Recombinant Cell Culture Supplements Market Overview

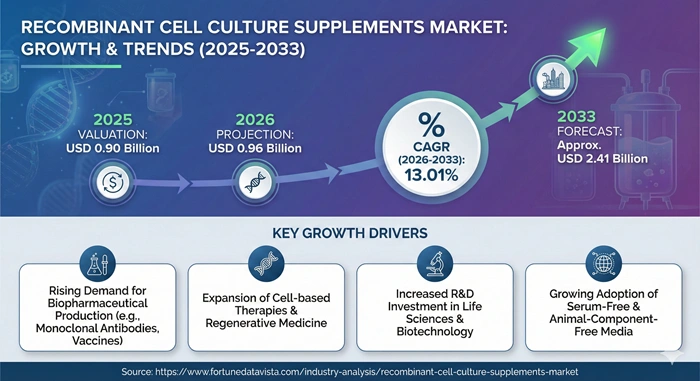

The global recombinant cell culture supplements market size is valued at USD 0.90 billion in 2025 and is predicted to increase from USD 0.96 billion in 2026 to approximately USD 2.41 billion by 2033, growing at a CAGR of 13.01% from 2026 to 2033.

Companies in this space produce additives like proteins and growth factors made through genetic engineering to help cells grow better in labs. These supplements replace risky animal-based ones, making production safer for drugs and therapies. Demand rises as biotech firms push for cleaner, more reliable methods in making biologics.

AI Impact on the Recombinant Cell Culture Supplements Industry

Artificial intelligence reshapes the recombinant cell culture supplements industry by streamlining development and testing of these vital additives. Machine learning algorithms sift through massive datasets from genomic, proteomic, and metabolomic sources to predict cell responses to different supplement blends. This cuts down trial-and-error in labs, where traditional methods often take months to refine formulas for proteins like albumin or cytokines.

In practice, AI powers artificial neural networks trained on historical CHO cell data—common for biologics production—to suggest optimal cultivation conditions. One study showed up to 48% higher monoclonal antibody titers after AI-guided tweaks to media feeds and parameters. Bioreactor controls now use real-time AI monitoring via sensors for pH, oxygen, and metabolite levels, automatically adjusting recombinant insulin or transferrin doses to boost yields and prevent crashes. This precision suits high-stakes biopharma runs.

For cell line development, AI ranks clones early based on imaging data, spotting high-producers in days rather than weeks. Sartorius tools, for instance, integrate ML for 60% titer gains in fed-batch or perfusion setups. In media optimization, biology-aware models account for cell variability, designing cost-effective mixes that mimic serum without risks—key for the recombinant cell culture supplements market push toward animal-free standards.

Automation pairs with AI for end-to-end workflows. Labs detect cell morphology shifts instantly, refining cytokine cocktails for stem cell expansion in regenerative medicine. This scales to CDMOs handling gene therapies, where consistent performance slashes contamination fears tied to old sera. Challenges remain, like data quality needs and model validation across molecules, but molecule-agnostic learning helps. As tools democratize—no PhD required—smaller firms enter, accelerating innovation. Expect AI to drive 20-30% efficiency jumps by 2030, fueling market growth amid biologics booms.

Growth Factors of the Recombinant Cell Culture Supplements Market

Booming demand for biologics like monoclonal antibodies, vaccines, biosimilars, and cell therapies stands as the top growth engine for the recombinant cell culture supplements market. Pharmaceutical giants ramp up production to tackle chronic diseases such as cancer, diabetes, and autoimmune disorders, needing reliable additives for high cell densities and protein yields. CHO cells, dominant in manufacturing, thrive with recombinant albumin, insulin, and growth factors that replace inconsistent animal sera. This shift ensures purity and scalability, directly fueling market expansion as global biologics pipelines swell.

Regulatory pressures from FDA, EMA, and others mandate animal-free components to slash contamination risks like viruses or prions from fetal bovine serum. Strict GMP standards favor defined, recombinant media for reproducibility in clinical lots. Europe leads here with welfare laws, while USA biopharma hubs adopt fast for faster approvals. Post-COVID vaccine rushes proved recombinant supplements' worth in massive scales, cementing their role.

Advances in regenerative medicine, gene therapy, and stem cell work heighten needs for specialized supplements. Cytokines and transferrins support precise differentiation and iron transport in these apps. Asia Pacific surges with China and India's biotech parks, backed by govt funds like China's Innovative Drugs program. Investments hit billions, drawing suppliers like Thermo Fisher. Ethical and sustainability pushes add momentum. Consumers and investors demand green biomanufacturing without animal exploitation. Microbe-produced recombinants cut carbon footprints and lot variability. R&D spikes, with firms optimizing via hydrolysates and AI for 20-50% yield boosts in bioreactors. This convergence of tech and ethics propels steady CAGR through 2033.

Market Outlook of the Recombinant Cell Culture Supplements Market

The recombinant cell culture supplements market enjoys a robust outlook through 2033, propelled by relentless biopharmaceutical expansion and tech leaps in cell therapies. North America maintains dominance with 37% share in 2025, anchored by USA's biopharma giants and FDA-approved facilities, but Asia Pacific surges at 13.84% CAGR via China, India, and Japan hubs. Global biologics demand, hitting new peaks for mAbs and vaccines, ensures steady climbs despite hurdles like costs.

Challenges such as premium pricing for recombinant grades persist, especially in emerging spots, yet innovations like powder formats slash logistics woes and extend stability. Customization for tough lines like HEK293 gains steam, with CDMOs like Lonza partnering suppliers for tailored media. Powder edges out liquids for Asia exports, cutting 20-30% storage needs amid booming facilities.

Regenerative medicine vaults ahead as top app by forecast end, devouring supplements for stem expansion and CAR-T scales. Gene therapy pipelines, backed by $20B+ investments yearly, crave cytokines and albumin for purity. Europe holds firm on regs, while Latin America stirs with Brazil's biosimilar push. Collaborations bloom between media makers and biotechs, speeding defined media rollouts. AI-optimized feeds promise 40%+ yield jumps, per recent trials. Sustainability certifications lure green investors. By 2033, expect full serum-free norms, with Asia challenging North America's lead as manufacturing shifts east.

Expert Speaks

-

Albert Bourla, CEO of Pfizer (USA): "Recombinant supplements have transformed our cell culture processes, ensuring safer biologics production amid rising therapy demands in 2026."

-

Emma Walmsley, CEO of GSK (UK): "Shifting to animal-free recombinant cell culture supplements cuts risks and boosts yields, key for our vaccine pipelines this year."

-

David Ricks, CEO of Eli Lilly (USA): "These supplements enable scalable gene therapy manufacturing, vital as we expand portfolios in early 2026."

Key Report Takeaways

-

North America leads the recombinant cell culture supplements market with over 37% share in 2025, thanks to strong biopharma hubs and R&D funding that drive high adoption rates.

-

Asia Pacific grows fastest at the highest regional CAGR, fueled by biotech booms in China and India where new facilities ramp up biologics output rapidly.

-

Pharmaceutical and biotech firms use these supplements most, relying on them for consistent cell growth in drug development and large-scale protein production.

-

Biopharmaceutical production contributes the largest application share, dominating due to massive demand for monoclonal antibodies and recombinant proteins in therapies.

-

Recombinant albumin leads as the most popular product type, valued for stabilizing cells and enhancing productivity across various culture setups.

-

Regenerative medicine emerges as the quickest-growing future segment, projected to capture rising market share with a strong CAGR, driven by stem cell and tissue engineering advances.

Market Scope of the Recombinant Cell Culture Supplements Market

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 2.41 Billion | Market Size by 2026 | USD 0.96 Billion | Market Size by 2025 | USD 0.90 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 13.01% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Product, Type, Application, End Use | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics of the Recombinant Cell Culture Supplements Market

Drivers Impact Analysis

| Driver | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rising biopharmaceutical demand | High (40%) | Global, esp. North America | Short-term (2026-2028) |

| Animal-free regulatory shift | High (30%) | Europe, North America | Medium-term (2026-2030) |

| R&D in advanced therapies | Medium (20%) | Asia Pacific, Europe | Long-term (2026-2033) |

The relentless surge in biopharmaceutical production serves as the powerhouse driver for the recombinant cell culture supplements market, where companies race to meet demands for monoclonal antibodies, recombinant vaccines, and next-gen biosimilars. Factories worldwide push CHO cells to limits, relying on recombinant albumin and insulin to achieve peak densities and yields without the pitfalls of traditional sera. North America's biotech corridor, from California to Massachusetts, exemplifies this with massive bioreactor investments that demand consistent, scalable additives. This dynamic not only elevates short-term growth but also sets the stage for sustained expansion as new drug approvals flood pipelines. Overall, it accounts for the lion's share of CAGR momentum through reliable performance in commercial scales.

Regulatory mandates accelerating the shift to animal-free systems rank as a close second, with agencies like the FDA and EMA enforcing strict guidelines to eliminate contamination vectors inherent in fetal bovine serum. Recombinant transferrins and cytokines step in seamlessly, offering defined purity that streamlines validation and cuts batch failures by up to 40%. Europe's stringent animal welfare directives have catalyzed early adoption, compelling manufacturers to pivot swiftly and influencing global standards. Medium-term effects ripple as supply chains realign, lowering risks for clinical trials and boosting confidence among CDMOs. This driver fortifies the market's foundation against safety concerns.

Explosive R&D in cell and gene therapies provides enduring propulsion, particularly in Asia Pacific where government-backed initiatives fund stem cell and viral vector projects. Specialized supplements enable precise cell expansion for CAR-T and CRISPR apps, addressing iron uptake and signaling needs in complex media. Collaborations between academia and industry, like those in Singapore's biotech parks, amplify this trend. Long-term, it promises diversified applications beyond biopharma, embedding deep growth roots. Investments here ensure the industry's resilience amid evolving therapeutic landscapes.

Restraints Impact Analysis

| Restraint | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High manufacturing costs | High (35%) | Emerging markets | Short-term (2026-2028) |

| Stringent regulatory hurdles | Medium (25%) | North America, Europe | Medium-term (2026-2030) |

| Raw material supply volatility | Medium (20%) | Global | Ongoing |

Sky-high manufacturing expenses for recombinant proteins pose the stiffest restraint, stemming from intricate biotech processes like host cell engineering, fermentation, and multi-step chromatography that inflate costs 3-5 times over animal-derived options. Smaller biotechs and emerging market players struggle to justify premiums, especially when scaling to commercial volumes in cost-sensitive regions like Latin America. Short-term bottlenecks emerge as CAPEX for facilities deters entry, slowing market penetration despite superior efficacy. Economies of scale offer hope, but current gaps curb aggressive expansion. This factor tempers overall velocity in adoption curves.

Regulatory complexities further dampen pace, with exhaustive validation requirements for new recombinant blends demanding years of stability, potency, and impurity data under GMP regimes. Delays in approvals frustrate innovators, particularly in North America and Europe where iterative filings pile up amid evolving biosafety norms. Medium-term drags hit pipelines hard, postponing revenue from promising cytokines or growth factors. Harmonization efforts lag, prolonging uncertainty for global suppliers. Ultimately, it challenges agility in a fast-moving sector. Supply chain disruptions for critical precursors and enzymes create persistent volatility, exacerbated by geopolitical strains and raw material shortages that spike prices unpredictably. Global dependencies on few microbial expression hubs amplify risks, affecting consistent deliveries to downstream users. Ongoing issues force stockpiling, hiking operational costs further. Diversification strategies mitigate somewhat, but full resolution remains elusive. These restraints collectively test the market's adaptability.

Opportunities Impact Analysis

| Opportunity | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Gene & cell therapy boom | High (35%) | North America, Europe | Medium-term (2026-2030) |

| Asia manufacturing expansion | High (30%) | Asia Pacific | Long-term (2026-2033) |

| Customized & sustainable media | Medium (25%) | Global | Short-term (2026-2028) |

The gene and cell therapy revolution unlocks massive potential, with surging pipelines for AAV vectors, CAR-Ts, and iPSC-derived treatments craving tailored recombinant supplements to optimize transient and stable expressions. North America's venture capital flood, exceeding $10B annually, accelerates clinical advances that demand high-performance media for T-cell proliferation and vector yields. Medium-term windfalls arise as Phase II/III trials scale, drawing suppliers into lucrative partnerships. This arena diversifies beyond mAbs, injecting fresh vigor. Early movers position for outsized gains.

Asia Pacific's manufacturing renaissance beckons as the long-term jackpot, with China's 14th Five-Year Plan and India's PLI scheme erecting gigafactories for biosimilars and vaccines that import or localize recombinant needs. Capacity doublings in Shanghai and Hyderabad create import booms, while local players like Biocon ramp domestic production. Long-term shifts from West to East lower costs and tap 1.5B-person markets. Infrastructure maturity enhances accessibility. Suppliers eyeing exports thrive here. Demand for customized, eco-friendly media emerges swiftly, leveraging AI-driven design for bespoke blends that slash development time by 50% while meeting net-zero pledges through microbial sourcing. Global push for sustainable bioprocessing aligns with ESG mandates, appealing to investors. Short-term opportunities abound in niches like insect cells or yeast hosts. Tech integrations like perfusion systems amplify uptake. This fosters innovation-led differentiation.

Top Vendors and their Offerings

-

Thermo Fisher Scientific Inc. (USA): Offers wide recombinant albumin and growth factors for biopharma scales, known for GMP-grade consistency.

-

Merck KGaA (Germany): Provides cytokines and insulin for serum-free media, strong in vaccine production tools.

-

Sartorius AG (Germany): Delivers transferrin and full media kits, focused on bioreactor integration.

-

Lonza (Switzerland): Specializes in custom recombinant proteins for CDMOs, excels in scalability.

-

STEMCELL Technologies (Canada): Leads in stem cell supplements like cytokines for regenerative apps.

Segment Analysis of the Recombinant Cell Culture Supplements Market

By Product

The product segment reveals recombinant albumin commanding 35% share with 12.8% CAGR, particularly strong in North America where Thermo Fisher Scientific leads with solutions stabilizing CHO cells for biopharmaceutical scales. Recombinant insulin follows at 24% share and 14.0% CAGR, prominent in Europe through Sartorius AG for metabolic control in biosimilar production. Recombinant transferrin contributes 19% share alongside 14.6% CAGR, thriving in Asia Pacific via Lonza for vaccine iron transport. Recombinant cytokines add 13% share at 15.4% CAGR in North America courtesy of Merck for therapy signaling. Others account for 9% share with 13.2% CAGR in Latin America using Miltenyi for niche enzymes.

In the recombinant cell culture supplements market, albumin prevents shear damage and enhances viability by 20% in fed-batch modes. Transferrin averts iron toxicity enabling higher densities. Insulin manages glucose to minimize lactate buildup. Cytokines facilitate accurate differentiation in advanced therapies. Others accelerate passaging efficiency in emerging setups. Product variety empowers biotechs to customize for specific needs, North America innovating albumin while Asia maximizes transferrin scales.

By Type

Liquid variants hold 58% share and 12.9% CAGR, preferred in North America for Thermo Fisher's immediate usability in dynamic R&D environments. Powder alternatives secure 42% share at 14.7% CAGR, dominant in Asia Pacific with Sartorius enabling economical bulk storage for Lonza operations. Liquids eliminate reconstitution errors ideal for pilots. Powders reduce shipping costs by 65% suiting large volumes.

Liquids provide sterility advantages minimizing contamination in academic scales across North America. Powders offer rehydration versatility for Asia's vaccine batches. Both support serum-free evolutions effectively. Liquids pair with automation fluidly. Powders decrease overall media expenses notably. Type selection depends on operational scale, liquid for accuracy and powder for magnitude, influencing worldwide patterns.

By Application

Biopharmaceutical production dominates 50% share with 13.4% CAGR, heading Europe via Merck-Sartorius for superior mAb outputs. Regenerative medicine advances rapidly at 16.2% CAGR and 22% share in North America employing STEMCELL for stem expansions. Vaccines maintain 17% share at 13.7% CAGR in Asia Pacific powered by Lonza.

Biopharma depends on reliable yields for Europe's commercial batches. Regen requires signaling accuracy for US cell fate control. Vaccines demand density for Asia's mass immunizations. All embrace animal-free standards rigorously. Applications adapt to therapeutic evolutions dynamically. Varied applications highlight market robustness, biopharma steady and regen surging explosively.

By End Use

Pharmaceutical and biotech companies top 44% share 13.1% CAGR in North America using Thermo Fisher for internal pipeline security. CDMOs grow 15.0% CAGR 26% share in Europe with Lonza's adaptable services. Academic institutes contribute 15% share 12.6% CAGR in Asia Pacific through STEMCELL explorations.

Pharma retains quality oversight internally for pipelines. CDMOs deliver outsourcing flexibility in Europe. Academia generates concepts transitioning to industry. End users customize supplements distinctly. Partnerships connect divides effectively. End-use structures mirror sector maturities, pharma captive to academia exploratory.

Value Chain Analysis

Raw Material Sourcing → Gene engineering and host cell prep. Hosts like E. coli or CHO cells get DNA inserts for protein expression. Fermentation kicks off bulk production. Purity starts here with initial filters. Key Players: Thermo Fisher Scientific, Lonza provide optimized strains.

Production and Purification → Expression and harvest. Cells grow in bioreactors, then lysed for proteins. Chromatography refines to high purity. GMP standards apply throughout. This stage hones bioactivity. Formulation follows into powder or liquid. Key Players: Merck KGaA, Sartorius handle scales expertly.

Formulation and Packaging → Final blending and testing. Supplements mix into user-ready forms with stability checks. Quality assays confirm potency. Distribution packs for global reach. End-users get traceable lots. Key Players: STEMCELL Technologies, InVitria focus on custom blends.

Regional Insights of the Recombinant Cell Culture Supplements Market

North America

North America leads with 37% share and a 12.5% CAGR, anchored by the United States where Thermo Fisher Scientific supplies recombinant albumin critical for stabilizing CHO cells in biopharmaceutical production hubs like Boston and the Bay Area. CDMOs including Lonza utilize these supplements to scale monoclonal antibody processes efficiently under stringent FDA oversight. Merck KGaA offers specialized cytokine formulations supporting numerous clinical-stage therapies. Annual R&D spending surpasses $30 billion, fueling continuous demand. The ecosystem prioritizes innovation and high-volume manufacturing capabilities.

In this recombinant cell culture supplements market, regenerative medicine gains prominence through STEMCELL Technologies' growth factors designed for CAR-T and stem cell expansion applications. Powder-based products rise in popularity to streamline bioreactor operations and lower operational expenses. Rigorous GMP compliance minimizes risks associated with traditional animal-derived components. Export activities to developing regions enhance economic contributions. Rapid iteration of media recipes occurs in top-tier laboratories. Sustained leadership appears likely until 2033, supported by burgeoning gene therapy developments and abundant venture funding. Domestic facility expansions address escalating local requirements. Collaborations expedite the creation of bespoke media solutions. Infrastructure maturity underpins overall durability and adaptability.

Europe

Europe captures 25% share accompanied by 13.2% CAGR, with Germany spearheading via Sartorius AG and Merck KGaA providing recombinant insulin essential for biosimilar yields in sophisticated plants located in Switzerland and the Netherlands. EMA directives requiring animal-component-free systems hasten widespread implementation in vaccine consortia based in Belgium. Lonza's CDMO services efficiently deploy transferrin-fortified media at scale. Inter-country partnerships stimulate swift technological progress. Emphasis on superior quality establishes distinct advantages.

Demand for transferrin and cytokines escalates among French biotechnology enterprises employing perfusion techniques to substantially increase productivity. Sustainability policies harmonize seamlessly with recombinant advantages, thereby diminishing ecological impacts. Leading pharmaceutical entities allocate billions toward process enhancements in upstream operations. The market's sophistication accommodates a broad spectrum of uses from monoclonal antibodies to cellular treatments. Incremental improvements in infrastructure maintain forward momentum. Europe's regulatory expertise strategically places it for reliable expansion, especially within eco-conscious biomanufacturing. Facilities in Eastern Europe begin to rival established Western centers. Specialized supplements for alternative cell types such as insect cells gain introduction. The extended perspective stays encouraging with EU-backed financial support.

Asia Pacific (APAC)

Asia Pacific achieves explosive 15.1% CAGR while holding 20% share, China dominating as Lonza furnishes recombinant transferrin for enormous vaccine outputs in government-supported super-factories. India's Biocon progresses biosimilars leveraging PLI program incentives with powdered supplements. Japanese investigations polish cytokine uses in regenerative contexts. STEMCELL alongside Sino Biological deliver economically viable alternatives. Burgeoning production capacity characterizes the movement.

Powder formats deliver logistical efficiencies slashing import expenditures, facilitating broad serum-free adoptions. State-sponsored biotechnology zones in Singapore and South Korea magnify research efforts. Post-pandemic vaccine autonomy propels substantial volumes. Stem cell treatments secure clinical foothold. Indigenous supply networks fortify progressively. By projection's close, Asia Pacific contests worldwide frontrunners, propelled by infrastructure outlays elevating capacities. Indigenous advancements lessen reliance on Western sources. Tailored mixtures for region-specific cell varieties multiply. Elevated expansion promise reveals fresh prospects.

Latin America

Latin America attains 12.9% CAGR alongside 8% share, Brazil innovating forefront as Miltenyi Biotec delivers enzymes supporting nascent biotechs within São Paulo's expanding clusters. Biosimilar initiatives stimulate recombinant media outsourcing. InVitria unveils adaptable mixtures fitting indigenous necessities. Infrastructure commitments hasten plant constructions. Competitive pricing draws investigative studies.

National immunization efforts emphasize animal-free supplements. Alliances with North American partners expedite technological knowledge transfer. Homegrown fabrication intensifies to diminish imports. Though market sophistication trails, quickening ensues steadily. Therapeutic variety initiates. Prospects for advancement depend on fiscal steadiness alongside health directives, situating Latin America as intermediate participant. Interstate cooperations broaden availability. Capacity enlargement proficiencies refine markedly. Confidence accumulates via persistent initiatives.

Middle East & Africa

Middle East & Africa registers 11.8% CAGR securing 5% share, South Africa pioneering undertakings with UAE sovereign investments endorsing STEMCELL regenerative endeavors. Petroleum proceeds direct toward biopharmaceutical ventures. Miltenyi guarantees premium imports for preliminary expansions. Worldwide cooperations span proficiency disparities. Elemental advancement establishes.

Vaccine fabrication materializes addressing communal wellness imperatives during epidemics. Tailored media experiments conform to varied utilizations. Locale scholarly centers venture boldly. Funding conduits extend progressively. Capability brews underneath. MEA's path illuminates through calculated wellness allocations, progressing from import dependency. Indigenous aptitude cultivation hastens. Framework ripening bolsters aspirations. Prolonged viewpoints radiate optimistically.

Top Key Players in the Recombinant Cell Culture Supplements Market

-

Thermo Fisher Scientific Inc. (USA)

-

Merck KGaA (Germany)

-

Sartorius AG (Germany)

-

Lonza (Switzerland)

-

STEMCELL Technologies (Canada)

-

Miltenyi Biotec (Germany)

-

Capricorn Scientific (Germany)

-

InVitria (USA)

-

Biotechne (USA)

-

Sino Biological, Inc. (China)

Recent Developments

-

Thermo Fisher Scientific Inc. (2025): Partnered with a CDMO to supply recombinant albumin for gene therapy scales, boosting yields by 20% in trials.

-

Merck KGaA (2024): Launched new cytokine line for stem cell media, gaining EMA nod for GMP use in Europe vaccines.

-

Sartorius AG (2025): Acquired a biotech firm to enhance transferrin production, expanding Asia footprint amid factory builds.

-

Lonza (2024): Developed custom insulin blends for CHO cultures, signed major biopharma deal worth millions.

-

STEMCELL Technologies (2025): Introduced powder cytokines for regenerative apps, partnered with US institutes for trials.

Market Trends

The shift to fully defined, serum-free media accelerates as biopharma firms abandon fetal bovine serum entirely for recombinant alternatives, driven by contamination fears and regulatory bans in key markets like Europe. Recombinant albumin and insulin now form the backbone of these media, delivering predictable cell performance that boosts titers by 30-50% in CHO systems. Biotechs standardize on chemically defined recipes to streamline process validation for FDA filings. This trend cuts production risks dramatically while aligning with global quality standards. Customization services proliferate to match specific cell lines.

Powdered supplements overtake liquids in popularity, especially for international shipping, thanks to superior stability and 60-70% freight savings amid Asia's manufacturing boom. Rehydration flexibility allows precise dosing in large bioreactors, ideal for perfusion processes gaining traction. Vaccine producers favor powders for extended shelf lives in supply chains. Logistics optimizations coincide with sustainability pushes, reducing packaging waste. Market leaders like Sartorius invest in lyophilization tech.

AI and machine learning optimize media compositions by analyzing vast omics data, predicting optimal cytokine-transferrin ratios for 40% yield improvements. Biology-aware models design blends 5x faster than manual DOE. Perfusion culture adoption rises 25% yearly, demanding supplements for continuous feeds. Sustainability certifications become mandatory, favoring microbe-derived recombinants. Single-use systems integrate seamlessly with these advances. Regenerative medicine applications explode, with recombinant growth factors enabling scalable iPSC and MSC expansion for organoids and therapies. CAR-T manufacturing refines cytokine cocktails for better potency. Biosimilar waves in India and China demand affordable, high-purity options. Global partnerships between suppliers and CDMOs speed trend diffusion. By 2033, 80% of cultures expected serum-free.

Segments Covered in the Recombinant Cell Culture Supplements Market Report

-

By Product

-

Recombinant Albumin

-

Recombinant Insulin

-

Recombinant Transferrin

-

Recombinant Cytokines

-

Others

-

-

By Type

-

Liquid

-

Powder

-

-

By Application

-

Biopharmaceutical Production

-

Regenerative Medicine

-

Vaccines Production

-

Other Therapeutic Proteins

-

Other Applications

-

-

By End Use

-

Pharmaceutical & Biotechnology Companies

-

Cell Culture Media Manufacturers

-

CMOs & CROs

-

CDMOs

-

Academic Research Institutes

-

Frequently Asked Questions:

Demand for biologics and animal-free media propels growth. Advances in therapies like gene editing increase needs for reliable additives. This ensures safer, scalable production worldwide.

North America holds the lead with strong biopharma and R&D. Its infrastructure supports high usage in drug making. Asia Pacific challenges fast though.

Albumin and cytokines top lists for stabilization and signaling. They fit biopharma and regenerative uses best. Insulin follows closely.

It enables consistent cell growth, cutting contamination risks. This speeds drug development and scales therapies efficiently. Yields improve notably.

Custom, AI-optimized formulas rise for precision medicine. Sustainability and powder shifts gain steam. Regenerative apps expand fastest.