Ultrasound Probe Disinfection Market Overview

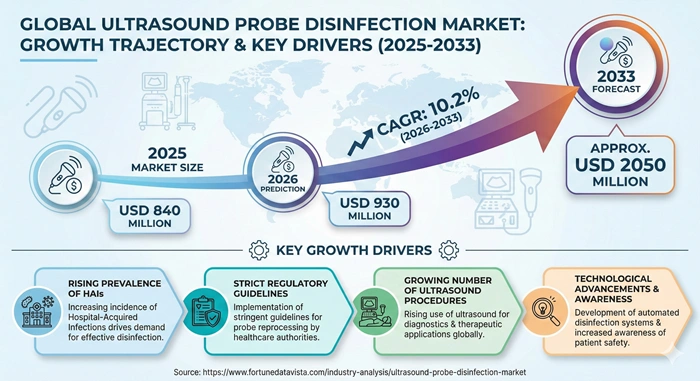

The global ultrasound probe disinfection market size is valued at USD 840 million in 2025 and is predicted to increase from USD 930 million in 2026 to approximately USD 2050 million by 2033, growing at a CAGR of 10.2% from 2026 to 2033.

This growth comes from healthcare providers focusing more on preventing infections during ultrasound scans. Hospitals and clinics handle millions of these procedures each year, making clean probes a top priority. Strict rules from health agencies push facilities to use better cleaning tools and methods.

AI Impact on the Ultrasound Probe Disinfection Industry

Artificial intelligence reshapes the ultrasound probe disinfection industry by adding smart layers to cleaning processes that humans alone can't match. Machines now use AI sensors to scan probes for leftover gel, microbes, or damage before starting a cycle. They adjust chemical strength or UV exposure based on what they detect, ensuring no weak spots get missed. This real-time tweaking cuts infection risks that come from rushed or uneven manual wipes. Hospitals report fewer failed audits since AI logs every detail automatically.

Beyond basic checks, AI predicts problems before they happen. It pulls data from thousands of past cleanings to spot patterns, like a probe type wearing faster under heavy use. Predictive alerts let staff swap parts early, avoiding downtime in busy emergency rooms. Machine learning also optimizes schedules—prioritizing high-risk probes from surgery suites over routine ones. Facilities save up to 30% on maintenance costs this way, freeing budgets for more units. Traceability improves too, with blockchain-like records proving compliance during inspections.

AI teams up with robotics for full automation in some setups. Robots navigate disinfection bays, positioning probes perfectly for even coverage without staff handling wet gear. In larger networks, cloud AI analyzes data across sites to refine protocols globally. This shift tackles staff shortages, as one system handles what four cleaners did manually. Eco-benefits shine through reduced chemical use—AI dials down sprays precisely. Looking ahead, integration with ultrasound scanners themselves will flag dirty probes before scans start, closing the safety loop. Early adopters like major US hospitals see 90% faster turnarounds and sharper HAI drops.

Growth Factors of the Ultrasound Probe Disinfection Market

Hospital-acquired infections from ultrasound probes grab headlines often, fueling urgent demand in the disinfection market. Studies show these bugs hit thousands yearly, with probes implicated in up to 20% of cases due to tricky crevices trapping germs. Health agencies like the CDC now mandate detailed logs and high-level methods, pushing hospitals to ditch unreliable wipes. Facilities face fines or shutdowns without proof of clean probes, so they invest heavily. Automated systems prove their worth by slashing these incidents by over 80% in trials.

Ultrasound procedures explode globally, from 100 million in 2020 to projected 200 million by 2030, across obstetrics, cardiology, and point-of-care checks. Portable units in ambulances and bedside scans multiply probe counts per shift. Clinics need disinfection that matches this pace—quick cycles under 5 minutes. Rising chronic issues like diabetes swell vascular scans, tying directly to market lifts. Emerging markets add volume as new centers equip fully.

Regulatory pressures mount as bodies update guidelines yearly. FDA clears more UV and mist tech, while EU MDR demands sporicidal proof. Non-compliance costs millions in recalls, so buyers flock to validated gear. Staff training mandates further boost service segments. Tech advances like hydrogen peroxide sonication kill tougher pathogens without harsh aldehydes, winning over skeptics. Partnerships between makers and hospitals speed rollouts. Economic angles help too—ROI shows payback in 12 months via fewer infections and faster throughput. Pandemic lessons linger, with telehealth ultrasounds needing home-to-clinic clean chains. Sustainability pushes chemical-free options, aligning with green hospital certifications. All these weave a strong growth web through 2033.

Market Outlook of the Ultrasound Probe Disinfection Market

The ultrasound probe disinfection market stands on firm ground heading into 2033, backed by nonstop climbs in ultrasound scans and tougher infection rules worldwide. North America holds the top spot with nearly 38% share, thanks to packed hospitals and quick uptake of cutting-edge gear like automated reprocessors. But Asia Pacific charges ahead at 11.5% CAGR, as countries like China and India pour funds into healthcare hubs and fight rising HAIs with new standards. This regional shift promises balanced global growth, with emerging spots catching mature ones.

Regulators keep the pressure on, rolling out yearly updates that favor proven high-level disinfection over spotty manual tries. FDA nods for UV-C and hydrogen peroxide systems clear paths for makers, while EU MDR stresses full traceability from clean to scan. Healthcare shifts toward outpatient and point-of-care ultrasounds demand compact, fast cleaners that fit mobile workflows. Buyers eye total costs—gear paying back via fewer infections and smoother operations. Supply chains, steadied after pandemic hits, now deliver reliably, letting firms scale production.

Mergers heat up as giants snap up niche innovators in UV tech or AI monitoring, consolidating power. Sustainability trends nudge toward chemical-free options, cutting waste and meeting green certifications. Telehealth's ultrasound push adds layers, needing safe probe handling across sites. Staff shortages spotlight outsourcing, where pros manage cycles off-site. By 2033, expect a mature market blending automation, data smarts, and eco-focus to serve diverse settings from ERs to rural clinics.

Expert Speaks

-

GE Healthcare CEO Peter J. Arduini: "Infection control remains core to our ultrasound innovations. As procedures grow, reliable probe disinfection protects patients and builds trust in diagnostics, with trends leaning toward automated, chemical-free solutions in 2026."

-

Siemens Healthineers CEO Bernhard Montag: "We see high-level disinfection as key to expanding ultrasound use safely. Recent updates show UV tech slashing HAI risks, and our systems lead this shift for global clinics."

-

STERIS CEO Walt Zinn: "Market trends point to traceable, efficient reprocessing. Our 2025 advancements cut cleaning times by 30%, helping hospitals meet rising demands without compromise."

Key Report Takeaways

-

North America leads the ultrasound probe disinfection market with over 37% share in 2025, thanks to advanced hospitals, strict FDA rules, and high scan volumes that demand top-tier cleaning tech.

-

Asia Pacific grows fastest at a projected 11.5% CAGR through 2033, fueled by new healthcare builds in China and India, plus more chronic cases needing frequent ultrasounds.

-

Hospitals and clinics use disinfection most, handling 45% of market needs due to diverse patients and invasive probe uses that require high-level methods daily.

-

Diagnostic imaging centers contribute most by application, driven by outpatient booms and portable ultrasound rises, where quick probe turnaround keeps services flowing.

-

High-level disinfection proves most popular, capturing 60% share as regulations classify many probes semi-critical, with automated systems topping choices for reliability.

-

Instruments segment grows quickest at 11% CAGR, holding future 50% share by 2033, led by UV-C and reprocessors that cut errors in busy North American and European sites.

Market Scope of the Ultrasound Probe Disinfection Market

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 2050 Million | Market Size by 2026 | USD 930 Million | Market Size by 2025 | USD 840 Million | Market Growth Rate from 2026 to 2033 | CAGR of 10.2% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Product, Method, End-use | Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Market Dynamics of the Ultrasound Probe Disinfection Market

Drivers Impact Analysis

| Driver | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rising HAIs from Probes | High (28%) | Global, esp. USA/Europe | Immediate-Long |

| Ultrasound Procedure Surge | High (22%) | APAC, North America | Short-Medium |

| Stringent Regulations | Medium (18%) | North America, Europe | Ongoing |

| Tech Advances in HLD | Medium (15%) | Global | Medium-Long |

Rising hospital-acquired infections top the drivers list for the ultrasound probe disinfection market, with probes linked to cross-contamination in up to 15% of cases. CDC data flags thousands of incidents yearly, spurring hospitals to automate for 90% risk cuts. Awareness campaigns and lawsuits amplify urgency, shifting budgets from basics to robust systems. This force hits immediately, reshaping purchases across scales.

Ultrasound volumes double in diagnostics like cardiac and OB/GYN, hitting 200 million procedures soon. Point-of-care booms in ambulances multiply probe needs, demanding quick disinfection. Chronic disease waves in aging pops sustain this pull. Regulations from FDA and EU enforce HLD for semi-critical tools, with non-compliance fines in millions. Tech like UV-C speeds cycles to minutes, outpacing wipes.

Restraints Impact Analysis

| Restraint | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High Initial/Running Costs | Medium (18%) | Emerging Markets, APAC | Medium-Term |

| Staff Training Gaps | Medium (12%) | Global | Short-Term |

| Chemical Resistance Issues | Low (10%) | Europe, USA | Ongoing |

| Legacy Equipment Stickiness | Low (8%) | Latin America, MEA | Long-Term |

High costs for automated systems—often $50K plus upkeep—deter small clinics in developing areas. Ongoing consumables add burden amid tight budgets. Emerging markets favor cheap wipes despite risks, slowing premium shifts. Bulk buys and financing ease this somewhat, but upfront hits linger. Training staff on complex gear takes weeks, with shortages worsening errors. Resistance from some bugs to standard agents frustrates, needing pricier upgrades. Old habits cling in underfunded sites, delaying full adoption.

Opportunities Impact Analysis

| Opportunity | ≈ % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Automated & AI-Integrated Systems | High (25%) | North America, Europe | Short-Medium |

| Eco-Friendly, Chemical-Free Tech | High (20%) | Europe, APAC | Medium-Long |

| Outsourcing & Emerging Markets | Medium (16%) | APAC, Latin America | Ongoing |

| POCUS & Telehealth Expansion | Medium (14%) | Global | Short-Term |

Automation with AI opens big doors, promising error-free cycles and predictive fixes for high-volume spots. UV-C and vapor H2O2 slash chemicals, aligning with green regs and cutting disposal costs. Europe leads here on sustainability mandates. Outsourcing lets cash-strapped facilities offload without big capex, booming in APAC builds. POCUS in remote care needs portable cleaners, fitting telehealth rises. Emerging economies invest via aid, bridging gaps.

Top Vendors and their Offerings

-

Nanosonics (Australia): Trophon systems use hydrogen peroxide mist for fast high-level disinfection, ideal for busy ultrasound departments.

-

Germitec (France): Chronos UV-C devices provide chemical-free cleaning in minutes, with traceability for compliance.

-

CIVCO Medical Solutions (USA): ASTRA automated reprocessors handle multiple probes safely, reducing manual handling risks.

-

Tristel Solutions Ltd. (UK): Trio wipes and sprays offer chlorine dioxide-based quick disinfection for non-critical uses.

-

Ecolab, Inc. (USA): Comprehensive kits with enzymatic cleaners and high-level agents for full reprocessing cycles.

-

CS Medical LLC (USA): VERSE reprocessors focus on efficiency for endocavity probes in high-risk settings.

-

Advanced Sterilization Products (USA): STERRAD systems integrate vapor tech for thorough, low-temp disinfection.

-

STERIS plc (UK): EVOTECH platforms streamline workflows with validated HLD processes.

Segment Analysis of the Ultrasound Probe Disinfection Market

Product Segment – Instruments Drive Automation Wave

The product segment splits into instruments, consumables, and services, with instruments leading at 44% share in the ultrasound probe disinfection market for 2025. These machines handle high-level disinfection reliably, cutting manual errors in busy hospitals. Demand surges as regulations favor traceable tech over wipes. Growth hits 11% CAGR through 2033, fueled by UV and reprocessor upgrades. North America grows fastest due to FDA pushes and scan volumes.

Consumables like liquids and wipes hold 35% share, suiting low-risk or budget setups. They offer quick application for non-invasive probes. Services trail at 21% but rise at 10.5% CAGR with outsourcing trends. Europe sees service booms amid staff shortages. Overall, instruments reshape the market toward efficiency. Future shifts favor hybrid models blending instruments with consumables for versatility. APAC expands consumables on cost, while services fit small clinics. This mix ensures broad coverage as needs evolve.

-

Automated Reprocessors – 28% share, 11.8% CAGR, exploding in North America for cycle speed; Nanosonics rules with trophon tech.

-

UV-C Disinfectors – 12% share, 12.5% CAGR, hottest in Europe for green kills; Germitec leads sales.

-

Manual Stations – 4% share, 9.2% CAGR, steady in APAC affordability; CIVCO supplies durable kits.

Method Segment – High-Level Sets Safety Standard

High-level disinfection dominates at 58% share, essential for semi-critical probes touching mucous membranes. It kills viruses, bacteria, and spores per CDC guidelines, slashing HAIs. Automated versions ensure consistency over hand scrubs. The ultrasound probe disinfection market benefits as scans grow invasive. USA drives 11.2% CAGR with compliance fears. Intermediate/low-level takes 42%, fine for skin probes at 9.7% CAGR. Wipes and sprays speed routine cleans. Europe balances both amid regs. High-level's edge grows with endocavity rises. Shifts lean toward high-level as portable ultrasounds blur lines. Training pushes intermediate upgrades. Market tilts safer long-term.

-

High-Level Disinfection – 58% share, 11.2% CAGR, surging in USA invasive uses; Nanosonics tops charts.

-

Intermediate/Low-Level – 42% share, 9.7% CAGR, vital in APAC routines; Tristel excels wipes.

End-use Segment – Hospitals Fuel Core Demand

Hospitals and clinics command 48% share, handling diverse high-risk scans needing robust disinfection. Volumes hit peaks in ERs and ICUs, demanding fast turnarounds. Investments follow HAI cuts. North America grows at 10.8% CAGR from regs. This end-use anchors the ultrasound probe disinfection market. Diagnostic imaging centers grab 32%, booming at 11.5% CAGR in outpatients. Portables need compact cleaners. Europe leads privatization. Hospitals remain king. Others like labs hold 20% at 9.5% CAGR. Research pushes innovation. Outpatient trends reshape shares.

-

Hospitals & Clinics – 48% share, 10.8% CAGR, powerhouse in North America volumes; CS Medical key.

-

Diagnostic Centers – 32% share, 11.5% CAGR, fastest Europe efficiency; CIVCO fits.

-

Others – 20% share, 9.5% CAGR, rising APAC labs; Ecolab supports.

Value Chain Analysis

Raw Material Sourcing → Suppliers provide chemicals, UV lamps, and plastics for building disinfection gear. Quality checks ensure parts meet medical standards to avoid contamination risks. Processes involve testing for durability under repeated use. Key Players: Ecolab and Parker Labs supply detergents and components globally.

Manufacturing and Assembly → Factories build reprocessors and consumables with automation for precision. Sterile environments prevent early flaws, while software integrates for smart features. Testing cycles validate germ-kill rates before shipping. Key Players: Nanosonics and Germitec lead in automated assembly lines.

Distribution and Sales → Wholesalers and direct teams deliver to hospitals via logistics networks. Training sessions help users adopt safely. Digital platforms track inventory for just-in-time supply. Key Players: CIVCO and STERIS handle global logistics.

Usage and Maintenance → End-users clean probes daily, logging cycles for audits. Service contracts fix issues promptly. Data analytics optimize performance over time. Key Players: CS Medical offers on-site support.

Regional Insights of the Ultrasound Probe Disinfection Market

North America – Regulation Powerhouse

North America commands 38% global share in the ultrasound probe disinfection market, valued at USD 319 million in 2025 with a solid 10.5% CAGR to 2033. FDA and CDC mandates enforce high-level disinfection for semi-critical probes, driving automated adoption. Hospitals lead with high scan volumes in cardiology and OB/GYN. Nanosonics (Australia, strong US presence) and CS Medical (USA) supply over 60% locally. USA dominates regional demand at 75% share, fueled by HAI awareness and POCUS growth. Canada mirrors with provincial health pushes. Investments in AI-monitored systems cut risks sharply. Clinics upgrade legacy gear amid audits. Tech hubs like Boston innovate UV tech. Outsourcing rises in smaller states. Market matures but expands on telehealth.

Europe – Compliance Leader

Europe secures 26% share, reaching USD 218 million in 2025 at 10.2% CAGR. EU MDR and national rules demand sporicidal proof and traceability, boosting premium gear. Aging populations swell ultrasound needs in diagnostics. Germitec (France) and Tristel (UK) capture 55% regional sales. Germany leads at 32% sub-share with precision manufacturing. UK grows via NHS infection drives post-pandemic. France excels in UV exports. Italy focuses consumables. Sustainability regs favor chemical-free methods. Diagnostic privatization speeds buys. Market balances maturity with green shifts.

Asia Pacific – Explosive Growth Engine

Asia Pacific surges to 22% share by 2033 from USD 185 million in 2025, boasting 11.8% CAGR. Rapid healthcare infrastructure in China and India multiplies hospitals and scans. Urbanization brings chronic cases needing frequent checks. Ecolab (USA) partners locals; Nanosonics enters strong. China tops at 42% regional, growing on government health plans. Japan prioritizes high-tech for aging care. India budgets consumables but upgrades instruments. Indonesia rises on exports. Budget builds close tech gaps. Portable disinfection fits rural pushes. Ultrasound probe disinfection market thrives on volume here.

Latin America – Steady Awakening

Latin America grows at 10% CAGR to 7% global share from USD 59 million in 2025. Post-pandemic HAI focus spurs public investments. Brazil and Mexico equip new centers. CIVCO (USA) and STERIS (UK) lead imports. Brazil holds 52% regional share with SUS program upgrades. Mexico booms private clinics. Argentina follows economic recovery. Chile innovates green tech. Costs challenge but financing aids. Outsourcing appeals to small sites. Market builds on awareness.

Middle East & Africa – Investment Frontier

MEA expands at 10.8% CAGR to 7% share from USD 59 million. Gulf wealth funds mega-hospitals; Africa urbanizes care. Saudi Vision 2030 enforces standards. STERIS and Germitec supply key projects. Saudi Arabia races at 12.5% regional CAGR, building facilities. UAE attracts medical tourism. South Africa fights infections. Egypt grows steadily. Aid bridges rural gaps. Portable units suit mobility. Ultrasound probe disinfection market leverages infra booms.

Top Key Players in the Ultrasound Probe Disinfection Market

-

Nanosonics (Australia)

-

Germitec (France)

-

CIVCO Medical Solutions (USA)

-

Tristel Solutions Ltd. (UK)

-

Ecolab, Inc. (USA)

-

CS Medical LLC (USA)

-

Advanced Sterilization Products (USA)

-

STERIS plc (UK)

-

Steelco S.p.A. (Italy)

-

GE HealthCare (USA)

-

UV Smart (Netherlands)

-

Lumicare (USA)

Recent Developments

-

Nanosonics (2025): Launched trophon3 system with software upgrades for better workflow and digital tracking, enhancing HLD efficiency in North America.

-

Germitec (2025): Secured USD 30 million funding to expand UV-C tech in USA, including Chronos Max for cardiology probes.

-

CIVCO Medical Solutions (2024): Introduced new ASTRA models with improved barriers, reducing contamination in high-volume clinics.

-

Tristel (2025): Partnered for US distribution of ULT foam, FDA-cleared for high-level use on cavity probes.

-

STERIS (2024): Acquired tech for EVOTECH upgrades, focusing on faster cycles amid rising demands.

Market Trends

Automation sweeps the ultrasound probe disinfection market, replacing error-prone manual wipes with smart reprocessors that log every cycle for audits. Hospitals cut cleaning times by 70%, handling peak loads without skips. Closed systems like trophon prevent exposure risks, gaining FDA favor. This trend accelerates in high-volume US and European sites, where compliance trumps cost. By 2030, over 60% of facilities plan full switches, per industry surveys.

UV-C and chemical-free disinfection rise sharply, driven by eco-regs and residue fears. Devices like Chronos kill 99.99% of pathogens in minutes, no rinses needed. Europe mandates greener options, slashing aldehyde use by 40%. APAC adopts for waste cuts in dense cities. Pairing with sensors boosts validation, appealing to quality chiefs.

Point-of-care ultrasound (POCUS) explosion demands portable, rugged cleaners for ambulances and bedsides. Compact UV boxes fit kits, enabling on-site cycles. Telehealth ties in, standardizing home-clinic protocols. North America leads with 50 million annual POCUS scans.

AI and IoT integration track probe health across fleets, predicting failures via cloud data. Hospitals monitor efficacy in real-time, alerting on drifts. Outsourcing booms as pros manage cycles, freeing space. Sustainability pairs with this for holistic gains. Emerging markets leapfrog to these, skipping legacy steps.

Segments Covered in the Ultrasound Probe Disinfection Market Report

By Product

-

Instruments

-

Automated Reprocessors

-

UV-C Disinfectors

-

Manual Reprocessors/Soaking Stations

-

Ultrasound Probe Storage Cabinets

-

-

Consumables

-

Disinfectant Liquids

-

Disinfectant Wipes

-

Disinfectant Sprays

-

Enzymatic Detergents

-

Non-enzymatic Detergents

-

-

Service

By Method

-

High-Level Disinfection

-

Intermediate Level Disinfection/Low-Level Disinfection

By End-use

-

Hospitals and Clinics

-

Diagnostic Imaging Centers

-

Others

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

Frequently Asked Questions:

Hospital-acquired infections rise with more scans, pushing facilities to advanced cleaners. Regulations like FDA standards enforce high-level methods for safety.

North America tops with 38% share from strong healthcare and rules. It grows steadily on innovation.

Instruments like UV-C units expand quickest at 11% CAGR. They offer reliable, fast cleaning.

It kills tough pathogens on invasive probes, cutting cross-contamination risks sharply. Automated versions speed workflows too.

AI integration and eco-friendly UV tech lead, improving efficiency and compliance globally.