Ultrasonic Skin Care Devices Market Overview

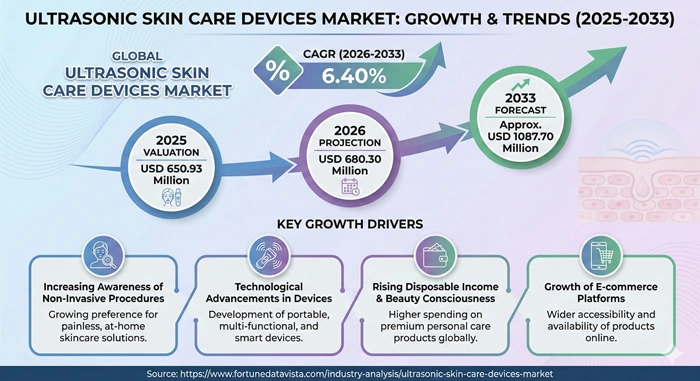

The global ultrasonic skin care devices market size is valued at USD 650.93 million in 2025 and is predicted to increase from USD 680.30 million in 2026 to approximately USD 1087.70 million by 2033, growing at a CAGR of 6.40% from 2026 to 2033.

Ultrasonic skin care devices represent a revolutionary shift in beauty technology, utilizing high-frequency sound waves to deliver non-invasive treatments for various skin concerns. These advanced tools have transformed how consumers approach skincare, offering professional-grade results in both clinical and home settings. The technology works by generating ultrasonic vibrations that penetrate deep into skin layers, promoting cellular renewal, enhancing product absorption, and stimulating collagen production without causing damage to the skin's surface.

The market encompasses a diverse range of products, from handheld portable devices designed for everyday home use to sophisticated professional-grade tabletop systems employed in dermatology clinics and medical spas. As consumers increasingly prioritize preventive skincare and seek alternatives to surgical procedures, ultrasonic skin care devices have emerged as a preferred solution for addressing aging signs, acne treatment, skin rejuvenation, and deep cleansing needs.

AI Impact on the Ultrasonic Skin Care Devices Industry

Artificial Intelligence is revolutionizing the ultrasonic skin care devices market by introducing unprecedented levels of personalization and precision in skincare treatments. AI-powered ultrasonic devices now incorporate smart algorithms that analyze individual skin conditions in real-time, automatically adjusting ultrasound intensity, frequency, and treatment duration based on detected skin characteristics. These intelligent systems can identify specific skin concerns such as fine lines, wrinkles, acne scars, and pigmentation issues, then customize treatment parameters to address these conditions effectively.

The integration of AI extends beyond device functionality to create comprehensive skincare ecosystems. Modern ultrasonic devices connect seamlessly with smartphone applications, enabling users to track treatment progress, receive personalized skincare recommendations, and maintain detailed skin health logs over time. These app-connected platforms utilize machine learning to recognize patterns in skin behavior, predict treatment outcomes, and suggest optimal product combinations for enhanced results. The technology also provides guided routines with visual instructions, making professional-level treatments accessible to users regardless of their skincare expertise.

AI-driven diagnostic capabilities have significantly enhanced treatment safety and efficacy. Advanced ultrasonic systems now employ real-time ultrasound imaging analysis to identify critical anatomical structures beneath the skin surface, ensuring treatments target appropriate depths while avoiding sensitive areas. This technological advancement reduces treatment risks, minimizes potential side effects, and optimizes therapeutic outcomes. Furthermore, AI assists manufacturers in analyzing vast amounts of consumer data and feedback to identify emerging trends, enabling rapid product innovation and development of more effective formulations tailored to diverse consumer needs across different demographics and geographic regions.

Growth Factors of the Ultrasonic Skin Care Devices Market

The ultrasonic skin care devices market is experiencing robust expansion driven by multiple converging factors that reflect changing consumer preferences and technological capabilities. The rising global demand for non-invasive aesthetic treatments stands as a primary growth driver, with consumers increasingly seeking alternatives to surgical procedures that offer minimal downtime and reduced risk. According to industry data, over 20.5 million non-surgical cosmetic procedures were performed worldwide in 2024, highlighting the massive shift toward minimally invasive beauty solutions that ultrasonic devices perfectly address.

Demographic trends are playing a crucial role in market acceleration. The aging global population, particularly in developed markets, has created substantial demand for anti-aging solutions that can address wrinkles, fine lines, and skin laxity without requiring clinical interventions. Simultaneously, younger consumers are embracing preventive skincare practices, adopting ultrasonic devices as part of their regular beauty routines to maintain skin health and delay visible aging signs. This multi-generational appeal has significantly broadened the target market, creating sustained demand across diverse age groups with varying skincare objectives.

Technological innovation continues to propel market growth through the development of multifunctional devices that combine ultrasonic technology with complementary treatments such as LED therapy, microcurrent stimulation, and radiofrequency energy. These hybrid systems deliver comprehensive skincare benefits in single devices, offering consumers greater value and convenience. Manufacturers are also focusing on ergonomic designs, improved battery life, wireless connectivity, and compact form factors that enhance portability and user experience. The miniaturization of technology has made professional-grade treatments accessible for home use, democratizing access to advanced skincare solutions previously available only in clinical settings.

The proliferation of e-commerce platforms and digital marketing channels has dramatically expanded market reach and consumer awareness. Social media influencers and beauty content creators regularly showcase ultrasonic device benefits through demonstrations and testimonials, significantly influencing purchase decisions. Online retailers provide extensive product information, user reviews, and tutorial content that educate consumers and build confidence in device efficacy. This digital-first distribution model has proven particularly effective in reaching tech-savvy millennials and Gen Z consumers who prefer researching and purchasing beauty products online. Additionally, subscription models and virtual consultation services offered by some brands have created ongoing customer relationships that drive repeat purchases and brand loyalty.

Market Outlook

The ultrasonic skin care devices market outlook remains exceptionally positive, with industry experts projecting sustained growth momentum throughout the forecast period driven by continued technological advancement and expanding consumer adoption. The market is witnessing a fundamental transformation in how consumers approach skincare, with preventive maintenance and regular at-home treatments becoming standard practices rather than occasional indulgences. This behavioral shift is supported by growing awareness of skin health importance, increased disposable incomes in emerging markets, and the normalization of technology-enhanced beauty routines across demographic segments.

Professional adoption of ultrasonic technology in dermatology clinics, medical spas, and aesthetic centers is accelerating as practitioners recognize the complementary value these devices provide to traditional treatment modalities. Clinics are integrating professional-grade ultrasonic systems into comprehensive skincare programs, offering clients non-invasive alternatives that require no recovery time and can be performed alongside other procedures. This clinical validation enhances consumer confidence in the technology and creates a halo effect that benefits the home-use device segment. The growing trend of hybrid skincare models—combining periodic professional treatments with daily at-home maintenance—is creating sustained demand across both market segments.

Regional market dynamics present varied growth opportunities, with Asia Pacific emerging as the fastest-growing region driven by rapid urbanization, rising beauty consciousness, and strong manufacturing capabilities in countries like China, South Korea, and Japan. These markets benefit from established beauty device manufacturing ecosystems, innovative product development, and aggressive pricing strategies that make advanced technology accessible to broader consumer bases. North America and Europe continue to represent substantial market shares, supported by high consumer spending power, established distribution networks, and strong preference for clinically validated, medical-grade devices. Emerging markets in Latin America, Middle East, and Africa are showing promising growth potential as economic development increases disposable incomes and beauty awareness campaigns drive interest in advanced skincare technologies.

Regulatory environments are evolving to address the expanding ultrasonic device market, with authorities implementing stricter safety standards and efficacy validation requirements. While this creates compliance challenges for manufacturers, it ultimately benefits the industry by building consumer trust and eliminating inferior products. Companies investing in clinical studies, obtaining proper certifications, and demonstrating product safety are positioned to gain competitive advantages. The trend toward evidence-based marketing and dermatologist endorsements is becoming increasingly important as informed consumers seek validated solutions backed by scientific research rather than marketing claims alone.

Expert Speaks

-

Kecia Steelman, CEO of Ulta Beauty – "The beauty industry is experiencing unprecedented transformation as consumers increasingly seek technology-driven skincare solutions that deliver professional results at home. We're seeing remarkable growth in advanced beauty devices, particularly ultrasonic technologies that combine convenience with clinical-grade efficacy, reflecting the broader consumer shift toward preventive wellness and personalized beauty routines that fit modern lifestyles."

-

Mary Dillon, Former CEO of Ulta Beauty (Current CEO of Foot Locker) – "The democratization of beauty technology represents one of the most significant industry trends we've witnessed in recent years. Consumers are no longer satisfied with basic skincare products; they're investing in sophisticated devices that offer measurable results and long-term value. This shift is driving innovation across the beauty ecosystem and creating opportunities for brands that can deliver authentic, science-backed solutions that build trust and loyalty."

-

Elizabeth Ashmun, CEO of Phlur – "Building authentic brands in today's beauty landscape requires cutting through enormous noise while staying true to brand values and delivering real innovation that disrupts categories. The most successful companies are those that understand the democratization of beauty, invest in long-term customer relationships, and leverage creator influence to build genuine connections rather than pursuing short-term commercial gains. Technology-enabled beauty products succeed when they solve real consumer problems with transparency and authenticity."

Key Report Takeaways

-

North America dominates the ultrasonic skin care devices market with a commanding 46.8% revenue share in 2026, driven by strong consumer willingness to invest in premium technology-driven skincare solutions, widespread access to dermatological care, established beauty infrastructure, and high disposable incomes that support adoption of advanced at-home treatment devices across diverse consumer segments.

-

Asia Pacific is emerging as the fastest-growing region with an impressive CAGR of 7.8% between 2026 and 2033, fueled by rapid urbanization, rising disposable incomes, strong beauty consciousness particularly in China, South Korea and Japan, large tech-savvy populations that readily adopt smart beauty tools, and well-established manufacturing ecosystems that enable cost-efficient production and faster product launches.

-

The handheld devices segment maintains market leadership with 56.4% revenue share in 2026, reflecting strong consumer preference for portable, easy-to-use tools that enable regular at-home skincare treatments without clinical visits, offering convenience, affordability and portability while delivering visible benefits including improved cleansing, enhanced product absorption and anti-aging results.

-

The skin rejuvenation application segment dominates with 41.8% market share in 2026, driven by rising consumer demand for non-invasive solutions that improve skin texture, radiance and tone without requiring clinical procedures or downtime, with ultrasonic devices widely used to enhance collagen production, boost microcirculation and reduce fine lines.

-

The aesthetic clinics segment leads end-user categories with 52.8% revenue share in 2026, reflecting growing preference for professional-grade treatments delivering faster, more visible results compared to standard home devices, with clinics offering higher-intensity ultrasonic technologies for lifting, firming, deep cleansing and enhanced product penetration that attract consumers seeking medically supervised procedures.

-

The acne treatment segment is projected to be the fastest-growing application with a notable CAGR of 9.2% from 2026 to 2033, propelled by increasing acne prevalence, rising consumer demand for non-invasive treatment solutions, and integration of IoT and AI technologies that use high-frequency vibrations for deep cleansing, exfoliation and product infusion targeting acne-prone skin.

Market Scope of the Ultrasonic Skin Care Devices Market

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 1087.70 Million | Market Size by 2026 | USD 680.30 Million | Market Size by 2025 | USD 650.93 Million | Market Growth Rate from 2026 to 2033 | CAGR of 6.40% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Product Type, Application, End-User, Distribution Channel, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

The ultrasonic skin care devices market is propelled by powerful demand drivers that are fundamentally reshaping consumer skincare behaviors and industry dynamics. The accelerating consumer preference for non-invasive, minimal-downtime aesthetic treatments represents the most significant growth catalyst, with individuals increasingly rejecting surgical interventions in favor of safer, gentler alternatives that deliver comparable results without recovery periods or associated risks. This preference shift is supported by mounting clinical evidence demonstrating the efficacy of ultrasonic technology in addressing multiple skin concerns, from aging signs to acne treatment, which has built substantial consumer confidence in these devices.

Technological innovation continues to drive market expansion through the introduction of increasingly sophisticated features that enhance treatment outcomes and user experiences. The integration of AI-powered skin analysis, app connectivity, and multi-functional capabilities combining ultrasound with LED therapy, microcurrent, and radiofrequency technologies has created devices that offer comprehensive skincare solutions in compact, user-friendly formats. These advancements have effectively brought professional-grade treatments into consumers' homes, eliminating the need for frequent clinic visits while maintaining treatment efficacy. The wireless, portable nature of modern devices further enhances convenience, enabling users to incorporate treatments into busy lifestyles without disruption.

The demographic convergence of aging populations seeking anti-aging solutions and younger consumers embracing preventive skincare has created a broad, multi-generational market for ultrasonic skin care devices. Older consumers are drawn to the technology's ability to address visible aging signs including wrinkles, fine lines, and skin laxity through collagen stimulation and improved microcirculation. Simultaneously, millennials and Gen Z consumers are incorporating these devices into regular beauty routines to maintain skin health, prevent premature aging, and achieve the flawless complexions promoted through social media platforms. This dual-demographic appeal ensures sustained demand across age groups with varying skincare objectives and purchasing behaviors.

| Drivers | ≈% Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rising demand for non-invasive beauty treatments | High (+2.5% to +3.0%) | Global, particularly North America & Europe | Immediate & Long-term |

| Technological advancements in AI and IoT integration | High (+2.0% to +2.5%) | North America, Asia Pacific, Europe | Medium to Long-term |

| Growing aging population and anti-aging awareness | Medium (+1.5% to +2.0%) | Global, especially developed markets | Long-term |

| Expansion of e-commerce and social media influence | Medium (+1.0% to +1.5%) | Global, particularly Asia Pacific | Immediate & Medium-term |

Restraints Impact Analysis

Despite robust growth prospects, the ultrasonic skin care devices market faces meaningful challenges that could moderate expansion rates and create barriers for certain manufacturers and market segments. Increasingly stringent regulatory oversight for energy-based aesthetic devices represents a significant constraint, particularly concerning safety protocols, thermal exposure limits, and long-term skin effect documentation. Ultrasonic skincare devices often undergo additional scrutiny due to mixed or limited clinical validation across different indications, which can substantially delay product approvals, restrict marketing claims manufacturers can make, and increase development costs through required clinical studies and compliance documentation.

Competition from established alternative technologies poses another substantial challenge to market growth. Laser and radiofrequency systems have achieved strong market positions supported by extensive clinical evidence, widespread practitioner familiarity, and proven treatment versatility across multiple indications. These competing modalities often dominate clinic-based procedures, making differentiation difficult for ultrasonic platforms seeking to establish equivalent efficacy claims. The maturity, trust, and documented outcomes associated with laser and RF solutions create high barriers for ultrasonic technologies attempting to capture professional market share, particularly in premium segments where consumers prioritize results-backed treatments and are willing to pay premium prices for proven technologies.

Price sensitivity in emerging markets and among certain consumer segments creates adoption barriers that limit market penetration in price-conscious demographics. While premium devices command strong sales in affluent markets, the higher costs associated with advanced features including AI integration, app connectivity, and multi-functional capabilities can deter budget-conscious consumers who perceive these enhancements as unnecessary or unproven. Additionally, lack of proper usage knowledge and skepticism regarding home-use device effectiveness without clinical validation can impede purchase decisions, particularly among older consumers less familiar with technology-enabled beauty solutions or those who have experienced disappointing results from previous device purchases.

| Restraints | ≈% Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Stringent regulatory requirements and approval delays | Medium (-1.0% to -1.5%) | Global, particularly North America & Europe | Medium to Long-term |

| Competition from established laser and RF technologies | Medium (-0.8% to -1.2%) | Global, especially professional markets | Ongoing |

| High device costs limiting emerging market adoption | Low to Medium (-0.5% to -1.0%) | Asia Pacific, Latin America, Middle East & Africa | Medium-term |

| Limited clinical validation and consumer skepticism | Low (-0.3% to -0.6%) | Global | Short to Medium-term |

Opportunities Impact Analysis

The ultrasonic skin care devices market presents substantial growth opportunities that forward-thinking companies can capitalize on to expand market presence and capture emerging demand segments. The rapid advancement of smart beauty ecosystems powered by AI-driven personalization represents a transformative opportunity for differentiation and value creation. Devices that incorporate intelligent skin analysis, adaptive treatment protocols, and comprehensive tracking capabilities through connected smartphone applications can command premium pricing while building long-term customer relationships through enhanced engagement and demonstrable results. These smart platforms create data-rich environments that enable continuous product improvement, personalized recommendations, and predictive maintenance alerts that maximize device lifespan and treatment efficacy.

The expanding professional adoption of ultrasonic technology in med-spas, dermatology clinics, and aesthetic centers creates significant opportunities for manufacturers to develop specialized professional-grade systems that meet clinical requirements for higher intensity, precision, and reliability. This professional channel offers higher margins, validates technology credibility through clinical endorsement, and creates referral pathways to home-use devices as practitioners recommend at-home maintenance between professional treatments. Companies that successfully bridge professional and consumer segments through integrated product portfolios can capture revenue across the entire skincare journey while building brand authority that differentiates them from consumer-only competitors.

Emerging markets in Asia Pacific, Latin America, and Middle East Africa regions present substantial untapped growth potential as rising disposable incomes, increasing beauty awareness, and expanding e-commerce infrastructure make advanced skincare technologies accessible to broader populations. Manufacturers that adapt products to local preferences, optimize pricing for regional income levels, and establish strong distribution partnerships can capture first-mover advantages in markets poised for rapid expansion. The social media influence in these regions, particularly among younger demographics, creates opportunities for viral marketing campaigns and influencer partnerships that can rapidly build brand awareness and drive adoption at scale with relatively modest marketing investments.

| Opportunities | ≈% Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| AI-powered personalization and smart device ecosystems | High (+2.0% to +2.8%) | Global, particularly North America & Asia Pacific | Medium to Long-term |

| Professional adoption in clinics and med-spas | Medium to High (+1.5% to +2.2%) | North America, Europe, Asia Pacific | Immediate & Medium-term |

| Emerging market expansion with localized strategies | Medium (+1.2% to +1.8%) | Asia Pacific, Latin America, Middle East & Africa | Medium to Long-term |

| Hybrid multifunctional devices combining technologies | Medium (+1.0% to +1.5%) | Global | Immediate & Medium-term |

Top Vendors and Their Offerings

-

FOREO – Offers advanced ultrasonic facial cleansing devices with smart technology integration, including the LUNA Ultra line featuring biometric sensors for personalized treatments and app connectivity for guided skincare routines.

-

NuFACE – Provides hybrid beauty devices combining ultrasonic functions with microcurrent technology, focusing on anti-aging solutions with clinical positioning and strong dermatologist endorsements.

-

Panasonic Corporation – Delivers reliable consumer electronics including ultrasonic skincare devices featuring ergonomic designs, multiple intensity settings, and established brand trust in technology products.

-

Philips – Manufactures medical-grade and consumer ultrasonic devices with emphasis on clinical validation, safety certifications, and integration with broader health and wellness product ecosystems.

-

Trophy Skin – Targets mid-to-high-end markets with dermatologist-approved ultrasonic facial systems, including the BrightenMD Pro device combining ultrasound with LED features for comprehensive skincare.

-

Beurer GmbH – Produces affordable yet effective ultrasonic beauty devices with focus on European market preferences, offering compact designs and straightforward functionality for home use.

-

YA-MAN Ltd. – Specializes in advanced Japanese beauty technology with ultrasonic devices featuring precision engineering, compact designs, and integration of traditional skincare philosophies with modern technology.

-

Project E Beauty – Provides versatile multifunctional devices combining ultrasonic technology with LED therapy, radiofrequency, and other modalities for comprehensive at-home treatments at accessible price points.

-

Silk'n – Offers clinically tested home-use aesthetic devices including ultrasonic options, with emphasis on safety, ease of use, and visible results backed by scientific research.

-

Merz Pharma GmbH & Co. kGaA – Develops professional-grade ultrasonic systems like Ultherapy PRIME with FDA clearance, targeting clinical markets with advanced visualization capabilities and body treatment applications.

Segment Analysis of the Ultrasonic Skin Care Devices Market

By Product Type

Handheld Devices – Dominating the Consumer Market with Portability and Convenience

Handheld devices command the ultrasonic skin care devices market with a substantial 56.4% revenue share in 2026, reflecting the strong consumer preference for portable, user-friendly tools that enable regular at-home skincare treatments without requiring clinical visits. These compact devices offer an optimal combination of convenience, affordability, and effectiveness that resonates particularly well with younger, tech-savvy consumers who prioritize flexibility in their beauty routines. The segment's dominance is reinforced by widespread product availability through multiple distribution channels including e-commerce platforms, specialty beauty retailers, and direct-to-consumer brands that make purchase decisions seamless and informed through extensive product information, user reviews, and tutorial content.

The handheld segment continues to evolve through continuous innovation in battery technology, ergonomic design, and feature integration that enhances user experience without compromising portability. Modern handheld ultrasonic devices incorporate advanced capabilities such as app-based skin tracking, adjustable intensity settings, and combination technologies including LED therapy and microcurrent that previously required separate devices or professional treatments. These multifunctional capabilities deliver spa-like results at home while maintaining the compact form factors that consumers demand. North America and Europe represent the largest markets for handheld devices, driven by high disposable incomes and established cultures of at-home beauty treatments, while Asia Pacific is experiencing the fastest growth as urbanization and rising income levels make these devices accessible to expanding middle-class populations.

Major manufacturers including FOREO, NuFACE, and Panasonic dominate the handheld segment through strong brand recognition, continuous product innovation, and effective marketing strategies that leverage social media influencers and beauty content creators. These companies invest heavily in user experience design, ensuring devices are intuitive to operate regardless of users' technical expertise or prior experience with ultrasonic technology. The segment benefits from relatively lower regulatory hurdles compared to professional-grade equipment, enabling faster product development cycles and more aggressive pricing strategies that expand market accessibility. Looking forward, the handheld devices segment is expected to maintain strong growth supported by increasing consumer acceptance of technology-enabled skincare, expanding product portfolios addressing diverse skin concerns, and continued miniaturization of advanced features that previously required larger professional systems.

Table-Top/Professional Devices – Delivering Clinical-Grade Results in Professional Settings

Table-top and professional ultrasonic devices represent a smaller but high-value market segment focused on dermatology clinics, medical spas, and professional aesthetic centers seeking advanced capabilities that deliver superior results compared to home-use alternatives. These professional-grade systems offer significantly higher ultrasound intensity, precision control, and sophisticated treatment parameters that enable practitioners to perform more aggressive treatments targeting deeper skin layers for enhanced lifting, firming, and rejuvenation outcomes. The segment appeals to consumers willing to invest in professional treatments that provide faster, more dramatic visible results under medical supervision, particularly for addressing advanced aging signs or preparing for special events where immediate improvement is desired.

Professional devices benefit from clinical validation and FDA clearance for specific indications, which builds consumer confidence and enables practitioners to make stronger efficacy claims than home-use products can legally assert. Recent developments such as Merz Aesthetics' Ultherapy PRIME, which received FDA clearance for treating skin laxity on arms and abdomen, demonstrate the expanding applications for professional ultrasonic technology beyond traditional facial treatments. North America leads the professional segment with its highly developed aesthetic services infrastructure, extensive network of dermatology clinics and med-spas, and consumer culture that values professional expertise and clinical supervision for advanced treatments. Europe follows with strong demand in Germany, UK, and France where consumers prioritize medical-grade equipment and clinical validation.

The professional segment is growing at a CAGR of approximately 5.5% from 2026 to 2033, driven by increasing consumer demand for non-surgical alternatives to invasive procedures, rising disposable incomes that support premium service spending, and expanding med-spa networks offering convenient access to advanced aesthetic treatments. Key manufacturers including Alma Lasers, Cynosure Lutronic, Solta Medical, and Cutera dominate this segment through extensive clinical research, strong relationships with dermatology professionals, and comprehensive training programs that ensure practitioners can maximize treatment efficacy and safety. The professional market also benefits from repeat treatment requirements, as most protocols recommend series of sessions for optimal results, creating recurring revenue streams for clinics and sustained demand for professional-grade equipment that can withstand high utilization rates in commercial settings.

Wearable Devices – Emerging Innovation in Continuous Skincare Technology

Wearable ultrasonic devices represent an emerging and innovative segment projected to grow at a remarkable CAGR of 9.0% between 2026 and 2035, reflecting increasing consumer demand for convenient, hands-free skincare solutions that integrate seamlessly into daily routines without requiring dedicated treatment time. These devices, which can be worn while performing other activities, appeal particularly to busy professionals and multitasking consumers who struggle to maintain consistent skincare regimens with traditional handheld devices. The wearable segment benefits from advancing miniaturization technology, improved battery efficiency, and smart fabric integration that enable comfortable extended wear without compromising treatment efficacy or user mobility.

Innovation leaders are incorporating AI-driven personalization features that automatically adjust treatment intensity based on real-time skin analysis, activity levels, and environmental conditions, creating truly adaptive skincare experiences that optimize results while minimizing user intervention. Asia Pacific, particularly South Korea and Japan, leads wearable device innovation driven by these markets' strong beauty technology ecosystems and consumer willingness to embrace novel formats that challenge traditional skincare approaches. Major electronics companies including Panasonic and YA-MAN are investing in wearable research, leveraging their expertise in miniaturized sensors, power management, and ergonomic design to create devices that balance efficacy with wearability.

The wearable segment faces unique challenges including achieving adequate ultrasound intensity in miniaturized form factors, ensuring consistent skin contact during movement, and managing heat dissipation in enclosed designs worn against skin for extended periods. However, successful solutions to these technical hurdles represent significant competitive advantages and patent opportunities for innovating companies. North America and Europe are showing increasing interest in wearable devices, particularly among younger demographics who already embrace wearable fitness trackers and smart watches, creating natural adoption pathways for beauty wearables. The segment's growth trajectory depends heavily on demonstrating measurable efficacy comparable to handheld alternatives, maintaining comfortable wear experiences, and building consumer confidence through clinical studies and dermatologist endorsements that validate this emerging format's ability to deliver promised benefits.

By Application

Anti-Aging/Wrinkle Reduction – Leading Application Driven by Global Aging Demographics

The anti-aging and wrinkle reduction application segment dominates the ultrasonic skin care devices market with a commanding 43.5% share in 2025, driven by universal consumer concern about visible aging signs and strong demand for non-invasive solutions that delay or reverse age-related skin changes. This application's market leadership reflects the broad appeal of anti-aging benefits across demographic segments, from consumers in their thirties seeking preventive treatments to older individuals addressing established wrinkles, fine lines, and skin laxity. Ultrasonic devices address aging concerns through multiple mechanisms including collagen stimulation, improved microcirculation, enhanced lymphatic drainage, and deeper penetration of anti-aging serums that amplify treatment effects.

The segment benefits from extensive clinical research demonstrating ultrasonic technology's effectiveness in improving skin firmness, reducing fine lines, and enhancing overall skin texture through regular use over time. North America and Europe lead anti-aging device adoption, supported by aging populations, high awareness of preventive skincare, and established cultures of investing in appearance maintenance. Manufacturers including NuFACE, FOREO, and Trophy Skin have built strong market positions through targeted anti-aging product lines, clinical validation studies, and partnerships with dermatologists and aesthetic practitioners who recommend devices to patients seeking non-surgical alternatives. The segment also benefits from social acceptance of age management practices and normalization of beauty device use among both women and men concerned about professional appearance.

Growth in the anti-aging segment is supported by continuous product innovation including combination technologies that pair ultrasound with microcurrent for enhanced lifting effects, LED therapy for improved collagen synthesis, and radiofrequency for deeper tissue tightening. Premium devices targeting this application incorporate sophisticated features such as real-time skin analysis, treatment tracking, and personalized intensity recommendations that optimize outcomes for individual skin types and aging patterns. Asia Pacific is emerging as the fastest-growing region for anti-aging devices, driven by rapidly aging populations in Japan and South Korea, increasing beauty consciousness in China, and strong cultural emphasis on maintaining youthful appearance. The segment's sustained growth throughout the forecast period is assured by favorable demographics, expanding consumer awareness of non-invasive options, and ongoing technological improvements that enhance treatment efficacy and user experience.

Skin Rejuvenation – Comprehensive Treatment for Overall Skin Health

The skin rejuvenation application segment holds significant market share at 41.8% in 2026, reflecting growing consumer focus on overall skin health rather than targeting specific concerns. This holistic approach appeals to consumers seeking to improve skin texture, enhance radiance, even skin tone, and maintain general skin vitality through regular treatments that support natural renewal processes. Skin rejuvenation treatments using ultrasonic technology work by promoting collagen and elastin production, boosting microcirculation that delivers nutrients to skin cells, enhancing waste removal through improved lymphatic flow, and facilitating deeper penetration of nourishing serums and treatments that amplify rejuvenating effects.

The segment benefits from broad applicability across age groups and skin types, as rejuvenation goals are relevant for younger consumers maintaining healthy skin and older individuals seeking overall improvement beyond specific problem areas. Multifunctional home-use devices combining ultrasound with LED therapy or microcurrent deliver comprehensive rejuvenation benefits that replicate professional spa treatments at convenient home settings. North America leads skin rejuvenation device adoption with 46.8% regional market share, driven by strong consumer culture of regular skincare maintenance, high awareness of skin health importance, and preference for preventive approaches over reactive treatments. Major beauty retailers including Sephora and Ulta Beauty prominently feature rejuvenation-focused devices, providing experiential retail environments where consumers can test products and receive expert guidance.

Marketing strategies for skin rejuvenation devices emphasize visible improvements in skin quality, glow, and texture that create noticeable "before and after" effects through consistent use, leveraging user-generated content and influencer demonstrations that showcase real-world results. Asia Pacific is experiencing rapid growth in this segment, particularly in South Korea and Japan where consumers prioritize comprehensive skincare routines and embrace technology-enhanced treatments as standard beauty practices. The segment's growth is supported by increasing awareness that skin health requires ongoing maintenance rather than problem-specific interventions, rising disposable incomes that enable investment in premium beauty tools, and social media influence that normalizes extensive skincare routines and showcases visible results from consistent device use. Leading manufacturers including FOREO, Panasonic, and Philips dominate through science-backed marketing, clinical validation studies, and comprehensive product ecosystems that combine devices with complementary skincare formulations optimized for ultrasonic treatment.

Acne Treatment – Fastest Growing Segment Addressing Persistent Skin Concern

The acne treatment application represents the fastest-growing segment in the ultrasonic skin care devices market, projected to expand at a notable CAGR of 9.2% between 2026 and 2035, driven by increasing acne prevalence across demographics and strong demand for non-invasive treatment alternatives to harsh medications or chemical treatments. Ultrasonic technology addresses acne through deep cleansing that removes pore-clogging debris, gentle exfoliation that prevents buildup, antibacterial effects from high-frequency vibrations, and enhanced absorption of acne-fighting topical treatments that improve therapeutic efficacy. This multi-mechanism approach appeals to consumers seeking comprehensive acne management that addresses root causes rather than temporarily masking symptoms.

The segment benefits from expanding target demographics beyond traditional teenage acne sufferers to include adults experiencing hormonal acne, stress-related breakouts, and persistent acne conditions that resist conventional treatments. Integration of IoT and AI technologies enables devices to identify acne-prone areas, adjust treatment intensity for sensitive inflamed skin, and track outbreak patterns over time to optimize prevention strategies. North America and Europe show strong adoption rates for acne treatment devices, supported by high acne prevalence, consumer preference for at-home treatments that avoid embarrassment of clinical visits, and growing awareness of antibiotic resistance concerns with traditional acne medications. Asia Pacific is emerging as the fastest-growing regional market, driven by high acne rates in hot, humid climates, expanding middle-class populations seeking effective solutions, and strong social media influence that creates pressure for clear, flawless skin.

Key manufacturers are developing specialized acne-focused devices with features including blue LED therapy for bacterial reduction, adjustable ultrasonic frequencies optimized for deep pore cleansing, and waterproof designs enabling use with cleansing solutions. The segment faces competition from established acne treatment modalities including topical medications, oral antibiotics, and professional treatments like chemical peels, requiring ultrasonic device manufacturers to emphasize advantages including no side effects, no antibiotic resistance concerns, and complementary use with existing treatments rather than replacement. Growth is supported by increasing dermatologist recommendations for ultrasonic cleansing as adjunct therapy, expanding clinical evidence demonstrating efficacy, and consumer testimonials showing visible improvement that drive social proof and word-of-mouth adoption. The segment's strong growth trajectory is expected to continue throughout the forecast period as manufacturers refine technologies specifically for acne management, expand clinical validation, and build targeted marketing campaigns addressing this specific consumer need.

By End-User

Aesthetic Clinics – Professional Market Leader with Clinical-Grade Capabilities

Aesthetic clinics dominate the ultrasonic skin care devices market end-user segment with a substantial 52.8% revenue share in 2026, reflecting strong consumer preference for professional-grade treatments that deliver faster, more dramatic visible results under expert supervision. These clinical settings offer higher-intensity ultrasonic technologies with advanced capabilities for lifting, firming, deep cleansing, and enhanced product penetration that significantly exceed home-use device specifications. Consumers seeking medically supervised treatments, customized protocols addressing specific concerns, and professional expertise in treatment optimization preferentially choose clinic-based options despite higher per-treatment costs compared to at-home alternatives.

The aesthetic clinics segment benefits from practitioners' ability to combine ultrasonic treatments with complementary modalities including LED therapy, microcurrent stimulation, radiofrequency energy, and professional-grade skincare products that amplify therapeutic effects beyond what single-modality home treatments can achieve. Premium positioning and clinical validation enable aesthetic centers to command higher pricing while building consumer confidence through medical authority and proven results. North America leads the aesthetic clinics segment with extensive networks of dermatology practices, medical spas, and dedicated aesthetic centers that have integrated advanced ultrasonic systems into comprehensive treatment menus. Major markets including the United States, Canada, and Mexico show strong consumer willingness to invest in professional treatments, supported by high disposable incomes, established skincare cultures, and insurance coverage for certain dermatological conditions.

Growth in the aesthetic clinics segment is driven by expanding med-spa networks offering convenient access to professional treatments in relaxing, spa-like environments that reduce clinical anxiety, rising consumer demand for non-surgical alternatives to invasive procedures with no recovery time, and increasing professional adoption of ultrasonic technology as evidence of efficacy strengthens. Leading professional device manufacturers including Alma Lasers, Cynosure Lutronic, Solta Medical, and Cutera maintain strong relationships with aesthetic practitioners through comprehensive training programs, ongoing clinical support, and equipment financing options that reduce capital barriers. The segment also benefits from treatment protocols requiring multiple sessions for optimal results, creating recurring revenue streams that support equipment investments. Asia Pacific is showing rapid growth in aesthetic clinic adoption, particularly in South Korea, Japan, and China where aesthetic medicine is highly developed, beauty consciousness is strong, and consumers actively seek professional treatments as regular maintenance rather than occasional indulgences.

Home Care Settings – Rapidly Expanding Consumer Market for Convenient Treatments

The home care settings segment holds significant market presence with 43.7% share in 2025, driven by strong consumer demand for convenient, affordable alternatives to professional treatments that enable daily skincare routines without travel time, appointment scheduling, or ongoing per-treatment costs. This segment encompasses handheld and wearable devices designed specifically for consumer use, featuring user-friendly interfaces, safety mechanisms preventing misuse, and lower intensity levels appropriate for unsupervised application. The home care market appeals particularly to younger, tech-savvy consumers comfortable with self-administered beauty treatments, budget-conscious individuals seeking cost-effective long-term solutions, and those who prefer privacy of at-home treatments over clinical environments.

Growth in home care settings is accelerated by continuous product innovation delivering increasingly sophisticated features in compact, affordable packages that previously required professional equipment. Modern consumer devices incorporate AI-powered skin analysis, app connectivity providing guided treatments, and multi-functional capabilities combining cleansing, anti-aging, and rejuvenation functions in single units. E-commerce expansion has dramatically increased product accessibility, with major online retailers including Amazon, specialty beauty e-tailers, and direct-to-consumer brand websites offering extensive product information, comparative reviews, and tutorial content that educate consumers and build purchase confidence. Social media influence through beauty bloggers, YouTube demonstrations, and Instagram before-and-after posts creates powerful social proof that drives adoption among younger demographics.

North America and Europe represent the largest home care markets, supported by high rates of online shopping, established cultures of DIY beauty treatments, and consumer comfort with technology-enabled products. Asia Pacific is emerging as the fastest-growing regional market for home-use devices, driven by rapid urbanization creating time-constrained consumers seeking convenient solutions, rising disposable incomes enabling beauty device purchases, and strong manufacturing ecosystems producing affordable yet effective products. Leading consumer brands including FOREO, NuFACE, and Panasonic dominate through strong brand recognition, extensive retail distribution, and effective marketing leveraging influencer partnerships and user-generated content. The segment benefits from relatively lower regulatory requirements compared to professional devices, enabling faster product development and more aggressive pricing strategies. Growth is expected to accelerate throughout the forecast period as devices become more effective, affordable, and user-friendly, expanding adoption beyond early adopters to mainstream consumers seeking to enhance everyday skincare routines.

Dermatology Clinics – Medical Setting with Strong Growth Potential

Dermatology clinics represent a high-value end-user segment projected to grow at a significant CAGR of 9.5% between 2026 and 2035, driven by increasing consumer demand for medically supervised, non-surgical aesthetic procedures that combine therapeutic efficacy with clinical safety. These medical practices offer professional-grade ultrasonic systems with advanced capabilities exceeding aesthetic clinic specifications, including higher treatment intensities, precise parameter control, and integration with diagnostic equipment enabling comprehensive skin assessment before treatment initiation. Dermatologists' medical expertise and ability to diagnose underlying conditions, customize treatment protocols for individual patients, and monitor outcomes through clinical follow-up create unique value propositions that justify premium pricing.

The dermatology clinics segment benefits from medical credibility that builds strong consumer trust, particularly among conservative patients skeptical of spa-based treatments or home-use devices lacking clinical validation. Table-top professional ultrasonic systems employed in dermatology practices utilize high-frequency sound waves for deep cleansing, exfoliation, product absorption enhancement, and therapeutic applications including skin tightening, acne treatment, and tissue rejuvenation. North America leads dermatology clinic adoption with its extensive network of private practices, large group dermatology organizations, and academic medical centers incorporating advanced aesthetic technologies. The segment shows strong performance in the United States where cosmetic dermatology is highly developed, insurance reimbursement supports certain procedures, and consumers actively seek dermatologist recommendations for skincare investments.

Growth drivers include expanding scope of cosmetic dermatology beyond traditional medical treatments, increasing dermatologist interest in offering non-invasive aesthetic services that enhance practice revenue, and rising consumer preference for medical supervision when undergoing skin treatments. Major device manufacturers target dermatology clinics through specialized sales forces, clinical education programs, peer-reviewed research publications, and conference exhibitions at major dermatology meetings where practitioners learn about new technologies. Europe shows strong dermatology clinic adoption, particularly in Germany, France, and the United Kingdom where medical aesthetic treatments are well-established and consumers prioritize clinical validation. Asia Pacific is emerging as a high-growth region, driven by expanding dermatology infrastructure in China and India, rising medical tourism to South Korea and Thailand for aesthetic procedures, and increasing integration of Western aesthetic medicine practices with traditional approaches. The segment's premium positioning and recurring treatment requirements create sustainable revenue streams supporting continued investment in advanced ultrasonic equipment.

Value Chain Analysis

Research and Development

The value chain for ultrasonic skin care devices begins with intensive research and development activities focused on advancing ultrasonic technology capabilities, improving treatment efficacy, enhancing user experience, and developing innovative features that differentiate products in competitive markets. R&D teams conduct extensive clinical studies validating device safety and effectiveness, optimize ultrasonic frequency ranges for specific applications, develop proprietary algorithms for AI-powered skin analysis, and design ergonomic form factors that balance functionality with aesthetics. These foundational activities require substantial investment in specialized equipment, clinical trial infrastructure, regulatory expertise, and multidisciplinary teams combining engineers, dermatologists, materials scientists, and user experience designers. Innovation cycles typically span 18-36 months from concept to market-ready product, with iterative prototyping, user testing, and regulatory preparation occurring throughout development.

Key Players: Major beauty technology companies including FOREO, NuFACE, Philips, Panasonic, and Beurer GmbH maintain dedicated R&D facilities focused on advancing ultrasonic skincare technology, while specialized medical device manufacturers like Alma Lasers, Cynosure Lutronic, and Merz Pharma invest heavily in clinical-grade system development targeting professional markets.

Component Manufacturing and Sourcing

Following product development, the value chain transitions to component manufacturing and sourcing activities where specialized electronic components, ultrasonic transducers, power management systems, sensors, and housing materials are produced or procured. Ultrasonic transducers represent critical components requiring precision manufacturing to achieve specified frequency outputs, consistent performance, and long-term reliability. Advanced devices incorporating AI capabilities require microprocessors, memory chips, and connectivity modules enabling app integration and data processing. Battery systems must balance power output with compact size and safe operation against skin. Housing materials combine durability with aesthetics while ensuring proper ultrasound transmission and comfortable handling. Component sourcing often involves global supply chains with specialized suppliers in Asia, Europe, and North America providing specific subsystems and materials.

Key Players: Electronic component suppliers including semiconductor manufacturers (Taiwan Semiconductor, Samsung Electronics), specialty transducer producers, battery manufacturers (Panasonic, LG Chem), and materials suppliers provide essential inputs, while contract manufacturers and original design manufacturers (ODMs) particularly concentrated in China, South Korea, and Japan handle component production and subassembly.

Device Assembly and Quality Control

Device assembly represents a critical value chain stage where sourced components are integrated into finished ultrasonic skin care devices through precise manufacturing processes ensuring quality, safety, and performance consistency. Assembly operations involve electronic circuit board population, transducer mounting and calibration, housing assembly, power system integration, software loading, and comprehensive testing protocols validating device functionality. Quality control procedures include electrical testing, ultrasonic output verification, safety testing, durability assessments, and cosmetic inspections ensuring products meet specifications before packaging. Manufacturing typically occurs in specialized facilities employing both automated production lines for high-volume consumer devices and skilled technicians for lower-volume professional systems requiring hand assembly and calibration. Facilities must maintain certifications including ISO 13485 for medical device quality management, FDA registration for products entering US markets, and CE marking for European distribution.

Key Players: Major brands including FOREO, Panasonic, Philips, and YA-MAN operate proprietary manufacturing facilities for flagship products while also utilizing contract manufacturers, while professional device manufacturers like Cutera, Cynosure, and Alma Lasers typically maintain in-house production for quality control. Leading contract manufacturers in China, South Korea, and Taiwan provide assembly services for numerous brands, offering economies of scale and manufacturing expertise.

Regulatory Compliance and Certification

Regulatory compliance represents an essential value chain component ensuring ultrasonic skin care devices meet safety standards and efficacy requirements for target markets. Professional-grade devices typically require more stringent regulatory clearances including FDA 510(k) approval in the United States, CE marking under Medical Device Directive in Europe, and PMDA approval in Japan, involving extensive clinical data, technical documentation, and safety testing. Consumer devices face varying requirements depending on claimed benefits and markets, with some jurisdictions treating them as cosmetic appliances requiring minimal approval while others apply medical device standards. Compliance activities include preparing detailed technical files, conducting required clinical studies, obtaining third-party certifications, preparing labeling and instructions, and maintaining quality management systems supporting ongoing compliance. Regulatory strategy significantly impacts time-to-market and market access scope, with companies balancing claims specificity against approval complexity.

Key Players: Specialized regulatory consulting firms guide manufacturers through approval processes, third-party testing laboratories including Intertek, SGS, and TÜV provide required safety and performance testing, while notified bodies in Europe and regulatory agencies including FDA, PMDA, and CFDA assess applications and grant market authorizations enabling commercial distribution.

Distribution and Retail

Distribution and retail operations connect manufactured ultrasonic skin care devices with end consumers through diverse channels optimized for different product categories and target markets. Consumer devices utilize multi-channel distribution including e-commerce platforms (Amazon, brand websites, specialty beauty e-tailers), specialty retail stores (Sephora, Ulta Beauty, department stores), and direct-to-consumer models enabling brand control and customer relationships. Professional devices employ specialized distribution through aesthetic equipment dealers, direct sales forces calling on clinics and spas, and distribution partnerships with established medical device distributors accessing clinical markets. Effective distribution strategies balance broad market reach with brand positioning, providing appropriate customer education, demonstration opportunities, and post-purchase support. Digital commerce has become increasingly dominant for consumer products, offering extensive product information, comparative reviews, tutorial content, and convenient purchasing, while professional markets still rely heavily on relationship-driven sales requiring technical expertise and clinical credibility.

Key Players: Major e-commerce platforms including Amazon, Alibaba, and specialty beauty retailers provide consumer market access, while professional distributors like Henry Schein, Patterson Companies, and regional aesthetic equipment dealers serve clinical markets. Brand-owned e-commerce sites and retail stores enable direct customer relationships for leading manufacturers.

Marketing and Customer Engagement

Marketing and customer engagement activities create awareness, build brand preference, educate consumers on proper use, and maintain ongoing relationships supporting repeat purchases and brand loyalty. Consumer device marketing heavily leverages digital channels including social media campaigns, influencer partnerships, user-generated content, tutorial videos, and targeted advertising reaching beauty-conscious demographics. Professional device marketing emphasizes clinical evidence, peer-reviewed publications, conference presentations at dermatology and aesthetic medicine meetings, and key opinion leader relationships building credibility among practitioners. Effective marketing combines product education explaining technology benefits with emotional appeals showcasing visible results and lifestyle enhancement. Customer engagement extends beyond initial purchase through mobile apps providing guided treatments, usage tracking, skincare tips, and product recommendations that maintain brand connections and support optimal device utilization.

Key Players: Leading brands including FOREO, NuFACE, and Silk'n employ sophisticated digital marketing teams and agency partnerships, while social media influencers and beauty content creators serve as critical marketing channels. Professional device companies work with aesthetic medicine publications, conference organizers, and key opinion leaders including prominent dermatologists and plastic surgeons who influence clinical adoption decisions.

After-Sales Support and Service

After-sales support and service complete the value chain, ensuring customer satisfaction, device longevity, and ongoing brand relationships that drive repeat purchases and positive word-of-mouth. Consumer device support includes warranty coverage, customer service channels addressing usage questions and technical issues, replacement part availability, and product education content helping users maximize results. Professional device service involves installation support, staff training, technical service for repairs and maintenance, software updates, and ongoing clinical education ensuring optimal treatment outcomes. Effective after-sales programs build customer loyalty, reduce product returns, generate valuable feedback for product improvement, and create opportunities for accessory sales and device upgrades. Digital technologies including chatbots, video tutorials, and app-based troubleshooting have enhanced support efficiency while maintaining customer satisfaction.

Key Players: Brand-owned customer service operations handle tier-one support, while third-party service providers and authorized repair centers provide technical service for professional-grade equipment. Technology platforms enabling remote diagnostics and software updates facilitate efficient support delivery, while consumer goods companies leverage comprehensive FAQ databases and user communities providing peer-to-peer assistance.

Regional Insights

North America – Market Leader with Established Beauty Technology Culture

North America dominates the global ultrasonic skin care devices market with a commanding 46.8% revenue share in 2026, driven by the region's strong consumer culture embracing technology-enhanced beauty solutions, high disposable incomes supporting premium device purchases, and extensive aesthetic infrastructure facilitating both professional and home-use adoption. The United States leads regional performance, accounting for the majority of North American market value, supported by early technology adoption patterns, established skincare consciousness across demographics, and widespread availability through diverse distribution channels. Consumers in this region demonstrate strong willingness to invest in proven beauty technologies, particularly devices offering clinical validation, dermatologist endorsements, and visible results documented through before-and-after imagery and user testimonials.

The region benefits from a highly developed aesthetic services ecosystem comprising extensive networks of dermatology clinics, medical spas, aesthetic centers, and beauty salons that have integrated ultrasonic technologies into comprehensive treatment menus. This professional infrastructure accelerates consumer awareness and acceptance as practitioners recommend home-use devices for maintenance between professional treatments, creating synergistic demand across market segments. Major retail chains including Sephora, Ulta Beauty, Nordstrom, and specialty beauty retailers provide experiential shopping environments where consumers can test devices, receive expert guidance, and make informed purchase decisions. Online commerce has achieved significant penetration, with Amazon, brand websites, and specialty e-tailers offering extensive product selections, comparative information, and convenient purchasing that appeals particularly to younger, digital-native consumers.

Technological sophistication characterizes the North American market, with strong consumer demand for advanced features including AI-powered skin analysis, app connectivity enabling treatment tracking and personalized recommendations, and multifunctional devices combining ultrasonic technology with LED therapy, microcurrent, and other complementary modalities. The region's regulatory environment, while rigorous, provides clear pathways for device approval through FDA oversight that builds consumer confidence in product safety and efficacy. Leading manufacturers including US-based NuFACE, Swedish company FOREO with strong North American presence, and multinational corporations like Philips and Panasonic maintain significant market share through continuous innovation, strong brand recognition, and effective marketing leveraging influencer partnerships and digital campaigns. The market is projected to grow at a steady pace throughout the forecast period, supported by aging demographics driving anti-aging device demand, expanding male grooming market, and increasing integration of beauty devices into comprehensive wellness routines.

Key Players: NuFACE (United States), Trophy Skin (United States), FOREO (Sweden with strong US presence), Philips (Netherlands with extensive North American operations), Panasonic (Japan with major US distribution), leading the regional market through innovation, strong brand recognition, and comprehensive distribution networks reaching both consumer and professional segments.

Asia Pacific – Fastest Growing Region with Innovation Leadership

Asia Pacific represents the fastest-growing regional market for ultrasonic skin care devices, projected to expand at an impressive CAGR of 7.8% between 2026 and 2033, driven by rapid urbanization, rising disposable incomes, strong beauty consciousness particularly pronounced in East Asian cultures, and large tech-savvy populations readily embracing smart beauty tools and connected devices. Countries including China, South Korea, Japan, and increasingly India lead regional growth, each contributing unique dynamics to market expansion. South Korea and Japan serve as innovation hubs where advanced ultrasonic technologies are developed, tested, and refined before global commercialization, with these markets demonstrating high consumer acceptance of novel beauty technologies and willingness to adopt cutting-edge devices.

The region benefits from well-established beauty device manufacturing ecosystems, particularly concentrated in China, South Korea, and Japan, enabling cost-efficient production, rapid product launches, and extensive original equipment manufacturer (OEM) and original design manufacturer (ODM) capabilities that support both domestic brands and international companies seeking Asian manufacturing partners. This manufacturing strength translates to competitive pricing that makes advanced technologies accessible to broader consumer bases compared to Western markets, accelerating mass market adoption. Chinese consumers represent the largest demographic opportunity, with expanding middle class, increasing beauty spending, strong e-commerce infrastructure through platforms like Alibaba and JD.com, and growing awareness of preventive skincare driving substantial demand for both entry-level and premium devices.

South Korean consumers demonstrate the highest per-capita spending on beauty devices globally, reflecting the culture's strong emphasis on appearance, extensive multi-step skincare routines, and willingness to invest in advanced technologies promising enhanced results. Japanese manufacturers including YA-MAN and Panasonic lead in developing compact, precision-engineered devices incorporating AI-driven skin analysis and personalized treatment protocols that align with preferences for technology-enabled solutions. India represents an emerging high-potential market, driven by large young population, rapidly growing middle class with increasing disposable incomes, rising beauty awareness influenced by social media and Bollywood culture, and expanding e-commerce penetration making devices accessible beyond major urban centers. The region shows strong growth across all device categories, with particular strength in handheld consumer products appealing to budget-conscious yet quality-focused consumers, and increasing adoption of professional systems as aesthetic medicine infrastructure expands in major cities.

Key Players: YA-MAN Ltd. (Japan), Panasonic Corporation (Japan), Shenzhen Leaflife Technology Co. Ltd. (China), Kingdom Cares (China), Silk'n (Israel with strong Asian operations), Asterasys Co. Ltd. (South Korea), Bomtech Electronics Co. Ltd. (Taiwan), dominating regional markets through innovation, local market expertise, competitive pricing, and extensive distribution networks.

Europe – Mature Market with Quality-Focused Consumers

Europe holds substantial market share in the ultrasonic skin care devices market, characterized by strong consumer preference for high-quality, clinically validated products, stringent safety standards driving product excellence, and established skincare cultures particularly pronounced in Western European markets. Countries including Germany, United Kingdom, France, Italy, Spain, and Scandinavia lead regional adoption, with consumers demonstrating willingness to invest in premium devices offering medical-grade engineering, CE compliance, and scientific backing. The region's regulatory environment, while demanding, creates competitive advantages for compliant manufacturers by building consumer trust and eliminating substandard products that could damage category credibility.

European consumers show strong preference for devices with clinical validation, dermatologist endorsements, and transparent safety information, reflecting the region's evidence-based approach to health and beauty products. This quality focus supports premium pricing and creates opportunities for brands emphasizing scientific research, long-term skin health benefits, and sustainable manufacturing practices aligned with European environmental values. Germany represents the largest single-country market, driven by high consumer spending power, strong demand for medical-grade beauty tools, extensive network of dermatology clinics and aesthetic centers, and cultural preference for engineering excellence and product reliability. The country's market shows significant growth driven by increasing aging population, rising disposable incomes, and rapid technological innovations particularly in AI-powered, multifunctional, app-connected devices offering personalized treatment experiences.

The United Kingdom demonstrates strong adoption of home-use devices, supported by well-developed e-commerce infrastructure, extensive beauty retail networks including Boots and Superdrug, and consumer comfort with online purchasing including virtual consultations and digital skin assessments. France, with its prestigious beauty and cosmetics heritage, shows sophisticated consumer demand for elegant design combined with effective functionality, with Parisian consumers particularly influential in setting European beauty device trends. Eastern European markets including Poland, Czech Republic, and Romania represent emerging growth opportunities as economic development increases disposable incomes and Western beauty practices gain adoption. The region shows balanced growth across professional and consumer segments, with aesthetic clinics maintaining strong positions while home-use devices gain increasing acceptance particularly among younger demographics influenced by social media and beauty content creators.

Key Players: Beurer GmbH (Germany), Philips (Netherlands), FOREO (Sweden), Silk'n (Israel with strong European presence), Project E Beauty (UK operations), dominating regional markets through quality positioning, clinical validation, CE compliance, and distribution through established retail networks and growing e-commerce channels.

Latin America – Emerging Market with Growing Beauty Consciousness

Latin America represents an emerging market for ultrasonic skin care devices, projected to grow at a CAGR of approximately 6.8% from 2026 to 2033, driven by expanding middle-class populations with increasing disposable incomes, rising beauty consciousness influenced by social media and celebrity culture, and growing awareness of advanced skincare technologies. Brazil dominates regional market activity, accounting for the largest share of Latin American revenue, supported by the country's established beauty culture, high per-capita spending on personal care products, extensive aesthetic services infrastructure, and strong social emphasis on appearance across age groups. Brazilian consumers demonstrate particular interest in anti-aging and skin rejuvenation applications, with professional treatments in aesthetic clinics showing strong adoption rates.

Mexico represents the second-largest market, benefiting from proximity to North American trends, increasing cross-border commerce, growing medical tourism industry attracting consumers from Central America and United States for aesthetic procedures, and expanding retail infrastructure in major cities including Mexico City, Guadalajara, and Monterrey. The country shows balanced growth across professional and consumer segments, with increasing numbers of dermatology clinics and med-spas incorporating ultrasonic technologies while home-use device adoption accelerates particularly among urban, middle-to-upper-income demographics. Argentina, Chile, and Colombia represent additional growth markets, each demonstrating increasing consumer interest in beauty technologies despite economic volatility creating price sensitivity that favors mid-range devices offering proven value.

Regional challenges include economic instability affecting purchasing power, import restrictions and tariffs increasing device costs, limited distribution infrastructure outside major urban centers, and varying regulatory frameworks creating market access complexity. However, opportunities exist for manufacturers who adapt pricing strategies to regional income levels, establish local distribution partnerships, and leverage digital commerce to reach consumers beyond traditional retail networks. Social media influence proves particularly powerful in Latin American markets, with beauty influencers and content creators driving awareness and adoption through demonstrations and testimonials that resonate with culturally relevant beauty ideals. The region shows strongest growth potential in handheld consumer devices priced accessibly while offering multifunctional benefits, and in professional systems serving expanding networks of aesthetic clinics in major metropolitan areas where aesthetic medicine is well-established and growing.

Key Players: International brands including FOREO, Philips, and Silk'n maintain presence through import distribution and e-commerce, while local distributors and retailers including beauty retail chains and department stores provide market access. Brazilian aesthetic device distributors and Mexican medical equipment suppliers serve professional markets.

Middle East & Africa – High-Potential Region with Diverse Market Dynamics

The Middle East and Africa region represents a diverse market landscape with significant untapped potential, projected to grow at approximately 7.2% CAGR from 2026 to 2033, characterized by varying economic development levels, cultural factors influencing beauty practices, and rapidly expanding urban populations driving demand for advanced skincare solutions. The Gulf Cooperation Council (GCC) countries including United Arab Emirates, Saudi Arabia, Qatar, and Kuwait lead regional adoption, supported by high per-capita incomes, strong beauty consciousness among affluent populations, extensive luxury retail infrastructure, and cultural emphasis on appearance and grooming across genders. Dubai and Abu Dhabi serve as regional beauty technology hubs, featuring premium aesthetic clinics, luxury spas, and high-end retail establishments offering latest ultrasonic devices to wealthy local and expatriate populations.

Saudi Arabia shows particularly strong growth following social reforms increasing women's economic participation and public presence, driving substantial increases in beauty product and device spending among Saudi female consumers who demonstrate willingness to invest in premium quality technologies. The country's Vision 2030 economic diversification program supports aesthetic medicine sector development, creating opportunities for professional-grade ultrasonic systems in expanding clinic networks. South Africa leads the African continent in market development, supported by relatively developed economy, established aesthetic services sector, growing middle class particularly among Black South African populations increasing beauty spending, and retail infrastructure concentrated in major cities including Johannesburg, Cape Town, and Durban.

Egypt, Nigeria, and Kenya represent additional African markets showing emerging potential, driven by large young populations, increasing urbanization, growing middle-class segments, and expanding access to international beauty brands through e-commerce channels that bypass limited physical retail infrastructure. Regional challenges include economic constraints limiting premium device affordability in many markets, cultural preferences for natural beauty approaches in certain segments, limited awareness of ultrasonic technology benefits requiring consumer education, and varying regulatory frameworks creating market entry complexity. Opportunities exist for manufacturers who develop market-specific strategies including accessible pricing tiers, partnerships with regional distributors having local market expertise, and culturally appropriate marketing emphasizing benefits relevant to regional skin types, climate conditions, and beauty preferences. The region shows strongest potential in premium segments serving affluent consumers in GCC countries and in mid-range devices targeting expanding middle classes in South Africa and North African markets.

Key Players: International premium brands including FOREO, Philips, and Silk'n serve high-end segments through luxury retail and professional channels, while regional distributors and retailers including Gulf-based beauty retail chains and South African pharmacy chains provide market access. Local aesthetic equipment distributors serve professional markets in major urban centers.

Top Key Players

FOREO (Sweden)

NuFACE (United States)

Panasonic Corporation (Japan)

Philips (Netherlands)