Viral Vectors & Plasmid DNA Manufacturing Market Overview

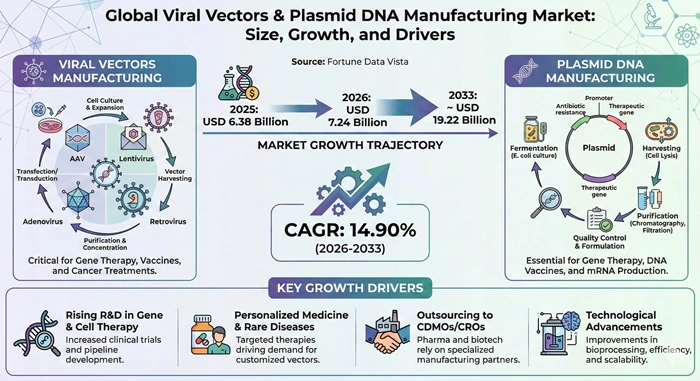

The global viral vectors & plasmid DNA manufacturing market size is valued at USD 6.38 billion in 2025 and is predicted to increase from USD 7.24 billion in 2026 to approximately USD 19.22 billion by 2033, growing at a CAGR of 14.90% from 2026 to 2033. This specialized sector serves as the backbone of modern gene therapy development, enabling the production of critical components required for advanced therapeutic interventions targeting genetic disorders, cancers, and rare diseases.

The viral vectors & plasmid DNA manufacturing market has emerged as a cornerstone of biotechnology innovation, driven by rapid advancements in cell and gene therapy applications. Manufacturing facilities worldwide are expanding their capabilities to meet escalating demand from pharmaceutical companies, research institutions, and clinical trial sponsors. These biological materials function as delivery vehicles that transport therapeutic genes into patient cells, offering transformative treatment options for conditions previously considered incurable. The industry encompasses sophisticated production processes including upstream cell cultivation, downstream purification, and quality control measures that ensure regulatory compliance and patient safety.

AI Impact on the Viral Vectors & Plasmid DNA Manufacturing Industry

Revolutionizing Production Efficiency Through Intelligent Automation and Predictive Analytics

Artificial intelligence is fundamentally transforming the viral vectors & plasmid DNA manufacturing market by introducing unprecedented levels of precision and efficiency into bioprocessing operations. Machine learning algorithms analyze vast datasets from production runs to identify optimal cultivation conditions, predict yield outcomes, and detect potential quality deviations before they impact final product specifications. AI-powered systems monitor thousands of process parameters in real time, enabling manufacturers to maintain consistent quality across batches while reducing production timelines by up to thirty percent. These intelligent platforms evaluate complex interactions between cell growth kinetics, nutrient consumption patterns, and environmental variables to recommend process adjustments that maximize vector titers and plasmid purity.

The integration of AI technologies extends beyond process optimization to encompass design and development phases within the viral vectors & plasmid DNA manufacturing market. Computational models predict the safety and efficacy profiles of novel vector constructs by analyzing genomic sequences, structural configurations, and historical performance data from similar therapeutic candidates. This accelerates the identification of promising gene targets while minimizing costly experimental iterations during early development stages. Quality assurance procedures benefit from AI-driven image recognition systems that detect subtle anomalies in cell morphology and automated analytics that ensure linearity, robustness, and reproducibility of manufactured products. Manufacturing facilities implementing these technologies report significant reductions in deviation rates and faster regulatory approval timelines for their gene therapy products.

Growth Factors

Surging Demand for Gene Therapies and Regulatory Approvals Fuel Market Expansion

The viral vectors & plasmid DNA manufacturing market experiences robust growth propelled by the accelerating clinical development and commercialization of gene-based therapeutics across multiple disease areas. Regulatory agencies worldwide have approved numerous gene therapy products over recent years, including CAR-T cell therapies for hematological malignancies and adeno-associated virus treatments for inherited retinal disorders and hemophilia. Each approved therapy creates sustained demand for large-scale manufacturing capacity capable of producing clinical-grade viral vectors and plasmid DNA under stringent good manufacturing practice standards. Pharmaceutical companies transitioning successful candidates from Phase III trials to commercial launch require manufacturing partners who can deliver consistent quality at significantly larger volumes than research-scale production.

Technological breakthroughs in vector engineering and bioprocessing methodologies continue driving expansion within the viral vectors & plasmid DNA manufacturing market. Innovations such as suspension cell culture systems, transient transfection platforms, and continuous bioprocessing enable manufacturers to achieve higher productivity with improved cost efficiency. Single-use bioreactor systems reduce capital expenditure requirements while minimizing contamination risks and turnaround times between production campaigns. Advanced purification technologies including membrane-based chromatography and tangential flow filtration deliver superior product purity while reducing processing time. These manufacturing enhancements make gene therapies more economically viable, encouraging pharmaceutical developers to pursue broader patient populations and expand their therapeutic pipelines in oncology, rare diseases, and genetic disorder treatment.

Market Outlook

Industry Dynamics and Strategic Positioning Shape Future Trajectory

The viral vectors & plasmid DNA manufacturing market represents a critical intersection of molecular biology expertise and industrial-scale production capabilities. This sector underpins the therapeutic revolution occurring across precision medicine, where treatments are tailored to individual genetic profiles rather than employing one-size-fits-all approaches. Manufacturing operations require sophisticated infrastructure including specialized cleanroom facilities, validated production equipment, and highly trained personnel capable of executing complex multistep processes under regulatory oversight. Strategic partnerships between biopharmaceutical companies and contract development and manufacturing organizations have become increasingly prevalent as therapeutic developers seek to access specialized capabilities without bearing the substantial capital costs of building proprietary facilities.

The competitive landscape within the viral vectors & plasmid DNA manufacturing market continues evolving through consolidation, capacity expansions, and technological differentiation. Established players leverage their global footprints and comprehensive service offerings to secure long-term supply agreements with major pharmaceutical clients, while specialized manufacturers focus on specific vector platforms or niche applications to establish technical leadership. Geographic expansion into Asia Pacific markets reflects both cost optimization strategies and proximity to emerging biotechnology ecosystems in China, India, and Japan. Investment activity remains robust as venture capital firms, pharmaceutical corporations, and government entities recognize the strategic importance of manufacturing capacity to support the gene therapy revolution. This capital influx funds facility construction, equipment upgrades, and workforce development initiatives that collectively strengthen the industry's ability to meet escalating demand.

Expert Speaks

-

Albert Bourla, CEO of Pfizer, emphasized that gene therapy manufacturing capabilities represent a cornerstone of future pharmaceutical innovation, with viral vector production capacity becoming as strategically important as traditional small molecule manufacturing infrastructure for the industry's next decade of growth.

-

Emma Walmsley, CEO of GSK, highlighted that partnerships with specialized viral vector manufacturers enable faster advancement of gene therapy candidates through clinical development, allowing pharmaceutical companies to focus resources on therapeutic discovery while leveraging external manufacturing expertise.

-

Pascal Soriot, CEO of AstraZeneca, noted that the integration of artificial intelligence into biomanufacturing processes for viral vectors is transforming production economics, making gene therapies accessible to broader patient populations through improved yields and reduced manufacturing costs.

Key Report Takeaways

-

North America dominates the viral vectors & plasmid DNA manufacturing market with approximately 49% revenue share, driven by extensive clinical trial activity, concentrated pharmaceutical industry presence, and favorable regulatory frameworks supporting gene therapy development.

-

Asia Pacific emerges as the fastest-growing region with substantial investments in biotechnology infrastructure, expanding contract manufacturing capabilities, and supportive government initiatives that accelerate regional market growth at an exceptional pace.

-

Research institutes constitute the largest end-use segment, accounting for nearly 58% market share, as academic and government research facilities conduct fundamental studies supporting early-stage gene therapy innovation and translational research programs.

-

The adeno-associated virus segment commands the highest vector type market share at approximately 21%, reflecting widespread adoption across approved gene therapies due to its favorable safety profile, broad tissue tropism, and efficient gene delivery characteristics.

-

Vaccinology represents the dominant application segment with 22.5% market share, accelerated by viral vector platforms' critical role in modern vaccine development including COVID-19 immunization programs and emerging infectious disease preparedness initiatives.

-

The downstream processing workflow segment maintains market leadership with 54% share, as purification and formulation steps remain the most technically complex and cost-intensive components of viral vector and plasmid DNA production operations.

-

The cancer disease segment holds the largest market share at 38% and demonstrates the fastest growth trajectory, fueled by expanding CAR-T cell therapy applications and increasing clinical trials for gene-based oncology treatments targeting solid tumors.

Market Scope

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 19.22 Billion | Market Size by 2026 | USD 7.24 Billion | Market Size by 2025 | USD 6.38 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 14.90% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Vector Type, Workflow, Application, End-Use, Disease | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics

Drivers Impact Analysis

Exponential Growth in Clinical Trials and Therapeutic Approvals Propelling Manufacturing Demand

| Impact Factor | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Gene Therapy Clinical Trials Expansion | +4.2% | Global (North America, Europe) | 2026-2030 |

| Regulatory Approval Acceleration | +3.8% | North America, Europe | 2026-2033 |

| Personalized Medicine Adoption | +3.5% | Global | 2027-2033 |

The viral vectors & plasmid DNA manufacturing market benefits significantly from the unprecedented expansion of gene therapy clinical development programs worldwide. Over two thousand active clinical trials currently employ viral vectors or plasmid DNA as therapeutic components, with oncology and rare disease indications representing the most substantial trial concentrations. Regulatory pathways established by the FDA and EMA specifically for advanced therapy medicinal products have accelerated approval timelines, encouraging pharmaceutical companies to advance more candidates through late-stage development. This regulatory support creates sustained demand for manufacturing capacity capable of producing materials meeting increasingly stringent quality specifications. The success of pioneering gene therapies such as Luxturna, Zolgensma, and various CAR-T products demonstrates clinical viability and encourages additional investment in therapeutic development programs requiring viral vector and plasmid DNA manufacturing services.

Contract development and manufacturing organizations within the viral vectors & plasmid DNA manufacturing market provide critical infrastructure enabling smaller biotechnology companies to advance therapeutic candidates without substantial capital investment in proprietary facilities. Building a compliant viral vector manufacturing facility requires investments ranging from two hundred to five hundred million dollars and development timelines extending three to five years, creating significant barriers for emerging companies. Industry surveys indicate that seventy-eight percent of biotechnology developers outsource viral vector manufacturing to preserve capital efficiency and accelerate development timelines. This outsourcing trend drives capacity expansion among specialized manufacturers who collectively provide the backbone supporting gene therapy innovation across academic institutions, biotech startups, and established pharmaceutical corporations pursuing next-generation treatment modalities.

Restraints Impact Analysis

Manufacturing Complexity and Cost Pressures Challenging Market Accessibility

| Impact Factor | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High Production Costs | -2.5% | Global | 2026-2033 |

| Technical Complexity | -1.8% | Emerging Markets | 2026-2030 |

| Regulatory Stringency | -1.2% | Global | 2026-2033 |

The viral vectors & plasmid DNA manufacturing market faces significant challenges related to the inherent complexity and elevated costs associated with producing clinical-grade biological materials. Downstream processing steps including purification, concentration, and formulation account for substantial portions of total manufacturing expenses due to sophisticated chromatography systems, ultrafiltration equipment, and extensive analytical testing requirements. Process development timelines extend months or years as manufacturers optimize cultivation conditions, transfection protocols, and purification strategies for each unique vector construct. Variability in cell-based assays creates noise that complicates process improvement efforts, requiring extensive trending analysis to establish confidence in optimization strategies. These technical hurdles result in manufacturing costs that can reach hundreds of thousands of dollars per batch, limiting accessibility for resource-constrained therapeutic developers and potentially restricting patient access to approved gene therapies.

Quality control and regulatory compliance requirements impose additional constraints on the viral vectors & plasmid DNA manufacturing market. Manufacturers must maintain comprehensive documentation systems, validate all production equipment and analytical methods, and demonstrate consistent performance across multiple production campaigns before regulatory agencies approve facilities for commercial manufacturing. Host cell impurities, residual DNA fragments, and endotoxin contamination must be reduced to extraordinarily low levels through multiple purification steps, each requiring specialized equipment and technical expertise. Regulatory inspections assess facility design, environmental monitoring systems, personnel training programs, and deviation management processes with exacting standards. These requirements create substantial operational overhead and necessitate continuous investment in quality systems, potentially discouraging market entry by smaller manufacturers and concentrating production capacity among established industry leaders.

Opportunities Impact Analysis

Emerging Markets and Novel Vector Platforms Opening Growth Avenues

| Impact Factor | (≈) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Asia Pacific Market Expansion | +3.2% | China, India, Japan | 2026-2033 |

| mRNA Vaccine Platform Growth | +2.8% | Global | 2026-2030 |

| Novel Vector Engineering | +2.4% | North America, Europe | 2027-2033 |

Geographic expansion into Asia Pacific markets presents substantial growth opportunities within the viral vectors & plasmid DNA manufacturing market. China, India, Japan, and South Korea have implemented government initiatives supporting biotechnology development, established regulatory frameworks facilitating gene therapy approvals, and invested heavily in biomanufacturing infrastructure. These markets offer cost advantages including lower labor expenses and operational costs while maintaining increasingly sophisticated technical capabilities and quality standards. Multinational pharmaceutical companies are establishing strategic partnerships with Asian manufacturers to access regional production capacity and serve local patient populations more effectively. The substantial patient populations in these countries experiencing high rates of genetic disorders and cancers create robust domestic demand for gene therapies, encouraging both local and international manufacturers to expand operations in the region.

Novel vector engineering approaches and emerging therapeutic modalities create additional opportunities within the viral vectors & plasmid DNA manufacturing market. Non-integrating lentiviral vectors designed to avoid insertional mutagenesis represent promising platforms for applications requiring transient gene expression without permanent genomic modification. Synthetic biology techniques enable the design of plasmid backbones with enhanced production characteristics, improved safety profiles, and optimized gene expression patterns. The success of mRNA vaccine platforms during the COVID-19 pandemic has demonstrated the viability of nucleic acid therapeutics and created substantial demand for plasmid DNA used as starting materials in mRNA production processes. Gene editing technologies including CRISPR-Cas9 systems rely on efficient delivery mechanisms where viral vectors play essential roles, expanding addressable markets beyond traditional gene replacement strategies. These innovations diversify revenue streams for manufacturers and position the industry to support an expanding spectrum of therapeutic approaches.

Segment Analysis

Adeno-Associated Virus (AAV) Segment

Dominant Vector Platform Driving Clinical and Commercial Gene Therapy Success

The adeno-associated virus segment commands the leading position within the viral vectors & plasmid DNA manufacturing market, accounting for approximately twenty-one percent of total market revenue in recent assessments. This prominence reflects AAV's exceptional safety profile characterized by low immunogenicity, absence of pathogenic potential, and well-tolerated administration across diverse patient populations. AAV vectors demonstrate broad tissue tropism with engineered serotypes capable of targeting specific organs including retina, liver, muscle, and central nervous system tissues with remarkable precision. Multiple AAV-based gene therapies have received regulatory approvals including Luxturna for inherited retinal dystrophy, Zolgensma for spinal muscular atrophy, and Hemgenix for hemophilia B, validating the platform's clinical effectiveness and creating substantial commercial manufacturing demand. North America leads AAV manufacturing capacity with concentrated expertise among contract development organizations located in the United States, while European manufacturers in Germany, Switzerland, and the United Kingdom contribute significant production capabilities supporting both clinical development and commercial supply requirements.

Manufacturing complexity within the AAV segment necessitates sophisticated production platforms and extensive process optimization efforts that distinguish leading manufacturers in the viral vectors & plasmid DNA manufacturing market. AAV production typically employs mammalian cell systems including HEK293 or insect cell platforms, each requiring specialized cultivation expertise and downstream processing strategies. Purification challenges arise from the need to separate full viral particles containing therapeutic genes from empty capsids lacking genetic cargo, demanding advanced analytical capabilities and high-resolution chromatography systems. The segment demonstrates strong growth projections exceeding eighteen percent compound annual growth rate through the forecast period, driven by expanding clinical pipelines addressing ophthalmologic conditions, neuromuscular disorders, metabolic diseases, and cardiovascular indications. Major pharmaceutical companies including Novartis, Roche, and BioMarin maintain active AAV therapeutic development programs, while specialized manufacturers such as Oxford Biomedica, FUJIFILM Diosynth Biotechnologies, and Lonza expand dedicated AAV production facilities to meet escalating demand from both clinical trial sponsors and commercial therapy producers.

Vaccinology Application Segment

Pandemic Response and Infectious Disease Preparedness Anchoring Market Leadership

The vaccinology application segment maintains the largest market share within the viral vectors & plasmid DNA manufacturing market, representing approximately twenty-two and a half percent of segment revenue and demonstrating exceptional growth momentum. Viral vectors serve as critical platforms for modern vaccine development, offering advantages including rapid design cycles, scalable production processes, and robust immune response generation compared to traditional vaccine technologies. The COVID-19 pandemic dramatically accelerated adoption of viral vector vaccine platforms, with products such as the Oxford-AstraZeneca and Johnson & Johnson vaccines demonstrating efficacy and safety across millions of administered doses worldwide. This success validated viral vector approaches for infectious disease applications and stimulated substantial investment in manufacturing infrastructure capable of producing vaccine vectors at population-scale volumes. Plasmid DNA components serve as essential starting materials for mRNA vaccine production, creating additional demand streams within this application category that persist beyond pandemic responses.

Geographic concentration of vaccinology manufacturing within the viral vectors & plasmid DNA manufacturing market reflects established pharmaceutical infrastructure and regulatory expertise in North America and Europe. The United States maintains leadership through companies including Emergent BioSolutions, Catalent, and Thermo Fisher Scientific, which expanded capacity during pandemic responses and now provide commercial manufacturing services for next-generation vaccine candidates. European manufacturers leverage strong academic collaborations and government research funding supporting vaccine innovation programs. Asia Pacific markets demonstrate the fastest growth rates within the vaccinology segment as countries including China, India, and South Korea establish domestic vaccine manufacturing capabilities addressing regional health security objectives. Applications extend beyond infectious diseases to include therapeutic cancer vaccines employing viral vectors for delivering tumor-associated antigens and immunomodulatory genes. Leading companies such as Merck KGaA, BioNTech, and Moderna partner with specialized viral vector manufacturers to access production capacity supporting their vaccine development pipelines targeting influenza, Zika virus, respiratory syncytial virus, and various oncology indications.

Regional Insights

North America

Market Leadership Through Innovation Ecosystem and Manufacturing Infrastructure

North America dominates the viral vectors & plasmid DNA manufacturing market with approximately forty-nine percent of global market share, driven by the region's unparalleled biotechnology ecosystem and extensive clinical development activity. The United States accounts for the majority of regional revenue, hosting over two-thirds of worldwide gene therapy clinical trials and maintaining the highest concentration of approved gene and cell therapy products. This clinical activity generates sustained demand for viral vector and plasmid DNA manufacturing services across all development stages from preclinical research through commercial production. Major pharmaceutical corporations including Pfizer, Johnson & Johnson, Gilead Sciences, and Bristol Myers Squibb maintain headquarters and substantial research operations within the region, while biotechnology hubs in Boston, San Francisco, San Diego, and Research Triangle Park concentrate hundreds of emerging companies pursuing gene therapy innovations.

Manufacturing capacity within North America's viral vectors & plasmid DNA manufacturing market encompasses both captive facilities operated by pharmaceutical companies and extensive contract manufacturing capabilities. Leading contract development and manufacturing organizations including Lonza, Thermo Fisher Scientific, Catalent, FUJIFILM Diosynth Biotechnologies, and Charles River Laboratories operate multiple facilities throughout the United States and Canada, collectively providing thousands of square feet of good manufacturing practice production space. These organizations continue expanding capacity through facility construction projects, equipment installations, and technology platform enhancements responding to demand projections indicating continued market growth exceeding fifteen percent annually. Regional market share reaches approximately 3.12 billion USD in 2026, with forecasts projecting growth to 8.89 billion USD by 2033 at a CAGR of 15.91%. Regulatory support from the FDA through expedited review pathways, orphan drug designations, and collaborative development programs accelerates therapeutic approvals and reinforces North America's leadership position within the global viral vectors & plasmid DNA manufacturing market.

Asia Pacific

Fastest-Growing Region Capitalizing on Infrastructure Investment and Cost Advantages

Asia Pacific emerges as the fastest-growing region within the viral vectors & plasmid DNA manufacturing market, demonstrating exceptional expansion rates as governments prioritize biotechnology development and healthcare infrastructure modernization. China leads regional growth through massive investments in biomanufacturing capacity, supportive regulatory reforms accelerating gene therapy approvals, and rapidly expanding domestic biotechnology sector comprising hundreds of companies pursuing cell and gene therapy development. Government initiatives including Made in China 2025 and the National Biotechnology Development Plan designate biologics manufacturing as strategic priorities, providing funding, tax incentives, and policy support encouraging facility construction and technology transfer. India contributes substantial growth momentum through its skilled scientific workforce, lower operational costs, and increasing participation in global clinical trial networks requiring local manufacturing capabilities.

Manufacturing infrastructure development within Asia Pacific's viral vectors & plasmid DNA manufacturing market reflects both domestic capacity building and international partnerships. Companies such as WuXi Advanced Therapies, GenScript, and Samsung Biologics operate large-scale facilities providing contract manufacturing services to global pharmaceutical clients seeking cost-effective production solutions without compromising quality standards. Japanese manufacturers leverage advanced regenerative medicine expertise and favorable regulatory frameworks supporting innovation in gene and cell therapies, with companies including Takara Bio and Daiichi Sankyo contributing specialized manufacturing capabilities. Regional market projections indicate growth from approximately 1.45 billion USD in 2026 to 4.23 billion USD by 2033, representing a CAGR of 16.45% that substantially exceeds global average growth rates. The substantial patient populations experiencing high disease burdens from genetic disorders, cancers, and infectious diseases create robust domestic demand complementing export-oriented manufacturing strategies, positioning Asia Pacific as an increasingly critical component of global viral vectors & plasmid DNA manufacturing market supply chains.

Top Key Players

-

Lonza Group (Switzerland)

-

Thermo Fisher Scientific (United States)

-

Merck KGaA (Germany)

-

FUJIFILM Diosynth Biotechnologies (United States)

-

Catalent Inc. (United States)

-

Oxford Biomedica (United Kingdom)

-

Cobra Biologics (United Kingdom)

-

WuXi Biologics (China)

-

Charles River Laboratories (United States)

-

Takara Bio Inc. (Japan)

-

Aldevron (United States)

-

VGXI Inc. (United States)

-

Batavia Biosciences (Netherlands)

-

Miltenyi Biotec GmbH (Germany)

-

Genezen Laboratories (United States)

Recent Developments

-

Lonza Group (2025) – Inaugurated a new viral vector manufacturing facility in Houston, Texas in June 2025, designed to increase adeno-associated virus and lentiviral vector output for clinical and commercial applications, leveraging advanced purification systems and automated analytics platforms to enhance production efficiency and quality consistency.

-

Thermo Fisher Scientific (2025) – Expanded plasmid DNA production capacity in the United States during 2025, introducing enhanced single-use bioreactor technologies and automated purification platforms supporting large-scale gene therapy and mRNA vaccine manufacturing requirements for pharmaceutical clients worldwide.

-

Asimov and AGC Biologics (2026) – Signed a licensing agreement in January 2026 for Asimov's off-the-shelf LV Edge Packaging cell line, enabling AGC Biologics' Milan facility to offer lentiviral packaging systems producing vectors from single-plasmid transfection instead of standard four-plasmid processes, significantly reducing production complexity.

-

ProBio (2025) – Announced the opening of its flagship Cell and Gene Therapy Center of Excellence at Princeton West Innovation Campus in Hopewell, New Jersey in June 2025, establishing a 128,000-square-foot good manufacturing practice facility producing high-quality plasmid DNA, AAV, and lentiviral platforms.

-

3P Biovian (2025) – Launched the AAVion platform in May 2025, providing a fully integrated adeno-associated virus manufacturing solution designed to accelerate gene therapy development through streamlined production processes and enhanced analytical capabilities supporting preclinical through clinical-stage therapeutic candidates.

Market Trends

Technological Integration and Sustainability Initiatives Reshaping Industry Standards

The viral vectors & plasmid DNA manufacturing market experiences transformative shifts driven by automation technologies, process intensification strategies, and sustainability considerations that collectively redefine industry best practices. Single-use bioreactor systems continue displacing traditional stainless-steel equipment across manufacturing facilities, offering advantages including reduced capital expenditures, eliminated cleaning validation requirements, decreased contamination risks, and enhanced operational flexibility enabling rapid changeovers between production campaigns. Continuous bioprocessing platforms replace batch manufacturing approaches, delivering improved productivity through uninterrupted operation while reducing facility footprint requirements and overall production timelines. Advanced analytics incorporating process analytical technology sensors provide real-time monitoring of critical quality attributes, enabling immediate process adjustments maintaining optimal production conditions throughout manufacturing runs. These technological enhancements address industry imperatives for improved cost efficiency, shortened development timelines, and enhanced product consistency supporting regulatory compliance objectives.

Environmental sustainability initiatives gain prominence within the viral vectors & plasmid DNA manufacturing market as manufacturers recognize operational efficiency benefits and stakeholder expectations regarding environmental stewardship. Companies implement energy-efficient facility designs incorporating renewable power sources, water reclamation systems reducing consumption, and waste minimization programs addressing both environmental impact and operational costs. Single-use technologies previously criticized for plastic waste generation undergo redesign emphasizing recyclability and reduced material usage without compromising sterility assurances. Digital monitoring systems optimize resource utilization by precisely controlling environmental conditions, minimizing energy consumption, and reducing material waste throughout production processes. Industry consortia collaborate on establishing circular bioeconomy principles where manufacturing byproducts become inputs for other processes, collectively advancing sustainability objectives while maintaining the rigorous quality standards essential for therapeutic applications. These trends position the viral vectors & plasmid DNA manufacturing market as a leader in combining scientific innovation with environmental responsibility.

Segments Covered in the Report

By Vector Type

-

Adeno-Associated Virus (AAV)

-

Lentivirus

-

Adenovirus

-

Retrovirus

-

Plasmid DNA

-

Others

By Workflow

-

Upstream Processing

-

Vector Amplification & Expansion

-

Vector Recovery/Harvesting

-

-

Downstream Processing

-

Purification

-

Fill-Finish

-

By Application

-

Gene Therapy

-

Vaccinology

-

Cell Therapy

-

Antisense & RNAi Therapy

-

Research Applications

By End-Use

-

Research Institutes

-

Pharmaceutical and Biotechnology Companies

By Disease

-

Cancer

-

Genetic Disorders

-

Infectious Diseases

-

Others

By Region

-

North America (United States, Canada, Mexico)

-

Europe (Germany, United Kingdom, France, Italy, Spain, Netherlands, Switzerland)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Thailand)

-

Latin America (Brazil, Argentina)

-

Middle East & Africa (Saudi Arabia, United Arab Emirates, South Africa)

Frequently Asked Questions:

Answer: The viral vectors & plasmid DNA manufacturing market is expected to reach approximately 19.22 billion USD by 2033, growing from 6.38 billion USD in 2025. This expansion reflects increasing gene therapy approvals and manufacturing capacity investments worldwide.

Answer: North America leads the viral vectors & plasmid DNA manufacturing market with approximately forty-nine percent global market share. The region benefits from extensive clinical trial activity, concentrated pharmaceutical industry presence, and supportive regulatory frameworks.

Answer: Vaccinology represents the largest application segment within the viral vectors & plasmid DNA manufacturing market, accounting for over twenty-two percent market share. Gene therapy and cell therapy applications also contribute substantially to overall market expansion.

Answer: The viral vectors & plasmid DNA manufacturing market grows rapidly due to increasing gene therapy approvals, expanding clinical trial pipelines, and technological advancements improving production efficiency. Rising investment in personalized medicine further accelerates market development.

Answer: Adeno-associated virus commands the largest vector type segment within the viral vectors & plasmid DNA manufacturing market with approximately twenty-one percent share. AAV's favorable safety profile and clinical success drive its market leadership position.