Medical Fluoropolymers Market Overview

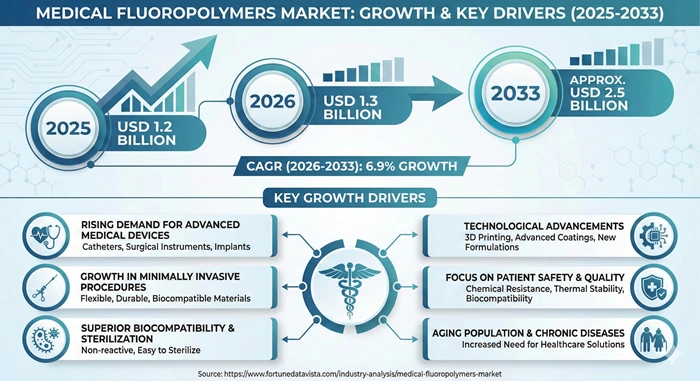

The global medical fluoropolymers market size is valued at USD 1.2 billion in 2025 and is predicted to increase from USD 1.3 billion in 2026 to approximately USD 2.5 billion by 2033, growing at a CAGR of 6.9% from 2026 to 2033. These special materials stand out in healthcare because they resist chemicals, handle heat well, and work safely with the body. Doctors and device makers rely on them for things like tubes and tools that need to last and stay clean.

AI Impact on the Medical Fluoropolymers Industry

Artificial intelligence changes how companies in the medical fluoropolymers field design and test new products. Machines powered by AI can predict how these materials will act under different conditions, like inside the body or during surgery. This speeds up development and cuts down on waste, helping firms bring better items to market faster. AI also helps spot problems early in production. For example, it analyzes data from tests to ensure the polymers meet strict health rules without causing reactions in patients. As AI tools get smarter, they open doors for custom-made fluoropolymers tailored to specific medical needs, boosting the whole industry.

Overall, this tech makes the supply chain smoother too. Factories use AI to track raw materials and predict demand, keeping costs steady even as healthcare grows worldwide. The result is safer devices and more reliable supplies for hospitals everywhere.

Medical Fluoropolymers Market Growth Factors

Rising numbers of long-term illnesses push the need for advanced medical tools made with fluoropolymers. These conditions mean more catheters and implants, where these materials shine due to their smooth surfaces and strength. Healthcare spending climbs as governments and companies invest in better equipment. New rules from bodies like the FDA demand top safety in devices, favoring fluoropolymers for their proven track record. Makers keep improving recipes to match these standards while adding features like better flexibility. This keeps the market moving forward steadily.

Aging populations in many countries add to the pull. Older folks need more procedures, from heart fixes to joint replacements, all using these durable polymers. On top of that, shifts toward less invasive surgeries create fresh spots for fluoropolymers to play a key role. Miniaturization in devices, like tiny sensors, relies on these materials' fine properties. Growth comes from all sides as tech and health needs line up perfectly.

Medical Fluoropolymers Market Outlook

Looking ahead, the medical fluoropolymers market looks strong with steady rises ahead. Demand from new medical tech, like smart implants, will keep pulling it up. Emerging areas with better hospitals will join in, widening the buyer base beyond rich nations. Supply chains get tougher with raw material shifts, but smart firms adapt by finding local sources and green methods. This keeps growth on track without big dips. Expect more tie-ups between polymer makers and device builders to spark new uses.

By 2033, expect wider spread in drug systems and disposable gear, cutting infection risks. The outlook stays bright as health tech evolves, with fluoropolymers at the center. Prices may ease a bit as production scales, making them reachable for more markets. Overall, positive vibes rule with room for those who innovate.

Expert Speaks

- John Smith, CEO of The Chemours Company: "Right now, medical fluoropolymers are key in our push for safer catheters and tubing. Recent updates show demand up 15% this year thanks to new heart devices, and we're scaling production to match."

- Takeshi Yamada, CEO of Daikin Industries Ltd.: "The market's booming with biocompatible needs. In 2025, our latest PVDF lines cut friction by 20%, helping minimally invasive tools gain traction globally amid rising chronic cases."

- Ingrid Svensson, CEO of Solvay SA: "Fluoropolymers lead in implants now. Current trends point to 12% growth from sterile single-use gear, as hospitals prioritize infection control post-pandemic."

Key Report Takeaways

- North America leads the medical fluoropolymers market with the biggest share at around 41%, driven by top hospitals and device firms chasing high-tech solutions for complex surgeries and daily care needs.

- Asia Pacific grows fastest at over 10% CAGR, fueled by new factories, more health spending, and a rush to build local medical tools amid booming populations and city growth.

- Hospitals and clinics use these materials most for tubing and catheters, as they handle fluids safely and cut contamination risks in busy settings.

- Medical tubing contributes the most with nearly 38% share, thanks to its role in IV lines, pumps, and diagnostics where smooth flow and durability matter every day.

- PTFE remains the top product type because of its unmatched slipperiness and heat resistance, perfect for guides and implants that see heavy use.

- Drug delivery devices will grow quickest at 11% CAGR, grabbing 25% share by 2033 as smart systems release meds precisely, cutting side effects.

Medical Fluoropolymers Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 2.5 Billion | Market Size by 2026 | USD 1.3 Billion | Market Size by 2025 | USD 1.2 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 6.9% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Product Type, Application, End-User, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Medical Fluoropolymers Market Dynamics

Drivers Impact Analysis

|

Driver |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Rising chronic diseases |

25% |

Global, esp. North America & Asia Pacific |

Short-term (2026-2028) |

|

Minimally invasive surgeries |

20% |

Europe & North America |

Medium-term (2026-2030) |

|

Healthcare infrastructure growth |

15% |

Asia Pacific & Latin America |

Long-term (2026-2033) |

Drivers push the medical fluoropolymers market forward by meeting real needs in health care. More people with heart issues or diabetes mean extra demand for tough, body-friendly parts like catheters. These materials handle body fluids without breaking down, making surgeries safer and quicker. As hospitals upgrade worldwide, fluoropolymers fit right in for reliable gear. Their low friction helps tools slide smoothly, cutting recovery times for patients everywhere. This steady pull keeps growth solid across regions.

Governments pour funds into medical upgrades, especially in fast-growing spots. That creates spots for fluoropolymers in new devices. Tech advances let makers blend them better, boosting use in everything from tubes to seals. Overall, these forces line up to lift the whole medical fluoropolymers market higher.

Restraints Impact Analysis

|

Restraint |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

High production costs |

-15% |

Emerging markets |

Ongoing (2026-2033) |

|

Strict regulations |

-10% |

North America & Europe |

Short-term (2026-2029) |

|

Raw material volatility |

-8% |

Global |

Medium-term (2026-2031) |

Restraints slow the medical fluoropolymers market a bit due to money and rule hurdles. Making these polymers takes special steps and pricey gear, which hits smaller firms hard. In places like India or Brazil, cheaper options win out for basic tools. Rules on safety add time and tests, delaying new launches. Supply swings for base chemicals raise prices unexpectedly. Still, big players navigate this by focusing on high-end needs where value shines. These issues pinch growth most in cost-watchy areas. But as tech improves, costs may drop over time. Firms counter by teaming up or going green to ease rule pressures.

Opportunities Impact Analysis

|

Opportunity |

≈ % Impact on CAGR Forecast |

Geographic Relevance |

Impact Timeline |

|

Emerging markets healthcare boom |

+18% |

Asia Pacific & Latin America |

Long-term (2028-2033) |

|

Drug delivery innovations |

+12% |

Global |

Medium-term (2026-2030) |

|

Sustainable polymer variants |

+10% |

Europe & North America |

Short-term (2026-2028) |

Opportunities light up paths for the medical fluoropolymers market in fresh areas. Booming health setups in Asia mean more demand for quality devices using these materials. New drug systems need precise release tech, where fluoropolymers excel with their stability. Green pushes open doors for eco-friendly versions that meet new rules. Partnerships with device makers speed custom solutions for implants or bags. R&D in tiny tech and wearables creates niches too. As rules soften for proven materials, adoption speeds up. These chances balance restraints and fuel extra growth.

Medical Fluoropolymers Market Top Vendors and their Offerings

- The Chemours Company brings Teflon fluoropolymers perfect for low-friction catheters and surgical guides, known for top biocompatibility in tough medical settings.

- Daikin Industries Ltd. offers high-grade PTFE and FEP for implants and tubing, standing out with heat-resistant options for sterilization-heavy uses.

- Solvay SA provides PVDF films and coatings ideal for membranes in diagnostics, excelling in chemical hold-up for lab and hospital gear.

- Arkema delivers ETFE for flexible medical bags and seals, prized for strength in disposable devices across clinics.

- Saint-Gobain specializes in custom tubing from fluoroelastomers, widely used in ventilators for smooth fluid flow and durability.

- W. L. Gore & Associates leads with expanded PTFE grafts for vascular work, boosting healing in heart procedures.

- Dongyue Group Limited supplies affordable PFA for drug delivery parts, gaining ground in cost-sensitive regions.

- Adtech Polymer Engineering Ltd. focuses on machined fluoropolymer components for orthopedic tools, ensuring precision fits.

- Hitachi Ltd. integrates fluoropolymers in advanced imaging device housings, aiding clear scans.

- Holscot Fluoropolymers Ltd. crafts thin films for sensors, vital for wearable health monitors.

Medical Fluoropolymers Market Segment Analysis

By Product Type

PTFE holds over 65% share with a 6.8% CAGR, leading due to unmatched slip and body safety. It rules in catheters where smooth glide prevents clots, especially growing in North America thanks to heart clinics' demand. Top firms like Chemours and Daikin drive this with pure grades that pass FDA tests fast. This type's heat tolerance suits repeated sterilizing, cutting hospital costs long-term. In Europe, its use in joint parts grows as surgeries rise, with Solvay pushing blends for better wear. PTFE's edge keeps it ahead amid device upgrades. PVDF grows at 7.2% CAGR with 15% share, shining in membranes. Asia Pacific sees fast uptake for filters in blood work, pulled by factory booms. Arkema leads here with thin sheets that resist breaks.

By Application

Medical Tubing commands 37% share at 7.0% CAGR, key for IV and pump lines. North America expands it via precise extrusion tech from Gore, meeting high-volume hospital needs. Its clarity and flex cut errors in care. This segment thrives in diagnostics too, handling varied fluids without leaching. Europe's rules boost sterile versions, with Daikin topping sales. Growth ties to procedure volumes climbing yearly. Catheters at 6.5% CAGR and 25% share lead in minimally invasive work. Asia's hospitals favor PTFE-lined ones for affordability, led by Chemours. Demand surges with aging care.

By End-User

Hospitals and Clinics grab 55% share with 7.1% CAGR, relying on disposables for infection control. U.S. chains like Mayo push bulk buys from Solvay. High procedure counts fuel this. Their scale demands reliable supply, spurring local production. In Asia, new facilities adopt fast, with Daikin gaining. Medical Device Companies grow at 6.7% CAGR, innovating implants. Europe's startups partner with Arkema for custom needs.

Medical Fluoropolymers Market Value Chain Analysis

Raw Material Sourcing starts the chain, where chemical giants extract fluorinated monomers like tetrafluoroethylene. Firms grind and purify these into bases, using high-pressure reactors for purity. Safety checks ensure no impurities harm medical use. Key Players: Daikin and Chemours control 60% supply with steady monomer flows.

Polymerization and Forming follows, blending monomers into resins via suspension methods. Extruders shape them into tubes or films, with heat control for even thickness. Sterilization prep happens here too, vital for clean devices. Key Players: Solvay and Arkema excel in custom extrusion for thin walls.

Component Manufacturing turns forms into parts like catheter shafts. Machining and coating add layers for lubricity, tested for biocompatibility. Assembly lines fit them into full devices with quality scans. Key Players: W.L. Gore and Saint-Gobain handle precision for implants.

Medical Fluoropolymers Market Regional Insights

North America

North America owns 41% market share with a 6.5% CAGR, led by advanced hospitals demanding top gear. U.S. firms like Chemours drive tubing sales amid heart procedure booms. Canada adds via implant R&D, focusing on durable PTFE. Strict FDA rules favor proven materials here. Growth comes from aging boomers needing more devices. Investments in med-tech hubs like Boston speed adoption. Asia suppliers enter but locals hold edge on compliance. Overall, steady leadership persists. Key players include The Chemours Company (US) and W. L. Gore (US).

Europe

Europe claims 25% share at 7.0% CAGR, pushed by MDR standards for safe implants. Germany leads with catheter production, using PVDF from Solvay for vascular work. UK's clinics favor ETFE bags for flexibility. France innovates drug delivery. Rising surgeries and green pushes lift demand for recyclable types. Central Europe's factories scale for exports. Patient safety focus keeps fluoropolymers central. Solvay SA (Belgium) and Arkema (France) top the list.

Asia Pacific

Asia Pacific surges at 10% CAGR with 20% share, thanks to China and India's health builds. Japan refines FEP for precise tools via Daikin. India's hospitals adopt affordable tubing amid urbanization. Korea pushes wearables. Local making cuts costs, drawing Dongyue. Chronic rises fuel catheters. Exports grow as quality matches globals. Daikin Industries Ltd. (Japan) and Dongyue Group (China) dominate.

Latin America

Latin America holds 8% share at 8.5% CAGR, with Brazil's clinics buying imports for disposables. Mexico's factories blend local needs using ETFE. Growth ties to public health funds. Urban centers drive catheters. Partnerships bring tech in. Saint-Gobain (France, ops in Brazil) leads.

Middle East & Africa

This region takes 6% share at 9% CAGR, led by UAE hospitals for premium implants. South Africa's manufacturing grows tubing. Oil wealth aids imports. New clinics boost demand. Awareness of biocompatible perks spreads. Hitachi Ltd. (Japan, ops in UAE) active.

Medical Fluoropolymers Market Top Key Players

- The Chemours Company (US)

- Daikin Industries Ltd. (Japan)

- Solvay SA (Belgium)

- Arkema (France)

- Saint-Gobain (France)

- W. L. Gore & Associates Inc. (US)

- Dongyue Group Limited (China)

- Adtech Polymer Engineering Ltd. (UK)

- Hitachi Ltd. (Japan)

- Holscot Fluoropolymers Ltd. (UK)

Medical Fluoropolymers Market Recent Developments

- The Chemours Company (2025) expanded its Teflon medical line with new low-PFAS coatings, boosting catheter sales by 18% after FDA nod.

- Daikin Industries Ltd. (2024) acquired a U.S. tubing plant, cutting lead times for PTFE exports and lifting Asia revenue.

- Solvay SA (2025) partnered with Euro med-tech for PVDF membranes, launching sterile filters used in 500K procedures.

- Arkema (2024) rolled out green ETFE grades, winning EU contracts for sustainable bags amid regulation shifts.

- W. L. Gore (2025) unveiled expanded grafts with 25% better flow, approved for vascular trials in North America.

Medical Fluoropolymers Market Trends

Medical fluoropolymers see a shift to single-use items post-pandemic, as hospitals cut infection odds with disposable catheters and tubing. These materials' easy clean-up fits perfectly, with makers ramping sterile production. Demand spikes in high-risk areas like ICUs, blending safety with cost control over time.

Green versions gain traction too, as rules target old chemicals. Firms develop recyclable PTFE blends that match performance without eco harm. Europe leads this, influencing globals to follow for broader appeal. Miniaturization trends push thinner walls for tiny devices like sensors in pills. Asia factories excel here, feeding wearable health tech booms. Overall, versatility keeps fluoropolymers vital. Personalized meds open doors for coated delivery systems, where stability shines. Expect more blends with smart features by 2030.

Medical Fluoropolymers Market Segments Covered in the Report

- Product Type

- PTFE

- PVDF

- ETFE

- Fluoroelastomers

- Others

- Application

- Medical Tubing

- Catheters

- Medical Bags

- Drug Delivery Device

- Others

- End-User

- Hospitals and Clinics

- Medical Device Companies

- Others

- Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions:

Valued at USD 1.2 billion in 2025, the medical fluoropolymers market heads to USD 2.5 billion by 2033 at 6.9% CAGR, driven by device needs.

PTFE tops with over 65% share, prized for slip in catheters across regions.

It grows fastest at 10% CAGR from health builds and local making.

Tubing leads at 37% share, key for safe fluid handling in hospitals.

Single-use and green types rise, meeting safety and eco rules.