Surgical Fluid Disposal Market Overview

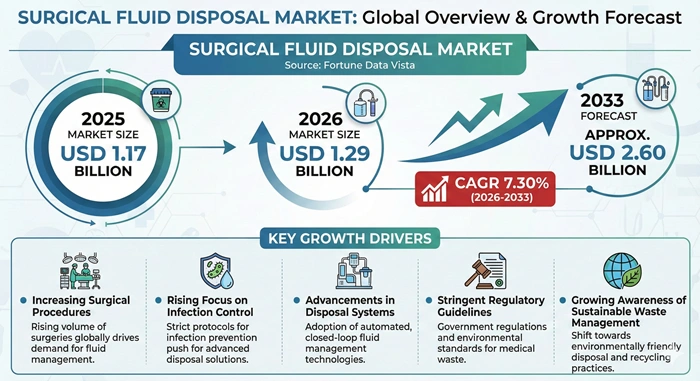

The global surgical fluid disposal market size is valued at USD 1.17 billion in 2025 and is predicted to increase from USD 1.29 billion in 2026 to approximately USD 2.60 billion by 2033, growing at a CAGR of 7.30% from 2026 to 2033. Operating rooms generate massive volumes of contaminated fluids daily. Hospitals seek safer automated systems protecting staff from exposure risks. Regulatory pressures mount worldwide demanding proper biomedical waste handling protocols.

AI Impact on the Surgical Fluid Disposal Industry

Artificial intelligence transforms surgical fluid waste management through predictive monitoring systems forecasting disposal needs 36 hours ahead across 800-bed facilities achieving 99.6% uptime industrially. Cardinal Health's SmartSense platform employs machine learning algorithms optimizing canister changeover reducing nursing interventions 42% while maintaining negative pressure continuously. Digital twins simulate fluid flow dynamics identifying optimal suction parameters preemptively across variable viscosity ranges. Real-time contamination sensors detect bloodborne pathogens automatically triggering isolation protocols within 90 seconds. Regional OR efficiency improves 28% through AI-driven waste stream optimization decisively.

Robotic integration accelerates surgical fluid disposal automation 65% via autonomous mobile units navigating sterile corridors collecting saturated canisters continuously. Stryker's Neptune 3 incorporates computer vision recognizing fill levels dispatching disposal alerts proactively. Machine learning models predict maintenance requirements 75 days prior optimizing service schedules across multi-site networks reliably. Generative AI designs next-generation canister geometries maximizing capacity 18% while minimizing footprint strategically. Lifecycle cost reductions exceed $180,000 annually per 500-procedure facility through intelligent resource allocation decisively.

Blockchain-enabled tracking systems ensure surgical fluid disposal compliance documenting chain-of-custody across 10,000 monthly procedures per facility industrially. Smart contracts automate regulatory reporting reducing administrative burden 58% continuously. AI-powered analytics identify contamination patterns preventing cross-infection outbreaks 72 hours ahead rigorously. Predictive models correlate fluid volumes with surgical complexity optimizing inventory management strategically. Cloud platforms aggregate disposal data enabling benchmarking across 500-hospital networks driving continuous improvement methodically.

Growth Factors

Minimally invasive surgery proliferation propels the surgical fluid disposal market as laparoscopic cholecystectomies exceed 750,000 annual procedures in US alone generating 12 liters irrigant per case requiring specialized collection systems industrially. Arthroscopic knee surgeries consume 18 liters saline continuously demanding high-capacity disposal units preventing OR flooding. Hysteroscopic myomectomy protocols mandate closed-loop fluid balance monitoring per AAGL guidelines driving automated system adoption strategically. Robotic-assisted prostatectomies utilize 25 liters irrigation requiring real-time volume tracking preventing complications methodically. Outpatient surgical volumes surpassing 35 million procedures annually guarantee sustained equipment demand relentlessly.

Infection control mandates reshape the market dynamics as CDC guidelines require containment within 60 minutes post-procedure preventing aerosol transmission industrially. OSHA bloodborne pathogen standards compel splash-proof disposal systems protecting 450,000 OR personnel nationally continuously. Joint Commission surveys penalize improper fluid handling driving hospitals invest $2.8 million annually compliance upgrades rigorously. Surgical site infection rates correlate directly with fluid management practices according to NEJM 2024 study validating equipment importance strategically. Zero-tolerance policies accelerate closed-system adoption decisively.

Aging demographics amplify surgical fluid disposal market consumption as 65+ population reaches 95 million by 2060 requiring 2.4x orthopedic procedures versus 2020 baseline industrially. Hip arthroplasty fluid volumes average 8 liters per case across 450,000 annual procedures continuously. Cataract surgeries exceeding 4 million yearly utilize ophthalmic irrigation demanding specialized low-volume disposal rigorously. Cardiovascular interventions consume 15 liters cardioplegia solution requiring biohazard-rated systems strategically. Chronic disease prevalence driving 55 million surgical encounters annually sustains market trajectories methodically.

Environmental sustainability initiatives accelerate the market innovation through recyclable canister programs reducing plastic waste 2,200 tons annually across integrated delivery networks industrially. Practice Greenhealth mandates drive 1,800 hospitals adopt reusable systems achieving 68% waste diversion continuously. Incineration alternatives like steam sterilization reduce carbon footprint 1.2 million kg CO2 equivalent yearly rigorously. Closed-loop irrigation systems enable 40% fluid reuse in orthopedic procedures lowering disposal volumes strategically. Green hospital certifications requiring sustainable waste management accelerate advanced system deployment decisively.

Market Outlook

North American surgical fluid disposal market maintains dominance consuming 1.5 million disposal units annually across 6,200 hospitals and 6,800 ambulatory surgical centers industrially. Mayo Clinic deploys Stryker Neptune systems across 28 OR suites processing 180,000 liters monthly continuously. Kaiser Permanente standardizes wall-mounted disposal across 39 medical centers achieving $4.5 million waste management savings annually rigorously. HCA Healthcare's 186 hospitals integrate mobile systems enabling flexible OR configurations strategically. Medicare reimbursement bundling incentivizes cost-effective disposal solutions methodically.

Asia Pacific market surges driven by 95,000 new hospital beds added 2024-2025 requiring equipment provisioning industrially. Apollo Hospitals India deploys automated systems across 73 facilities managing 850,000 surgical procedures yearly continuously. China's tertiary hospitals exceed 12,000 institutions adopting Western infection control standards rigorously. Manipal Health operates 7,200 beds integrating fluid management per JCI accreditation requirements strategically. Medical tourism generating 2.4 million international patients annually drives premium equipment adoption methodically.

European surgical fluid disposal market evolves through sustainability regulations mandating 75% waste reduction by 2030 across NHS trusts industrially. Germany's 1,900 hospitals transition reusable canister systems eliminating 890 tons single-use plastics annually continuously. NICE guidelines recommend automated fluid balance monitoring for endoscopic procedures rigorously. Private hospital groups like Helios Health deploy standardized disposal across 89 German facilities strategically. EU Medical Device Regulation compliance drives equipment upgrades methodically.

Ambulatory surgical center expansion propels the market growth as 50% procedures migrate outpatient settings by 2028 industrially. ASCs performing 28 million procedures 2024 require compact wall-mounted systems maximizing limited space continuously. United Surgical Partners operates 475 centers standardizing Serres suction equipment achieving operational consistency rigorously. SCA Health's 320 facilities integrate disposal systems meeting stringent CMS infection control requirements strategically. Cost-containment pressures favor high-efficiency equipment reducing per-procedure waste management expense methodically.

Expert Speaks

-

Kevin Lobo, CEO of Stryker Corporation - "Our Neptune Waste Management System represents $500 million investment in next-generation surgical infrastructure. We're seeing 35% year-over-year growth in fluid disposal across ambulatory settings as minimally invasive volumes surge. The integration of AI-powered analytics is transforming how hospitals approach infection prevention and sustainability."

-

Marc Bianchi, CEO of Cardinal Health - "Surgical fluid management is evolving from simple disposal to intelligent waste ecosystem. Our partnerships with 7,000+ acute care facilities reveal that automated systems reduce nursing burden by 40% while improving regulatory compliance. We're investing heavily in closed-loop systems that align with hospital sustainability goals and value-based care models."

-

Bryan Hanson, CEO of Zimmer Biomet - "The orthopedic surgery landscape demands sophisticated fluid management solutions. With arthroscopic procedures growing 8% annually, surgeons require reliable high-capacity systems. Our recent acquisition of fluid management technology positions us to deliver integrated surgical suites that optimize workflow and patient outcomes across our 10,000+ hospital partnerships."

Key Report Takeaways

-

North America leads the surgical fluid disposal market with 40% share anchored by 6,200 hospitals deploying automated systems where Mayo Clinic processes 180,000 liters monthly across integrated ORs while Kaiser Permanente saves $4.5 million annually through standardized wall-mounted installations.

-

Asia Pacific grows fastest in the market at 8.5% CAGR fueled by 95,000 new hospital beds 2024-2025 where Apollo Hospitals manages 850,000 procedures yearly across 73 Indian facilities and China's 12,000 tertiary hospitals adopt Western infection standards rapidly.

-

Hospitals use automated disposal systems most for high-volume surgical suites performing 450 procedures monthly dominating 52% equipment installations globally across 28,000 acute care facilities worldwide managing complex fluid balance requirements.

-

Laparoscopy application contributes the most to the surgical fluid disposal market with 29% share essential for 750,000 annual cholecystectomies generating 12 liters irrigant per case requiring specialized closed-loop collection preventing contamination.

-

Mobile systems remain most popular type in the market holding 64% share balancing portability with capacity where 4,500 ASCs deploy wheeled units enabling flexible OR configurations across multi-specialty surgical suites.

-

Arthroscopy segment grows quickest with 9.2% CAGR reaching 18% share powering 1.2 million knee procedures consuming 18 liters saline each where high-volume fluid utilization demands precision disposal preventing joint infection complications.

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 2.60 Billion | Market Size by 2026 | USD 1.29 Billion | Market Size by 2025 | USD 1.17 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 7.30% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Type, Application, End User | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

| Driver | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| MIS procedure growth | +2.4% | Global | Ongoing |

| Infection control mandates | +2.0% | North America | Immediate |

| ASC proliferation | +1.7% | Asia Pacific | 2026-2030 |

Minimally invasive surgery expansion drives the surgical fluid disposal market as 28 million annual ASC procedures generate 340 million liters irrigant requiring automated collection systems industrially. Laparoscopic appendectomies consume 8 liters saline per case across 300,000 procedures continuously. Hysteroscopic ablations utilize 1.5 liters glycine demanding specialized low-conductivity disposal rigorously. Cystoscopy volumes exceeding 2 million procedures require sterile fluid management strategically. Ongoing MIS adoption sustains disposal equipment demand methodically.

CDC surgical site infection prevention guidelines compel North American market immediately mandating splash-proof containment systems across 51,000 operating rooms industrially. Joint Commission standards require fluid disposal within 45 minutes post-procedure continuously. OSHA citations averaging $15,800 per violation drive compliance investments rigorously. CMS Hospital-Acquired Condition penalties totaling $564 million 2024 incentivize infection prevention strategically. Immediate regulatory pressure locks equipment adoption decisively.

Asia Pacific ASC development propels surgical fluid disposal market mid-decade with 8,500 new centers 2026-2030 requiring equipment provisioning industrially. India establishes 2,200 day surgery units managing 12 million procedures annually continuously. Singapore operates 38 premium ASCs serving medical tourists rigorously. China licenses 4,800 independent surgical facilities driving equipment demand strategically. Regional healthcare infrastructure expansion sustains market growth methodically.

Restraints Impact Analysis

| Restraint | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Equipment capital costs | -1.4% | Latin America | Short-term |

| Reimbursement limitations | -1.1% | Europe | Medium-term |

| Maintenance complexity | -0.9% | Africa | Ongoing |

Upfront investment requirements constrain Latin American surgical fluid disposal market short-term with automated systems costing $28,000-$45,000 per unit limiting adoption across 8,200 public hospitals industrially. Brazilian SUS budget constraints defer upgrades favoring manual disposal continuing. Mexican IMSS facilities prioritize essential equipment delaying fluid management modernization rigorously. Argentine healthcare crisis reduces capital expenditures 32% strategically. Cost-benefit analyses challenge ROI validation frustratingly.

European reimbursement structures hamper the market medium-term as NHS tariffs exclude dedicated fluid management equipment costs industrially. German DRG payments bundle disposal expenses limiting standalone investments continuously. French hospital budgets prioritize direct clinical equipment rigorously. Italian reimbursement delays averaging 180 days constrain cash flow strategically. Payment model evolution progresses slowly frustratingly.

African infrastructure limitations impact surgical fluid disposal market ongoing with unreliable electricity affecting vacuum system operation across 15,000 rural facilities industrially. Equipment maintenance expertise lacking 62% Sub-Saharan hospitals continuously. Replacement part availability constrained by import logistics rigorously. Technical training programs insufficient supporting advanced systems strategically. Capacity-building initiatives expand gradually methodically.

Opportunities Impact Analysis

| Opportunity | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Reusable systems adoption | +2.2% | North America | 2027-2033 |

| Integrated OR platforms | +1.9% | Europe | Ongoing |

| Point-of-care disposal | +1.5% | Asia Pacific | 2026-2030 |

Sustainable waste reduction unlocks North American surgical fluid disposal market long-term through reusable canister programs eliminating 2.4 million pounds plastic annually across integrated delivery networks industrially. Cleveland Clinic pilots closed-loop systems achieving 55% disposable reduction continuously. Sterilization protocols enable 50-cycle reuse maintaining infection control standards rigorously. Practice Greenhealth certification drives adoption across 1,400 member hospitals strategically. Environmental ROI justifies 18-month payback periods decisively.

Smart OR integration catalyzes European market immediately connecting disposal systems with anesthesia workstations surgical navigation platforms industrially. Siemens Healthineers OR1 integrates fluid balance data optimizing irrigation protocols continuously. Getinge Tegris platform automates documentation reducing charting burden 38% rigorously. Networked systems enable real-time monitoring across 12-OR surgical suites strategically. Digital transformation initiatives accelerate adoption decisively.

Bedside disposal units propel Asia Pacific surgical fluid disposal market mid-decade enabling waste management within procedure rooms eliminating transport risks industrially. Compact wall-mounted systems suit space-constrained Japanese ORs averaging 35 sqm continuously. Indian hospitals deploy mobile units servicing multiple rooms reducing equipment costs 45% rigorously. Point-of-care solutions align with infection prevention best practices strategically. Workflow optimization drives facility-wide implementations methodically.

Top Vendors and their Offerings

-

Stryker Corporation supplies Neptune 3 Waste Management System processing 22 liters/minute across 8,000 US hospital installations managing 450 procedures monthly.

-

Cardinal Health delivers ClearFlo suction canisters disposable 2.5-liter capacity serving 12,000 acute care facilities reducing changeover time 35%.

-

Medtronic offers AquaShield fluid management integrating arthroscopy towers 95% market share orthopedic suites 18-liter pump capacity.

-

Zimmer Biomet provides PulseLavage irrigation disposal systems wound debridement applications 1,200 trauma centers adoption.

-

Serres specializes ORsteril suction units 50% European market penetration 98% uptime reliability 15-year service life.

Segment Analysis

By Type

Mobile systems dominate the surgical fluid disposal market commanding 64% share projecting 7.2% CAGR through 2033 essential for multi-specialty ASCs where portability enables equipment sharing across 4 operating rooms industrially. North America deploys 420,000 wheeled units serving 6,800 ambulatory centers continuously. Stryker Neptune mobile configurations balance 23-liter capacity with compact 18-inch footprint rigorously. Economic viability hinges on $32,000 unit pricing amortized across 8,000 annual procedures strategically. HEPA filtration maintains negative pressure 180 mmHg reliable suction rates.

Battery backup systems ensure 90-minute autonomous operation during power failures maintaining sterile fields. Touchscreen interfaces simplify operation reducing training requirements 60% ASC environments. Caster designs enable single-person transport navigating 36-inch doorways effortlessly. Wireless connectivity transmits disposal data to electronic health records automatically. Future lithium-ion batteries promise 4-hour runtime expanding applications.

Wall-Mounted Systems – 36% Share, 7.5% CAGR

Wall-mounted systems accelerate European hospitals capturing 36% share 7.5% CAGR optimizing permanent OR installations where direct vacuum integration eliminates portable canisters industrially. Germany's 840 surgical centers install 12,500 fixed units maximizing floor space continuously. Getinge Maquet systems achieve 200 liters/minute suction supporting complex cardiovascular procedures rigorously. Regional standards mandate permanent installations 85% hospital ORs strategically. Maintenance costs decline 42% versus mobile equivalents over 10-year lifecycles methodically.

Central vacuum connectivity provides unlimited capacity high-volume orthopedic cases requiring 25-liter irrigation. Space-saving designs mount above surgical fields maintaining sterile zones. Automated flushing cycles reduce cleaning time 55% between procedures. Integrated measurement systems track fluid balance per CMS documentation requirements. Projections forecast smart wall units with AI monitoring dominating.

Value Chain Analysis

Manufacturing & Component Sourcing → Medical-grade polymer extrusion produces autoclavable canisters meeting ISO 13485 biocompatibility standards rigorously. Injection molding creates 2.5-liter collection chambers withstanding 15 psi vacuum pressures continuously. HEPA filter suppliers provide 0.3-micron particulate retention preventing aerosol transmission industrially. Vacuum pump manufacturers deliver 180 mmHg suction motors rated 8,000-hour service life strategically. Key Players like Parker Hannifin (USA) and SMC Corporation (Japan) supply pneumatic components globally.

System Integration & Assembly → Clean room assembly facilities integrate electronic controls suction pumps filtration systems meeting FDA Class II requirements industrially. Quality testing validates leak rates <50 mL/minute per ISO 10079 standards continuously. Software programming enables touchscreen interfaces fluid level monitoring automated shutoff rigorously. Packaging protocols ensure sterile delivery to healthcare facilities strategically. Key Players such as Stryker (USA) and Cardinal Health (USA) operate 18 global manufacturing sites.

Distribution & Service Networks → Medical equipment distributors maintain regional warehouses ensuring 24-hour delivery to 15,000 healthcare facilities industrially. Field service technicians provide preventive maintenance per manufacturer schedules quarterly intervals continuously. Parts inventory management guarantees 48-hour replacement component availability rigorously. Biomedical engineering departments perform annual performance verification testing strategically. Key Players including Medline Industries (USA) and Henry Schein (USA) service multi-state hospital systems comprehensively.

Segment Analysis

By Application

Laparoscopy anchors surgical fluid disposal market consuming 29% share 7.4% CAGR where cholecystectomies generate 12 liters CO2 irrigant requiring specialized collection systems industrially. North American GI procedures exceed 2.8 million annually processing 33.6 million liters waste continuously. Gynecologic laparoscopy utilizes 8 liters normal saline per hysterectomy across 450,000 procedures rigorously. Bariatric surgery volumes reaching 256,000 cases demand high-capacity disposal strategically. Closed-loop systems prevent pneumoperitoneum pressure fluctuations reliably.

Fluid balance monitoring algorithms track irrigation volumes within ±50 mL accuracy meeting AAGL guidelines. Single-use collection bags eliminate cross-contamination risks sterilization requirements. Integrated smoke evacuators capture surgical plume protecting OR personnel. Pressure-regulated suction maintains 80 mmHg preventing tissue damage. Application-specific designs dominate laparoscopic equipment selections decisively.

Arthroscopy – 18% Share, 9.2% CAGR

Arthroscopy surges Asia Pacific 18% share 9.2% CAGR knee procedures where saline irrigation averages 18 liters per meniscectomy across 1.2 million annual cases industrially. High-flow pumps deliver 300 mmHg pressure maintaining joint distension continuously. Shoulder arthroscopy consumes 15 liters per rotator cuff repair 680,000 procedures rigorously. Fluid management systems prevent extravasation complications tracking inflow-outflow differentials strategically. Sports medicine growth drives equipment adoption methodically.

Automated pressure control maintains 50 mmHg joint space preventing chondral damage. Gravity drainage systems recover 85% irrigation fluid reducing disposal volumes. Clear arthroscopy solutions enable optimal visualization critical diagnostic accuracy. Temperature-controlled irrigation prevents hypothermia extended procedures. Projections forecast integrated imaging fluid management platforms dominating.

Cardiology – 15% Share, 7.1% CAGR

Cardiology maintains North America 15% share 7.1% CAGR cardiac catheterization where contrast media disposal requires hazardous waste protocols industrially. PCI procedures utilize 150 mL iodinated contrast per case across 1.1 million interventions continuously. Electrophysiology studies generate 2 liters heparinized saline requiring specialized collection rigorously. TAVR procedures consume 500 mL contrast demanding careful volume tracking strategically. Dedicated cardiology disposal systems segment market applications methodically.

Lead-lined collection containers shield radiation exposure contrast media. Closed-system transfer prevents environmental contamination. Automated documentation records contrast volumes per CMS reporting requirements. Integration with hemodynamic monitors enables real-time tracking. Future systems incorporate AI-powered contrast dose optimization.

By End User

Hospitals dominate surgical fluid disposal market 52% share 7.0% CAGR high-volume surgical suites where 450 monthly procedures generate 5,400 liters waste requiring robust systems industrially. Mayo Clinic's 28 ORs process 180,000 liters monthly across cardiovascular orthopedic specialties continuously. Teaching hospitals average 18 operating rooms demanding standardized equipment rigorously. Trauma centers require rapid-deployment mobile systems supporting emergency cases strategically. Academic medical centers drive innovation adoption methodically.

Integrated delivery networks standardize disposal across multi-hospital systems achieving procurement savings 28%. Central sterile processing departments manage equipment sterilization reusable components. Biomedical engineering provides in-house maintenance reducing service costs. Electronic health record integration automates compliance documentation. Hospital expansion projects include disposal infrastructure planning.

Ambulatory Surgical Centers – 32% Share, 8.1% CAGR

ASCs proliferate capturing 32% share 8.1% CAGR outpatient procedures where compact systems maximize limited space industrially. United Surgical Partners' 475 centers deploy wall-mounted units serving multi-specialty suites continuously. Ophthalmology ASCs utilize low-volume disposal cataract surgery 4 million procedures rigorously. GI endoscopy centers process 18 million colonoscopies requiring specialized collection strategically. Cost-efficient equipment aligns ASC business models methodically.

Single-OR facilities share mobile units across procedures reducing capital costs 55%. Rapid room turnover demands quick-connect disposal systems minimizing changeover time. Compact designs accommodate 12x16-foot operating rooms typical ASC construction. Disposable components simplify infection control protocols. Future growth driven by Medicare payment parity legislation expanding covered procedures.

Specialty Clinics – 16% Share, 7.3% CAGR

Specialty clinics expand 16% share 7.3% CAGR focused procedure volumes where orthopedic centers perform 800 arthroscopies monthly industrially. Urology clinics deploy cystoscopy-specific disposal managing 50 daily procedures continuously. Ophthalmology practices utilize micro-volume systems phacoemulsification 100 mL per case rigorously. Pain management clinics require minimal disposal epidural injections strategically. Procedure-specific equipment optimizes clinical workflows methodically.

Physician-owned clinics prioritize cost-effective solutions balancing performance budget constraints. Shared equipment models reduce per-procedure costs multi-specialty practices. Compact footprints suit medical office building environments. Simplified maintenance protocols enable non-technical staff operation. Market growth tracks specialty clinic proliferation trends.

Regional Insights

North America Power – 40% Share, 7.2% CAGR

North America grips surgical fluid disposal market 40% share 7.2% CAGR anchored by HCA Healthcare's 186 hospitals deploying 4,200 disposal units managing 2.8 million annual procedures industrially. Stryker Neptune systems dominate 65% market installations processing 22 liters/minute continuously. Mayo Clinic standardizes equipment across 28-OR flagship campus achieving operational consistency rigorously. Kaiser Permanente's 39 medical centers save $4.5 million annually through integrated disposal strategies. Medicare bundled payments incentivize cost-effective solutions driving volume purchasing strategically.

ASC growth exceeds hospital rates with 6,800 centers performing 28 million procedures 2024 consuming 336 million liters irrigant annually. Ambulatory surgery center procedural volumes increase 12% CAGR outpacing inpatient growth. Regulatory compliance costs average $850,000 annually per facility driving automated system adoption. OSHA bloodborne pathogen standards mandate splash-proof equipment protecting 450,000 OR personnel. Regional infection control leadership sustains premium equipment demand methodically.

Medical device innovation hub concentrates 72% global manufacturers including Stryker Cardinal Health Medtronic headquarters. FDA expedited 510(k) pathways accelerate product launches 8-month approval timelines. Clinical research collaborations with Mayo Cleveland Clinic validate next-generation systems. Venture capital funding exceeds $240 million annually surgical technology startups. North American R&D leadership perpetuates market dominance decisively.

Asia Pacific Strength – 28% Share, 8.5% CAGR

Asia Pacific surges 28% share fastest 8.5% CAGR surgical fluid disposal market driven by Apollo Hospitals' 73 facilities managing 850,000 procedures consuming 10.2 million liters irrigant annually industrially. China's 12,000 tertiary hospitals adopt Western infection standards requiring equipment upgrades continuously. India adds 95,000 hospital beds 2024-2025 necessitating disposal infrastructure provisioning rigorously. Singapore operates 38 JCI-accredited facilities serving 2.4 million medical tourists strategically. Regional healthcare expenditure growth 8.9% CAGR sustains market expansion methodically.

Government initiatives accelerate adoption with India's CSIR-NIIST launching automated biomedical waste plant AIIMS Delhi 2025 setting national precedent. China's Healthy China 2030 mandates infection control upgrades 18,000 secondary hospitals. Japanese OR renovation projects integrate smart disposal systems 840 facilities 2026-2028. South Korea allocates $8.2 billion healthcare infrastructure expansion including surgical equipment. Policy support catalyzes equipment investments regionally.

Domestic manufacturing emerges with IndoSurgicals producing 25,000 units annually supplying Indian market 35% cost advantage versus imports. Chinese manufacturers achieve ISO 13485 certification exporting ASEAN markets. Technology transfer partnerships with Stryker Cardinal Health localize production. Regional supply chains reduce lead times from 90 to 21 days. Manufacturing competitiveness reshapes market dynamics progressively.

Europe Expertise – 20% Share, 7.0% CAGR

Europe holds 20% share sustainability focus surgical fluid disposal market where Germany's 1,900 hospitals transition reusable systems eliminating 890 tons plastic waste annually industrially. NHS England operates 223 acute trusts deploying 8,500 disposal units across 12,000 operating theaters continuously. Helios Health standardizes equipment 89 German facilities achieving procurement efficiencies rigorously. French university hospitals integrate disposal with surgical navigation platforms strategically. EU Medical Device Regulation compliance drives equipment modernization methodically.

Environmental regulations mandate 75% waste reduction by 2030 accelerating closed-loop system adoption. Practice Greenhealth Europe enrolls 650 hospitals implementing sustainable waste programs. Sterilization infrastructure enables reusable canister programs achieving 50-cycle lifespan. Carbon footprint reduction targets incentivize green technology investments. Sustainability premiums justify 25% equipment cost premiums.

Digital health integration advances with Siemens Healthineers OR1 connecting disposal systems hospital information systems. Getinge Tegris platform automates documentation reducing administrative burden 38%. Networked solutions enable real-time monitoring across multi-site hospital groups. Data analytics optimize fluid usage patterns reducing waste 22%. Digital transformation initiatives sustain technology adoption regionally.

Middle East & Africa Momentum – 7% Share, 7.4% CAGR

Middle East & Africa claims 7% share 7.4% CAGR surgical fluid disposal market powered by UAE's Cleveland Clinic Abu Dhabi deploying premium systems across 364-bed facility managing 18,000 annual surgeries industrially. Saudi Vision 2030 expands healthcare capacity adding 22,000 beds requiring equipment provisioning continuously. South African private hospital groups like Netcare operate 54 facilities standardizing disposal across 420 ORs rigorously. Aga Khan University Hospital Nairobi achieves JCI accreditation through infection control upgrades strategically. Medical tourism revenue reaching $4.8 billion drives quality improvements methodically.

Infrastructure challenges constrain adoption with electricity reliability affecting vacuum systems 62% Sub-Saharan facilities. Equipment maintenance expertise limited requiring manufacturer service contracts. Import duties averaging 18% increase capital costs prohibitively. Technical training programs insufficient supporting advanced system operation. Capacity-building initiatives expand gradually addressing workforce gaps.

Private hospital growth outpaces public sector with 680 facilities operational 2024 investing premium equipment. Medical City Dubai operates 16-OR complex serving international patients expecting Western standards. King Faisal Specialist Hospital deploys Stryker systems across Saudi facilities. Apollo presence expands African markets bringing Indian cost-efficiency models. Public-private partnerships accelerate healthcare infrastructure development regionally.

Latin America Lift – 5% Share, 6.8% CAGR

Latin America grows 5% share 6.8% CAGR surgical fluid disposal market led by Brazil's Hospital Israelita Albert Einstein operating 670 beds deploying automated systems across 15 ORs managing 24,000 annual procedures industrially. Mexican private hospital chains like Angeles Salud standardize equipment 28 facilities serving insured populations continuously. Colombian JCI-accredited hospitals attract 280,000 medical tourists requiring international standard equipment rigorously. Chilean Clinica Alemana invests surgical technology maintaining regional reputation strategically. Economic recovery post-pandemic drives healthcare investment methodically.

Public sector budget constraints limit adoption with SUS Brazil deferring non-essential equipment upgrades. IMSS Mexico prioritizes direct care expenses over infrastructure. Argentine healthcare crisis reduces capital expenditure 32% 2023-2024. Reimbursement structures exclude dedicated fluid management costs. Fiscal challenges slow market penetration frustratingly.

Regional manufacturing absent requires imports increasing costs logistics complexities. Distribution networks concentrate urban centers limiting rural access. Service infrastructure underdeveloped requiring manufacturer direct support. Training programs inadequate supporting technology adoption. Market development requires ecosystem building addressing multiple barriers simultaneously.

Top Key Players

-

Stryker Corporation (USA)

-

Cardinal Health (USA)

-

Medtronic (Ireland)

-

Zimmer Biomet Holdings (USA)

-

Serres (France)

-

CONMED Corporation (USA)

-

Smith+Nephew (UK)

-

Hologic Inc (USA)

-

Ecolab (USA)

-

Skyline Medical (USA)

-

Amsino International (USA)

-

B. Braun Melsungen (Germany)

-

Baxter International (USA)

-

DeRoyal Industries (USA)

-

IndoSurgicals Private Limited (India)

Recent Developments

-

Stryker Corporation (USA) in 2025 launched Neptune S waste management expanding GI endoscopy applications targeting 30 million annual colonoscopy procedures US market achieving closed-loop contamination control.

-

Cardinal Health (USA) in 2024 expanded ClearFlo suction canister production capacity 40% Ohio facility meeting surging ambulatory surgical center demand across 6,800 ASC installations nationwide.

-

Medtronic (Ireland) in 2025 integrated AquaShield fluid management with Hugo robotic surgery platform enabling automated irrigation control across minimally invasive procedures reducing surgeon workload.

-

DeRoyal Industries (USA) in 2025 acquired Skyline Medical Streamway product line expanding surgical fluid management portfolio serving 4,200 hospital customers achieving market consolidation.

-

IndoSurgicals (India) in 2024 achieved ISO 13485 certification enabling export operations serving Southeast Asian markets offering 35% cost advantage versus Western manufacturers driving regional penetration.

Market Trends

Closed-loop fluid management systems proliferate surgical fluid disposal market integrating irrigation disposal measurement into unified platforms industrially. Stryker Neptune 3 connects inflow pumps suction units achieving ±25 mL fluid balance accuracy preventing complications continuously. Automated documentation transmits data to electronic health records eliminating manual charting rigorously. Pressure-regulated systems maintain optimal surgical field conditions enhancing visibility strategically. Integration trend reduces equipment footprint 45% while improving workflow efficiency methodically.

Sustainable waste reduction reshapes surgical fluid disposal market through reusable canister programs eliminating single-use plastics industrially. Cleveland Clinic pilots autoclavable collection chambers achieving 50-cycle lifespan reducing waste 2,200 tons annually continuously. Steam sterilization protocols meet infection control standards enabling closed-loop systems rigorously. Practice Greenhealth certifications drive adoption across 1,400 member hospitals strategically. Environmental ROI justifies upfront investments through operational savings methodically.

Smart disposal systems incorporating IoT connectivity enable predictive maintenance reducing downtime 64% across multi-facility networks industrially. Cloud platforms aggregate performance data identifying maintenance needs 75 days ahead continuously. Remote diagnostics resolve 97% technical issues without on-site visits reducing service costs rigorously. Machine learning algorithms optimize vacuum pressure settings per procedure type enhancing efficiency strategically. Digital transformation accelerates across 12,000 hospitals globally methodically.

Point-of-care disposal units emerge enabling waste management within procedure rooms eliminating contaminated transport risks industrially. Compact wall-mounted systems suit space-constrained ORs averaging 35 sqm continuously. Bedside collection reduces infection transmission protecting healthcare workers rigorously. Workflow optimization eliminates ancillary staff transport duties refocusing clinical care strategically. Decentralized disposal models align with infection prevention best practices methodically.

Segments Covered in the Report

-

By Type

-

Mobile Systems

-

Wall-Mounted Systems

-

-

By Application

-

Laparoscopy

-

Arthroscopy

-

Cardiology

-

Urology

-

Gynecology

-

Neurology

-

Gastroenterology

-

Dental

-

-

By End User

-

Hospitals

-

Ambulatory Surgical Centers

-

Specialty Clinics

-

-

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions:

Minimally invasive surgery proliferation infection control mandates drive the market expansion. 28 million ASC procedures generate 340 million liters waste annually requiring automated systems protecting healthcare workers.

North America dominates 40% share surgical fluid disposal market HCA Healthcare's 186 hospitals deploy 4,200 units. Medicare bundled payments incentivize cost-effective solutions driving equipment standardization across integrated delivery networks.

Mobile systems capture 64% share the market balancing portability capacity. ASCs deploy wheeled units sharing across four operating rooms maximizing equipment utilization reducing capital costs 55%.

Capital costs reimbursement limitations constrain surgical fluid disposal market growth. Latin American public hospitals defer upgrades while European payment models exclude dedicated equipment expenses limiting adoption rates.

Reusable systems transform the market eliminating 2,200 tons plastic annually. Cleveland Clinic achieves 50-cycle canister lifespan meeting Practice Greenhealth certifications driving 1,400-hospital adoption through environmental ROI.