Vehicle Control Unit Market Overview

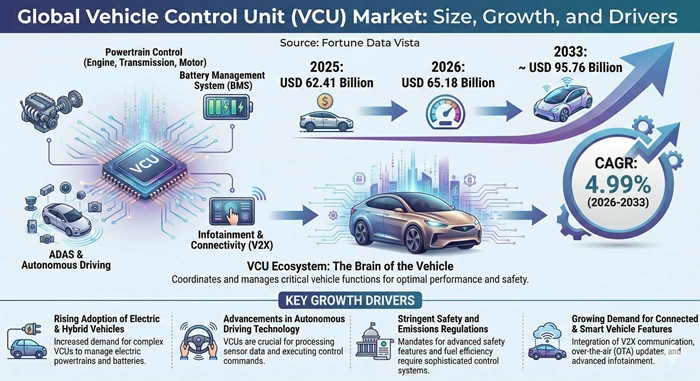

The global vehicle control unit market size is valued at USD 62.41 billion in 2025 and is predicted to increase from USD 65.18 billion in 2026 to approximately USD 95.76 billion by 2033, growing at a CAGR of 4.99% from 2026 to 2033. The increasing adoption of electric vehicles and advanced driver-assistance systems are transforming the automotive electronics landscape, with vehicle control units emerging as the central command system for modern automobiles. These sophisticated electronic devices manage critical functions ranging from powertrain control and battery management to safety systems and connectivity features, making them indispensable for next-generation vehicles.

AI Impact on the Vehicle Control Unit Industry

Transforming Automotive Intelligence Through Machine Learning and Predictive Analytics

Artificial intelligence is revolutionizing the vehicle control unit market by enabling predictive analytics and real-time decision-making capabilities that were previously impossible. AI-powered vehicle control units utilize machine learning algorithms to continuously analyze driving patterns, environmental conditions, and vehicle performance data to optimize energy distribution and enhance safety features. These intelligent systems can predict maintenance requirements before failures occur, adjust braking systems dynamically based on road conditions, and improve autonomous driving functions through continuous learning processes. The integration of AI into vehicle control units allows manufacturers to deliver vehicles that adapt to individual driver behaviors, optimize battery life in electric vehicles, and provide seamless coordination between multiple electronic control units within the vehicle architecture.

The implementation of AI technologies within vehicle control units is accelerating the transition toward software-defined vehicles, where functionality can be updated and enhanced through over-the-air updates rather than hardware replacements. This capability reduces vehicle downtime, extends product lifecycles, and creates new revenue opportunities through subscription-based features. As neural networks become more sophisticated, vehicle control unit systems are achieving unprecedented levels of efficiency in managing complex sensor data from cameras, radar, and lidar systems, enabling higher levels of autonomous driving capabilities. The market is witnessing substantial investments from automotive manufacturers and technology companies focused on developing AI-optimized chipsets that can handle the massive computational requirements of modern intelligent vehicles while maintaining low power consumption and high reliability standards.

Growth Factors

Electrification and Regulatory Mandates Driving Unprecedented Market Expansion

The vehicle control unit market is experiencing robust growth driven primarily by the rapid electrification of the automotive industry and increasingly stringent emission regulations worldwide. Electric vehicles require sophisticated vehicle control units to manage battery charging and discharging cycles, thermal management systems, regenerative braking, and power distribution across multiple electric motors. Unlike traditional internal combustion engine vehicles that rely primarily on engine control units, electric vehicles demand integrated vehicle control units that coordinate complex interactions between battery management systems, traction inverters, and charging infrastructure. Government mandates for emission reduction in North America, Europe, and Asia-Pacific are compelling automotive manufacturers to accelerate their transition to electric powertrains, directly increasing demand for advanced vehicle control unit technologies that can optimize energy efficiency and extend driving range.

The proliferation of advanced driver-assistance systems and the gradual progression toward autonomous vehicles are creating additional growth opportunities within the market. Modern vehicles incorporate numerous ADAS features including adaptive cruise control, lane-keeping assistance, automatic emergency braking, and parking assistance, all of which require seamless integration and coordination through centralized vehicle control units. As safety regulations become more stringent and consumer expectations for advanced safety features continue to rise, automotive manufacturers are investing heavily in developing vehicle control units with enhanced processing power and lower latency communication capabilities. The shift toward domain controllers and zone-based vehicle architectures is transforming the market, with manufacturers consolidating multiple electronic control units into fewer, more powerful central computing platforms that can manage cross-domain functions more efficiently while reducing vehicle weight, wiring complexity, and overall production costs.

Market Outlook

Strategic Positioning for the Software-Defined Vehicle Era

The vehicle control unit market is positioned at the intersection of several transformative automotive trends that will define the industry's future trajectory through 2033 and beyond. The transition from distributed electronic control unit architectures to centralized domain controllers represents a fundamental shift in vehicle electrical and electronic architecture, with vehicle control units serving as the orchestration layer for increasingly complex vehicle systems. Software-defined vehicle platforms are emerging as the dominant design philosophy among leading automotive manufacturers, requiring vehicle control units capable of supporting over-the-air updates, cybersecurity protocols, and cross-domain functionality. This architectural evolution is creating opportunities for semiconductor companies, tier-one automotive suppliers, and technology firms to establish new partnerships and develop integrated solutions that combine hardware, software, and cloud connectivity.

The competitive landscape within the market is intensifying as traditional automotive suppliers face competition from technology companies and electric vehicle startups with different approaches to vehicle architecture and software development. Established players are leveraging their expertise in automotive-grade components, functional safety standards, and global manufacturing capabilities, while new entrants are introducing innovative software platforms and agile development methodologies. The market is witnessing increased consolidation through strategic partnerships, joint ventures, and acquisitions as companies seek to combine complementary capabilities and accelerate time-to-market for next-generation vehicle control unit solutions. Regional dynamics are also shaping the market outlook, with Asia-Pacific emerging as a manufacturing powerhouse, North America leading in autonomous vehicle development, and Europe maintaining strong positions in premium vehicle segments and regulatory innovation that influences global standards.

Expert Speaks

-

Mary Barra, CEO of General Motors (USA): "EVs remain our North Star, and we continue to invest in battery technology and vertical integration to deliver an all-electric future that satisfies and delights customers while addressing emissions and congestion challenges."

-

Jim Farley, CEO of Ford Motor Company (USA): "The automotive industry is undergoing one of its most transformative periods, and we must be careful about consumer demand while accelerating our investments in electric vehicle technology and intelligent vehicle systems."

-

Elon Musk, CEO of Tesla (USA): "Software and electronics are becoming the defining characteristics of vehicles, with the traditional automotive value chain being disrupted by companies that understand how to integrate battery management, autonomous driving, and over-the-air updates into seamless vehicle experiences."

Key Report Takeaways

-

Asia-Pacific dominates the market with the largest revenue share, driven by massive electric vehicle production volumes in China, strong automotive manufacturing ecosystems in Japan and South Korea, and rapidly expanding automotive industries in India and Southeast Asian markets

-

North America represents the fastest-growing region for vehicle control units, exhibiting accelerated adoption rates due to substantial investments in electric vehicle infrastructure, aggressive electrification timelines from major automotive manufacturers, and consumer demand for advanced driver-assistance systems and connected vehicle technologies

-

Passenger vehicles account for the dominant vehicle control unit market share at approximately 68% with the highest CAGR of 5.2%, as consumers increasingly demand electric vehicles and advanced safety features in personal transportation, while commercial vehicle segments are experiencing strong growth driven by fleet electrification initiatives and logistics optimization requirements

-

ADAS applications contribute the most significant share to the market, representing approximately 42% of total demand, as regulatory requirements and consumer safety expectations drive widespread adoption of collision avoidance systems, lane-keeping assistance, and automated parking features across vehicle segments

-

Body electronics and powertrain control processes are most popular in current vehicle control unit deployments, with body electronics managing lighting, climate control, and access systems, while powertrain control dominates in electric vehicles where sophisticated battery management and motor control are critical for performance and range optimization

-

The electric vehicle segment will experience the fastest growth through 2033, projected to expand at a CAGR of 6.8% with an anticipated market share of 38%, as automotive manufacturers accelerate their transition to zero-emission powertrains and governments implement increasingly stringent emission regulations and electrification incentives

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 95.76 Billion | Market Size by 2026 | USD 65.18 Billion | Market Size by 2025 | USD 62.41 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 4.99% | Dominating Region | Asia-Pacific | Fastest Growing Region | North America | Segments Covered | By Vehicle Type, By Application, By Voltage, By Capacity, By Propulsion Type, By Region | Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

Electrification Momentum and ADAS Integration Accelerating Vehicle Control Unit Adoption

| Approximate % Impact on CAGR Forecast | +2.5% to +3.2% |

|---|---|

| Geographic Relevance | Global, particularly strong in Asia-Pacific and North America |

| Impact Timeline | 2025-2033 with peak impact 2027-2030 |

The accelerating transition to electric vehicles represents the most significant driver propelling the vehicle control unit market forward, as electrified powertrains require sophisticated electronic management systems that far exceed the complexity of traditional internal combustion engines. Electric vehicles demand vehicle control units capable of managing battery thermal conditions, optimizing energy recuperation during regenerative braking, coordinating power distribution across multiple electric motors, and interfacing with external charging infrastructure. Major automotive manufacturers including Tesla, General Motors, Ford, Volkswagen, and numerous Chinese electric vehicle producers are committing billions of dollars to electrification programs, with many announcing plans to transition their entire product portfolios to electric powertrains within the next decade. This widespread industry commitment is creating sustained demand for advanced vehicle control unit technologies across all vehicle segments, from compact passenger cars to heavy commercial vehicles, with particular intensity in markets where government incentives and regulatory mandates are accelerating electric vehicle adoption rates beyond organic consumer demand.

The proliferation of advanced driver-assistance systems is simultaneously driving the market growth as automotive manufacturers integrate increasingly sophisticated safety and convenience features to meet regulatory requirements and differentiate their products in competitive markets. Modern ADAS implementations require vehicle control units to process data from multiple sensor types including cameras, radar, ultrasonic sensors, and increasingly lidar systems, while executing real-time control decisions for steering, braking, and acceleration systems. The market is benefiting from regulatory mandates in Europe, North America, and Asia requiring automatic emergency braking, lane departure warning, and other ADAS features as standard equipment on new vehicles. As autonomous driving capabilities progress through SAE levels toward higher automation, the market will experience additional growth driven by the need for redundant systems, enhanced computational power, and fail-operational architectures that can maintain safe vehicle operation even when individual components experience failures.

Restraints Impact Analysis

High Development Costs and Cybersecurity Concerns Creating Market Entry Barriers

| Approximate % Impact on CAGR Forecast | -1.2% to -1.8% |

|---|---|

| Geographic Relevance | Global, particularly affecting emerging markets and smaller manufacturers |

| Impact Timeline | 2025-2029 with gradual mitigation thereafter |

The substantial investment required to develop automotive-grade vehicle control unit technologies represents a significant barrier restraining market expansion, particularly for smaller automotive manufacturers and suppliers attempting to compete with established industry leaders. Developing vehicle control units that meet stringent automotive safety standards including ISO 26262 for functional safety, ASPICE for software development processes, and various electromagnetic compatibility requirements demands extensive engineering resources, sophisticated testing facilities, and lengthy validation cycles that can extend product development timelines to five years or more. The vehicle control unit market faces additional cost pressures from the need to achieve automotive qualification for semiconductor components, which requires extensive reliability testing under extreme temperature ranges, vibration profiles, and electrical stress conditions that far exceed consumer electronics standards. These high development costs create consolidation pressures within the market, favoring large tier-one suppliers with global scale and deep engineering capabilities while limiting opportunities for innovative startups and regional players to gain market share.

Cybersecurity vulnerabilities and data privacy concerns are emerging as critical restraints within the market as vehicles become increasingly connected and software-defined. Vehicle control units that communicate with external networks for over-the-air updates, telematics services, and vehicle-to-everything connectivity create potential attack vectors that malicious actors could exploit to compromise vehicle safety, steal personal information, or disrupt transportation systems. The market must address evolving cybersecurity regulations including the United Nations ECE R155 and R156 standards that mandate comprehensive cybersecurity management systems and software update processes throughout vehicle lifecycles. Implementing robust cybersecurity measures adds complexity and cost to vehicle control unit development, requiring secure boot processes, encrypted communications, intrusion detection systems, and security operations centers to monitor threats. Consumer concerns about data privacy and potential hacking incidents can slow vehicle control unit market adoption, particularly for connected features and autonomous driving capabilities that rely heavily on data collection and external communications.

Opportunities Impact Analysis

Vehicle-to-Everything Connectivity and Software-Defined Architectures Opening New Revenue Streams

| Approximate % Impact on CAGR Forecast | +1.8% to +2.5% |

|---|---|

| Geographic Relevance | North America, Europe, and developed Asia-Pacific markets leading adoption |

| Impact Timeline | 2027-2033 with accelerating impact |

The emergence of vehicle-to-everything communication technologies presents substantial opportunities within the vehicle control unit market as automotive ecosystems evolve from isolated vehicles to integrated nodes within intelligent transportation systems. Vehicle control units are becoming the central interface enabling vehicles to exchange information with other vehicles, roadside infrastructure, pedestrians, and cloud-based services to improve traffic flow, enhance safety, and enable new mobility services. The market will benefit from government investments in smart city infrastructure, particularly in North America, Europe, China, and Japan, where transportation authorities are deploying connected traffic signals, digital roadside infrastructure, and cooperative perception systems that can share information with vehicles. As 5G networks expand coverage and cellular vehicle-to-everything technology matures, vehicle control units will enable applications including coordinated intersection crossing, platooning for commercial vehicles, hazard warnings from other vehicles, and predictive traffic management that reduces congestion and emissions.

Software-defined vehicle architectures are creating opportunities for vehicle control unit manufacturers to capture recurring revenue through over-the-air updates and feature-on-demand business models that were previously impossible with traditional automotive hardware. The market is shifting from a purely hardware-centric transaction model to a hybrid approach where base vehicle control unit hardware is designed with excess computational capacity that can be unlocked through software purchases throughout the vehicle lifecycle. Automotive manufacturers are developing subscription services for enhanced ADAS features, performance upgrades, and comfort functions that are delivered through vehicle control unit software updates, creating continuous revenue streams that improve profitability beyond initial vehicle sales. This transformation is attracting technology companies, semiconductor manufacturers, and software firms to the market, as the value proposition shifts toward software development capabilities, cloud service integration, and user experience design rather than purely hardware engineering expertise.

Segment Analysis

By Application: ADAS Segment

Advanced Safety Systems Driving Premium Vehicle Control Unit Demand Across All Vehicle Categories

The advanced driver-assistance systems application segment dominates the vehicle control unit market with a commanding share of approximately 42.5% and is projected to expand at a CAGR of 5.4% through 2033, driven by regulatory mandates, consumer safety expectations, and the gradual progression toward autonomous driving capabilities. ADAS applications require vehicle control units with exceptional processing power, low-latency sensor fusion capabilities, and redundant safety architectures that can process data from multiple camera systems, radar sensors, and ultrasonic detectors simultaneously while executing real-time control decisions for steering, braking, and acceleration systems. The market for ADAS applications is experiencing particularly strong growth in North America and Europe, where regulatory requirements mandate automatic emergency braking, lane-keeping assistance, and other safety features on new vehicles, compelling automotive manufacturers to integrate sophisticated vehicle control units even on entry-level models. Leading companies including Robert Bosch, Continental AG, and Denso Corporation are investing heavily in developing centralized ADAS domain controllers that consolidate multiple sensor processing functions into single high-performance vehicle control units, reducing system complexity while improving reliability and enabling over-the-air feature updates.

The evolution from basic ADAS features toward higher levels of driving automation is transforming vehicle control unit requirements, as Level 3 and Level 4 autonomous systems demand fail-operational architectures with redundant processing, power supplies, and communication networks to maintain safe vehicle operation even during component failures. The market is witnessing increased adoption of high-performance computing platforms incorporating multiple system-on-chip processors, hardware accelerators for neural network inference, and specialized safety microcontrollers that monitor system integrity continuously. Regional variations in ADAS adoption rates create distinct opportunities within the market, with Asia-Pacific emerging as the fastest-growing region driven by Chinese electric vehicle manufacturers integrating advanced autonomous driving features as standard equipment and Japanese automotive companies leveraging their semiconductor expertise to develop integrated vehicle control unit solutions. Companies operating in the ADAS segment of the market must navigate complex certification requirements, achieve automotive safety integrity levels appropriate for safety-critical functions, and develop robust sensor fusion algorithms that perform reliably across diverse environmental conditions including adverse weather, poor lighting, and challenging urban scenarios.

By Vehicle Type: Passenger Cars Segment

Volume Production and Feature Proliferation Establishing Passenger Vehicles as Core Market Segment

Passenger cars represent the largest vehicle type segment within the market, accounting for approximately 68% of total demand with a projected CAGR of 5.2% through 2033, as personal mobility transitions rapidly toward electrification and digitalization across all market tiers from economy to luxury segments. The passenger car segment of the market encompasses vehicles ranging from compact electric city cars to premium sedans and sport utility vehicles, each requiring vehicle control units tailored to specific performance, efficiency, and feature requirements. Asia-Pacific dominates passenger car vehicle control unit production, led by Chinese electric vehicle manufacturers including BYD, NIO, and Xpeng that are producing millions of electric vehicles annually, each equipped with sophisticated vehicle control units managing battery systems, electric powertrains, and advanced connectivity features. North American and European passenger car markets are experiencing accelerated vehicle control unit adoption as traditional automotive manufacturers including General Motors, Ford, Volkswagen Group, and Stellantis execute aggressive electrification strategies and integrate advanced driver-assistance systems across their product portfolios to meet regulatory requirements and consumer expectations.

The premium passenger car segment within the market is driving innovation in computational power, sensor integration, and software-defined functionality, as luxury vehicle manufacturers differentiate their products through advanced autonomous driving capabilities, personalized user experiences, and seamless connectivity with smartphones and smart home ecosystems. Vehicle control units deployed in premium passenger cars increasingly incorporate high-performance computing platforms based on latest-generation automotive processors from companies including NXP Semiconductors, Infineon Technologies, and NVIDIA, enabling sophisticated functions including natural language voice control, gesture recognition, augmented reality displays, and predictive maintenance analytics. The vehicle control unit market for passenger cars is witnessing architectural convergence as manufacturers consolidate distributed electronic control units into centralized domain controllers and zone-based architectures that reduce vehicle wiring harnesses by up to 30%, decrease vehicle weight, and enable more flexible software-defined feature activation throughout vehicle lifecycles. Regional preferences significantly influence passenger car vehicle control unit specifications, with North American consumers prioritizing performance and towing capabilities, European buyers emphasizing efficiency and emissions reduction, and Asian markets showing strong demand for connectivity features and integration with mobile payment ecosystems.

Regional Insights

Asia-Pacific

Manufacturing Scale and Electric Vehicle Leadership Establishing Regional Dominance

Asia-Pacific commands the dominant position in the market with approximately 46% of global revenue share and is projected to maintain leadership throughout the forecast period, driven by the region's position as the global automotive manufacturing hub and the rapid electrification of transportation led by Chinese government policies and substantial domestic electric vehicle production. The market in Asia-Pacific benefits from China's status as the world's largest automotive market and leading electric vehicle producer, with annual electric vehicle sales exceeding 8 million units and continuing to grow at double-digit rates as government incentives, charging infrastructure expansion, and consumer acceptance drive mainstream adoption. Chinese automotive manufacturers including BYD, Geely, Great Wall Motors, and SAIC Motor are integrating advanced vehicle control units across their product portfolios, while Chinese electric vehicle startups such as NIO, Xpeng, Li Auto, and WM Motor are developing proprietary vehicle control unit technologies and software platforms that compete directly with Western automotive suppliers. Japan maintains significant influence within the Asia-Pacific vehicle control unit market through companies including Denso Corporation, Mitsubishi Electric, and Hitachi Automotive Systems that supply sophisticated electronic components to global automotive manufacturers, while South Korean companies including Hyundai Mobis and LG Electronics are developing integrated vehicle control unit solutions for the Hyundai-Kia automotive group's aggressive electrification programs.

The competitive dynamics within the Asia-Pacific vehicle control unit market differ substantially from Western markets, with greater vertical integration among automotive manufacturers, closer collaboration between vehicle producers and semiconductor companies, and more rapid product development cycles that emphasize feature richness and connectivity over traditional automotive validation timelines. The market in Asia-Pacific is experiencing robust growth in India, where domestic manufacturers including Tata Motors and Mahindra & Mahindra are developing electric vehicle platforms for both passenger and commercial vehicle segments, supported by government electrification targets and localization incentives. Southeast Asian markets including Thailand, Indonesia, and Vietnam are emerging as secondary manufacturing hubs within the Asia-Pacific vehicle control unit market as automotive companies diversify production away from concentrated Chinese facilities and leverage lower labor costs and preferential trade agreements. Key players dominating the Asia-Pacific market include Denso Corporation (Japan), Hyundai Mobis (South Korea), Mitsubishi Electric (Japan), BYD (China), and numerous specialized Chinese electronics companies that supply components and subsystems to the region's extensive automotive manufacturing ecosystem.

North America

Innovation Leadership and Accelerated Electrification Driving Fastest Regional Growth

North America represents the fastest-growing regional market for vehicle control units with a projected CAGR of 6.2% through 2033, driven by aggressive electrification commitments from major automotive manufacturers, substantial government incentives supporting electric vehicle adoption, and consumer demand for advanced autonomous driving capabilities and connectivity features. The vehicle control unit market in North America benefits from the region's leadership in electric vehicle innovation led by Tesla, which has demonstrated the commercial viability of premium electric vehicles with sophisticated vehicle control units managing integrated powertrains, battery systems, and advanced driver-assistance features. Traditional North American automotive manufacturers including General Motors, Ford Motor Company, and Stellantis are investing over 100 billion dollars collectively in electric vehicle development and manufacturing capacity through 2030, with each company planning to transition significant portions of their product portfolios to electric powertrains that require advanced vehicle control unit technologies. The North American market is characterized by high-value vehicle segments with consumers willing to pay premium prices for advanced features, creating opportunities for sophisticated vehicle control units with enhanced processing capabilities, multiple sensor inputs, and over-the-air update functionality.

Government policy is playing a critical role in accelerating North American vehicle control unit market growth through infrastructure investments, tax incentives, and regulatory requirements that favor electric vehicle adoption and advanced safety technologies. The United States Infrastructure Investment and Jobs Act allocated 7.5 billion dollars for electric vehicle charging infrastructure development, while the Inflation Reduction Act provides tax credits up to 7500 dollars for qualifying electric vehicle purchases, both of which are stimulating demand for vehicles equipped with advanced vehicle control units. The market in Canada is growing rapidly driven by provincial zero-emission vehicle mandates in British Columbia and Quebec, while Mexico is emerging as a significant manufacturing location for vehicle control unit components and assemblies as automotive suppliers establish production facilities to serve North American automotive manufacturers. Leading players in the North American market include Continental AG with major engineering centers in Michigan, Robert Bosch with extensive North American operations, Aptiv (USA) which develops electrical architecture and vehicle control unit solutions, Texas Instruments (USA) supplying semiconductor components, and numerous specialized suppliers including Karma Automotive and Rivian developing proprietary vehicle control unit platforms for their electric vehicle programs.

Top Key Players

-

Robert Bosch GmbH (Germany)

-

Continental AG (Germany)

-

Denso Corporation (Japan)

-

NXP Semiconductors N.V. (Netherlands)

-

Texas Instruments Incorporated (USA)

-

STMicroelectronics N.V. (Switzerland)

-

Infineon Technologies AG (Germany)

-

Mitsubishi Electric Corporation (Japan)

-

ZF Friedrichshafen AG (Germany)

-

Hyundai Mobis (South Korea)

-

Valeo S.A. (France)

-

Autoliv Inc. (Sweden)

-

Aptiv PLC (USA)

-

NVIDIA Corporation (USA)

-

Qualcomm Technologies Inc. (USA)

Recent Developments

-

Robert Bosch GmbH, Continental AG, Infineon Technologies, and NXP Semiconductors (2023): Announced a joint venture with TSMC to establish European Semiconductor Manufacturing Company in Dresden, Germany, with total investments exceeding 10 billion euros to produce advanced semiconductors for automotive applications including vehicle control units, with production targeted to begin by 2027

-

General Motors (2025): Announced strategic partnerships with multiple semiconductor suppliers to secure dedicated manufacturing capacity for automotive-grade processors and vehicle control unit components, supporting the company's plan to produce 1 million electric vehicles annually by 2026 and maintain its commitment to an all-electric future

-

Tesla Inc. (2024): Completed development of its proprietary Hardware 4 vehicle control unit platform featuring significantly enhanced processing capabilities for autonomous driving, improved neural network inference performance, and reduced manufacturing costs through vertical integration of semiconductor design and software development

-

Denso Corporation (2024): Expanded its vehicle control unit manufacturing capacity in Asia with a new 500 million dollar facility in Thailand dedicated to producing integrated domain controllers and zone-based vehicle control units for electric vehicles, supporting Japanese and international automotive manufacturers' electrification programs

-

Continental AG (2025): Acquired a specialized software company to strengthen its capabilities in over-the-air updates, cybersecurity, and software-defined vehicle architectures, enabling the company to offer comprehensive vehicle control unit solutions that combine hardware, embedded software, and cloud services for next-generation vehicles

Market Trends

Centralization and Software-Defined Architectures Reshaping Vehicle Electronics Landscape

The vehicle control unit market is experiencing a fundamental architectural transformation as automotive manufacturers transition from distributed electronic control unit networks to centralized domain controllers and zone-based architectures that consolidate functionality into fewer, more powerful computing platforms. This centralization trend is driven by the need to reduce vehicle wiring complexity, decrease manufacturing costs, enable more flexible software-defined features, and support over-the-air updates throughout vehicle lifecycles. Modern vehicle control unit architectures are organized around domain controllers responsible for specific functional areas including ADAS, body electronics, powertrain, and infotainment, with high-speed Ethernet backbones replacing traditional controller area network communications to support the massive data rates required for multiple high-resolution cameras and sensor systems. The market is witnessing increased adoption of zone controllers that consolidate all electronic functions within specific physical areas of vehicles, further reducing wiring requirements while enabling more modular vehicle designs where functionality is defined through software rather than fixed hardware configurations.

Software-defined vehicle approaches are transforming business models within the market as automotive manufacturers seek to capture recurring revenue through feature-on-demand offerings, subscription services, and continuous feature enhancements delivered through over-the-air updates. The market is experiencing convergence between automotive engineering practices and consumer electronics development methodologies, with shorter development cycles, agile software development processes, and continuous integration approaches replacing traditional waterfall development methods. Cybersecurity and functional safety are becoming increasingly intertwined within vehicle control unit development, as connected vehicles must address both traditional safety hazards from component failures and emerging security threats from malicious actors attempting to compromise vehicle systems. The vehicle control unit market is also witnessing increased collaboration between automotive manufacturers, semiconductor companies, and cloud service providers to develop integrated solutions that combine edge computing capabilities within vehicles with cloud-based analytics, machine learning model training, and remote diagnostics that optimize vehicle performance throughout operational lifecycles.

Segments Covered in the Report

By Vehicle Type

-

Passenger Cars

-

Commercial Vehicles

-

Electric Two-Wheelers

-

Off-Highway Vehicles

By Application

-

Advanced Driver Assistance Systems (ADAS)

-

Body Electronics

-

Powertrain Control

-

Infotainment Systems

-

Battery Management

-

Thermal Management

By Voltage

-

12/24V

-

36/48V

-

High Voltage (above 400V)

By Capacity

-

16-bit

-

32-bit

-

64-bit

By Propulsion Type

-

Internal Combustion Engine (ICE)

-

Battery Electric Vehicle (BEV)

-

Hybrid Electric Vehicle (HEV)

-

Plug-in Hybrid Electric Vehicle (PHEV)

-

Fuel Cell Electric Vehicle (FCEV)

By Region

-

North America (USA, Canada, Mexico)

-

Europe (Germany, France, UK, Italy, Spain, Rest of Europe)

-

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Rest of Asia-Pacific)

-

Latin America (Brazil, Argentina, Rest of Latin America)

-

Middle East & Africa (GCC Countries, South Africa, Rest of MEA)

Frequently Asked Questions:

Answer: The vehicle control unit market is projected to reach USD 95.76 billion by 2033, growing from USD 62.41 billion in 2025. This growth is driven by electric vehicle adoption and advanced driver-assistance systems integration.

Answer: The vehicle control unit market is expected to grow at a CAGR of 4.99% from 2026 to 2033. This growth rate reflects increasing electrification trends and autonomous driving technology development across global automotive markets.

Answer: Asia-Pacific dominates the vehicle control unit market with approximately 46% market share, driven by China's massive electric vehicle production volumes. North America is emerging as the fastest-growing region with accelerated electrification investments from major automotive manufacturers.

Answer: Advanced driver-assistance systems represent the largest application segment in the vehicle control unit market with 42.5% share, followed by body electronics and powertrain control. These applications are critical for modern vehicle safety, efficiency, and user experience delivery.

Answer: Leading companies in the vehicle control unit market include Robert Bosch, Continental AG, Denso Corporation, NXP Semiconductors, and Texas Instruments. These companies provide comprehensive vehicle control unit solutions combining hardware, software, and automotive expertise to global manufacturers.