Photoacoustic Tomography (PAT) Market Overview

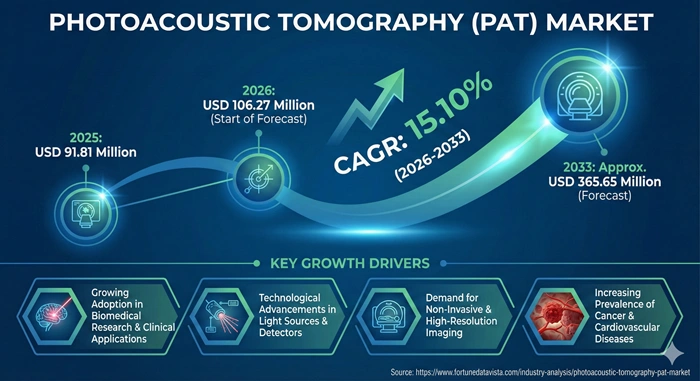

The global Photoacoustic Tomography (PAT) market size is valued at USD 91.81 million in 2025 and is predicted to increase from USD 106.27 million in 2026 to approximately USD 365.65 million by 2033, growing at a CAGR of 15.10% from 2026 to 2033.

Photoacoustic Tomography represents a groundbreaking hybrid imaging technology that merges optical absorption contrast with ultrasound depth capabilities to deliver precise visualization of biological tissues. This advanced diagnostic method converts pulsed laser light into ultrasonic waves, enabling healthcare professionals to obtain functional and molecular information without exposing patients to harmful ionizing radiation. The market expansion is primarily attributed to the growing burden of chronic diseases worldwide, particularly cancer and cardiovascular conditions, coupled with rising demand for non-invasive diagnostic solutions. Medical institutions and research facilities increasingly adopt PAT technology due to its exceptional ability to visualize tumor angiogenesis, blood oxygenation levels, and metabolic activity with unprecedented clarity.

The technology demonstrates remarkable versatility across multiple medical disciplines including oncology, cardiology, neurology, and dermatology. Healthcare providers value PAT systems for their capacity to deliver high-resolution images at tissue depths unattainable by conventional optical imaging methods. Recent innovations in laser sources, ultrasound transducer sensitivity, and image reconstruction algorithms have substantially improved spatial resolution and penetration depth. Academic research institutions and pharmaceutical companies extensively utilize PAT for preclinical studies involving small animal models, enabling longitudinal tracking of disease progression and therapeutic responses.

AI Impact on the Photoacoustic Tomography Industry

Artificial intelligence integration is fundamentally transforming the Photoacoustic Tomography market by revolutionizing image reconstruction processes and automating diagnostic analysis workflows. AI-powered algorithms enhance image quality by reducing noise artifacts, correcting signal aberrations, and improving the signal-to-noise ratio in raw data processing. Deep learning models demonstrate exceptional capability in distinguishing benign tissues from malignant formations, significantly boosting diagnostic confidence among clinicians. Machine learning applications reduce operator dependency while standardizing results across different facilities and equipment configurations.

Real-time processing capabilities enabled by AI technology make PAT systems more accessible for clinical applications, facilitating faster diagnostic workflows in hospital environments. Automated feature extraction through neural networks enables precise quantification of physiological parameters including blood oxygenation levels, hemoglobin concentration, and tissue perfusion rates. These advanced capabilities support comprehensive longitudinal monitoring in both preclinical research and translational clinical studies. AI-driven analysis improves consistency across repeated scans, addressing variability concerns that previously hindered widespread adoption.

The integration of AI with Photoacoustic Tomography market technologies strengthens both research methodologies and emerging clinical evaluation frameworks. Intelligent algorithms facilitate early detection of microscopic disease changes that might escape human observation. Pharmaceutical companies leverage AI-enhanced PAT systems to accelerate drug development timelines by providing detailed insights into therapeutic efficacy at molecular levels. Academic institutions utilize machine learning models to identify novel biomarkers and establish correlations between imaging patterns and disease outcomes, advancing translational medicine objectives.

Growth Factors of the Photoacoustic Tomography Market

The Photoacoustic Tomography market experiences robust expansion driven by escalating prevalence of chronic diseases requiring advanced diagnostic capabilities. Cancer incidence continues rising globally, creating substantial demand for imaging technologies that visualize tumor characteristics including vascularization patterns, hypoxic regions, and metabolic signatures. Cardiovascular disorders affecting millions of patients worldwide necessitate precise vascular imaging solutions that PAT technology uniquely provides. Neurological conditions ranging from stroke to neurodegenerative diseases require functional brain imaging capabilities that traditional modalities cannot adequately address.

Technological breakthroughs in laser engineering and ultrasound transducer design continuously enhance PAT system performance. Modern systems achieve deeper tissue penetration while maintaining exceptional spatial resolution, expanding the range of clinical applications. Miniaturization efforts produce portable and handheld PAT devices suitable for point-of-care diagnostics, outpatient clinics, and continuous patient monitoring scenarios. Integration with complementary imaging modalities including MRI and CT scanners creates powerful multimodal platforms that combine strengths of different technologies. These innovations reduce equipment costs and improve accessibility for smaller healthcare facilities.

Government initiatives and private sector investments fuel research and development activities across major economies. Regulatory agencies increasingly recognize PAT technology potential, streamlining approval pathways for innovative systems. National health programs in developed nations allocate substantial funding toward cancer research and imaging infrastructure modernization. Academic-industry collaborations accelerate prototype-to-product translation, bringing laboratory innovations to clinical markets faster. Pharmaceutical and biotechnology companies invest heavily in preclinical imaging capabilities, recognizing PAT value for drug discovery and efficacy monitoring.

Growing awareness among healthcare professionals and patients regarding benefits of non-invasive, radiation-free diagnostic methods drives market adoption. Medical education programs increasingly incorporate PAT technology training, building clinical expertise necessary for widespread implementation. Patient preference for safer diagnostic procedures without ionizing radiation exposure influences clinical decision-making. Healthcare institutions seek technologies that improve diagnostic accuracy while reducing patient risk, positioning PAT favorably against traditional imaging alternatives. Market expansion in emerging economies reflects healthcare infrastructure improvements and rising medical technology investments.

Market Outlook of the Photoacoustic Tomography Market

The Photoacoustic Tomography market trajectory indicates explosive growth through 2033, driven by fundamental shifts from research-focused applications toward mainstream clinical utilization. Medical institutions worldwide recognize PAT technology as essential for visualizing functional and molecular biomarkers that conventional imaging cannot adequately capture. Oncology departments increasingly depend on PAT systems for tumor characterization, treatment monitoring, and early recurrence detection. Vascular imaging applications expand as cardiologists and vascular surgeons appreciate the technology's ability to visualize atherosclerotic plaque composition and blood flow dynamics.

Neuroscience research laboratories adopt PAT for brain imaging studies that require non-invasive visualization of cerebral blood flow, neuronal activity, and metabolic processes. The shift toward personalized medicine amplifies demand for imaging technologies capable of molecular-level tissue characterization. Clinical trials increasingly incorporate PAT endpoints to assess therapeutic responses with greater precision than traditional anatomical imaging provides. Regulatory pathways for PAT system approvals become more defined, reducing commercialization timelines for manufacturers.

Industry consolidation through strategic partnerships between established medical imaging companies and innovative PAT startups accelerates technology diffusion. Large medical device manufacturers leverage their distribution networks to bring PAT systems to broader global markets. Component suppliers continuously innovate in laser technology, detector arrays, and signal processing hardware, driving system performance improvements while reducing costs. Software developers create sophisticated image analysis platforms that extract maximum diagnostic value from PAT data. Healthcare economics increasingly favor PAT adoption as reimbursement frameworks evolve to recognize technology value.

Emerging markets in Asia Pacific, Latin America, and Middle East regions represent substantial growth opportunities as healthcare infrastructure modernization progresses. Government policies promoting medical technology adoption and healthcare access expansion create favorable conditions for PAT market penetration. Academic institutions in developing nations establish imaging research centers equipped with advanced PAT systems, building local expertise and driving technology awareness. Medical tourism destinations invest in cutting-edge diagnostic capabilities including PAT to attract international patients seeking advanced healthcare services.

Expert Speaks

-

Marc Gruwez, President of Canon Medical Systems Europe: "Healthcare providers increasingly demand imaging solutions that deliver comprehensive diagnostic information while prioritizing patient safety. Advanced non-invasive technologies enabling molecular and functional tissue characterization represent the future of diagnostic imaging, particularly in oncology and cardiovascular applications where early detection significantly impacts patient outcomes".

-

Teiichi Goto, President and CEO of FUJIFILM Corporation: "Innovation in medical imaging continues accelerating through integration of artificial intelligence, miniaturization of complex systems, and development of multimodal platforms. Technologies combining optical and acoustic imaging principles demonstrate exceptional potential for translating research discoveries into clinical practice, particularly in cancer diagnosis and treatment monitoring".

-

Dr. Nadir Alikacem, CEO of Seno Medical Instruments: "The evolution toward functional and molecular imaging reflects fundamental changes in how clinicians approach disease diagnosis and management. Imaging technologies providing real-time physiological and biochemical tissue information enable more informed clinical decisions, supporting the broader transition toward precision medicine and personalized treatment strategies".

Key Report Takeaways

-

North America dominates the Photoacoustic Tomography market with 42.10% market share in 2025, attributed to advanced healthcare infrastructure, substantial research investments, presence of leading technology developers, and strong government funding for medical innovation initiatives

-

Asia Pacific emerges as the fastest-growing region with projected CAGR of 16.10% from 2026 to 2035, driven by healthcare infrastructure expansion, rising government support for medical technology adoption, large patient populations with chronic diseases, and increasing investments from public and private sectors

-

PAT imaging systems segment leads product categories capturing 68.20% market share in 2025 due to superior deep-tissue visualization capabilities, high-resolution imaging performance, and versatility across clinical and preclinical applications, particularly in oncology and vascular imaging

-

Academic and research institutes represent the largest end-user segment with 34.60% market share in 2025, reflecting extensive utilization in preclinical research, drug development studies, and biomedical discovery programs supported by substantial institutional and government funding

-

Preclinical imaging mode accounts for the dominant application segment with 63.40% market share in 2025, driven by pharmaceutical companies and research institutions requiring non-invasive high-resolution imaging for small animal studies, disease mechanism research, and therapeutic efficacy evaluation

-

Oncology application segment demonstrates fastest growth potential with projected CAGR of 15.20% from 2026 to 2035, fueled by PAT technology's exceptional capability to visualize tumor angiogenesis, hypoxia, and metabolic characteristics critical for early cancer detection and treatment response monitoring

Market Scope of the Photoacoustic Tomography Market

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 365.65 Million | Market Size by 2026 | USD 106.27 Million | Market Size by 2025 | USD 91.81 Million | Market Growth Rate from 2026 to 2033 | CAGR of 15.10% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Product Type, Technology, Application, End User, Imaging Mode, and Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Market Dynamics of the Photoacoustic Tomography Market

Drivers Impact Analysis

The Photoacoustic Tomography market experiences significant momentum from rising chronic disease burden affecting global populations. Cancer prevalence continues escalating across all demographics, creating urgent demand for imaging technologies capable of early tumor detection and therapeutic monitoring. Cardiovascular diseases remain leading causes of mortality worldwide, necessitating advanced vascular imaging solutions for atherosclerosis assessment and intervention planning. Neurological disorders including stroke, Alzheimer's disease, and Parkinson's disease require sophisticated brain imaging capabilities that conventional modalities inadequately provide.

| Driver | Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rising chronic disease prevalence | ≈2.5% contribution | Global, strongest in North America and Europe | Immediate to long-term |

| Technological advancements in laser and ultrasound | ≈2.8% contribution | Global, R&D concentrated in developed markets | Medium to long-term |

| Growing demand for non-invasive diagnostics | ≈2.3% contribution | Global, accelerating in Asia Pacific | Immediate to long-term |

| AI integration enhancing diagnostic accuracy | ≈2.1% contribution | Developed markets initially, expanding globally | Short to medium-term |

| Increasing healthcare investments | ≈2.4% contribution | Strongest in emerging markets | Medium to long-term |

Technological innovations continuously enhance PAT system capabilities across multiple dimensions. Advanced laser sources deliver higher pulse energies with improved wavelength tunability, enabling better chromophore differentiation and deeper tissue penetration. Next-generation ultrasound transducers feature enhanced sensitivity and broader frequency response, capturing acoustic signals with greater fidelity. Sophisticated image reconstruction algorithms leverage computational advances to produce clearer images from raw data while reducing processing time. These technical improvements expand PAT applicability across broader patient populations and clinical scenarios.

Healthcare economic factors increasingly favor PAT technology adoption as systems become more cost-effective through manufacturing scale and component innovations. Portable and handheld PAT devices reduce capital investment requirements, making technology accessible to smaller clinics and outpatient facilities. Integration capabilities with existing ultrasound infrastructure lower implementation barriers for hospitals already equipped with complementary imaging equipment. Reimbursement policy developments in major healthcare markets recognize PAT diagnostic value, improving financial viability for clinical providers. Growing evidence base demonstrating PAT clinical utility strengthens adoption justification across healthcare systems.

Restraints Impact Analysis

High initial capital costs for comprehensive Photoacoustic Tomography market systems present substantial barriers for smaller healthcare facilities and institutions in resource-limited settings. Complete PAT platforms incorporating advanced laser sources, sensitive detector arrays, and sophisticated image processing hardware represent significant investments. Installation requirements including dedicated spaces with appropriate electrical infrastructure, cooling systems, and safety protocols add to total ownership costs. Maintenance expenses for complex laser and ultrasound components require specialized technical expertise not universally available.

| Restraint | Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High equipment costs | ≈-1.8% impact | Strongest in developing markets | Immediate to medium-term |

| Limited clinical evidence | ≈-1.2% impact | Global, particularly affecting regulatory approval | Short to medium-term |

| Shortage of trained professionals | ≈-1.5% impact | Global, more acute in emerging markets | Immediate to long-term |

| Regulatory complexities | ≈-0.9% impact | Varies by region, stringent in developed markets | Short to medium-term |

| Competition from established modalities | ≈-1.3% impact | Global | Immediate to long-term |

Clinical evidence gaps regarding long-term PAT diagnostic value compared to established imaging modalities create adoption hesitation among conservative healthcare administrators. Prospective clinical trials demonstrating PAT superiority or complementary value remain limited compared to decades of evidence supporting MRI, CT, and conventional ultrasound. Standardization challenges across different PAT system implementations complicate direct comparison of results between institutions. Reimbursement uncertainties in various healthcare markets deter investment until payment frameworks clearly recognize PAT procedures.

Workforce development challenges constrain market expansion as PAT technology requires specialized operator training and interpretive expertise. Medical imaging curricula at universities and training hospitals have not universally incorporated PAT principles and practical applications. Radiologists and technologists familiar with traditional modalities require additional education to effectively utilize PAT capabilities. Interpretation guidelines and standardized reporting frameworks remain under development, creating variability in diagnostic accuracy across different practitioners. Building adequate professional expertise pipelines demands time and coordinated educational initiatives.

Opportunities Impact Analysis

Emerging applications in Photoacoustic Tomography market extend beyond current primary uses into diverse medical specialties. Dermatology presents substantial opportunities for PAT application in melanoma detection and characterization, leveraging technology's ability to visualize pigmentation and vascular patterns. Ophthalmology applications include retinal imaging and choroidal visualization for conditions like age-related macular degeneration. Gastroenterology endoscopic applications enable real-time tissue characterization during diagnostic and therapeutic procedures. Orthopedic uses encompass bone and joint imaging for inflammatory conditions and trauma assessment.

| Opportunity | Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Expanding into new clinical applications | ≈2.2% contribution | Global, innovation-driven in developed markets | Medium to long-term |

| Development of portable devices | ≈2.6% contribution | Global, highest impact in resource-limited settings | Short to medium-term |

| Integration with other imaging modalities | ≈1.9% contribution | Developed markets initially | Medium-term |

| Growing telemedicine adoption | ≈1.5% contribution | Global, accelerated post-pandemic | Short to medium-term |

| Personalized medicine initiatives | ≈2.1% contribution | Strongest in North America and Europe | Medium to long-term |

Multimodal imaging platform development combining PAT with established technologies creates powerful diagnostic tools leveraging complementary strengths. PAT-ultrasound hybrid systems integrate seamlessly into existing clinical workflows while adding functional imaging capabilities. PAT-MRI combinations provide exceptional soft tissue contrast alongside molecular and vascular information. PAT-CT integration enables correlation between anatomical structures and functional parameters. These integrated approaches enhance diagnostic confidence while minimizing additional examination burden on patients.

Point-of-care and wearable PAT device development opens vast market opportunities in ambulatory settings, emergency departments, and home healthcare scenarios. Miniaturized systems enable continuous monitoring applications for chronic disease management and post-surgical surveillance. Portable devices facilitate healthcare delivery in remote and underserved regions lacking sophisticated imaging infrastructure. Wearable sensors incorporating PAT principles enable non-invasive physiological monitoring for fitness tracking and early disease warning. These innovations democratize access to advanced diagnostic capabilities beyond traditional hospital environments.

Top Vendors and Their Offerings

-

FUJIFILM VisualSonics Inc. - Provides advanced preclinical PAT imaging systems including the Vevo LAZR series featuring integrated ultrasound and photoacoustic capabilities for small animal research, offering high-resolution anatomical and functional imaging

-

Seno Medical Instruments Inc. - Develops the Imagio Breast Imaging System combining optoacoustic and ultrasound technology specifically designed for breast cancer detection and characterization in clinical settings

-

iThera Medical GmbH - Offers MSOT (Multispectral Optoacoustic Tomography) platforms for clinical and preclinical applications, enabling visualization of multiple tissue chromophores and molecular markers

-

TomoWave Laboratories Inc. - Manufactures LOUISA systems providing real-time volumetric PAT imaging for breast cancer screening and diagnosis with laser optoacoustic ultrasonic technology

-

Kibero GmbH - Specializes in photoacoustic imaging solutions for preclinical research applications with focus on tumor microenvironment visualization and drug response monitoring

-

Advantest Corporation - Develops PAT components and systems leveraging semiconductor testing expertise to create high-precision imaging platforms for research applications

-

Aspectus GmbH - Provides innovative photoacoustic imaging technology for dermatological applications including melanoma detection and characterization

-

Vibronix Inc. - Offers compact PAT systems designed for point-of-care applications with emphasis on portability and ease of integration into clinical workflows

Segment Analysis of the Photoacoustic Tomography Market

By Product Type

PAT Imaging Systems - Market Leadership Through Comprehensive Functionality

Complete PAT imaging systems dominate the market landscape with commanding 68.20% share in 2025, reflecting their indispensable role in both clinical and research environments. These integrated platforms combine sophisticated laser sources, sensitive ultrasound detector arrays, and advanced image processing software into unified solutions. Medical institutions prefer complete systems for their reliability, standardized performance, and comprehensive vendor support including installation, training, and maintenance services. Leading manufacturers concentrate development efforts on imaging systems that deliver exceptional deep-tissue visualization while maintaining cellular-level resolution.

North American academic medical centers and research universities represent primary adopters of high-end PAT imaging systems, driven by substantial government and private research funding. European institutions increasingly acquire these platforms for translational research bridging preclinical discoveries with clinical applications. Companies like FUJIFILM VisualSonics and iThera Medical establish strong market positions through continuous innovation in system capabilities and expanding application libraries. The segment benefits from growing recognition among oncologists, cardiologists, and neuroscientists regarding PAT's unique diagnostic advantages over conventional imaging.

Asia Pacific markets show accelerating PAT imaging system adoption as healthcare infrastructure modernization progresses and research institutions expand capabilities. Government initiatives in China, Japan, and South Korea promote advanced medical technology deployment through favorable procurement policies and research grants. Pharmaceutical companies globally invest in preclinical PAT systems for drug development pipelines, particularly for oncology and cardiovascular therapeutic candidates. System manufacturers focus on improving user interfaces, automating calibration procedures, and enhancing integration with laboratory information systems to broaden market accessibility.

PAT Components and Accessories - Fastest Growth Through Continuous Innovation

Components and accessories segment achieves fastest projected growth at 14.60% CAGR from 2026 to 2035, driven by continuous technological advancement and system upgrade demand. This category encompasses laser modules, ultrasound transducers, optical fibers, detector arrays, contrast agents, and specialized software packages. Existing PAT system owners regularly upgrade components to access latest performance capabilities without complete system replacement. Research institutions with custom-built PAT platforms represent significant component consumers, assembling specialized configurations for unique experimental requirements.

Laser technology evolution particularly drives accessories market expansion as new wavelength options, higher pulse energies, and improved beam quality enable enhanced imaging capabilities. Ultrasound transducer innovations including broader bandwidth, higher sensitivity, and specialized geometries address specific anatomical imaging challenges. Software developers create advanced algorithms for image reconstruction, artifact reduction, and quantitative analysis that existing system owners can integrate through updates. Contrast agent development expands PAT applications by enabling targeted molecular imaging of specific biomarkers.

North America maintains leadership in PAT components market due to concentration of system manufacturers, component suppliers, and research institutions engaged in technology development. Europe shows strong component demand driven by academic research programs and collaborations between universities and industry partners. Asia Pacific component market grows rapidly as regional manufacturing capabilities expand and domestic PAT system development accelerates. Component standardization efforts improve interoperability between different vendors' systems, facilitating market growth through increased flexibility.

By Technology

Photoacoustic Microscopy (PAM) - Dominant Technology for High-Resolution Applications

Photoacoustic Microscopy commands 41.50% technology segment share in 2025, establishing dominance through unparalleled high-resolution imaging capabilities. PAM systems achieve cellular and subcellular visualization far exceeding conventional PAT resolution, enabling detailed microstructure examination critical for fundamental biological research. Academic institutions and pharmaceutical research laboratories extensively utilize PAM for visualizing capillary networks, studying cellular metabolism, and tracking individual cells in tissue microenvironments. The technology proves indispensable for neuroscience research requiring detailed brain vasculature mapping and neuronal activity visualization.

Scanning-based PAM implementations provide excellent spatial resolution through point-by-point tissue interrogation, though requiring longer acquisition times than wide-field approaches. Research applications tolerating longer scan durations benefit from PAM's exceptional detail, particularly in small animal models used for disease mechanism studies. Universities in United States, Europe, and increasingly Asia maintain sophisticated PAM facilities supporting diverse biomedical research programs. Companies including FUJIFILM VisualSonics develop commercial PAM systems combining ease-of-use with research-grade performance, expanding technology accessibility beyond custom-built laboratory setups.

Preclinical pharmaceutical research drives substantial PAM adoption for drug efficacy assessment and toxicity screening in animal models. Cancer research programs utilize PAM extensively for tumor angiogenesis studies, metastasis tracking, and therapeutic response monitoring at microscopic scales. Cardiovascular researchers employ PAM for detailed atherosclerosis imaging and blood flow dynamics visualization. The segment benefits from continuous innovations in laser scanning mechanisms, detector sensitivity, and image reconstruction algorithms that improve both resolution and acquisition speed.

Multispectral Optoacoustic Tomography (MSOT) - Fastest Growth Through Molecular Imaging Capabilities

MSOT technology segment achieves fastest projected expansion at 15.80% CAGR from 2026 to 2035, driven by unique multi-wavelength capabilities enabling tissue chromophore differentiation. MSOT systems sequentially illuminate tissues with multiple laser wavelengths, generating spectroscopic data that distinguishes various absorbers including oxygenated hemoglobin, deoxygenated hemoglobin, melanin, and exogenous contrast agents. This molecular imaging capability proves invaluable for cancer research, enabling detailed tumor oxygenation mapping and metabolic characterization. Clinical translation potential attracts substantial investment as MSOT bridges preclinical research with diagnostic applications.

Leading technology developers including iThera Medical advance MSOT platforms combining speed, depth penetration, and spectral discrimination capabilities. Research institutions adopt MSOT for inflammatory disease studies, drug delivery monitoring, and stem cell tracking applications. The technology overcomes light scattering limitations that constrain conventional optical imaging, achieving high-resolution optical contrast deep within tissues. Clinical pilot studies demonstrate MSOT value for breast cancer characterization, inflammatory bowel disease assessment, and peripheral vascular disease evaluation.

North American and European research centers lead MSOT adoption, supported by substantial government funding for translational imaging research. Pharmaceutical companies integrate MSOT into drug development workflows for assessing therapeutic mechanisms and predicting clinical responses from preclinical data. Hardware cost reductions through laser technology advances and detector manufacturing improvements enhance MSOT accessibility. Software development focusing on real-time spectral unmixing and quantitative analysis strengthens clinical utility. Asia Pacific markets show growing MSOT interest as regional research capabilities expand and clinical validation studies progress.

By Application

Preclinical and Research Imaging - Leading Application Through Extensive Research Utilization

Preclinical and research imaging dominates application segments with 37.90% market share in 2025, reflecting PAT's transformative impact on biomedical research methodologies. Academic institutions, pharmaceutical companies, and biotechnology firms extensively employ PAT for small animal studies that form foundations of disease understanding and therapeutic development. The technology enables non-invasive longitudinal studies tracking disease progression and treatment responses in individual animals, reducing variability and required sample sizes compared to terminal endpoint methodologies. Cancer research particularly benefits from PAT's ability to visualize tumor growth, angiogenesis, hypoxia, and metastasis in living subjects.

Universities across North America, Europe, and Asia Pacific maintain dedicated PAT facilities supporting diverse research programs spanning oncology, neuroscience, cardiovascular biology, and immunology. Government agencies including National Institutes of Health provide substantial grant funding for studies incorporating advanced imaging technologies. Pharmaceutical companies invest heavily in preclinical PAT capabilities recognizing technology value for target validation, lead optimization, and efficacy demonstration before clinical trials. Contract research organizations offer PAT imaging services to clients requiring specialized expertise without internal infrastructure investment.

Drug development workflows increasingly incorporate PAT endpoints providing mechanistic insights beyond traditional efficacy measurements. Researchers utilize PAT for assessing drug delivery, biodistribution, pharmacodynamics, and off-target effects in preclinical models. Neuroscience applications include brain function studies, neurodegeneration research, and neural activity mapping in animal models. Cardiovascular researchers employ PAT for atherosclerosis progression monitoring, ischemia detection, and angiogenesis quantification. The segment benefits from continuous PAT performance improvements expanding detectable biomarkers and enabling more sophisticated experimental designs.

Oncology - Fastest Growing Application Through Critical Clinical Need

Oncology application segment achieves fastest projected growth at 15.20% CAGR from 2026 to 2035, driven by cancer's enormous global health burden and PAT's exceptional tumor characterization capabilities. The technology excels at non-invasively visualizing tumor angiogenesis, hypoxia, and metabolic characteristics critical for cancer detection, staging, and treatment monitoring. PAT combines light absorption sensitivity with ultrasound depth penetration to map blood vessel distributions and oxygen saturation levels within tumors, revealing biological information that X-rays, CT, and conventional ultrasound miss. These capabilities align perfectly with oncology's shift toward personalized medicine requiring detailed tumor biology understanding.

Clinical trials increasingly incorporate PAT for monitoring therapeutic responses, particularly for anti-angiogenic treatments and immunotherapies where functional changes precede anatomical tumor size alterations. Breast cancer represents primary clinical focus area with multiple companies developing PAT systems specifically for breast imaging. Research demonstrates PAT value for distinguishing benign from malignant breast lesions based on vascular patterns and oxygen saturation. Melanoma detection represents another promising application leveraging PAT's pigment visualization capabilities. Early-stage clinical studies explore PAT utility for brain tumors, prostate cancer, and colorectal cancer.

Government funding agencies worldwide prioritize cancer research, channeling substantial resources toward imaging technology development and validation. North American cancer centers lead PAT clinical adoption through academic-industry partnerships and NIH-sponsored trials. European oncology programs increasingly integrate PAT into translational research bridging laboratory discoveries with clinical practice. Asia Pacific cancer burden growth drives regional interest in advanced diagnostic technologies including PAT. Continued evidence generation demonstrating PAT clinical value will accelerate oncology segment expansion as reimbursement frameworks evolve and clinician familiarity increases.

By End User

Academic and Research Institutes - Dominant End Users Through Research Leadership

Academic and research institutes command 34.60% end-user segment share in 2025, reflecting their pivotal role driving PAT technology development and application expansion. Universities, national laboratories, and independent research centers extensively utilize PAT for fundamental biological discovery, disease mechanism elucidation, and therapeutic strategy development. These institutions maintain sophisticated imaging facilities operated by specialized personnel supporting diverse research programs. Strong government funding for biomedical research, particularly in United States and Europe, enables academic centers to acquire cutting-edge PAT systems and continuously upgrade capabilities.

Research universities function as innovation engines where PAT technology advances originate before commercial translation. Academic-industry collaborations accelerate prototype development, performance validation, and application discovery. Graduate students and postdoctoral researchers trained on PAT systems create workforce expertise essential for broader technology adoption. Publications from academic studies establish evidence base supporting clinical utility and guide commercial system development priorities. Leading institutions including Stanford University, MIT, Johns Hopkins University, and Max Planck Institutes publish groundbreaking PAT research attracting global attention.

European academic centers benefit from substantial national and EU research funding supporting advanced imaging infrastructure. Asia Pacific universities rapidly expand PAT capabilities supported by government science initiatives in China, Japan, South Korea, and Singapore. Academic conferences and workshops facilitate knowledge exchange, standardization development, and collaborative study formation. Research institutes serve as reference sites where clinicians and industry personnel receive training on PAT principles and applications. The segment's dominance reflects PAT's current position in technology maturity cycle with substantial room for clinical translation growth.

Pharmaceutical and Biotechnology Companies - Fastest Growing Through Drug Development Integration

Pharmaceutical and biotechnology companies segment achieves fastest projected expansion at 15.60% CAGR from 2026 to 2035, driven by PAT's valuable contributions to drug development processes. Companies utilize PAT for non-invasive high-resolution preclinical research enabling detailed efficacy assessment and safety profiling in animal models. The technology visualizes drug delivery, target engagement, pharmacodynamic effects, and potential toxicities with unprecedented detail. Oncology drug developers particularly value PAT for monitoring tumor responses, angiogenesis modulation, and metastasis inhibition. Cardiovascular therapeutic developers employ PAT for atherosclerosis intervention assessment and cardiac function monitoring.

Major pharmaceutical corporations including Pfizer, Johnson & Johnson, Novartis, and Roche invest substantially in advanced imaging capabilities supporting discovery and development pipelines. Biotechnology companies developing innovative therapeutics require sophisticated preclinical tools demonstrating mechanism of action and predicting clinical outcomes. Contract research organizations serving pharmaceutical clients establish PAT capabilities offering imaging services and expertise. The technology's ability to reduce animal usage while providing more comprehensive data aligns with industry's commitment to ethical research practices and regulatory requirements.

PAT integration into pharmaceutical workflows improves decision-making efficiency, potentially accelerating development timelines and reducing costs through earlier identification of promising candidates and failed approaches. Regulatory agencies increasingly recognize advanced imaging endpoints in preclinical packages supporting investigational new drug applications. North American and European pharmaceutical sectors lead PAT adoption while Asia Pacific pharmaceutical industry growth drives regional demand expansion. Neurological disorder therapeutic development represents emerging application area as PAT enables detailed brain function assessment in animal models. The segment's rapid growth reflects PAT's proven value proposition for pharmaceutical research applications.

By Imaging Mode

Preclinical Imaging - Dominant Mode Through Extensive Research Applications

Preclinical imaging mode captures commanding 63.40% segment share in 2025, reflecting PAT's established role in biomedical research involving animal models. This application encompasses small animal imaging for disease studies, therapeutic development, and basic biological discovery. Pharmaceutical and biotechnology companies heavily utilize preclinical PAT for drug candidate evaluation throughout development pipelines. Academic institutions conduct fundamental research using preclinical PAT to understand biological processes, disease mechanisms, and potential therapeutic targets. The mode benefits from well-established regulatory pathways, proven methodologies, and extensive published literature supporting experimental design.

Small animal imaging represents core preclinical PAT application with mice and rats serving as primary subjects for cancer, cardiovascular, and neurological research. Technology providers develop specialized systems optimized for small animal imaging including appropriate field-of-view dimensions, resolution specifications, and animal handling accessories. Researchers conduct longitudinal studies tracking disease progression and therapeutic responses in individual animals over weeks or months. This approach reduces statistical variability compared to cross-sectional studies requiring large animal cohorts sacrificed at different timepoints. PAT's non-invasive nature enables humane research practices aligning with evolving ethical standards.

North American research institutions lead preclinical PAT utilization supported by National Institutes of Health and private foundation funding. European animal research facilities adopt PAT complying with strict regulations promoting alternatives and refinements to traditional methods. Asia Pacific preclinical imaging market grows rapidly as regional pharmaceutical industry expands and academic research capabilities strengthen. Government funding in China particularly supports advanced imaging infrastructure development. Contract research organizations offering preclinical imaging services expand PAT capabilities meeting pharmaceutical client demand. The segment's dominance reflects current technology maturity with substantial opportunity remaining for clinical translation.

Clinical Imaging - Fastest Growth Through Healthcare Translation

Clinical imaging mode achieves fastest projected expansion at 14.90% CAGR from 2026 to 2035, representing PAT's crucial transition from research tool toward mainstream diagnostic modality. This growth reflects increasing evidence supporting PAT clinical utility, regulatory approval progress, and system developments optimized for hospital environments. Clinical PAT applications focus on cancer detection and characterization, vascular disease assessment, and emerging applications in neurology and dermatology. Integration capabilities with existing clinical ultrasound infrastructure reduce implementation barriers for hospitals already equipped with complementary imaging technology.

Breast imaging represents primary clinical application area with multiple companies pursuing regulatory approvals and conducting clinical validation studies. PAT adds functional vascular information to conventional ultrasound anatomy, potentially improving diagnostic accuracy for suspicious lesions detected through mammography or palpation. Clinical studies demonstrate PAT value for reducing unnecessary biopsies by better characterizing benign versus malignant lesions. Early clinical results also show promise for inflammatory disease assessment, peripheral vascular disease evaluation, and skin cancer detection. Clinician training programs and standardized interpretation guidelines support clinical adoption.

Regulatory approvals accelerate clinical segment growth as systems receive clearances from FDA, European regulatory authorities, and other regional agencies. Reimbursement policy development providing payment for PAT procedures removes financial barriers to clinical implementation. North American academic medical centers lead clinical PAT adoption through research protocols and early clinical use. European hospitals increasingly incorporate PAT particularly in countries with strong medical technology support. Asia Pacific clinical adoption grows as regulatory frameworks mature and healthcare quality improvement initiatives promote advanced diagnostic capabilities. The segment represents PAT's future growth frontier as technology completes clinical translation journey.

Value Chain Analysis

Research and Development

PAT value chain originates with fundamental research conducted at universities, national laboratories, and corporate research centers developing core technology principles and components. Scientists investigate photoacoustic phenomena, laser-tissue interactions, ultrasound signal generation and detection, and image reconstruction algorithms. This stage involves physicists, biomedical engineers, and applied mathematicians creating theoretical frameworks and experimental validations. Research outcomes appear in scientific publications, conference presentations, and patent applications establishing intellectual property foundations. Government agencies including NSF, NIH, and European Research Council provide primary funding supporting academic research. Corporate R&D investments focus on translating fundamental discoveries toward commercial applications.

Key Players: Stanford University, MIT, University of Cambridge, Max Planck Institutes, FUJIFILM Corporation Research Laboratories, Canon Medical Systems Research Division

Component Manufacturing

Specialized manufacturers produce critical components including laser sources, ultrasound transducers, optical fibers, detector arrays, and electronic signal processing hardware. Laser manufacturers develop high-power pulsed systems with specific wavelength capabilities and beam characteristics required for PAT applications. Ultrasound transducer companies create sensitive broadband detectors capturing acoustic signals generated by laser-induced thermoelastic expansion. Optical component suppliers provide fiber delivery systems, beam shaping optics, and wavelength selection devices. Electronics manufacturers produce high-speed data acquisition systems, amplifiers, and signal processors. Component quality directly impacts final system performance, reliability, and cost.

Key Players: Litron Lasers, InnoLas Laser GmbH, PerkinElmer, Teledyne Technologies, Texas Instruments, Analog Devices

System Integration and Manufacturing

Medical imaging companies integrate components into complete PAT systems designed for specific applications and market segments. Integration involves mechanical design, software development, safety systems, quality control procedures, and regulatory compliance activities. Manufacturers develop user interfaces, automated calibration routines, and data management systems enabling non-specialist operation. Preclinical systems optimize small animal imaging with appropriate positioning devices, anesthesia delivery, and physiological monitoring. Clinical systems emphasize patient comfort, examination efficiency, and integration with hospital information systems. Quality management systems ensure consistent manufacturing meeting regulatory requirements and customer expectations.

Key Players: FUJIFILM VisualSonics Inc., Seno Medical Instruments, iThera Medical GmbH, TomoWave Laboratories, Kibero GmbH

Distribution and Sales

Distribution channels vary by market segment with direct sales predominating for high-value preclinical and clinical systems while dealer networks serve broader markets. Manufacturers establish regional offices providing sales support, technical consultation, and customer relationship management. Medical equipment distributors represent multiple manufacturers offering comprehensive imaging portfolios. Online platforms increasingly facilitate component and accessory sales. International distribution requires navigating diverse regulatory environments, import regulations, and local market preferences. Sales personnel require technical expertise explaining PAT principles, application possibilities, and competitive advantages. Demonstration facilities allow potential customers experiencing system capabilities.

Key Players: FUJIFILM Medical Systems, Genetik Inc., regional medical equipment distributors

Installation and Training

Successful PAT deployment requires professional installation ensuring proper system configuration, calibration, and integration with facility infrastructure. Installation teams coordinate with hospital facilities departments addressing electrical requirements, cooling systems, and safety protocols. Comprehensive operator training programs cover system operation, maintenance procedures, image acquisition techniques, and basic troubleshooting. Clinical systems require additional training for radiologists and physicians interpreting PAT images and integrating findings with other diagnostic information. Ongoing education addresses software updates, new applications, and advanced techniques. Remote support capabilities enable troubleshooting and guidance without on-site visits.

Key Players: Manufacturer service departments, third-party medical equipment service providers, academic training centers

Clinical and Research Applications

End users including hospitals, diagnostic centers, research institutions, and pharmaceutical companies employ PAT systems for intended applications. Clinical users integrate PAT into diagnostic pathways supplementing or replacing existing imaging approaches. Research facilities conduct studies generating data supporting publications, grant applications, and technology advancement. Pharmaceutical companies evaluate drug candidates using PAT endpoints. Application development continues through user innovation, protocol optimization, and workflow integration. User feedback informs manufacturers regarding needed improvements, desired features, and emerging application opportunities. Successful applications drive market growth through demonstrated value and published evidence.

Key Players: Academic medical centers, cancer treatment centers, pharmaceutical companies, contract research organizations

After-Sales Support and Service

Ongoing maintenance, repair services, software updates, and technical support ensure continued system performance and user satisfaction. Service contracts provide scheduled preventive maintenance, priority repair response, and application support. Manufacturers maintain spare parts inventory, service personnel networks, and remote diagnostic capabilities. Software updates deliver performance improvements, new features, and security patches. Application specialists assist users optimizing protocols and troubleshooting image quality issues. Customer satisfaction directly impacts repeat purchases, technology adoption rates, and market reputation. Strong after-sales support differentiates manufacturers in competitive markets.

Key Players: Manufacturer service divisions, authorized service partners, independent medical equipment service companies

Regional Insights of the Photoacoustic Tomography Market

North America - Established Market Leadership Through Innovation Excellence

North America maintains dominant position in the global Photoacoustic Tomography market capturing 42.10% regional share in 2025, valued at approximately USD 38.48 million. The region's leadership stems from exceptional healthcare infrastructure, substantial research and development investments, concentrated presence of leading technology developers, and robust government funding supporting medical innovation. United States represents primary market driver hosting pioneering PAT companies including FUJIFILM VisualSonics, Seno Medical Instruments, and TomoWave Laboratories. Academic powerhouses such as Stanford University, Massachusetts Institute of Technology, and Johns Hopkins University conduct groundbreaking PAT research attracting global attention and talent.

Federal agencies including National Institutes of Health, National Science Foundation, and Department of Defense provide substantial grant funding supporting PAT technology development and clinical validation studies. State governments and private foundations supplement federal support creating comprehensive research funding ecosystem. Strong collaboration networks connecting universities, hospitals, and industry partners accelerate technology translation from laboratory prototypes to commercial products. Regulatory environment balances innovation encouragement with safety assurance through FDA's established pathways for novel imaging device approvals. Early-adopter academic medical centers create reference sites where clinicians receive training and generate evidence supporting broader technology diffusion.

North American pharmaceutical and biotechnology industries represent substantial PAT customer base driven by competitive pressures for efficient drug development. Companies recognize PAT value for preclinical efficacy assessment, mechanistic studies, and biomarker validation. Cancer research receives particularly strong support with billions allocated annually toward understanding disease biology and developing improved treatments. Healthcare economics increasingly favor non-invasive diagnostic technologies reducing patient risk and potentially lowering overall care costs. The region's projected growth at 15.84% CAGR from 2026 to 2033 reaching approximately USD 168.37 million by 2035 reflects sustained innovation leadership and clinical translation progress.

United States - Innovation Powerhouse Driving Technology Advancement

United States commands North American PAT market with approximately USD 28.78 million valuation in 2025, projected to reach USD 126.65 million by 2035 at 15.92% CAGR. The nation's dominance reflects unparalleled research infrastructure, entrepreneurial ecosystem supporting medical technology startups, and healthcare system willing to adopt innovative diagnostic approaches. Leading academic institutions conduct fundamental PAT research while training next-generation scientists and clinicians. Technology transfer offices facilitate intellectual property commercialization connecting university discoveries with industry partners and venture capital.

Government regulatory framework through FDA provides clear pathways for PAT system approvals while maintaining rigorous safety and efficacy standards. Breakthrough device designation program accelerates promising technologies addressing unmet medical needs. National Institutes of Health annual budget exceeding USD 40 billion supports biomedical research including substantial imaging technology investments. SBIR and STTR grant programs specifically fund small businesses developing innovative medical devices. Private venture capital actively invests in medical imaging startups recognizing PAT commercial potential. Healthcare delivery system combines academic medical centers conducting cutting-edge research with community hospitals serving broader populations.

Cancer remains national health priority with comprehensive research programs supported by National Cancer Institute, American Cancer Society, and disease-specific foundations. Cardiovascular disease research receives substantial support addressing nation's leading mortality cause. Neuroscience initiatives including BRAIN program promote advanced brain imaging technologies. Clinical trial infrastructure enables efficient patient recruitment and data collection supporting PAT validation studies. Medical device industry concentration in regions like California, Massachusetts, and Minnesota creates innovation clusters with specialized expertise, supply chains, and talent pools. Strong intellectual property protection encourages technology investment and commercialization.

Asia Pacific - Fastest Regional Growth Through Healthcare Expansion

Asia Pacific achieves fastest projected regional growth at 16.10% CAGR from 2026 to 2035, driven by healthcare infrastructure modernization, rising government support for medical technology adoption, large patient populations with chronic diseases, and increasing public and private sector investments. China, Japan, India, and South Korea lead regional market development through distinct but complementary approaches. Healthcare spending rapidly escalates across the region as economic prosperity enables greater health investment. Government policies actively promote medical technology innovation and clinical adoption supporting national development objectives.

China demonstrates extraordinary growth potential combining massive population, expanding healthcare coverage, government commitment to healthcare improvement, and growing domestic medical device industry. National initiatives promote advanced manufacturing including medical equipment with subsidies, tax incentives, and procurement preferences for domestic products. Leading Chinese universities establish world-class research facilities increasingly contributing to global PAT literature. Japan leverages technological sophistication, aging population driving healthcare demand, and strong medical device industry developing innovative solutions. Japanese government supports medical technology through regulatory streamlining and reimbursement policies.

India represents emerging market with enormous long-term potential driven by population size, rising middle class, healthcare infrastructure expansion, and government universal healthcare initiatives. Leading Indian medical institutions adopt advanced imaging technologies establishing centers of excellence. South Korea combines advanced technology capabilities, universal healthcare coverage, and government support for medical innovation. Southeast Asian nations including Singapore, Thailand, and Malaysia invest in healthcare infrastructure attracting medical tourism and establishing regional medical hubs. Regional pharmaceutical industry growth drives preclinical imaging demand. Academic research expansion creates educated workforce and technology expertise supporting market development.

Europe - Strong Position Through Research Excellence and Clinical Adoption

Europe maintains significant global Photoacoustic Tomography market position supported by robust healthcare infrastructure, substantial government and private R&D funding, presence of innovative technology companies, and strong clinical adoption of advanced diagnostics. The region hosts leading PAT developers including iThera Medical GmbH, Kibero GmbH, and Aspectus GmbH concentrating in Germany's strong medical technology sector. Academic research centers across United Kingdom, Germany, France, Netherlands, and Switzerland conduct influential PAT studies advancing technology capabilities and clinical applications.

European Union research funding programs including Horizon Europe allocate billions toward health research and innovation with medical imaging representing priority area. National research councils in individual countries provide additional support creating comprehensive funding ecosystem. Strong university-industry collaboration networks facilitate technology translation with mechanisms supporting spin-off companies and partnerships. Regulatory environment through European Medicines Agency provides harmonized approval pathways across member states while maintaining high safety standards. Healthcare systems with universal coverage and emphasis on preventive care create favorable environment for advanced diagnostic adoption.

Germany functions as European PAT innovation hub hosting major manufacturers, component suppliers, and research institutions. Fraunhofer Institutes conduct applied research bridging fundamental science and commercial applications. Strong engineering traditions and precision manufacturing capabilities support high-quality medical device production. United Kingdom maintains research strength through universities and National Health Service providing large patient populations for clinical studies. France contributes through biomedical research excellence and growing medical technology sector. Regional collaboration through EU programs enables multinational research projects and clinical trials accelerating evidence generation. Healthcare economics emphasizing value and outcomes support technologies demonstrating clinical utility and cost-effectiveness.

Latin America - Emerging Market Through Healthcare Modernization

Latin America represents growing Photoacoustic Tomography market opportunity driven by healthcare infrastructure investments, rising chronic disease burden, and expanding focus on advanced diagnostic capabilities. Brazil, Mexico, Argentina, and Chile lead regional development with healthcare systems undergoing modernization. Government initiatives improve healthcare access and quality supporting medical technology adoption. Rising cancer and cardiovascular disease prevalence creates demand for advanced diagnostic tools enabling early detection and treatment monitoring. Growing middle class demands higher quality healthcare services including access to latest technologies.

Brazil dominates regional market as largest economy and population with healthcare system combining public universal coverage and private insurance. Major Brazilian cities host sophisticated medical centers adopting advanced imaging technologies. Government programs promote healthcare infrastructure expansion and technology adoption particularly in oncology centers. Medical device imports grow as domestic demand exceeds local production capabilities. Mexico benefits from proximity to United States enabling technology transfer and professional exchange. Healthcare reforms expand coverage and improve quality supporting advanced diagnostic adoption.

Academic medical centers in major Latin American cities establish research programs increasingly including advanced imaging capabilities. Partnerships with North American and European institutions facilitate knowledge transfer and collaborative studies. Pharmaceutical companies establish regional research facilities requiring preclinical imaging capabilities. Medical tourism in certain countries drives healthcare quality improvements and technology investments. Regional challenges including economic variability, healthcare access disparities, and cost constraints influence adoption patterns. However, long-term trajectory favors gradual PAT market expansion as healthcare systems mature and technology costs decline through manufacturing improvements.

Middle East and Africa - Developing Market Through Targeted Investments

Middle East and Africa demonstrates increasing Photoacoustic Tomography market interest driven by healthcare transformation initiatives, particularly in Gulf Cooperation Council nations. Saudi Arabia, United Arab Emirates, Qatar, and Kuwait invest substantially in healthcare infrastructure as part of economic diversification strategies. Government-led initiatives establish world-class medical facilities attracting international expertise and technology. Healthcare spending increases significantly supporting adoption of advanced diagnostic equipment. Growing medical tourism positions region as destination for quality healthcare combining modern facilities with cultural considerations.

Saudi Arabia pursues ambitious healthcare sector development under Vision 2030 economic transformation plan. Major hospital construction projects in Riyadh, Jeddah, and other cities incorporate latest medical technologies. Government procurement actively seeks advanced diagnostic capabilities supporting national health objectives. Specialized oncology centers adopt cutting-edge imaging technologies addressing growing cancer burden. United Arab Emirates, particularly Dubai and Abu Dhabi, establishes healthcare free zones attracting international hospital groups and medical technology companies. Academic medical centers pursue research excellence including advanced imaging capabilities.

South Africa leads sub-Saharan African market with most developed healthcare infrastructure and strong academic medical centers. Research institutions conduct studies addressing regional health priorities while building local expertise. Private healthcare sector adopts advanced technologies serving affluent populations. However, broad market development faces challenges including healthcare access disparities, economic constraints, and infrastructure limitations. North African nations including Egypt show gradual healthcare modernization with growing interest in advanced diagnostics. Long-term regional potential exists as economic development progresses, healthcare priorities strengthen, and technology becomes more accessible through cost reductions and financing mechanisms.

Top Key Players

-

FUJIFILM VisualSonics Inc. (Canada)

-

Seno Medical Instruments Inc. (United States)

-

iThera Medical GmbH (Germany)

-

TomoWave Laboratories Inc. (United States)

-

Kibero GmbH (Germany)

-

Advantest Corporation (Japan)

-

Aspectus GmbH (Germany)

-

Vibronix Inc. (United States)

-

Endra Life Sciences Inc. (United States)

-

PerkinElmer Inc. (United States)

-

Litron Lasers Ltd. (United Kingdom)

-

InnoLas Laser GmbH (Germany)

-

PreXion Corporation (Japan)

-

Canon Inc. (Japan)

-

Teledyne Technologies (United States)

Recent Developments

-

FUJIFILM VisualSonics Inc. (June 2025) - Launched the Vevo F2 LAZR-X20 Photoacoustic Imaging Platform featuring cutting-edge laser technology delivering unprecedented anatomical accuracy for preclinical animal research. The advanced system enhances imaging depth penetration and spatial resolution capabilities, enabling researchers to conduct non-invasive detection of tissue chromophores with exceptional precision. This platform significantly advances tumor microenvironment visualization applications and provides quantitative assessment of therapeutic efficiency in oncology research programs.

-

Seno Medical Instruments Inc. (November 2024) - Achieved significant market validation as the Imagio Breast Imaging System received an Innovative Technology contract designation from Vizient Inc., America's largest provider-driven healthcare performance improvement organization. This recognition accelerates clinical adoption by facilitating streamlined procurement processes for healthcare institutions nationwide. The designation highlights growing acceptance of optoacoustic-ultrasound hybrid imaging for breast cancer detection within mainstream clinical practice.

-

Verasonics Inc. (April 2025) - Announced Vantage NXT software release version 2.0 introducing the groundbreaking Acquisition SDK Programming Model. This C-based application programming interface enables researchers and commercial developers to program the Vantage NXT Research Ultrasound System without MATLAB dependencies, substantially simplifying integration of legacy software applications. The development accelerates commercialization pathways for academic research innovations and facilitates custom application development by industry partners.

-

Seno Medical Instruments Inc. (July 2023) - Achieved major standardization milestone as the Imagio Breast Imaging System received inclusion in the Digital Imaging and Communications in Medicine Standards 2023c update. This incorporation into the globally recognized DICOM framework, overseen by Medical Imaging & Technology Alliance, enables seamless integration with existing hospital picture archiving and communication systems. Standardization removes technical barriers to clinical adoption and facilitates interoperability with complementary imaging modalities.

-

Seno Medical Instruments Inc. (January 2023) - Established exclusive distribution partnership with Genetik Inc. for marketing, sales, and service of the innovative Imagio Opto-Acoustic/Ultrasound Breast Imaging System in Singapore. This inaugural distributor agreement represents strategic international expansion approach, leveraging local market expertise and established customer relationships.

Market Trends

The Photoacoustic Tomography market experiences profound transformation through artificial intelligence integration fundamentally altering image processing, analysis, and diagnostic interpretation. Machine learning algorithms now automate complex reconstruction processes that previously required significant computational resources and expert intervention. Deep learning models trained on extensive datasets recognize pathological patterns with accuracy matching or exceeding experienced radiologists in certain applications. Neural networks enhance real-time imaging capabilities, making PAT more practical for time-sensitive clinical scenarios including intraoperative guidance and emergency diagnostics. AI-powered noise reduction and artifact correction improve image quality from lower-cost systems, democratizing access to advanced imaging capabilities.

Miniaturization represents another critical trend reshaping market dynamics as manufacturers develop portable and handheld PAT devices suitable for point-of-care applications. Traditional systems requiring dedicated imaging suites give way to mobile units deployable in outpatient clinics, emergency departments, rural healthcare facilities, and even patient homes. Wearable PAT sensors emerge for continuous physiological monitoring applications including fitness tracking, chronic disease management, and post-surgical surveillance. These compact devices leverage advances in laser diode technology, microelectromechanical systems ultrasound transducers, and low-power signal processing. Portability expands potential user base beyond specialized imaging centers to primary care physicians, emergency medical technicians, and home healthcare providers.

Multimodal imaging platform development accelerates as manufacturers recognize value in combining PAT with complementary technologies. Hybrid PAT-ultrasound systems provide anatomical structure visualization alongside functional hemodynamic information within unified examinations. PAT-MRI combinations under development promise exceptional soft tissue contrast combined with molecular and metabolic characterization. Integration with conventional clinical ultrasound systems follows particularly strategic approach, leveraging installed base of ultrasound equipment and familiar clinical workflows. Software platforms increasingly support data fusion from multiple imaging modalities, enabling radiologists to correlate findings and improve diagnostic confidence. This convergence trend reflects healthcare's broader movement toward comprehensive diagnostic approaches rather than siloed technologies.

Personalized medicine initiatives drive growing Photoacoustic Tomography market adoption as healthcare systems transition from population-based protocols toward individualized treatment strategies. PAT's molecular and functional imaging capabilities support patient-specific therapy selection by characterizing tumor biology, predicting treatment responses, and monitoring interventions in real-time. Oncology particularly embraces personalized approaches with treatment decisions increasingly guided by detailed tumor characterization beyond simple anatomical staging. Cardiovascular medicine similarly moves toward individualized risk assessment and intervention planning based on detailed vascular characterization. Pharmaceutical companies develop companion diagnostics using PAT to identify patient populations most likely to benefit from specific therapeutics, improving clinical trial success rates and market strategies.

Segments Covered in the Report

By Product Type

-

PAT Imaging Systems

-

Components and Accessories

-

Contrast Agents

-

Software Solutions

By Technology

-

Photoacoustic Microscopy (PAM)

-

Photoacoustic Computed Tomography (PACT)

-

Multispectral Optoacoustic Tomography (MSOT)

-

Intravascular Photoacoustic Imaging (IVPA)

By Application

-

Preclinical and Research Imaging

-

Oncology

-

Cardiology

-

Neurology

-

Dermatology

-

Gastroenterology

-

Ophthalmology

By End User

-

Academic and Research Institutes

-

Pharmaceutical and Biotechnology Companies

-

Hospitals and Diagnostic Centers

-

Contract Research Organizations

-

Medical Device Companies

By Imaging Mode

-

Preclinical Imaging

-

Clinical Imaging

By Region

-

North America (United States, Canada, Mexico)

-

Europe (Germany, United Kingdom, France, Italy, Spain, Rest of Europe)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Singapore, Rest of Asia Pacific)

-

Latin America (Brazil, Mexico, Argentina, Chile, Rest of Latin America)

-

Middle East and Africa (Saudi Arabia, United Arab Emirates, South Africa, Rest of Middle East and Africa)

Frequently Asked Questions:

The global Photoacoustic Tomography market is projected to reach approximately USD 365.65 million by 2033, growing from USD 106.27 million in 2026. This substantial expansion reflects increasing adoption across clinical and research applications, technological advancements improving system performance, and growing recognition of PAT's unique diagnostic capabilities combining optical absorption contrast with ultrasound depth penetration.

North America dominates the global PAT market with 42.10% market share in 2025, valued at approximately USD 38.48 million. The region's leadership stems from advanced healthcare infrastructure, substantial research investments, presence of leading technology developers, and robust government funding through agencies like the National Institutes of Health supporting medical innovation and clinical validation studies.

Primary growth drivers include rising chronic disease prevalence particularly cancer and cardiovascular conditions, technological advancements in laser and ultrasound components enhancing system capabilities, increasing demand for non-invasive radiation-free diagnostic methods, artificial intelligence integration improving image quality and diagnostic accuracy, and growing healthcare investments especially in emerging markets supporting medical technology adoption.

The oncology application segment demonstrates fastest projected growth at 15.20% CAGR from 2026 to 2035, driven by PAT technology's exceptional ability to visualize tumor angiogenesis, hypoxia, and metabolic characteristics critical for cancer detection and treatment monitoring. Growing cancer burden worldwide and shift toward personalized medicine requiring detailed tumor biology understanding further accelerate this segment's expansion.

Leading companies include FUJIFILM VisualSonics Inc. offering advanced Vevo LAZR platforms for preclinical research, Seno Medical Instruments Inc. developing Imagio systems for breast cancer imaging, iThera Medical GmbH providing MSOT multispectral platforms, TomoWave Laboratories Inc. manufacturing LOUISA volumetric imaging systems, and Kibero GmbH specializing in tumor microenvironment visualization solutions for pharmaceutical research applications.