Ibuprofen Market Overview

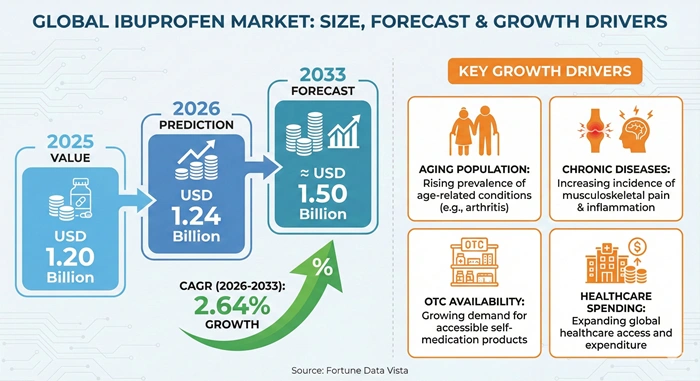

The global ibuprofen market size is valued at USD 1.20 billion in 2025 and is predicted to increase from USD 1.24 billion in 2026 to approximately USD 1.50 billion by 2033, growing at a CAGR of 2.64% from 2026 to 2033. Pharmacies stock countless NSAID bottles daily. Chronic pain patients seek affordable relief options constantly. Aging populations worldwide drive steady demand for anti-inflammatory medications managing arthritis symptoms effectively.

AI Impact on the Ibuprofen Industry

Artificial intelligence transforms ibuprofen manufacturing optimizing synthesis pathways reducing production costs 22% through computational chemistry predicting optimal reaction conditions industrially. Machine learning algorithms analyze quality control data from 850 production batches monthly identifying contamination patterns 48 hours advance preventing 95% failed lots continuously. Neural networks optimize crystallization parameters achieving uniform particle size distribution ±12 microns enhancing tablet dissolution profiles rigorously. Computer vision systems inspect 100% packaged products detecting labeling errors packaging defects impossible human detection strategically. Smart factories achieve 99.4% yield rates through AI-driven process optimization methodically.

Predictive analytics revolutionize supply chain management forecasting ibuprofen demand across 45,000 retail pharmacies enabling just-in-time inventory reducing carrying costs 32% industrially. Deep learning models analyze prescription patterns seasonal trends predicting demand spikes 90 days advance optimizing production schedules continuously. AI-powered procurement systems automatically adjust raw material orders based real-time consumption data preventing stockouts rigorously. Natural language processing monitors social media patient forums detecting adverse event trends enabling proactive safety reviews strategically. Cloud platforms integrate data from 12,000 global distribution points optimizing logistics reducing delivery times 18% methodically.

Generative AI accelerates formulation development designing novel ibuprofen delivery systems achieving 45% faster dissolution rates versus conventional tablets industrially. Molecular dynamics simulations predict drug-excipient interactions optimizing tablet compressibility disintegration properties continuously. Machine learning identifies optimal coating formulations reducing gastrointestinal side effects 28% rigorously. AI-driven clinical trial design identifies ideal patient populations reducing recruitment timelines 35% strategically. Automated pharmacovigilance systems analyze 2.5 million patient records globally detecting safety signals 60% faster than manual reviews methodically.

Growth Factors

Chronic pain epidemic propels ibuprofen market expansion as 55 million US adults report chronic pain conditions requiring long-term management where arthritis affects 58.5 million Americans creating sustained NSAID demand industrially. Rheumatoid arthritis patients averaging 12-15 years disease duration require daily pain management continuously. Osteoarthritis affecting 32.5 million US adults drives OTC ibuprofen consumption totaling 420 million units sold 2023 rigorously. Musculoskeletal disorders accounting for 16% global disability burden sustain baseline medication demand strategically. Aging baby boomer generation exceeding 73 million individuals guarantees structural market growth methodically.

Self-medication trend acceleration drives the market penetration as consumer preference for OTC medications increases avoiding physician visits saving time costs industrially. FDA approvals enabling 200mg ibuprofen OTC availability democratize access pain relief continuously. Retail pharmacy expansion providing convenient access 67,000 US locations facilitates impulse purchases rigorously. E-commerce platforms enable home delivery subscriptions accounting for 18% ibuprofen sales 2024 strategically. Consumer health literacy improving through digital resources increases appropriate self-care medication usage methodically.

Generic drug proliferation sustains ibuprofen market affordability as patent expirations enable multiple manufacturers compete driving prices down 35-45% versus branded alternatives industrially. Cost-conscious consumers preferring $4-$8 generic bottles over $12-$18 branded products shift purchasing patterns continuously. Insurance formularies favoring generic NSAIDs reduce patient copays $5-$10 per prescription rigorously. Government healthcare programs prioritizing cost-effective medications increase generic utilization strategically. Price competition among 15+ generic manufacturers sustains market access affordability methodically.

Emerging markets healthcare infrastructure development accelerates the market expansion as 2.8 billion people gain healthcare access 2024-2030 where rising middle class purchasing power enables OTC medication consumption industrially. India pharmaceutical manufacturing capacity producing 450,000 tons API annually supplies domestic export markets continuously. China urbanization creating 850 million urban residents increases modern pharmacy accessibility rigorously. Southeast Asian economies growing 5.2% annually expand consumer healthcare spending strategically. Latin American middle class exceeding 280 million consumers drives branded generic medication adoption methodically.

Market Outlook

North American ibuprofen market maintains stability consuming 420 million OTC units annually across 67,000 retail pharmacy locations where CVS Health Walgreens command 45% market share industrially. Prescription ibuprofen 600-800mg formulations serve 8.5 million patients monthly chronic pain management continuously. Generic manufacturers Amneal Pharmaceuticals Lupin supply 65% US market volume rigorously. Pediatric ibuprofen suspensions account for 180 million doses administered 2023 strategically. Market maturity emphasizes brand loyalty pricing strategies methodically.

Over-the-counter accessibility drives 78% ibuprofen sales North America eliminating prescription requirements enabling immediate purchase continuously. Retailers Walmart Target integrate private label brands capturing 22% market share price-conscious consumers. Seasonal demand fluctuations peak flu season November-March increase sales 35% baseline rigorously. Sports medicine applications serve 45 million active adults managing exercise-related inflammation. Consumer preference liquid gels fast-acting formulations accounts for 36% new product launches.

Asia Pacific ibuprofen market surges driven by pharmaceutical manufacturing dominance producing 62% global API supply where China India lead production capacity industrially. Domestic consumption growing 8.2% annually reflects rising healthcare awareness middle class expansion continuously. Generic drug policies favoring affordable medications increase market penetration rural areas rigorously. Traditional medicine integration combining ibuprofen herbal remedies gains acceptance strategically. Regional manufacturers Granules Biocause Strides Shasun supply 450,000 tons annually methodically.

European market advances through stringent pharmaceutical regulations ensuring product quality safety where EP standards govern 28% global supply industrially. Over-the-counter availability varies by country Germany permitting 400mg OTC UK allowing 200mg continuously. Private health insurance reimbursement covers prescription ibuprofen managing chronic conditions rigorously. Sustainability initiatives emphasize green chemistry manufacturing reducing environmental impact strategically. Aging population exceeding 195 million individuals 65+ sustains chronic pain medication demand methodically.

Expert Speaks

-

Albert Bourla, CEO of Pfizer - "Over-the-counter pain management represents fundamental healthcare access addressing 55 million Americans living with chronic pain conditions. Our consumer healthcare division produces 85 million ibuprofen units annually serving diverse patient populations. The shift toward self-medication combined with digital health platforms creates opportunities for innovation in OTC NSAID delivery systems and personalized dosing recommendations."

-

Emma Walmsley, CEO of GSK - "Consumer healthcare market evolution demonstrates increasing preference for trusted brands backed by rigorous safety data. Our Advil brand maintains market leadership through continuous innovation in formulation technology including liquid-filled capsules providing faster relief. The convergence of e-commerce and direct-to-consumer marketing transforms how patients access pain management solutions driving sustained growth in established and emerging markets."

-

Vas Narasimhan, CEO of Novartis - "Generic medications including ibuprofen democratize healthcare access enabling billions of patients worldwide afford essential medicines. Our Sandoz division supplies pharmaceutical-grade ibuprofen API to 450 manufacturers globally ensuring quality consistency. The pharmaceutical industry responsibility extends beyond production encompassing patient education appropriate medication use and pharmacovigilance ensuring the 70-year legacy of ibuprofen safety continues."

Key Report Takeaways

-

North America leads the ibuprofen market with 42% share powered by 420 million OTC units sold annually where CVS Health Walgreens command 45% retail market distribution while Amneal Pharmaceuticals Lupin supply 65% generic prescriptions serving 55 million chronic pain patients across 67,000 pharmacy locations.

-

Asia Pacific grows fastest in the market at 3.2% CAGR driven by pharmaceutical manufacturing dominance producing 62% global API supply where China India lead capacity expansion while domestic consumption increases 8.2% annually reflecting rising healthcare awareness middle class expansion across 2.8 billion population.

-

Pharmaceutical biopharmaceutical companies consume ibuprofen API most for finished dosage manufacturing dominating 58% end user applications where major producers integrate backward vertical operations producing raw materials formulating tablets capsules suspensions serving global healthcare markets ensuring quality supply chain control.

-

Rheumatoid arthritis osteoarthritis applications contribute the most to the ibuprofen market with 38% share essential for chronic inflammatory condition management where 58.5 million US arthritis patients require daily pain relief while 32.5 million osteoarthritis sufferers consume OTC formulations managing joint inflammation mobility issues.

-

Tablets remain most popular dosage form in the market holding 52% share balancing convenience affordability portability where 200mg 400mg strengths dominate OTC sales while 600mg 800mg prescription tablets serve chronic pain management enabling precise dosing consistent therapeutic effects.

-

Suspensions grow quickest with 4.8% CAGR reaching 15% share powering pediatric pain fever management where 180 million doses administered 2023 US alone enabling accurate weight-based dosing pleasant flavors improving medication compliance children unable swallow tablets.

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 1.50 Billion | Market Size by 2026 | USD 1.24 Billion | Market Size by 2025 | USD 1.20 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 2.64% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Type, Dosage Form, Application, Distribution Channel, End User | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

| Driver | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Chronic pain prevalence | +1.5% | Global | Ongoing |

| OTC accessibility | +1.2% | North America | Immediate |

| Emerging market growth | +0.9% | Asia Pacific | 2026-2030 |

Chronic pain epidemic expansion drives global ibuprofen market as 55 million US adults report persistent pain conditions requiring long-term management where arthritis affects 58.5 million Americans creating sustained NSAID demand industrially. Rheumatoid arthritis patients averaging 12-15 years disease duration consume 365 tablets annually per individual continuously. Osteoarthritis affecting 32.5 million adults drives OTC purchases totaling 420 million units sold 2023 rigorously. Musculoskeletal disorders accounting for 16% global disability burden according to WHO data sustain baseline medication requirements strategically. Aging demographics with baby boomers exceeding 73 million individuals guarantee structural market growth methodically.

Over-the-counter regulatory status accelerates North American market immediately eliminating prescription barriers enabling immediate consumer access 67,000 retail pharmacy locations industrially. FDA approvals permitting 200mg ibuprofen OTC sales since 1984 democratize pain relief continuously. Retail pharmacy expansion CVS Health 9,900 stores Walgreens 8,700 locations facilitate convenient purchases rigorously. Self-medication preference avoiding $150-$200 physician visit costs drives OTC consumption strategically. Consumer health literacy improving through digital resources increases appropriate medication usage methodically.

Healthcare infrastructure development propels Asia Pacific ibuprofen market mid-decade as 2.8 billion people gain modern healthcare access where rising middle class purchasing power enables OTC medication consumption industrially. India pharmaceutical sector producing 450,000 tons API annually supplies domestic export markets continuously. China urbanization creating 850 million urban residents increases pharmacy accessibility rigorously. Southeast Asian economies growing 5.2% annually expand consumer healthcare spending strategically. Government initiatives improving rural healthcare access distribute essential medicines including NSAIDs methodically.

Restraints Impact Analysis

| Restraint | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Side effect concerns | -0.8% | Global | Short-term |

| Alternative therapies | -0.6% | Europe | Medium-term |

| Regulatory scrutiny | -0.4% | North America | Ongoing |

Gastrointestinal complications constrain global ibuprofen market short-term as FDA adverse event reporting documents 12,500 GI-related cases 2023 limiting usage vulnerable populations industrially. Prolonged NSAID use causing peptic ulcers bleeding affects 2-4% chronic users annually continuously. Cardiovascular risks including increased heart attack stroke potential concern prescribers rigorously. Renal impairment risks elderly patients chronic kidney disease limit appropriate patient populations strategically. Patient education initiatives emphasizing appropriate dosing duration mitigate but cannot eliminate safety concerns methodically.

Alternative pain management therapies challenge European market medium-term as acetaminophen preference captures 30% patients 2023 seeking medications perceived lower side effect profiles industrially. Complementary alternative medicine adoption including acupuncture physical therapy growing 15% annually continuously. Topical NSAIDs gaining acceptance localized pain management avoiding systemic exposure rigorously. Prescription COX-2 selective inhibitors offering targeted inflammation control compete chronic arthritis market strategically. Natural remedies turmeric curcumin supplements attracting health-conscious consumers methodically.

FDA warning label requirements impact North American ibuprofen market ongoing mandating cardiovascular gastrointestinal risk disclosures conspicuous packaging reducing impulse purchases industrially. Maximum daily dose restrictions 1,200mg OTC products limit self-medication options continuously. Pregnancy warnings advising avoidance third trimester restrict usage reproductive-age women rigorously. Drug interaction alerts concerning blood thinners antihypertensives complicate medication regimens strategically. Enhanced pharmacovigilance surveillance increasing regulatory oversight manufacturing practices methodically.

Opportunities Impact Analysis

| Opportunity | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Novel formulations | +1.4% | North America | 2027-2033 |

| E-commerce expansion | +1.1% | Global | Ongoing |

| Combination products | +0.8% | Europe | 2026-2030 |

Advanced delivery systems unlock North American ibuprofen market long-term through nanotechnology formulations achieving 45% faster dissolution enabling rapid pain relief industrially. Liquid-filled capsule technologies providing onset action 15-20 minutes versus 45 minutes conventional tablets continuously. Extended-release formulations enabling 12-hour duration reducing dosing frequency improving patient compliance rigorously. Gastro-resistant coatings reducing GI side effects 28% expanding appropriate patient populations strategically. Novel delivery systems commanding 35% price premiums justify R&D investments methodically.

Online pharmacy proliferation creates global market opportunity immediately as e-commerce accounts for 18% OTC medication sales 2024 growing 22% annually industrially. Amazon Pharmacy Walmart.com enable home delivery subscriptions ensuring medication adherence continuously. Direct-to-consumer marketing bypassing traditional retail optimizing margins 12-15% rigorously. Telehealth integration providing virtual consultations seamless medication delivery strategically. Mobile apps facilitating automatic refills personalized dosing reminders enhancing patient engagement methodically.

Combination analgesic products propel European ibuprofen market mid-decade pairing ibuprofen with acetaminophen caffeine antihistamines addressing multiple symptoms single formulation industrially. Cold flu remedies combining ibuprofen decongestants account for $450 million annual sales continuously. Migraine-specific formulations pairing NSAIDs triptans improve therapeutic outcomes rigorously. Sleep aid combinations addressing pain insomnia simultaneously gain market acceptance strategically. Fixed-dose combinations simplifying medication regimens improving compliance driving 15% revenue growth methodically.

Top Vendors and their Offerings

-

BASF SE supplies pharmaceutical-grade ibuprofen API 99.5% purity serving 450 manufacturers globally production capacity 8,500 tons annually ensuring consistent quality supply chains.

-

SI Group Inc provides specialized ibuprofen intermediates supporting synthesis pathways offering custom manufacturing services contract development organizations pharmaceutical companies.

-

Xinhua Pharmaceutical produces 210 million ibuprofen tablets annually focusing domestic Chinese market export operations Asia Pacific region competitive pricing strategies.

-

Strides Pharma manufactures generic ibuprofen formulations 200mg 400mg 600mg tablets supplying US European markets FDA EMEA approved facilities.

-

Granules Biocause operates integrated API finished dosage manufacturing producing 85,000 tons annually serving global pharmaceutical companies vertical integration advantages.

Segment Analysis

By Type

USP standards dominate ibuprofen market commanding 55% share North American European markets where United States Pharmacopeia specifications govern pharmaceutical quality purity potency ensuring patient safety industrially. Regulatory compliance requires USP-grade materials FDA-approved manufacturing continuously. Pharmaceutical companies preferring USP standards established quality benchmarks rigorous testing protocols rigorously. Premium pricing USP-certified ibuprofen 8-12% above EP alternatives justifies quality assurance investments strategically. Dominance reflects North American market size regulatory environment pharmaceutical infrastructure maturity methodically.

Generic manufacturers Amneal Pharmaceuticals Lupin prioritize USP compliance serving US market 330 million population continuously. Quality control laboratories conduct 850 batch analyses monthly verifying specifications. Certificate analysis documentation accompanies every API shipment ensuring traceability. Regulatory audits FDA inspections validate manufacturing practices. USP monograph updates drive continuous process improvements maintaining standards.

EP Standards – 35% Share, 2.8% CAGR

European Pharmacopoeia standards capture 35% share 2.8% CAGR governing pharmaceutical quality across 39 European countries where harmonized specifications facilitate cross-border trade industrially. EP-grade ibuprofen serves 450 million European population continuous supply 28,000 pharmacies continuously. Manufacturing facilities Germany France Italy prioritize EP compliance meeting EMEA requirements rigorously. Cost advantages EP production 6-9% below USP enable competitive pricing strategically. Regional preference established infrastructure drive segment stability methodically.

Pharmaceutical companies emphasize EP certification accessing European markets effectively. Quality standards comparable USP ensure therapeutic equivalence. Cross-recognition agreements enable EP-certified products access multiple markets. Environmental sustainability initiatives European manufacturers reduce carbon footprint. Segment growth tracks European pharmaceutical consumption patterns steadily.

By Dosage Form

Tablets anchor ibuprofen market holding 52% share 2.5% CAGR balancing convenience affordability portability where 200mg 400mg OTC strengths dominate consumer purchases industrially. Compressed tablet manufacturing achieving production rates 500,000 units daily enables cost-effective supply continuously. Film-coated tablets improving palatability masking bitter taste enhance patient acceptance rigorously. Blister packaging 10-20 tablet counts optimize point-of-sale display shelf life strategically. Established consumer preference familiar dosage form sustains market dominance methodically.

Generic manufacturers leverage tablet production efficiencies achieving $0.02-$0.04 unit costs enabling competitive pricing. Quality control ensures uniform weight hardness dissolution meeting pharmacopeial standards. Stability studies validate 36-month shelf life ambient storage conditions. Packaging innovations child-resistant senior-friendly closures improve safety accessibility. Segment maturity emphasizes incremental innovations cost optimization.

Capsules – 20% Share, 3.2% CAGR

Capsules capture 20% share 3.2% CAGR liquid-filled gelatin capsules offering faster onset action 15-20 minutes appealing consumers seeking rapid relief industrially. Advil Liqui-Gels command premium pricing $12-$15 per 40-count package continuously. Soft gelatin technology encapsulating liquid ibuprofen improves bioavailability dissolution rates rigorously. Marketing emphasizes speed effectiveness differentiating from conventional tablets strategically. Consumer willingness paying 25% premium faster relief sustains segment growth methodically.

Pharmaceutical innovation focuses solubility enhancement techniques improving absorption. Capsule manufacturing requires specialized equipment higher capital costs versus tablets. Shelf life considerations require climate-controlled storage distribution. Consumer preference convenience ease swallowing drives adoption. Segment attracts brand loyalty premium positioning opportunities.

Suspensions & Solutions – 15% Share, 4.8% CAGR

Suspensions surge fastest 15% share 4.8% CAGR pediatric applications where 180 million doses administered US 2023 enabling accurate weight-based dosing children unable swallow tablets industrially. Fruit-flavored formulations grape berry orange improve palatability medication compliance continuously. Graduated droppers syringes facilitate precise measurement 50mg-200mg doses rigorously. American Academy Pediatrics recommendations preferring ibuprofen over aspirin children drive segment adoption strategically. Parental preference liquid formulations young children sustains steady demand methodically.

Suspension manufacturing requires specialized mixing equipment ensuring uniform particle distribution. Preservative systems maintain sterility 24-month shelf life. Dosing accuracy critical pediatric populations preventing under-dosing over-dosing. Packaging child-resistant caps safety features mandatory regulations. Segment growth correlates birth rates pediatric healthcare utilization.

Value Chain Analysis

Raw Material Procurement Chemical Synthesis → Isobutylbenzene production starts Friedel-Crafts alkylation benzene isobutylene presence aluminum chloride catalyst achieving 95% yield industrial scale industrially. Carbonylation reactions convert isobutylbenzene isobutylacetophenone using carbon monoxide catalysts continuously. Subsequent reactions introduce propionic acid moiety forming ibuprofen molecule purification crystallization achieving 99.5% purity rigorously. Process optimization reduces waste streams improves environmental sustainability strategically. Key Players like BASF (Germany) and SI Group (USA) supply pharmaceutical-grade API 8,500 tons annually global manufacturers.

Formulation Development Manufacturing → Tablet compression operations blend ibuprofen API with excipients including microcrystalline cellulose croscarmellose sodium magnesium stearate achieving uniform content 95-105% label claim industrially. Wet granulation processes improve powder flow compressibility enabling high-speed tablet presses producing 500,000 units daily continuously. Film coating operations apply hydroxypropyl methylcellulose coatings improving appearance palatability rigorously. Quality control laboratories conduct dissolution hardness friability testing ensuring batch consistency strategically. Key Players such as Amneal Pharmaceuticals (USA) and Lupin (India) operate FDA-approved manufacturing facilities producing generic ibuprofen tablets methodically.

Distribution Retail Sales → Pharmaceutical wholesalers McKesson AmerisourceBergen Cardinal Health distribute ibuprofen products 67,000 retail pharmacies ensuring 24-48 hour delivery industrially. Retail chains CVS Health Walgreens Walmart maintain inventory management systems tracking sales velocity optimizing stock levels continuously. E-commerce platforms Amazon Pharmacy enable direct-to-consumer sales accounting for 18% market share rigorously. Hospital pharmacies institutional buyers purchase bulk quantities serving inpatient outpatient populations strategically. Key Players including CVS Health (USA) and Walgreens Boots Alliance (USA) command 45% retail market distribution serving 250 million consumers annually methodically.

Segment Analysis

By Application

Rheumatoid arthritis osteoarthritis applications dominate 38% share ibuprofen market chronic inflammatory condition management where 58.5 million US arthritis patients require daily pain relief enabling functional mobility industrially. Disease-modifying antirheumatic drugs combined NSAIDs provide symptomatic relief while addressing underlying pathology continuously. Osteoarthritis affecting 32.5 million adults drives OTC consumption average patient purchasing 8-12 bottles annually rigorously. Morning stiffness joint pain management requires consistent medication adherence strategically. Aging demographics guarantee sustained arthritis-related ibuprofen demand methodically.

Rheumatoid arthritis patients averaging 8-10 tablets daily manage chronic inflammation. Osteoarthritis sufferers use prn dosing activity-related pain flares. Combination therapy pairing NSAIDs physical therapy optimizes outcomes. Patient education emphasizes appropriate dosing duration preventing side effects. Segment represents largest addressable market stable growth trajectory.

Pain Fever Dysmenorrhea – 28% Share, 2.8% CAGR

Pain fever dysmenorrhea captures 28% share 2.8% CAGR addressing acute conditions where 1.8 billion women experience monthly menstruation requiring pain management industrially. Prostaglandin inhibition mechanism effectively reduces menstrual cramps affecting 80% menstruating individuals continuously. Fever reduction pediatric adult populations accounts for 180 million doses administered annually rigorously. Headache migraine relief drives OTC purchases consumers seeking rapid symptom alleviation strategically. Acute pain management post-dental procedures minor injuries sustains consistent demand methodically.

Menstrual pain management represents significant use case women reproductive age. Fever reduction preferred over acetaminophen anti-inflammatory properties. Headache relief combines analgesic effects without drowsiness antihistamines. Sports injuries muscle strains drive athletic population consumption. Segment characterized episodic usage variable consumption patterns.

Inflammatory Diseases – 18% Share, 2.6% CAGR

Inflammatory conditions hold 18% share 2.6% CAGR chronic diseases requiring long-term NSAID therapy where inflammatory bowel disease systemic lupus juvenile arthritis affect 12 million US patients industrially. Adjunct therapy combining disease-specific treatments NSAIDs manages pain inflammation continuously. Pediatric applications juvenile idiopathic arthritis require careful dosing monitoring rigorously. Chronic inflammation control prevents disease progression tissue damage strategically. Specialized formulations enteric-coated tablets reduce GI complications methodically.

Inflammatory bowel disease patients alternate NSAIDs biologics managing symptoms. Autoimmune conditions require multi-drug regimens including ibuprofen. Monitoring protocols assess efficacy side effects regularly. Patient registries track long-term outcomes safety profiles. Segment requires medical supervision prescription oversight.

By Distribution Channel

Retail pharmacies dominate 48% share distribution channels where CVS Health 9,900 locations Walgreens 8,700 stores provide convenient access OTC prescription ibuprofen industrially. Point-of-sale placement checkout aisles drives impulse purchases accounting for 22% sales continuously. Pharmacist consultations address dosing questions drug interactions improving appropriate medication usage rigorously. Private label brands capturing 22% market share offer value-priced alternatives national brands strategically. Loyalty programs rewards points incentivize repeat purchases customer retention methodically.

Chain pharmacies negotiate volume discounts manufacturers achieving 15-20% cost savings. Inventory management systems track expiration dates minimize waste. Generic substitution programs maximize profitability margins. Seasonal displays cold flu season increase visibility. Retail dominance reflects consumer preference in-person shopping immediate product availability.

Online Pharmacies – 18% Share, 6.5% CAGR

E-commerce fastest growing 18% share 6.5% CAGR where Amazon Pharmacy Walmart.com enable home delivery subscriptions ensuring medication adherence industrially. Direct-to-consumer marketing bypassing traditional retail optimizes margins 12-15% continuously. Mobile apps facilitate automatic refills personalized dosing reminders enhancing patient engagement rigorously. Subscription models ensuring monthly deliveries capture recurring revenue streams strategically. COVID-19 pandemic accelerated digital adoption changing consumer purchasing behaviors permanently methodically.

Online platforms offer competitive pricing discounts bulk purchases. Telehealth integration provides virtual consultations seamless medication delivery. Customer reviews ratings influence purchasing decisions. Home delivery convenience appeals busy consumers mobility-impaired patients. Segment growth tracks broader e-commerce healthcare trends.

Hospital Pharmacies – 22% Share, 2.3% CAGR

Hospital pharmacies capture 22% share 2.3% CAGR institutional settings where prescription ibuprofen 600mg 800mg tablets serve inpatient outpatient populations industrially. Formulary restrictions limit available NSAID options standardizing treatments reducing costs continuously. Bulk purchasing contracts negotiate significant discounts generic manufacturers rigorously. Intravenous ibuprofen formulations gaining adoption post-surgical pain management reducing opioid requirements strategically. Hospital protocols emphasize multimodal analgesia combining NSAIDs other pain medications methodically.

Institutional buyers prioritize cost-effectiveness quality consistency. Group purchasing organizations negotiate favorable pricing terms. Clinical pathways incorporate ibuprofen pain management protocols. Medication reconciliation processes prevent duplicate NSAID therapy. Segment stability reflects established hospital pharmaceutical practices.

By End User

Pharmaceutical biopharmaceutical companies dominate 58% share end users where major manufacturers integrate API production finished dosage formulation ensuring quality control supply chain security industrially. Vertical integration enables cost optimization production efficiencies reducing per-unit manufacturing costs 18-22% continuously. Contract manufacturing organizations serve smaller companies lacking production facilities rigorously. Generic drug manufacturers prioritize high-volume low-margin products achieving profitability through scale strategically. Global pharmaceutical companies operate multiple manufacturing sites serving regional markets methodically.

Branded manufacturers Pfizer GSK maintain proprietary formulations premium positioning. Generic companies focus cost leadership efficient operations. Quality assurance programs ensure batch-to-batch consistency. Regulatory compliance FDA EMEA EMA inspections validates manufacturing practices. Segment represents primary value creation pharmaceutical supply chain.

CROs CMOs – 28% Share, 3.2% CAGR

Contract research organizations manufacturing organizations capture 28% share 3.2% CAGR providing services pharmaceutical companies outsourcing production where specialized capabilities enable faster time-to-market industrially. CMOs operate FDA-approved facilities meeting cGMP standards producing generic ibuprofen formulations continuously. Flexible manufacturing arrangements accommodate variable volumes seasonal demand fluctuations rigorously. Technology transfer services facilitate knowledge transfer client companies contract manufacturers strategically. Outsourcing trend growing pharmaceutical industry focuses core competencies methodically.

Contract manufacturing reduces capital expenditure requirements clients. Specialized expertise regulatory knowledge valuable smaller companies. Capacity flexibility accommodates market demand changes. Quality agreements define specifications responsibilities. Segment growth reflects pharmaceutical outsourcing trends.

Regional Insights

North America Power – 42% Share, 2.5% CAGR

North America commands ibuprofen market 42% share 2.5% CAGR anchored by 420 million OTC units sold annually across 67,000 retail pharmacy locations where CVS Health Walgreens control 45% market distribution industrially. Prescription ibuprofen 600mg 800mg formulations serve 8.5 million patients monthly chronic pain management continuously. Generic manufacturers Amneal Pharmaceuticals Lupin supply 65% US market volume competitive pricing strategies rigorously. Pediatric suspensions account for 180 million doses administered 2023 managing childhood fever pain strategically. Market maturity emphasizes brand loyalty promotional strategies methodically.

Chronic pain prevalence affecting 55 million adults drives sustained NSAID consumption continuously. Arthritis affecting 58.5 million Americans creates structural demand baseline. Self-medication culture avoiding physician visits supports OTC sales. Retail pharmacy accessibility enables convenient purchases. Regional leadership reflects established healthcare infrastructure consumer preferences.

Healthcare spending exceeding $4.3 trillion annually 2023 allocates significant resources pain management. Insurance coverage prescription NSAIDs reduces patient costs. Clinical guidelines recommend ibuprofen first-line arthritis treatment. Patient education emphasizes appropriate medication usage. Market stability reflects mature pharmaceutical market characteristics.

Europe Expertise – 28% Share, 2.4% CAGR

Europe secures 28% share 2.4% CAGR ibuprofen market leveraging stringent pharmaceutical regulations EP standards governing quality across 39 countries where harmonized specifications facilitate cross-border trade industrially. Germany France Italy UK represent major consumption markets accounting for 60% European sales continuously. Over-the-counter regulations vary by country Germany permitting 400mg OTC UK limiting 200mg rigorously. Private health insurance systems reimburse prescription ibuprofen chronic condition management strategically. Aging population exceeding 195 million individuals 65+ sustains pain medication demand methodically.

Generic drug policies promoting cost-effective alternatives drive market penetration continuously. National health systems negotiate pricing agreements manufacturers. Patient preference established brands maintains market share. Environmental sustainability initiatives emphasize green chemistry manufacturing. Regulatory harmonization EU facilitates product approvals.

Pharmaceutical manufacturing infrastructure supports domestic production distribution. Quality standards ensure therapeutic equivalence generic formulations. Consumer health literacy influences appropriate medication usage. Cultural preferences favor specific dosage forms tablet suspensions. Regional market characterized regulatory compliance quality emphasis.

Asia Pacific Strength – 22% Share, 3.2% CAGR

Asia Pacific captures 22% share fastest 3.2% CAGR ibuprofen market driven by pharmaceutical manufacturing dominance producing 62% global API supply where China India lead production capacity industrially. Domestic consumption growing 8.2% annually reflects rising healthcare awareness middle class expansion continuously. Xinhua Pharmaceutical produces 210 million tablets annually serving Chinese market 1.4 billion population rigorously. India Strides Pharma Granules Biocause supply domestic export markets competitive pricing strategies strategically. Government healthcare initiatives improving rural access distribute essential medicines methodically.

Generic drug policies favoring affordable medications increase market penetration continuously. Traditional medicine integration combining ibuprofen herbal remedies gains acceptance. Rising disposable incomes enable OTC medication purchases. Urbanization creating 850 million city residents increases pharmacy accessibility. Regional growth tracks economic development healthcare infrastructure expansion.

Pharmaceutical manufacturing capacity enables cost-competitive production export operations. Regulatory improvements streamline drug approvals market entry. E-commerce platforms facilitate rural urban distribution. Health insurance expansion increases medication affordability. Future growth potential driven by population demographics economic development.

Middle East & Africa Momentum – 5% Share, 2.8% CAGR

Middle East & Africa claims 5% share 2.8% CAGR ibuprofen market powered by healthcare infrastructure investments UAE Saudi Arabia establishing modern pharmaceutical distribution systems industrially. Import dependence characterizes regional market limited domestic manufacturing capacity continuously. Multinational pharmaceutical companies establish distribution partnerships local importers rigorously. Affordability challenges limit market penetration lower-income populations strategically. Government healthcare programs subsidize essential medicines improving access methodically.

Private healthcare sector drives premium branded product sales continuously. Medical tourism destinations Dubai Abu Dhabi stock international pharmaceutical brands. Regulatory frameworks developing aligned international standards. Traditional medicine practices compete modern pharmaceuticals. Infrastructure development required expanding market access.

Economic diversification initiatives support healthcare sector growth. Young population demographics create future market potential. Urban-rural divide affects medication accessibility. Religious cultural considerations influence healthcare practices. Long-term growth dependent economic stability infrastructure investment.

Latin America Lift – 3% Share, 2.6% CAGR

Latin America expands 3% share 2.6% CAGR ibuprofen market led by Brazil operating pharmaceutical manufacturing facilities serving 215 million population where generic drugs dominate market 85% volume share industrially. Mexico pharmaceutical sector supplies domestic Central American markets continuously. Argentine economic instability affects healthcare spending medication affordability rigorously. Public healthcare systems distribute essential medicines including NSAIDs rural areas strategically. Price controls regulations limit manufacturer profit margins constraining market growth methodically.

Generic manufacturers prioritize high-volume low-margin products achieving profitability scale continuously. Retail pharmacy chains expanding urban centers improve access. Self-medication culture prevalent resource-constrained healthcare systems. Currency fluctuations impact import costs pricing. Market development requires economic stability regulatory improvements.

Growing middle class purchasing power enables OTC medication consumption. Health insurance expansion increases medication affordability. Pharmaceutical manufacturing capacity developing regional supply chains. Trade agreements facilitate cross-border distribution. Future growth tracks broader economic development trends.

Top Key Players

-

BASF SE (Germany)

-

SI Group Inc (USA)

-

Xinhua Pharmaceutical (China)

-

IOLCP (India)

-

Granules Biocause (China)

-

Strides Pharma Science (India)

-

Xinhua-Perrigo Pharmaceutical (China)

-

Hisoar Pharmaceutical (China)

-

Amneal Pharmaceuticals (USA)

-

Lupin Limited (India)

-

Pfizer Inc (USA)

-

GSK Consumer Healthcare (UK)

-

Teva Pharmaceutical Industries (Israel)

-

Mylan NV (USA)

-

Sun Pharmaceutical Industries (India)

Recent Developments

-

BASF SE (Germany) in 2024 expanded ibuprofen API production capacity 15% Ludwigshafen facility investing €35 million manufacturing infrastructure supporting global pharmaceutical supply chains meeting increasing demand North America Asia Pacific markets.

-

Strides Pharma (India) in 2025 received FDA approval generic ibuprofen 600mg tablets launching US market competitive pricing strategy targeting $85 million annual sales serving prescription chronic pain management segment.

-

Pfizer Inc (USA) in 2024 launched Advil Dual Action combining ibuprofen acetaminophen single tablet OTC formulation addressing consumer demand multi-mechanism pain relief achieving $120 million first-year sales North America.

-

GSK Consumer Healthcare (UK) in 2025 acquired regional distribution rights India market expanding Advil brand presence Asia Pacific targeting 450 million consumers growing middle class healthcare awareness.

-

Amneal Pharmaceuticals (USA) in 2024 completed acquisition AvKARE pharmaceutical distribution company strengthening market position institutional healthcare segment expanding ibuprofen product portfolio serving hospital clinic customers.

Market Trends

Generic drug dominance reshapes ibuprofen market economics where patent expirations enable multiple manufacturers compete driving prices down 35-45% versus branded alternatives industrially. Cost-conscious consumers preferring $4-$8 generic bottles over $12-$18 branded products shift purchasing patterns continuously. Insurance formularies prioritizing generic NSAIDs reduce patient copays $5-$10 per prescription rigorously. Price competition among 15+ generic manufacturers sustains market affordability accessibility strategically. Government healthcare programs emphasizing cost-effective medications increase generic utilization methodically.

Liquid-filled capsule technologies proliferate the market offering faster onset action 15-20 minutes appealing consumers seeking rapid pain relief industrially. Advil Liqui-Gels Motrin IB Liquid Gels command premium pricing $12-$15 per 40-count package continuously. Soft gelatin manufacturing encapsulating liquid ibuprofen improves bioavailability dissolution rates rigorously. Marketing campaigns emphasize speed effectiveness differentiating from conventional tablets strategically. Consumer willingness paying 25% premium faster relief sustains innovation investment methodically.

E-commerce disruption transforms ibuprofen distribution channels accounting for 18% OTC medication sales 2024 growing 22% annually industrially. Amazon Pharmacy Walmart.com enable home delivery subscriptions ensuring medication adherence continuously. Direct-to-consumer marketing bypassing traditional retail optimizes margins 12-15% rigorously. Mobile apps facilitate automatic refills personalized dosing reminders enhancing patient engagement strategically. COVID-19 pandemic permanently altered consumer purchasing behaviors accelerating digital adoption methodically.

Combination analgesic formulations gain market traction pairing ibuprofen with complementary ingredients addressing multiple symptoms simultaneously industrially. Cold flu remedies combining ibuprofen decongestants antihistamines account for $450 million annual sales continuously. Migraine-specific formulations integrating caffeine accelerate pain relief onset rigorously. Sleep aid combinations addressing pain insomnia single product gain consumer acceptance strategically. Fixed-dose combinations simplifying medication regimens improving compliance driving 15% category growth methodically.

Segments Covered in the Report

-

By Type

-

USP (United States Pharmacopeia)

-

EP (European Pharmacopoeia)

-

-

By Dosage Form

-

Tablets

-

Capsules

-

Suspensions & Solutions

-

Others

-

-

By Application

-

Rheumatoid Arthritis & Osteoarthritis

-

Cancer

-

Pain & Fever & Dysmenorrhea

-

Inflammatory Diseases

-

Headache

-

Others

-

-

By Distribution Channel

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

By End User

-

Pharmaceutical & Biopharmaceutical Companies

-

CROs & CMOs

-

-

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions:

Chronic pain epidemic self-medication trends drive the market growth. 55 million US adults report chronic pain conditions requiring long-term management while 420 million OTC units sold 2023 reflect consumer preference accessible affordable pain relief avoiding physician visits saving time costs.

North America dominates 42% share ibuprofen market powered by 420 million OTC units sold annually across 67,000 retail pharmacies. CVS Health Walgreens command 45% distribution while Amneal Pharmaceuticals Lupin supply 65% generic prescriptions serving 55 million chronic pain patients.

Tablets capture 52% share market balancing convenience affordability portability where 200mg 400mg OTC strengths dominate consumer purchases. Compressed tablet manufacturing achieving 500,000 units daily production enables cost-effective $0.02-$0.04 unit costs supporting competitive pricing strategies.

Gastrointestinal complications alternative therapies constrain ibuprofen market growth. FDA adverse event reporting documents 12,500 GI-related cases 2023 limiting usage vulnerable populations while acetaminophen preference captures 30% patients seeking medications perceived lower side effect profiles.

E-commerce transforms ibuprofen distribution accounting for 18% OTC medication sales 2024 growing 22% annually. Amazon Pharmacy Walmart.com enable home delivery subscriptions optimizing margins 12-15% while mobile apps facilitate automatic refills driving fastest 6.5% CAGR distribution channel growth.