Specialty Insurance Market Overview

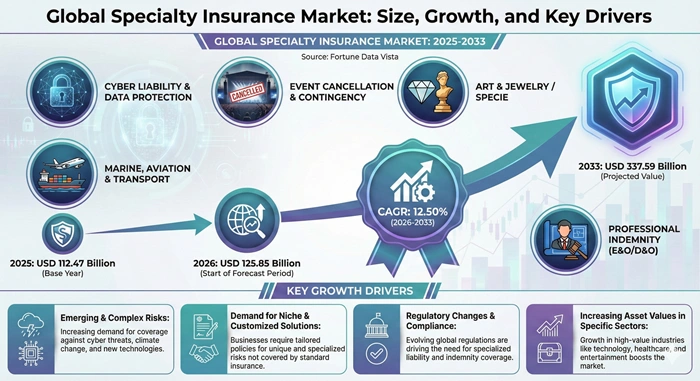

The global specialty insurance market size is valued at USD 112.47 billion in 2025 and is predicted to increase from USD 125.85 billion in 2026 to approximately USD 337.59 billion by 2033, growing at a CAGR of 12.50% from 2026 to 2033. Specialty insurance provides customized protection for unique, high-risk exposures that standard insurance policies typically exclude, covering areas such as marine transportation, aviation operations, cyber threats, political instability, fine arts collections, entertainment productions, and professional liabilities across diverse industries.

AI Impact on the Specialty Insurance Industry

Transforming Risk Management Through Tailored Insurance Solutions Amid Rising Global Complexities

Artificial intelligence is fundamentally reshaping how specialty insurance market providers assess risks, underwrite policies, and process claims with unprecedented accuracy and speed. Machine learning algorithms now analyze vast datasets from satellite imagery for marine tracking, telematics for aviation safety, and behavioral patterns for cyber threat detection, enabling insurers to price specialty risks more precisely than traditional actuarial methods allowed. Advanced AI systems can evaluate complex exposures across political risk scenarios, art valuation authenticity, and entertainment production liabilities within minutes rather than weeks, dramatically improving underwriting efficiency while reducing human error in the market operations.

The integration of predictive analytics and natural language processing has revolutionized claims management in the market, particularly for intricate cases involving directors and officers liability or professional indemnity disputes. AI-powered chatbots and virtual assistants now handle routine customer inquiries about policy coverage, while sophisticated fraud detection algorithms identify suspicious patterns in high-value specialty claims before payouts occur. Insurers leveraging these technologies report 30-40% reductions in claims processing times and significant improvements in customer satisfaction scores, positioning AI as an essential competitive differentiator in the evolving specialty insurance landscape.

Growth Factors

Expanding Risk Complexity Drives Unprecedented Demand for Specialized Coverage Solutions

The specialty insurance market experiences robust expansion driven by escalating business complexities and emerging risk categories that traditional insurance products cannot adequately address. Global trade intensification has amplified demand for marine, aviation, and transport coverage as companies move higher-value cargo across volatile geopolitical regions, while digital transformation initiatives expose organizations to sophisticated cyber threats requiring specialized protection beyond standard commercial policies. Climate change impacts have created unprecedented demand for catastrophe-related specialty products, particularly in coastal regions vulnerable to hurricanes and flooding, prompting businesses to seek tailored solutions that address specific geographic and operational vulnerabilities.

Regulatory transformations across financial services, healthcare, technology, and energy sectors have significantly increased liability exposures for corporate executives and professionals, fueling growth in directors and officers insurance alongside errors and omissions coverage. The proliferation of intangible assets—including intellectual property, data repositories, and brand reputation—has created entirely new insurance categories within the market as companies recognize vulnerabilities that conventional property policies never contemplated. Additionally, wealth accumulation among high-net-worth individuals globally has driven demand for fine art insurance, collectibles protection, and unique personal liability coverages, while the entertainment industry's expansion into streaming platforms and international productions requires increasingly sophisticated production insurance solutions.

Market Outlook

Strategic Positioning for Sustained Growth Amid Evolving Risk Landscapes and Market Dynamics

The specialty insurance market outlook remains exceptionally positive through 2033 as insurers capitalize on hardening market conditions that have persisted for over five years, enabling premium rate increases while maintaining disciplined underwriting standards. Capacity constraints in admitted markets have accelerated premium migration to excess and surplus lines carriers who specialize in difficult-to-place risks, creating sustainable growth trajectories for specialty providers with deep technical expertise and flexible underwriting approaches. Investment in insurtech platforms and data analytics capabilities positions leading market participants to capture market share by offering faster quote turnaround times, customized policy structures, and seamless digital experiences that meet evolving customer expectations.

Geographic expansion opportunities in Asia-Pacific and Latin America present significant growth potential as emerging economies develop sophisticated industrial sectors requiring specialized coverage, while regulatory maturation in these regions enables international specialty insurers to establish distribution networks and build brand recognition. The convergence of previously distinct coverage categories—particularly cyber and directors and officers liability—creates opportunities for innovative product development that addresses interconnected risks through holistic policy solutions. Market consolidation among specialty providers through strategic acquisitions enhances scale advantages and technical capabilities, while partnerships between traditional insurers and insurtech startups accelerate innovation cycles in underwriting technology, claims processing automation, and customer engagement platforms within the market.

Expert Speaks

-

Evan Greenberg, Chairman and CEO of Chubb Limited, stated that commercial insurance market conditions present numerous growth opportunities despite increasing competition, emphasizing the company's strategic advantages through broad diversification across geography, product lines, commercial and consumer segments, and distribution channels while achieving record underwriting results.

-

Peter Zaffino, Chairman and CEO of American International Group (AIG), highlighted that the specialty insurance sector continues evolving through technological integration and strategic partnerships, noting that carriers must focus on disciplined underwriting and innovative solutions to maintain profitability amid changing risk landscapes and customer demands.

-

Oliver Bäte, CEO of Allianz SE, emphasized rising global demand for protection across all insurance segments, particularly noting that increasing natural catastrophes and infrastructure investments will drive specialty insurance growth as businesses and individuals recognize gaps in their current coverage and seek comprehensive risk mitigation strategies.

Key Report Takeaways

-

North America dominates the market with approximately 38% revenue share, driven by robust industrial activity, high insurance penetration rates, sophisticated regulatory frameworks, and concentration of multinational corporations requiring complex risk management solutions across marine, aviation, cyber, and professional liability segments.

-

Asia-Pacific emerges as the fastest-growing region with projected CAGR exceeding 14% through 2033, fueled by rapid economic expansion, increasing middle-class wealth, industrialization trends, regulatory developments supporting specialty insurance adoption, and growing awareness of cyber risks and professional liability exposures across emerging markets.

-

Business customers represent the dominant end-user segment accounting for over 58% of specialty insurance market premiums, as corporations face increasingly complex operational risks, regulatory compliance requirements, executive liability exposures, and unique industry-specific vulnerabilities requiring customized coverage solutions beyond standard commercial policies.

-

Marine, Aviation, and Transport (MAT) insurance contributes the largest application share at approximately 34%, driven by global trade expansion, supply chain complexity, port congestion challenges, geopolitical tensions affecting transportation routes, and increasing value of goods moving across international borders requiring specialized cargo and fleet protection.

-

The broker distribution channel maintains market leadership with more than 60% share, as specialized intermediaries provide essential technical expertise, carrier access, negotiation capabilities, and customized solutions that complex specialty risks demand, though direct digital channels are gaining traction among smaller commercial clients.

-

Cyber liability insurance represents the fastest-growing market segment with anticipated CAGR exceeding 18% and market share projected to reach 12% by 2033, as organizations across all sectors recognize escalating ransomware threats, data breach vulnerabilities, and regulatory penalties driving urgent demand for specialized cyber risk protection.

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 337.59 Billion | Market Size by 2026 | USD 125.85 Billion | Market Size by 2025 | USD 112.47 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 12.50% | Dominating Region | North America | Fastest Growing Region | Asia-Pacific | Segments Covered | Type, Distribution Channel, End-User, Region | Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

Market Dynamics

Drivers Impact Analysis

Technological Advancements and Digital Transformation Accelerate Risk Exposure and Coverage Demand

| Factor | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Digital transformation and cyber risk exposure | 25-30% | Global, particularly North America and Europe | 2026-2033 |

| Climate change and catastrophic events | 20-25% | Coastal regions, North America, Asia-Pacific | 2026-2033 |

| Regulatory complexity and compliance requirements | 15-20% | North America, Europe, emerging Asia-Pacific | 2026-2033 |

Digital transformation initiatives across industries have created unprecedented cyber vulnerability exposures that market providers must address through innovative policy structures and risk assessment methodologies. Organizations migrating critical operations to cloud platforms, implementing Internet of Things devices, and expanding remote workforce capabilities face escalating ransomware attacks, data breach incidents, and system disruption threats that traditional property and casualty policies explicitly exclude from coverage. Financial institutions, healthcare providers, manufacturing enterprises, and retail operations now recognize cyber insurance as essential rather than optional, driving sustained premium growth within the market as underwriters develop sophisticated models incorporating threat intelligence, security posture assessments, and incident response capabilities into pricing algorithms.

The frequency and severity of climate-related catastrophic events have intensified demand for specialized insurance products addressing flood risks, wildfire exposures, hurricane vulnerabilities, and other weather-related perils that standard homeowners and commercial property policies either exclude or provide inadequate limits to cover. Businesses located in high-risk coastal zones, wildfire-prone regions, and areas experiencing increased tornado activity seek specialty insurance market solutions offering higher coverage limits, parametric trigger structures, and customized policy terms reflecting their unique geographic and operational exposures. Regulatory agencies worldwide have implemented stringent compliance frameworks governing data privacy, environmental liability, financial reporting accuracy, and professional conduct standards, compelling organizations to purchase directors and officers insurance, errors and omissions coverage, and other specialty products protecting against regulatory penalties, shareholder litigation, and reputational damage resulting from compliance failures.

Restraints Impact Analysis

Premium Cost Pressures and Coverage Complexities Challenge Market Accessibility and Adoption

| Factor | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High premium costs and affordability constraints | -10 to -15% | Emerging markets, small businesses globally | 2026-2033 |

| Policy complexity and coverage understanding gaps | -8 to -12% | Global, particularly individuals and SMEs | 2026-2033 |

| Capacity constraints and underwriting selectivity | -5 to -8% | High-risk segments across all regions | 2026-2033 |

Escalating premium rates within hardening specialty insurance market conditions have created affordability barriers for small and medium-sized enterprises, individual consumers, and organizations operating in emerging economies where insurance penetration remains relatively low compared to developed markets. Complex underwriting requirements, extensive documentation demands, and lengthy quote processes deter potential customers from pursuing specialty coverage, particularly when they struggle to quantify intangible risks like cyber threats or reputational damage that these policies address. Small businesses facing cash flow constraints often prioritize immediate operational needs over specialized risk protection, viewing directors and officers insurance or cyber liability coverage as discretionary expenses rather than essential risk management investments.

The technical complexity of market products creates significant comprehension challenges for buyers unfamiliar with policy language, coverage triggers, exclusions, and claims procedures that differ substantially from straightforward property or auto insurance policies. Professional liability, errors and omissions, and cyber insurance policies contain intricate definitions, sublimits, and conditions that require substantial time investment to understand properly, leading to purchase hesitation or inadequate coverage selection when buyers misinterpret policy terms. Capacity constraints among specialty insurers have intensified underwriting selectivity, with carriers declining risks they consider outside acceptable parameters or demanding risk mitigation measures that applicants find burdensome or cost-prohibitive, effectively limiting market accessibility for higher-risk industry segments or geographic locations experiencing elevated loss frequencies.

Opportunities Impact Analysis

Emerging Risk Categories and Geographic Expansion Create Substantial Growth Avenues

| Factor | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Emerging economies and market penetration | 18-22% | Asia-Pacific, Latin America, Middle East | 2026-2033 |

| New risk categories and product innovation | 15-20% | Global, technology-driven markets | 2026-2033 |

| Insurtech integration and distribution efficiency | 12-15% | North America, Europe, advanced Asia-Pacific | 2026-2033 |

Rapid economic development across Asia-Pacific nations, Latin American countries, and Middle Eastern markets presents exceptional expansion opportunities for specialty insurance market providers willing to establish local presence, develop regional expertise, and customize products addressing unique cultural and regulatory requirements. Growing middle-class populations in India, Indonesia, Vietnam, Brazil, and other emerging economies accumulate wealth requiring protection through fine art insurance, collectibles coverage, and personal liability products, while industrial expansion across these regions drives demand for marine, professional liability, and political risk insurance solutions. Regulatory maturation in emerging markets increasingly mandates certain specialty coverages or creates liability frameworks that make directors and officers insurance and professional indemnity policies prudent risk management investments.

Technological innovations continuously generate novel risk exposures requiring specialized insurance product development, including autonomous vehicle liability, drone operation coverage, cryptocurrency custody protection, artificial intelligence errors and omissions, genetic data privacy insurance, and space tourism liability products that forward-thinking market participants can develop and commercialize. The convergence of traditional risk categories creates opportunities for integrated policy solutions addressing interconnected exposures, such as combined cyber and directors and officers coverage recognizing that data breaches frequently trigger shareholder litigation against executives, or environmental liability products incorporating climate risk modeling and parametric trigger mechanisms. Insurtech platforms leveraging artificial intelligence, blockchain technology, and advanced analytics enable specialty insurers to streamline distribution, automate underwriting processes, enhance customer experiences, and reduce operational costs while expanding addressable markets through digital channels reaching previously underserved customer segments and geographic territories within the market.

Segment Analysis

Marine, Aviation, and Transport Insurance Dominates Specialty Insurance Market

Comprehensive Coverage Solutions for Complex Logistics and Transportation Risk Exposures

Marine, Aviation, and Transport insurance commands the largest share within the market at approximately 34% due to the essential role these coverage types play in facilitating international commerce, protecting high-value cargo movements, and addressing unique liability exposures inherent in transportation operations. Global trade expansion has intensified demand for specialized marine cargo insurance protecting goods in transit across ocean routes, aviation hull and liability coverage safeguarding aircraft fleets and passenger operations, and transport insurance addressing trucking, rail, and intermodal logistics risks that standard commercial policies exclude or provide insufficient limits to cover adequately. Supply chain disruptions experienced during recent years have heightened awareness among shippers, carriers, and logistics providers regarding vulnerability to port congestion, geopolitical tensions affecting shipping routes, piracy threats in certain maritime regions, and catastrophic events that can result in total cargo losses or extended business interruption periods.

The segment demonstrates robust growth projections with CAGR exceeding 12% through 2033, particularly strong across Asia-Pacific regions where manufacturing export activities and intra-regional trade flows continue expanding rapidly, driving demand for comprehensive marine and transport coverage solutions. Leading market providers including Lloyd's of London syndicates, AIG's global marine division, Allianz Global Corporate and Specialty, and Chubb's marine insurance operations maintain dominant positions through deep technical expertise, extensive international networks, and sophisticated risk assessment capabilities addressing complex exposures across maritime, aviation, and surface transportation segments. North American and European markets represent mature regions with established marine and aviation insurance frameworks, while emerging Asia-Pacific economies including China, India, Singapore, and Vietnam experience accelerated adoption as regulatory environments mature and awareness of transportation risk management importance increases among commercial enterprises engaging in cross-border trade activities.

Cyber Liability Insurance Represents Fastest-Growing Specialty Insurance Market Segment

Rapid Expansion Driven by Escalating Digital Threats and Regulatory Compliance Requirements

Cyber liability insurance has emerged as the fastest-expanding market segment with projected CAGR approaching 18% through 2033 and anticipated market share reaching 12% by the forecast period conclusion, reflecting escalating digital threat landscapes and universal recognition across industries that data breach incidents pose existential risks requiring specialized insurance protection. Ransomware attacks have proliferated exponentially, targeting organizations of all sizes across healthcare, financial services, manufacturing, retail, and government sectors with sophisticated encryption techniques that paralyze operations and demand substantial payments for data restoration, while regulatory frameworks including GDPR in Europe, CCPA in California, and similar privacy legislation worldwide impose significant financial penalties for inadequate data protection practices. The financial impact of cyber incidents extends far beyond immediate remediation costs to encompass business interruption losses, customer notification expenses, credit monitoring services, regulatory fines, litigation defense costs, and reputational damage that can permanently impair brand value and customer trust.

North America leads cyber insurance adoption with particularly strong penetration among financial institutions, healthcare providers, and technology companies facing stringent regulatory oversight and heightened litigation risk, though European markets are experiencing accelerated growth as GDPR enforcement intensifies and businesses recognize cyber insurance as essential compliance component. Leading market participants including AIG, Chubb, Beazley, AXA XL, and Hiscox have developed sophisticated cyber underwriting capabilities incorporating security posture assessments, vulnerability scanning, incident response planning evaluations, and multi-factor authentication verification into pricing models that reward proactive risk management while excluding organizations demonstrating inadequate cybersecurity controls. The segment continues evolving rapidly as insurers refine policy language addressing ransomware coverage, social engineering fraud, cryptocurrency theft, cloud service provider failures, and nation-state attack exclusions, while capacity constraints periodically tighten as carriers reassess accumulation exposures and catastrophic loss potential within interconnected digital infrastructure across the market landscape.

Regional Insights

North America

Mature Market Leadership Through Sophisticated Risk Management and Regulatory Frameworks

North America maintains dominant position within the market, commanding approximately 38% global revenue share valued at USD 47.82 billion in 2026 and projected to reach USD 128.28 billion by 2033 with CAGR of 12.1%. The region's leadership stems from highly developed insurance infrastructure, sophisticated regulatory environments encouraging specialized coverage adoption, concentration of multinational corporations with complex risk exposures, and mature broker distribution networks providing technical expertise across marine, aviation, cyber, professional liability, and other specialty segments. United States markets drive the majority of regional premium volume through robust excess and surplus lines frameworks enabling flexible policy structures, while Canadian markets contribute significantly particularly within energy, natural resources, and transportation specialty insurance categories.

The region hosts headquarters for leading specialty insurance market providers including AIG, Chubb, Berkshire Hathaway Specialty Insurance, Liberty Mutual Insurance, The Hartford, Markel Corporation, and W.R. Berkley Corporation, which leverage extensive distribution networks, deep technical underwriting expertise, and substantial financial capacity to dominate both domestic and international specialty insurance placements. Cyber liability insurance experiences particularly strong growth within North American market as organizations across all sectors recognize escalating ransomware threats and data breach vulnerabilities, while directors and officers insurance maintains steady demand driven by active shareholder litigation environments and stringent regulatory oversight across financial services, healthcare, and technology industries. Professional liability coverage categories including medical malpractice, errors and omissions, and legal malpractice insurance remain mature segments with stable premium volumes, though emerging professional categories including cybersecurity consultants, data privacy officers, and artificial intelligence developers create new growth opportunities within the evolving North American market landscape.

Asia-Pacific

Fastest-Growing Region Driven by Economic Expansion and Industrialization Trends

Asia-Pacific represents the fastest-growing specialty insurance market region with projected CAGR exceeding 14% through 2033, driven by rapid economic development, increasing middle-class wealth accumulation, industrial sector expansion, and growing awareness of specialized risk management needs across diverse economies including China, India, Japan, South Korea, Singapore, Indonesia, Vietnam, and Australia. Market value within the region is estimated at USD 37.76 billion in 2026 and anticipated to reach USD 108.43 billion by 2033 as insurance penetration rates gradually increase from relatively low baseline levels compared to mature Western markets. Manufacturing export activities fuel robust demand for marine and transport insurance protecting cargo movements across intra-regional trade routes and international shipping lanes, while aviation insurance experiences strong growth supporting expanding airline operations and aircraft leasing activities concentrated in Singapore, Hong Kong, and Tokyo financial centers.

Leading international market providers including AIG, Allianz, AXA, Chubb, and Zurich Insurance have established substantial presence throughout Asia-Pacific through local subsidiaries, joint ventures with regional partners, and dedicated specialty underwriting teams addressing unique regulatory requirements and cultural considerations across diverse national markets. Japan and Australia represent mature markets with well-established regulatory frameworks and sophisticated buyer awareness, while China and India present exceptional growth potential through their massive populations, rapidly expanding corporate sectors, and regulatory developments mandating certain specialty coverages including directors and officers insurance for publicly listed companies. Cyber insurance adoption accelerates particularly within financial services, technology, and e-commerce sectors as data breach incidents proliferate and privacy regulations similar to GDPR gain implementation across jurisdictions, while professional liability and product liability specialty insurance market segments experience increasing demand as quality standards rise and consumer protection frameworks mature throughout the Asia-Pacific region.

Top Key Players

-

American International Group - AIG (United States)

-

Chubb Limited (Switzerland)

-

Allianz SE (Germany)

-

AXA Group (France)

-

Berkshire Hathaway Specialty Insurance (United States)

-

Zurich Insurance Group (Switzerland)

-

Munich Re (Germany)

-

Tokio Marine Holdings (Japan)

-

Beazley Plc (United Kingdom)

-

Hiscox Ltd (Bermuda)

-

Markel Corporation (United States)

-

Assicurazioni Generali SpA (Italy)

-

QBE Insurance Group (Australia)

-

Liberty Mutual Insurance (United States)

-

The Hartford Financial Services Group (United States)

Recent Developments

-

Chubb Limited (2025) - Achieved record property and casualty underwriting income of USD 6.53 billion for full-year 2025, with net premiums written reaching USD 47.56 billion representing 5.4% growth from 2024, driven by strategic expansion across specialty lines including cyber, marine, and professional liability segments while maintaining disciplined underwriting standards despite competitive market conditions.

-

AIG (2025) - Completed strategic transformation initiatives focusing on core specialty insurance capabilities and announced enhanced digital underwriting platform leveraging artificial intelligence for risk assessment across marine, aviation, cyber, and political risk segments, positioning the company for accelerated growth in emerging market categories.

-

Beazley Plc (2024) - Expanded cyber insurance capacity and launched innovative parametric cyber coverage solutions addressing ransomware and business interruption exposures, while achieving 18% premium growth in specialty lines during 2024 through enhanced digital distribution capabilities and strategic focus on high-growth segments including technology errors and omissions insurance.

-

Allianz Global Corporate and Specialty (2024) - Strengthened presence across Asia-Pacific markets through strategic partnerships with regional brokers and technology investments enabling faster quote turnaround times for marine, aviation, and political risk coverages, while expanding renewable energy specialty insurance offerings addressing wind, solar, and battery storage project risks.

-

Markel Corporation (2024) - Completed acquisition of specialty insurance managing general agency expanding capabilities in professional liability and errors and omissions segments, adding USD 450 million in annual premium volume and enhancing distribution reach across targeted industry verticals including financial institutions, healthcare providers, and technology companies.

Market Trends

Digital Transformation and Product Innovation Reshape Specialty Insurance Market Landscape

Digital distribution channels and insurtech platforms are fundamentally transforming how market providers interact with customers, streamline underwriting processes, and deliver policy administration services through seamless online experiences. Traditional broker-dominated distribution models face disruption from direct digital channels, comparison platforms, and embedded insurance solutions integrated within industry-specific software applications, enabling faster quote generation, simplified application processes, and transparent pricing that appeals particularly to small and medium-sized commercial buyers seeking cyber, professional liability, and general specialty coverages. Blockchain technology implementation enables smart contracts automating certain claims payments based on predefined trigger events, particularly relevant for parametric specialty insurance products addressing weather catastrophes, cargo delays, or supply chain disruptions where traditional loss adjustment processes create inefficiencies and payment delays that digital solutions can eliminate.

Product innovation accelerates within the market as carriers develop coverage solutions addressing emerging risk categories including cryptocurrency custody liability, genetic data privacy insurance, autonomous vehicle operations, drone commercial use, artificial intelligence errors and omissions, environmental social and governance liability, and space tourism risks that traditional policy forms never contemplated. Integrated policy structures combining previously separate coverage categories gain traction as buyers seek comprehensive solutions addressing interconnected risks through single policy placements, exemplified by cyber and directors and officers combination products recognizing that data breaches frequently trigger shareholder litigation, or environmental liability policies incorporating climate risk modeling and business interruption protection. Sustainability considerations increasingly influence underwriting decisions and product development as market participants face stakeholder pressure to align portfolios with environmental, social, and governance principles, leading to enhanced coverage for renewable energy projects, exclusions for certain fossil fuel activities, and specialized products addressing climate adaptation, carbon credit verification, and green building certification risks.

Segments Covered in the Report

By Type:

-

Marine, Aviation, and Transport (MAT) Insurance

-

Cyber Liability Insurance

-

Political Risk and Credit Insurance

-

Professional Liability Insurance (Errors and Omissions)

-

Directors and Officers (D&O) Insurance

-

Entertainment Insurance

-

Fine Art and Collectibles Insurance

-

Livestock and Aquaculture Insurance

-

Environmental Liability Insurance

-

Product Recall Insurance

-

Kidnap and Ransom Insurance

-

Others

By Distribution Channel:

-

Brokers

-

Non-Brokers (Direct, Bancassurance, Digital Platforms)

By End-User:

-

Business

-

Individuals

By Region:

-

North America (United States, Canada, Mexico)

-

Europe (United Kingdom, Germany, France, Italy, Spain, Rest of Europe)

-

Asia-Pacific (China, Japan, India, South Korea, Singapore, Australia, Rest of Asia-Pacific)

-

Latin America (Brazil, Argentina, Rest of Latin America)

-

Middle East and Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Frequently Asked Questions:

Answer: The specialty insurance market size reached USD 112.47 billion in 2025 and is projected to grow from USD 125.85 billion in 2026 to USD 337.59 billion by 2033. The market demonstrates strong expansion with CAGR of 12.50% during the forecast period driven by increasing risk complexity and specialized coverage demand.

Answer: Marine, Aviation, and Transport insurance represents the largest specialty insurance market segment with approximately 34% share, driven by global trade expansion and complex logistics risk exposures. Cyber liability insurance emerges as the fastest-growing segment with projected CAGR exceeding 18% through 2033 as digital threats escalate.

Answer: Digital transformation creating cyber vulnerabilities, climate change increasing catastrophic event frequency, regulatory complexity demanding compliance coverage, and wealth accumulation among high-net-worth individuals drive specialty insurance market expansion. Emerging risk categories and geographic expansion into Asia-Pacific markets present additional growth opportunities.

Answer: North America dominates the specialty insurance market with approximately 38% revenue share, leveraging sophisticated regulatory frameworks and mature distribution networks. Asia-Pacific represents the fastest-growing region with CAGR exceeding 14% through 2033, fueled by rapid economic development and increasing insurance awareness.

Answer: The specialty insurance market has developed sophisticated cyber liability products incorporating security assessments, incident response planning, and ransomware coverage addressing escalating digital threats. Insurers leverage artificial intelligence for risk evaluation while creating integrated policies combining cyber and directors and officers coverage recognizing interconnected exposures.