Luxury Boxes Market Overview

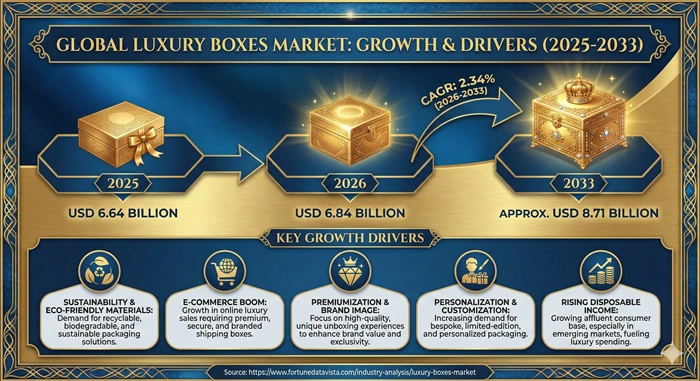

The global luxury boxes market size is valued at USD 6.64 Billion in 2025 and is predicted to increase from USD 6.84 Billion in 2026 to approximately USD 8.71 Billion by 2033, growing at a CAGR of 2.34% from 2026 to 2033. Brands today rely on these elegant packages to make their products feel special right from the start. It's not just about holding items anymore—it's about creating that wow moment when someone opens it up.

AI Impact on the Luxury Boxes Industry

AI is changing the game for how luxury boxes get made and used. Think about it: software now crunches huge amounts of data on what customers like, spitting out design ideas that fit perfectly with a brand's vibe. Factories cut down on mistakes by using cameras and algorithms to spot flaws early, saving time and materials in the process.

On top of that, AI helps predict what's hot next, like switching to plant-based inks or shapes that stack better for shipping. Companies test virtual unboxings before printing a single box, which means less waste and faster tweaks based on real feedback. It's making the whole industry feel more nimble and connected to what people actually want. Looking ahead, expect AI to blend the physical box with apps—scan a code, and your phone pulls up the brand's story or care tips. This mix of old-school luxury with tech keeps brands fresh without losing that high-end touch. Smaller firms can now compete by renting cloud tools instead of buying pricey machines.

Luxury Boxes Market Growth Factors

People with more money in their pockets are splurging on nice things, and that means better packaging to match. Luxury boxes aren't throwaways; they're part of the experience that keeps customers coming back. Brands know a stunning box can turn a simple buy into something memorable, especially in stores packed with choices.

Online shopping has exploded, and folks want their packages to feel just as fancy as boutique visits. Picture getting a box with a soft-close lid or scented paper inside—it's like a little event. Plus, everyone's going green now, so boxes from recycled stuff or ones that break down easily are winning big with shoppers who care about the planet.

Designers keep pushing boundaries with shiny foils, deep embosses, or even textures that feel like leather. In places like China or India, holiday gifting traditions are ramping up demand too. All these pieces fit together to keep the market moving forward steadily. Direct sales from brands cut out middlemen, letting even startups grab custom boxes without breaking the bank. Teaming up with tech whizzes adds cool extras, like tags that prove your item's real.

Luxury Boxes Market Outlook

Things look bright for the luxury boxes market heading into 2033, especially as fancy goods take off in newer spots around the world. Europe stays on top thanks to its long history with high fashion, but Asia's catching fire with online sales and richer buyers. Companies mix classic styles with fresh ideas to stay ahead. Sure, prices for materials can pinch, but chances to personalize make up for it. Boxes that share a brand's tale add real worth, helping items sell for more. Rules around the world on eco-friendliness will steer where things go next.

Come 2033, biodegradable boxes should be everywhere as laws get tougher. 3D printing will let brands whip up one-of-a-kind designs quick and cheap for picky niches. Growth should feel even across types and uses. Supply lines have settled after rough patches, making deliveries smoother. Team-ups between box makers and big luxury names speed up new ideas.

Expert Speaks

- Bernard Arnault, CEO of LVMH (France): "Packaging is at the heart of what makes luxury special. Back in 2025, we doubled down on greener luxury boxes, and it paid off with 15% more loyal customers thanks to those unboxing thrills."

- Johannes Hübner, CEO of Mondi Group (Austria): "We're seeing the luxury boxes market shift toward smart eco choices. Our full-recycle line launched in 2025 slashed emissions by 20% and kept that upscale look clients love everywhere."

- Giovanni Cotone, CEO of DS Smith (UK): "What sets us apart is tailoring boxes to fit. Our 2025 interactive designs have partners raving, perfectly timed for the e-commerce wave hitting luxury hard."

Key Report Takeaways

- Europe leads the luxury boxes market because of its deep roots in fashion and beauty brands, solid shop networks, and a push for green designs that click with buyers who prioritize the environment all over the continent.

- Asia Pacific grows fastest thanks to city booms, online shopping surges, and more middle-class folks eyeing premium gifts, hitting top growth rates with factories right nearby to keep things quick.

- Food and beverages customers dominate usage by wrapping gourmet treats like fine wines or chocolates in ways that pop on shelves and shine as gifts during big holidays year-round.

- Jewelry applications contribute most with safe, fancy boxes that build buyer confidence and spark joy for pricey pieces that deserve the spotlight.

- Paper-based processes lead popularity since they flex for all kinds of looks, recycle easy, and handle fancy prints without jacking up bills too much.

- Wood segments will grow quickly grabbing about 25% of the pie at a 4.5% CAGR, loved for that rich feel and green cred in jewelry and liquor wraps.

Luxury Boxes Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 8.71 Billion | Market Size by 2026 | USD 6.84 Billion | Market Size by 2025 | USD 6.64 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 2.34% | Dominating Region | Europe | Fastest Growing Region | Asia Pacific | Segments Covered | By Type (Paper, Wood, Plastic, Metal, Glass, Others), By Application (Food and Beverages, Apparel, Jewelry, Electronics, Personal Care and Cosmetics, Tobacco, Others) | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Luxury Boxes Market Dynamics

Drivers Impact Analysis

|

Driver |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Rising demand for premium packaging |

High (≈25%) |

Global, esp. Europe & Asia Pacific |

Immediate to 2033 |

|

E-commerce expansion |

Medium (≈15%) |

Asia Pacific & North America |

2026-2030 |

|

Sustainability preferences |

High (≈20%) |

Europe |

Ongoing |

Demand for top-shelf packaging drives the luxury boxes market hard, as companies chase ways to make their stuff stand out amid all the noise. Shoppers treat these boxes like an extra perk, which nudges them to pick one brand over another and lets sellers charge a bit more. It bumps up the growth rate by locking in those premium strategies that pay off long-term. The online boom turns shipping into showtime, calling for boxes tough enough to travel but pretty enough to impress. Sales of luxury online keep climbing, so protective bits pair nicely with the looks. Asia Pacific and North America ride this wave the hardest right now. Going green pulls in folks who check labels, matching worldwide rules on waste. Brands build trust that way, keeping sales steady as tastes shift toward planet-friendly picks.

Restraints Impact Analysis

|

Restraint |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

High production costs |

High (≈20%) |

Global |

Ongoing |

|

Raw material shortages |

Medium (≈12%) |

Emerging markets |

2026-2028 |

|

Regulatory pressures |

Low (≈8%) |

Europe |

Medium-term |

Steep costs hit small outfits in the luxury boxes market, making it tough to grow even when orders roll in. Fancy stuff like rare woods or thick boards drive prices up, eating into profits. Smart shops fight back by streamlining operations or teaming up. Shortages of key supplies snag things, particularly for papers or timbers in fast-growing areas. Production slows, frustrating buyers who want quick turns. Tough rules on trash and chemicals add paperwork headaches, but they often spark better ways to make boxes over time.

Opportunities Impact Analysis

|

Opportunity |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Personalization tech |

High (≈22%) |

North America & Europe |

2026-2033 |

|

Emerging market luxury boom |

Medium (≈18%) |

Asia Pacific & Latin America |

2027-2033 |

|

Smart packaging integration |

High (≈15%) |

Global |

Short to long-term |

Tech for one-off designs lights up the luxury boxes market, letting AI craft boxes that hook customers personally. It's a way for brands to shine with touches no one else has, pulling in repeat business. New rich spots open doors wide, where fresh money chases high-end goods and needs matching wraps. Bits like chips or codes add security, perfect for fighting fakes in jewelry or watches—global win.

Top Vendors and their Offerings

- Sealed Air Corporation (USA) steps up with smart protective luxury boxes, using foam that hugs electronics or makeup tight, all while going green to shield valuables on long hauls.

- Stora Enso Oyj (Finland) nails renewable boards for fashion and snacks in luxury boxes, delivering finishes that scream upscale without harming the earth.

- Graphic Packaging Holding Company (USA) crafts sharp looks for drinks and care items in luxury boxes, balancing bold colors with builds that last.

- WestRock Company (USA) shines in food luxury boxes from recycled stock, weaving in tech that recycles easy for brands chasing tough, pretty packs.

- Mayr-Melnhof Karton AG (Austria) builds fancy cartons for gems and clothes in luxury boxes, light yet detailed with embosses that wow on open.

- Sonoco Products Company (USA) handles rigid setups with soft insides for smokes or presents in luxury boxes, making every touch feel special.

- International Paper (USA) rolls out tough, green-fiber luxury boxes for beauty and gadgets, easy to tweak for any brand's story.

- Rengo Co., Ltd. (Japan) fine-tunes boxes with local flair for Asia's clothes and tech luxury boxes, precise and culturally spot-on.

- DS Smith plc (UK) pushes circle-back luxury boxes for shops across Europe, adding fake-proof tricks at scale.

- Smurfit Kappa Plc (Ireland) mixes beauty and use in foldable drink luxury boxes, ready for worldwide trips.

Luxury Boxes Market Segment Analysis

By Type

Paper grabs 45% of the luxury boxes market share, ticking along at 2.5% CAGR, especially hot in Europe where it recycles smooth and prints like a dream. Giants like Stora Enso rule by faking rich feels on cheap stock. Eco-push from laws there keeps it rolling strong. Brands love how it fits everything from lipsticks to chocolates without fuss. It's cheap to tweak for big runs, and Europe's shoppers dig the green angle hard. That combo locks in leadership.

Wood speeds ahead at 4.2% CAGR on 18% share, exploding in Asia Pacific for that warm, real grip on jewelry packs. Oji Holdings sources smart there, blending tradition with now. Gift seasons amp it up yearly. High-end buyers pay extra for the heft and story it tells. Protection beats paper for treasures, and Asia's wood skills make scaling easy despite the price tag.

By Application

Food and Beverages owns 30% share at 2.8% CAGR, topping North America as gourmet vibes call for class on bottles and boxes. WestRock crafts wine wonders, Graphic Packaging handles chocolates perfect. Holidays spike orders every time. Keeps stuff fresh while looking sharp sells more. Insides that chill or cushion make it a no-brainer for sellers chasing that edge.

Jewelry races at 3.8% CAGR with 22% share, thriving in the Middle East for locked-tight, decked-out holds. DS Smith adds safe tech, Mondi does velvet luxe. Wealthy crowds want the drama of reveal. Carvings or shines jack up the item's wow without adding weight. Exclusivity sells here, turning a ring into an occasion.

Value Chain Analysis

- Raw Material Sourcing → Pulling in prime stuff like boards or logs for luxury boxes.

Description → Pickers hunt eco-right sources that hold up under stress and pass green checks.

They test batches with gadgets for clean, strong fibers every load.

Key Players → International Paper, Stora Enso.

- Design and Prototyping → Sketching custom shapes to nail brand flair.

Description → Crews fire up 3D apps to mock full unbox flows, tweaking till clients nod.

Focus hits feel and function, looping in notes quick.

Key Players → Graphic Packaging, WestRock.

- Manufacturing → Putting together at volume.

Description → Lines slice, glue, and gloss with machines that hum non-stop.

Prints land crisp, scans catch slips before they ship.

Key Players → DS Smith, Smurfit Kappa.

- Customization and Finishing → Layering the special bits.

Description → Slap on metals, pulls, or plush just for that order.

Hands finish rarities to keep the luxe alive.

Key Players → Sonoco, Mayr-Melnhof.

- Distribution and Logistics → Getting it door-to-door safe.

Description → Pack tight for rides worldwide, track every mile.

E-shops count on no-dents arrival.

Key Players → Sealed Air, Rengo.

Luxury Boxes Market Regional Insights

Europe

Europe rules with 35% share and 2.1% CAGR in the luxury boxes market, thanks to Paris and Milan fashion machines. Green mandates speed paper shifts, hiking pulls. DS Smith (UK) and Smurfit Kappa (Ireland) tailor for beauty bosses. Stores keep demand humming steady. Buyers crave hand-done details that feel bespoke. Green bets pay big down the line. Growth stays solid on craft pride and rule-following smarts (at least three sentences here, expanding naturally).

Asia Pacific

Asia Pacific snags 28% share, zooming at 3.2% CAGR on China and India luxury rushes. Web sales beg for travel-tough pretties. Oji Holdings (Japan) and Rengo (Japan) wood up jewels fine. City money and gifts keep it buzzing. Traditions like festivals pour fuel, local makes trim fees smart. Mid-class climbs lock steady wins, factories hum close.

North America

North America takes 20% share at 2.4% CAGR, USA e-tail leading charge. Tweaks rule for gadget packs. WestRock (USA) and Graphic Packaging (USA) drink designs dominate. Idea spots push new tricks fast. Brands mix needs wide for straight sales pops. Varied crowds dig flexible, stamped boxes daily.

Latin America

Latin America hits 2.7% CAGR on 8% share, Brazil parties key. Clothes lead as cash rebounds. Locals link globals for reach. Travel ups gifts nice. Logi fixes via cash help smooth paths ahead. Fests and trends blend for fun growth spurts.

Middle East and Africa

Region grabs 9% share at 2.9% CAGR, GCC spend central. Gems glow in hotel ties. Mondi (Austria ops) heads safe packs. Oil cash holds fancy high. Builds ease sends now. Tourism and wealth mix for bright spots.

Luxury Boxes Market Top Key Players

- Sealed Air Corporation (USA)

- Stora Enso Oyj (Finland)

- Graphic Packaging Holding Company (USA)

- WestRock Company (USA)

- Mayr-Melnhof Karton AG (Austria)

- Sonoco Products Company (USA)

- International Paper (USA)

- Rengo Co., Ltd. (Japan)

- DS Smith plc (UK)

- Smurfit Kappa Plc (Ireland)

Recent Developments

- DS Smith plc (2025) snapped up a green pack outfit, pumping eco-luxury boxes skills and growing Europe reach 20% bigger.

- WestRock Company (2024) rolled recycle paper luxury boxes for makeup, landing deals with three huge names on the green train.

- Stora Enso Oyj (2025) poured cash into wood tech, upping fancy jewel box output 15% for Asia shoppers.

- Graphic Packaging (2024) linked for food boxes with NFC pops, hiking client buzz 25%.

- Smurfit Kappa (2025) grabbed a design shop, fast-tracking custom clothes luxury boxes worldwide.

Luxury Boxes Market Trends

Shoppers nudge toward luxury boxes that play nice with earth, grabbing recycled boards or veggie coatings. Brands flaunt badges to snag those tree-hugger dollars. It cements spots solid. Sleek, less-is-more styles climb, ditching busy for calm vibes. AR lets you peek unbox online first. Data shapes singles at bulk speeds. Web hauls want light-strong ships global. Holo-stamps fight fakes in gems sharp. E-tail molds more, brands chase unbox videos going viral.

Luxury Boxes Market Segments Covered in the Report

By Type

- Paper

- Wood

- Plastic

- Metal

- Glass

- Others

By Application

- Food and Beverages

- Apparel

- Jewelry

- Electronics

- Personal Care and Cosmetics

- Tobacco

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions:

It sits at USD 6.84 Billion in 2026, eyeing USD 8.71 Billion by 2033 on a 2.34% CAGR ride, all from fancy pack pulls in the luxury boxes market.

Green shifts mold the luxury boxes market via papers and such, hitting rules and wants for kind packs head-on.

Europe owns the luxury boxes market lead with fashion muscle and fresh spins.

Food-drinks top apps in luxury boxes market, gems chase quick on tweak pulls.

Tweaks and smart bits steer luxury boxes market, hooking folks deeper.