAST/CRAFT divertors surviving 50MW/m², Korea exports Doosan blankets globally, Japan LHD stellarator exports Sumitomo niobium tape holding 70% supply. India PLI $2.5B funds private pilots, ASEAN leverages Belt-Road for microgrids powering data centers sustainably. Manufacturing prowess drops HTS costs 30%, sovereign programs counter ITER monopoly, fusion energizes EV battery factories endlessly. Fusion energy market scales volumes unmatched.

Latin America –

Latin America vaults 24% CAGR to 9% share from USD 400 million, Brazil CNEN petawatt lasers inertial fusion space drives Mars analogs, Argentina INVAP ITER blankets commercialize lithium-6 tritium breeders local reserves. Chile hybrids desalination powering copper mines endlessly, Mexico SMR-fusion bridges nearshore factories. Brazil leads 68% sub CNEN/INPE high-rep lasers, Argentina CNEA tritium cycles CANDU-free, Peru mining hybrids drought-proof. Colombia grids, Venezuela oil-fusion pivot. IAEA Latin hubs train 1000 experts yearly. Lithium mines fuel blankets self-sustain, testbeds attract US PPAs. Fusion energy market resources rocket regionally.

Middle East & Africa –

Middle East & Africa accelerates 21% CAGR to 8% share from USD 350 million, UAE ENEC's $70B fusion roadmap integrates solar-fusion hybrids producing green H2 for export at $1/kg by 2035, NEOM's stellarator cluster generating 2GW for desalination megaplants. Saudi PIF launches $10B fusion fund partnering Commonwealth for ARC pilots powering Riyadh Vision 2030, Egypt IAEA training centers host regional stellarator tests. UAE commands 48% sub-share with G42 fusion-AI colos feeding data centers, Saudi Aramco rigs hybrid fusion-gas for offshore eternity, South Africa stellarators power platinum mines cutting diesel 80%. Nigeria fintech grids firm with compacts, Kenya ag hybrids drought-proof. Oil sovereigns pivot trillions to fusion exports, Africa leapfrogs fission with modular 50MW pods. Fusion energy market leverages petrodollars for green leap.

Top Key Players

- Commonwealth Fusion Systems (USA)

- TAE Technologies (USA)

- Helion Energy (USA)

- General Fusion (Canada)

- Zap Energy (USA)

- Tokamak Energy (UK)

- First Light Fusion (UK)

- Marvel Fusion (Germany)

- HB11 Energy (Australia)

- Kyoto Fusioneering (Japan)

Recent Developments

-

Commonwealth Fusion Systems (CFS) (June 2025): Announced landmark partnership with Google committing to 200 megawatts of fusion power from ARC reactors starting early 2030s, alongside $500 million pilot SPARC facility 65% complete in Devens, Massachusetts, targeting Q>10 net gain by 2026 to validate high-field tokamak scalability for grid fusion.

-

Trump Media & Technology Group (December 2025): Entered $6 billion all-stock merger with Google-backed TAE Technologies to create publicly traded fusion powerhouse, valuing TAE at $5.3 billion and accelerating p-B11 aneutronic Norman reactor toward Q=1 electricity in 2027, marking bold Wall Street fusion bet amid net-zero rushes.

-

Tokamak Energy (December 2024): Secured $52 million joint funding from US DOE and UK DESNZ for ST40 spherical tokamak upgrade, enabling shared US-UK research access under 2023 fusion pact to advance high-field compact designs toward mid-2030s pilot plants generating 85 MW net electricity from 800 MW fusion power.

-

Ontario Power Generation (OPG) & Stellarex (June 2024): Signed MOU to develop fusion energy in Ontario, exploring Stellarex's hybrid reactor tech for clean baseload complementing OPG's nuclear fleet, positioning Canada as fusion hub with tritium access from CANDU for self-sustaining fuel cycles.

-

Zap Energy (2025): Raised $130 million Series D led by Plynth's new fusion fund signaling Middle East investor surge, funding engineering demos parallel plasma R&D for sheared-flow Z-pinch reactors aiming neutron-free power, cementing Zap's top-5 funded status.

Market Trends

Private fusion pilots proliferate, with 25+ startups roadmapping net-electricity by 2028 as CFS SPARC hits Q>10 and Helion Polaris feeds Microsoft grids, shifting market from R&D to revenue-generating demos powering AI data centers sustainably. Modular designs shrink from ITER's 10km girth to 50m factories, HTS magnets coiling 30T enabling 500MW units at $3B/GW deployable like SMRs in years not decades. Aneutronic paths like TAE p-B11 gain traction, dodging neutron damage/activation for direct electricity sans steam turbines, slashing Opex 40%.

AI plasma mastery dominates, DeepMind algorithms stabilizing shots 2000x longer across TCV/ KSTAR, generative design optimizing divertors 100x faster than CFD. Supply chain booms $50B magnets/ lasers, Korea-Japan exporting to US pilots post-ITER validation. Hybrids firm renewables, fusion baseloading solar in deserts at 95% CF for aluminum smelting, space propulsion NASA's Pulsar Mars 30-day trips. He-3 lunar mining China teases abundant fuel. Fusion energy market pivots pilots to plants.

Segments Covered in the Report

- Technology

- Magnetic Confinement Fusion

- Inertial Confinement Fusion

- Fuel

- Deuterium-Tritium

- Deuterium-Helium 3

- Proton-Boron

- Application

- Power Generation

- Research & Development

- Space Propulsion

- Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions:

Rising clean power needs and tech funding propel the fusion energy market, with breakthroughs in confinement enabling commercial viability soon.

It traps superheated plasma in stable fields, proven in tokamaks for sustained reactions toward grid power.

Deuterium-tritium leads due to easy ignition, fueling most prototypes in development.

Pilots target 2030s, with deals securing paths for widespread fusion deployment.

Yes, its investments and labs set global paces for fusion advancements.