High Purity Citric Acid Market Overview

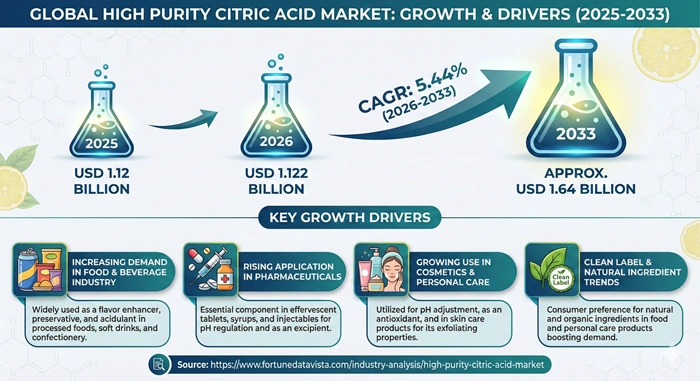

The global high purity citric acid market size is valued at USD 1.12 billion in 2025 and is predicted to increase from USD 1.122 billion in 2026 to approximately USD 1.64 billion by 2033, growing at a CAGR of 5.44% from 2026 to 2033. This essential ingredient powers foods, drugs, and cosmetics with its clean sour kick and safe profile. Makers refine it through fermentation for top-notch purity over 99%. Demand rises as brands chase natural additives free from junk.

AI Impact on the High Purity Citric Acid Industry

AI shakes up the high purity citric acid industry by fine-tuning fermentation vats. Smart systems watch pH, temp, and yeast action live, hitting peak yields without waste. This cuts energy use and boosts batch consistency. Factories now predict mold growth or sugar dips using data patterns. Machine learning tweaks recipes on the fly, slashing off-spec runs by 25%. Labs test virtual mixes first, speeding new grades to market. Supply chains get smarter too. AI forecasts raw sugar needs from crop data, dodging shortages. Quality checks via image scans spot impurities fast, ensuring pharma-ready batches roll out smooth.

High Purity Citric Acid Market Growth Factors

Food and drink firms lean hard on high purity citric acid for zing and shelf life. Clean labels draw shoppers who skip fake stuff. Rules from FDA back its safe use in sodas, jams, and yogurts. Pharma needs it steady for pills and syrups as pH balancers. Aging pops boost med demand, pulling more volume. Makers ramp plants to match. Cosmetics love its gentle peel power in creams and shampoos. Green beauty trends favor bio-based sources like molasses ferments. Asia's boom in skincare adds fuel. Sustainability pushes growth as firms swap chemicals for fermented citric acid. Lower carbon footprints win grants and buyer nods.

Market Outlook

High purity citric acid market eyes steady climbs with food giants locking long deals. Processed eats surge in emerging spots, needing preservatives that taste real. Europe holds firm on rules, Asia races ahead. Plants upgrade for biotech grades as labs multiply. Nutraceuticals grab share with vitamin boosts. Expect tighter supply nets by 2030. Personal care shifts natural, citric acid fits perfect as exfoliant. Industrial cleaners eye it for eco swaps from harsh acids. Overall vibe stays positive. Clean trends lock in demand across boards. Watch for bio-ferment leaps cutting costs further.

Expert Speaks

- James Quincey, CEO of The Coca-Cola Company: "High purity citric acid remains core to our natural flavor profiles, meeting consumer calls for transparent, clean ingredients in beverages worldwide."

- Ramon Laguarta, CEO of PepsiCo: "We prioritize ultra-pure citric acid in our portfolio to ensure safety and taste, aligning with rising clean-label demands across snacks and drinks."

- Alberto Baldivieso, CEO of Archer Daniels Midland (ADM): "Sustainable fermentation for high purity citric acid drives our growth, supplying food and pharma with reliable, nature-derived solutions."

Key Report Takeaways

- Europe leads the high purity citric acid market with strict rules and big plants.

- Asia Pacific grows fastest at over 6% CAGR from food and pharma booms.

- Food makers use it most for taste and preserve jobs.

- Food & beverages contribute the most, holding 42% share.

- Anhydrous form proves most popular for stable shelf life.

- Laboratory grade will grow quickly at 5.8% CAGR, grabbing 25% share by 2033.

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 1.64 Billion | Market Size by 2026 | USD 1.122 Billion | Market Size by 2025 | USD 1.12 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 5.44% | Dominating Region | Europe | Fastest Growing Region | Asia Pacific | Segments Covered | Form, Purity Grade, Application | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

|

Driver |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Food Demand Surge |

High (35%) |

Global |

Short-Term |

|

Pharma Rules |

High (28%) |

Europe, North America |

Medium-Term |

|

Clean Beauty |

Medium (20%) |

Asia Pacific |

Long-Term |

Food giants drive the high purity citric acid market with massive orders for drinks and snacks. It adds tart pop while blocking spoilage natural. FDA nods keep it top pick over synthetics. Pharma firms bulk up on pharma-grade for stable meds. Effervescent tabs and syrups need exact pH holds. High purity citric acid market swells as drug plants expand global. Consumer green shifts amp drivers. Shoppers hunt no-junk labels, pulling brands to fermented pure stuff. Cost drops from scale help too.

Restraints Impact Analysis

|

Restraint |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Raw Price Swings |

High (25%) |

Global |

Short-Term |

|

Alt Acids |

Medium (20%) |

Asia Pacific |

Medium-Term |

|

Reg Hurdles |

Medium (15%) |

Europe |

Long-Term |

Sugar and molasses jumps hit high purity citric acid market hard. Crop fails or fuel hikes pass to buyers, slowing buys. Molds need steady feeds too. Cheaper lactic or malic acids tempt budget lines. They mimic sour but skip ferment costs. High purity citric acid market fights back on purity perks. Tough purity tests and eco rules add tabs. Audits and certs like USP eat time. Small makers struggle most.

Opportunities Impact Analysis

|

Opportunity |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Nutra Boom |

High (30%) |

North America |

Short-Term |

|

Bio Ferments |

High (25%) |

Europe, Asia |

Medium-Term |

|

Green Cleaners |

Medium (20%) |

Global |

Long-Term |

Nutraceuticals open big doors in high purity citric acid market. It mixes vitamins stable, hits health trends. Gummies and powders fly off shelves. New yeast strains lift yields green. Waste drops, costs fall in high purity citric acid market. Grants fund pilots. Household cleaners swap bleaches for citric chelate. Eco lines grow fast, pulling industrial grades.

Top Vendors and their Offerings

- Jungbunzlauer Suisse AG: Pharma and food grades from sustainable ferments.

- Cargill Inc.: Anhydrous pure for beverages and cleansers.

- Tate & Lyle PLC: High-lab grades with custom purity certs.

- ADM: Bulk pharma acid from corn-based processes.

- Citrique Belge NV: Monohydrate for cosmetics and meds.

High Purity Citric Acid Market Segment Analysis

By Form

Anhydrous Citric Acid

Anhydrous citric acid leads with no water weight for easy ship and long hold. Crystals dissolve clean in dry blends like powders. Food firms love it for stable jams and drinks. Europe's Jungbunzlauer (Switzerland) pumps top anhydrous from mold ferments. Asia's RZBC (China) scales huge for exports. High purity citric acid market sees it grab 57% slice. Powder form fits capsules perfect too. Growth ties to shelf-stable trends at 5.2% clip.

Liquid Citric Acid

Liquid citric acid mixes instant for ready drinks and lotions. No lumps, flows even in big tanks. Pharma picks it for syrup pours. North America's Cargill (USA) blends liquid pure for soda giants. Europe's Tate & Lyle (UK) tunes for shampoos. Fastest in high purity citric acid market at 5.9% CAGR. Handles high-speed lines best. Volume booms with bev surges.

By Purity Grade

≥99.5% Pharmaceutical Grade

Pharma grade rules with ultra-clean for injects and tabs. Buffers drugs exact, no side junk. Rules demand it strict. USA's ADM leads pharma supply. Europe's Citrique Belge (Belgium) certs USP heavy. High purity citric acid market pharma hits 62% hold. Stability wins in long shelf meds. Steady demand from aging care.

≥99.8% Laboratory/Reagent Grade

Lab grade blasts pure for tests and biotech brews. Cells grow best at true pH. Research labs stock it steady. Germany's Merck sets lab standards. Japan's suppliers eye R&D hubs. Tops growth at 5.8% in high purity citric acid market. Bio firm rise pulls it up fast.

By Application

Pharmaceuticals

Pharma tops use for fizz tabs and syrup pH. Solves actives smooth. Global med boom feeds it. Swiss Jungbunzlauer feeds big pharma. China's COFCO scales for exports. High purity citric acid market pharma at 39% share. New drugs need fresh batches often.

Food & Beverages

Food & bev dominate with sour lift in colas and yogurt. Preserves natural sans chem taste. Clean labels seal deals. USA Cargill juices lines. India's players hit local sweets. Leads high purity citric acid market volume wise. Proc essed eats keep climbing.

Value Chain Analysis

Farms kick off with sugar beets or cane for molasses feed. Molds like Aspergillus chew it to crude acid in tanks. Purity starts here with strain picks. Refine steps filter, crystallize, dry to hit 99+ pure. Ion swaps yank impurities. Pharma lines add sterile packs.

Distros haul bulk to blenders. Food giants tweak for taste, pharma for dose exact. End users mix final. Whole chain eyes green with waste reuse. Bio firms cut steps smart.

Regional Insights

North America

North America takes 28% share at 5.1% CAGR. Pharma rules pull pure grades heavy. Food giants lock supplies. USA's Cargill and ADM run mega ferments. Canada tests bio variants. High purity citric acid market thrives on clean eats push. Rules favor certified imports too.

Europe

Europe commands 33% at 5.6% CAGR. Strict EFSA nods boost trust. Green ferments lead world. Switzerland's Jungbunzlauer exports wide. Belgium's Citrique shines pharma. Tops high purity citric acid market on regs. Cosmetics hub adds steady pull.

Asia Pacific

Asia Pacific surges 6.1% CAGR, 25% share. Bev boom and pharma rise feed growth. Cheap sugar aids. China's RZBC masses anhydrous. India's TTCA grows fast. High purity citric acid market export king here. Urban snacks drive volume.

Latin America

Latin America at 4.8% CAGR, 7% share. Fruit wastes feed local ferments. Bev firms ramp. Brazil's players eye exports. Mexico blends for US. Emerging high purity citric acid market player. Policy greens open doors.

Middle East & Africa

Middle East & Africa grows 4.9% CAGR, 7% share. Import hubs turn local. Food process up. UAE stocks pharma grade. South Africa ferments start. High purity citric acid market potential high. Tourist eats boost needs.

Top Key Players

- Jungbunzlauer Suisse AG (Switzerland)

- Cargill Inc. (USA)

- Tate & Lyle PLC (UK)

- Archer Daniels Midland (ADM) (USA)

- Citrique Belge NV (Belgium)

- TTCA Co. Ltd. (China)

- RZBC Group Co. Ltd. (China)

- COFCO Biochemical (China)

- Gadot Biochemical Industries (Israel)

- Weifang Ensign Industry (China)

- Laiwu Taihe Biochemistry (China)

- Huangshi Xinghua Biochemical (China)

Recent Developments

- Jungbunzlauer Suisse AG (Switzerland): Teamed Vienna uni in 2024 for advanced mold strains boosting yields.

- Cargill Inc. (USA): Expanded organic acid plant 2025 for clean label surge.

- Tate & Lyle PLC (UK): Acquired bio-ferment tech firm 2024 to hit pharma pure.

- ADM (USA): Partnered French organics 2025, upped bio citric sales 20%.

- Citrique Belge NV (Belgium): Extended Brenntag deal Jan 2025 for global excipient push.

Market Trends

Anhydrous rules dry mixes as packs shrink carbon. Powders ship light, store forever. Bev shifts liquid smart. Lab grades spike with bio labs multiply. Gene work needs dead-pure buffers. R&D bucks flow heavy. Nutra gummies boom citric fizz. Health shots pull pure dissolves. Functional eats trend up. Green chains cut waste with loop ferments. Molasses scraps feed next batch. Certs like RSPO win buyers.

Segments Covered in the Report

- Form Outlook

- Anhydrous Citric Acid

- Monohydrate Citric Acid

- Liquid Citric Acid

- Purity Grade Outlook

- ≥99.5% Pharmaceutical Grade

- ≥99.8% Laboratory/Reagent Grade

- Application Outlook

- Pharmaceuticals

- Food & Beverages

- Cosmetics & Personal Care

Frequently Asked Questions:

The high purity citric acid market hits USD 1.64 billion by 2033 on steady demand climbs.

Anhydrous leads for dry stability in foods and meds.

Europe rules with regs and production muscle.

Pharma and food & bev pull most volume.

5.44% CAGR marks solid path through 2033.