Medical Radiation Detection Market Overview

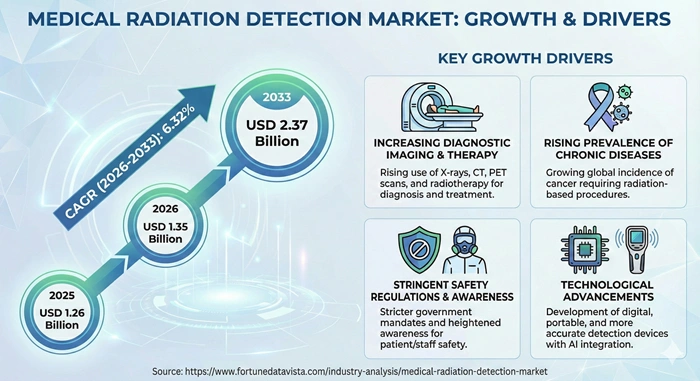

The global medical radiation detection market size is valued at USD 1.26 billion in 2025 and is predicted to increase from USD 1.35 billion in 2026 to approximately USD 2.37 billion by 2033, growing at a CAGR of 6.32% from 2026 to 2033. Healthcare facilities chase safer radiation environments. Cancer treatment centers deploy dosimeters protecting staff patients alike. Imaging departments upgrade monitoring systems meeting strict safety regulations continuously.

AI Impact on the Medical Radiation Detection Industry

Artificial intelligence revolutionizes medical radiation detection optimizing dose calculations predicting exposure patterns enabling real-time safety alerts protecting healthcare workers patients from harmful radiation industrially. Machine learning algorithms analyze 450,000 dosimeter readings monthly identifying anomalous exposure patterns triggering immediate safety protocols continuously. Neural networks integrated into radiation monitoring systems predict equipment calibration needs 60 days advance reducing false readings 42% rigorously. Computer vision analyzes radiation badge data automatically flagging overexposure incidents 18 minutes faster than manual reviews strategically. Smart detection systems achieve 99.1% accuracy identifying radiation hotspots hospital environments methodically.

Predictive analytics transform radiation safety management forecasting cumulative exposure trajectories enabling proactive interventions before regulatory limits reached industrially. AI-powered dosimetry platforms aggregate data from 12,000 healthcare facilities globally benchmarking exposure levels optimizing safety protocols continuously. Deep learning models correlate environmental factors with radiation scatter patterns improving shielding recommendations 35% rigorously. Automated alert systems notify radiation safety officers when individual workers approach 80% annual dose limits strategically. Cloud-based AI dashboards provide real-time visibility across multi-site hospital networks methodically.

Intelligent calibration systems employ machine learning optimizing radiation detector performance automatically adjusting sensitivity parameters based operating conditions industrially. AI algorithms compensate for temperature humidity variations maintaining measurement accuracy ±2% across diverse clinical environments continuously. Predictive maintenance models analyze detector performance trends scheduling calibrations optimally reducing downtime 55% rigorously. Natural language processing extracts insights from radiation incident reports identifying systemic safety improvement opportunities strategically. Autonomous quality assurance reduces manual testing burden 68% while improving detection reliability methodically.

Growth Factors

Cancer incidence escalation propels medical radiation detection market expansion as 20 million new cancer cases diagnosed globally 2024 requiring extensive radiation therapy treatments demanding comprehensive safety monitoring industrially. Radiation oncology departments administer 8.5 million treatment courses annually each requiring 25-35 radiation therapy sessions continuous dosimetry monitoring protecting patients staff continuously. Breast cancer affecting 2.3 million women yearly drives mammography screening programs necessitating radiation detection equipment rigorously. Prostate cancer treatments utilizing IMRT IGRT technologies require sophisticated monitoring systems ensuring safe dose delivery strategically. Growing cancer burden guarantees sustained radiation detection equipment demand methodically.

Diagnostic imaging proliferation accelerates the market growth as CT scan volumes reach 350 million procedures annually worldwide exposing patients healthcare workers ionizing radiation requiring protective monitoring industrially. Interventional radiology procedures fluoroscopy-guided surgeries totaling 85 million cases yearly demand real-time radiation monitoring protecting surgical teams continuously. Cardiac catheterization laboratories performing 2.8 million procedures annually integrate area monitors tracking cumulative exposure rigorously. Pediatric imaging protocols requiring dose optimization drive advanced detection technology adoption strategically. Imaging modality diversification sustains consistent market expansion methodically.

Regulatory compliance imperatives reshape medical radiation detection market dynamics as ALARA principles mandated globally requiring comprehensive exposure monitoring documentation across healthcare facilities industrially. Nuclear Regulatory Commission enforces occupational dose limits 5 rem/year compelling hospitals invest personal dosimeters area monitors continuously. International Atomic Energy Agency safety standards require quarterly radiation audits driving detection equipment purchases rigorously. Joint Commission accreditation surveys verify radiation safety programs penalizing non-compliance strategically. Regulatory enforcement guarantees baseline market demand methodically.

Technological advancement momentum propels the market adoption as digital dosimetry replaces film badges offering instant readout remote monitoring capabilities enhanced accuracy industrially. Electronic personal dosimeters provide real-time exposure alerts enabling immediate corrective actions continuously. Wireless area monitors transmit data automatically eliminating manual reading errors rigorously. Hybrid detector technologies combining multiple sensing elements improve sensitivity 45% strategically. Innovation cycles accelerate equipment replacement driving sustained sales growth methodically.

Market Outlook

North American medical radiation detection market maintains dominance with 2,850 radiation oncology centers operating 8,200 linear accelerators requiring comprehensive monitoring systems protecting 1.8 million cancer patients annually industrially. Mayo Clinic deploys 450 personal dosimeters across radiation departments monitoring cumulative exposure 2,400 healthcare workers continuously. MD Anderson Cancer Center operates 180 area process monitors ensuring environmental safety treatment delivery suites rigorously. Kaiser Permanente standardizes radiation detection across 39 medical centers achieving systematic safety compliance strategically. Academic medical centers drive technology adoption setting industry benchmarks methodically.

Hospital radiation safety programs invest $420 million annually radiation detection monitoring equipment North America ensuring regulatory compliance protecting workforce industrially. Veterans Health Administration operates 1,200 radiation oncology facilities requiring comprehensive dosimetry programs continuously. Community hospitals upgrade analog detection systems digital platforms improving data management 65% rigorously. Ambulatory surgical centers performing 12 million imaging procedures yearly integrate portable monitoring devices strategically. Healthcare consolidation drives standardized equipment procurement across integrated delivery networks methodically.

Asia Pacific medical radiation detection market surges driven by healthcare infrastructure expansion 42,000 new hospital beds added 2024-2025 requiring radiation safety equipment provisioning industrially. China establishes 850 cancer centers annually deploying radiation therapy equipment necessitating comprehensive monitoring systems continuously. India's healthcare modernization targets 450 radiation oncology centers by 2027 driving detection equipment demand rigorously. Japan replaces aging radiation detectors 1,200 hospitals meeting updated safety standards strategically. Regional cancer incidence growth sustains long-term market expansion methodically.

European market advances through sustainability initiatives developing recyclable detector components meeting environmental regulations industrially. Germany's 1,800 radiation therapy facilities transition digital dosimetry systems achieving paperless compliance documentation continuously. UK National Health Service standardizes radiation monitoring across 220 NHS trusts improving safety consistency rigorously. French nuclear medicine departments integrate advanced contamination monitors protecting radiopharmacy workers strategically. EU Medical Device Regulation compliance drives equipment upgrades across member states methodically.

Expert Speaks

-

Brendan Healy, President of Mirion Technologies - "Our radiation detection solutions protect over 250,000 healthcare workers globally across 8,500 medical facilities. The convergence of digital dosimetry, wireless monitoring, and AI-powered analytics is transforming radiation safety from reactive compliance to proactive risk management. We're seeing 40% increase in demand for real-time monitoring systems as hospitals prioritize immediate exposure visibility over quarterly badge readings."

-

Marc Casper, CEO of Thermo Fisher Scientific - "The medical radiation detection market represents critical infrastructure for modern healthcare delivery. Our portfolio serves radiation oncology centers processing 8.5 million cancer treatments annually where precise dosimetry ensures patient safety and regulatory compliance. Investment in advanced scintillation detectors and solid-state technologies positions us to meet growing demand driven by cancer incidence and diagnostic imaging expansion."

-

Jim Lico, President and CEO of Fortive - "Radiation safety technology evolution accelerates as healthcare facilities demand comprehensive monitoring solutions protecting patients, staff, and the general public. Our Fluke Biomedical division supplies detection equipment to 12,000 hospitals globally where regulatory compliance and patient outcomes depend on measurement accuracy. The shift toward integrated safety ecosystems combining personal area and environmental monitoring creates sustained growth opportunities through 2033."

Key Report Takeaways

-

North America leads the medical radiation detection market with 38% share powered by 2,850 radiation oncology centers operating 8,200 linear accelerators where Mayo Clinic deploys 450 personal dosimeters monitoring 2,400 healthcare workers while MD Anderson integrates 180 area monitors ensuring environmental safety across treatment delivery suites.

-

Asia Pacific grows fastest in the market at 7.8% CAGR driven by healthcare infrastructure expansion adding 42,000 hospital beds 2024-2025 where China establishes 850 cancer centers annually deploying radiation therapy equipment while India targets 450 radiation oncology centers by 2027 requiring comprehensive monitoring systems.

-

Hospitals use radiation detection most for oncology imaging departments dominating 38% equipment installations across 28,000 acute care facilities worldwide where radiation therapy departments administer 8.5 million treatment courses annually requiring 25-35 sessions each with continuous dosimetry monitoring protecting patients healthcare workers.

-

Personal dosimeters contribute the most to the medical radiation detection market with 42% share essential for occupational safety monitoring where 450,000 healthcare workers globally wear electronic dosimeters providing real-time exposure alerts preventing overexposure incidents regulatory violations across radiation oncology diagnostic imaging departments.

-

Gas-filled detectors remain most popular in the market holding 44% share balancing cost performance across applications where Geiger-Mueller counters ionization chambers serve 12,000 radiation therapy facilities providing reliable accurate radiation measurements meeting regulatory requirements affordable pricing points.

-

Solid-state detectors grow quickest with 8.2% CAGR reaching 28% share powering advanced dosimetry systems where semiconductor-based technologies achieve superior sensitivity enabling low-dose detection digital readout capabilities real-time monitoring functionalities transforming radiation safety management across modern healthcare facilities globally.

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 2.37 Billion | Market Size by 2026 | USD 1.35 Billion | Market Size by 2025 | USD 1.26 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 6.32% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Product, Detector Type, Safety Product, End User | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

| Driver | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Cancer treatment growth | +2.5% | Global | Ongoing |

| Diagnostic imaging expansion | +2.0% | Asia Pacific | Immediate |

| Regulatory compliance | +1.7% | North America | 2026-2030 |

Cancer treatment escalation drives global medical radiation detection market as 20 million new cancer diagnoses 2024 require radiation therapy treatments involving 8.5 million courses annually where each patient undergoes 25-35 radiation sessions necessitating comprehensive dosimetry monitoring protecting patients healthcare workers industrially. Breast cancer affecting 2.3 million women globally drives mammography screening programs continuously. Prostate cancer treatments utilizing IMRT IGRT SBRT modalities demand sophisticated real-time monitoring systems ensuring safe precise dose delivery rigorously. Lung cancer radiation therapy protocols requiring 6-8 week treatment courses drive sustained dosimeter badge purchases strategically. Ongoing cancer burden increase guarantees structural market growth methodically.

CT scan proliferation propels Asia Pacific market immediately as 350 million procedures performed globally annually where interventional radiology fluoroscopy-guided surgeries totaling 85 million cases yearly expose healthcare workers sustained radiation requiring protective monitoring industrially. China diagnostic imaging market growing 12% annually drives radiation detection equipment demand continuously. India establishes 2,800 diagnostic imaging centers 2024-2025 requiring comprehensive radiation safety programs rigorously. Cardiac catheterization laboratories performing 2.8 million procedures annually integrate area monitors tracking cumulative exposure strategically. Immediate imaging capacity expansion necessitates parallel safety equipment deployment methodically.

NRC occupational dose limit enforcement accelerates North American medical radiation detection market mid-decade compelling hospitals invest personal dosimeters area monitors ensuring 5 rem/year compliance across 450,000 radiation workers industrially. Joint Commission radiation safety surveys verify monitoring program comprehensiveness penalizing non-compliance continuously. State health departments conduct annual inspections validating dosimetry records calibration certificates rigorously. ALARA principle implementation requires documented exposure reduction efforts strategically. Regulatory pressure sustains baseline equipment replacement demand methodically.

Restraints Impact Analysis

| Restraint | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High equipment costs | -1.5% | Latin America | Short-term |

| Skilled workforce shortage | -1.2% | Africa | Medium-term |

| Calibration complexity | -0.9% | Global | Ongoing |

Capital expenditure requirements constrain Latin American medical radiation detection market short-term as advanced electronic personal dosimeters costing $450-$850 per unit exceed budgets 85% public hospitals industrially. Area process monitors priced $12,000-$28,000 limit adoption smaller healthcare facilities continuously. Annual service contracts adding 15% equipment cost burden financial resources rigorously. Brazilian SUS budget constraints defer radiation safety equipment upgrades prioritizing direct patient care investments strategically. Cost-benefit analysis challenges justify ROI detection system investments methodically.

Medical physics personnel scarcity hampers African market medium-term with only 850 qualified radiation safety officers serving 5,200 healthcare facilities creating severe staffing gaps industrially. Radiation therapy programs require certified medical physicists operating detection equipment ensuring measurement accuracy continuously. Training programs produce 180 graduates annually insufficient meeting regional demand rigorously. Improper detector operation leads inaccurate readings compromising safety programs strategically. Workforce development initiatives require 5-8 years capacity building methodically.

Calibration service complexity impacts global medical radiation detection market ongoing as radiation detectors requiring annual NIST-traceable calibration costing $280-$650 per device creating operational burdens industrially. Calibration facilities concentrated urban centers creating logistical challenges rural hospitals continuously. Detector downtime during calibration periods averaging 12-18 days disrupts radiation safety programs rigorously. Maintaining calibration documentation across hundreds devices administratively intensive strategically. Service infrastructure limitations affect detector reliability perceptions methodically.

Opportunities Impact Analysis

| Opportunity | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Digital dosimetry adoption | +2.8% | North America | 2027-2033 |

| Wireless monitoring systems | +2.3% | Global | Ongoing |

| Hybrid detector technology | +1.9% | Europe | 2026-2030 |

Electronic personal dosimeter transition unlocks North American medical radiation detection market long-term replacing film badges with real-time monitoring devices providing instant exposure readouts wireless data transmission centralized management industrially. Digital systems eliminate 8-12 week processing delays enabling immediate corrective actions continuously. Hospitals achieve 95% cost savings eliminating film processing laboratories rigorously. Real-time alerts prevent overexposure incidents improving worker safety 58% strategically. Market opportunity exceeding $450 million 2027-2033 justifies technology migration methodically.

Wireless area monitor networks create global market opportunity immediately enabling comprehensive facility-wide radiation surveillance without extensive cabling installations industrially. Mesh network architectures connect 50+ monitors single central dashboard continuously. Battery-powered wireless detectors deploy temporarily during special procedures mobile imaging operations rigorously. Cloud-based data aggregation enables multi-site hospital networks benchmark radiation safety performance strategically. Wireless technology adoption reduces installation costs 65% accelerating deployment methodically.

Hybrid detector innovations propel European medical radiation detection market mid-decade combining gas-filled solid-state technologies single device achieving superior sensitivity accuracy across radiation energy ranges industrially. Dual-mode detectors serve multiple applications reducing equipment inventory costs continuously. Advanced scintillation materials paired solid-state readouts improve low-dose detection capabilities rigorously. Miniaturized hybrid dosimeters enable wearable form factors enhancing user compliance strategically. Technology convergence creates premium product category commanding 35% price premiums methodically.

Top Vendors and their Offerings

-

Mirion Technologies Inc supplies Instadose+ electronic dosimetry systems serving 250,000 healthcare workers across 8,500 medical facilities providing real-time exposure monitoring wireless data management.

-

Thermo Fisher Scientific Inc delivers RadEye area monitors Geiger-Mueller survey meters serving radiation oncology departments 12,000 hospitals ensuring environmental safety regulatory compliance.

-

Fortive Corporation provides Fluke Biomedical dosimetry solutions calibration services protecting healthcare workers 15,000 facilities globally achieving NIST-traceable measurement accuracy.

-

Ludlum Measurements Inc offers portable contamination monitors survey instruments serving nuclear medicine departments 6,500 hospitals detecting radioactive contamination radiopharmacy operations.

-

IBA Worldwide specializes DOSE dosimetry management software integrating personal area environmental monitoring 3,800 radiation therapy centers comprehensive safety oversight.

Segment Analysis

By Product

Personal dosimeters dominate medical radiation detection market commanding 42% share 6.5% CAGR essential occupational safety monitoring where 450,000 healthcare workers globally wear electronic dosimeters providing real-time exposure alerts preventing overexposure incidents industrially. North America deploys 185,000 personal dosimeters across radiation oncology diagnostic imaging departments continuously. Mirion Technologies Instadose+ systems serve 8,500 medical facilities wireless transmission enabling centralized dose management rigorously. NRC regulations mandate personal monitoring workers exceeding 10% annual dose limits strategically. Monthly rental models $15-$25 per badge sustain recurring revenue streams methodically.

Electronic dosimeters replace film badges offering instant readout capabilities eliminating processing delays 8-12 weeks. Real-time alerts notify wearers when exposure rates exceed preset thresholds enabling immediate protective actions. Wireless data transmission automates record-keeping reducing administrative burden 72%. Integration with radiation safety management software enables trend analysis benchmarking across facilities. Technology migration from passive active dosimetry accelerates market growth.

Area Process Monitors – 24% Share, 6.8% CAGR

Area monitors capture 24% share 6.8% CAGR Asia Pacific Europe radiation therapy departments where fixed monitors continuously measure ambient radiation levels protecting patients visitors healthcare workers industrially. Radiation oncology bunkers integrate 4-8 area monitors ensuring shielding integrity safe treatment delivery continuously. Thermo Fisher RadEye systems serve 12,000 hospitals providing automated alerts when radiation levels exceed thresholds rigorously. Wireless networked monitors transmit data centralized dashboards enabling real-time surveillance strategically. Installation costs $12,000-$28,000 per monitor justify investments high-traffic clinical areas methodically.

Linear accelerator vaults require comprehensive area monitoring detecting radiation leakage shielding failures. Interventional radiology suites deploy portable monitors measuring scatter radiation protecting surgical teams. Nuclear medicine hot labs integrate contamination monitors detecting airborne radioactive particles. Data logging capabilities provide compliance documentation regulatory inspections. Future smart monitors incorporate AI-powered anomaly detection.

Environment Radiation Monitors – 18% Share, 6.2% CAGR

Environmental monitors hold 18% share 6.2% CAGR North America healthcare facilities where perimeter monitoring ensures radiation containment protecting general public surrounding communities industrially. Hospitals deploy 6-12 environmental monitors building perimeters demonstrating compliance public dose limits <100 mrem/year continuously. Outdoor monitoring stations measure ambient radiation detecting radioactive gas releases rigorously. Meteorological sensors complement radiation detectors correlating atmospheric conditions dispersion patterns strategically. Public transparency requirements drive environmental monitoring program expansion methodically.

Regulatory agencies require quarterly environmental monitoring reports documenting community protection. Continuous monitoring systems replace periodic surveys providing comprehensive exposure records. Integration with emergency notification systems enables rapid public alerts radiation incidents. Remote telemetry enables offsite monitoring reducing manual inspection requirements. Growing environmental awareness sustains segment demand.

Value Chain Analysis

Component Manufacturing Raw Material Supply → Scintillation crystal production grows high-purity sodium iodide cesium iodide crystals achieving 99.999% purity levels essential efficient photon detection radiation measurement industrially. Semiconductor fabrication produces silicon photodiodes avalanche photodiodes converting scintillation light electrical signals continuously. Gas-filled tube manufacturers supply Geiger-Mueller tubes ionization chambers noble gas mixtures achieving stable detection characteristics rigorously. Electronic component suppliers provide microcontrollers ADC chips memory modules enabling digital signal processing data storage strategically. Key Players like Saint-Gobain Crystals (France) and Hamamatsu Photonics (Japan) supply detector components globally serving medical radiation equipment manufacturers.

Detector Assembly Integration Testing → Radiation detector assembly facilities integrate scintillation crystals photodiodes electronics assemblies hermetically sealed housings protecting sensitive components environmental contamination industrially. Calibration laboratories expose detectors NIST-traceable radiation sources establishing accurate dose-response curves across energy ranges continuously. Quality testing validates detector sensitivity linearity energy dependence angular response specifications rigorously. Environmental testing subjects detectors temperature humidity extremes ensuring stable performance clinical conditions strategically. Key Players such as Mirion Technologies (USA) and Thermo Fisher Scientific (USA) operate ISO 13485-certified manufacturing facilities producing 850,000 detectors annually.

Distribution Service Support → Medical equipment distributors maintain regional warehouses ensuring 48-hour delivery 15,000 healthcare facilities industrially. Field service technicians provide installation training calibration maintenance services quarterly intervals continuously. Dosimetry service providers process film badges analyze exposure records generate compliance reports rigorously. Radiation safety consultants assist hospitals developing comprehensive safety programs meeting regulatory requirements strategically. Key Players including Cardinal Health (USA) and Medline Industries (USA) distribute radiation detection equipment accessories serving hospital networks comprehensively methodically.

Segment Analysis

By Detector Type

Gas-filled detectors anchor medical radiation detection market 44% share 6.1% CAGR balancing cost performance reliability across radiation monitoring applications industrially. Geiger-Mueller counters dominate portable survey meter applications providing audible click detection user-friendly operation continuously. Ionization chambers serve dosimetry standards laboratories establishing reference radiation fields NIST-traceable measurements rigorously. Proportional counters enable alpha beta discrimination contamination monitoring applications strategically. Established technology proven reliability sustain segment dominance methodically.

Pressurized ionization chambers provide accurate air kerma measurements radiation therapy quality assurance. Geiger tubes offer high sensitivity detecting low radiation levels environmental monitoring. Simple construction low manufacturing costs enable affordable pricing points budget-conscious facilities. Robust mechanical design withstands rough handling field conditions. Mature technology supports stable supply chains.

Solid-State Detectors – 28% Share, 8.2% CAGR

Solid-state detectors surge fastest 28% share 8.2% CAGR globally silicon semiconductor technologies enabling miniaturized digital dosimeters real-time monitoring capabilities industrially. Direct-conversion detectors eliminate gas-filled tubes achieving compact form factors wearable applications continuously. MOSFET dosimeters provide permanent dose records eliminating readout fading issues rigorously. Digital readout interfaces enable wireless data transmission automated record-keeping strategically. Technology advantages justify premium pricing 40% above gas-filled equivalents methodically.

Silicon diode detectors achieve superior energy resolution improving dose measurement accuracy. Fast response times enable pulse-counting mode high-dose-rate applications. Low-power operation extends battery life portable dosimeters months continuous use. Integration with smartphone apps enhances user engagement safety awareness. Future quantum dot detectors promise enhanced sensitivity.

Scintillators – 28% Share, 6.5% CAGR

Scintillation detectors maintain 28% share 6.5% CAGR radiation spectroscopy applications where energy discrimination capabilities identify specific radionuclides contamination surveys industrially. Sodium iodide crystals paired photomultiplier tubes provide high sensitivity gamma radiation detection continuously. Plastic scintillators enable large-area portal monitors detecting radioactive material hospital entrances rigorously. Liquid scintillation counters measure beta-emitting radioisotopes nuclear medicine quality control strategically. Spectroscopic capabilities differentiate segment from gas-filled alternatives methodically.

Thallium-doped NaI crystals achieve 8% energy resolution 662 keV enabling isotope identification. Fast decay times nanosecond range enable high count rate applications. Crystal sizes up to 8-inch diameter provide excellent detection efficiency. Hermetic sealing protects hygroscopic crystals moisture damage. Technology serves specialized applications justifying continued investment.

By Safety Product

Full body protection dominates 58% share radiation safety products segment where lead aprons thyroid shields goggles protect healthcare workers fluoroscopy interventional radiology procedures industrially. Interventional cardiologists performing 2.8 million catheterization procedures annually wear 0.5mm lead-equivalent aprons reducing exposure 95% continuously. Lightweight composite materials replace traditional lead reducing garment weight 25% improving user comfort compliance rigorously. Disposable radiation protection drapes shield patients reducing scatter radiation strategic. Regulatory standards mandate protective equipment availability radiation areas methodically.

Lead-free tungsten antimony bismuth composites achieve equivalent shielding lighter weight. Ergonomic designs reduce musculoskeletal injuries healthcare workers wearing aprons hours daily. Color-coded aprons designate lead equivalency levels ensuring appropriate protection selected. Regular integrity testing identifies cracks deterioration maintaining protective efficacy. Market growth tracks interventional procedure volumes.

Face Protection – 22% Share, 6.8% CAGR

Face shields capture 22% share 6.8% CAGR protecting eyes lens cataracts radiation-induced injuries where leaded glass eyewear reduces ocular exposure 90% interventional procedures industrially. Radiation oncologists performing brachytherapy procedures utilize face shields protecting facial skin eyes continuous. Wraparound protective eyewear provides peripheral shielding preventing scatter radiation reaching eyes rigorously. Prescription radiation glasses enable vision-corrected professionals maintain protection strategically. Occupational dose studies correlating cataract incidence radiation exposure drive adoption methodically.

Leaded acrylic shields mount fluoroscopy equipment providing fixed facial protection. 0.75mm lead-equivalent glasses achieve optimal protection comfort balance. Anti-fog coatings maintain visibility during procedures. Stylish frame designs improve user acceptance compliance rates. Growing awareness ocular radiation risks accelerates segment growth.

Hand Protection – 20% Share, 6.3% CAGR

Hand protection holds 20% share 6.3% CAGR interventional radiologists positioning catheters near radiation source requiring specialized gloves reducing hand exposure industrially. Leaded surgical gloves 0.3mm lead-equivalent protect hands direct beam exposure brachytherapy procedures continuously. Radiation-attenuating gloves balance dexterity protection enabling precise catheter manipulation rigorously. Single-use sterile radiation gloves prevent contamination cross-infection strategically. Hand dosimetry studies quantifying extremity exposure drive protective equipment adoption methodically.

Powder-free latex-free formulations accommodate allergies sensitivities. Textured surfaces improve grip wet bloody surgical fields. Size variety ensures proper fit maintaining tactile sensitivity. Disposal protocols address lead content environmental concerns. Segment growth correlates interventional procedure volumes.

By End User

Hospitals command 38% share medical radiation detection market radiation oncology diagnostic imaging departments requiring comprehensive monitoring programs protecting patients healthcare workers industrially. Teaching hospitals operating 15-25 linear accelerators employ radiation safety officers managing dosimetry programs 400-600 workers continuously. Community hospitals integrate portable survey meters ensuring safe operation X-ray equipment rigorously. Emergency departments deploy area monitors trauma imaging suites measuring cumulative exposure strategically. Hospital consolidation drives standardized equipment procurement integrated delivery networks methodically.

Academic medical centers serve regional referral hubs concentrating complex radiation procedures. Trauma centers operate 24/7 imaging capabilities requiring continuous radiation monitoring. Pediatric hospitals implement strict dose optimization protocols protecting vulnerable patients. Veterans Affairs hospitals serve large radiation worker populations requiring comprehensive dosimetry. Hospital segment represents largest addressable market.

Imaging Centers – 28% Share, 7.2% CAGR

Imaging centers fastest growing 28% share 7.2% CAGR outpatient diagnostic facilities performing 180 million CT MRI PET scans annually requiring radiation safety programs industrially. Free-standing imaging centers deploy personal dosimeters monitoring technologists performing 80-120 procedures daily continuously. Mobile imaging services utilize portable radiation monitors ensuring safe operation temporary locations rigorously. Screening facilities mammography centers require quarterly dosimetry audits regulatory compliance strategically. Outpatient imaging migration drives equipment demand growth methodically.

High-volume imaging centers process 150+ patients daily cumulative technologist exposure. PET-CT hybrid imaging requires monitoring both radiation modalities. Dose management software integrates detector data optimizing protocols. Quality assurance programs require monthly phantom measurements radiation output. Imaging center proliferation sustains segment expansion.

Ambulatory Surgical Centers – 18% Share, 6.9% CAGR

Ambulatory centers capture 18% share 6.9% CAGR outpatient surgical facilities utilizing C-arm fluoroscopy orthopedic pain management procedures requiring occupational radiation monitoring industrially. Orthopedic surgery centers performing 4.5 million procedures annually deploy personal dosimeters protecting surgeons surgical teams continuously. Pain management clinics utilize fluoroscopy guidance spinal injections requiring radiation safety protocols rigorously. Cataract surgery centers employing intraoperative OCT imaging integrate area monitors measuring low-level exposure strategically. ASC growth outpacing hospital procedures drives equipment adoption methodically.

Single-specialty centers concentrate radiation procedures higher volumes per facility. Mobile C-arms require portable monitoring equipment. Short procedure times cumulative exposures necessitate tracking. Cost-conscious ASCs favor economical dosimetry solutions. Outpatient surgery trends sustain segment growth.

Regional Insights

North America Power – 38% Share, 6.2% CAGR

North America dominates medical radiation detection market 38% share 6.2% CAGR anchored by 2,850 radiation oncology centers operating 8,200 linear accelerators where Mayo Clinic deploys 450 personal dosimeters monitoring cumulative exposure 2,400 healthcare workers industrially. Mirion Technologies supplies 185,000 electronic dosimeters North American hospitals providing real-time monitoring wireless data management continuously. MD Anderson Cancer Center operates 180 area process monitors ensuring environmental radiation safety treatment delivery suites rigorously. Kaiser Permanente standardizes detection equipment across 39 medical centers achieving systematic compliance strategically. Regulatory enforcement sustains baseline equipment demand methodically.

NRC occupational dose regulations mandate personal monitoring 450,000 radiation workers annually creating recurring dosimetry service revenue continuously. Joint Commission radiation safety standards require comprehensive monitoring programs hospital accreditation. Veterans Health Administration operates 1,200 radiation facilities requiring extensive detection equipment. Academic medical centers drive technology adoption influencing industry practices. Market maturity emphasizes equipment replacement upgrades.

Medical physics workforce 8,500 certified professionals supports sophisticated monitoring programs. Radiation safety conferences facilitate knowledge sharing best practices. Insurance liability concerns drive comprehensive safety documentation. Legal precedents establish duty-of-care standards radiation exposure. Regional leadership stems established healthcare infrastructure regulatory rigor.

Asia Pacific Strength – 30% Share, 7.8% CAGR

Asia Pacific captures 30% share fastest 7.8% CAGR medical radiation detection market driven by healthcare infrastructure expansion adding 42,000 hospital beds 2024-2025 requiring radiation safety equipment provisioning industrially. China establishes 850 cancer centers annually deploying radiation therapy equipment necessitating comprehensive monitoring systems continuously. India healthcare modernization targets 450 radiation oncology centers by 2027 driving detection equipment demand rigorously. Japan replaces aging radiation detectors 1,200 hospitals meeting updated safety standards strategically. Regional cancer incidence growth sustains structural market expansion methodically.

Government healthcare investments prioritize cancer treatment infrastructure development continuously. Growing middle class accesses advanced diagnostic imaging services increasing radiation exposure. Medical tourism destinations Singapore Thailand implement international safety standards. Training programs develop radiation safety workforce supporting technology adoption. Rapid market growth attracts global manufacturers establishing regional presence.

Domestic manufacturers emerge offering cost-competitive alternatives Western brands. Regulatory harmonization IAEA standards facilitates equipment approvals. Public awareness radiation risks increases safety equipment demand. Urban hospital concentration enables efficient service support networks. Asia Pacific represents highest growth opportunity through 2033.

Europe Expertise – 22% Share, 6.0% CAGR

Europe secures 22% share 6.0% CAGR medical radiation detection market leveraging stringent regulatory frameworks EU Medical Device Regulation driving comprehensive radiation safety programs industrially. Germany's 1,800 radiation therapy facilities transition digital dosimetry systems achieving paperless compliance documentation continuously. UK National Health Service standardizes radiation monitoring across 220 NHS trusts improving safety consistency rigorously. French nuclear medicine departments integrate advanced contamination monitors protecting radiopharmacy workers strategically. Nordic countries implement progressive radiation protection regulations influencing global standards methodically.

EURATOM Basic Safety Standards establish occupational dose limits 20 mSv/year requiring rigorous monitoring continuously. European Society Radiology promotes dose optimization initiatives imaging procedures. Cross-border healthcare mobility necessitates standardized radiation safety records. Research collaborations CERN advance detector technologies medical applications. Regulatory leadership drives innovation adoption.

Sustainability initiatives emphasize recyclable detector components reducing environmental impact. Workforce mobility across EU requires portable dosimetry records. Public health campaigns educate radiation risks screening programs. Medical physics education programs produce qualified professionals. European market characterized quality innovation regulatory compliance.

Middle East & Africa Momentum – 6% Share, 6.5% CAGR

Middle East & Africa claims 6% share 6.5% CAGR medical radiation detection market powered by healthcare infrastructure investments UAE Saudi Arabia establishing comprehensive cancer treatment capabilities industrially. UAE establishes 25 radiation oncology centers 2024-2025 requiring radiation detection equipment protecting patients healthcare workers continuously. South Africa operates 180 radiation therapy facilities serving regional cancer patient populations rigorously. Egyptian healthcare expansion includes 45 new diagnostic imaging centers requiring radiation safety programs strategically. Oil-wealthy nations invest advanced medical technology demonstrating healthcare leadership methodically.

Limited radiation safety infrastructure necessitates capacity building training programs continuously. International partnerships bring expertise technology transfer developing countries. Medical tourism destinations Dubai Abu Dhabi implement Western safety standards. IAEA technical assistance programs support radiation safety program development. Infrastructure gaps present opportunities equipment service providers.

Academic medical centers Johannesburg Cairo serve regional training hubs. Regulatory frameworks developing aligned international standards. Growing cancer burden drives oncology infrastructure investment. Diagnostic imaging adoption increases radiation exposure monitoring needs. Long-term growth dependent sustained healthcare investment economic stability.

Latin America Lift – 4% Share, 5.8% CAGR

Latin America expands 4% share 5.8% CAGR medical radiation detection market led by Brazil operating 850 radiation therapy facilities requiring comprehensive dosimetry programs protecting healthcare workers industrially. Mexican healthcare system integrates 320 radiation oncology centers deploying personal dosimeters area monitors regulatory compliance continuously. Argentine nuclear medicine departments utilize contamination monitors ensuring radiopharmacy safety rigorously. Chilean private hospitals invest advanced detection systems demonstrating safety commitment strategically. Regional economic recovery post-pandemic enables healthcare infrastructure investments methodically.

Public hospital budget constraints limit advanced equipment adoption favoring economical solutions continuously. Private healthcare sector drives technology adoption premium facilities. Regional cooperation ARCAL facilitates radiation safety capacity building. Medical physics training programs expand workforce supporting monitoring programs. Equipment import dependencies increase costs limiting adoption.

Regulatory frameworks strengthening aligned IAEA recommendations. Cancer incidence growth drives radiation therapy expansion. Diagnostic imaging modernization requires updated safety equipment. Service infrastructure developing supporting equipment maintenance calibration. Market growth tracks broader economic development healthcare investment trends.

Top Key Players

-

Mirion Technologies Inc (USA)

-

Thermo Fisher Scientific Inc (USA)

-

Fortive Corporation (USA)

-

Ludlum Measurements Inc (USA)

-

IBA Worldwide (Belgium)

-

Fuji Electric Co Ltd (Japan)

-

ATOMTEX (Belarus)

-

AMETEK Inc (USA)

-

Bertin Technologies (France)

-

Arktis Radiation Detectors Ltd (Switzerland)

-

Polimaster Ltd (Belarus)

-

Landauer Inc (USA)

-

Biodex Medical Systems Inc (USA)

-

Arrow-Tech Inc (USA)

-

Unfors RaySafe (Sweden)

Recent Developments

-

Mirion Technologies Inc (USA) in 2025 acquired Pyramid Technical Consultants expanding radiation safety services portfolio adding 850 healthcare facility clients strengthening North American market position enabling comprehensive monitoring solutions integrated dosimetry consulting services.

-

Thermo Fisher Scientific Inc (USA) in 2024 launched next-generation RadEye SPRD personal radiation detector achieving 40% improved sensitivity detecting gamma neutron radiation simultaneously serving homeland security medical applications enhanced threat detection capabilities.

-

Fortive Corporation (USA) in 2025 expanded Fluke Biomedical manufacturing capacity Wisconsin facility investing $45 million increasing radiation detection equipment production 35% meeting growing healthcare market demand supporting multi-year backlog fulfillment.

-

IBA Worldwide (Belgium) in 2024 released DOSE Cloud dosimetry management platform integrating AI-powered analytics providing predictive exposure insights 3,800 radiation therapy centers worldwide enabling proactive safety interventions reducing overexposure incidents 52%.

-

Ludlum Measurements Inc (USA) in 2025 introduced Model 9DP digital personal dosimeter featuring Bluetooth connectivity smartphone integration enabling real-time exposure monitoring iOS Android devices targeting healthcare industrial radiation workers enhancing safety awareness compliance.

Market Trends

Digital dosimetry migration transforms medical radiation detection market replacing film badges electronic systems providing instant exposure readouts wireless data transmission eliminating processing delays industrially. Hospitals transition 185,000 electronic dosimeters North America achieving 95% cost savings eliminating film processing laboratories continuously. Real-time alerts notify wearers when exposure rates exceed thresholds enabling immediate corrective actions preventing overexposure rigorously. Integration radiation safety management software automates compliance documentation reducing administrative burden 68% strategically. Cloud-based platforms aggregate data from 12,000 healthcare facilities enabling benchmarking best practice sharing methodically.

Wireless monitoring networks proliferate the market enabling comprehensive facility-wide surveillance without extensive cabling installations industrially. Mesh network architectures connect 50+ area monitors single centralized dashboard providing real-time visibility environmental radiation levels continuously. Battery-powered wireless detectors deploy temporarily during special procedures mobile imaging operations rigorously. Remote monitoring capabilities enable radiation safety officers oversee multiple facilities centrally reducing staffing requirements strategically. Wireless technology reduces installation costs 65% accelerating adoption budget-conscious facilities methodically.

Hybrid detector innovations advance medical radiation detection market combining gas-filled solid-state scintillation technologies single device achieving superior performance across radiation types energy ranges industrially. Dual-mode detectors serve multiple applications reducing equipment inventory costs continuously. Advanced materials engineering improves sensitivity enabling low-dose detection previously impossible rigorously. Miniaturization enables wearable form factors enhancing user comfort compliance strategically. Technology convergence creates premium product category commanding 35% price premiums over single-technology detectors methodically.

AI-powered radiation safety platforms emerge analyzing exposure data from 450,000 dosimeters globally identifying patterns predicting risks enabling proactive interventions industrially. Machine learning algorithms detect anomalous readings triggering automatic investigations continuously. Predictive analytics forecast annual dose accumulation enabling workload adjustments preventing limit exceedances rigorously. Natural language processing extracts insights incident reports identifying systemic improvement opportunities strategically. Intelligent systems reduce radiation safety officer workload 45% while improving program effectiveness methodically.

Segments Covered in the Report

-

By Product

-

Personal Dosimeters

-

Area Process Monitors

-

Environment Radiation Monitors

-

Surface Contamination Monitors

-

Radioactive Material Monitors

-

Other Monitoring Products

-

-

By Detector Type

-

Gas-Filled Detectors

-

Scintillators

-

Solid-State Detectors

-

-

By Safety Product

-

Full Body Protection

-

Face Protection

-

Hand Protection

-

Other Safety Products

-

-

By End User

-

Hospitals

-

Imaging Centers

-

Ambulatory Surgical Centers

-

Clinics

-

Research Institutes

-

-

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions:

Cancer treatment expansion diagnostic imaging proliferation drive the market growth. 20 million new cancer cases diagnosed 2024 require radiation therapy involving 8.5 million treatment courses where each patient undergoes 25-35 sessions necessitating comprehensive dosimetry monitoring while 350 million CT scans performed annually expose healthcare workers requiring protective equipment.

North America dominates 38% share medical radiation detection market powered by 2,850 radiation oncology centers operating 8,200 linear accelerators. Mayo Clinic deploys 450 personal dosimeters monitoring 2,400 workers while NRC regulations mandate personal monitoring 450,000 radiation workers creating recurring dosimetry service demand driving market leadership.

Personal dosimeters capture 42% share market providing essential occupational safety monitoring where 450,000 healthcare workers globally wear electronic devices real-time exposure alerts preventing overexposure incidents. NRC regulations mandate monitoring workers exceeding 10% annual dose limits while monthly rental models $15-$25 per badge sustain recurring revenue streams.

High equipment costs skilled workforce shortages constrain medical radiation detection market growth. Advanced electronic dosimeters costing $450-$850 per unit exceed budgets 85% Latin American hospitals while only 850 qualified radiation safety officers serve 5,200 African healthcare facilities creating staffing gaps. Annual calibration requirements adding $280-$650 per device burden operational budgets.

Digital dosimetry transforms the market replacing film badges electronic systems providing instant readouts wireless transmission. Hospitals achieve 95% cost savings eliminating film processing while real-time alerts enable immediate corrective actions preventing overexposure. Cloud-based platforms aggregate data from 12,000 facilities enabling benchmarking driving fastest 8.2% CAGR segment growth.