Port Infrastructure Market Overview

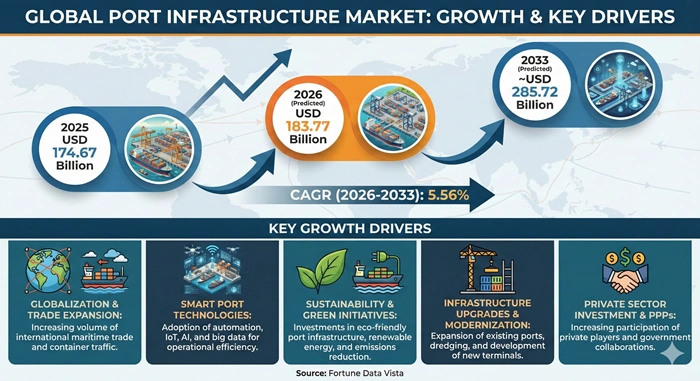

The global port infrastructure market size is valued at USD 174.67 billion in 2025 and is predicted to increase from USD 183.77 billion in 2026 to approximately USD 285.72 billion by 2033, growing at a CAGR of 5.56% from 2026 to 2033. Port infrastructure encompasses the physical facilities, structures, and systems essential for maritime transportation operations, including terminals, berths, docks, cargo handling equipment, warehouses, and supporting technologies that enable efficient movement of goods and passengers across international waters. Modern port facilities serve as critical gateways connecting global supply chains, facilitating seamless transitions between maritime and inland transportation networks while supporting diverse cargo types ranging from containerized goods to bulk commodities and specialized energy products.

AI Impact on the Port Infrastructure Industry

Transforming Maritime Logistics Through Advanced Digital Solutions and Sustainable Infrastructure Development

Artificial intelligence is revolutionizing the port infrastructure market by introducing unprecedented levels of automation, predictive analytics, and operational optimization across global maritime facilities. AI-powered systems are transforming warehouse operations through intelligent inventory management, demand forecasting algorithms, and automated picking and packing processes that significantly reduce human errors while enhancing space utilization and order fulfillment efficiency. Machine learning algorithms analyze historical operational data combined with real-time inputs such as vessel arrival schedules, weather patterns, and cargo volumes to enable ports to anticipate resource requirements and allocate assets more effectively, thereby minimizing vessel waiting times and reducing operational costs substantially.

Advanced AI applications extend beyond basic automation to include sophisticated surveillance systems utilizing cameras and drones for comprehensive security monitoring, predictive maintenance capabilities that analyze equipment sensor data to anticipate failures before they occur, and digital twin technologies that allow real-time simulation of entire port operations for precise planning and rapid response to disruptions. Major facilities such as the Port of Rotterdam and Port of Los Angeles have successfully deployed autonomous container trucks, AI-driven cranes, and intelligent berth management systems that optimize vessel scheduling and reduce turnaround times by up to thirty percent. These technological advancements are positioning AI as an indispensable component in the evolution of smart ports, enabling freight forwarders to automate documentation processes, optimize shipment consolidation, provide real-time cargo tracking, and ultimately deliver enhanced customer service while streamlining complex maritime logistics operations across the global port infrastructure market.

Growth Factors

Expanding Global Trade Volumes and Government Infrastructure Investments Drive Robust Market Expansion

Increased government spending on port infrastructure development represents a primary catalyst propelling the port infrastructure market forward, as nations recognize the critical importance of maritime facilities in ensuring safe, efficient commercial activity and maintaining competitive positions in international trade. Rising demand for liquefied natural gas exports via marine transport channels, coupled with the fundamental dependence of countless businesses on maritime shipping for importing and exporting goods internationally, continues to fuel sustained growth across the sector. The construction of additional port facilities in emerging economies is accelerating rapidly as nations strengthen economic linkages and accommodate expanding trade volumes, exemplified by India's expansion from 199 ports in 2008 to 217 by 2018, demonstrating the pace of infrastructure development in high-growth markets.

The global shift toward ultra-large container ships necessitates continuous port upgrades including harbor deepening projects, terminal expansion initiatives, and investments in advanced crane systems capable of handling these massive vessels efficiently. E-commerce expansion places unprecedented pressure on port and logistics systems to handle and distribute large volumes of smaller packages with enhanced speed and reliability, while sustainability regulations and climate change mitigation policies drive investments in cleaner, more efficient port infrastructure incorporating renewable energy sources and emission reduction technologies. Maritime trade's inherent advantages over other transportation modes—including cost-effectiveness for heavy cargo, reduced traffic congestion, and capacity for transporting massive volumes—continue to strengthen the fundamental value proposition of the port infrastructure market, supporting its projected growth trajectory through 2033.

Market Outlook

Strategic Modernization and Technological Innovation Reshape Global Maritime Infrastructure Landscape

The port infrastructure market is experiencing transformative growth driven by expanding international commerce, increasing vessel dimensions, and substantial investments in sustainability-focused automation technologies that enhance operational capabilities. Global expansion patterns reveal an accelerating shift toward accommodating ultra-large container ships, requiring ports to undertake major infrastructure upgrades including deepening harbors, expanding terminal footprints, and deploying more powerful crane systems to efficiently handle these vessels while maintaining competitive turnaround times. Major investors and operators dominating the sector include leading international terminal operators such as DP World, APM Terminals, Hutchison Ports, and PSA International, alongside large private conglomerates and government bodies implementing strategic modernization programs across key maritime regions.

Industry growth trajectories indicate strong momentum particularly in Asian markets where rapid economic development in China and India, combined with expanding Southeast Asian economies, contribute substantially to regional expansion of maritime trade operations utilizing ports for more than ninety-five percent of trade volumes. North America maintains its dominant market position through ongoing infrastructure modernization efforts and strategic integration with comprehensive logistics networks, while European ports focus on incorporating advanced digital technologies, automation systems, and green infrastructure solutions including hydrogen and electricity-based equipment to achieve efficiency and sustainability targets. The rise of nearshoring trends and multimodal port connectivity requirements, combined with customs digitization initiatives and enhanced last-mile delivery capabilities, position the port infrastructure market for sustained growth as stakeholders ranging from national governments to global shipping conglomerates and technology startups collaborate to develop automation, digitalization, and sustainability innovations defining future-ready global maritime facilities.

Expert Speaks

-

Vincent Clerc, CEO of A.P. Moller-Maersk, emphasized the importance of infrastructure modernization in supporting global supply chain resilience, noting that investments in terminal automation and digital integration are essential for meeting growing customer demands in an increasingly complex trade environment.

-

Sultan Ahmed bin Sulayem, Group Chairman and CEO of DP World, highlighted that strategic port development combined with advanced technology adoption enables faster cargo processing times and enhanced connectivity, positioning ports as critical enablers of international commerce and economic growth.

-

Gautam Adani, Chairman of Adani Group, stated that significant capital allocations toward port expansion and capacity enhancement across multiple facilities demonstrate the sector's vital role in supporting India's economic ambitions and strengthening the nation's position in global maritime trade networks.

Key Report Takeaways

-

Asia Pacific leads the port infrastructure market with the largest regional share of approximately 47%, driven by massive trade volumes flowing through major facilities in China, India, Japan, Singapore, and other Southeast Asian economies that handle substantial containerized cargo and bulk commodities.

-

Asia Pacific is also the fastest-growing region with robust expansion fueled by rapid industrialization, urbanization, government-backed infrastructure development programs, and strategic initiatives such as China's Belt and Road projects and India's Sagarmala Programme.

-

Seaports dominate by port type capturing approximately 74% of the market share as these coastal facilities remain essential for berthing ultra-large container vessels and handling the vast majority of international maritime cargo traffic.

-

Cargo handling represents the largest application segment accounting for approximately 82% of revenue share, reflecting the predominant use of port facilities for transporting goods including containerized products, bulk commodities, energy resources, and specialized cargo rather than passenger services.

-

The terminals segment contributes most significantly to infrastructure type holding around 32% of the market share due to increasing investments in automated container handling systems, advanced tracking technologies, and terminal expansion projects necessary for accommodating larger vessels and higher cargo volumes.

-

The coastal ports segment is projected to grow rapidly exhibiting strong CAGR driven by strategic locations enabling efficient high-volume cargo handling, sustainability initiatives including port electrification, and supportive government funding from infrastructure legislation.

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 285.72 Billion | Market Size by 2026 | USD 183.77 Billion | Market Size by 2025 | USD 174.67 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 5.56% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Port Type, Application, Construction Type, Infrastructure Type, Port Location, Service Type, Level Outlook, Facility Type, End Use, and Geography | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

Government Infrastructure Spending and Maritime Trade Expansion Propel Market Growth

| ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|

| High (+1.2% to +1.8%) | Global, particularly Asia Pacific and Middle East | 2026-2033 |

Increased government spending on port infrastructure development serves as a fundamental driver propelling the port infrastructure market forward globally, as nations prioritize investments ensuring safe and productive commercial maritime activities that support national economic objectives. Rising international trade volumes coupled with the expansion of global supply chains necessitate continuous enhancement of port capacity and operational efficiency to accommodate growing cargo throughput, particularly as businesses increasingly depend on maritime shipping for importing raw materials and exporting finished goods across international markets. The substantial growth in liquefied natural gas exports transported via marine channels creates additional demand for specialized port facilities equipped with appropriate handling and storage infrastructure capable of safely managing these energy commodities.

Strategic construction of new port facilities in emerging economies accelerates as nations strengthen economic linkages and respond to expanding trade volumes, exemplified by rapid development in countries like China and India where port networks have expanded significantly within the past decade. Policy initiatives implemented by governments worldwide focus on enhancing port infrastructure quality, streamlining environmental clearance processes, establishing regulatory frameworks for service and performance standards, and creating special purpose investment vehicles specifically designed to attract private capital into port development projects. The inherent advantages of maritime transportation—including cost-effectiveness for heavy cargo, reduced traffic congestion compared to road transport, and capacity for handling massive volumes—continue to reinforce the critical importance of the port infrastructure market in supporting efficient business operations and facilitating international commerce across diverse industry sectors.

Restraints Impact Analysis

Aging Infrastructure and Regulatory Complexities Constrain Development Pace

| ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|

| Moderate (-0.6% to -1.0%) | Primarily North America and Europe | 2026-2030 |

Aging and traditional infrastructure across numerous existing port facilities represents a significant constraint affecting the port infrastructure market, as outdated structures require substantial capital investments for upgrades and maintenance to accommodate modern shipping demands and increasingly larger vessel dimensions. Regulatory hurdles combined with complex permitting processes create substantial delays in project timelines while simultaneously increasing overall development costs, particularly in regions with stringent environmental protection requirements and multi-layered approval frameworks. Environmental concerns coupled with community opposition frequently lead to modifications in expansion plans or complete project delays, as coastal populations raise objections regarding potential impacts on marine ecosystems, air quality, and local quality of life.

Limited funding availability and budget constraints impede necessary investments in critical upgrades and innovative technologies, particularly affecting smaller ports competing for capital resources against larger facilities with established track records and greater revenue-generating capabilities. Geopolitical uncertainties and trade volume fluctuations directly impact cargo throughput projections, affecting the economic viability assessments for new infrastructure projects and creating risk factors that deter private investment participation. Labor-related challenges including skilled worker shortages, operational inefficiencies, and potential strikes further compound difficulties within the port infrastructure market, as the expanding global trade environment demands capable workforces proficient in operating advanced cargo management systems and maintaining quick vessel turnaround times essential for supply chain efficiency.

Opportunities Impact Analysis

E-commerce Growth and Sustainability Initiatives Create Expansion Pathways

| ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|

| High (+1.5% to +2.2%) | Global, particularly emerging markets | 2026-2033 |

The dramatic rise in e-commerce activities worldwide creates substantial opportunities for the port infrastructure market as expanding online retail generates unprecedented demand for efficient logistics systems capable of handling increased volumes of smaller package shipments requiring rapid processing and distribution. Modernization and expansion of port facilities to accommodate larger vessels and higher cargo volumes becomes essential as global trade continues its upward trajectory, necessitating investments in advanced terminal technologies, automated handling systems, and expanded storage capabilities. Advancements in automation, digitalization, and smart port solutions offer tremendous potential for enhancing operational efficiency and reducing vessel turnaround times through implementation of IoT-based monitoring systems, AI-driven predictive analytics, and robotic cargo handling equipment.

Emphasis on sustainability and green infrastructure initiatives presents compelling growth avenues as ports invest in eco-friendly technologies including renewable energy sources such as shore power systems, electric cargo handling equipment, and advanced waste management practices aligned with emissions reduction targets. Government funding programs and public-private partnership arrangements substantially enhance investment opportunities as agencies worldwide allocate resources for upgrading aging facilities and improving connectivity through integrated multimodal transport systems linking maritime, rail, and road networks. The evolution of trade routes combined with ongoing urbanization trends positions the port infrastructure market to capitalize on economic development patterns, with emerging markets in Asia, Africa, and Latin America offering particularly attractive growth prospects as these regions upgrade facilities to meet rising trade demands and establish themselves as critical nodes in global commerce networks.

Segment Analysis

Seaports Segment

Dominant Market Position Driven by International Trade Volumes and Large Vessel Handling Capabilities

Seaports maintain a commanding position within the port infrastructure market, accounting for approximately 74% of total market share, primarily because only coastal facilities possess the physical characteristics necessary for berthing ultra-large container vessels that dominate modern international shipping operations. This segment's dominance anchors market valuations at the higher end of capital allocation requirements, driving substantial investments in critical infrastructure including dredging projects to deepen shipping channels, breakwater reinforcement to protect harbors from wave action, and advanced automation systems that enable efficient cargo handling at volumes unmatched by inland or offshore installations. The concentration of global trade flowing through seaports creates powerful network effects that attract third-party logistics providers, customs agencies, freight forwarders, and fintech platforms, establishing comprehensive maritime ecosystems that reinforce the strategic importance and market leadership of seaport infrastructure.

Expanding global trade volumes combined with the escalating size of container ships necessitate continuous infrastructure enhancements at seaport facilities, as vessels exceeding 20,000 TEU capacity require specialized berths, ultra-high-capacity cranes, and extensive terminal areas for efficient loading and unloading operations within competitive timeframes. Seaports serve as essential economic engines particularly in coastal regions, facilitating the movement of massive cargo volumes including containerized manufactured goods, bulk commodities such as grains and minerals, liquid products including petroleum and chemicals, and specialized cargo ranging from automobiles to project equipment. Investment priorities within the seaports segment focus increasingly on sustainability initiatives including shore power infrastructure enabling vessels to shut down auxiliary engines while docked, renewable energy installations such as solar panels and wind turbines, and electrification of cargo handling equipment to reduce emissions and align with international environmental standards shaping the future trajectory of the port infrastructure market through 2033.

Cargo Handling Application

Largest Revenue Contributor Fueled by E-commerce Expansion and Global Supply Chain Requirements

The cargo handling application segment dominates the port infrastructure market with approximately 82% revenue share, reflecting the fundamental role of ports in facilitating international goods movement across diverse product categories and industry sectors. Growing global trade volumes driven by manufacturing sector expansion, agricultural exports, energy commodity shipments, and extended supply chains spanning multiple continents generate sustained demand for efficient cargo transportation infrastructure capable of handling containers, bulk materials, and specialized freight. E-commerce growth contributes significantly to cargo segment expansion, as online retail platforms require robust logistics networks capable of processing increasing volumes of consumer goods shipments moving through maritime channels before final distribution to end customers across domestic and international markets.

Heavy cargo transportation needs remain particularly strong for equipment components, industrial machinery, raw materials, and finished goods requiring maritime shipping due to volume, weight, or cost considerations that make alternative transportation modes economically unfeasible. The cargo application benefits from inherent advantages of maritime transportation including cost-effectiveness for long-distance bulk movements, reduced traffic congestion compared to road freight, time savings for intercontinental shipments, and unmatched capacity for transporting massive volumes in single vessel voyages. Leading port operators and terminal companies within the port infrastructure market continuously invest in advanced cargo handling technologies including automated stacking cranes, computer-vision-based container tracking systems, AI-powered load planning software, and robotic equipment that collectively enhance throughput rates while reducing operational costs and improving safety standards across facilities handling diverse cargo types ranging from standardized containers to specialized project cargo requiring customized handling solutions.

Regional Insights

North America

Market Leadership Sustained Through Strategic Modernization and Comprehensive Logistics Integration

North America maintains a dominant position in the port infrastructure market, capturing approximately 30% of global market share driven by its extensive network of strategically located major ports facilitating substantial volumes of regional and international trade. The region hosts over 300 coastal and inland port facilities across the United States alone, with major seaports strategically situated in large metropolitan areas along the Atlantic, Pacific, and Gulf coasts, while inland ports leverage connections to the Great Lakes and comprehensive inland waterway systems enabling cargo movement deep into continental interior regions. These facilities demonstrate remarkable versatility in handling diverse product categories including bulk agricultural commodities, manufactured goods, containerized consumer products, liquid petroleum and chemical shipments, and specialized cargo supporting various industry sectors.

United States ports contributed significantly to national economic performance, supporting approximately 30.8 million jobs and generating roughly 26% of total GDP according to recent assessments, underscoring the critical economic importance of port infrastructure within the regional economy. Substantial investment commitments totaling approximately USD 163 billion planned between 2021 and 2025 reflect ongoing efforts to enhance capacity and operational efficiency in response to challenges posed by vessel size increases and cargo volume growth. Leading facilities in the region include major container ports such as Los Angeles, Long Beach, New York/New Jersey, Savannah, and Seattle-Tacoma, alongside specialized energy ports along the Gulf Coast and bulk commodity facilities on the Great Lakes. Key market players operating significant terminals in North America include PSA International (Singapore), Ports America (United States), SSA Marine (United States), Carrix (United States), and Hutchison Ports (Hong Kong), who collectively drive technological innovation and operational excellence across the port infrastructure market through implementations of automation technologies, sustainability programs, and infrastructure expansion projects positioning the region for continued market leadership through the forecast period.

Asia Pacific

Fastest Growing Region Propelled by Economic Development and Massive Trade Volumes

Asia Pacific represents the fastest-growing region within the port infrastructure market, exhibiting robust expansion with projected CAGR of approximately 5.30% driven by rapid industrialization, urbanization, and escalating trade demands across major economies including China, India, Japan, and Southeast Asian nations. The region accounts for approximately 47% of global market share, handling massive cargo volumes that reflect its position as the world's manufacturing hub and rapidly expanding consumer market requiring extensive import and export infrastructure. Major ports in the region including Shanghai, Singapore, Hong Kong, Shenzhen, Ningbo-Zhoushan, Busan, and Port Klang rank among the world's busiest container facilities, collectively processing hundreds of millions of TEUs annually while continuously expanding capacity to accommodate projected growth.

China leads regional development with aggressive port infrastructure investment programs supporting its Belt and Road Initiative and domestic economic expansion, while India implements transformative programs such as the Sagarmala initiative aimed at port-led development and enhanced coastal shipping connectivity. Maritime transportation serves as the primary conduit for over 95% of India's trade by volume and approximately 70% by value, emphasizing the critical importance of port infrastructure for national economic performance and international commerce participation. Government-supported policies throughout Asia Pacific nations focus on attracting private investment through public-private partnerships, streamlining regulatory processes, and developing greenfield port projects in strategic locations. Major regional players shaping the port infrastructure market include China COSCO Shipping Ports (China), PSA International (Singapore), Hutchison Ports (Hong Kong), DP World (United Arab Emirates), APM Terminals (Denmark), Adani Ports & SEZ (India), and Japan's major port authorities, who collectively drive technological innovation, capacity expansion, and operational efficiency improvements positioning Asia Pacific for continued market leadership and fastest growth trajectory through 2033.

Top Key Players

-

CS Group (France)

-

Larsen & Toubro Limited (India)

-

Man Infraconstruction Limited (India)

-

Hyundai Engineering (South Korea)

-

Essar Ports Limited (India)

-

Adani Ports & SEZ (India)

-

DP World (United Arab Emirates)

-

APM Terminals (Denmark)

-

Hutchison Ports (Hong Kong)

-

PSA International (Singapore)

-

China COSCO Shipping Ports (China)

-

Bechtel Corporation (United States)

-

IL&FS Engineering & Construction Company Limited (India)

-

Consolidated Engineering Construction Company (United States)

-

IQPC (United States)

-

The Great Eastern Shipping Company (India)

-

Schneider Electric (France)

-

Soletanche Bachy (France)

-

Telefonaktiebolaget LM Ericsson (Sweden)

-

Terminal Investment Limited (Switzerland)

Recent Developments

-

December 2024 – Terminal Investment Limited Sarl based in Switzerland announced a major investment proposal of approximately USD 2.31 billion for the comprehensive development of Vadhavan Port and its associated maritime ecosystem near Dahanu in Maharashtra's Palghar district, with the facility being developed by Vadhavan Port Project Limited involving total capital allocation of USD 8.81 billion.

-

November 2024 – The United States Department of Transportation's Maritime Administration allocated nearly USD 580 million from the Bipartisan Infrastructure Law to support 31 port improvement projects spanning 15 states and one U.S. territory, aiming to enhance capacity and productivity at coastal seaports, Great Lakes facilities, and inland river ports.

-

September 2025 – Adani Ports and Special Economic Zone announced investment plans totaling approximately INR 30,000 crore over the subsequent two years, with significant capital allocations focused on major facilities including Dhamra, Mundra, and Vizhinjam ports to enhance capacity and operational capabilities.

-

July 2024 – The Port of Barcelona deployed a new private 5G network infrastructure with investment of approximately USD 3.93 million over five years in partnership with telecommunications provider Orange, establishing pioneering advanced technological infrastructure supporting implementation of innovative digital solutions within the European port ecosystem.

-

April 2024 – X-Press Feeders, the world's largest independent common carrier, executed agreements with six major European ports across Belgium, Estonia, Finland, Latvia, and Lithuania through memorandums of understanding jointly promoting development of green shipping corridors and advancing decarbonization initiatives throughout Scandinavian and Baltic Sea regions.

Market Trends

Digital Transformation and Sustainability Initiatives Reshape Industry Standards

Automation and digitalization adoption is fundamentally transforming the port infrastructure market through integration of advanced technologies including Internet of Things sensors, artificial intelligence algorithms, 5G communication networks, and robotic equipment that collectively improve operational efficiency while reducing labor costs and minimizing human error. Smart port initiatives leveraging these digital technologies optimize container handling workflows, enhance cargo security through sophisticated surveillance systems, and enable seamless real-time data exchange among stakeholders including shipping lines, terminal operators, customs agencies, and logistics providers. Port management systems increasingly incorporate predictive analytics capabilities that forecast equipment maintenance requirements, anticipate congestion patterns, and optimize berth allocation decisions, enabling proactive management approaches that prevent disruptions and maximize asset utilization across complex maritime facilities.

Green port initiatives represent another major trend within the port infrastructure market as facilities worldwide prioritize emissions reduction, implement comprehensive waste management programs, and transition toward renewable energy sources including solar installations, wind turbines, and shore power infrastructure enabling vessels to utilize grid electricity rather than auxiliary engines while docked. Environmental regulations and carbon reduction targets established by international agreements and national legislation drive substantial investments in port electrification programs, with initiatives such as the United States Environmental Protection Agency's USD 4 billion allocation from the Inflation Reduction Act specifically targeting equipment upgrades and clean energy transitions at terminal facilities. Sustainability investments extend beyond emissions to encompass water quality protection, habitat preservation, noise reduction measures, and circular economy principles that position modern ports as responsible environmental stewards while simultaneously improving operational efficiency and long-term competitiveness within the evolving global trade landscape.

Segments Covered in the Report

By Port Type

-

Seaports

-

Inland Ports

-

Offshore Ports

By Application

-

Cargo Handling

-

Passenger Handling

By Construction Type

-

Terminals

-

Equipment

-

Others

By Infrastructure Type

-

Terminals

-

Berths and Docks

-

Storage Facilities

-

Port Equipment

-

Container Infrastructure

-

Energy Infrastructure

-

Break-bulk Infrastructure

-

Roll-on/Roll-off Infrastructure

By Port Location

-

Coastal Ports

-

Inland Ports

By Service Type

-

Loading and Unloading Services

-

Maintenance and Repair Services

-

Customs and Logistics Services

-

Transport and Distribution Services

-

Others

By Level Outlook

-

Fully Automated

-

Semi-Automated

By Facility Type

-

Deep-water Seaports

-

Standard Seaports

-

River Ports

-

Harbors

-

Piers, Jetties, and Wharfs

-

Port Terminals

-

Offshore Terminals

-

Canals

By End Use

-

Industrial Goods

-

Consumer Goods

-

Food and Agriculture

-

Automobiles

-

Chemicals and Petrochemicals

-

Energy and Natural Resources

-

Others

By Region

-

North America (United States, Canada, Mexico)

-

Europe (United Kingdom, Germany, France, Italy, Spain, Rest of Europe)

-

Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific)

-

Latin America (Brazil, Argentina, Rest of Latin America)

-

Middle East & Africa (United Arab Emirates, Saudi Arabia, South Africa, Rest of MEA)

Frequently Asked Questions:

Answer: The global port infrastructure market was valued at USD 174.67 billion in 2025 and is projected to reach approximately USD 285.72 billion by 2033. The market is expected to grow at a compound annual growth rate of 5.56% during the forecast period from 2026 to 2033.

Answer: Asia Pacific dominates the global port infrastructure market with approximately 47% market share driven by massive trade volumes and rapid economic growth. Major facilities in China, India, Japan, and Southeast Asian nations handle substantial cargo throughput supporting the region's manufacturing and export activities.

Answer: Key drivers include increased government infrastructure spending, expanding global trade volumes, e-commerce growth requiring efficient logistics, and the need to accommodate ultra-large container vessels. Rising liquefied natural gas exports and sustainability initiatives also contribute significantly to market expansion through 2033.

Answer: Seaports represent the largest segment by port type with approximately 74% market share, while cargo handling dominates the application segment with 82% revenue share. These segments lead due to their critical roles in international maritime trade and goods transportation across global supply chains.

Answer: Artificial intelligence transforms port operations through automation of cargo handling, predictive maintenance systems, AI-powered surveillance, and optimization algorithms that reduce vessel turnaround times. Smart port technologies incorporating AI enable real-time monitoring, efficient resource allocation, and enhanced operational efficiency across the port infrastructure market.