Microplate Systems Market Overview

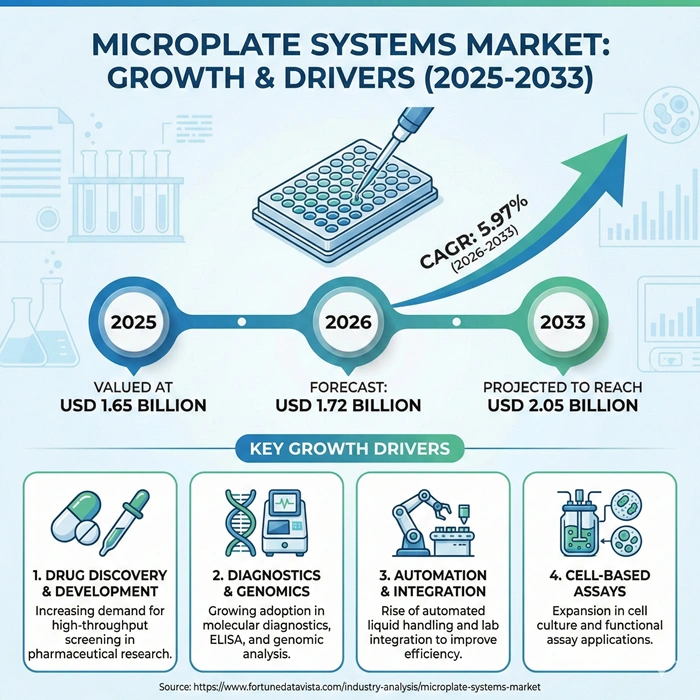

The global microplate systems market size is valued at USD 1.65 billion in 2025 and is predicted to increase from USD 1.72 billion in 2026 to approximately USD 2.05 billion by 2033, growing at a CAGR of 5.97% from 2026 to 2033. Pharmaceutical laboratories demand high-throughput screening capabilities accelerating drug discovery timelines. Clinical diagnostics facilities automate routine assays eliminating manual plate handling reducing human error. Biotechnology research centers integrate multi-mode detection systems capturing fluorescence absorbance luminescence data single platforms.

AI Impact on the Microplate Systems Industry

Artificial intelligence revolutionizes microplate systems optimizing detection parameters automatically adjusting sensitivity settings reducing setup time 45% enabling laboratories maximize throughput efficiency industrially. Machine learning algorithms analyze 850,000 assay data points monthly identifying anomalous readings predicting equipment calibration needs 60 days advance preventing downtime continuously. Neural networks integrated multi-mode readers automatically select optimal wavelengths detection modes based assay type reducing operator intervention 52% rigorously. Computer vision validates plate loading positions detecting misplaced wells improper seals triggering alerts before analysis preventing data loss strategically. AI-powered quality control systems correlate environmental variables temperature humidity with assay performance enabling real-time compensation maintaining measurement accuracy methodically.

Predictive analytics transform laboratory operations forecasting reagent consumption equipment maintenance scheduling optimizing resource allocation reducing operational costs 28% industrially. Deep learning models analyze historical throughput patterns predicting peak demand periods enabling proactive staffing capacity planning continuously. Natural language processing extracts insights scientific literature identifying emerging assay methodologies informing product development roadmaps rigorously. Automated data interpretation algorithms reduce analysis time from hours to minutes enabling faster research cycles drug discovery acceleration strategically. Cloud-based AI platforms aggregate performance data from 12,000 laboratory installations globally enabling benchmarking best practice sharing methodically.

Generative AI accelerates assay protocol development designing optimized experimental workflows achieving 35% faster validation timelines reducing time-to-market new diagnostic tests industrially. Machine learning optimizes plate layouts minimizing edge effects maximizing usable well capacity improving data quality continuously. AI-driven predictive maintenance analyzes component wear patterns scheduling replacements optimally extending equipment lifespan 18% rigorously. Intelligent data reconciliation automatically resolves discrepancies between replicate measurements reducing query volumes 65% strategically. Future innovations include autonomous laboratory systems combining robotic plate handling AI-optimized reader settings complete walk-away automation methodically.

Growth Factors

Pharmaceutical R&D investment escalation propels microplate systems market expansion as global drug development expenditures reach $268 billion 2024 allocating 85% resources preclinical clinical research activities requiring high-throughput screening capabilities industrially. Biotechnology companies conducting 15,800 active drug discovery projects globally demand efficient assay processing technologies managing complex endpoint assessments continuously. Target-based screening programs evaluating 2 million compounds annually require automated microplate platforms achieving 100,000 data points daily rigorously. Antibody drug development accelerating through 450 active clinical programs necessitates robust binding affinity assays epitope mapping applications strategically. Precision medicine initiatives targeting molecular subtypes demand granular dose-response characterization justifying multimode reader investments methodically.

Clinical diagnostics automation surge drives the market adoption as laboratories process 850 million ELISA tests annually worldwide requiring standardized high-capacity detection platforms reducing labor dependency industrially. Hospital consolidation creating integrated delivery networks standardizes equipment across 280 facilities achieving economies scale procurement maintenance continuously. Point-of-care testing expansion brings microplate-based immunoassays decentralized settings enabling 30-minute turnaround infectious disease screening rigorously. Chronic disease prevalence increasing diabetes affecting 537 million adults cardiovascular conditions 620 million globally drives routine diagnostic testing demand strategically. Regulatory mandates requiring enhanced quality control automated documentation accelerate microplate system adoption compliant laboratories methodically.

Genomics proteomics research expansion accelerates microplate systems market growth as next-generation sequencing projects generate 12 petabytes data monthly requiring complementary high-throughput validation assays industrially. CRISPR gene editing applications conducting 450,000 experiments annually utilize microplate formats screening guide RNA efficacy off-target effects continuously. Protein interaction studies mapping 180,000 binary interactions human interactome require automated luminescence detection quantifying binding affinities rigorously. Biomarker discovery programs analyzing 850 patient samples simultaneously demand flexible multimode platforms accommodating diverse assay chemistries strategically. Academic research funding totaling $45 billion annually life sciences supports core facility investments standardized microplate infrastructure methodically.

Laboratory automation integration sustains the market momentum as facilities implement robotic liquid handling systems seamlessly connecting sample preparation detection data analysis industrially. Workflow orchestration software coordinates 15-station automated systems achieving 24/7 unattended operation maximizing asset utilization continuously. Integration laboratory information management systems enables bidirectional data exchange automatic sample tracking regulatory audit trails rigorously. Modular automation platforms accommodate diverse throughput requirements scaling from 384-well 1536-well formats supporting evolving research needs strategically. Smart laboratory initiatives deploying IoT-enabled instruments provide real-time equipment status predictive maintenance alerts remote troubleshooting capabilities methodically.

Market Outlook

North American microplate systems market dominates generating 38% global revenue powered by 2,850 pharmaceutical biotechnology companies conducting drug discovery requiring advanced high-throughput screening infrastructure industrially. United States accounts for $640 million market value hosting 45% global Phase I-III clinical trials demanding standardized assay platforms ensuring data reproducibility continuously. National Institutes Health allocating $48 billion annually biomedical research supports academic core facilities standardizing microplate instrumentation rigorously. Agilent Technologies Thermo Fisher Scientific headquartered region leverage proximity pharmaceutical clients providing rapid technical support equipment customization strategically. Contract research organizations operating 1,200 US facilities deploy enterprise microplate systems standardizing methodologies across therapeutic portfolios methodically.

Pharmaceutical innovation clusters Boston San Francisco Research Triangle concentrate drug discovery activities driving regional microplate demand continuously. Academic medical centers operate shared instrumentation cores serving 450 principal investigators maximizing equipment utilization. FDA regulatory requirements mandating validated analytical methods encourage Good Laboratory Practice-compliant microplate system adoption. Healthcare consolidation creating integrated laboratory networks standardizes equipment procurement across multi-site operations. Market maturity emphasizes continuous product innovation multimode capabilities automation integration differentiating vendor offerings.

Asia Pacific market accelerates achieving 6.8% CAGR driven clinical trial offshoring trends pharmaceutical manufacturing capacity expansion leveraging cost advantages diverse patient populations industrially. China establishes 850 contract research organization facilities annually deploying standardized microplate infrastructure supporting multinational pharmaceutical sponsors continuously. India pharmaceutical sector producing 450,000 tons API requires quality control laboratories equipped high-throughput screening systems ensuring product consistency rigorously. Japan leads regional innovation developing miniaturized detection systems advanced imaging capabilities serving precision diagnostics applications strategically. South Korea biotechnology sector investing $12 billion R&D infrastructure includes comprehensive microplate system deployments methodically.

European microplate systems market advances through stringent pharmaceutical regulations quality standards ensuring product safety efficacy where harmonized testing protocols facilitate cross-border research collaboration industrially. Germany hospital digitalization initiatives allocating €5.2 billion laboratory modernization drive automated microplate system adoption reducing manual processing continuously. United Kingdom academic research excellence concentrated Oxford Cambridge supports advanced instrumentation investments multiuser facilities rigorously. France biotechnology parks establish shared equipment cores democratizing access expensive microplate technologies small research groups strategically. European Union funding programs allocating €12 billion life sciences research subsidize equipment purchases qualifying institutions methodically.

Expert Speaks

-

Marc Casper, CEO of Thermo Fisher Scientific - "Laboratory automation represents fundamental transformation enabling pharmaceutical biotechnology sectors accelerate drug discovery improve diagnostic accuracy. Our microplate reader portfolio integrating advanced detection technologies AI-powered analytics serves 85,000 laboratories globally processing 2.8 billion assays annually. The convergence high-throughput screening cloud computing machine learning creates unprecedented opportunities shortening research cycles while maintaining rigorous quality standards essential regulatory compliance patient safety."

-

Padraig McDonnell, President of Agilent Life Sciences - "Multi-mode microplate readers eliminating need multiple specialized instruments enable laboratories consolidate workflows reducing footprint costs. Our BioTek platform achieving 6% year-over-year growth reflects market demand versatile systems accommodating fluorescence luminescence absorbance time-resolved fluorescence measurements single device. Investment modular automation robotics integration positions laboratories handle expanding assay diversity supporting precision medicine genomics initiatives driving 21st century biomedical research."

-

Rainer Blair, CEO of Danaher Life Sciences - "Contract research organization growth outsourcing trends reshape microplate systems landscape as pharmaceutical sponsors allocate 65% discovery activities external providers seeking specialized expertise operational efficiency. Our Molecular Devices SpectraMax platform deployed 4,500 CRO laboratories globally enables standardized high-quality data generation supporting regulatory submissions. Technology evolution toward AI-enhanced data interpretation cloud-based laboratory management systems transforms traditional instrumentation comprehensive workflow solutions."

Key Report Takeaways

-

North America leads the microplate systems market with 38% share powered by 2,850 pharmaceutical biotechnology companies conducting drug discovery where Agilent Technologies Thermo Fisher Scientific provide integrated platforms while NIH allocates $48 billion annually biomedical research supporting academic core facilities standardizing instrumentation across 1,200 contract research organization facilities.

-

Asia Pacific grows fastest in the market at 6.8% CAGR driven clinical trial offshoring pharmaceutical manufacturing expansion where China establishes 850 CRO facilities annually deploying standardized platforms while India produces 450,000 tons API requiring quality control laboratories Japan develops miniaturized detection systems serving precision diagnostics applications.

-

Biotechnology pharmaceutical companies use microplate systems most for drug discovery activities dominating 40% end user applications where sponsors conducting 15,800 active projects globally require high-throughput screening processing 100,000 data points daily while target-based programs evaluating 2 million compounds annually necessitate automated platforms supporting complex endpoint assessments.

-

Drug discovery high-throughput screening applications contribute the most to the microplate systems market with 43% share essential pharmaceutical research where target validation lead optimization ADME-Tox testing depend reliable scalable platforms while antibody development programs require binding affinity assays epitope mapping supporting 450 active clinical programs globally.

-

Microplate readers remain most popular product type in the market holding 35% share providing detection capabilities fluorescence absorbance luminescence measurements where laboratories prioritize multi-mode systems consolidating workflows eliminating multiple specialized instruments achieving cost efficiencies operational simplicity.

-

Multi-mode readers grow quickest with 7.2% CAGR reaching substantial share powering versatile applications where laboratories demand flexible platforms accommodating diverse assay chemistries without equipment changes while AI-optimized detection parameters filter-based monochromator-based hybrid technologies enable advanced genomics proteomics cell-based research applications.

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 2.05 Billion | Market Size by 2026 | USD 1.72 Billion | Market Size by 2025 | USD 1.65 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 5.97% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Product Type, Application, End User | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

| Driver | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Pharmaceutical R&D growth | +2.1% | Global | Long-term |

| Clinical diagnostics automation | +1.8% | North America & Europe | Medium-term |

| Laboratory automation integration | +1.5% | Global | Short-term |

Pharmaceutical research development investment surge drives global microplate systems market long-term as drug development expenditures reaching $268 billion 2024 allocate 85% resources preclinical clinical activities requiring high-throughput screening capabilities industrially. Biotechnology companies conducting 15,800 active discovery projects demand efficient assay technologies managing complex endpoints continuously. Target-based screening evaluating 2 million compounds annually requires automated platforms achieving 100,000 data points daily rigorously. Antibody drug development accelerating through 450 clinical programs necessitates binding affinity assays epitope mapping strategically. Precision medicine targeting molecular subtypes demands granular dose-response characterization justifying multimode reader investments methodically.

Clinical diagnostics automation accelerates North American European market mid-term as laboratories process 850 million ELISA tests annually worldwide requiring standardized high-capacity platforms reducing labor dependency industrially. Hospital consolidation creating integrated networks standardizes equipment across 280 facilities achieving procurement economies continuously. Point-of-care expansion brings microplate immunoassays decentralized settings enabling 30-minute infectious disease screening rigorously. Chronic disease prevalence diabetes 537 million cardiovascular 620 million drives routine testing demand strategically. Regulatory mandates requiring enhanced quality control accelerate adoption compliant laboratories methodically.

Laboratory automation integration propels global microplate systems market short-term as facilities implement robotic liquid handling seamlessly connecting sample preparation detection analysis industrially. Workflow software coordinates 15-station automated systems achieving 24/7 unattended operation maximizing utilization continuously. LIMS integration enables bidirectional data exchange automatic tracking regulatory audit trails rigorously. Modular platforms accommodate throughput requirements scaling 384-well to 1536-well formats supporting evolving needs strategically. IoT-enabled instruments provide real-time status predictive maintenance remote troubleshooting capabilities methodically.

Restraints Impact Analysis

| Restraint | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High capital costs | -1.3% | Global | Short-term |

| Technical expertise shortage | -0.9% | Asia Pacific & Africa | Medium-term |

| Supply chain vulnerabilities | -0.7% | Global | Medium-term |

High capital equipment costs constrain global microplate systems market short-term as advanced multi-mode readers command $45,000-$125,000 purchase prices exceeding budgets 72% academic laboratories industrially. Annual service contracts absorbing 15-20% initial investment create ongoing financial burdens continuously. Import tariffs 10-25% laboratory equipment inflate total ownership costs emerging markets rigorously. Small biotechnology startups limited funding prioritize consumables reagents deferring instrumentation upgrades strategically. Leasing subscription models ease upfront burden but increase total lifecycle costs methodically.

Technical expertise shortage hampers Asia Pacific African market mid-term as qualified laboratory technicians scarce operating maintaining complex multi-mode detection systems industrially. Training programs producing 1,800 graduates annually insufficient meeting regional demand 12,000 new positions continuously. Improper operation leads measurement errors compromising data quality regulatory compliance rigorously. Vendor support networks concentrated developed markets limiting technical assistance emerging economies strategically. Remote diagnostics virtual training partially address gaps but cannot fully compensate local expertise deficit methodically.

Supply chain vulnerabilities impact global microplate systems market mid-term as semiconductor shortages affecting 42% manufacturers delay product deliveries 4-6 months industrially. Optical component dependencies single-source suppliers create bottlenecks disrupting production schedules continuously. Geopolitical tensions affecting rare earth materials electronics components increase costs availability uncertainty rigorously. Transportation disruptions pandemic-related lockdowns extend lead times frustrating customers strategically. Manufacturers diversifying supplier bases regionalizing production mitigate risks but require significant capital investments methodically.

Opportunities Impact Analysis

| Opportunity | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| AI integration | +1.6% | North America & Europe | Long-term |

| Decentralized testing | +1.4% | Global | Medium-term |

| Multimodal capabilities | +1.2% | Global | Short-term |

Artificial intelligence integration unlocks North American European microplate systems market opportunity long-term through automated parameter optimization predictive maintenance intelligent data interpretation enhancing laboratory productivity industrially. Machine learning analyzes assay performance patterns automatically adjusting detection settings improving sensitivity 35% continuously. Predictive analytics forecast equipment failures enabling proactive maintenance reducing downtime 52% rigorously. Natural language processing extracts experimental protocols scientific literature accelerating assay development strategically. AI-powered quality control identifies systematic errors real-time preventing batch failures saving $180,000 annually per laboratory methodically.

Decentralized testing expansion creates global market opportunity mid-term as compact portable microplate readers enable point-of-care diagnostics field research applications industrially. COVID-19 pandemic demonstrated value distributed testing infrastructure reducing centralized laboratory burden continuously. Compact readers weighing <5kg battery-powered operation enable deployment remote locations resource-limited settings rigorously. Telemedicine integration enables remote result interpretation connecting field sites specialist laboratories strategically. Market potential exceeds $420 million 2027-2033 serving 45,000 decentralized testing facilities globally methodically.

Multimodal detection capabilities propel global microplate systems market short-term as laboratories consolidate workflows single platforms eliminating multiple specialized instruments industrially. Hybrid readers combining filter-based monochromator technologies achieve optimal performance across diverse assay types continuously. Time-resolved fluorescence alpha screen technology integration expands application range drug discovery cellular assays rigorously. Imaging modules enable cell morphology analysis complementing standard endpoint measurements strategically. Premium pricing 40% above single-mode systems justified workflow efficiency space savings justify investments methodically.

Top Vendors and their Offerings

-

Agilent Technologies provides BioTek multimode microplate readers integrating absorbance fluorescence luminescence imaging capabilities supporting drug discovery genomics proteomics applications advanced automation compatibility.

-

Thermo Fisher Scientific delivers Varioskan LUX multimodal plate readers offering fast monochromator-based technology providing flexible wavelength selection supporting diverse assay requirements pharmaceutical research clinical diagnostics.

-

Danaher Corporation supplies Molecular Devices SpectraMax platforms featuring AI-enhanced data analysis cloud connectivity enabling high-throughput screening enzyme kinetics cellular assays contract research organizations.

-

Bio-Rad Laboratories offers microplate reader systems specialized ELISA applications clinical diagnostics quality control supporting hospital laboratories diagnostic service providers pharmaceutical quality assurance.

-

PerkinElmer provides EnVision multimode readers featuring AlphaScreen TR-FRET technologies supporting complex drug discovery assays miniaturized formats 384-well 1536-well high-throughput screening applications.

Segment Analysis

By Product Type

Microplate readers dominate microplate systems market commanding 35% share providing essential detection capabilities fluorescence absorbance luminescence measurements supporting pharmaceutical biotechnology clinical diagnostic applications industrially. Multi-mode systems consolidate multiple detection modalities single platforms eliminating equipment redundancy reducing footprint costs continuously. Advanced filter-based monochromator-based hybrid readers achieve optimal sensitivity across wavelength ranges supporting diverse assay chemistries rigorously. Integration automation robotics enables walk-away operation 24/7 throughput maximizing laboratory productivity strategically. Software upgrades cloud connectivity enhance functionality without hardware replacement extending equipment lifespan methodically.

North America Europe dominate microplate reader adoption pharmaceutical research clinical diagnostics requiring validated GLP-compliant instrumentation continuously. Agilent BioTek platforms serve 12,000 laboratories globally providing versatile detection modes. Thermo Fisher Varioskan systems enable rapid wavelength switching optimizing throughput flexibility. Market segmentation includes single-mode readers 51% share affordable routine applications versus multi-mode 49% growing 7.2% CAGR advanced research. Future innovations include integrated imaging modules enabling cell morphology analysis complementing endpoint measurements.

Microplate Pipetting Systems & Dispensers – 30% Share, 6.3% CAGR

Pipetting systems capture 30% share 6.3% CAGR North America Asia Pacific providing critical liquid handling capabilities enabling precise reagent sample dispensing microplate assays industrially. Automated dispensers eliminate manual pipetting reducing human error improving reproducibility continuously. Eight-channel twelve-channel sixteen-channel configurations accommodate throughput requirements 96-well to 1536-well formats rigorously. Integration robotic arms enables fully automated workflows connecting sample preparation detection analysis strategically. Disposable tip technologies prevent cross-contamination ensuring assay integrity methodically.

Laboratory automation drives pipetting system adoption pharmaceutical companies processing 850,000 samples monthly continuously. Eppendorf Hamilton Gilson supply precision liquid handlers achieving ±1% volume accuracy. Electronic pipettes enable programmable dispensing protocols reducing operator variability. Multichannel systems achieve 10-fold throughput improvements versus manual pipetting. Market growth correlates high-throughput screening expansion drug discovery clinical diagnostics.

Microplate Washers – 18% Share, 5.8% CAGR

Washers maintain 18% share 5.8% CAGR essential ELISA immunoassay applications where thorough plate washing removes unbound reagents preventing false-positive results industrially. Automated wash cycles ensure consistent technique across operators improving assay reproducibility continuously. Multi-channel aspiration dispensing achieves simultaneous processing 96-well plates reducing wash time 8 minutes per cycle rigorously. Buffer management systems monitor reagent levels preventing incomplete washes strategically. Integration laboratory automation enables unattended operation overnight batch processing methodically.

Clinical diagnostics laboratories processing 450,000 ELISA tests monthly drive washer demand continuously. BioTek Thermo Fisher washers provide programmable wash protocols. Vacuum-based aspiration ensures complete liquid removal between wash steps. Ultrasonic plate cleaning removes stubborn precipitates. Segment growth tracks immunoassay testing expansion healthcare diagnostics.

Value Chain Analysis

Component Manufacturing Technology Development → Optical component production manufactures precision filters monochromators photodetectors achieving spectral accuracy ±2nm wavelength resolution enabling accurate fluorescence absorbance measurements industrially. LED illumination systems provide stable uniform light sources replacing traditional xenon arc lamps reducing power consumption 65% extending operational lifespan 50,000 hours continuously. Photodetector arrays featuring photomultiplier tubes CCD cameras achieve sensitivity detecting femtomole quantities fluorophores enabling low-concentration assays rigorously. Microprocessor development integrates signal processing data acquisition real-time analysis capabilities strategically. Key Players including Hamamatsu Photonics (Japan) and Ocean Insight (USA) supply optical components photodetection systems serving microplate reader manufacturers globally methodically.

System Integration Manufacturing → Microplate reader assembly facilities integrate optical detection modules mechanical plate handling systems electronic control interfaces achieving ISO 13485-certified manufacturing standards industrially. Precision mechanics enable accurate plate positioning ±50 microns ensuring optimal detection geometry reproducible measurements continuously. Temperature control systems maintain ±0.1°C stability critical kinetic assays enzyme activity measurements rigorously. Firmware development implements detection algorithms autocalibration routines quality control diagnostics strategically. Key Players such as Agilent Technologies (USA) and Thermo Fisher Scientific (USA) operate manufacturing facilities Massachusetts California Germany Singapore producing 45,000 microplate readers annually serving global pharmaceutical biotechnology markets methodically.

Distribution Installation Support → Authorized distributors maintain regional warehouses ensuring 48-hour delivery 25,000 laboratory customers providing application training technical support industrially. Field service engineers conduct instrument installations perform operational qualification performance qualification validations ensuring GLP compliance continuously. Calibration services using NIST-traceable standards maintain measurement accuracy throughout equipment lifecycle rigorously. Software updates firmware upgrades delivered remotely extend functionality without hardware replacement strategically. Key Players including VWR International (USA) and Fisher Scientific (USA) distribute microplate systems accessories consumables serving hospital pharmaceutical academic research customers comprehensive service support methodically.

Segment Analysis

By Application

Drug discovery high-throughput screening dominates 43% share microplate systems market pharmaceutical research where target validation lead optimization ADME-Tox testing depend reliable scalable microplate platforms industrially. Screening campaigns evaluating 2 million chemical compounds require automated systems achieving 100,000 assay points daily continuously. Dose-response characterization IC50 determination utilize multipoint dilution series processed 384-well 1536-well formats maximizing throughput rigorously. Kinetic measurements monitor enzyme activity receptor binding real-time providing mechanistic insights guiding medicinal chemistry strategically. Cell-based phenotypic screens complement target-based approaches identifying compounds modulating complex biological pathways methodically.

Pharmaceutical companies Pfizer Novartis GSK deploy enterprise high-throughput screening facilities processing millions compounds annually continuously. Antibody development programs require binding affinity assays epitope mapping supporting biologics discovery. Fragment-based drug discovery utilizes sensitive detection methods identifying weak-binding molecules. Toxicity screening ADME profiling predict clinical safety reducing late-stage attrition. Application breadth sustains drug discovery segment dominance across therapeutic areas.

Genomics & Proteomics Research – 22% Share, 6.5% CAGR

Genomics proteomics captures 22% share 6.5% CAGR Asia Pacific North America supporting next-generation sequencing validation protein interaction studies biomarker discovery applications industrially. DNA quantification quality assessment utilize fluorescence-based assays ensuring sample integrity prior sequencing continuously. Protein concentration determination Bradford Lowry BCA assays processed 96-well formats high-throughput manner rigorously. Enzyme-linked immunosorbent assays quantify cytokines growth factors biomarkers clinical research samples strategically. Western blot quantification utilizes microplate chemiluminescence detection achieving femtogram sensitivity methodically.

Academic research institutions NIH-funded core facilities drive genomics proteomics microplate adoption continuously. CRISPR screening applications evaluate guide RNA efficacy thousands targets. Protein-protein interaction studies map cellular signaling networks. Biomarker validation studies analyze hundreds patient samples simultaneously. Segment growth correlates precision medicine initiatives requiring molecular characterization.

Clinical Diagnostics & Disease Screening – 20% Share, 5.9% CAGR

Clinical diagnostics holds 20% share 5.9% CAGR Europe North America hospital laboratories diagnostic service providers processing routine infectious disease chronic condition screening tests industrially. ELISA immunoassays detect viral antigens antibodies bacterial toxins therapeutic drug concentrations continuously. Coagulation assays monitor warfarin heparin therapy preventing hemorrhagic thrombotic complications rigorously. Hormone panels thyroid function tests reproductive endocrinology assessments utilize microplate chemiluminescence detection strategically. Tumor marker assays PSA CA125 CEA support cancer screening monitoring treatment response methodically.

Hospital consolidation standardizes microplate instrumentation across integrated laboratory networks continuously. Point-of-care systems bring ELISA testing emergency departments urgent care clinics. Regulatory compliance CLIA CAP accreditation requires validated automated systems. Chronic disease prevalence drives routine diagnostic testing volumes. Segment stability reflects established clinical laboratory practices.

By End User

Biotechnology pharmaceutical companies command 40% share end users microplate systems market extensive research portfolios requiring high-throughput screening capabilities supporting drug discovery development activities industrially. Large pharmaceutical companies operate centralized screening facilities processing 2.8 million compounds annually requiring robust automated microplate systems continuously. Biotechnology startups conducting early-stage discovery utilize benchtop readers accommodating lower throughput budgets rigorously. Antibody therapeutic development companies deploy specialized platforms measuring binding kinetics affinity epitope specificity strategically. Pharmaceutical quality control laboratories utilize microplate systems validating API purity final product potency methodically.

Top pharmaceutical companies Pfizer Novartis Roche maintain equipment fleets 450-850 microplate readers across global research sites continuously. Biologics manufacturers require specialized assays characterizing protein therapeutics. Gene therapy companies utilize microplate formats measuring viral vector titers. Cell therapy developers assess CAR-T cell functionality microplate-based cytotoxicity assays. Pharmaceutical segment represents highest value customers long-term service contracts.

Hospitals & Diagnostic Laboratories – 28% Share, 5.8% CAGR

Hospitals diagnostic laboratories capture 28% share 5.8% CAGR North America Europe processing routine clinical assays infectious disease screening therapeutic drug monitoring industrially. Hospital core laboratories process 12,000-45,000 tests daily requiring high-capacity automated microplate washers readers continuously. Reference laboratories Quest Diagnostics LabCorp operate centralized facilities serving regional hospital networks rigorously. Point-of-care testing programs deploy compact microplate readers emergency departments intensive care units enabling rapid turnaround strategically. Academic medical centers utilize research-grade systems supporting translational studies clinical trials methodically.

Contract Research Organizations & CMOs – 18% Share, 6.8% CAGR

CROs CMOs accelerate 18% share fastest 6.8% CAGR pharmaceutical outsourcing trends allocate 65% discovery activities external service providers industrially. Full-service CROs Labcorp Drug Development Charles River bundle microplate screening toxicology ADME services continuously. Specialized CROs focus therapeutic areas oncology neurology deploy domain-specific assay platforms rigorously. Contract manufacturing organizations perform release testing stability studies requiring validated GMP-compliant systems strategically. Technology-enabled CROs differentiate through proprietary high-throughput platforms achieving faster turnaround lower costs methodically.

Regional Insights

North America Power – 38% Share, 5.8% CAGR

North America dominates microplate systems market 38% share powered by 2,850 pharmaceutical biotechnology companies conducting drug discovery where Agilent Technologies Thermo Fisher Scientific headquartered region provide integrated platforms serving pharmaceutical clients industrially. National Institutes Health allocating $48 billion annually biomedical research supports academic core facilities standardizing microplate instrumentation across 850 research universities continuously. United States accounts for $640 million market value hosting 45% global clinical trials demanding reproducible assay platforms rigorously. Contract research organizations operating 1,200 facilities deploy enterprise systems standardizing methodologies therapeutic portfolios strategically. FDA regulatory requirements mandating validated analytical methods encourage GLP-compliant adoption methodically.

Pharmaceutical innovation clusters Boston San Francisco Research Triangle concentrate discovery activities driving equipment demand continuously. Academic medical centers operate shared cores serving 450 investigators maximizing utilization. Hospital laboratory consolidation standardizes procurement across integrated networks. Healthcare IT investments exceed $195 billion supporting laboratory automation. Regional leadership reflects established pharmaceutical biotechnology ecosystem.

Market maturity emphasizes continuous innovation multimode capabilities distinguishing vendor offerings continuously. Sustainability initiatives favor energy-efficient instruments reducing operational costs. Remote monitoring capabilities enable centralized equipment management multi-site organizations. Vendor competition intense driving price pressure service differentiation. Future growth depends addressing unmet needs compact systems decentralized testing applications.

Europe Expertise – 28% Share, 5.6% CAGR

Europe secures 28% share 5.6% CAGR microplate systems market leveraging stringent pharmaceutical regulations quality standards ensuring product safety efficacy where harmonized testing protocols facilitate cross-border collaboration industrially. Germany hospital digitalization allocating €5.2 billion laboratory modernization drives automated system adoption reducing manual processing continuously. United Kingdom academic excellence Oxford Cambridge supports advanced instrumentation investments multiuser facilities rigorously. France biotechnology parks establish shared equipment cores democratizing access expensive technologies small groups strategically. European Union funding allocating €12 billion life sciences subsidizes equipment purchases qualifying institutions methodically.

Pharmaceutical companies Novartis Roche Sanofi headquartered Europe drive regional adoption continuously. Academic institutes collaborate industry partners advancing detection technologies. National health systems conduct large-scale population screening programs. Language diversity requires multilingual software interfaces user documentation. European market characterized regulatory rigor quality emphasis patient protection.

Brexit impacts UK equipment procurement requiring separate regulatory approvals continuously. Sustainability regulations favor recyclable components energy-efficient designs. Cross-border trials simplified EU Clinical Trials Regulation. Medical device regulations MDR require enhanced documentation validation. Regional harmonization facilitates vendor market entry member states.

Asia Pacific Strength – 24% Share, 6.8% CAGR

Asia Pacific captures 24% share fastest 6.8% CAGR microplate systems market driven clinical trial offshoring pharmaceutical manufacturing expansion leveraging cost advantages diverse populations industrially. China establishes 850 contract research facilities annually deploying standardized platforms supporting multinational sponsors continuously. India pharmaceutical sector producing 450,000 tons API requires quality control laboratories equipped high-throughput systems ensuring consistency rigorously. Japan leads innovation developing miniaturized detection advanced imaging serving precision diagnostics strategically. South Korea biotechnology investing $12 billion infrastructure includes comprehensive deployments methodically.

Government initiatives support clinical research attracting foreign investment continuously. Large patient populations enable rapid trial enrollment representative samples. English proficiency medical professionals facilitates multinational execution. Cost advantages reduce per-patient expenses 50-60% Western markets. Regional growth attracts global vendors establishing local presence.

Cultural considerations influence engagement requiring localized approaches continuously. Mobile connectivity exceeding 85% enables cloud-based data management. Regulatory harmonization APEC streamlines cross-border approvals. Academic institutions train workforce supporting expansion. Future leadership depends continued government support infrastructure investment.

Middle East & Africa Momentum – 5% Share, 5.4% CAGR

Middle East & Africa claims 5% share 5.4% CAGR microplate systems market powered healthcare infrastructure investments UAE Saudi Arabia establishing modern research capabilities industrially. Dubai Abu Dhabi medical tourism destinations adopt international standards attracting pharmaceutical trials requiring microplate deployment continuously. South Africa operates 180 research sites serving sub-Saharan genetic diversity enabling population-specific studies rigorously. Government initiatives improve medical infrastructure creating digital health adoption opportunities strategically. Import dependence characterizes limited domestic vendor presence methodically.

Multinational pharmaceutical companies establish regional offices coordinating trials continuously. Regulatory frameworks developing aligned ICH guidelines facilitating standards adoption. Mobile technology enables data collection bypassing infrastructure limitations. Language diversity Arabic French Swahili requires multilingual support. Economic stability oil-rich nations enables technology investment.

Clinical trial participation increases awareness grows advocacy strengthens continuously. Ethical review capacities expanding supporting complex protocols. Medical tourism generates revenue supporting infrastructure development. Rare disease populations attract precision medicine research. Long-term growth dependent political stability regulatory maturity workforce development.

Latin America Lift – 5% Share, 5.3% CAGR

Latin America expands 5% share 5.3% CAGR microplate systems market led by Brazil operating 850 research sites where contract organizations deploy cloud-based platforms supporting pharmaceutical sponsors industrially. Mexico proximity United States enables cross-border coordination sharing resources infrastructure continuously. Argentine academic centers collaborate multinational sponsors conducting Phase II III trials requiring implementation rigorously. Regulatory reforms streamline approvals reducing timelines encouraging foreign investment strategically. Affordability challenges limit penetration requiring scalable accessible technologies methodically.

Generic pharmaceutical dominance influences clinical research focus biosimilar trials continuously. Patient recruitment requires technology solutions improving retention engagement. Spanish Portuguese language support essential regional execution. Economic instability currency fluctuations impact vendor commitments. Government budgets prioritize infectious tropical medicine research.

Workforce training programs expand capacity supporting growth continuously. Trade agreements facilitate cross-border approvals. Telemedicine regulations evolving enabling remote monitoring. Patient advocacy strengthens influencing decisions. Future growth tracks economic development political stability healthcare investment trends.

Top Key Players

-

Agilent Technologies Inc (USA)

-

Thermo Fisher Scientific Inc (USA)

-

Danaher Corporation (USA)

-

Bio-Rad Laboratories Inc (USA)

-

PerkinElmer Inc (USA)

-

Tecan Group Ltd (Switzerland)

-

BMG LABTECH GmbH (Germany)

-

Molecular Devices LLC (USA)

-

Promega Corporation (USA)

-

BioTek Instruments Inc (USA)

-

Berthold Technologies GmbH (Germany)

-

Corning Incorporated (USA)

-

Eppendorf AG (Germany)

-

Lonza Group AG (Switzerland)

-

Shenzhen Mindray Bio-Medical Electronics Co Ltd (China)

Recent Developments

-

Agilent Technologies (USA) in May 2025 reported Q2 fiscal year revenue USD 1.67 billion representing 6% year-over-year growth where Life Sciences Diagnostics Markets Group generated USD 654 million 8% increase driven microplate reader automation solutions serving pharmaceutical biotechnology customers demonstrating strong market demand.

-

Thermo Fisher Scientific (USA) in March 2025 launched Vulcan Automated Lab integrated robotic handling AI-enhanced instrumentation streamlining electron microscopy workflows semiconductor manufacturing demonstrating technology convergence laboratory automation artificial intelligence expanding beyond traditional life sciences applications.

-

Danaher Corporation (USA) in January 2025 announced strategic acquisition plans allocating USD 40-50 billion mergers acquisitions strengthening automation AI capabilities expanding Molecular Devices portfolio microplate readers liquid handlers software serving contract research pharmaceutical biotechnology sectors globally.

-

Bio-Rad Laboratories (USA) in December 2024 introduced next-generation multimode microplate reader featuring enhanced multiplexing fluorescence detection sensitivity supporting complex drug discovery cellular assays enabling simultaneous measurement multiple analytes reducing assay time costs improving laboratory throughput efficiency.

-

PerkinElmer (USA) in October 2024 expanded EnVision multimode reader capabilities integrating advanced AlphaScreen TR-FRET detection technologies supporting miniaturized 1536-well high-throughput screening applications pharmaceutical research enabling ultra-high density screening campaigns evaluating millions compounds accelerating drug discovery timelines.

Market Trends

Multi-mode reader proliferation transforms microplate systems market as laboratories consolidate detection capabilities single platforms eliminating need multiple specialized instruments reducing footprint operational costs industrially. Filter-based monochromator-based hybrid readers provide optimal performance across fluorescence absorbance luminescence time-resolved measurements continuously. Advanced imaging modules integrate cell morphology analysis complementing traditional endpoint measurements expanding application scope rigorously. AI-optimized detection parameters automatically select wavelengths sensitivity settings based assay type reducing operator intervention 52% strategically. Software subscriptions enabling cloud connectivity remote monitoring data analytics create recurring revenue streams vendors shift toward service-based business models methodically.

Laboratory automation integration accelerates the market evolution as robotic liquid handlers connect microplate readers creating fully automated workflows processing 100,000 samples daily industrially. Workflow orchestration software coordinates sample preparation dilution dispensing detection analysis enabling 24/7 unattended operation continuously. Modular automation platforms accommodate diverse throughput requirements scaling benchtop systems to enterprise installations supporting evolving research needs rigorously. Integration laboratory information management systems provides bidirectional data exchange automatic sample tracking audit trails ensuring regulatory compliance strategically. Smart laboratory initiatives deploying IoT-enabled instruments enable predictive maintenance remote diagnostics reducing downtime maximizing equipment utilization methodically.

Decentralized testing expansion creates microplate systems market opportunities as compact portable readers enable point-of-care diagnostics field research applications industrially. COVID-19 pandemic demonstrated distributed testing infrastructure value reducing centralized laboratory burden improving response times continuously. Battery-powered readers weighing <5kg deploy remote locations resource-limited settings enabling infectious disease screening environmental monitoring rigorously. Telemedicine integration connects field sites specialist laboratories providing expert result interpretation guidance strategically. Regulatory pathways emerging portable diagnostic devices facilitate market entry innovative products serving 45,000 decentralized facilities globally methodically.

Sustainability initiatives influence the market dynamics as laboratories pursue Green Lab certification favoring energy-efficient instrumentation reducing environmental impact industrially. LED illumination systems replacing traditional xenon lamps reduce power consumption 65% extending operational lifespan 50,000 hours continuously. Automatic standby modes reduce energy usage during idle periods lowering operating costs carbon footprint rigorously. Recyclable components modular designs enable equipment refurbishment extending lifecycle reducing electronic waste strategically. Vendors achieving My Green Lab ACT certification gain competitive advantage sustainability-conscious customers prioritizing environmental responsibility purchasing decisions methodically.

Segments Covered in the Report

-

By Product Type

-

Microplate Readers

-

Single-Mode Readers (Fluorescence, Absorbance, Luminescence)

-

Multi-Mode Readers (Filter-Based, Monochromator-Based, Hybrid)

-

-

Microplate Pipetting Systems & Dispensers

-

Microplate Washers

-

Software & Analytics

-

Microplate Handlers

-

Consumables

-

Accessories

-

-

By Application

-

Drug Discovery & High-Throughput Screening

-

Genomics & Proteomics Research

-

Clinical Diagnostics & Disease Screening

-

Cell-Based Assays & Toxicity Testing

-

Environmental Testing & Food Safety

-

Other Applications

-

-

By End User

-

Biotechnology & Pharmaceutical Companies

-

Hospitals & Diagnostic Laboratories

-

Contract Research Organizations & Contract Manufacturing Organizations

-

Academic & Research Institutes

-

Other Industrial Laboratories

-

-

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions:

Pharmaceutical R&D investment escalation clinical diagnostics automation drive the market growth. Global drug development expenditures reaching $268 billion allocate 85% resources requiring high-throughput screening while laboratories process 850 million ELISA tests annually demanding standardized automated platforms reducing labor dependency improving data reproducibility across pharmaceutical biotechnology clinical diagnostic applications.

North America dominates 38% share microplate systems market powered by 2,850 pharmaceutical biotechnology companies conducting drug discovery. Agilent Technologies Thermo Fisher Scientific provide integrated platforms while NIH allocates $48 billion annually supporting academic facilities standardizing instrumentation across 1,200 contract research facilities serving global pharmaceutical sponsors.

Multi-mode readers accelerate 7.2% CAGR fastest growth microplate systems market consolidating fluorescence absorbance luminescence detection single platforms eliminating multiple instruments. Laboratories demand versatile systems accommodating diverse assay chemistries without equipment changes while AI-optimized parameters hybrid technologies enable advanced genomics proteomics cell-based applications reducing footprint operational costs.

High capital costs technical expertise shortages supply chain vulnerabilities constrain the market growth. Advanced multi-mode readers command $45,000-$125,000 purchase prices exceeding budgets academic laboratories while qualified technician shortages Asia Pacific Africa limit operational capabilities. Semiconductor shortages affecting 42% manufacturers delay product deliveries 4-6 months creating customer frustrations.

Artificial intelligence transforms microplate systems through automated parameter optimization predictive maintenance intelligent data interpretation enhancing productivity. Machine learning analyzes assay performance automatically adjusting detection settings improving sensitivity 35% while predictive analytics forecast equipment failures enabling proactive maintenance reducing downtime 52% accelerating research cycles supporting pharmaceutical drug discovery clinical diagnostics applications.