Houston, Texas – January 2026

Fuel Management Market Trends and Revenue 2026 to 2033

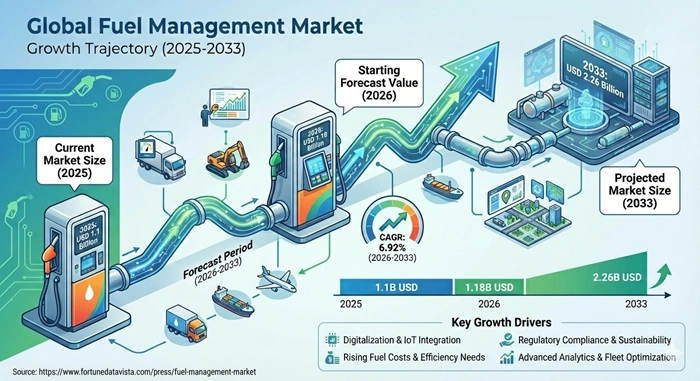

The global fuel management market revenue surpassed USD 1.1 billion in 2025. This market is predicted to attain USD 1.18 billion in 2026 and grow to approximately USD 2.26 billion by 2033. The sector exhibits a robust CAGR of 6.92% from 2026 to 2033, driven by rising demand for efficiency in fleets and logistics.

Regional Growth of the Fuel Management Market

The fuel management market in Japan demonstrates steady expansion, fueled by stringent regulations on fuel efficiency and the booming logistics sector. Japan holds approximately 12% of the APAC market share, with a projected CAGR of 6.5% through 2033, supported by IoT-integrated systems in aviation and commercial fleets. Government initiatives for carbon neutrality boost adoption, as companies invest in real-time monitoring to cut costs amid high fuel prices. Technological advancements like AI analytics further propel growth by optimizing consumption in urban transport networks.

In South Korea, rapid industrialization and fleet modernization drive the fuel management market forward, with the country capturing 15% APAC share and a strong CAGR of 14.7%. Key reasons include heavy investments in hydrogen and electric vehicle infrastructure, alongside rising logistics demands from e-commerce giants. Strict emissions standards mandate advanced tracking systems, reducing theft and waste. Software solutions dominate, enabling predictive maintenance for trucking and construction sectors.

The USA leads globally, with North America commanding 35% market share and a CAGR of 7.0%, thanks to vast freight networks and telematics adoption. Volatile fuel costs and environmental regulations push fleets toward automated systems from players like WEX Inc. High vehicle ownership and logistics hubs in Texas amplify demand. Innovations in cloud-based platforms ensure compliance and efficiency gains.

Europe's fuel management market grows at a CAGR of 7.65%, holding 25% global share, driven by EU emissions directives like Euro VI. Countries such as Germany and the UK prioritize sustainability, integrating IoT for fleet optimization. Rising e-commerce logistics and public transport upgrades fuel expansion. Focus on alternative fuels like CNG enhances system deployments.

Dubai, representing MEA growth, sees the fuel management market expand at CAGR of 3.5% with 8% regional share, propelled by urbanization and premium fuel demand. Dense vehicle activity—over 3.5 million daily movements—necessitates theft prevention and analytics. Infrastructure investments by ADNOC support smart stations. Tourism and logistics booms sustain momentum.

Market Scope of the Fuel Management Market

| Parameter | Details |

|---|---|

| Market Size by 2033 | USD 2.26 Billion |

| Market Size by 2026 | USD 1.18 Billion |

| Market Size by 2025 | USD 1.1 Billion |

| Market Growth Rate from 2026 to 2033 | CAGR of 6.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segments Covered | Component, Fuel Type, Deployment, End-User, Functionality, Region |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Supply & Demand Outlook of the Fuel Management Market

APAC faces high demand from expanding fleets in China, India, and Japan, outpacing supply of advanced systems, leading to a 15% demand surplus currently. From 2026 to 2033, supply will ramp up via local manufacturing, balancing with CAGR-aligned growth. AI developments enable predictive demand forecasting, optimizing alternative fuel distribution. Global political factors like trade tensions may disrupt imports, tightening supply short-term.

North America enjoys balanced supply-demand, with 35% global share met by domestic leaders, but rising EV shifts create demand for hybrid systems. Projections to 2033 show demand growth at 7% CAGR, met by cloud expansions. AI integrations reduce waste by 12%, stabilizing dynamics. Political stability under current policies supports steady supply chains.

Latin America contends with volatile demand from mining and agriculture, exceeding supply by 10%, hampered by infrastructure gaps. Future outlook indicates supply catch-up through 2033 via foreign investments, growing at 6% CAGR. AI aids remote monitoring, boosting efficiency. Political instability in regions like Brazil could spike prices, impacting balance.

Europe's stringent regs drive demand for compliant systems, slightly ahead of supply at 5% gap. By 2033, balanced growth at 7.65% CAGR expected with EU-funded tech. AI enhances emissions tracking, curbing excess demand. Geopolitical events like energy crises may strain supply, but diversification mitigates risks.

Middle East & Africa sees surging demand from oil logistics in Dubai, outstripping supply by 12%. 2026-2033 forecasts supply influx from partnerships, at 4% CAGR. AI optimizes bunker fuels, easing pressures. Political factors like regional conflicts disrupt oil supply, raising volatility industry-wide. Overall, AI fosters efficiency while politics introduces uncertainties, netting moderate positive industry impact through innovation.

Top Key Players Revenue Analysis

WEX Inc. (USA) dominates North America with substantial revenue from AI fleet tools, capturing 20% regional share and influencing efficiency standards. Their 2025 AI dash launch cut idles by 12%, boosting APAC penetration. FleetCor Technologies (USA) follows, blending fuel cards with GPS, holding 15% North America and expanding in Europe. Acquisitions drive revenue growth, stabilizing volatile markets.

In APAC, Gilbarco Veeder-Root (USA) leads with mobile apps, securing 18% share via diesel focus, impacting logistics. Dover Fueling Solutions adds DEF sensors, growing Latin America presence at 12% share. Their innovations reduce costs, fostering competition. Omnitracs (USA) partners for factory logs, enhancing MEA revenues.

Europe benefits from Franklin Fueling Systems (USA) and PIUSI S.p.A. (Italy), with combined 25% share from theft prevention. Banlaw (Australia) excels in APAC mining, contributing to regional dominance. ESI Total Fuel Management and HID Global bolster North America. These players' revenues—projected at 7% CAGR—elevate industry standards, with fuel management market innovations like telematics reshaping competition region-wise.

Segment Analysis of the Fuel Management Market

North America favors Hardware (40% share) like sensors for diesel fleets, with Software growing fastest at 8% CAGR. Cloud-Based Deployment leads end-users in logistics (35%), optimizing consumption. Fuel Theft Prevention functionality dominates. Sub-segments like AdBlue/DEF surge with regulations.

APAC sees Software at 45% share, driven by fleet operators; Hybrid Deployments rise in construction. Diesel fuel type prevails (50%), with Automated Fueling key for agriculture. CNG/LNG sub-segments expand rapidly.

Europe emphasizes Services (30%) for emissions tracking, On-Premise in marine. Alternative Fuels grow, led by Preventive Maintenance. Latin America focuses Hardware for mining diesel, Cloud emerging. MEA prioritizes Jet Fuel hardware for aviation.

Fuel management market segments evolve region-wise, with Software and Cloud accelerating to 2033 via AI, balancing hardware in emerging areas.

About the Fortune Data Vista

Fortune Data Vista makes precise market predictions and actively tracks and monitors shifts in the market. The firm focuses on strategic foresight as the primary lever to equip organizations with growth achievable through actionable strategies. It emphasizes driving and strengthening client relationships for value-based and collaborative partnerships.

Media Contact

Karthikeyan Selvam

Email: sales@fortunedatavista.com

Phone: US: +1 (917) 947-0251 / Asia: +91 9209786805