Radio-Fluoroscopy Systems Market Overview

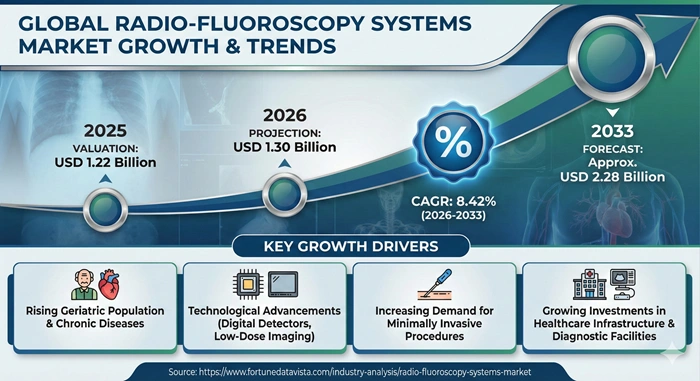

The global radio-fluoroscopy systems market size is valued at USD 1.22 billion in 2025 and is predicted to increase from USD 1.30 billion in 2026 to approximately USD 2.28 billion by 2033, growing at a CAGR of 8.42% from 2026 to 2033.

Radio-fluoroscopy systems represent advanced medical imaging technologies that combine real-time fluoroscopic visualization with static digital radiography capabilities in unified platforms. These hybrid systems enable healthcare providers to perform dynamic and static diagnostic examinations during single patient sessions, eliminating the need for multiple equipment setups or room transfers. The technology utilizes continuous X-ray beams to create live moving images of internal structures, allowing physicians to observe organ function, trace contrast agent movement, guide minimally invasive procedures, and assess anatomical responses in real time.

The systems have become essential tools across multiple medical specialties, supporting gastrointestinal examinations including barium swallow studies and motility assessments, cardiovascular interventions requiring catheter guidance, orthopedic procedures involving joint injections and spinal evaluations, urological diagnostics, and pain management interventions. Modern radio-fluoroscopy platforms incorporate advanced digital detectors, automated dose reduction protocols, high-resolution imaging capabilities, and seamless integration with hospital information systems, transforming clinical workflows while prioritizing patient and operator safety.

AI Impact on the Radio-Fluoroscopy Systems Industry

Artificial intelligence is fundamentally transforming the radio-fluoroscopy systems market by introducing unprecedented levels of automation, precision, and safety into real-time imaging procedures. AI-powered algorithms now enhance image processing capabilities, automatically optimizing contrast, brightness, and clarity during live fluoroscopic examinations to improve visualization of anatomical structures and detect abnormalities with greater accuracy. These intelligent systems analyze patient-specific factors including body mass index, tissue density, and procedural requirements to dynamically adjust imaging parameters in real time, ensuring optimal image quality while minimizing radiation exposure. Advanced AI tools can identify critical anatomical landmarks, highlight areas of clinical interest, and provide decision support to radiologists and interventional specialists during complex procedures.

Workflow management represents another area where AI delivers substantial value in radio-fluoroscopy operations. Intelligent systems now automate routine tasks including patient positioning verification, equipment calibration, protocol selection, and quality control checks that traditionally required manual intervention and consumed significant technologist time. AI-driven workflow engines learn from historical procedural patterns to predict optimal imaging sequences, suggest appropriate contrast timing, and alert operators to potential issues before they impact examination quality. These capabilities reduce procedure duration, increase department throughput, and standardize outcomes across different operators and clinical settings, addressing persistent challenges in radiology departments struggling with staffing shortages and variable operator experience levels.

Radiation dose management has emerged as a critical application area for AI in radio-fluoroscopy systems. Advanced dose optimization algorithms continuously monitor cumulative radiation exposure during procedures, automatically adjusting fluoroscopy pulse rates, beam collimation, and detector sensitivity to maintain diagnostic image quality while operating at the lowest achievable dose levels. These AI-powered dose management tools provide real-time feedback to operators, generate comprehensive dose reports for regulatory compliance, and identify opportunities for protocol refinement based on analysis of thousands of historical examinations. The technology proves particularly valuable in pediatric imaging and interventional procedures requiring extended fluoroscopy time, where minimizing radiation exposure without compromising diagnostic efficacy represents a constant balancing challenge. As regulatory requirements for dose tracking and reduction intensify globally, AI-enabled dose management is transitioning from competitive differentiator to essential system capability driving purchasing decisions across hospital systems and imaging centers.

Growth Factors of the Radio-Fluoroscopy Systems Market

The radio-fluoroscopy systems market is experiencing robust expansion driven by the accelerating global adoption of minimally invasive surgical and interventional procedures that require real-time imaging guidance. The fundamental shift in clinical practice toward minimally invasive techniques reflects multiple converging advantages including reduced surgical trauma, shorter patient recovery times, lower infection risks, decreased hospital length of stay, and improved cost-effectiveness compared to traditional open surgeries. Interventional cardiology procedures such as angioplasty and stent placement, gastroenterological interventions including endoscopic retrograde cholangiopancreatography, orthopedic treatments involving guided joint injections and vertebroplasty, and pain management procedures all depend critically on continuous fluoroscopic visualization for safe and effective execution. As procedural volumes increase across these specialties driven by aging populations, rising chronic disease prevalence, and expanding clinical indications, demand for advanced radio-fluoroscopy systems capable of supporting these complex interventions continues accelerating.

The rising global burden of chronic diseases represents a powerful demographic and epidemiological driver amplifying radio-fluoroscopy system demand. Cardiovascular diseases remain the leading cause of mortality worldwide, with aging populations experiencing increasing rates of coronary artery disease, peripheral vascular disease, and structural heart conditions requiring fluoroscopy-guided interventions. Similarly, gastrointestinal disorders including inflammatory bowel disease, gastroesophageal reflux disease, swallowing disorders, and GI cancers are rising in prevalence, creating sustained demand for fluoroscopic diagnostic examinations and therapeutic procedures. The increasing incidence of musculoskeletal conditions including osteoarthritis, spinal disorders, and chronic pain syndromes drives orthopedic and pain management applications of radio-fluoroscopy technology. These demographic trends prove particularly pronounced in developed markets with rapidly aging populations, but emerging economies are also witnessing rising chronic disease burdens as lifestyle factors and improved life expectancy shift disease patterns toward conditions requiring interventional imaging support.

Technological innovation continues propelling market growth through development of next-generation radio-fluoroscopy systems offering enhanced capabilities that expand clinical applications and improve operational efficiency. Modern digital flat-panel detector technology delivers superior image quality compared to legacy image intensifier systems, with benefits including higher spatial resolution, wider dynamic range, reduced image distortion, and more consistent performance across the detector field. Advanced dose reduction technologies incorporating pulsed fluoroscopy, automatic exposure control, spectral beam filtration, and real-time dose tracking enable safer imaging with radiation exposure reductions of 50% or more compared to conventional systems while maintaining diagnostic image quality. Multifunctional hybrid platforms combining radiography and fluoroscopy capabilities in single integrated systems appeal to space-constrained facilities and budget-conscious purchasers seeking to consolidate equipment and optimize room utilization. Remote-controlled systems that enable operators to perform examinations from shielded control rooms reduce occupational radiation exposure while supporting sterile procedural environments, addressing both safety concerns and operational preferences in modern radiology departments.

Healthcare infrastructure expansion in emerging markets creates substantial growth opportunities as developing nations invest in modernizing diagnostic capabilities and expanding access to advanced medical imaging. Countries throughout Asia Pacific, Latin America, Middle East, and Africa are constructing new hospitals, upgrading existing facilities, and establishing diagnostic imaging centers to serve growing populations with rising healthcare expectations. Government-funded healthcare initiatives, public-private partnerships, and foreign investment are accelerating deployment of advanced medical technologies including radio-fluoroscopy systems in markets that previously relied on basic X-ray equipment or lacked adequate imaging infrastructure entirely. These emerging markets often leapfrog legacy analog technologies, adopting digital systems as first-time installations, which supports vendor strategies emphasizing compact, affordable, and user-friendly platforms optimized for diverse clinical environments and varying operator skill levels. The combination of large unmet need, growing healthcare expenditure, and improving economic conditions positions emerging markets as the fastest-growing regional segment for radio-fluoroscopy system adoption throughout the forecast period.

Market Outlook of the Radio-Fluoroscopy Systems Market

The radio-fluoroscopy systems market outlook remains exceptionally positive, with industry fundamentals supporting sustained growth momentum driven by technological advancement, expanding clinical applications, and favorable regulatory environments emphasizing patient safety. The market is witnessing a decisive transition from analog image intensifier systems to digital flat-panel detector platforms, a generational technology shift comparable to earlier transitions from film-based to digital radiography. This digital migration creates substantial replacement demand as facilities retire aging equipment that has reached end-of-serviceable-life while simultaneously failing to meet contemporary standards for image quality, dose efficiency, and system integration. The replacement cycle proves particularly robust in developed markets including North America, Europe, and Japan where installed bases of legacy systems remain significant, though emerging markets are also driving incremental demand through first-time digital installations at newly constructed or recently upgraded facilities.

Clinical workflow optimization has emerged as a critical value proposition influencing purchasing decisions and vendor competitive positioning. Healthcare providers face intensifying pressures to improve operational efficiency, increase patient throughput, reduce examination times, and maximize utilization of expensive capital equipment and skilled personnel. Modern radio-fluoroscopy systems address these imperatives through features including rapid room setup and patient positioning, one-touch protocol selection, automated quality control and calibration, intuitive user interfaces reducing operator learning curves, and seamless connectivity with PACS, RIS, and electronic medical record systems. The concept of hybrid imaging rooms capable of performing multiple examination types using consolidated equipment is gaining traction, particularly among mid-sized hospitals and outpatient imaging centers where space limitations and budget constraints make dedicated single-purpose rooms impractical. Vendors successfully articulating and demonstrating workflow benefits through quantifiable metrics including examination time reduction, patient throughput improvement, and total cost of ownership advantages are capturing market share at the expense of competitors emphasizing technical specifications over operational outcomes.

Regulatory dynamics are shaping market development trajectories across regions, with diverging approaches to radiation safety standards, dose monitoring requirements, and equipment approval processes creating both opportunities and challenges for manufacturers. European markets have implemented stringent dose reference levels and mandatory dose tracking for fluoroscopic procedures, driving demand for systems with advanced dose management capabilities while creating compliance barriers for legacy equipment. The United States FDA 510(k) clearance pathway provides relatively streamlined market access for fluoroscopy systems demonstrating substantial equivalence to predicate devices, supporting rapid introduction of incremental innovations while higher-risk novel technologies undergo more extensive premarket approval processes. Emerging markets exhibit varying regulatory maturity, with some countries adopting international standards while others maintain less rigorous requirements that potentially advantage cost-focused manufacturers over premium technology leaders. Understanding and navigating these regional regulatory landscapes proves essential for vendors pursuing global market strategies.

Investment activity in the radio-fluoroscopy sector reflects growing institutional recognition of the market's attractive fundamentals and long-term growth potential. Strategic corporate investors including diversified medical technology conglomerates view radio-fluoroscopy as a core imaging modality warranting continued R&D investment and portfolio expansion through both organic development and targeted acquisitions. Private equity firms are increasingly active in the medical imaging space, acquiring standalone imaging equipment manufacturers, diagnostic imaging center chains, and imaging IT companies, then pursuing operational improvement and add-on acquisition strategies to build scale and capture consolidation premiums. Venture capital investment flows toward innovative startups developing breakthrough technologies including AI-powered imaging analytics, mobile and compact fluoroscopy platforms, dose monitoring software, and image-guided intervention tools that complement established hardware platforms. This multilayered investment ecosystem supports continued innovation, competitive intensity, and market dynamism benefiting end users through expanding choice, improving technology, and favorable pricing dynamics.

Expert Speaks

-

Peter J. Arduini, President and CEO of GE HealthCare – "We are in a new era in which providers and patients rely on medical imaging and digital solutions for critical insights across the entire care pathway from screening, diagnosis, monitoring, and therapy delivery, as well as research and discovery. The imaging division's establishment aligns with our overall goals for the medical technology industry, ensuring we continue advancing technologies that improve patient outcomes while supporting clinicians with tools that enhance precision, efficiency, and safety in every procedure."

-

Bernd Montag, CEO of Siemens Healthineers – "Healthcare systems worldwide face unprecedented challenges balancing rising demand, constrained resources, and expectations for improved outcomes. Advanced imaging technologies including next-generation radiography and fluoroscopy platforms represent essential infrastructure enabling more efficient, precise, and safer diagnostic and interventional procedures. Our focus remains on developing integrated solutions that combine hardware excellence with intelligent software, delivering actionable insights that empower clinical teams to make faster, more confident decisions while optimizing resource utilization across the care continuum."

-

Roy Jakobs, CEO of Philips – "The future of healthcare depends on leveraging technology to extend specialized care beyond traditional hospital settings, bringing advanced diagnostics and interventions closer to patients in ambulatory, community, and even home environments. Imaging modalities must evolve to support this decentralization through compact form factors, intuitive operation requiring minimal specialized training, and connectivity enabling remote collaboration and AI-assisted interpretation. Our strategy prioritizes developing accessible, patient-centric imaging solutions that maintain clinical excellence while adapting to diverse care delivery models that define modern healthcare ecosystems."

Key Report Takeaways

-

North America dominates the radio-fluoroscopy systems market with a commanding 36.8% revenue share in 2025, driven by extensive hospital infrastructure supporting high procedural volumes, early adoption of advanced digital and AI-enabled systems particularly in tertiary care institutions, established reimbursement frameworks favoring minimally invasive interventions, strong emphasis on radiation safety compliance accelerating legacy system replacement, and presence of leading equipment manufacturers including GE HealthCare, Siemens Healthineers, and Philips maintaining robust service and support networks throughout the region.

-

Asia Pacific emerges as the fastest-growing regional market with an impressive CAGR of 6.7% between 2026 and 2033, fueled by massive healthcare infrastructure expansion including new hospital construction and facility modernization across China, India, Southeast Asia, government-sponsored healthcare initiatives funding advanced diagnostic equipment procurement, rising prevalence of cardiovascular and gastrointestinal diseases increasing procedural demand, growing middle-class populations with improving healthcare access and willingness to pay for quality care, and strong local manufacturing capabilities supporting cost-competitive system offerings tailored to regional market requirements.

-

The fixed radio-fluoroscopy systems segment maintains market leadership with a substantial 64.7% revenue share in 2025, reflecting clinical preference for stable, high-resolution imaging platforms supporting complex multidisciplinary procedures including interventional cardiology, gastroenterology, and orthopedics, seamless integration capabilities with existing hospital infrastructure and PACS networks, established familiarity among radiology personnel reducing training requirements and setup time, and reliability advantages important for high-volume tertiary care facilities performing demanding interventional procedures requiring consistent equipment performance.

-

Digital fluoroscopy technology dominates with a commanding 71.9% market share in 2025 and projected 6.1% CAGR through 2035, driven by superior image quality advantages over analog systems including higher spatial resolution and wider dynamic range, advanced dose reduction capabilities addressing regulatory requirements and clinical safety priorities, flat-panel detector benefits including consistent performance and reduced maintenance compared to image intensifiers, and workflow efficiency improvements through faster image acquisition, processing, and transmission supporting higher patient throughput in busy radiology departments.

-

Gastrointestinal imaging represents the leading application segment with 38.4% market share in 2025, reflecting widespread fluoroscopic use for diverse digestive tract assessments including upper GI series, small bowel studies, barium swallow examinations, and therapeutic interventions such as ERCP, rising global prevalence of GI disorders including inflammatory bowel disease, GERD, and esophageal conditions, procedural volume growth particularly in aging populations experiencing higher rates of GI pathology, and established clinical protocols making GI fluoroscopy a standard component of gastroenterology practice worldwide.

-

The ambulatory surgical centers segment is projected as the fastest-growing end-user category with a notable CAGR of 6.9% from 2026 to 2035, propelled by healthcare delivery model shifts toward outpatient settings for cost efficiency and patient convenience, increasing ASC capabilities to perform interventional procedures previously restricted to hospitals, growing adoption of mobile and compact fluoroscopy systems optimized for space-constrained ambulatory environments, favorable reimbursement dynamics for outpatient procedures, and rising patient preference for convenient same-day procedures avoiding hospital admission.

Market Scope of the Radio-Fluoroscopy Systems Market

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 2.28 Billion | Market Size by 2026 | USD 1.30 Billion | Market Size by 2025 | USD 1.22 Billion | Market Growth Rate from 2026 to 2033 | CAGR of 8.42% | Dominating Region | North America | Fastest Growing Region | Asia Pacific | Segments Covered | Product Type, Technology, Application, End User, Configuration, Region | Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Market Dynamics of the Radio-Fluoroscopy Systems Market

Drivers Impact Analysis

The radio-fluoroscopy systems market is propelled by powerful demand drivers fundamentally reshaping how healthcare providers approach diagnostic imaging and interventional procedures. The accelerating shift toward minimally invasive procedures represents the most significant growth catalyst, with physicians across specialties increasingly adopting techniques that reduce patient trauma, shorten recovery periods, and improve outcomes compared to traditional open surgical approaches. These minimally invasive interventions including angioplasty, endovascular repair, arthroscopy, and endoscopic procedures absolutely require continuous real-time imaging guidance that radio-fluoroscopy systems uniquely provide, creating an inextricable link between procedural volume growth and imaging equipment demand. Clinical evidence demonstrating superior patient outcomes, faster recovery, reduced complications, and lower overall healthcare costs continues building momentum for minimally invasive approaches across cardiovascular, gastrointestinal, orthopedic, and pain management specialties.

The rising global burden of chronic diseases creates sustained and growing demand for diagnostic and interventional procedures supported by radio-fluoroscopy technology. Cardiovascular disease remains the leading cause of death worldwide, with interventional cardiology procedures including angiography, angioplasty, and structural heart interventions all dependent on fluoroscopic guidance. The increasing prevalence of gastrointestinal disorders drives diagnostic barium studies, therapeutic ERCP procedures, and motility assessments that constitute core applications for radio-fluoroscopy systems. Musculoskeletal conditions including osteoarthritis and spinal disorders propel orthopedic fluoroscopy utilization for guided injections, vertebroplasty, and kyphoplasty procedures providing pain relief and functional improvement for aging populations. These demographic and epidemiological trends prove particularly pronounced in developed nations with rapidly aging populations, but emerging markets are also experiencing rising chronic disease burdens as lifestyle factors including obesity, sedentary behavior, and dietary changes increase cardiovascular and metabolic disease rates.

Healthcare infrastructure modernization in emerging markets creates substantial incremental demand as developing nations invest in expanding diagnostic capabilities and improving access to advanced medical technologies. Government healthcare initiatives across Asia Pacific, Latin America, Middle East, and Africa regions allocate significant funding for hospital construction, facility upgrades, and medical equipment procurement to serve growing populations with rising healthcare expectations. These markets often adopt digital radio-fluoroscopy systems as first-time installations rather than upgrading from analog predecessors, enabling technology leapfrogging that benefits patients through immediate access to advanced imaging capabilities. International development organizations, public-private partnerships, and foreign direct investment supplement domestic healthcare spending, accelerating the pace of infrastructure development and equipment deployment in regions with historically limited diagnostic imaging access.

| Drivers | ≈% Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rising adoption of minimally invasive procedures | High (+2.8% to +3.5%) | Global, particularly North America & Europe | Immediate & Long-term |

| Increasing chronic disease prevalence | High (+2.5% to +3.0%) | Global, especially aging populations | Long-term |

| Healthcare infrastructure expansion in emerging markets | High (+2.2% to +2.8%) | Asia Pacific, Latin America, Middle East & Africa | Medium to Long-term |

| Advanced dose reduction technology adoption | Medium (+1.5% to +2.0%) | Global, particularly regulated markets | Immediate & Medium-term |

Restraints Impact Analysis

Despite robust growth prospects, the radio-fluoroscopy systems market faces meaningful challenges that could moderate expansion rates and create barriers for certain market segments and geographic regions. The high capital costs associated with advanced radio-fluoroscopy systems represent a significant constraint, particularly for smaller facilities, rural hospitals, and healthcare providers in price-sensitive emerging markets. Premium digital systems with remote control capabilities, AI integration, advanced dose management, and comprehensive PACS connectivity can require investments exceeding several hundred thousand dollars, creating substantial financial barriers for institutions with limited capital budgets or constrained access to equipment financing. These cost pressures prove particularly acute in developing nations where healthcare spending per capita remains low and public healthcare systems struggle to fund basic medical infrastructure, let alone advanced diagnostic technologies. Budget-conscious buyers may opt for refurbished equipment, lower-specification systems, or延 extended replacement cycles for existing equipment, all of which moderate market growth rates.

Regulatory complexity and varying approval requirements across different markets create challenges for manufacturers pursuing global commercialization strategies while potentially delaying market access and increasing development costs. Radio-fluoroscopy systems must meet stringent safety standards addressing radiation exposure, electrical safety, electromagnetic compatibility, and cybersecurity requirements that vary across jurisdictions. The United States FDA 510(k) clearance process, European Union Medical Device Regulation compliance, Japanese PMDA approval, and registration requirements in other markets each demand substantial technical documentation, clinical data, and quality system evidence. Radiation safety regulations including dose reference levels, operator training requirements, and facility licensing standards differ across regions, complicating product specifications and potentially necessitating market-specific customization that increases costs and extends time-to-market. Smaller manufacturers and new market entrants face particularly steep regulatory hurdles lacking the resources and regulatory expertise that established multinational corporations leverage to navigate complex approval processes efficiently.

Competition from alternative imaging modalities and evolving clinical practices could potentially limit radio-fluoroscopy system demand in certain application areas. Advanced ultrasound systems offering real-time imaging without ionizing radiation appeal for some interventional guidance applications previously performed under fluoroscopy, particularly in obstetrics, guided biopsies, and vascular access procedures. Cross-sectional imaging modalities including CT and MRI with interventional capabilities compete for certain procedural guidance applications, especially when superior soft tissue contrast proves clinically valuable. Evolving endoscopic techniques incorporating advanced visualization technologies may reduce dependence on fluoroscopic guidance for some gastrointestinal procedures. While radio-fluoroscopy maintains strong positions across core applications including interventional cardiology, GI contrast studies, and orthopedic procedures, technology advancement in competing modalities could moderate growth rates in specific segments where clinical preferences shift toward alternative imaging approaches.

| Restraints | ≈% Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High capital costs limiting adoption | Medium (-1.2% to -1.8%) | Global, particularly emerging markets | Ongoing |

| Regulatory complexity and approval delays | Medium (-0.8% to -1.2%) | Global, varies by region | Medium-term |

| Competition from alternative imaging modalities | Low to Medium (-0.6% to -1.0%) | Developed markets primarily | Long-term |

| Radiation safety concerns | Low (-0.3% to -0.6%) | Global | Ongoing |

Opportunities Impact Analysis

The radio-fluoroscopy systems market presents substantial growth opportunities that forward-thinking manufacturers can capitalize on to expand market presence, capture emerging demand segments, and differentiate from competitors. The development of hybrid multifunction imaging rooms represents a transformative opportunity addressing healthcare providers' imperatives to optimize space utilization, improve workflow efficiency, and maximize return on capital equipment investments. Modern radio-fluoroscopy platforms capable of performing both dynamic fluoroscopic examinations and static digital radiography in consolidated systems enable facilities to serve diverse patient needs using shared infrastructure, eliminating duplicate equipment purchases and reducing facility space requirements. This hybrid room concept appeals particularly to mid-sized hospitals, ambulatory surgical centers, and outpatient imaging facilities where space constraints and budget limitations make dedicated single-purpose rooms impractical, creating addressable market opportunities for vendors offering flexible, multifunctional platforms with rapid mode-switching capabilities and intuitive operation.

Artificial intelligence integration presents significant opportunities for differentiation and value creation as healthcare providers seek technologies that improve diagnostic accuracy, enhance workflow efficiency, and support clinical decision-making. AI-powered capabilities including automated image quality optimization, intelligent dose management, anatomical landmark recognition, and decision support tools create compelling value propositions that justify premium pricing while building competitive moats through proprietary algorithms and datasets. Manufacturers investing in AI development, establishing partnerships with leading AI technology companies, and accumulating large training datasets through installed base connectivity can establish technology leadership positions that translate into market share gains. The AI opportunity extends beyond hardware platforms to software and services including cloud-based analytics, remote monitoring, predictive maintenance, and outcomes tracking that create recurring revenue streams and strengthen customer relationships beyond one-time equipment sales.

Emerging market expansion offers substantial untapped growth potential as developing nations invest in healthcare infrastructure modernization and expanding access to advanced diagnostic capabilities. Countries throughout Asia Pacific, Latin America, Middle East, and Africa are constructing new hospitals, upgrading existing facilities, and establishing diagnostic imaging networks to serve growing populations with rising healthcare expectations and improving ability to pay for quality medical services. Manufacturers that adapt products to regional requirements through optimized pricing, simplified operation, robust construction for challenging environments, and localized service support can capture first-mover advantages in markets poised for rapid expansion. Strategic approaches including local manufacturing partnerships, distributor relationships with regional market expertise, government tender participation, and financing solutions addressing capital constraints enable market penetration in price-sensitive regions while building sustainable competitive positions as these markets mature and purchasing power increases over time.

| Opportunities | ≈% Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| AI-powered imaging and workflow automation | High (+2.5% to +3.2%) | Global, particularly developed markets | Medium to Long-term |

| Hybrid multifunction imaging rooms | Medium to High (+2.0% to +2.6%) | Global | Immediate & Medium-term |

| Emerging market penetration strategies | High (+2.2% to +2.8%) | Asia Pacific, Latin America, MEA | Medium to Long-term |

| Mobile and compact system development | Medium (+1.5% to +2.0%) | Global, particularly ASCs | Immediate & Medium-term |

Top Vendors and Their Offerings

-

GE HealthCare – Offers comprehensive portfolio of digital radio-fluoroscopy systems featuring AI-powered image processing, automated workflow solutions, advanced dose reduction technologies, and seamless PACS integration, targeting high-volume hospital radiology departments and hybrid operating rooms with emphasis on operational efficiency and clinical outcomes.

-

Siemens Healthineers – Provides precision-engineered remote-controlled and table-based RF platforms including the Luminos Q.namix series with advanced automation, intuitive user interfaces, built-in AI workflow guidance, and dose optimization capabilities, focusing on European and North American markets with strict regulatory requirements.

-

Canon Medical Systems – Delivers cost-effective hybrid radio-fluoroscopy solutions including the Adora DRFi combining radiographic and fluoroscopic capabilities in compact, space-efficient platforms optimized for mid-sized hospitals and imaging centers in Asia Pacific, Latin America, and emerging markets.

-

Philips Healthcare – Manufactures ergonomically designed radio-fluoroscopy systems emphasizing patient comfort, operator ease-of-use, intuitive controls, and aesthetic design appealing to ambulatory imaging centers, academic medical centers, and facilities performing patient-facing GI procedures.

-

Shimadzu Corporation – Specializes in mechanically reliable, compact radio-fluoroscopy platforms with advanced dose reduction capabilities and space-efficient designs targeting high-throughput GI clinics, orthopedic practices, and mid-tier hospitals in Asia Pacific and emerging markets.

-

Carestream Health – Produces versatile digital radiography and fluoroscopy systems with emphasis on image quality, workflow efficiency, and competitive pricing, serving diverse markets including hospitals, imaging centers, and specialty clinics worldwide.

-

Hitachi Medical Systems – Develops advanced fluoroscopy platforms incorporating innovative detector technologies, dose management systems, and clinical applications tailored to Asian markets with particular strength in Japan and expanding presence in Southeast Asia.

-

Hologic Inc. – Offers specialized imaging systems including radio-fluoroscopy capabilities integrated with broader women's health imaging portfolio, targeting facilities focused on comprehensive diagnostic services for female patients.

-

Villa Sistemi Medicali – Provides customizable, budget-conscious radio-fluoroscopy solutions with modular designs supporting diverse room configurations, competing aggressively in European, Middle Eastern, and African markets through public tenders and distributor networks.

-

Konica Minolta Healthcare – Supplies digital radiography systems with fluoroscopy capabilities emphasizing reliability, ease of maintenance, and value pricing, focusing on community hospitals, urgent care facilities, and price-sensitive markets globally.

Segment Analysis of the Radio-Fluoroscopy Systems Market

By Product Type

Fixed Radio-Fluoroscopy Systems – Dominating Through Reliability and Clinical Versatility

Fixed radio-fluoroscopy systems command the market with a substantial 64.7% revenue share in 2025, reflecting strong clinical preference for stable, permanently installed platforms that deliver high-resolution imaging across diverse procedural applications. These systems feature robust mechanical construction, precise motorized positioning, dedicated room infrastructure, and comprehensive integration with hospital information systems that support complex multidisciplinary procedures including interventional cardiology, gastroenterology examinations, orthopedic interventions, and pain management treatments. The segment's dominance stems from established installation bases in tertiary care hospitals and large medical centers that perform high volumes of fluoroscopic procedures requiring consistent equipment performance, standardized imaging protocols, and reliable operation under demanding clinical conditions. Fixed systems typically incorporate remote control capabilities enabling operators to conduct examinations from shielded control rooms, reducing occupational radiation exposure while maintaining sterile procedural environments.

The fixed systems segment benefits from technological advancement including flat-panel digital detectors delivering superior image quality compared to legacy image intensifiers, advanced dose reduction capabilities incorporating pulsed fluoroscopy and automatic exposure control, and AI-powered features optimizing imaging parameters and workflow efficiency. North America and Europe represent the largest markets for fixed radio-fluoroscopy systems, driven by extensive hospital infrastructure, high procedural volumes, established capital equipment budgets, and regulatory environments emphasizing radiation safety that favor advanced digital systems over aging analog equipment. Major manufacturers including GE HealthCare, Siemens Healthineers, and Philips Healthcare dominate the fixed systems segment through comprehensive product portfolios, strong hospital relationships, established service networks, and continuous innovation addressing evolving clinical requirements and operational priorities.

Investment in fixed radio-fluoroscopy systems reflects strategic decisions by healthcare institutions to establish core diagnostic and interventional imaging capabilities supporting multiple clinical specialties and revenue-generating procedures. The segment shows steady growth driven by replacement demand as facilities retire end-of-life equipment, technology upgrades accessing advanced features unavailable in legacy systems, and capacity expansion at growing hospitals and medical centers experiencing increasing procedural volumes. While growth rates for fixed systems trail more dynamic segments including mobile platforms, the segment's large installed base, essential clinical role, and ongoing technology evolution ensure sustained demand throughout the forecast period. Emerging markets including China and India show increasing adoption of fixed systems as tertiary hospitals and specialized cardiac centers invest in comprehensive fluoroscopy capabilities, though mobile and compact alternatives often prove more popular in smaller facilities and space-constrained environments common in these regions.

Mobile Radio-Fluoroscopy Systems – Fastest Growth Through Clinical Flexibility

Mobile radio-fluoroscopy systems represent the fastest-growing product segment with a robust CAGR of 6.8% between 2026 and 2035, driven by clinical demand for portable imaging capabilities supporting point-of-care examinations, bedside procedures, and multi-location service models. These mobile platforms feature compact designs, integrated power sources, wireless connectivity, and streamlined operation enabling rapid deployment across diverse clinical settings including emergency departments, intensive care units, operating rooms, and ambulatory procedure areas. The versatility advantages prove particularly valuable in acute care environments where patient stability constraints preclude transport to fixed fluoroscopy suites, enabling clinicians to perform essential diagnostic and therapeutic procedures at bedsides or in specialized treatment areas equipped for critical patient management.

The mobile systems segment appeals to diverse facility types including hospitals seeking to expand fluoroscopy access beyond centralized radiology departments, ambulatory surgical centers performing outpatient procedures in compact facilities, specialty clinics offering interventional services, and multi-site healthcare networks requiring shared equipment that can be transported between locations. Modern mobile units deliver image quality approaching fixed systems through advanced flat-panel detectors and sophisticated image processing, while maintaining portability and ease of operation that enable rapid setup and breakdown. Asia Pacific emerges as the fastest-growing regional market for mobile systems, reflecting space constraints common in urban hospitals, growing adoption of minimally invasive procedures in diverse clinical settings, and cost-effectiveness advantages for facilities unable to justify dedicated fixed installations for modest procedural volumes.

Key manufacturers including Canon Medical Systems, Shimadzu Corporation, and GE HealthCare are expanding mobile product portfolios with features including battery-powered operation for maximum flexibility, wireless image transmission to PACS networks, compact footprints navigating crowded clinical areas, and intuitive touchscreen interfaces supporting operation by varied clinical staff. The segment faces challenges including lower per-unit pricing compared to premium fixed systems and concerns about image quality consistency in portable applications, but growing clinical acceptance and expanding use cases support strong growth trajectories. Looking forward, mobile radio-fluoroscopy systems are positioned to capture increasing market share as healthcare delivery models emphasize flexibility, point-of-care diagnostics, and cost-efficient resource utilization, particularly in ambulatory settings and emerging markets where compact, versatile solutions offer compelling value propositions compared to traditional fixed installations.

By Technology

Digital Fluoroscopy – Overwhelming Market Dominance Through Superior Performance

Digital fluoroscopy technology dominates the radio-fluoroscopy systems market with a commanding 71.9% share in 2025 and projected 6.1% CAGR through 2035, reflecting the decisive transition from legacy analog systems to modern digital platforms delivering superior image quality, enhanced dose efficiency, and improved workflow integration. Digital systems utilize flat-panel detectors or charge-coupled device technology to directly capture X-ray photons and convert them to digital images, eliminating the image intensifier tubes, analog video chains, and film-based recording that characterized earlier fluoroscopy generations. The technology advantages prove substantial, including higher spatial resolution enabling visualization of fine anatomical details, wider dynamic range capturing both dense bones and soft tissues in single exposures, reduced image noise improving low-contrast detectability, and elimination of geometric distortion that plagued image intensifier systems.

Dose reduction represents a critical driver accelerating digital fluoroscopy adoption as healthcare providers respond to regulatory requirements, professional society guidelines, and patient safety concerns regarding cumulative radiation exposure from medical imaging. Digital systems enable advanced dose management strategies including pulsed fluoroscopy reducing beam-on time, automatic exposure control optimizing technique factors for patient size, spectral beam filtration removing low-energy photons that contribute dose without improving image quality, and last-image-hold capabilities minimizing unnecessary exposure. These dose reduction capabilities prove particularly important in pediatric imaging and prolonged interventional procedures where radiation exposure can accumulate to clinically significant levels, making digital platforms essential for facilities seeking to maintain safety standards while performing necessary diagnostic and therapeutic procedures.

North America and Europe lead digital fluoroscopy adoption with market shares exceeding 75% in mature healthcare systems, driven by replacement of aging analog equipment, regulatory emphasis on radiation safety, and clinical demand for advanced imaging capabilities supporting complex interventional procedures. Major manufacturers including Siemens Healthineers, GE HealthCare, and Canon Medical Systems have largely discontinued analog product lines, focusing development resources entirely on digital platforms with progressively more sophisticated features including AI-powered image enhancement, automated protocol selection, and comprehensive dose tracking. Asia Pacific shows rapid digital adoption as new installations overwhelmingly favor digital technology, though some legacy analog systems remain in service at smaller facilities and rural hospitals with limited capital budgets. The digital fluoroscopy segment's sustained growth reflects ongoing replacement cycles, expanding clinical applications, and continuous technology advancement delivering incremental performance improvements that maintain upgrade demand even among facilities with relatively recent digital installations.

Analog Fluoroscopy – Legacy Technology in Managed Decline

Analog fluoroscopy represents a declining market segment as legacy image intensifier-based systems are progressively retired and replaced with superior digital technology, though some installations persist in cost-constrained environments and facilities with limited procedural volumes justifying basic imaging capabilities. Analog systems utilize image intensifier tubes to convert X-ray photons to visible light, which is then captured by analog video cameras and displayed on monitors or recorded on videotape or film. The technology suffers from multiple limitations compared to digital alternatives, including lower spatial resolution, geometric distortion particularly at image periphery, blooming artifacts in bright regions, limited dynamic range requiring multiple exposures for optimal visualization of different tissue densities, and degraded image quality over time as image intensifier tubes age.

The analog segment now represents less than 30% of global radio-fluoroscopy systems market and continues shrinking as replacement demand, regulatory pressure, and technology obsolescence drive facilities toward digital platforms. Remaining analog installations concentrate in developing markets, rural hospitals, small clinics, and veterinary practices where limited budgets, low procedural volumes, or basic clinical requirements do not justify digital system investments. Some facilities maintain analog equipment beyond typical replacement cycles due to capital constraints, functioning equipment that meets minimal clinical needs, or regulatory environments that do not mandate digital migration. However, service and support for analog systems become increasingly challenging as manufacturers discontinue product lines, replacement parts become scarce, and technical expertise maintaining legacy technology diminishes.

The transition away from analog technology proves inevitable as the value proposition for digital systems strengthens through declining prices, improved reliability, enhanced capabilities, and regulatory incentives favoring safer, more efficient imaging platforms. Manufacturers including GE HealthCare, Siemens Healthineers, and Philips have eliminated analog fluoroscopy from active product portfolios, focusing entirely on digital platform development and commercialization. Refurbished equipment markets provide some life extension for analog systems as secondary buyers in price-sensitive markets acquire decommissioned equipment from facilities upgrading to digital, but even these markets are transitioning toward refurbished digital systems as primary market penetration reaches saturation. The analog fluoroscopy segment is projected to continue declining throughout the forecast period, ultimately representing negligible market share as even the most cost-constrained facilities eventually adopt digital technology through generational equipment replacement cycles.

By Application

Gastrointestinal Imaging – Leading Application Through Diverse Clinical Utility

Gastrointestinal imaging dominates radio-fluoroscopy system applications with 38.4% market share in 2025, reflecting the technology's essential role across diverse digestive tract diagnostic and therapeutic procedures. Fluoroscopy enables dynamic visualization of GI anatomy and function through contrast studies including upper GI series evaluating esophagus, stomach, and duodenum; small bowel follow-through examinations assessing intestinal transit and pathology; barium enema or lower GI studies examining colon structure; and specialized examinations including modified barium swallow studies for dysphagia evaluation and defecography for pelvic floor disorders. The real-time imaging capabilities prove indispensable for observing contrast agent flow, identifying anatomical abnormalities including strictures and fistulas, assessing organ motility and function, and guiding therapeutic interventions including endoscopic retrograde cholangiopancreatography procedures addressing biliary and pancreatic conditions.

The GI imaging segment benefits from high global prevalence of digestive disorders including gastroesophageal reflux disease, inflammatory bowel diseases, esophageal motility disorders, and structural abnormalities affecting swallowing and digestion. Aging populations experience increasing rates of GI pathology including age-related dysphagia, diverticular disease, and GI cancers requiring diagnostic evaluation and surveillance. Procedural volumes remain robust across both developed and emerging markets, with tertiary hospitals in China reportedly performing over 43 million endoscopic GI procedures in 2023 alone, many involving fluoroscopic guidance. The segment shows steady growth driven by population aging, rising chronic disease prevalence, expanding access to gastroenterology services in emerging markets, and clinical practice guidelines recommending fluoroscopic evaluation for specific GI symptoms and conditions.

North America and Europe represent the largest markets for GI fluoroscopy applications, supported by established gastroenterology practices, comprehensive insurance coverage for diagnostic studies, and strong adherence to evidence-based clinical protocols incorporating fluoroscopic examinations. Asia Pacific shows particularly robust growth as healthcare infrastructure expands, gastroenterology specialty training increases provider capacity, and rising living standards enable broader access to diagnostic services. Major equipment manufacturers tailor radio-fluoroscopy systems for GI applications through optimized imaging protocols, specialized patient positioning accessories, and workflow features supporting high-volume GI examination schedules common in busy radiology departments. The segment faces some pressure from competing diagnostic modalities including CT enterography and MR enterography offering cross-sectional imaging for certain indications, but fluoroscopy maintains strong positions for functional assessments, contrast studies, and therapeutic procedures where real-time visualization proves essential for clinical decision-making and procedural guidance.

Cardiovascular Imaging – Fastest Growth Driven by Interventional Procedures

Cardiovascular imaging represents the fastest-growing application segment with a healthy CAGR of 6.5% between 2026 and 2035, propelled by expanding interventional cardiology and vascular surgery procedures requiring continuous fluoroscopic guidance. Fluoroscopy plays an indispensable role in diagnostic cardiac catheterization evaluating coronary anatomy and ventricular function, therapeutic interventions including percutaneous coronary intervention with angioplasty and stent placement, structural heart procedures addressing valve disease and septal defects, electrophysiology studies and ablations treating arrhythmias, and peripheral vascular interventions managing arterial occlusive disease. The technology enables real-time visualization of catheter positioning, guidewire advancement, contrast agent distribution, and device deployment that proves absolutely essential for safe and effective procedural execution.

The cardiovascular application segment is driven by rising global burden of heart disease, which remains the leading cause of mortality worldwide, with increasing prevalence of coronary artery disease, heart failure, valvular disease, and arrhythmias in aging populations. The decisive shift toward minimally invasive interventional approaches and away from traditional open heart surgery for many cardiac conditions creates sustained procedural volume growth directly translating to fluoroscopy equipment demand. Expanding clinical indications for transcatheter interventions including transcatheter aortic valve replacement, left atrial appendage closure, and other structural heart procedures broaden the patient population benefiting from fluoroscopy-guided treatments. Technological advancement in catheters, guidewires, stents, and implantable devices enables increasingly complex procedures that push boundaries of minimally invasive cardiac care while remaining dependent on sophisticated fluoroscopic visualization.

North America leads cardiovascular fluoroscopy applications with extensive networks of cardiac catheterization laboratories, high per-capita rates of interventional cardiac procedures, advanced training infrastructure producing skilled interventional cardiologists, and comprehensive reimbursement supporting procedure volumes. Europe shows strong performance driven by aging populations, established cardiac care infrastructure, and national health systems investing in interventional capacity as cost-effective alternatives to cardiac surgery. Asia Pacific emerges as the fastest-growing regional market as countries including China, India, and Southeast Asian nations rapidly expand cardiac catheterization laboratory infrastructure, train interventional cardiology workforces, and improve access to advanced cardiac care for growing middle-class populations. The cardiovascular imaging segment's robust growth trajectory reflects favorable demographic and epidemiological trends, expanding procedural indications, and continuous clinical innovation advancing minimally invasive cardiac care, all supporting sustained fluoroscopy system demand throughout the forecast period.

Orthopedic Procedures – Essential Role in Musculoskeletal Interventions

Orthopedic applications represent a significant and growing segment for radio-fluoroscopy systems, supporting diagnostic imaging and therapeutic procedures addressing musculoskeletal conditions affecting joints, spine, and extremities. Fluoroscopy enables real-time guidance for minimally invasive orthopedic interventions including spinal injections for pain management, vertebroplasty and kyphoplasty treating vertebral compression fractures, joint injections delivering corticosteroids or viscosupplementation, fracture reduction and fixation verification, and specialized procedures including discography and facet joint interventions. The technology's ability to provide continuous visualization during needle placement, contrast injection, and therapeutic agent delivery proves essential for procedural safety, accuracy, and efficacy, particularly when targeting deep anatomical structures or navigating complex anatomy.

The orthopedic fluoroscopy segment benefits from rising prevalence of musculoskeletal conditions including osteoarthritis, spinal stenosis, degenerative disc disease, and osteoporotic vertebral fractures in aging global populations. Chronic pain represents a massive healthcare challenge affecting hundreds of millions of people worldwide, driving demand for fluoroscopy-guided pain management procedures offering relief without requiring surgical intervention. Sports medicine and traumatology applications support fluoroscopy utilization for intraoperative imaging during fracture fixation, joint reconstruction, and other orthopedic surgical procedures. Outpatient spine and pain management clinics increasingly adopt compact mobile fluoroscopy systems enabling office-based procedures, expanding market opportunities beyond traditional hospital settings.

North America shows particularly strong orthopedic fluoroscopy utilization, driven by high chronic pain prevalence, established pain management specialty, comprehensive insurance coverage for interventional procedures, and extensive networks of spine and pain clinics performing high procedure volumes. Europe demonstrates solid demand supported by aging demographics and established orthopedic specialty practices. Asia Pacific growth accelerates as musculoskeletal conditions rise with population aging and lifestyle changes, orthopedic specialty training expands, and interventional pain management gains clinical acceptance. Equipment manufacturers targeting orthopedic applications emphasize compact mobile systems, dose reduction capabilities important for frequent users, and specialized imaging protocols optimized for bone and soft tissue visualization during interventional procedures.

By End User

Hospitals – Dominant End User Through Comprehensive Procedural Capacity

Hospitals dominate the radio-fluoroscopy systems market with 56.2% revenue share in 2025, reflecting these institutions' roles as primary providers of diagnostic imaging services and interventional procedures across diverse clinical specialties. Large tertiary care hospitals and teaching medical centers maintain extensive fluoroscopy infrastructure including multiple dedicated suites supporting high procedural volumes in cardiology, gastroenterology, interventional radiology, orthopedics, and urology departments. These institutions invest in premium fixed radio-fluoroscopy systems with advanced capabilities including remote control operation, AI-powered image optimization, comprehensive dose management, and seamless integration with hospital information systems supporting efficient workflows and quality assurance programs. Multi-specialty utilization justifies capital investments in sophisticated equipment, while high patient volumes generate returns supporting ongoing technology upgrades and capacity expansion.

The hospital segment benefits from established reimbursement frameworks covering fluoroscopic procedures, capital equipment budgets supporting major purchases, and clinical expertise operating and maintaining sophisticated imaging systems. Teaching hospitals play additional roles in training radiology residents, technologists, and clinical specialists in fluoroscopic techniques, creating institutional commitments to maintaining current technology platforms. Academic medical centers often serve as early adopters of innovative fluoroscopy technologies, participating in clinical research studies, technology evaluations, and pilot programs that inform broader market adoption patterns. The segment shows steady growth driven by replacement demand as facilities retire aging equipment, technology upgrades accessing advanced capabilities, and capacity expansion at growing institutions experiencing increasing procedural volumes across multiple specialties utilizing fluoroscopic imaging.

North America and Europe represent the largest hospital markets for radio-fluoroscopy systems, characterized by extensive institutional infrastructure, high equipment penetration rates, and continuous replacement cycles maintaining modern technology standards. Asia Pacific shows robust growth as hospital construction accelerates, existing facilities undergo modernization programs, and tertiary care capacity expands in countries including China, India, and Southeast Asian nations responding to growing healthcare demand from expanding middle-class populations. Leading manufacturers including GE HealthCare, Siemens Healthineers, and Philips Healthcare maintain strong hospital relationships through dedicated sales forces, comprehensive service networks, ongoing clinical education programs, and participation in industry conferences and professional society meetings where institutional decision-makers evaluate equipment options and industry trends.

Ambulatory Surgical Centers – Fastest Growth Through Outpatient Procedure Migration

Ambulatory surgical centers represent the fastest-growing end-user segment with an impressive 6.9% CAGR between 2026 and 2035, driven by healthcare delivery model shifts toward outpatient settings offering cost efficiency, patient convenience, and focused procedural excellence. ASCs increasingly perform interventional procedures previously restricted to hospital settings, including pain management injections, GI endoscopy with fluoroscopy, peripheral vascular interventions, and orthopedic procedures, creating demand for compact, user-friendly radio-fluoroscopy systems optimized for ambulatory environments. These facilities prioritize equipment that delivers reliable performance, enables rapid patient throughput, requires minimal space, and supports same-day discharge protocols that differentiate the ASC value proposition from traditional hospital care.

The ASC segment benefits from favorable reimbursement dynamics as payers including Medicare and commercial insurers actively encourage outpatient procedure migration through payment policies that create financial incentives for site-of-service shifts away from higher-cost hospital settings. Patients increasingly prefer convenient outpatient procedures avoiding hospital admission, enabling same-day return home, and reducing disruption to work and family responsibilities. ASC operators invest in modern equipment as competitive differentiators attracting referring physicians and patients seeking comfortable, efficient care experiences. The growing ASC sector, particularly strong in the United States with over 5,000 Medicare-certified facilities, creates expanding market opportunities for radio-fluoroscopy systems tailored to ambulatory requirements including compact footprints, streamlined operation, and cost-effective pricing matching ASC budget parameters.

Equipment manufacturers targeting the ASC segment emphasize mobile and compact radio-fluoroscopy platforms with features including rapid setup and breakdown, intuitive operation requiring minimal specialized training, reliable performance with minimal maintenance, and price points appropriate for facilities with more constrained capital budgets than large hospitals. Canon Medical Systems, Shimadzu Corporation, and other manufacturers offer ASC-optimized solutions balancing capabilities, ease-of-use, and affordability. North America leads ASC adoption of radio-fluoroscopy systems, supported by the region's extensive ambulatory surgery infrastructure and well-established reimbursement supporting outpatient procedures. Other regions show growing but more modest ASC development, with Europe demonstrating steady expansion and Asia Pacific representing an emerging opportunity as ambulatory care models gain acceptance in healthcare systems historically centered on hospital-based service delivery.

Diagnostic Imaging Centers – Independent Providers Expanding Access

Diagnostic imaging centers represent an important end-user segment comprising independent radiology practices, hospital-affiliated outpatient imaging facilities, and specialized diagnostic service providers offering comprehensive imaging services in convenient community locations. These centers invest in radio-fluoroscopy systems to diversify service offerings beyond basic X-ray and ultrasound, capturing referrals for GI contrast studies, specialized procedures including hysterosalpingography and voiding cystourethrography, and interventional services that generate higher margins than commodity imaging examinations. The centers emphasize patient experience through comfortable facilities, convenient scheduling, and efficient throughput that differentiate from hospital-based radiology departments often perceived as institutional and less patient-friendly.

The diagnostic imaging center segment benefits from growing physician and patient preference for convenient outpatient imaging services, particularly in suburban and urban locations with ample parking and accessibility advantages over hospital campuses. Many centers operate as joint ventures between hospitals and referring physicians or as independent entities contracting with multiple health systems and physician groups. Competition drives investment in modern equipment as centers seek to attract referrals through reputation for quality, technology leadership, and service excellence. The segment shows particular strength in North America where independent imaging has achieved significant market share, with more modest but growing presence in Europe and select Asia Pacific markets including Australia and parts of Southeast Asia where private healthcare sectors are well-developed.

Equipment purchasing decisions in diagnostic imaging centers emphasize versatility, reliability, workflow efficiency, and total cost of ownership, with many centers preferring fixed systems for primary installations and mobile units for flexible capacity expansion. Centers typically install single fluoroscopy systems serving multiple applications rather than dedicated specialty equipment, making multifunctional platforms particularly appealing. Manufacturers target imaging centers through specialized distribution channels, competitive pricing recognizing centers' typically smaller scale compared to hospitals, and service offerings supporting efficient operations with minimal downtime. The segment's growth prospects remain solid though more modest than ASCs, supported by continued shift toward outpatient imaging, demographic trends driving imaging volume growth, and ongoing competition requiring technology investment to maintain competitive positioning in crowded markets.

Value Chain Analysis

Research and Development

The radio-fluoroscopy systems value chain originates with intensive research and development activities focused on advancing imaging technologies, improving dose efficiency, enhancing workflow automation, and developing innovative features that address evolving clinical requirements and competitive dynamics. R&D organizations within major manufacturers invest heavily in detector technology advancement including next-generation flat-panel detectors with improved quantum efficiency and spatial resolution, image processing algorithms leveraging artificial intelligence for automated optimization and artifact reduction, and mechanical systems engineering delivering precise positioning, stability, and reliability under demanding clinical utilization. Development programs span multiple years from concept through commercial launch, requiring substantial capital investment, multidisciplinary teams combining electrical engineering, software development, clinical expertise, and regulatory affairs capabilities, and extensive testing and validation ensuring product safety, performance, and regulatory compliance.

Clinical research represents a critical R&D component, with manufacturers sponsoring studies demonstrating system performance, validating dose reduction claims, and generating evidence supporting clinical and economic value propositions. Collaboration with leading academic medical centers, key opinion leaders, and professional societies helps shape product requirements, validate design decisions, and build clinical acceptance for innovative features. Regulatory strategy development occurs throughout R&D, ensuring new systems meet applicable standards including FDA requirements, European Medical Device Regulation, and other jurisdiction-specific regulations governing medical imaging equipment safety and efficacy.

Key Players: GE HealthCare, Siemens Healthineers, Philips Healthcare, and Canon Medical Systems maintain substantial R&D organizations driving continuous innovation in radio-fluoroscopy technology, while specialized component suppliers including detector manufacturers, AI technology companies, and medical imaging software developers contribute enabling technologies through development partnerships and component supply relationships.

Component Manufacturing and Sourcing

Following product design, the value chain transitions to component manufacturing and procurement activities where specialized subsystems and materials are produced or sourced from supply networks

spanning global manufacturing ecosystems. Critical components include flat-panel X-ray detectors representing the most sophisticated and costly subsystem, requiring advanced semiconductor fabrication, scintillator materials, and precision assembly in cleanroom environments. Generator systems providing precise X-ray energy control, high-voltage power supplies, and sophisticated control electronics are sourced from specialized suppliers or manufactured in-house by major imaging companies. Mechanical assemblies including patient tables, tube stands, positioning systems, and structural components require precision machining, robust construction, and ergonomic design balancing functionality with patient comfort. Software platforms incorporating operating systems, image processing algorithms, user interfaces, and network connectivity represent increasingly important components as systems become more intelligent and integrated.

Supply chain management proves critical given the global nature of component sourcing, with manufacturers balancing cost optimization through geographic diversification against supply security risks including logistics disruptions, quality variability, and geopolitical uncertainties. Strategic supplier relationships with long-term contracts, joint development agreements, and quality partnerships help ensure component availability, performance consistency, and technology access. Vertical integration strategies vary by manufacturer, with some companies producing critical components in-house while others rely predominantly on specialized suppliers, reflecting different strategic philosophies regarding control, flexibility, and capital efficiency.

Key Players: Detector manufacturers including Varex Imaging and Trixell supply flat-panel detectors to multiple system manufacturers, specialized electronics suppliers provide generators and control systems, mechanical component suppliers and contract manufacturers produce structural elements, while software companies and AI technology providers contribute enabling technologies through licensing agreements and development partnerships.

System Integration and Manufacturing

System integration and manufacturing represent the core value chain stage where sourced and manufactured components are assembled into complete radio-fluoroscopy platforms, tested for performance and safety compliance, and prepared for commercial distribution. Manufacturing operations occur in specialized facilities with controlled environments, precision assembly equipment, and comprehensive quality management systems complying with ISO 13485 medical device quality standards and jurisdiction-specific requirements. Assembly processes combine mechanical construction installing structural components and positioning systems, electronic integration connecting detectors, generators, computers, and control systems, software installation and configuration, and comprehensive testing validating imaging performance, safety features, and system integration.

Quality assurance programs implement rigorous inspection protocols, performance validation testing against specifications, safety testing ensuring electrical safety and radiation protection, and documentation supporting regulatory submissions and customer acceptance. Manufacturing scale varies significantly across manufacturers, with market leaders including GE HealthCare and Siemens Healthineers operating multiple global production facilities enabling regional market service, while smaller manufacturers may concentrate production in single locations with global distribution. Build-to-order and configure-to-order manufacturing approaches allow customization addressing customer-specific requirements including room configurations, optional accessories, and market-specific regulatory compliance while managing inventory costs and production efficiency.

Key Players: Major manufacturers including GE HealthCare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, and Shimadzu Corporation operate dedicated medical imaging manufacturing facilities, while some smaller companies utilize contract manufacturers for assembly operations, focusing internal resources on design, engineering, and go-to-market activities.

Regulatory Approval and Market Access

Regulatory approval represents a mandatory value chain stage ensuring radio-fluoroscopy systems meet safety and performance standards before commercial distribution. The approval process varies substantially across markets, with the United States FDA requiring 510(k) premarket notification demonstrating substantial equivalence to legally marketed predicate devices for most systems, or more extensive Premarket Approval for novel technologies. European markets require conformity assessment under Medical Device Regulation demonstrating compliance with essential safety and performance requirements, typically involving notified body review for Class IIb medical devices. Other major markets including Japan, China, and Australia maintain distinct regulatory frameworks with specific technical standards, clinical data requirements, and approval processes that manufacturers must navigate for global market access.

Regulatory strategy significantly impacts time-to-market and commercial success, with experienced manufacturers leveraging established regulatory pathways, comprehensive technical documentation, and strong regulatory affairs capabilities to achieve efficient approvals. Clinical data requirements vary by jurisdiction and novelty of technology claims, ranging from literature reviews and bench testing for incremental improvements to prospective clinical studies for breakthrough innovations. Post-market surveillance obligations including adverse event reporting, periodic safety updates, and quality system maintenance continue throughout product commercial life, requiring ongoing regulatory resources and compliance management.

Key Players: Regulatory affairs departments within major manufacturers manage approval processes, specialized regulatory consulting firms provide expertise supporting smaller companies, notified bodies in Europe and regulatory agencies including FDA, PMDA, and NMPA conduct reviews and grant market authorizations enabling commercial distribution.

Distribution and Sales

Distribution and sales activities connect manufactured radio-fluoroscopy systems with end-user healthcare facilities through diverse channels optimized for different market segments and geographic regions. Direct sales forces employed by major manufacturers call on large hospital systems, academic medical centers, and integrated delivery networks, providing consultative selling, technical expertise, and relationship management appropriate for complex capital equipment purchases involving multiple stakeholders and lengthy decision cycles. Independent distributors serve regional markets, smaller facilities, and specialized segments, offering local market knowledge, established customer relationships, and multi-vendor portfolios providing purchasing convenience. Group purchasing organizations and healthcare system contracting departments negotiate pricing and terms for member institutions, influencing purchasing decisions through preferred vendor agreements and volume commitments.

Sales processes for radio-fluoroscopy systems involve needs assessment understanding clinical applications and workflow requirements, system configuration selecting appropriate features and accessories, financial structuring including capital purchase, leasing, or bundled service agreements, and project management coordinating installation, facility preparation, and system commissioning. Demonstration capabilities including temporary installations, site visits to reference customers, and simulation tools help customers evaluate systems before purchase commitments. Sales cycles typically span 6-18 months from initial engagement to installation, with significant variation based on customer size, purchase complexity, and decision-making processes.

Key Players: Direct sales organizations within GE HealthCare, Siemens Healthineers, Philips Healthcare, and other manufacturers provide primary distribution for their respective products, while independent distributors including regional medical equipment dealers, national distributors, and international trading companies extend market reach particularly in emerging markets where direct presence proves economically challenging.

Installation and Commissioning

Installation and commissioning represent critical value chain stages transitioning radio-fluoroscopy systems from delivered equipment to operational clinical tools ready for patient examinations. Installation activities include site preparation ensuring adequate electrical power, structural support, radiation shielding, and space configurations meeting equipment requirements, equipment delivery coordinating logistics and facility access, mechanical installation positioning and securing system components, electrical and network connections integrating with facility infrastructure, and initial system testing verifying basic functionality. Commissioning involves comprehensive performance testing validating imaging performance against specifications, radiation output measurement ensuring compliance with safety standards, integration testing confirming connectivity with PACS, RIS, and hospital information systems, and operator training ensuring clinical and technical staff can safely and effectively utilize system capabilities.