Livestock Monitoring Market Overview

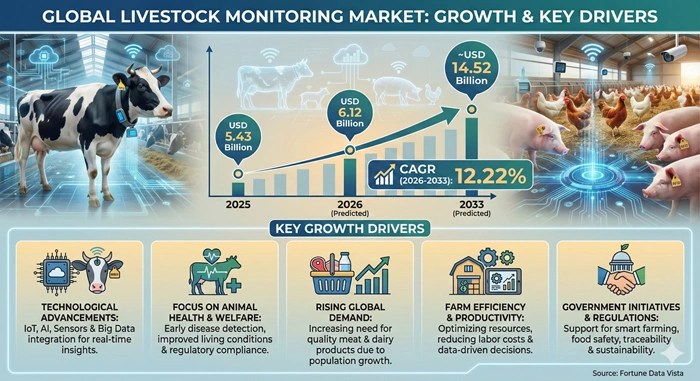

The global livestock monitoring market size is valued at USD 5.43 billion in 2025 and is predicted to increase from USD 6.12 billion in 2026 to approximately USD 14.52 billion by 2033, growing at a CAGR of 12.22% from 2026 to 2033.

Livestock monitoring systems have emerged as transformative solutions that enable farmers and livestock managers to track animal health, behavior, reproduction cycles, and feeding patterns using advanced technologies. These systems integrate hardware components such as smart sensors, wearable devices, GPS tracking tags, and RFID systems with sophisticated software platforms that process real-time data to provide actionable insights. The livestock monitoring market encompasses various applications across dairy farming, beef production, poultry operations, and swine management, helping farmers optimize productivity while ensuring animal welfare and reducing operational costs.

The growing adoption of precision livestock farming techniques is revolutionizing traditional animal husbandry practices by enabling continuous monitoring of vital parameters. Farmers can now detect early signs of diseases, identify optimal breeding times, monitor feeding efficiency, and track animal location across large pastures without manual intervention. This technological shift addresses critical challenges such as labor shortages, rising animal healthcare costs, and increasing consumer demand for ethically produced animal products. The livestock monitoring market is witnessing accelerated growth as stakeholders across the agricultural value chain recognize the benefits of data-driven decision-making in improving farm profitability and sustainability.

AI Impact on the Livestock Monitoring Industry

Revolutionizing Farm Management Through Intelligent Automation and Predictive Analytics

Artificial intelligence is fundamentally transforming the livestock monitoring market by introducing predictive capabilities that enable farmers to anticipate health issues before they become critical. AI-powered algorithms analyze patterns in animal behavior data collected through sensors and cameras to identify subtle changes that indicate stress, illness, or reproductive readiness. Machine learning models trained on millions of data points can now predict disease outbreaks with remarkable accuracy, allowing veterinary interventions to occur proactively rather than reactively. This shift from responsive to preventive care significantly reduces mortality rates, improves animal welfare, and minimizes the economic impact of livestock diseases on farming operations.

The integration of computer vision and natural language processing is enabling sophisticated monitoring systems that can assess body condition scoring, detect lameness, and monitor feeding behaviors without requiring physical contact with animals. AI-driven platforms aggregate data from multiple sources including wearable sensors, environmental monitors, and automated milking systems to create comprehensive health profiles for individual animals and entire herds. These intelligent systems provide farmers with prioritized alerts and actionable recommendations, dramatically reducing the cognitive load associated with managing large-scale livestock operations. The livestock monitoring market is experiencing rapid innovation as AI technologies become more accessible and affordable for farms of all sizes.

Growth Factors

Escalating Demand for Sustainable and Efficient Livestock Production Methods

The livestock monitoring market is experiencing robust growth driven by the urgent need to enhance productivity while addressing sustainability concerns in animal agriculture. Global meat and dairy consumption continues to rise alongside population growth and economic development in emerging markets, placing unprecedented pressure on livestock producers to increase output without proportionally expanding environmental footprint. Monitoring technologies enable farmers to optimize feed conversion ratios, reduce waste, minimize greenhouse gas emissions per unit of production, and implement more sustainable grazing practices. Governments and agricultural organizations worldwide are incentivizing technology adoption through subsidies, grants, and technical assistance programs that accelerate the deployment of smart farming solutions across both commercial and smallholder operations.

Consumer awareness regarding animal welfare standards and food safety traceability has created market pressure for transparent livestock management practices. Retailers and food processing companies increasingly require suppliers to demonstrate compliance with welfare standards and provide documentation of animal health management throughout the production cycle. The livestock monitoring market benefits from this trend as tracking systems provide auditable records of veterinary care, feeding regimens, and environmental conditions. Additionally, the shortage of skilled agricultural labor in developed markets is compelling farmers to adopt automated monitoring solutions that reduce dependence on manual observation while maintaining or improving herd management quality.

Market Outlook

Technology Integration and Digital Transformation Reshaping Livestock Agriculture

The livestock monitoring market outlook remains exceptionally positive as technological convergence accelerates innovation across hardware, software, and connectivity solutions. The proliferation of low-cost sensors, improvements in battery technology, and expansion of rural broadband and satellite connectivity are eliminating traditional barriers to technology adoption in remote agricultural regions. Cloud computing platforms enable farmers to access sophisticated analytics capabilities without investing in expensive on-premise infrastructure, democratizing access to enterprise-grade herd management tools. The emergence of integrated farm management ecosystems that connect livestock monitoring with crop management, financial planning, and supply chain coordination is creating comprehensive digital agriculture solutions.

Strategic partnerships between traditional agricultural equipment manufacturers, technology companies, animal health corporations, and telecommunications providers are driving market consolidation and ecosystem development. Major players in the livestock monitoring market are investing heavily in research and development to incorporate emerging technologies such as edge computing, advanced biometrics, and satellite-based tracking systems. The ongoing digital transformation of agriculture is attracting significant venture capital investment in agritech startups developing innovative monitoring solutions for specific livestock segments and geographic markets. Market projections indicate sustained double-digit growth rates as technology penetration increases across both developed and developing agricultural economies.

Expert Speaks

-

Jeff Simmons, Former CEO of Elanco Animal Health (Fortune 500), emphasized that digital health monitoring technologies represent the future of sustainable livestock production, enabling farmers to produce more food with fewer resources while maintaining the highest standards of animal welfare and environmental stewardship.

-

Kristin Peck, CEO of Zoetis (Fortune 500), highlighted that precision animal health technologies including advanced monitoring systems are critical tools for addressing global food security challenges, stating that data-driven insights allow farmers to optimize animal health outcomes and operational efficiency simultaneously.

-

Juan Luciano, CEO of Archer Daniels Midland (Fortune 500), noted that technology integration across the agricultural value chain including livestock monitoring systems is essential for building resilient and sustainable food systems that can adapt to climate challenges and evolving consumer expectations.

Key Report Takeaways

-

North America maintains the largest regional share of the livestock monitoring market at approximately 28% with advanced technology infrastructure and high adoption rates among commercial farming operations

-

Asia Pacific emerges as the fastest-growing region with projected CAGR exceeding 13% driven by increasing meat consumption, government modernization initiatives, and expanding commercial livestock production in countries like China, India, and Southeast Asian nations

-

Bovine segment dominates animal-type categorization accounting for over 47% market share as dairy and beef operations invest heavily in health monitoring, reproduction management, and productivity optimization technologies

-

Software and services segment is experiencing the highest growth rate as farmers recognize value in data analytics platforms and cloud-based management systems that transform raw sensor data into actionable business intelligence

-

Health monitoring application represents the largest use case with rising emphasis on early disease detection, preventive veterinary care, and compliance with animal welfare regulations driving adoption across all livestock segments

-

Large commercial farms constitute the primary customer segment though medium-sized operations are increasingly adopting modular and scalable monitoring solutions as technology costs decline and accessibility improves

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 14.52 Billion | Market Size by 2026 | USD 6.12 Billion | Market Size by 2025 | USD 5.43 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 12.22% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Animal Type, Solution Type, Application, Sector, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

Technological Advancements Enabling Real-Time Animal Health Management

| Impact Factor | Details |

|---|---|

| Approximate Impact on CAGR Forecast | +3.5% to +4.2% |

| Geographic Relevance | Global (Highest in North America, Europe, and Asia Pacific) |

| Impact Timeline | 2025 to 2033 (Peak impact 2027-2030) |

The livestock monitoring market is experiencing significant growth momentum driven by breakthrough innovations in sensor technology, wireless connectivity, and artificial intelligence algorithms. Modern monitoring systems utilize miniaturized biosensors that can continuously track vital signs including body temperature, heart rate variability, rumination patterns, and activity levels with medical-grade precision. These sensors transmit data through low-power wide-area networks (LPWAN) and satellite communication systems that maintain connectivity even in remote grazing areas lacking traditional cellular coverage. The integration of edge computing capabilities allows real-time processing of data streams, enabling immediate alerts when animals exhibit behaviors indicative of health problems or requiring intervention.

Cloud-based analytics platforms aggregate information from individual animals and entire herds to identify trends, predict outcomes, and recommend management actions backed by scientific evidence and machine learning insights. The livestock monitoring market benefits tremendously from cross-industry technology transfer as advances in consumer wearables, medical devices, and industrial IoT find agricultural applications. Farmers can now access sophisticated tools previously available only to large commercial operations, democratizing precision livestock farming techniques across operation sizes and geographic locations. The declining cost of technology components combined with improving ease of use is accelerating adoption rates and expanding market penetration into previously underserved segments and regions.

Restraints Impact Analysis

High Initial Investment Costs Creating Adoption Barriers for Small-Scale Producers

| Impact Factor | Details |

|---|---|

| Approximate Impact on CAGR Forecast | -1.8% to -2.5% |

| Geographic Relevance | Developing Markets and Small Farm Segments Globally |

| Impact Timeline | 2025 to 2029 (Declining impact as prices fall) |

The livestock monitoring market faces adoption challenges stemming from substantial upfront capital requirements for implementing comprehensive monitoring systems across livestock operations. Small and medium-sized farms operating on tight profit margins find it difficult to justify the initial investment in hardware devices, software licenses, connectivity infrastructure, and training programs necessary for effective system deployment. The total cost of ownership extends beyond equipment purchase to include ongoing subscription fees for cloud services, maintenance contracts, periodic device replacements, and technical support expenses. Many farmers in developing agricultural markets lack access to financing options or government subsidy programs that could offset technology acquisition costs.

Return on investment calculations for livestock monitoring systems can be complex and variable depending on factors such as herd size, production system type, baseline management practices, and local market conditions for animal products. Smaller operations may struggle to achieve the economies of scale that make monitoring technology financially viable for large commercial farms with thousands of animals. The livestock monitoring market must address these economic barriers through innovative business models such as equipment leasing, pay-per-use pricing, and cooperative purchasing arrangements that distribute costs across multiple farmers. Additionally, limited technical literacy and resistance to change among traditional farmers in some regions create non-financial barriers that slow market penetration despite improving technology affordability.

Opportunities Impact Analysis

Expanding Focus on Sustainable Livestock Production and Carbon Footprint Reduction

| Impact Factor | Details |

|---|---|

| Approximate Impact on CAGR Forecast | +2.8% to +3.5% |

| Geographic Relevance | Europe, North America, and Progressive Markets Globally |

| Impact Timeline | 2026 to 2033 (Accelerating throughout period) |

The livestock monitoring market is poised to benefit substantially from growing environmental consciousness and regulatory pressures to reduce the carbon intensity of animal agriculture. Monitoring technologies enable farmers to implement precision feeding strategies that optimize nutrient utilization, minimize methane emissions from enteric fermentation, and reduce nitrogen excretion that contributes to water pollution. Advanced systems track individual animal feed intake and correlate consumption patterns with productivity outcomes, allowing customized rations that improve efficiency while reducing waste. These capabilities align perfectly with sustainability mandates emerging across major agricultural markets and voluntary corporate commitments from food companies to reduce supply chain emissions.

Carbon credit programs and environmental subsidy schemes are creating new revenue streams for farmers who can document and verify emission reductions through monitoring data. The livestock monitoring market is developing specialized analytics modules that quantify environmental impacts and generate compliance reports for regulatory authorities and certification bodies. Consumer preferences for sustainably produced meat and dairy products are influencing purchasing decisions and creating premium market opportunities for farms demonstrating superior environmental stewardship. Companies throughout the livestock value chain including processors, retailers, and foodservice operators are seeking supply partnerships with technologically advanced farms capable of providing transparency regarding production practices and environmental performance metrics.

Segment Analysis

By Animal - Bovine

Dominance in Dairy and Beef Production Driving Technology Adoption

The bovine segment commands the largest share of the livestock monitoring market accounting for approximately 47% of total market value due to the economic significance of cattle in global agricultural systems. Dairy operations represent particularly intensive users of monitoring technology as they require precise tracking of milk production, reproductive cycles, and health status to maximize profitability in commodity markets with thin margins. Modern dairy farms increasingly rely on automated milking systems integrated with health monitoring sensors that detect mastitis, track somatic cell counts, and identify optimal breeding times through estrus detection algorithms. Beef cattle operations adopt GPS-based tracking systems and behavioral monitoring solutions to manage animals across extensive grazing areas while ensuring animal welfare and preventing losses from theft or predation.

The livestock monitoring market in the bovine segment benefits from well-established veterinary infrastructure, extensive research into cattle health management, and sophisticated breeding programs that justify technology investments. North America and Europe lead in adoption rates with commercial dairy operations routinely employing comprehensive monitoring systems covering individual cow identification, automated activity monitoring, body condition scoring cameras, and rumination sensors. Major technology providers including Zoetis, DeLaval, and GEA Group compete intensively in this segment with feature-rich solutions offering predictive analytics for metabolic disorders, lameness detection, and feed efficiency optimization. The segment is projected to grow at a robust CAGR exceeding 12% as precision livestock farming principles extend to smaller operations and emerging markets with expanding cattle populations.

By Solution - Software & Services

Cloud-Based Analytics Platforms Transforming Raw Data into Business Intelligence

The software and services segment represents the fastest-growing component of the livestock monitoring market as farmers recognize that hardware sensors generate value only when paired with sophisticated analytics capabilities. Cloud-based herd management platforms aggregate data from diverse sources including wearable sensors, automated feeding systems, milking parlors, and environmental monitors to create unified dashboards providing comprehensive operational visibility. These software solutions employ machine learning algorithms that identify patterns invisible to human observation, generate early warning alerts for health problems, recommend interventions, and track key performance indicators against industry benchmarks and historical farm data.

The livestock monitoring market is witnessing rapid innovation in software user interfaces designed for accessibility by farmers with varying technical expertise operating across different devices including smartphones, tablets, and desktop computers. Services including system integration, training programs, technical support, and consulting offerings ensure successful technology deployment and ongoing optimization of monitoring system utilization. The segment is experiencing particularly strong growth in Asia Pacific and Latin America where improving internet connectivity and smartphone penetration enable cloud-based solutions that bypass expensive on-premise infrastructure requirements. Leading providers such as Merck Animal Health, Afimilk, and specialized agtech startups compete by offering differentiated analytics capabilities, seamless integration with existing farm equipment, and subscription pricing models that reduce barriers to entry. The software and services segment is projected to expand at the highest CAGR approaching 13.5% as the livestock monitoring market matures and farmers prioritize decision support tools over standalone hardware devices.

Regional Insights

North America

Technology Leadership and Precision Agriculture Infrastructure Driving Market Dominance

North America maintains its position as the dominant region in the livestock monitoring market holding approximately 28% of global market share with particularly strong presence in the United States and Canada. The region benefits from highly developed agricultural technology infrastructure, widespread broadband connectivity in rural areas, and progressive farming operations that rapidly adopt innovative management practices. Large-scale commercial dairy and beef operations in states like Wisconsin, California, Texas, and Idaho deploy comprehensive monitoring systems as standard practice, viewing technology investment as essential for maintaining competitiveness in global commodity markets. The livestock monitoring market in North America is characterized by sophisticated buyers with high expectations for system performance, reliability, and integration with existing farm management software.

The United States leads regional growth with major agricultural corporations and family-owned mega-farms driving demand for enterprise-grade monitoring solutions covering thousands of animals across multiple production facilities. Companies including Zoetis, Allflex (Merck Animal Health), and American-based technology providers maintain dominant market positions through extensive distribution networks, strong customer relationships, and continuous product innovation. Government support through USDA programs, land grant university research initiatives, and agricultural extension services facilitates technology adoption and provides technical assistance to farmers implementing monitoring systems. The North American livestock monitoring market is projected to grow at approximately 11.8% CAGR with increasing penetration into medium-sized operations and expansion of monitoring applications beyond traditional dairy uses into beef feedlots, specialty livestock, and organic production systems where animal welfare documentation requirements are particularly stringent.

Asia Pacific

Rapid Modernization and Rising Protein Consumption Fueling Fastest Regional Growth

Asia Pacific emerges as the fastest-growing region in the livestock monitoring market with projected CAGR exceeding 13% driven by dramatic expansion of commercial livestock production and government-led agricultural modernization initiatives. Countries including China, India, Australia, Japan, and emerging Southeast Asian markets are investing heavily in technology infrastructure to meet soaring domestic demand for meat and dairy products accompanying economic development and dietary transitions. The livestock monitoring market in this region encompasses diverse production systems ranging from highly automated Australian cattle stations utilizing satellite tracking to rapidly modernizing Chinese dairy megafarms implementing comprehensive monitoring solutions on herds numbering tens of thousands of animals.

Government policies promoting precision agriculture, food safety improvements, and rural economic development provide substantial support for technology adoption through subsidies, demonstration programs, and public-private partnerships. India's National Livestock Mission and China's agricultural modernization plans specifically emphasize technology integration to improve productivity and sustainability. The Asia Pacific livestock monitoring market features intense competition between established international providers and emerging domestic technology companies developing solutions tailored to regional production practices, animal breeds, and climate conditions. Companies including DeLaval, GEA Group, Lely, and regional players like Stellapps in India are establishing manufacturing facilities and support networks throughout Asia Pacific to capitalize on explosive growth opportunities. The region's market expansion is particularly pronounced in poultry and swine segments alongside traditional cattle applications as integrated production systems adopt automated monitoring to manage disease risks and optimize feed efficiency across large animal populations.

Top Key Players

-

DeLaval (Sweden)

-

Afimilk Ltd. (Israel)

-

BouMatic (United States)

-

Merck & Co., Inc. / Allflex (United States)

-

Zoetis (United States)

-

Lely International NV (Netherlands)

-

Moocall (Ireland)

-

GEA Group Aktiengesellschaft (Germany)

-

Fullwood JOZ (United Kingdom)

-

Dairymaster (Ireland)

-

Fancom BV (Netherlands)

-

Nedap Livestock Management (Netherlands)

-

SCR by Allflex (United States)

-

CowManager BV (Netherlands)

-

Quantified AG (United States)

-

Cainthus (Ireland)

-

IceRobotics Ltd. (United Kingdom)

-

Connecterra (Netherlands)

-

HerdDogg (United States)

-

Cowlar (Pakistan)

Recent Developments

-

Zoetis (2025): Completed acquisition of Smartbow, an Austrian livestock monitoring technology company specializing in AI-powered ear sensor systems for dairy cattle health and reproduction management, expanding Zoetis' precision animal health portfolio and European market presence

-

DeLaval (2024): Launched the Milking Automation MA Series featuring cloud connectivity and real-time herd insights, integrating parlor equipment with advanced data analytics platforms to optimize dairy farm operations and improve milk quality monitoring capabilities

-

Merck Animal Health (2024): Introduced SenseHub Dairy Youngstock, the first comprehensive calf monitoring technology utilizing AI-driven behavioral algorithms for early disease detection in young cattle, addressing critical productivity challenges in dairy replacement heifer management

-

GEA Group (2024): Released the CattleEye solution with AI-powered Body Condition Scoring and lameness detection capabilities following acquisition of Irish agricultural technology company CattleEye Ltd., expanding automated visual monitoring offerings for dairy operations

-

CowManager (2024): Launched the Youngstock Monitor providing real-time calf health surveillance through machine learning algorithms that analyze behavioral patterns to predict illness, reducing mortality rates and treatment costs in dairy calf-rearing operations

Market Trends

Integration of Satellite Connectivity and Edge Computing Transforming Remote Livestock Management

The livestock monitoring market is experiencing a fundamental shift toward satellite-enabled communication systems that overcome connectivity limitations in remote grazing regions and developing agricultural markets. Direct-to-device satellite technologies eliminate dependence on cellular infrastructure, enabling real-time tracking and monitoring across vast rangeland areas where traditional wireless networks are unavailable or unreliable. This technological advancement is particularly transformative for extensive beef production systems in regions like Australia, Brazil, Argentina, and the western United States where cattle graze across millions of acres. Edge computing capabilities embedded in monitoring devices reduce bandwidth requirements by processing data locally and transmitting only relevant information and alerts through satellite links, making these solutions economically viable despite higher communication costs compared to terrestrial networks.

The livestock monitoring market is also witnessing increased emphasis on interoperability and data standardization as farms deploy multiple technology systems that must communicate effectively. Open APIs and platform integration capabilities are becoming essential product features as farmers resist vendor lock-in and demand flexibility to combine best-in-class solutions from different providers. Blockchain technology is emerging in supply chain traceability applications where livestock monitoring data contributes to transparent documentation of animal origins, health history, and production practices for consumers and regulatory compliance. The convergence of monitoring technologies with precision feeding systems, automated milking equipment, and environmental control systems is creating integrated farm management ecosystems that optimize resource utilization across all production inputs while maintaining detailed records supporting sustainability certifications and premium market access for responsibly produced animal products.

Segments Covered in the Report

By Animal:

-

Bovine

-

Poultry

-

Swine

-

Other Animals (Equine, Sheep, Goats)

By Solution:

-

Hardware

-

Sensors

-

Collars

-

Limb Wearables

-

GPS/RFID Systems

-

Collars

-

Tags

-

-

Other Hardware

-

-

Software & Services

-

On-Premise Solutions

-

Cloud-Based Solutions

-

By Application:

-

Milking Management

-

Breeding Management

-

Feeding Management

-

Health Monitoring

-

Behavioral Monitoring

-

Other Applications (Heat Stress Management, Sorting & Weighing)

By Sector:

-

Dairy

-

Meat Production

-

Other Sectors

By Region:

-

North America (United States, Canada, Mexico)

-

Europe (United Kingdom, Germany, France, Italy, Spain, Denmark, Sweden, Norway)

-

Asia Pacific (Japan, China, India, Australia, South Korea, Thailand, New Zealand)

-

Latin America (Brazil, Argentina, Chile)

-

Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait, Qatar, Oman)

Frequently Asked Questions:

Answer: The global livestock monitoring market is projected to reach USD 14.52 billion by 2033, growing from USD 5.43 billion in 2025 at a CAGR of 12.22% during the forecast period.

Answer: North America leads the livestock monitoring market with approximately 28% share, driven by advanced technology adoption in commercial dairy and beef operations. Asia Pacific represents the fastest-growing region with expanding livestock production.

Answer: Health monitoring represents the largest application segment, followed by milking management and breeding management, as farmers prioritize early disease detection and productivity optimization. Behavioral monitoring shows the fastest growth rate as welfare regulations tighten.

Answer: Bovine cattle dominate with over 47% market share due to economic importance of dairy and beef production globally. Poultry segment exhibits fastest growth driven by large-scale commercial operations and automation requirements.

Answer: Artificial intelligence enables predictive health analytics and early disease detection, while IoT connectivity facilitates real-time monitoring across distributed farm locations. These technologies reduce labor requirements and improve decision-making accuracy for modern livestock operations.